Latex Sealant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434171 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Latex Sealant Market Size

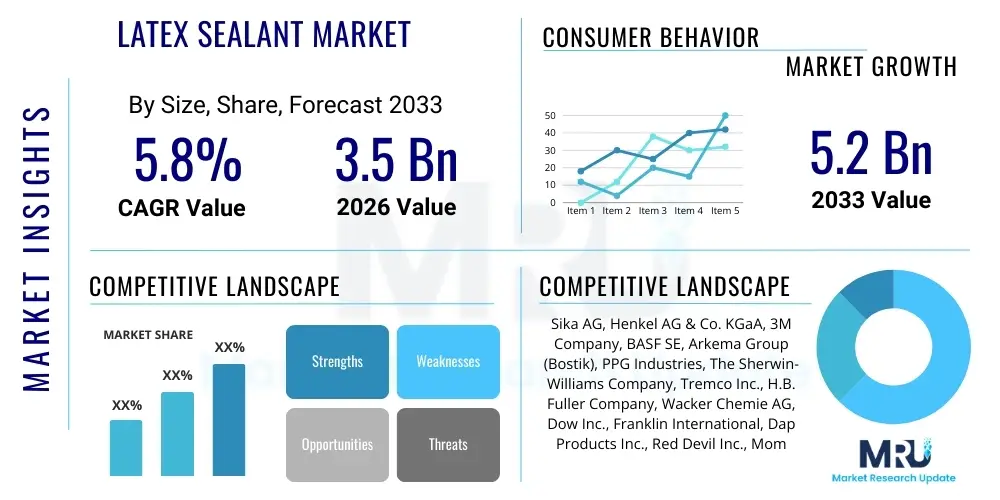

The Latex Sealant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by rising construction activities globally, particularly in emerging economies, coupled with increased consumer preference for eco-friendly, low-VOC (Volatile Organic Compound) sealing solutions. The intrinsic characteristics of latex sealants, such as ease of use, water clean-up, and paintability, make them highly desirable in both professional construction and Do-It-Yourself (DIY) sectors, securing their dominant position in general-purpose sealing applications. Market expansion is further catalyzed by stricter environmental regulations necessitating the phase-out of solvent-based alternatives.

Latex Sealant Market introduction

The Latex Sealant Market encompasses a wide range of water-based caulks and sealing compounds primarily formulated using acrylic or vinyl polymers dispersed in water. These sealants are critical components across diverse industries, offering adhesive and gap-filling properties crucial for waterproofing, air sealing, and preventing energy loss. Key applications span residential and commercial construction, remodeling, window and door installation, and general maintenance projects where expansion and contraction are minimal. Latex sealants are favored due to their inherent safety profile, low odor, non-flammability, and compatibility with a variety of porous and non-porous substrates, making them versatile tools for both specialized contractors and retail consumers.

The product description highlights characteristics such as excellent adhesion to wood, drywall, masonry, and painted surfaces. They are distinguished from solvent-based or specialized polymer sealants (like silicone or polyurethane) by their ease of application and clean-up using water, which significantly reduces project time and chemical exposure. Major applications include sealing joints around trim, baseboards, window frames, and interior structural gaps. Their affordability and performance in less demanding environments cement their position as the go-to choice for interior and sheltered exterior applications where moderate movement capability is sufficient. The primary benefit derived is long-term protection against moisture intrusion and air leakage, improving energy efficiency and structural longevity of buildings.

Driving factors propelling market expansion include the global infrastructure boom, increasing disposable income leading to higher residential renovation rates, and a strong regulatory push towards sustainable building materials. Furthermore, continuous product innovation, particularly the development of high-performance acrylic latex formulations offering improved flexibility and crack resistance, ensures the relevance of latex sealants against competing technologies. The growing DIY culture, especially in North America and Europe, acts as a significant volume driver, as latex sealants are widely accessible and user-friendly for non-professionals, minimizing the need for specialized tools or extensive training.

Latex Sealant Market Executive Summary

The Latex Sealant Market is characterized by robust growth driven by favorable construction sector dynamics and stringent environmental standards favoring water-based products. Key business trends include intense competition focused on product differentiation through enhanced durability, color matching capabilities, and specialized formulations (e.g., mold- and mildew-resistant variations). Companies are heavily investing in vertical integration and optimizing supply chains to manage fluctuating raw material costs, particularly acrylic monomers. Strategic partnerships with major distributors and large retail chains remain crucial for maximizing market penetration and capturing the high-volume consumer segment. Consolidation among smaller players is also observed as larger corporations seek to acquire niche technologies and expand their geographic footprint, aiming for economies of scale and broader product portfolios that cater to diverse market needs, from professional builders to individual homeowners.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, primarily due to rapid urbanization, massive government investment in infrastructure projects, and expanding manufacturing bases in countries like China and India. North America and Europe represent mature markets, emphasizing premium, high-performance, and sustainable offerings (low-VOC, bio-based content). Segmentation trends indicate that the Construction segment, specifically residential repair and remodeling, maintains the largest market share, fueled by aging infrastructure requiring persistent maintenance. By product type, acrylic latex remains dominant due to its cost-effectiveness, though modified latex blends offering superior elasticity and exterior performance are gaining traction, signaling a shift towards higher-value applications.

Overall, the market outlook is overwhelmingly positive, leveraging the dual advantage of regulatory support for green chemicals and sustained global construction demand. The central strategic imperatives for market participants involve ensuring competitive pricing while simultaneously innovating to meet evolving performance demands. Success in the forecast period hinges on adapting supply chains to geopolitical risks, exploiting digital channels for consumer engagement, and developing specialty sealants that bridge the performance gap between traditional latex and high-end elastomeric alternatives, thereby expanding the potential application range of water-based technology beyond interior and light-duty exterior use.

AI Impact Analysis on Latex Sealant Market

User queries regarding AI's impact on the Latex Sealant Market frequently center on themes such as optimization of formulation processes, efficiency improvements in manufacturing, predictive maintenance for production machinery, and sophisticated demand forecasting. Consumers and industry professionals are keenly interested in whether AI can assist in developing next-generation, high-performance latex sealants faster and cheaper, particularly formulations that mimic the durability of solvent-based products while maintaining water cleanup characteristics. Key concerns revolve around the integration costs of AI tools, the required data infrastructure, and the potential for AI-driven automation to disrupt existing labor patterns in sealant manufacturing and distribution logistics. Users expect AI to stabilize volatile raw material procurement through precise forecasting and enhance quality control by identifying microscopic defects during the curing and packaging stages.

Artificial Intelligence (AI) integration is primarily focused on enhancing operational efficiency within the manufacturing ecosystem. Machine learning algorithms are being deployed to analyze complex chemical reaction parameters, optimizing blending times and curing temperatures, which reduces batch variation and raw material waste, leading to substantial cost savings. Furthermore, predictive analytics models are becoming essential tools for supply chain resilience. By analyzing macroeconomic indicators, geopolitical events, and historical procurement data, AI systems can forecast the availability and pricing trends of critical inputs like acrylic acid monomers, enabling proactive purchasing strategies and minimizing supply disruptions for manufacturers. This precision in production and procurement minimizes lead times and maximizes production throughput.

The secondary impact of AI lies in enhancing market responsiveness and product development velocity. AI-driven sentiment analysis of online reviews and contractor feedback allows R&D teams to quickly identify unmet needs and performance shortcomings in existing products, accelerating the innovation cycle. Moreover, advanced simulation software powered by AI can model the long-term performance and durability of new latex formulations under various climate conditions without extensive, time-consuming field trials. This capability significantly reduces the time-to-market for specialized sealants, such as those optimized for extreme humidity or UV exposure, solidifying the competitive edge for firms embracing these digital transformation tools.

- AI optimizes chemical formulation recipes, reducing material wastage and ensuring consistent product quality.

- Machine learning models improve supply chain resilience by predicting volatility in raw material (e.g., acrylic monomer) pricing and availability.

- Predictive maintenance algorithms minimize unplanned downtime in high-volume sealant manufacturing lines.

- AI-driven analysis of user feedback accelerates the development of specialized, high-performance latex variants.

- Advanced robotics guided by AI enhances automated packaging and quality control inspections, identifying packaging defects faster than human operators.

DRO & Impact Forces Of Latex Sealant Market

The Latex Sealant Market is influenced by a powerful combination of drivers (D), restraints (R), and opportunities (O), which collectively shape the market’s trajectory and impact forces. Primary drivers include sustained global construction and renovation activities, particularly the strong emphasis on energy efficiency and green building codes that mandate air sealing using low-VOC materials. Opportunities arise predominantly from technological advancements, such as the synthesis of highly elastomeric latex polymers that can compete with high-end silicone in specific exterior applications, broadening the addressable market. However, the market faces significant restraints, including the inherent performance limitations of standard latex compared to specialized sealants in high-movement joints or submerged environments, alongside the volatile pricing of petrochemical-derived raw materials, which pressure manufacturers' profit margins and pricing stability. These interacting forces create a dynamic environment where sustainability and cost-effectiveness are key competitive battlefield determinants.

Impact forces dictate the rate and extent of market acceptance. The environmental impact force is particularly strong, with government mandates and public demand favoring water-based, non-toxic products, pushing traditional solvent-based competitors into niche applications or obsolescence. Economically, the cost-effectiveness and ease of use of latex sealants serve as a powerful force driving adoption, especially in the price-sensitive residential and DIY segments, enabling broad consumer access to effective sealing solutions. Technologically, ongoing innovation in cross-linking agents and polymer modification is gradually overcoming historical weaknesses related to flexibility and water resistance, expanding the utility of latex sealants into more rigorous external environments. The societal force, driven by increasing awareness of indoor air quality (IAQ), reinforces the shift towards low-odor and low-emitting sealants.

Manufacturers must strategically navigate these forces, leveraging the environmental drivers and technological opportunities while mitigating the risk posed by raw material price instability and performance restraints. This involves securing stable supply agreements, investing heavily in R&D to enhance product specifications, and clearly communicating the low-VOC benefits to the professional and consumer markets. The successful deployment of next-generation, high-solids latex formulations that offer minimal shrinkage and exceptional durability represents the principal means of converting inherent opportunities into tangible market share gains over the forecast period, ensuring sustained growth despite external economic pressures and competition from high-performance hybrid sealants.

Segmentation Analysis

The Latex Sealant Market is comprehensively segmented based on product type, application, end-user, and geography, allowing for precise analysis of market dynamics across diverse sectors. Product segmentation typically differentiates between pure acrylic latex, vinyl acrylic latex, and specialized blends, with acrylic dominating due to its balance of performance and cost. Application segmentation focuses on general-purpose sealing, waterproofing, gap filling, and architectural joint sealing, reflecting the versatility of the product. End-user analysis divides the market into residential construction (new build and renovation), commercial construction, industrial, and DIY sectors, recognizing the unique purchasing patterns and volume demands of each group. Understanding these segmentations is critical for manufacturers to tailor product specifications, pricing strategies, and distribution channels effectively, ensuring optimal market fit and maximized revenue capture across the value chain, from bulk industrial sales to single-unit consumer transactions.

- By Product Type:

- Acrylic Latex Sealant

- Vinyl Acrylic Latex Sealant

- Styrene-Butadiene Rubber (SBR) Latex Sealant

- Modified/Elastomeric Latex Sealant (High-performance blends)

- By Application:

- Construction (Residential, Commercial, Institutional)

- Industrial Sealing

- Automotive and Transportation

- DIY and Home Improvement

- Window and Door Installation

- General Maintenance and Repair

- By End-User:

- Professional Contractors

- Industrial Users

- Retail Consumers (DIY)

- By Distribution Channel:

- Direct Sales

- Distributors and Wholesalers

- Retail Stores (Home Centers, Hardware Stores)

- E-commerce Platforms

Value Chain Analysis For Latex Sealant Market

The value chain for the Latex Sealant Market begins with the upstream procurement of essential raw materials, dominated by petrochemical derivatives, specifically acrylic acid, vinyl acetate monomers, and various fillers (calcium carbonate, talc). This phase is characterized by intense price sensitivity and reliance on major chemical suppliers, often necessitating long-term supply contracts to mitigate volatility. Upstream analysis focuses on ensuring the stability of monomer supply and the quality control of specialized additives, such as rheology modifiers, biocides, and plasticizers, which determine the final performance characteristics like viscosity, shelf life, and mold resistance. Manufacturers often invest heavily in securing proprietary polymer technologies that offer superior elasticity and adhesion, creating a competitive barrier to entry for new market players.

The core of the value chain is the manufacturing process, involving polymerization (if performed in-house) and compounding, where raw materials are meticulously blended and dispersed in water. Downstream analysis focuses on effective distribution and market access. Sealants are typically heavy and volume-sensitive, making efficient logistics crucial for maintaining profitability. The distribution channels are highly diversified, ranging from direct sales to large construction firms for bulk orders, to complex networks utilizing specialized chemical distributors, and finally, reaching end-users through extensive retail networks (big-box home improvement stores) and a growing e-commerce presence. Effective inventory management at the distribution level is vital due to the limited shelf life of some water-based formulations, ensuring product freshness upon application.

The channel strategy typically involves a dual approach: direct channels are used for high-volume, B2B industrial clients requiring technical support and customized formulations, while indirect channels (retail and e-commerce) handle the vast, high-frequency, lower-volume consumer and contractor sales. E-commerce platforms are increasingly important not just for sales but for product education and brand visibility. The competitive advantage downstream is often secured through strong brand recognition, expansive retail shelf placement, and highly responsive technical service, ensuring contractors adopt and trust the product for critical structural sealing applications. The entire chain is optimized to deliver a low-cost, high-performing, easy-to-use product efficiently to a geographically dispersed end-user base.

Latex Sealant Market Potential Customers

The primary customer base for the Latex Sealant Market is remarkably broad, spanning professional tradespeople, large-scale construction companies, specialized subcontractors, and the mass consumer market engaged in Do-It-Yourself (DIY) projects. Professional contractors, including painters, drywall installers, window and door specialists, and general remodelers, constitute the largest volume consumers. These buyers prioritize application speed, paintability, minimal shrinkage, and reliable long-term adhesion for interior and sheltered exterior environments. Their purchasing decisions are heavily influenced by bulk pricing, brand reputation for consistency, and ease of compliance with regulatory standards, particularly low-VOC requirements. Manufacturers target these professionals through specialized distribution channels and tailored technical support programs, ensuring product efficacy across diverse construction materials and techniques.

The residential and commercial construction sectors are the foundational end-users, requiring vast quantities of general-purpose sealants for finishing work, air sealing, and energy efficiency upgrades in new builds and existing structures. Within the residential sector, homeowners represent a critical, highly dispersed segment driven by renovation cycles and basic home maintenance needs. These consumers prioritize ease of use (simple water cleanup), accessibility (availability at local hardware stores), and specific features such as resistance to mold and mildew in high-humidity areas like bathrooms and kitchens. Marketing efforts aimed at the DIY segment focus heavily on clear instructional labeling, attractive packaging, and affordable price points, often leveraging retail brand loyalty and seasonal promotional activities to stimulate purchases.

Furthermore, specialized industrial and manufacturing sectors utilize latex sealants for specific applications where solvent compatibility is a concern or where moderate movement and damp conditions are present, such as assembly of modular units or sealing in controlled environments. While these industrial applications represent a smaller volume share compared to construction, they often require customized formulations, driving innovation in areas like temperature resistance or specialized color options. Overall, potential customers seek a dependable, environmentally compliant, and cost-effective sealing solution, positioning latex sealants as the default choice for non-structural, general-purpose gap filling and weatherization projects across almost every segment of the built environment and consumer repair market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, Henkel AG & Co. KGaA, 3M Company, BASF SE, Arkema Group (Bostik), PPG Industries, The Sherwin-Williams Company, Tremco Inc., H.B. Fuller Company, Wacker Chemie AG, Dow Inc., Franklin International, Dap Products Inc., Red Devil Inc., Momentive Performance Materials, Soudal N.V., Illinois Tool Works (ITW), KCC Corporation, Selena FM S.A., Mapei S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Latex Sealant Market Key Technology Landscape

The core technology underpinning the Latex Sealant Market is emulsion polymerization, which allows polymers like acrylic and vinyl acetate to be synthesized and dispersed stably in water, forming a fluid, easy-to-apply compound. Recent technological advancements, however, are focused primarily on modifying the polymer backbone and incorporating advanced additives to overcome the traditional performance trade-offs associated with water-based systems. A key innovation is the shift towards higher solids content and lower volatile organic compounds (VOCs). High-solids formulations minimize shrinkage during the curing process, a major drawback of older latex sealants, thus improving the aesthetics and long-term durability of the sealed joint. Furthermore, the development of specialized cross-linking agents allows the latex film to achieve a more robust, elastomeric structure upon drying, significantly enhancing flexibility and resistance to cracking, enabling use in moderate movement joints previously reserved for high-performance polyurethane or silicone sealants.

Another crucial technological development involves advancements in hybrid formulations, often termed "modified acrylic latex" or "elastomeric sealants." These products frequently incorporate technologies borrowed from silicone or polyurethane chemistry, such as silanized acrylics, to improve adhesion to difficult substrates (like vinyl or glass) and dramatically boost water and UV resistance for exterior applications. The goal is to deliver near-silicone performance with the convenience of water cleanup and paintability. The use of specialized biocides and mildewcides is also continuously evolving, with formulators introducing encapsulated or non-leaching preservative technologies to provide long-lasting mold and mildew resistance, particularly vital for sealants used in high-humidity areas such as kitchens and bathrooms. This focus on performance enhancement is directly responsive to contractor demand for versatile products that reduce the complexity of material selection on job sites.

Digitalization also plays a role in the technology landscape, particularly in precision blending and color matching. Sophisticated Spectrophotometry systems and linked databases ensure manufacturers can rapidly formulate and produce custom-colored sealants to match specific paint lines or architectural finishes, catering to high-end construction and refurbishment projects. Automated quality assurance systems utilizing sensors and machine vision are implemented in production lines to monitor viscosity, consistency, and particle size distribution in real-time, ensuring stringent quality standards are maintained across high-volume production. This commitment to chemical innovation and manufacturing precision is essential for solidifying the market position of latex sealants as a dependable, environmentally superior alternative to legacy solvent-based products in increasingly demanding application environments, ultimately driving the shift towards sustainable construction practices globally.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by massive urbanization, substantial government investments in public infrastructure (roads, bridges, utilities), and rapid expansion of the housing sector, particularly in China, India, and Southeast Asian nations. The region is transitioning from basic construction materials to higher-quality, compliant sealants, fueled by stricter building codes focused on energy efficiency and low-VOC emissions. China's massive consumption base and expanding manufacturing capabilities position it as both a major producer and consumer.

- North America: North America holds a significant market share, characterized by a highly mature market, strong environmental regulations (e.g., California's air quality standards), and a robust DIY culture. Demand here is strongly focused on high-performance elastomeric latex sealants suitable for renovation, repair, and remodeling (RR&M) activities. The adoption of energy-efficient windows and siding requires large volumes of specialized, flexible exterior sealants.

- Europe: Europe is a mature market prioritizing sustainability and innovation. Stringent regulations like REACH and directives favoring green public procurement accelerate the shift towards advanced low-VOC and bio-based latex formulations. Western European nations, notably Germany and the UK, demand premium-quality sealants with excellent durability and fire resistance. The renovation wave aiming for carbon neutrality in buildings provides a long-term demand catalyst for high-efficiency sealants.

- Latin America (LATAM): Growth in LATAM is tied to fluctuating but generally increasing construction activity, particularly in Brazil and Mexico. The market is price-sensitive, leading to high demand for cost-effective, standard acrylic latex sealants. Infrastructure development remains a crucial driver, although political and economic instability can temper growth rates and investment certainty in the short term.

- Middle East and Africa (MEA): The MEA region exhibits moderate but significant growth, driven by large-scale commercial and residential projects in the GCC states (Saudi Arabia, UAE). Demand is highly influenced by the extreme climate, necessitating latex sealants with superior heat, UV, and sand abrasion resistance. South Africa acts as a regional hub for manufacturing and distribution within the African continent, leveraging its developed industrial base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Latex Sealant Market.- Sika AG

- Henkel AG & Co. KGaA

- 3M Company

- BASF SE

- Arkema Group (Bostik)

- PPG Industries

- The Sherwin-Williams Company

- Tremco Inc.

- H.B. Fuller Company

- Wacker Chemie AG

- Dow Inc.

- Franklin International

- Dap Products Inc.

- Red Devil Inc.

- Momentive Performance Materials

- Soudal N.V.

- Illinois Tool Works (ITW)

- KCC Corporation

- Selena FM S.A.

- Mapei S.p.A.

Frequently Asked Questions

Analyze common user questions about the Latex Sealant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a latex sealant and how does it differ from silicone?

Latex sealants are water-based compounds typically using acrylic polymers, offering easy water cleanup, excellent paintability, and low odor, making them ideal for interior and sheltered exterior applications. Silicone sealants are solvent-based elastomers offering superior flexibility and water resistance for high-movement and permanent exterior/wet area sealing, but they cannot typically be painted and require chemical cleanup.

What are the primary drivers of growth in the Latex Sealant Market?

The primary growth drivers are increasing residential and commercial construction activity, especially remodeling; stringent governmental regulations mandating the use of low-VOC, water-based products for improved air quality; and the sustained popularity of DIY home improvement projects due to the product’s ease of use and affordability.

Are latex sealants considered eco-friendly and low-VOC?

Yes, modern latex sealants are generally recognized as environmentally superior to traditional solvent-based counterparts. They are inherently low in VOCs (Volatile Organic Compounds) and often adhere to strict green building standards, meeting the rising demand for sustainable construction materials.

Which region currently dominates the global consumption of latex sealants?

North America and Europe traditionally hold significant market share due to mature construction sectors and high environmental awareness. However, the Asia Pacific region is expected to exhibit the highest growth rate due to rapid infrastructure development and urbanization in emerging economies like China and India.

What key innovations are shaping the future performance of latex sealants?

Key innovations include the development of high-solids, low-shrinkage formulations, the incorporation of cross-linking agents to boost elasticity (elastomeric latex), and hybrid technologies that improve exterior durability and adhesion, allowing latex products to compete in applications previously limited to specialized chemical sealants.

What are the typical application areas for high-performance elastomeric latex sealants?

High-performance elastomeric latex sealants are specifically designed for applications requiring greater flexibility than standard acrylics, such as sealing wider joints, around doors and windows subject to moderate movement, and exterior perimeter sealing where UV exposure and temperature fluctuations are significant concerns, while still maintaining paintability and water cleanup convenience.

How does raw material volatility affect the profitability of latex sealant manufacturers?

Raw material volatility, primarily concerning the pricing of acrylic monomers derived from petrochemicals, poses a significant restraint. Fluctuating costs compress profit margins for manufacturers, leading to increased pressure to optimize production processes, secure long-term supply agreements, or pass increased costs onto end-users, potentially affecting competitive pricing strategies.

What role does the DIY segment play in the Latex Sealant Market?

The DIY segment is a crucial volume driver, particularly in developed markets. Latex sealants are favored by retail consumers due to their user-friendliness, simple application method, and easy water cleanup, making them the default choice for general home repair, painting preparation, and basic gap filling tasks.

How do manufacturers ensure quality control in mass production of latex sealants?

Quality control is maintained through rigorous testing of incoming raw materials, precise computer-controlled blending processes, and the use of automated systems, including real-time viscosity and particle size measurement, often complemented by AI-driven analysis to ensure batch-to-batch consistency and conformity to established product specifications, minimizing performance variability.

What is the significance of the "Low-VOC" label in the market?

The "Low-VOC" label is critical as it indicates compliance with modern health and environmental standards, particularly regarding indoor air quality (IAQ). This designation drives professional contractor selection and is often a mandatory requirement for large-scale commercial and institutional construction projects across North America and Europe.

How is the market addressing the potential for mold and mildew growth in humid environments?

Manufacturers are addressing mold and mildew concerns by incorporating specialized, durable biocides and fungicides into latex formulations. Advanced products often feature non-leaching preservative technologies that provide long-term resistance, making them suitable for high-humidity areas like kitchens, bathrooms, and utility rooms where moisture accumulation is common.

What differentiates vinyl acrylic latex from pure acrylic latex sealants?

Pure acrylic latex generally offers superior adhesion, elasticity, and exterior durability compared to vinyl acrylic latex. Vinyl acrylic is typically the most economical option, offering excellent paintability and suitable performance for interior, static joints and light-duty applications where cost-effectiveness is the primary concern.

How important are distribution channels for market penetration?

Distribution channels are extremely important. For professional sales, manufacturers rely on specialized distributors and direct B2B contacts. For the high-volume consumer market, strong partnerships with major retail home centers and a robust e-commerce presence are essential for ensuring wide geographical coverage and immediate product accessibility to both contractors and DIY customers.

What impact does the growth of smart cities and green buildings have on demand?

The growth of smart cities and green buildings significantly boosts demand for latex sealants. These initiatives emphasize energy efficiency, requiring high-performance air sealing and insulation, and mandate the use of sustainable, low-emission materials, perfectly aligning with the core attributes of advanced water-based latex products.

Why is paintability a crucial feature for latex sealants?

Paintability is a crucial feature, especially for interior and finishing applications, as it allows the sealed joint to seamlessly blend with surrounding surfaces, providing an aesthetically pleasing finish. Latex sealants are generally preferred by painters and finish carpenters over silicone due to their strong compatibility with various paint types without requiring specialized primers.

How is the automotive industry utilizing latex sealants?

While specialized elastomers dominate heavy-duty automotive applications, specific types of latex or water-based hybrid sealants are increasingly used in light-duty applications such as noise damping, non-critical seam sealing, and assembly of interior components where low odor and ease of application are valued, contributing to overall safety and environmental compliance in assembly plants.

What challenges do latex sealants face regarding cold weather application?

Latex sealants face challenges in cold weather because they are water-based. Freezing during storage or application can compromise the emulsion stability, destroying the sealant's integrity and rendering it unusable. Manufacturers mitigate this by developing freeze-thaw stable formulas, but professional application is generally recommended above 40°F (4°C).

What is the concept of 'modified latex' and its market relevance?

'Modified latex' refers to advanced formulations that incorporate proprietary additives or blend acrylics with other polymers (like siliconized acrylics) to enhance elasticity, durability, and resistance to harsh environmental conditions. This modification is key to expanding the market reach of latex sealants into more demanding exterior and high-movement applications, challenging traditional solvent-based competitors.

How does inflation and economic instability affect consumer demand?

In periods of inflation and economic instability, professional construction may slow, but the consumer DIY segment often increases as homeowners opt for cheaper maintenance and repair projects rather than expensive professional services or full renovations. This shift favors affordable, user-friendly latex sealants over high-end alternatives.

What steps are manufacturers taking to improve the UV resistance of exterior latex products?

To improve UV resistance, manufacturers are utilizing higher-quality acrylic polymers that inherently resist degradation from sunlight and incorporating specialized UV stabilizers and light absorbers into the formulation. This technological refinement ensures that exterior latex sealants maintain color stability and structural integrity over long exposure periods, preventing premature cracking or yellowing.

How do manufacturing processes leverage technology to enhance quality?

Modern manufacturing utilizes automated, closed-loop systems powered by advanced sensors and control algorithms to manage precise ingredient dosing, mixing speed, and reaction temperatures. This technological control ensures uniformity in particle size and dispersion quality, which directly translates to consistent product performance, optimal shelf life, and minimal batch variations across all production sites.

What are the key concerns related to the long-term adhesion of latex sealants?

Key concerns related to long-term adhesion often involve application over unprepared, dirty, or improperly primed surfaces, or use in joints subject to excessive, prolonged movement or immersion. Manufacturers address this by offering advanced adhesion promoters in high-end formulations and providing clear guidance on surface preparation and joint size limitations for optimal performance.

Why is the repair and remodeling (RR&M) segment so vital for latex sealant sales?

The RR&M segment is vital because every repair or refurbishment project, particularly concerning windows, doors, trim, and baseboards, requires gap filling and finishing work. Latex sealants are the standard product used by contractors and homeowners for these tasks due to their paintability and ease of use, ensuring a steady, high-volume demand regardless of new construction cycles.

How are geopolitical factors influencing the procurement of raw materials?

Geopolitical factors, such as trade disputes, tariffs, and regional conflicts, significantly influence the global supply chain for petrochemicals, leading to price spikes and procurement instability for acrylic monomers. Manufacturers must diversify their sourcing and build strategic inventory reserves to mitigate the risk posed by such external pressures on their input costs.

What technical advantages do latex sealants offer for the painting industry?

For the painting industry, latex sealants offer significant technical advantages, primarily their rapid curing time (often faster than oil-based putty) and their smooth, paintable surface finish that accepts both latex and oil-based paints without bleeding or discoloration, resulting in professional, seamless cosmetic results essential for high-quality finishing work.

How do manufacturers customize formulations for specific geographic climate requirements?

Manufacturers customize formulations by adjusting polymer composition and additive packages based on regional climate needs. For example, sealants for hot, arid climates feature enhanced UV resistance and flexibility stabilizers, while those for cold, wet regions focus on maximized adhesion in damp conditions and superior freeze-thaw stability.

What types of industrial applications utilize high-grade latex sealants?

High-grade latex sealants are used in industrial applications such as sealing joints in pre-fabricated building modules, assembly line applications where workers require low-odor materials, and specific areas within HVAC ducting or clean rooms where water-based, non-flammable materials are preferred or mandated by safety regulations.

How does e-commerce impact the competitive landscape for latex sealants?

E-commerce intensifies competition by expanding product visibility and enabling niche brands to compete nationally or globally. It also forces traditional manufacturers to refine their packaging for direct shipping and invest in detailed online content and educational resources to serve the DIY segment effectively without relying solely on in-store guidance.

What are the limitations of standard acrylic latex sealants concerning joint movement?

Standard acrylic latex sealants typically have limitations regarding joint movement, often accommodating only ±7% to ±12% movement. If used in highly dynamic joints (e.g., expansion joints or material interfaces with high thermal cycling), they can crack or lose adhesion prematurely, necessitating the use of specialized elastomeric or hybrid sealants.

How is the market responding to demand for colored sealants?

The market is responding robustly to the demand for colored sealants by offering extensive color palettes and utilizing advanced tinting systems. This allows for superior color matching with common architectural elements like gutters, siding, and trim, moving beyond the traditional white, clear, and almond options to serve specialized aesthetic and restoration projects.

What is the typical shelf life of a quality latex sealant product?

The typical shelf life for a quality, unopened latex sealant cartridge stored under proper climate-controlled conditions (cool, dry) ranges from 12 to 24 months. Exceeding this period or improper storage can lead to phase separation, hardening, or loss of workability due to the nature of the water-based emulsion.

Why are latex sealants often preferred over polyurethane in residential remodeling?

Latex sealants are preferred over polyurethane in residential remodeling primarily because they are much easier to work with, feature water cleanup, possess low odor, and are readily paintable. Polyurethane, while highly durable, is more difficult to tool, requires solvents for cleanup, and often demands specialized preparation before painting.

What is the significance of the "ASTM" standard in the latex sealant industry?

The ASTM (American Society for Testing and Materials) standard, particularly specifications like ASTM C834 for latex sealing compounds, is highly significant. It provides a benchmark for minimum performance requirements related to adhesion, flexibility, and weathering, offering consumers and professionals assurance of product quality and reliability for specified applications.

How do bioplastics and bio-based materials factor into future latex sealant development?

Bioplastics and bio-based materials represent a key opportunity. Research focuses on replacing a portion of petrochemical derivatives (like acrylic acid) with renewable sources, such as bio-derived monomers or plant-based fillers, to further reduce the carbon footprint and enhance the sustainability profile of latex sealants, aligning with circular economy goals.

What are the strategic implications of vertical integration in this market?

Vertical integration, where a sealant manufacturer controls the production of its core polymers or raw additives, offers significant strategic implications. It ensures greater control over material quality, stabilizes procurement costs, and allows for rapid, proprietary customization of polymer technology, thus creating a strong competitive advantage in both cost structure and product innovation speed.

How does shrinkage affect the performance and aesthetics of a sealed joint?

Shrinkage occurs as the water evaporates from the sealant compound during curing. Excessive shrinkage can lead to cracking, pulling away from the joint edges (loss of adhesion), or creating visible depressions. Modern high-solids latex formulations are designed specifically to minimize shrinkage, maintaining the desired joint geometry and aesthetic finish.

What is the primary factor driving the high market growth rate in APAC?

The primary factor driving high market growth in APAC is the unprecedented scale of infrastructure development and housing expansion across densely populated countries. This demand, combined with an increasing shift towards adopting higher-quality, foreign-standard construction materials, fuels substantial consumption volumes of latex sealants.

How do manufacturers utilize digital tools for demand forecasting and inventory management?

Manufacturers utilize sophisticated digital tools, often incorporating AI and machine learning, to analyze point-of-sale data, historical trends, and economic indicators. This allows for highly accurate, localized demand forecasting, optimizing inventory levels in distribution centers and retail stores, thereby reducing warehousing costs and minimizing stock-outs.

What risks are associated with the improper application of latex sealants?

Risks associated with improper application include poor adhesion (due to dusty surfaces), insufficient curing (due to high humidity or low temperatures), and joint failure (due to overfilling or use in excessively wide or dynamic gaps). These risks lead to moisture intrusion, mold growth, and the need for costly rework, undermining the perceived quality of the product.

How do market leaders differentiate their standard acrylic latex products?

Market leaders differentiate standard acrylic latex products by focusing on incremental improvements in key characteristics such as minimal shrinkage, extended durability, superior resistance to dirt pick-up, and guaranteed performance lifespan. Strong branding, trusted warranties, and expansive retail placement also serve as crucial differentiation strategies in the highly competitive commodity segment.

What is the market relevance of water-based sealant technology beyond construction?

Beyond construction, water-based sealant technology is relevant in manufacturing processes, such as assembling appliances or modular furniture, where health and safety regulations prohibit solvent fumes. Their use is crucial in applications requiring non-flammable, low-toxicity materials near sensitive electronics or restricted ventilation zones, ensuring worker safety and product integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager