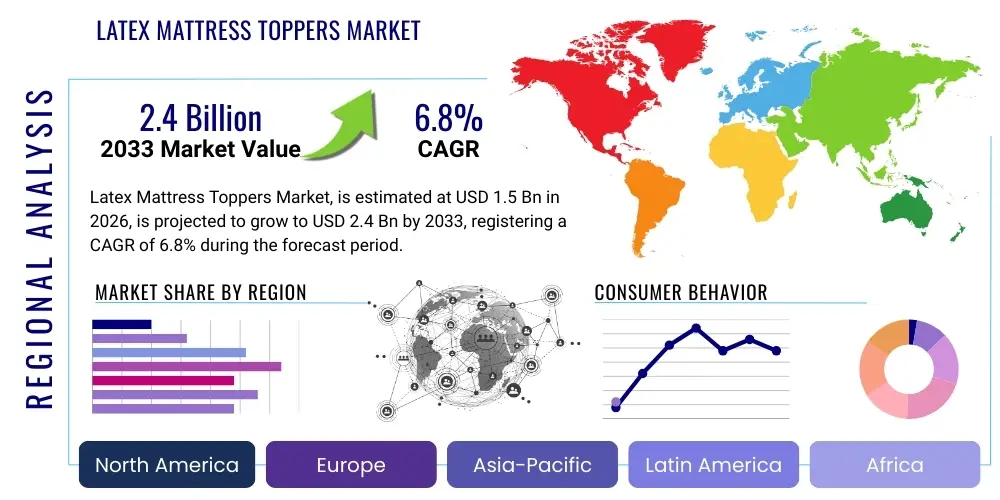

Latex Mattress Toppers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438074 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Latex Mattress Toppers Market Size

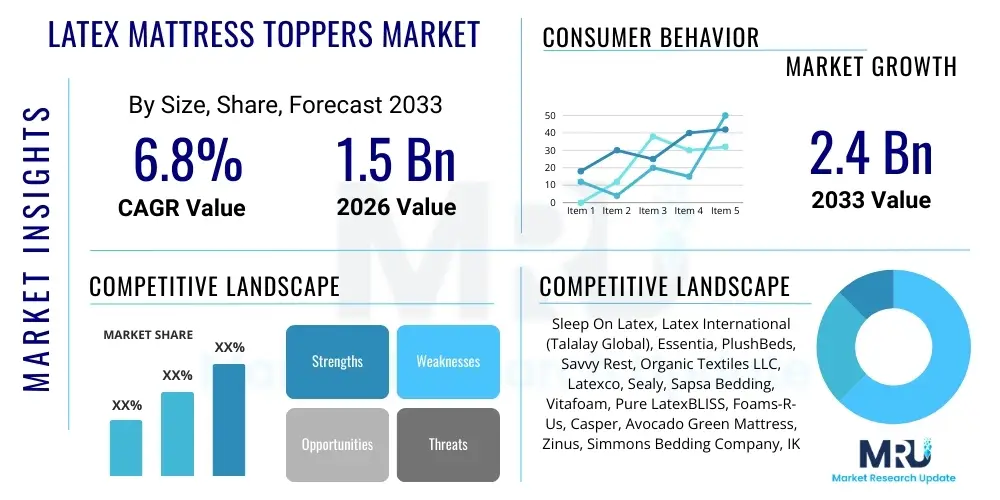

The Latex Mattress Toppers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by increasing consumer awareness regarding sleep health and the inherent benefits of natural, eco-friendly bedding materials. The shift towards premium bedding solutions, especially in developed economies, contributes significantly to market expansion, positioning latex toppers as a favored choice over synthetic alternatives.

Latex Mattress Toppers Market introduction

The Latex Mattress Toppers Market encompasses the production, distribution, and sale of thick, cushioned layers made from natural or synthetic latex, designed to be placed atop an existing mattress. These toppers serve multiple critical functions: they enhance comfort, provide targeted support, extend the lifespan of the underlying mattress, and offer hypoallergenic properties highly valued by consumers suffering from allergies. Products vary widely based on material source (Talalay, Dunlop), thickness, density, and inclusion of specialized features like ventilation holes or cooling additives. The primary application spans residential use, commercial lodging (hotels, resorts), and healthcare facilities, where durable, comfortable, and easy-to-maintain bedding is essential.

Major driving factors influencing market growth include a global rise in disposable incomes coupled with increasing consumer focus on personal wellness and adequate sleep quality. Furthermore, the robust marketing efforts emphasizing the sustainability and organic nature of natural latex are resonating strongly with environmentally conscious buyers, particularly Millennial and Gen Z demographics. The inherent elasticity, superior pressure relief, and exceptional durability of latex toppers provide a distinct advantage over memory foam or fiber alternatives, justifying their higher price point and sustaining premium market segmentation. The expanding e-commerce infrastructure has also played a crucial role, allowing niche manufacturers to reach a wider global audience and educate consumers effectively about product differentiation.

Latex Mattress Toppers Market Executive Summary

The global Latex Mattress Toppers Market demonstrates robust expansion driven by converging trends in sustainability, health awareness, and digital retail transformation. Business trends highlight a pronounced shift towards Direct-to-Consumer (DTC) models, enabling manufacturers to control brand narrative, optimize profit margins, and offer extensive customization options, such as specific firmness levels or zoned support. Furthermore, partnerships with sustainable rubber plantations and investments in transparent supply chain verification are becoming vital competitive differentiators, especially in European and North American markets where regulatory scrutiny and consumer demand for ethical sourcing are high. Technology integration is focusing on enhancing the manufacturing processes, specifically refining the Talalay and Dunlop methods to achieve consistency and introducing advanced ventilation designs for optimal temperature regulation, addressing the historical concern of heat retention in some foam products.

Regional trends indicate North America and Europe retaining significant market share due to high disposable income, well-established consumer bases for premium bedding, and strong awareness of natural products. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, propelled by rapid urbanization, increasing middle-class populations in India and China, and the region's geographical proximity to raw latex sources, reducing logistical costs. Segment trends underscore the dominance of the Natural Latex segment, favored for its superior longevity and environmental profile, despite its premium cost. Within distribution channels, the Online segment is outpacing traditional retail, offering greater price transparency, customer reviews, and convenient doorstep delivery, which is crucial for bulky items like mattress toppers.

AI Impact Analysis on Latex Mattress Toppers Market

User queries regarding AI's influence typically revolve around how technology can enhance the consumer experience, optimize supply chains, and personalize product recommendations. Consumers frequently ask if AI can determine the "perfect" firmness level based on their sleep patterns and body metrics, or if AI-powered chatbots can provide sophisticated pre-purchase guidance regarding the differences between Dunlop and Talalay processes. Key themes emerging from this analysis include the expectation of hyper-personalization, the desire for frictionless customer service, and the use of predictive analytics to manage complex inventory related to varying thickness and density options. Manufacturers are focused on deploying AI to interpret vast amounts of consumer data collected through smart wearables or online behavior, translating these insights into actionable product design improvements and targeted marketing campaigns that specifically address individual sleep needs and postural requirements.

- AI-driven personalized product recommendations based on captured sleep data (e.g., pressure points, movement frequency, preferred sleeping position).

- Optimization of complex global supply chains, forecasting raw latex demand, and managing inventory volatility through predictive analytics.

- Enhanced customer service via sophisticated natural language processing (NLP) chatbots that provide immediate, expert advice on latex material properties and topper fitting.

- Virtual showrooms and augmented reality (AR) tools powered by AI, allowing consumers to visualize how different toppers affect their existing bedding setup.

- Quality control improvements in manufacturing by analyzing sensor data from production lines, identifying and correcting inconsistencies in foam density and cell structure.

DRO & Impact Forces Of Latex Mattress Toppers Market

The Latex Mattress Toppers Market is shaped by significant Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. Key drivers include the overwhelming global trend towards natural and sustainable consumer goods, heightened awareness of the detrimental effects of VOCs (Volatile Organic Compounds) found in synthetic foams, and recommendations from medical professionals endorsing latex for its superior orthopedic support and pressure distribution capabilities. Restraints, however, include the comparatively high initial cost of natural latex products compared to viscoelastic foams, which deters price-sensitive consumers, and the significant logistical challenges associated with shipping heavy and bulky foam items, increasing distribution costs. Opportunities lie in penetrating emerging Asian markets through localized production and distribution, the development of specialty toppers catering to specific medical conditions (e.g., chronic back pain), and the leveraging of e-commerce platforms to bypass traditional expensive retail overheads. The balance between sustainable sourcing (Driver) and raw material price volatility (Restraint) represents a critical impact force requiring strategic foresight from market leaders.

Segmentation Analysis

The Latex Mattress Toppers Market segmentation provides a granular view of product diversification and consumer preferences, essential for targeted marketing and production planning. Key segmentation variables include the source of the latex, product thickness, distribution channel, and application type. The market is predominantly divided between natural latex (derived from rubber trees), synthetic latex (polymer-based), and blended variations. Natural latex maintains a premium positioning due to its elasticity, durability, and eco-friendliness, whereas synthetic latex offers a more cost-effective entry point for budget-conscious consumers. Thickness segmentation (ranging from 1 inch for minor adjustments to 4 inches for significant mattress alteration) directly correlates with the amount of support and pressure relief provided. Understanding these segments is vital for manufacturers looking to optimize their portfolio and address specific consumer pain points, whether they are seeking minor comfort adjustments or a complete overhaul of their sleep surface quality.

- By Type:

- Natural Latex (Talalay Process)

- Natural Latex (Dunlop Process)

- Synthetic Latex

- Blended Latex

- By Thickness:

- Less than 2 Inches

- 2 Inches to 3 Inches

- More than 3 Inches

- By Application:

- Residential (Household)

- Commercial (Hotels, Hospitals, Hostels)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Specialty Stores, Department Stores, Wholesale Chains)

Value Chain Analysis For Latex Mattress Toppers Market

The value chain for latex mattress toppers begins with the upstream analysis, centering on the cultivation and harvesting of natural rubber (Hevea brasiliensis) or the chemical synthesis of styrene-butadiene rubber (SBR) for synthetic latex. Natural latex sourcing is geographically concentrated in Southeast Asia (Thailand, Indonesia, Malaysia), making the upstream segment highly susceptible to weather patterns, agricultural output, and commodity price fluctuations. Key activities involve tapping the trees, processing the raw liquid latex into stable forms, and bulk transportation to manufacturing hubs. Manufacturers must engage in rigorous quality control measures at this stage, ensuring the purity and consistency of the latex feedstocks used in the foaming process (Dunlop or Talalay), which determines the final product's physical properties such as density and resilience.

The midstream phase involves manufacturing, where significant value addition occurs through energy-intensive foaming, vulcanization, and curing processes. Companies invest heavily in specialized machinery to achieve precise thickness, uniform cell structure, and cooling features. Downstream analysis focuses on logistics and distribution. Given the bulky nature of mattress toppers, efficient packaging (often vacuum-sealed and rolled) and strategic warehousing are paramount for minimizing shipping costs and transit damage. The distribution channel is bifurcated into direct and indirect routes. Direct sales (e-commerce via brand websites) allow maximum control over pricing and customer feedback, building brand loyalty and providing personalized consultation, which is crucial for high-value items. Indirect channels involve partnerships with large furniture retailers, specialized bedding stores, and online marketplaces (like Amazon or Wayfair), leveraging their existing customer traffic and logistics networks to reach broader consumer segments.

Competition in the downstream segment is characterized by aggressive digital marketing, SEO optimization for niche keywords (e.g., "organic latex topper," "hypoallergenic mattress pad"), and robust customer service networks to manage returns and product guarantees. The distribution complexity, particularly cross-border shipping, means that regional fulfillment centers are becoming increasingly necessary, shifting the focus towards localized supply chain management. Ultimately, profitability hinges on minimizing upstream volatility while maximizing efficiency in the high-cost manufacturing and complex downstream distribution phases.

Latex Mattress Toppers Market Potential Customers

Potential customers for latex mattress toppers span several distinct demographic and psychographic groups, all sharing a common need for enhanced sleep quality, specialized support, or sustainable products. The core consumer base includes health-conscious individuals and allergy sufferers who specifically seek hypoallergenic, dust mite-resistant, and low-VOC sleeping surfaces. These buyers are typically willing to pay a premium for certified organic or natural latex products that promise superior indoor air quality and relief from common nocturnal irritations. Another significant segment comprises individuals experiencing chronic back pain, joint issues, or those requiring orthopedic support; latex is often recommended by chiropractors and physical therapists due to its ability to conform to body contours without the excessive sinking associated with some memory foams, ensuring optimal spinal alignment throughout the night.

The market also heavily targets the hospitality sector, including luxury hotels and high-end resorts, which invest in durable, high-quality bedding to enhance guest satisfaction scores and minimize replacement frequency. Commercial buyers prioritize latex for its long lifespan and ability to maintain structural integrity under constant use. Additionally, the market is expanding among younger, affluent consumers who prioritize sustainability and eco-friendliness. This group actively seeks products with certifications like GOLS (Global Organic Latex Standard), driving demand for traceable and ethically sourced materials. Finally, consumers who possess older but structurally sound mattresses represent a steady replacement market, utilizing toppers as a cost-effective method to refresh comfort levels without purchasing an entirely new mattress set.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sleep On Latex, Latex International (Talalay Global), Essentia, PlushBeds, Savvy Rest, Organic Textiles LLC, Latexco, Sealy, Sapsa Bedding, Vitafoam, Pure LatexBLISS, Foams-R-Us, Casper, Avocado Green Mattress, Zinus, Simmons Bedding Company, IKEA, Tempur Sealy International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Latex Mattress Toppers Market Key Technology Landscape

The technological landscape of the Latex Mattress Toppers Market is dominated by two primary manufacturing methods: the Dunlop process and the Talalay process. The Dunlop method, being the older and simpler technique, involves whipping the liquid latex into a froth, pouring it into a mold, and baking it. This process often results in a final product that is denser at the bottom than the top due to sedimentation, yielding a product that is generally firmer and more durable. Technological refinements in Dunlop production focus on achieving greater consistency in density distribution through optimized mixing and vulcanization controls, minimizing the historical variation inherent in this method. Advances in blending natural latex with synthetic polymers also fall under this domain, seeking to achieve the desirable properties of natural rubber at a more competitive cost point.

The Talalay process, in contrast, is more complex and involves vacuum filling a mold and flash-freezing the latex before vulcanization. This creates a highly consistent cell structure, resulting in a lighter, airier, and more breathable foam that offers superior pressure relief and a softer feel. Modern technological innovations are heavily concentrated in refining the Talalay machinery to improve energy efficiency during the freezing stage and to introduce zonal support features. Zonal technology involves varying the density or firmness across different sections of the topper (e.g., softer for shoulders, firmer for hips) to cater to ergonomic requirements, requiring sophisticated mold design and precise computerized pouring techniques. Furthermore, there is significant research and development focused on creating open-cell structures within the foam to enhance air circulation, often marketed as "pin-core ventilation" or "air channels," directly addressing consumer concerns about heat buildup commonly associated with foam products.

Beyond core manufacturing, the technological focus includes certification technology and material science integration. The industry is witnessing a rising adoption of materials science to infuse additives like graphite, copper, or gel microbeads into the latex compound to actively regulate temperature and improve hygiene through antimicrobial properties. Certification technology, while not strictly product manufacturing, involves advanced testing protocols and digital traceability (sometimes leveraging blockchain) to verify GOLS or OEKO-TEX standards, ensuring that claims of organic sourcing and lack of harmful chemicals are substantiated, satisfying the increasingly informed and skeptical consumer base in mature markets.

Regional Highlights

The Latex Mattress Toppers Market exhibits varied dynamics across major global regions, reflecting differences in consumer purchasing power, regulatory environment, and sourcing proximity. North America, encompassing the United States and Canada, represents a mature market characterized by high consumer spending on premium bedding and a strong willingness to adopt natural and orthopedic products. This region is a major consumer of high-end Talalay latex toppers, driven by sophisticated marketing around sleep health and comfort. E-commerce dominance is particularly strong here, with brands investing heavily in digital logistics and competitive return policies to overcome the barrier of inability to physically test the product before purchase. Regulatory compliance related to fire retardancy standards also significantly impacts product formulation and production in this area.

Europe stands out due to its stringent environmental regulations, fostering a robust demand for GOLS-certified organic latex toppers. Germany, the UK, and Scandinavian countries are key markets, prioritizing ecological footprint and ethical sourcing. The market here is fragmented, featuring both large global players and numerous specialized local manufacturers who cater to specific national standards and traditional bedding preferences. The emphasis on sustainability has led to innovation in packaging and minimizing synthetic components, further differentiating the European consumer from global counterparts. Asia Pacific (APAC) is the engine of future growth, driven by massive population density, rising urbanization, and improving economic conditions in populous nations like China and India. While traditionally a sourcing hub for raw latex, the domestic consumption market is rapidly maturing. Affordable, blended, and synthetic latex toppers often find strong traction here, though luxury segments are burgeoning in metropolitan centers, creating a dual-market structure.

Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller market shares but present emerging opportunities. Growth in LATAM is tied to expanding middle-class demographics and improving retail infrastructure. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, demand for luxury, high-quality bedding is increasing within the hospitality sector and among high-net-worth individuals, favoring imported, premium-grade latex toppers that provide comfort solutions adapted to warmer climates, often requiring specialized cooling technologies and highly breathable structures to be incorporated.

- North America (NA): Dominant consumer market for premium, certified natural latex; high penetration of DTC and e-commerce models; strong focus on orthopedic and pressure relief benefits.

- Europe: Driven by strict environmental standards (GOLS, OEKO-TEX); robust demand for sustainable and organic products; sophisticated regional fragmentation requiring localized marketing strategies.

- Asia Pacific (APAC): Fastest growing region; simultaneously a primary source of raw latex and a rapidly expanding consumption market; significant investment in manufacturing capacity expansion, particularly in blending and Dunlop processes.

- Latin America (LATAM): Emerging market growth fueled by urbanization and rising disposable incomes; price sensitivity remains a factor, driving demand for cost-effective synthetic or blended options.

- Middle East & Africa (MEA): High-value demand in the hospitality and luxury residential segments, prioritizing breathability, imported quality, and durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Latex Mattress Toppers Market.- Sleep On Latex

- Latex International (Talalay Global)

- Essentia Natural Memory Foam

- PlushBeds

- Savvy Rest

- Organic Textiles LLC

- Latexco

- Sapsa Bedding

- Vitafoam

- Pure LatexBLISS

- Foams-R-Us

- Avocado Green Mattress

- Zinus

- Casper Sleep

- Saatva

- Tuft & Needle

- Sealy Corporation (Tempur Sealy International)

- Simmons Bedding Company

- IKEA Systems B.V.

- Reverie Sleep

Frequently Asked Questions

Analyze common user questions about the Latex Mattress Toppers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the main difference between Talalay and Dunlop latex toppers?

The primary difference lies in the manufacturing process and resulting foam structure. The Dunlop process is simpler and yields a denser, firmer foam with natural sedimentation, making it durable and heavy. The Talalay process involves flash freezing and vacuum technology, resulting in a more uniform, breathable, lighter, and softer foam structure, often preferred for superior pressure relief and consistency.

Are latex mattress toppers genuinely effective for alleviating back pain?

Yes, latex toppers are highly effective for back pain relief as they offer buoyant, contouring support that maintains spinal alignment without creating deep pressure points. Their inherent elasticity distributes body weight evenly, reducing strain on the lower back and joints, often recommended as an orthopedic solution superior to traditional synthetic foam alternatives.

How important are GOLS and OEKO-TEX certifications for purchasing natural latex toppers?

GOLS (Global Organic Latex Standard) and OEKO-TEX certifications are extremely important as they verify the organic sourcing of the raw material and confirm the final product is free from harmful substances, volatile organic compounds (VOCs), and hazardous chemicals. These certifications assure health-conscious and environmentally focused consumers of product safety and ethical compliance.

Do latex mattress toppers typically retain heat during sleep?

Compared to traditional memory foam, high-quality latex toppers, especially those manufactured using the breathable Talalay process or featuring pin-core ventilation, significantly reduce heat retention. The open-cell structure and natural elasticity promote superior airflow, resulting in a cooler sleep surface, which is a major technological focus area for leading manufacturers.

What is the typical lifespan and durability of a high-quality latex topper?

High-quality natural latex mattress toppers are renowned for their exceptional durability, often lasting between 8 to 10 years, significantly exceeding the lifespan of memory foam or fiber alternatives. This longevity is a key economic driver for consumers, providing long-term value despite the higher initial investment cost.

The extensive research underpinning this analysis confirms the robust and evolving nature of the Latex Mattress Toppers Market. The continuous interplay between rising consumer demand for health-centric and sustainable bedding solutions and technological advancements in foam manufacturing solidifies the market's trajectory towards sustained premium growth. Future market dynamics will largely be dictated by successful supply chain management, innovation in cooling technology, and effective navigation of increasingly complex global e-commerce landscapes.

The market expansion is not uniform, requiring regional customization of product offerings. North American and European markets demand high-specification, certified organic products, whereas the high-growth potential in APAC necessitates efficient scaling of production and the strategic introduction of blended options to cater to diverse economic segments. Furthermore, the role of digital transformation, particularly the implementation of AI for personalization and operational efficiency, will be critical in distinguishing market leaders in this competitive specialty bedding sector. Companies demonstrating foresight in sustainable sourcing and transparency will secure long-term consumer trust and competitive advantage.

A closer look at the competitive environment reveals that vertical integration—from plantation sourcing to DTC sales—is becoming a favored strategy for controlling quality and maximizing margin. Non-integrated players must rely heavily on strategic partnerships and rigorous third-party certifications to validate their product claims. The underlying material science continues to evolve, promising lighter, cooler, and more precisely zoned support structures that extend the therapeutic benefits of latex beyond simple comfort enhancement, making these toppers an increasingly critical component of orthopedic and wellness-focused bedding systems globally.

Understanding the interplay between cost constraints (Restraints) and consumer willingness to pay for certified quality (Drivers) is paramount for strategic planning. The market is effectively bifurcating: a premium segment focused entirely on natural, certified products, and a value segment utilizing high-quality synthetic blends. Successful market participation requires identifying which segment to target and tailoring the entire value proposition—from material selection to packaging and distribution—to meet that segment's specific expectations for price, performance, and environmental responsibility. This multi-faceted approach ensures resilience against commodity volatility and shifting consumer trends in the dynamic global sleep industry.

The strategic emphasis on technological refinement, particularly in areas addressing historical drawbacks like weight and initial off-gassing, is paying dividends. Advances in vulcanization and aeration techniques are yielding products that are easier to handle and install, thereby reducing distribution costs and improving customer satisfaction, crucial elements in the high-return e-commerce channel. As the global supply chain stabilizes post-pandemic disruptions, manufacturers are prioritizing investment in automated production facilities closer to major consumption hubs, minimizing reliance on expensive international logistics for finished goods. This localization trend is expected to enhance responsiveness to regional demand fluctuations and improve overall market efficiency.

In summary, the Latex Mattress Toppers Market is positioned for stable, above-average growth, driven by fundamental shifts in consumer values towards health, sustainability, and quality. Market stakeholders must leverage digital channels for education and sales while simultaneously securing reliable, ethical, and high-quality raw material streams. The future of the market lies in customization and certified transparency, catering to an increasingly discerning consumer who views sleep investment as integral to overall personal wellness.

The increasing regulatory pressure across jurisdictions regarding chemical content in bedding materials further cements the advantage held by natural latex producers. The long-term sustainability of the industry is intrinsically linked to the ethical management of rubber plantations and the development of closed-loop manufacturing systems that minimize waste and energy consumption. Companies that proactively invest in these sustainable practices not only meet compliance requirements but also capitalize on the significant market differentiation provided by certified eco-friendly credentials. This ongoing commitment to environmental stewardship is a non-negotiable factor for continued success in this competitive specialty niche of the bedding market. The confluence of demographic shifts, technological refinement, and ethical sourcing defines the current landscape and future prospects of the Latex Mattress Toppers Market, indicating a transition towards sophisticated, digitally integrated, and wellness-focused product offerings.

Furthermore, the competitive dynamic is seeing larger, diversified bedding conglomerates enter the niche through acquisitions or dedicated product lines, threatening specialty latex manufacturers. To maintain market share, independent latex firms are doubling down on highly specialized products, such as customized zoned firmness profiles or unique cooling technologies that utilize phase-change materials integrated directly into the latex compound. The ability to rapidly innovate and maintain intellectual property surrounding unique foam compositions is becoming a crucial defense against market consolidation. This intense focus on niche, high-performance product development ensures that the latex segment continues to lead in material quality and specialized support within the broader mattress accessory industry.

The ongoing education of consumers about the distinct benefits of natural latex versus other foams remains a strategic imperative. Since latex toppers command a higher price point, manufacturers must continually articulate the superior value proposition: unparalleled durability, natural resilience, hypoallergenic properties, and environmental superiority. Digital content strategies focusing on comparative material analysis, longevity guarantees, and health endorsements are essential for justifying the investment. This educational effort is particularly critical in emerging markets where consumers may be less familiar with the specific characteristics and benefits of premium latex over cheaper synthetic alternatives.

In conclusion, the Latex Mattress Toppers Market is characterized by a strong consumer-pull dynamic driven by health consciousness and sustainability trends. The path to market leadership involves strategic alignment across the value chain, from securing ethical, high-quality raw material sources to deploying advanced AI-driven customer engagement and personalization tools. Operational excellence in handling the logistics of bulky, high-value goods is equally critical. The market is poised for expansion, prioritizing quality, certification, and targeted innovation over mass-market volume, ensuring its status as a premium segment within the global sleep accessories industry for the foreseeable future.

The strategic deployment of manufacturing techniques to address climate-specific requirements is also emerging as a pivotal factor. For markets prone to high humidity, manufacturers are exploring enhancements to the latex composition to resist mold and mildew more effectively, maintaining product integrity and hygiene over extended periods. This adaptation demonstrates the industry's commitment to creating regionally optimized products, moving beyond a one-size-fits-all approach. The integration of antimicrobial treatments, often naturally derived from plant extracts, into the latex structure provides an additional layer of value, reinforcing the product's image as a clean and healthy sleep environment solution, further driving consumer acceptance in health-focused markets.

Technological advancement is not limited to material science; it extends into operational efficiency. The use of robotics and advanced automation in the molding and finishing stages of the Dunlop and Talalay processes is becoming prevalent. This minimizes human error, ensures batch-to-batch consistency, and accelerates production cycles, allowing companies to meet the volatile demand peaks associated with e-commerce promotional events. Investing in such capital-intensive automation is a clear trend among market leaders aiming for higher throughput and reduced labor costs, securing a long-term cost advantage despite the high raw material costs inherent to the natural latex industry. This dual focus on product quality and manufacturing efficiency defines the modern competitive strategy.

The financial viability of new market entrants often hinges on their ability to secure exclusive distribution agreements or establish strong, trust-based relationships with specific raw material suppliers. Barriers to entry remain high due to the specialized nature of the processing machinery (especially Talalay) and the significant upfront capital required. Therefore, much of the innovation and market disruption is expected to come either from established bedding giants leveraging their existing distribution networks or from well-funded, agile specialty firms utilizing sophisticated digital marketing to capture niche segments.

Furthermore, the segmentation based on thickness is revealing a preference shift. While 2-inch and 3-inch toppers remain standard, there is an increasing demand for 4-inch or thicker layers, which essentially function as a partial mattress replacement, offering maximum cushioning and support adjustment. This trend reflects consumers' willingness to invest substantially in modifying their current sleep system rather than replacing the entire mattress prematurely. This high-end thickness segment often commands the highest margins and requires the purest quality of natural latex to ensure long-term performance without breakdown or compression.

The expansion into commercial applications, particularly within the luxury cruise line and boutique hotel sectors, is accelerating. These sectors prioritize materials that offer exceptional fire retardancy (often achieved through natural wool encasements rather than chemical treatments), superior guest comfort, and long operational life, making natural latex toppers a highly specified component in their procurement processes. Securing large contracts in these commercial domains provides significant volume stability and brand prestige, further legitimizing the premium positioning of latex products in the broader bedding market ecosystem.

Finally, the growing movement towards modular and customizable mattresses is opening a novel application for latex toppers. Consumers are increasingly seeking mattress systems where the comfort layers can be individually adjusted or replaced. Latex toppers fit perfectly into this modular ecosystem, allowing buyers to fine-tune firmness levels and replace worn comfort sections without discarding the entire structural core. This trend ensures the relevance of the latex topper as a flexible, integral component of future bedding design, securing its market presence well into the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager