Laundry Detergent Sheets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436586 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Laundry Detergent Sheets Market Size

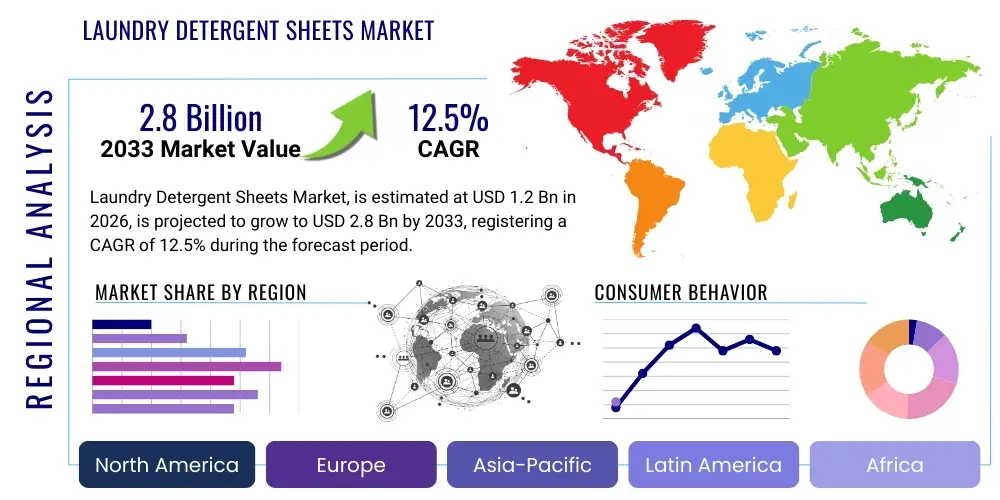

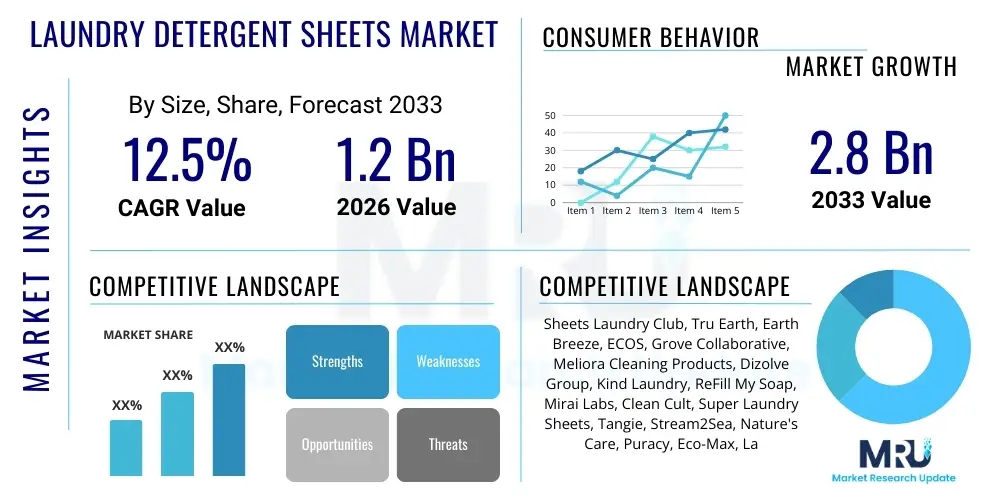

The Laundry Detergent Sheets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Laundry Detergent Sheets Market introduction

Laundry detergent sheets represent a significant evolution in the home care industry, moving away from traditional liquid and powder formats toward highly concentrated, water-soluble strips. These sheets are pre-measured, lightweight, and dissolve quickly in both hot and cold water, offering a supremely convenient, mess-free alternative to conventional detergents. The core product composition typically involves a sophisticated blend of potent cleaning agents, advanced surfactants (such as anionic and nonionic varieties optimized for cold water solubility), proprietary binding polymers (often food-grade PVA or similar biodegradable alternatives), and encapsulated essential oils or synthetic fragrances. This innovative format is characterized by its extremely low water content, resulting in a product that is highly efficient in terms of chemical concentration per load. The fundamental mechanism involves depositing the concentrated active ingredients onto a stable substrate which instantly disperses upon contact with water, releasing cleaning power precisely where and when needed. The initial introduction of these sheets targeted niche markets focused on deep sustainability, but rapid efficacy improvements have propelled them into the mainstream cleaning aisle, appealing to a much wider consumer demographic seeking simplicity and environmental responsibility in their daily routines.

Major applications for laundry detergent sheets span the entire spectrum of cleaning needs, ranging from standard residential use in conventional washing machines to highly specific commercial and niche applications. In the residential sector, they are rapidly gaining traction among Millennials and Generation Z consumers who consciously adopt zero-waste and minimalist lifestyles, valuing products that align with their ethical consumption mandates. Furthermore, the compact and lightweight nature makes them indispensable for specific niche markets such as frequent travelers, campers, military personnel, and residents of small urban apartments where space economy is paramount. Commercially, applications include small-to-medium sized laundromats, boutique hotels, cruise ships, and specific healthcare environments where consistent dosing and minimizing bulk storage are critical operational advantages. The primary benefits driving widespread adoption are multifold and transcend mere cleaning efficacy. The benefit of precise dosing eliminates guesswork, prevents potential fabric damage from overuse, and guarantees substantial cost savings over time. Moreover, the environmental superiority, stemming from the elimination of heavy plastic packaging and the drastic reduction in shipping weight, significantly lowers the overall carbon footprint associated with the product’s lifecycle, offering consumers a demonstrable path toward reduced environmental impact. Continuous investments in research and development are yielding sheets capable of handling specialized tasks, such as high-efficiency (HE) machine compatibility, specialized stain removal for baby clothing, and formulations optimized for specific fabric types like athletic wear or delicate woolens, broadening the product's functional utility.

The proliferation of laundry detergent sheets is driven by several macroeconomic and behavioral factors. Foremost among these is the escalating global imperative to address plastic pollution, bolstered by governmental legislation and consumer activism demanding sustainable alternatives. Regulatory actions, particularly in major economic zones like the EU and Canada, have placed explicit pressure on manufacturers to minimize packaging waste, making the sheet format an attractive compliance solution. The concurrent explosion of e-commerce and direct-to-consumer (D2C) business models has provided the perfect logistical platform for this product category. The low volumetric weight of the sheets translates directly into significantly reduced fulfillment and freight costs, making D2C distribution highly profitable compared to shipping heavy liquids. Furthermore, rapid technological maturation in green chemistry has ensured that performance parity with traditional detergents is maintained or even exceeded, alleviating the primary consumer concern regarding efficacy. Manufacturers are continuously integrating innovative features, such as biodegradable color-safe brighteners, built-in natural fabric conditioners, and hypoallergenic formulations certified by dermatologists, transforming the sheets from a novelty item into a high-performance household staple. This synergy of environmental demand, logistical efficiency, and technological competence is fueling the market's projected compound annual growth rate through the forecast period.

Laundry Detergent Sheets Market Executive Summary

The Executive Summary delineates a market characterized by high innovation, aggressive competition, and rapid consumer adaptation to sustainable alternatives. Key business trends are heavily skewed towards mergers, acquisitions, and strategic investments by large consumer packaged goods (CPG) companies seeking immediate entry into the high-growth, eco-friendly segment, often by acquiring niche start-ups like those focused on laundry sheets. This activity validates the long-term viability of the segment. Furthermore, market players are prioritizing end-to-end supply chain transparency, utilizing advanced digital tools and blockchain technology to authenticate the sourcing of plant-derived ingredients and sustainable polymers, thereby mitigating greenwashing risks and enhancing consumer trust—a vital component of success in this environmentally sensitive market. Another defining business trend is the reliance on highly scalable, flexible manufacturing processes that can quickly adapt to changing ingredient profiles and formulation advancements, maintaining high production yields while adhering to stringent zero-waste manufacturing protocols. Subscription service models remain the operational cornerstone, ensuring predictable recurring revenue streams and fostering unparalleled customer loyalty through seamless, automated replenishment.

Regional dynamics highlight a clear division between high-value consumption and high-growth potential. North America and Europe, representing approximately two-thirds of the current market value, are driven by mature consumer willingness to pay a premium for certified sustainable, convenient products. In these regions, growth is less about initial penetration and more about market share consolidation, brand loyalty, and expanding product lines to include specialized offerings (e.g., sensitive skin, high performance). The regulatory landscape in the EU, specifically, imposes strict standards for biodegradability and chemical composition, inadvertently driving high-quality product innovation. Conversely, the Asia Pacific (APAC) region is forecasted to exhibit explosive growth, primarily stemming from markets like China, India, and Southeast Asia. This growth is accelerated by the rapid development of robust e-commerce logistics, increasing urbanization resulting in smaller living spaces, and rising consumer awareness regarding environmental contamination. The low cost of transporting detergent sheets offers significant logistical advantages in APAC’s often complex and large distribution networks, making them a cost-effective solution for both consumers and distributors compared to traditional liquids.

Segmentation trends confirm that product specialization is key to capturing diverse consumer groups. The Hypoallergenic and Sensitive Skin segments are experiencing runaway growth, reflecting global increases in environmental allergies and skin sensitivities. Consumers in this segment prioritize highly clean, simple formulations devoid of harsh dyes, artificial fragrances, and common irritants. In terms of distribution, while online D2C remains the most strategic channel for brand building and margin capture, the expansion into mass-market grocery retailers is necessary for achieving scale and converting mainstream users skeptical of online-only purchases. Ingredient-based segmentation reveals a strong preference for 100% natural, plant-derived sheets, even if they sometimes carry a slight price premium, indicating that ethical sourcing is a primary purchase determinant for the core demographic. Furthermore, packaging trends are pushing beyond mere recyclability to embrace certified home-compostable materials, responding directly to consumer demand for truly zero-waste solutions that address end-of-life disposal concerns comprehensively. This holistic approach across business models, regions, and segments ensures the market's sustained, high-double-digit growth trajectory.

AI Impact Analysis on Laundry Detergent Sheets Market

Common user inquiries regarding AI's influence in the laundry detergent sheet market predominantly center on how technology can enhance personalization, optimize supply chain sustainability, and significantly improve product formulation efficacy in varied washing conditions. Users frequently pose questions such as, "Can AI predict the optimal concentration of cleaning enzymes needed for different fabric types?" or "How can machine learning reduce manufacturing waste during the sheet cutting process?" Based on this analysis, the key themes summarizing user concerns and expectations are multifaceted. Firstly, there is a strong expectation that AI will deliver hyper-efficiency, specifically through predictive demand forecasting to minimize inventory waste, which is crucial for sustainable operations. Secondly, users anticipate AI-driven personalization, where purchasing recommendations and usage instructions are precisely tailored based on regional data (like water hardness or average wash temperature) and individual consumer profiles (e.g., family size, frequency of washing, and textile composition). Lastly, AI is expected to accelerate the R&D cycle for formulations, using simulated environments to test thousands of ingredient combinations faster than traditional laboratory methods, ensuring that new, highly effective, and completely eco-friendly sheet compositions reach the market swiftly, thereby reinforcing the market's core sustainable proposition and maintaining competitive performance against legacy detergents.

- AI algorithms optimize supply chain logistics by predicting fluctuating, hyper-localized demand for both raw materials (surfactants, binders) and finished goods, minimizing stockouts and dramatically reducing both storage costs and inventory obsolescence waste.

- Machine learning enhances product formulation development by simulating the solubility, residue levels, and cleaning efficacy of thousands of new sheet compositions under diverse, real-world variables, including regional water chemistry, fluctuating wash temperatures, and varying textile loads.

- AI-powered quality control systems utilize sophisticated computer vision and thermal imaging to perform non-destructive, real-time inspection, detecting microscopic structural flaws, inconsistencies in active ingredient distribution, or dosage variations across the sheet matrix during high-speed manufacturing.

- Predictive maintenance analytics are deployed extensively on specialized, precision sheet coating and cutting machinery, minimizing unplanned downtime by anticipating mechanical failures, which significantly improves overall equipment effectiveness (OEE) and lowers the manufacturing cost per unit dose.

- AI-driven personalized marketing platforms analyze vast datasets of consumer washing habits, purchase history, and expressed environmental commitments to generate highly targeted recommendations, offering specific sheet variants (e.g., scent intensity, hypoallergenic options) that maximize consumer satisfaction and subscription conversion rates for D2C brands.

- Advanced data analytics facilitate granular, verifiable tracking of the product lifecycle's entire environmental impact, providing validated sustainability metrics necessary for stringent third-party environmental certifications, regulatory compliance reporting, and maintaining the high level of consumer transparency required in the eco-conscious market.

- Natural Language Processing (NLP) tools analyze massive volumes of unstructured customer feedback, including social media posts, online reviews, and call center transcripts, rapidly identifying emerging user concerns regarding critical factors like fragrance intensity, dissolving speed, or packaging integrity, thereby dramatically accelerating crucial product iteration and improvement cycles.

DRO & Impact Forces Of Laundry Detergent Sheets Market

The market dynamics are fundamentally defined by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively exert substantial influence over the market's trajectory and profitability, mediated by critical Impact Forces. A predominant driver is the irrefutable global acceleration of the sustainability movement, manifesting as an urgent consumer preference shift towards plastic-free and low-carbon footprint household goods. This deep-seated behavioral change is globally consistent across developed economies, compelling established legacy detergent brands to engage in rapid, often defensive, innovation to mitigate market share erosion to agile, eco-focused startups that specialize in the sheet format. The superior convenience factor—characterized by the sheets' precise pre-measurement, extreme lightweightness, and compact form factor—serves as a robust secondary driver, resonating powerfully with modern urban lifestyles that prioritize minimalism and efficiency. Furthermore, from an operational perspective, the inherent cost savings realized in global shipping, storage density, and warehousing efficiency, directly attributable to the product’s highly compressed nature and absence of water weight, constitute a powerful economic driver for manufacturers, distributors, and retailers, fundamentally reshaping conventional supply chain protocols and retail shelf space allocation.

Restraints continue to pose challenges, primarily revolving around residual consumer skepticism regarding the efficacy of such a concentrated format, especially when tasked with confronting heavy-duty stains in regions afflicted by extremely hard water conditions. Overcoming this ingrained efficacy perception requires continuous, significant investment in developing high-performing, bio-engineered concentrated formulations and publishing transparent, third-party testing data that rigorously validates performance parity against established liquid counterparts. Another substantial restraint is the comparatively higher unit dose cost, measured on a piece-by-piece basis, when contrasted with the perceived economic value of large, bulk containers of traditional liquid detergents, a factor that can substantially deter large, price-sensitive consumer segments, particularly in high-growth emerging economies. Furthermore, the substantial initial capital expenditure required to establish specialized, high-precision sheet manufacturing lines—necessitating advanced coating and cutting machinery—acts as a considerable barrier to entry for smaller or less capitalized manufacturers seeking to scale quickly. Finally, the persistent need for extensive consumer education regarding optimal sheet usage, particularly for first-time users transitioning from decades of liquid or powder habits, necessitates sustained and considerable marketing spend, adding an ongoing operational cost burden.

Opportunities within this dynamic landscape are extensive and potentially transformative, spearheaded by the immediate and high-value potential for geographical expansion into rapidly urbanizing and digitalizing Asia Pacific (APAC) and Middle East & Africa (MEA) markets, where the confluence of rising disposable income and increasing e-commerce penetration creates ideal conditions for adoption. Significant product development opportunities exist in engineering highly specialized, multi-functional sheets that seamlessly integrate advanced stain removers, high-performance fabric conditioners, or sophisticated antimicrobial agents into a single, compact strip, thereby dramatically enhancing perceived consumer value and simplifying the wash routine further. Furthermore, establishing strategic, high-volume collaborations with large institutional clients such such as international hotel chains, major hospital networks, and contract industrial laundry services offers a lucrative pathway for substantial bulk commercial sales, leveraging the sheets' unparalleled efficiency and minimizing institutional waste handling logistics. The overarching Impact Forces, particularly the strengthening global Environmental, Social, and Governance (ESG) mandates and the volatile, rising costs of global fuel and logistics, ensure that sustainability credentials and maximized logistical efficiency remain the core competitive battlegrounds determining long-term market leadership and differentiation.

Segmentation Analysis

The Laundry Detergent Sheets Market is meticulously segmented across various parameters, including product format, application environment, core ingredient composition, dominant distribution channel, and broad geographic scope. This comprehensive segmentation analysis provides market players with the necessary granularity to precisely tailor product development, marketing messaging, and distribution strategies to highly specific consumer cohorts and operational demands. Analyzing the market through the lens of formulation, differentiating between standard everyday sheets and highly specialized variants—such as sheets fortified with powerful stain enzymes or those offering integrated fabric softening capabilities—provides profound insights into the direction of current technological investment and premiumization strategies. The critical bifurcation based on ingredient composition (natural/plant-derived versus sophisticated synthetic formulations) reflects the deep-seated consumer ideological division between absolute sustainability priority and uncompromising cleaning performance, necessitating distinct product lines and corresponding marketing narratives for each segment.

- By Product Type:

- Standard Laundry Sheets (Core market offering, focus on basic cleaning and convenience)

- Concentrated Laundry Sheets (Ultra-high efficacy, often targeted at hard water regions and heavy stains)

- Two-in-One (Detergent + Softener) Sheets (Premium segment offering enhanced convenience and fabric care benefits)

- Specialty Sheets (e.g., Color-Safe, Delicate Fabric, Baby Clothing specific formulations)

- By Application:

- Residential Use (Largest segment, encompassing standard household washing)

- Commercial/Industrial Use (Hotels, Laundromats, Healthcare facilities prioritizing dosage control and logistics)

- Travel and Portable Use (Niche segment valuing extreme compactness and compliance with travel regulations)

- By Ingredient Composition:

- Plant-Derived/Natural Ingredients (High growth, driven by eco-conscious consumers seeking biodegradability and ethical sourcing)

- Synthetic/Chemical-Based Ingredients (Focus on maximum cleaning power and cost-effectiveness)

- Hypoallergenic/Sensitive Skin Formulas (Fastest-growing health-focused segment, excludes common irritants and fragrances)

- By Distribution Channel:

- Online Retail (Dominant channel; includes large E-commerce Platforms and high-margin D2C Subscription Services)

- Offline Retail (Supermarkets, Hypermarkets, and Mass Merchandisers essential for mass market adoption)

- Specialty Stores (Health and Wellness Stores, zero-waste shops; crucial for brand validation and initial market entry)

- By Packaging Type:

- Recyclable Cardboard Box (The industry standard for plastic elimination)

- Certified Home-Compostable Pouch (Highest sustainability claim, appealing to extreme eco-conscious consumers)

Value Chain Analysis For Laundry Detergent Sheets Market

The value chain for the Laundry Detergent Sheets Market is uniquely structured around sustainability and precision engineering, beginning intensely with Upstream Analysis, which focuses on the sourcing and ethical processing of highly concentrated raw materials. Key inputs are primarily high-performance surfactants—increasingly derived from sustainable vegetable oils or green chemistry processes—polymeric binders (like modified water-soluble PVA or renewable starch derivatives), robust cleaning enzymes, and natural essential oils for fragrance and antimicrobial properties. Upstream integrity is paramount; the final product’s environmental standing is directly dependent on the verifiable biodegradability, renewability, and ethical sourcing certifications of these components. Manufacturers face intense scrutiny over the origin of ingredients, such as responsibly sourced palm oil substitutes or the sustainable synthesis of synthetic inputs, necessitating transparent tracking systems. Establishing strong, long-term contractual relationships with third-party verified sustainable chemical suppliers is not merely a preference but a core requirement for mitigating reputational risk and ensuring a consistent supply of certified eco-friendly inputs, ultimately providing a definitive competitive advantage at the foundational stage of the value chain.

The mid-stream process encompasses the highly specialized manufacturing and conversion of raw materials into the finished, compact sheet strips. This stage demands proprietary, high-precision engineering technology. Unlike traditional liquid processing, sheet production necessitates strict, uniform deposition of highly concentrated powdered or semi-liquid active ingredients onto the substrate film, followed by rapid, controlled drying and curing processes. This ensures absolute consistency in dosage and structural integrity, essential for dissolution without residue. Advanced coating technologies, such as slot-die coating or specialized gravure printing, are critical for achieving this precision. This phase is characterized by significant capital expenditure for establishing proprietary machinery designed for non-liquid handling, cutting, and packaging. Optimization efforts are heavily concentrated on improving the mechanical efficiency of cutting systems (e.g., ultrasonic cutting to minimize dust waste) and refining the drying process to maximize throughput while minimizing energy consumption, directly supporting the product's overall low-carbon footprint claims.

Downstream analysis is defined by efficient distribution, heavily leveraging both Direct and Indirect sales channels. The Direct sales model, implemented predominantly through branded e-commerce platforms and sophisticated subscription service logistics, is strategically favored because it offers unparalleled control over pricing, allows for direct, data-rich engagement with the end consumer, and bypasses traditional retail margin splits. This model is exceptionally well-suited for detergent sheets due to their ideal dimensions and low weight for economical direct shipment. Indirect channels, involving large retail partners like major supermarkets, hypermarkets, and big-box stores, are vital for achieving genuine mass-market penetration and brand visibility, particularly in converting non-e-commerce shoppers. However, within these channels, the lightweight and physically small nature of the product often requires creative point-of-sale displays and strategic merchandising to ensure the sheets are not overlooked amidst the visually dominating presence of bulky liquid detergent containers. Specialized distribution through health food stores and zero-waste refill shops serves the crucial function of brand validation, confirming the product's premium, eco-friendly status to the core sustainability-driven demographic.

Laundry Detergent Sheets Market Potential Customers

The principal customer demographic for laundry detergent sheets is primarily composed of highly engaged, environmentally conscious consumers, predominantly within the Millennial and Gen Z age brackets, concentrated heavily in urban and suburban centers globally. This psychographic segment views purchasing decisions not merely as transactions but as affirmations of their values, leading them to actively seek out products offering demonstrably zero-plastic packaging, verified biodegradability, and cruelty-free production certifications. They are early adopters of new technologies, highly influential through social media, and exhibit strong loyalty to brands that maintain rigorous transparency regarding their ingredient sourcing and manufacturing processes. For this consumer, the sheets are integrated into a broader lifestyle choice emphasizing minimalism and responsibility, making D2C subscription services the preferred, frictionless purchase pathway. Their purchase decisions are often informed by eco-influencers and third-party certifications, positioning them as the key segment driving product innovation towards purer, fragrance-free, and plant-derived formulations.

A secondary, yet strategically important, customer cluster consists of urban inhabitants, particularly small families, students, and single-person households residing in smaller, high-density living environments. For this group, the critical purchasing determinant is convenience and space efficiency. The sheets’ compact packaging dramatically reduces clutter, simplifies storage in small utility closets or cabinets, and eliminates the risk of messy spills associated with heavy liquid jugs. This segment prioritizes the practical, everyday utility of the product, often placing convenience slightly above the absolute highest levels of environmental purity, making them amenable to moderately priced, accessible sheet options available through conventional grocery retailers. Manufacturers target this cohort by emphasizing the practical benefits, such as simplified travel and mess-free handling, positioning the sheets as a superior logistical solution for managing the challenges of modern, compact living. Pricing competitiveness against mid-range traditional detergents is crucial for converting these mainstream users.

The third significant segment encompasses the Commercial and Institutional sectors, including major hospitality groups (hotels, resorts), specialized healthcare facilities, and high-volume commercial laundromats. This B2B customer base is primarily motivated by operational efficiency, cost control, and compliance with increasingly strict corporate social responsibility (CSR) and environmental, health, and safety (EHS) mandates. For commercial clients, the precisely pre-measured format is a powerful tool for preventing employee overuse and standardizing laundry protocol, leading to guaranteed cost reductions and predictable inventory management. The reduced weight and volume significantly lower high-frequency procurement costs and simplify storage in facilities with limited back-of-house space. This sector typically demands sheets formulated for bulk, industrial-strength cleaning performance, focusing on anti-microbial properties and stain removal efficacy over intricate fragrance profiles. Securing large, multi-year contracts with global institutional buyers represents a highly lucrative, yet functionally distinct, revenue stream within the overall market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sheets Laundry Club, Tru Earth, Earth Breeze, ECOS, Grove Collaborative, Meliora Cleaning Products, Dizolve Group, Kind Laundry, ReFill My Soap, Mirai Labs, Clean Cult, Super Laundry Sheets, Tangie, Stream2Sea, Nature's Care, Puracy, Eco-Max, Laundress, Dropps, Seventh Generation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laundry Detergent Sheets Market Key Technology Landscape

The technological landscape of the laundry detergent sheets market is rapidly evolving, driven by the dual pressures of environmental sustainability and the necessity for superior cleaning performance. This evolution is concentrated in three interwoven areas: advancements in green surfactant technology, high-precision film casting and coating processes, and innovative sustainable packaging material science. In surfactant technology, the cutting edge involves developing next-generation, high-performance, plant-derived amphoteric and nonionic surfactants that are effective in cold water and rapidly biodegradable, surpassing the limitations of older, petroleum-derived counterparts. Significant research is dedicated to enzyme engineering, focusing on stabilizing highly active, stain-specific enzymes (proteases, lipases, cellulases) within the dry sheet matrix until activation upon contact with water, maximizing cleaning power while minimizing the necessary chemical load. Furthermore, incorporating highly effective, eco-friendly water softeners (chelating agents) into the strip formulation is a technical imperative to ensure consistent, residue-free performance across all water hardness profiles without compromising the product's sustainability claims.

Manufacturing technology focuses critically on achieving absolute uniformity and precision in the conversion of concentrated ingredients into the stable sheet form. The core technological bottleneck is maintaining micrometer-level precision in dosing and distributing the highly viscous cleaning slurry across a water-soluble polymer substrate film, often utilizing advanced slot-die coating or proprietary spray drying techniques. This requires specialized, hermetically sealed production environments to control moisture and prevent premature activation. The subsequent rapid, low-heat drying process must be meticulously controlled to ensure structural integrity while retaining enzyme viability. Furthermore, the development of high-speed, non-contact quality assurance systems, often integrating computer vision and specialized spectroscopic analysis, is mandatory for performing real-time defect detection and guaranteeing that every single pre-cut strip contains the exact specified dosage, a critical factor for maintaining brand trust and functional efficacy in the competitive market.

Sustainable material science extends across both the functional polymer binder and the exterior packaging. A crucial technological challenge involves transitioning away from conventional PVA binders, which require specific sewage conditions to fully degrade, toward advanced, bio-derived biopolymers (such as certain polysaccharides or modified starches) that are certified as completely home-compostable and leave zero microplastic residue. Simultaneously, innovation in packaging is centered on creating high-barrier, moisture-resistant packaging entirely from post-consumer recycled (PCR) paper pulp or agricultural waste fibers. This high-performance cardboard packaging must effectively protect the hygroscopic sheets from humidity and environmental degradation throughout the supply chain without relying on conventional plastic linings or solvent-based adhesives. Finally, digital integration technologies, such as machine-readable codes and Near Field Communication (NFC) tags embedded in the packaging, provide consumers with verifiable sourcing information, demonstrating the full commitment to transparency and sustainability, a key differentiator in the modern marketplace.

Regional Highlights

Regional analysis confirms that mature markets like North America and Europe currently dominate the revenue share, primarily due to high consumer spending power, established environmental awareness movements, and supportive regulatory frameworks pushing plastic reduction initiatives. In North America, the market growth is fueled by the aggressive entry of established CPG players like Unilever and P&G acquiring or partnering with successful D2C sheet startups, validating the market segment and increasing mass-market distribution. Consumer engagement is high, driven by robust subscription models, making the purchase routine frictionless and driving excellent customer retention rates. Europe’s dominance is particularly notable in countries with high density of eco-labels and certification programs, such as Germany, France, and the UK, where consumer skepticism towards greenwashing is low due to strong third-party validation.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is catalyzed by several macroeconomic factors: burgeoning e-commerce penetration, dense populations leading to demands for compact storage solutions, and a growing middle class capable of affording premium, convenient products. Specific markets within APAC, such as Australia and South Korea, are showing early adoption leadership, often importing advanced sheet technology or rapidly developing localized production capabilities. The logistical advantages of sheets—lower shipping costs within vast, fragmented geographies—make them an attractive, scalable alternative to heavy liquids in India and Southeast Asia, significantly reducing operational friction for regional distributors and online retailers.

Latin America (LATAM) and the Middle East & Africa (MEA) present significant, untapped growth potential. In LATAM, volatility in currency exchange rates and high import duties make locally manufactured or lightweight, easily imported products more desirable, favoring the sheet format. In MEA, the primary growth drivers are hospitality and commercial segments, particularly high-end hotels and resorts seeking to align with global sustainability standards and reduce their operational footprint. Furthermore, the inherent stability, non-spillage attribute, and long shelf life of detergent sheets make them ideal for reliable distribution across regions with challenging supply chain logistics and varying climate conditions, reducing product spoilage and minimizing operational risks compared to traditional liquid alternatives.

- North America (Dominant Market): High consumer adoption of subscription services; stringent state-level plastic reduction mandates; strong presence of key innovative startups and major CPG corporations consolidating market share and driving mainstream acceptance.

- Europe (Second Largest Market): Driven by strong regulatory pressures (EU Green Deal and packaging directives) and high density of eco-conscious consumers; leading innovation in plant-derived and fully biodegradable sheet components to meet strict regional standards.

- Asia Pacific (Fastest Growing Market): Exponential growth fueled by rapid urbanization, high e-commerce adoption rates, and intense demand for space-saving, low-weight products in metropolitan hubs across China, India, and Southeast Asia.

- Latin America: Growing interest in lightweight imports due to logistical cost benefits and high import duty mitigation; increasing environmental awareness driven by local sustainability movements and youth advocacy across major countries.

- Middle East & Africa (MEA): Emerging commercial opportunity in the hospitality sector seeking validated sustainability credentials for luxury services; product stability is crucial for distribution and inventory management in diverse climatic zones and developing supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laundry Detergent Sheets Market, analyzing their product portfolios, strategic initiatives, regional presence, and recent developments in sustainable formulation technology and packaging innovation.- Sheets Laundry Club

- Tru Earth

- Earth Breeze

- ECOS (Ecosense)

- Grove Collaborative

- Meliora Cleaning Products

- Dizolve Group Ltd.

- Kind Laundry

- ReFill My Soap

- Mirai Labs

- Clean Cult

- Super Laundry Sheets

- Tangie

- Stream2Sea

- Nature's Care

- Puracy

- Eco-Max

- Laundress

- Dropps

- Seventh Generation (Unilever Subsidiary)

Frequently Asked Questions

Analyze common user questions about the Laundry Detergent Sheets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary environmental advantage of laundry detergent sheets over traditional liquids?

The primary environmental advantage stems from the systemic elimination of heavy, non-recyclable plastic jugs and the drastic reduction in the product’s shipping weight and volume. This reduction directly translates to significantly lower fossil fuel consumption during transportation, thereby minimizing the overall carbon footprint of the product’s supply chain lifecycle.

Are laundry detergent sheets effective in hard water conditions, and do they leave residue?

Yes, advanced laundry detergent sheets are engineered with high concentrations of specialized chelating agents and optimized surfactants specifically designed to counteract mineral interference prevalent in hard water. When used according to instructions, quality sheets dissolve completely and rapidly, ensuring residue-free performance even in low-temperature wash cycles.

How do detergent sheets compare in cost efficiency to bulk liquid detergents over the long term?

While the initial cost per sheet may appear marginally higher than per-scoop pricing for bulk liquid, detergent sheets guarantee perfect, pre-measured dosing, entirely eliminating waste and consumer overuse. When calculated on an accurate "cost per effective load" basis, coupled with the societal benefit of reduced packaging disposal costs, sheets often provide superior long-term economic efficiency.

Are the water-soluble films used to hold the sheets together fully safe and biodegradable?

The most commonly used polymer, Polyvinyl Alcohol (PVA), is water-soluble and widely recognized as highly biodegradable in standard municipal wastewater treatment plants, classified as non-toxic. However, the market is actively shifting towards next-generation, bio-derived polymers that achieve certified home-compostability to satisfy growing consumer demand for zero-residual waste solutions.

Which factors contribute most significantly to the high projected growth rate of the laundry sheets market?

The market's high projected growth (12.5% CAGR) is primarily driven by three synergistic factors: escalating global environmental awareness fostering demand for plastic-free alternatives, the logistical efficiency gains derived from the product’s light weight that optimizes e-commerce and global shipping, and continuous technological innovation achieving cleaning parity with traditional heavy liquid formats.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager