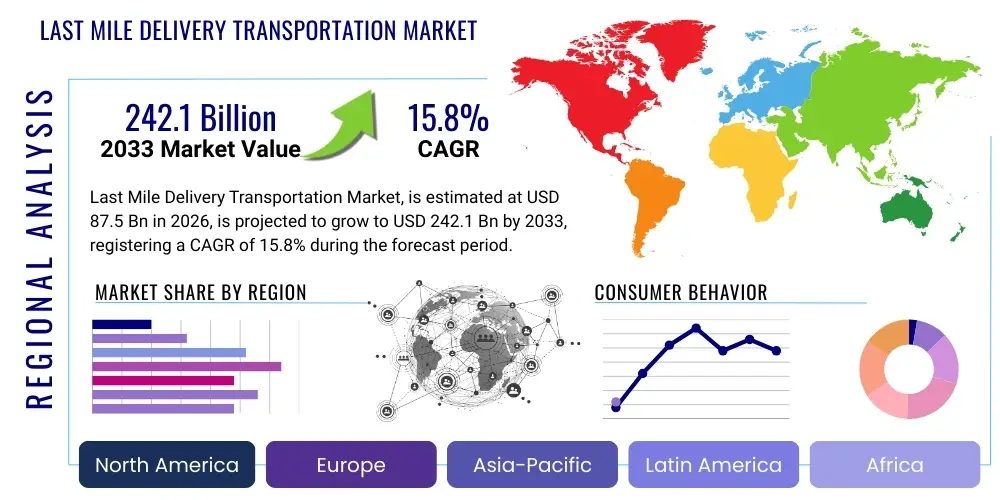

Last Mile Delivery Transportation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436322 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Last Mile Delivery Transportation Market Size

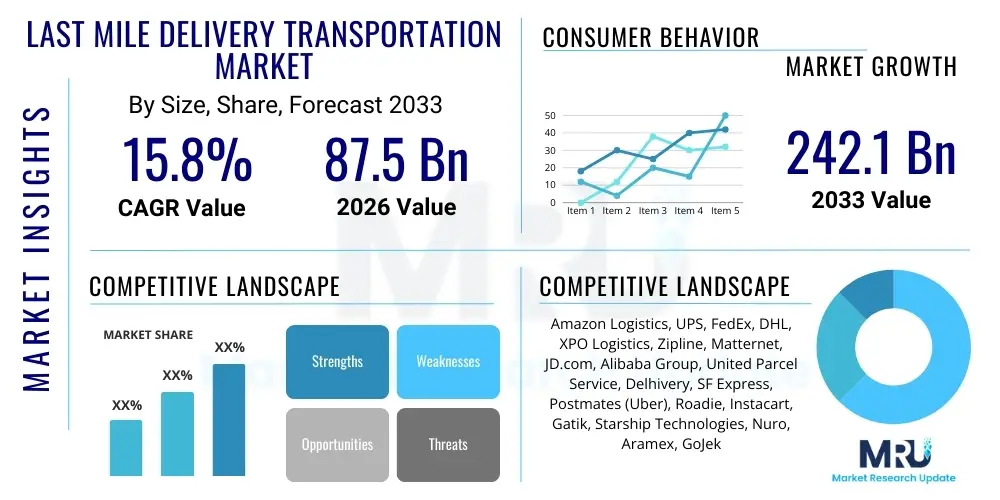

The Last Mile Delivery Transportation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 87.5 Billion in 2026 and is projected to reach USD 242.1 Billion by the end of the forecast period in 2033.

Last Mile Delivery Transportation Market introduction

The Last Mile Delivery Transportation Market encompasses the specialized logistical services and systems required to move goods from a distribution hub or transportation facility to the final destination, typically the consumer’s home or business. This crucial segment of the supply chain is defined by high complexity, significant cost pressures, and a direct impact on customer satisfaction. The rapid proliferation of e-commerce, accelerated by global events and changing consumer behavior, has fundamentally reshaped the demand landscape for efficient and rapid last-mile solutions. Key products within this market include specialized delivery vehicles, advanced routing software, mobile applications for tracking, and parcel management systems designed to optimize speed and minimize failed delivery attempts.

Major applications of last mile delivery span across retail, food and beverage, pharmaceuticals, and general e-commerce logistics. The primary benefit derived from effective last-mile transportation is enhanced customer experience, achieved through faster delivery times, greater flexibility in scheduling, and improved visibility into the shipment process. Furthermore, operational optimization through route planning and capacity utilization contributes significantly to reducing overall logistical costs for businesses. As urban density increases, the challenge of navigating congestion and meeting stringent emission standards further drives the need for innovative transportation modes, such as electric vehicles and autonomous solutions, propelling market evolution.

Driving factors propelling market expansion include increasing digitalization and smartphone penetration, which facilitate on-demand delivery services. The consumer expectation for immediate gratification, often encapsulated by same-day or two-hour delivery windows, mandates continuous investment in sophisticated transportation networks. Moreover, the shift towards micro-fulfillment centers and hyperlocal distribution models is minimizing the distance covered during the final leg, making multi-modal transportation systems—integrating bikes, scooters, and traditional vans—essential for operational agility and profitability in densely populated areas.

Last Mile Delivery Transportation Market Executive Summary

The Last Mile Delivery Transportation Market is experiencing transformative growth, primarily driven by seismic shifts in retail dynamics and escalating consumer expectations for speed and convenience. Current business trends indicate a strong move toward automation and the integration of artificial intelligence (AI) for predictive analytics and dynamic routing, which are critical for tackling urban congestion and high operational costs. Strategic partnerships between traditional logistics providers (3PLs) and specialized technology firms are becoming commonplace, aimed at building resilient, scalable, and highly optimized delivery ecosystems. Furthermore, sustainability initiatives are heavily influencing procurement decisions, favoring electric vehicles (EVs) and low-emission delivery alternatives to meet corporate social responsibility goals and regulatory compliance, particularly in European and North American metropolitan areas.

Regionally, the Asia Pacific (APAC) market dominates the volume of last-mile operations, fueled by dense populations, explosive e-commerce penetration in countries like China and India, and significant government investment in logistical infrastructure. North America and Europe, while having higher operational costs, lead in the adoption of advanced technologies, including drone delivery pilots and fully autonomous vehicle integration, often driven by the necessity to overcome labor shortages and improve route efficiency in complex urban landscapes. Emerging markets in Latin America and the Middle East and Africa (MEA) are rapidly catching up, characterized by high mobile commerce adoption and an urgent need for formal, structured logistics networks to replace informal delivery methods.

In terms of segmentation trends, the B2C segment remains the largest consumer, though the B2B segment is showing accelerated growth, particularly in just-in-time delivery for manufacturing and specialized parts fulfillment. Vehicle segmentation shows a pronounced shift towards Light Commercial Vehicles (LCVs) for suburban deliveries and two-wheelers/e-bikes for dense urban core areas. Crucially, the 'Same-Day Delivery' service type is becoming the benchmark standard rather than a premium offering, compelling service providers to invest heavily in micro-warehousing and advanced inventory management systems closer to the end consumer, fundamentally altering the economics of the last mile.

AI Impact Analysis on Last Mile Delivery Transportation Market

User queries regarding the impact of AI in last mile delivery predominantly revolve around operational efficiency, cost reduction, and the future role of human labor. Common questions address how AI optimizes complex, multi-variable routing problems in real-time (dynamic routing), its effectiveness in predicting delivery delays or failures based on historical and current data (predictive analytics), and its application in inventory placement (micro-fulfillment optimization). Users also express significant interest in the safety and reliability of AI-powered autonomous vehicles and drones, alongside concerns about the data privacy implications of utilizing customer location and preference data for highly personalized delivery services. The key themes summarized from user inquiries emphasize AI's transformative potential in moving from reactive logistics to proactive, intelligent fulfillment, setting a new benchmark for operational excellence.

The primary influence of Artificial Intelligence lies in its capability to process vast datasets—including traffic patterns, weather conditions, driver behavior, and package characteristics—to execute superior logistical decisions instantaneously, a task beyond human capacity. AI algorithms are fundamental in enabling sophisticated technologies like robotic process automation (RPA) for sorting and packaging, and computer vision systems for verification of successful delivery. This integration not only reduces the margin of human error but also ensures highly accurate estimated times of arrival (ETAs), which is critical for enhancing transparency and meeting increasingly tight customer delivery windows. The competitive advantage increasingly belongs to companies that can leverage machine learning to continuously refine their supply chain models.

Furthermore, AI-driven demand forecasting is revolutionizing inventory management by anticipating where and when specific items will be needed, enabling preemptive stocking in strategically located micro-hubs. This significantly reduces the total travel distance for the final delivery leg, directly addressing the last mile's inherent inefficiency and environmental impact. The adoption of AI is therefore not merely an incremental improvement but a systemic change, transforming the last mile from a cost center into a powerful differentiator by enabling hyper-efficient resource allocation and personalized delivery experiences previously unattainable through traditional operational planning methods.

- Enhanced Dynamic Route Optimization: Real-time adjustment of delivery paths minimizing travel time and fuel consumption.

- Predictive Delay Modeling: Machine learning identifies potential bottlenecks (traffic, weather, service failures) before they occur.

- Autonomous Vehicle Navigation: AI provides the core intelligence for operating self-driving delivery vans and ground robots safely.

- Optimized Warehouse Operations: AI-powered sorting robots and automated guided vehicles (AGVs) expedite parcel preparation for dispatch.

- Demand Forecasting and Micro-Fulfillment: Algorithms predict hyperlocal demand, enabling optimal placement of inventory near customers.

- Fraud Detection and Security: AI monitors delivery attempts and payment processes to mitigate financial and package security risks.

- Personalized Delivery Scheduling: AI algorithms offer customers the most convenient delivery slots based on driver availability and historical data.

DRO & Impact Forces Of Last Mile Delivery Transportation Market

The dynamics of the Last Mile Delivery Transportation Market are shaped by a powerful interplay of growth drivers, structural restraints, and emerging opportunities, all acting as significant impact forces. Key drivers include the exponential growth of global e-commerce, forcing retailers to prioritize fulfillment speed, and the consumer demand for transparency and tracking capabilities. These drivers exert upward pressure on market investment in technology and infrastructure. However, the market is constrained by high operational costs associated with labor-intensive delivery processes, escalating fuel and maintenance costs, and persistent urban congestion challenges that undermine efficiency. These constraints often lead to thin profit margins, particularly for small-scale logistics providers, necessitating continuous process innovation.

Significant opportunities are emerging through technological advancements, specifically the maturation of drone and autonomous vehicle technology, which promises radical cost reductions and speed enhancements in certain geographic corridors. Furthermore, the global push towards environmental sustainability is opening vast opportunities for electric and low-emission delivery solutions, supported by favorable government incentives and urban planning focusing on green logistics. Consolidating fragmented local delivery networks through partnerships (e.g., retailers collaborating with specialized tech logistics firms) represents another strategic avenue for optimizing capacity and achieving economies of scale in the complex final delivery stage.

The primary impact forces guiding the market trajectory are regulatory standardization of autonomous transport, which, once established, will unlock massive investment; the fluctuating cost of fossil fuels, which accelerates the transition to electric fleets; and, crucially, consumer willingness to pay for premium delivery speeds. The collective influence of these forces dictates that market players must pivot towards hyper-efficiency and sustainability. Firms failing to integrate advanced routing technology or transition toward greener fleets risk being outcompeted on both price and environmental credibility, making technological adoption the most potent long-term impact force on market viability.

Segmentation Analysis

The Last Mile Delivery Transportation Market is extensively segmented based on the type of vehicle used, the service level provided, the industry application, and the operational model employed. This granular segmentation allows stakeholders to accurately measure demand pockets and tailor investment strategies. Vehicle type is a crucial differentiator, reflecting the suitability of transport modes—ranging from traditional trucks and vans to futuristic drones and robots—for different urban and rural landscapes. The service type segmentation highlights the consumer preference for rapid fulfillment, dividing the market into standard, express, and increasingly dominant same-day or flexible delivery options.

Application analysis provides insights into sector-specific needs, with e-commerce remaining the primary driver, followed by the high-frequency demands of the food and beverage industry and the specialized cold-chain requirements of healthcare logistics. The operational model segment—delineating between in-house fleet management and outsourcing to third-party logistics (3PLs)—reflects strategic corporate decisions regarding capital expenditure, control, and agility. Understanding these distinct segments is essential for vendors specializing in complementary technologies, such as advanced telematics or supply chain software, ensuring their offerings align precisely with the operational needs of their target clientele.

The ongoing trend towards hyper-localization and micro-fulfillment centers is blurring the lines between these segments. For instance, the increase in same-day delivery necessitates a shift towards smaller, agile vehicles (two-wheelers or light electric vans) operating on highly optimized, AI-driven routes, thereby intertwining the vehicle type and service type segments. Furthermore, the rising regulatory pressure on carbon emissions is bolstering the 'electric vehicle' sub-segment across all application areas, making green fleet transformation a transversal factor influencing all segmentation categories and driving significant capital reallocation within the next seven years.

- By Vehicle Type: Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-wheelers/Bikes, Drones, Autonomous Delivery Vehicles/Robots.

- By Service Type: Standard Delivery, Express Delivery, Same-Day Delivery, Flexible Delivery/Scheduled Delivery.

- By Application: E-commerce & Retail, Food & Beverage (F&B), Postal & Courier, Healthcare & Pharmaceuticals, Others (Manufacturing Parts, Automotive).

- By Operational Model: In-house/Owned Fleet, Outsourced (3PL/4PL Logistics Providers).

- By End-User: Business-to-Consumer (B2C), Business-to-Business (B2B).

Value Chain Analysis For Last Mile Delivery Transportation Market

The value chain for Last Mile Delivery Transportation begins with upstream activities focused on procurement of essential resources, including the acquisition of vehicle fleets (both conventional and electric), securing warehousing space for transshipment or micro-fulfillment, and investing in advanced logistics software platforms (WMS, TMS, routing optimization). Upstream profitability is heavily influenced by global supply chain volatility affecting vehicle manufacturing costs and the competitive landscape for specialized software vendors. Key participants in the upstream segment include automotive manufacturers, fleet leasing companies, and enterprise software developers specializing in supply chain visibility tools.

The core of the value chain is the downstream segment, comprising the actual execution of the delivery process. This involves order processing and aggregation at the final sortation center, route planning and assignment, actual physical transport, and proof-of-delivery confirmation. The efficiency of this stage is paramount and is maximized through effective labor management, GPS tracking, and seamless integration with customer-facing applications. The distribution channel is bifurcated into direct channels, where major retailers or e-commerce giants utilize their own dedicated fleets (in-house model), and indirect channels, where delivery tasks are outsourced to specialized third-party logistics (3PL) providers, which leverage their scale and existing networks to offer competitive pricing and service levels.

Profit margins in the downstream segment are highly sensitive to operational scale, vehicle utilization rates, and fuel/labor costs. Direct channels offer greater control over customer experience and branding but demand high capital expenditure. Indirect channels, primarily facilitated by leading global and regional 3PLs, allow businesses to convert fixed logistics costs into variable expenses, providing flexibility and scalability, especially during peak season demands. The transition toward electric fleets and autonomous delivery mechanisms is structurally redefining the relationships within the value chain, shifting investment focus from pure transportation assets towards data analytics and specialized charging infrastructure development.

Last Mile Delivery Transportation Market Potential Customers

The potential customer base for last mile delivery services is vast and highly diversified, spanning nearly every sector involved in the retail and movement of physical goods. The most significant end-users are large-scale e-commerce platforms, which rely entirely on efficient last mile networks to monetize their online sales, followed closely by traditional brick-and-mortar retailers that have adopted omnichannel strategies, requiring seamless integration between physical stores and online fulfillment. These customers demand high volume capacity, speed consistency, and robust integration capabilities with their existing Enterprise Resource Planning (ERP) systems, often opting for a mix of in-house and outsourced delivery models based on geographic coverage and delivery urgency requirements.

A second major segment comprises the food and beverage industry, including both restaurant meal delivery services and grocery retailers. These customers necessitate specialized last mile capabilities, such as temperature-controlled transport (cold chain logistics) and extremely time-sensitive delivery windows, often measured in minutes rather than hours. The high frequency and perishability of these goods necessitate bespoke routing algorithms that prioritize speed and minimize dwell time. Pharmaceutical and healthcare providers represent a rapidly expanding customer group, requiring highly secure, compliant, and often monitored transport for sensitive medical supplies and prescriptions, making security and regulatory adherence paramount purchasing criteria.

Additionally, the B2B sector, encompassing light manufacturing, automotive parts suppliers, and office supply providers, represents a consistent customer base demanding reliable, often scheduled, deliveries. These businesses prioritize reliability and precise timing for inventory replenishment and just-in-time manufacturing processes, often favoring contracted 3PL services for predictable operational flow. Ultimately, any business engaged in direct customer interaction or complex supply chain management relies on the specialized efficiency of the last mile segment to maintain competitive edge and ensure continuity of service delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 87.5 Billion |

| Market Forecast in 2033 | USD 242.1 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon Logistics, UPS, FedEx, DHL, XPO Logistics, Zipline, Matternet, JD.com, Alibaba Group, United Parcel Service, Delhivery, SF Express, Postmates (Uber), Roadie, Instacart, Gatik, Starship Technologies, Nuro, Aramex, GoJek |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Last Mile Delivery Transportation Market Key Technology Landscape

The technological landscape of the Last Mile Delivery Transportation Market is defined by intense innovation across three primary domains: automation hardware, sophisticated software intelligence, and data communication infrastructure. Automation hardware includes the increasing deployment of specialized electric Light Commercial Vehicles (eLCVs) designed for urban deliveries, autonomous ground vehicles (AGVs) or sidewalk robots, and unmanned aerial vehicles (UAVs) or drones optimized for medical and remote area deliveries. These hardware platforms are crucial for addressing labor scarcity and minimizing carbon footprints in line with global sustainability goals, requiring significant capital investment in research and development and infrastructure for charging and maintenance.

Software intelligence represents the competitive core of the market, primarily centered on Advanced Route Planning and Optimization Systems (RPO). These systems leverage Artificial Intelligence and Machine Learning to process real-time data from various sources—traffic feeds, weather APIs, and historical driver performance—to create dynamic, optimized delivery sequences instantly. Furthermore, robust Parcel Tracking and Telematics Systems provide full transparency to both logistics managers and end-users, ensuring highly accurate Estimated Time of Arrival (ETA) predictions and improving operational accountability. The effectiveness of these software solutions is directly linked to customer satisfaction and operational cost efficiency.

The third critical element is the enabling infrastructure, primarily IoT (Internet of Things) sensors and enhanced 5G connectivity. IoT devices integrated into vehicles and parcels allow for continuous monitoring of location, temperature (critical for cold chain), and security status, feeding real-time data back to the central optimization software. The higher bandwidth and low latency offered by 5G networks are indispensable for supporting the complex, continuous data exchange required by autonomous vehicles and centralized AI control systems, thus paving the way for scalable, highly reliable autonomous operations across broader geographic areas and making complex urban delivery challenges manageable.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of delivery volume, propelled by massive e-commerce penetration in economies like China, India, and Southeast Asia. High population density and developing infrastructure necessitate a diverse fleet mix, heavily reliant on two-wheelers and smaller LCVs for micro-deliveries. Regulatory support for digitalization and strong competition among regional e-commerce giants fuel rapid adoption of localized fulfillment strategies.

- North America: Characterized by high labor costs and extensive geographic distances, driving early and heavy investment in automation, including piloting autonomous vehicles (Nuro, Gatik) and drone delivery systems in suburban and rural areas. Focus is on efficiency through AI-driven optimization and building specialized infrastructure for cold chain logistics and rapid grocery delivery.

- Europe: The market is defined by stringent environmental regulations (e.g., Ultra-Low Emission Zones), pushing rapid electrification of fleets (eLCVs, cargo bikes) and favoring sustainable delivery practices. Regulatory fragmentation across member states presents operational complexity, encouraging the adoption of sophisticated cross-border tracking and optimized urban logistical hubs to manage dense, historical city centers effectively.

- Latin America (LATAM): Exhibits high potential due to rising smartphone adoption and expanding middle-class consumer bases. Market growth is heavily concentrated in major metropolitan hubs (São Paulo, Mexico City). Challenges include infrastructure deficiencies and security concerns, leading to high reliance on localized platform economies and flexible outsourced delivery models.

- Middle East and Africa (MEA): Growth is primarily driven by large government investments in logistical infrastructure (e.g., UAE, Saudi Arabia) aiming to become global trade hubs. The presence of challenging environmental conditions (heat, sand) accelerates the need for specialized vehicle maintenance and robust cold-chain solutions, increasingly utilizing drones for rapid delivery in remote or newly developed urban areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Last Mile Delivery Transportation Market.- Amazon Logistics (A division of Amazon)

- United Parcel Service (UPS)

- FedEx Corporation

- DHL Group (Deutsche Post DHL)

- XPO Logistics

- Zipline International Inc.

- Matternet

- JD.com (Jingdong Logistics)

- Alibaba Group (Cainiao Smart Logistics Network)

- Delhivery Private Limited

- SF Express

- Uber (through its delivery subsidiaries/partnerships)

- Roadie Inc.

- Instacart

- Gatik AI, Inc.

- Starship Technologies

- Nuro, Inc.

- Aramex

- GoJek (GoTo Group)

- TForce Freight

Frequently Asked Questions

Analyze common user questions about the Last Mile Delivery Transportation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Last Mile Delivery Transportation Market?

The primary growth driver is the unprecedented, sustained expansion of the global e-commerce sector, coupled with escalating consumer expectations for ultra-fast, convenient, and transparent delivery services, such as same-day delivery.

How is Artificial Intelligence impacting last mile operational efficiency?

AI significantly enhances operational efficiency by enabling dynamic, real-time route optimization, predictive delay modeling, and automated decision-making for optimal parcel sorting and resource allocation, minimizing costs and delivery times.

Which vehicle type is expected to see the fastest growth in the urban last mile segment?

Two-wheelers (including electric bikes and scooters) and Light Commercial Vehicles (LCVs), especially electric variants, are expected to see the fastest growth due to their maneuverability in congested urban centers and their alignment with global sustainability mandates.

What are the main restraints affecting the profitability of last mile logistics?

The primary restraints include high operational expenditures driven by increasing fuel and labor costs, persistent urban congestion leading to delivery delays, and the high initial capital investment required for adopting advanced automation and electric vehicle technology.

Which region currently leads the adoption of drone delivery technologies?

North America, alongside specific high-growth areas in APAC, is leading the piloting and implementation of drone delivery technologies, often focused on delivering medical supplies or serving less densely populated, rural, or challenging geographic locations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager