Lawn Mower Batteries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432621 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Lawn Mower Batteries Market Size

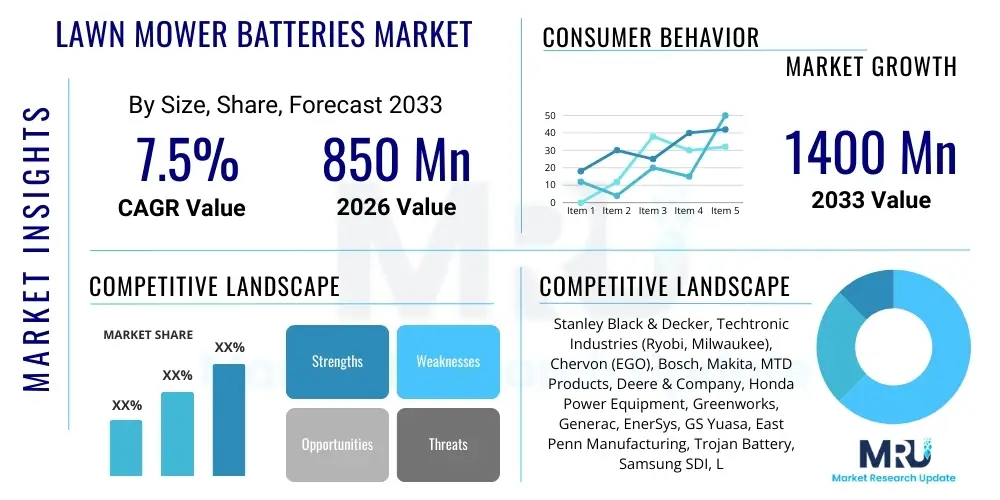

The Lawn Mower Batteries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1400 Million by the end of the forecast period in 2033.

Lawn Mower Batteries Market introduction

The Lawn Mower Batteries Market encompasses the sale and distribution of power storage units specifically designed to operate electric and cordless lawn maintenance equipment. Historically dominated by sealed lead-acid (SLA) batteries, the market has undergone a rapid paradigm shift towards advanced battery chemistries, primarily lithium-ion (Li-ion). This transition is fueled by the superior energy density, longer cycle life, lighter weight, and zero-emission profile offered by Li-ion technology, making electric mowing an increasingly viable and preferred alternative to traditional gasoline-powered equipment in both residential and professional landscaping sectors. The core product scope includes batteries for walk-behind push mowers, ride-on mowers, and increasingly, robotic lawn maintenance systems, addressing diverse power requirements and operational durations across various application segments.

Major applications for lawn mower batteries span residential lawn care, commercial landscaping operations, and specialized turf management (such as golf courses and sports fields). The benefits driving market adoption are numerous, centering on environmental sustainability, reduced noise pollution, and decreased maintenance complexity compared to internal combustion engines. Electric mowers eliminate the need for fuel, oil changes, and spark plug replacements, offering significant long-term operational cost savings. Furthermore, increasing urbanization and stricter noise ordinances in residential areas make battery-powered equipment particularly attractive. Key driving factors include rigorous environmental regulations targeting fossil fuel emissions, escalating consumer awareness regarding sustainable gardening practices, and continuous innovation in battery management systems (BMS) enhancing safety and performance metrics, particularly in high-voltage commercial models.

The operational landscape is further shaped by the growing integration of smart technologies. Modern lawn mower batteries are increasingly equipped with intelligent features that communicate remaining charge, monitor temperature, and optimize power output via Bluetooth or Wi-Fi connectivity, supporting the rise of connected gardening ecosystems. This technological maturation ensures that battery-powered mowers can now handle large lawns and demanding commercial tasks that were previously exclusive to gas models. The market is characterized by intense competition among traditional power tool manufacturers and specialized battery technology suppliers, all vying for market share through innovation in fast-charging capabilities, interchangeable battery platforms, and extended warranty periods to bolster consumer trust in the reliability and durability of electric lawn care solutions.

Lawn Mower Batteries Market Executive Summary

The Lawn Mower Batteries Market is experiencing robust expansion, fundamentally driven by shifts in environmental policy and consumer preference towards sustainable, quiet, and low-maintenance outdoor power equipment. Business trends indicate a strong focus on proprietary and standardized lithium-ion battery platforms, enabling users to interchange batteries across a range of tools (known as ecosystem bundling), which significantly enhances customer lock-in and replacement market growth. Investment in high-voltage (40V, 60V, and 80V+) systems is critical for commercial segment penetration, ensuring these electric units can match the power and longevity required by professional landscapers. Mergers, acquisitions, and strategic partnerships between battery producers and OEM lawn mower manufacturers are defining the competitive landscape, aimed at securing supply chains and accelerating technological deployment, especially in areas related to energy density and thermal management efficiency. The aftermarket segment for replacement batteries is also growing rapidly, benefiting from the widespread adoption of cordless devices sold over the past decade.

Regionally, North America and Europe are leading the market adoption due to stringent government mandates on emissions (such as those observed in California and several EU nations) and high disposable incomes facilitating the purchase of premium electric equipment. These regions exhibit strong consumer enthusiasm for smart home integration and robotic automation, particularly utilizing lightweight, long-lasting Li-ion batteries. The Asia Pacific (APAC) region, while still reliant on traditional methods in many areas, presents the highest growth potential, spurred by urbanization, rising middle-class disposable income, and increasing awareness of air quality issues in densely populated cities, driving demand for residential-grade electric mowers. Governments in APAC, notably China and India, are starting to introduce policies that favor electric over fossil fuel-powered small engine equipment, signaling future market acceleration and the necessity for robust local battery supply chains to support this shift.

Segmentation trends highlight the dominance of the Li-ion battery segment, which is rapidly displacing traditional sealed lead-acid (SLA) technology across all application types, reflecting a clear preference for performance and reduced weight. The commercial application segment, despite its higher initial cost hurdles, is projected to witness the fastest Compound Annual Growth Rate (CAGR), primarily due to the Total Cost of Ownership (TCO) benefits associated with eliminating fuel costs and drastically lowering maintenance requirements over the operational life of the equipment. Furthermore, the rising adoption of robotic lawn mowers, which are entirely dependent on compact, efficient, and durable battery power, is creating a distinct, high-growth niche within the residential and specialized turf segments, necessitating batteries optimized for prolonged, continuous light-duty cycling and precise charging protocols managed by sophisticated onboard electronics.

AI Impact Analysis on Lawn Mower Batteries Market

User inquiries regarding AI's influence on the Lawn Mower Batteries Market frequently revolve around optimizing battery life, predicting failures, enhancing charging efficiency, and enabling true autonomy for robotic mowers. Consumers and industry stakeholders are keen to understand how AI algorithms can maximize run-time by learning complex mowing patterns and terrain variables, thereby dynamically adjusting power draw from the battery. Furthermore, a significant concern is predictive maintenance: users expect AI-driven battery management systems (BMS) to analyze degradation patterns and temperature fluctuations to preemptively alert users about potential failures, extending the operational lifespan and safety profile of the battery unit. The primary expectation is that AI will move battery performance beyond static specifications into a dynamic, learning system, ensuring optimal usage cycles and drastically reducing unexpected downtime, crucial for high-value commercial landscaping contracts.

- AI optimizes Battery Management Systems (BMS) by predicting capacity fade and adjusting charging protocols dynamically, thus extending the overall cycle life of lithium-ion cells.

- Predictive maintenance algorithms analyze real-time operational data (temperature, voltage, current spikes) to forecast potential battery failures weeks in advance, improving safety and reliability.

- Integration of AI in robotic lawn mowers allows for smarter navigation and path planning, optimizing energy consumption based on turf density, slope, and previously mapped obstacles, directly translating to longer run times per charge.

- AI-driven smart charging stations can communicate with the battery to determine the fastest, yet least damaging, charging profile based on current state-of-health (SOH), minimizing heat generation and energy waste.

- Automated diagnostics utilize machine learning to instantly identify performance anomalies in multi-cell packs, isolating issues and informing users or service centers, reducing troubleshooting time significantly.

DRO & Impact Forces Of Lawn Mower Batteries Market

The dynamics of the Lawn Mower Batteries Market are governed by a complex interplay of stringent environmental regulations favoring electric alternatives, significant technological advancements in lithium-ion chemistry, high initial procurement costs, and emerging market opportunities in automation and connectivity. Drivers primarily center on global initiatives aimed at reducing greenhouse gas and noise emissions associated with small gasoline engines, pushing municipalities and commercial operators towards zero-emission solutions. Restraints chiefly involve the relatively high capital expenditure required for high-capacity Li-ion battery systems compared to legacy lead-acid units or traditional gas equipment, alongside consumer apprehension regarding the limited run-time and potential replacement cost of battery packs. However, vast opportunities arise from the convergence of battery technology with IoT and robotics, enabling fully automated, energy-efficient lawn care services, particularly appealing to the burgeoning smart home and commercial landscaping segments seeking efficiency gains.

The foremost impact force is the relentless pursuit of higher energy density and faster charging capabilities. As consumer demand for professional-grade power in cordless platforms increases, manufacturers must continuously improve the Watt-hour capacity within existing volumetric constraints, forcing rapid innovation in cell structure and cooling mechanisms. A secondary, but potent, force is standardization and compatibility, often termed the "platform wars." Major players are heavily invested in creating proprietary battery ecosystems that lock consumers into a single brand across multiple tools (mowers, trimmers, blowers), impacting consumer choice and the secondary aftermarket. Furthermore, global supply chain volatility, particularly concerning critical battery raw materials such as lithium and cobalt, exerts a persistent pressure on pricing and production stability, requiring strategic long-term sourcing agreements and diversification of battery material inputs to mitigate risks and stabilize the long-term cost of electric equipment.

These forces collectively shape the market's direction, pushing it towards sustainability and high performance. While the driver of environmental compliance provides foundational market growth, the restraint of cost demands innovative manufacturing scaling and optimization to achieve price parity with gasoline models. The opportunity presented by autonomous mowing systems places a premium on highly durable and communicative batteries that can withstand continuous duty cycles and integrate seamlessly with complex navigation software. Ultimately, the successful navigation of these drivers, restraints, and opportunities—while managing the profound impact forces of technology and supply chain risk—will determine which players successfully capture dominant market positions in the rapidly electrifying lawn care industry over the next decade.

Segmentation Analysis

The Lawn Mower Batteries Market segmentation provides a detailed structural breakdown based on battery chemistry, the application environment (end-user), and the distribution channel used for sales. Lithium-ion batteries currently dominate the market due to their unparalleled performance metrics, including superior energy-to-weight ratio and minimal self-discharge, making them the standard choice for modern cordless and robotic mowers. Application segmentation differentiates between the vast residential market, characterized by lower voltage (40V-60V) requirements for smaller areas, and the rapidly professionalizing commercial segment, demanding higher power output, rugged durability, and extended operational endurance typically requiring 80V or higher systems. Analyzing these segments is crucial for manufacturers to align product development, marketing strategies, and pricing structures with the distinct needs and purchasing power of their target user groups, particularly recognizing the differing replacement cycles and TCO considerations between home users and professional fleet operators.

Furthermore, segmentation by distribution channel clearly delineates between Original Equipment Manufacturers (OEMs), who bundle batteries with new mowers, and the Aftermarket, which serves replacement, upgrade, and additional battery pack purchases. The OEM channel is highly influential in setting the initial standard and technology adoption rate, often tied to proprietary battery platforms. Conversely, the aftermarket is a high-margin, consistent revenue stream driven by the natural degradation cycle of lithium-ion technology and the growing installed base of electric mowers. Understanding this split allows businesses to optimize inventory management and service networks, ensuring that replacement batteries are readily available to minimize downtime for consumers. The future growth trajectory is heavily dependent on the performance differentiation within the Li-ion category, specifically addressing the cost-efficiency trade-offs between Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP) chemistries, especially as safety and long-term stability become paramount for commercial fleets.

- By Battery Type:

- Lithium-ion (Li-ion)

- Lithium Nickel Manganese Cobalt (NMC)

- Lithium Iron Phosphate (LFP)

- Sealed Lead-Acid (SLA)

- Nickel Metal Hydride (NiMH)

- Lithium-ion (Li-ion)

- By Application:

- Residential (Push Mowers, Small Ride-Ons)

- Commercial/Professional (Heavy-Duty Walk-Behind, Commercial Ride-Ons, Landscaping Fleets)

- Specialized/Robotic (Autonomous Mowers, Turf Management)

- By Voltage:

- Below 40V

- 40V to 80V

- Above 80V

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Online, Service Centers)

Value Chain Analysis For Lawn Mower Batteries Market

The value chain for the Lawn Mower Batteries Market is extensive, starting with the complex upstream extraction and refining of raw materials, such as lithium, cobalt, nickel, and graphite, primarily concentrated in geopolitical hotspots, which introduces significant supply risk and pricing volatility. This raw material stage directly influences the subsequent cell manufacturing phase, where specialized battery companies (like LG Energy Solution or Samsung SDI) produce high-energy density cells tailored to meet the specific power and vibration resistance required for outdoor power equipment. The midstream involves the assembly of these cells into finished battery packs, incorporating sophisticated Battery Management Systems (BMS) and rugged casings by battery pack integrators or the lawn mower OEMs themselves. Quality control and rigorous testing for safety standards (e.g., thermal runaway resistance) are critical at this stage to ensure regulatory compliance and consumer confidence.

The downstream analysis focuses on the final distribution and sale of the finished battery packs. The primary distribution channels are split between direct sales to Original Equipment Manufacturers (OEMs), where batteries are bundled with the sale of a new lawn mower, and the aftermarket channel, which handles replacement batteries. Direct distribution through OEMs ensures control over proprietary battery systems and promotes ecosystem sales, often leveraging established dealer networks for physical product placement and professional support. Indirect distribution, predominantly through large retail hardware chains (Home Depot, Lowe's), specialized power equipment dealers, and rapidly growing e-commerce platforms, caters mainly to the aftermarket and residential segments, emphasizing convenience and competitive pricing. E-commerce platforms are increasingly vital as they allow smaller, specialized battery suppliers to reach a global consumer base, circumventing traditional dealer exclusivity.

In terms of logistics and service, the distribution channel must manage the unique challenges posed by lithium-ion batteries, including strict regulations regarding transport, storage, and disposal (End-of-Life management). Aftermarket service centers play a crucial role, providing warranty support, recycling services, and expert advice on battery maintenance, thereby completing the value chain loop. Successful players in this market optimize their logistics to minimize shipping costs while adhering to hazardous material transport protocols. Furthermore, the push towards sustainability means that manufacturers are increasingly scrutinizing the entire value chain, from raw material ethical sourcing to facilitating easy consumer participation in recycling programs, ensuring long-term responsible growth and compliance with evolving global environmental standards.

Lawn Mower Batteries Market Potential Customers

The potential customer base for the Lawn Mower Batteries Market is diverse, segmented primarily into residential end-users, large-scale commercial landscaping enterprises, and specialized governmental or institutional buyers. Residential customers represent the largest volume segment, seeking convenience, quiet operation, and ease of use for maintaining small to medium-sized yards. These buyers are typically sensitive to initial cost but are increasingly valuing the environmental benefits and seamless integration with other cordless yard tools. Their purchasing decisions are heavily influenced by brand loyalty, platform interoperability (the ability to share batteries among different tools), and marketing focused on simplifying yard care tasks. The demographic shift towards younger, tech-savvy homeowners also boosts demand for robotic mower batteries and smart charging solutions.

The commercial landscaping sector constitutes the high-value segment, focusing intensely on Total Cost of Ownership (TCO), durability, and power output. Professional buyers (landscaping companies, property managers) require batteries capable of continuous, heavy-duty operation over long periods, often demanding industrial-grade 80V+ systems and robust, fast-charging infrastructure. Their key criteria are minimizing fleet downtime, maximizing productivity per charge cycle, and achieving fuel cost savings sufficient to justify the higher upfront investment in high-capacity lithium-ion technology. These customers prioritize long warranties and guaranteed performance metrics, often engaging in bulk purchases directly through specialized equipment dealers or via contractual agreements with OEMs, making their decision processes centered on fleet reliability and longevity.

Specialized buyers include municipalities, universities, golf course management authorities, and corporate campuses. These entities often have complex requirements balancing large area maintenance with strict noise and emission regulations, making electric mowers powered by robust batteries an ideal solution. Golf courses, for instance, require highly efficient batteries for precision grooming equipment that operates continuously but cannot damage sensitive turf areas. Governmental and institutional buyers are highly influenced by sustainable procurement policies and often look for extended service life, robust recycling guarantees, and compliance with high safety standards, making them key targets for premium, long-cycle life battery technologies like Lithium Iron Phosphate (LFP) known for stability and longevity under rigorous operating conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1400 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Techtronic Industries (Ryobi, Milwaukee), Chervon (EGO), Bosch, Makita, MTD Products, Deere & Company, Honda Power Equipment, Greenworks, Generac, EnerSys, GS Yuasa, East Penn Manufacturing, Trojan Battery, Samsung SDI, LG Energy Solution, BYD, Clarios, Husqvarna, Positec Tool Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lawn Mower Batteries Market Key Technology Landscape

The technology landscape of the Lawn Mower Batteries Market is rapidly evolving, driven primarily by innovations in cell chemistry and the intelligence embedded within the battery pack itself. The primary technological shift involves the continuous refinement of lithium-ion chemistry, particularly focusing on increasing energy density (to maximize run-time without increasing weight) and improving thermal management systems. Modern battery packs for commercial mowers utilize advanced cooling technologies, such as active air circulation or sophisticated heat sinks, to prevent overheating during high-load operations, thereby extending battery life and preventing safety hazards like thermal runaway. Furthermore, the adoption of Lithium Iron Phosphate (LFP) cells is gaining traction in segments prioritizing safety and long cycle life over absolute energy density, providing a more stable, albeit heavier, alternative for fleet operations where longevity is key.

A crucial technological development is the sophistication of the Battery Management System (BMS). Today's BMS platforms are not merely passive monitors; they incorporate microprocessors and proprietary algorithms that perform cell balancing, deep cycle protection, and state-of-charge (SOC) calculation with high precision. These intelligent systems communicate wirelessly with the mower and charging station, providing vital diagnostics regarding battery health and usage patterns. This interconnectedness facilitates features like fast charging optimization, where the BMS intelligently manages the inflow of current to reduce charging time without compromising the long-term integrity of the cell structure, a critical factor for professional users who rely on short turnaround times between jobs.

Beyond the core battery components, the technology landscape is heavily influenced by proprietary quick-swap and high-power charging technologies. Many OEMs are investing heavily in establishing proprietary platforms, like 40V, 60V, or 82V systems, with patented locking and connection mechanisms. This strategy ensures compatibility across a brand’s entire tool lineup but also necessitates that replacement batteries must adhere strictly to these unique technological specifications. Furthermore, the development of solid-state battery technology represents a disruptive potential, promising significantly higher energy density and enhanced safety profiles compared to current liquid-electrolyte Li-ion cells. Although currently expensive and limited in commercial scale, breakthroughs in solid-state electrolytes could redefine the maximum operational capacity and runtime for high-end electric mowers by the end of the forecast period, providing the power parity needed to truly dominate the heavy-duty commercial market segment.

Regional Highlights

- North America: The North American market, particularly led by the United States and Canada, holds the dominant share in the lawn mower batteries market, primarily fueled by extensive suburban areas and a robust consumer base willing to invest in premium, high-voltage cordless equipment. Stringent environmental regulations in states like California drive accelerated adoption of zero-emission yard tools. The region benefits from high competition among major brands (including local giants and international players) who aggressively promote extensive battery sharing platforms (e.g., 60V and 80V systems). The commercial landscaping industry here is rapidly electrifying its fleets, shifting from gas-powered zero-turn mowers to battery equivalents, necessitating reliable, high-capacity replacement batteries and sophisticated charging infrastructure to manage large fleets efficiently. This focus on commercial fleet electrification is a key differentiating factor and growth engine for the region, supported by financial incentives and rebates available at local and state levels promoting the transition.

- Europe: Europe is characterized by a strong emphasis on sustainability, low noise levels, and compact residential areas, making electric and robotic mowers highly desirable. Countries in Western Europe, such as Germany, the UK, and the Scandinavian nations, show the highest penetration rates for robotic lawn mowers, driving demand for specialized, low-power consumption batteries optimized for continuous, automated use. Environmental policies dictated by the European Union, focusing on reducing small engine pollution, have accelerated the phase-out of gas-powered gardening equipment. The market structure is highly fragmented, with strong local brands competing alongside major international power tool manufacturers. Furthermore, Europe is a leader in recycling and end-of-life battery management regulations, influencing how battery manufacturers design their products for easy disassembly and material recovery, adding a layer of compliance complexity and innovation.

- Asia Pacific (APAC): The APAC region represents the fastest-growing market, driven by rapid urbanization, increasing disposable incomes, and escalating concern over localized air pollution in major metropolitan areas. While traditional gardening equipment remains prevalent in many developing markets, countries like China, Japan, and South Korea are witnessing explosive growth in the adoption of residential electric mowers and smaller walk-behind units. China, in particular, is both a massive consumer and a primary global manufacturing hub for lithium-ion batteries and related equipment, which supports competitive pricing and local supply chain optimization. The increasing establishment of professional property management services and commercial landscaping operations in large urban centers is beginning to drive demand for mid-range commercial battery systems, signaling a future shift from primarily residential demand to more diverse application needs across the region.

- Latin America (LATAM): The LATAM market is currently characterized by a lower adoption rate of high-end electric equipment compared to North America and Europe, largely due to initial cost sensitivity and the established dominance of traditional gasoline mowers. However, gradual growth is observed, particularly in economically stronger countries like Brazil and Mexico, focusing initially on residential electric push mowers and basic battery-powered tools. Market penetration is closely tied to improving economic stability and the development of reliable electricity grids, which are prerequisites for widespread adoption of battery-powered tools. The primary driver here is the availability of affordable, entry-level cordless systems, often supplied by manufacturers seeking to penetrate emerging markets.

- Middle East and Africa (MEA): The MEA region remains a nascent market, but selective growth is observed in the GCC countries (UAE, Saudi Arabia) due to high infrastructure investment, maintenance of large commercial and governmental green spaces (parks, golf courses), and the ability to absorb the high initial costs associated with premium electric equipment. The intense heat in this region poses significant technological challenges, requiring batteries and charging systems optimized for extreme thermal conditions, driving demand for robust and highly durable products with superior thermal management systems. The adoption in Africa remains limited, constrained by infrastructure challenges and focus on basic, low-cost maintenance solutions, though specialized commercial operations in key economic hubs are starting to evaluate electric fleet options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lawn Mower Batteries Market.- Stanley Black & Decker

- Techtronic Industries (Ryobi, Milwaukee)

- Chervon (EGO)

- Bosch

- Makita

- MTD Products

- Deere & Company

- Honda Power Equipment

- Greenworks (Globe Tools)

- Generac

- EnerSys

- GS Yuasa

- East Penn Manufacturing

- Trojan Battery

- Samsung SDI

- LG Energy Solution

- BYD

- Clarios (formerly Johnson Controls Power Solutions)

- Husqvarna Group

- Positec Tool Corporation (Worx)

Frequently Asked Questions

Analyze common user questions about the Lawn Mower Batteries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift from gas to battery-powered lawn mowers?

The primary driver is stringent environmental regulations aimed at reducing noise and air pollution from small engines, coupled with the superior convenience, lower maintenance costs, and high performance offered by modern lithium-ion battery technology, particularly in urban and suburban environments.

How do Lithium-ion (Li-ion) batteries compare to Sealed Lead-Acid (SLA) batteries for lawn mowers?

Li-ion batteries offer significantly higher energy density, resulting in lighter weight and longer run times, plus a much longer cycle life (more recharges). SLA batteries are cheaper initially but are heavier, require more maintenance, and have inferior performance characteristics suitable mostly for older or budget-focused ride-on mowers.

What voltage systems are most common in commercial electric lawn mowers?

Commercial electric lawn mowers typically utilize high-voltage systems, ranging from 60V to 80V and above, to ensure they can deliver the necessary power and endurance to handle large commercial properties and heavy-duty cutting requirements, often requiring multiple interconnected battery packs.

What are the main challenges affecting the supply chain of lawn mower batteries?

The main challenges include geopolitical instability impacting the sourcing and pricing of critical raw materials (lithium, cobalt, nickel), global logistics disruptions, and the need for significant investments in localized manufacturing capacity to meet soaring global demand for high-capacity Li-ion cells.

Is the aftermarket for lawn mower batteries growing, and why?

Yes, the aftermarket is experiencing substantial growth because lithium-ion batteries naturally degrade over several years, requiring replacement. Furthermore, many consumers purchase additional battery packs to extend the operational run-time of their existing cordless equipment, fueling steady replacement and upgrade sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager