Laxatives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435268 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Laxatives Market Size

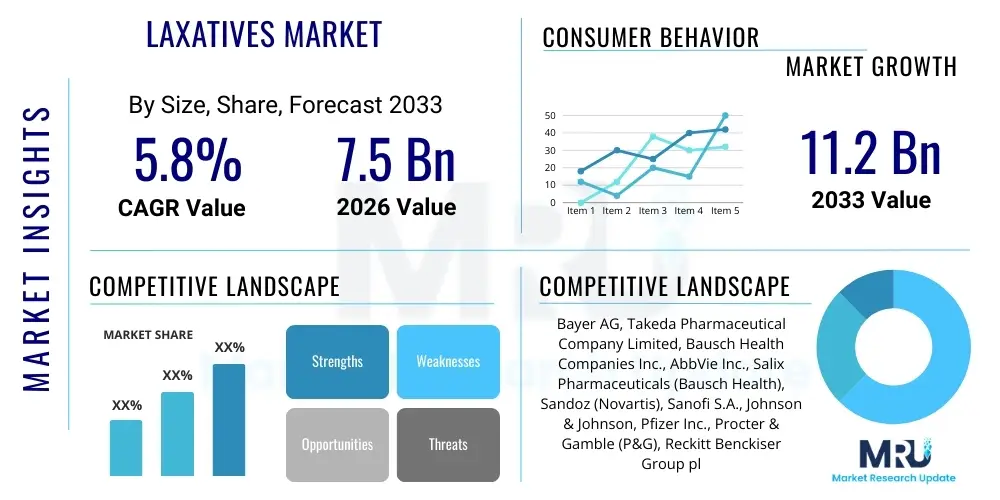

The Laxatives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Laxatives Market introduction

The Laxatives Market encompasses a broad range of pharmaceutical and over-the-counter (OTC) products designed to treat constipation, a highly prevalent gastrointestinal disorder affecting a significant portion of the global population across all age groups. These products work through various mechanisms, including increasing stool bulk, softening consistency, stimulating intestinal muscle contractions, or drawing water into the colon. The primary applications include the relief of chronic and acute constipation, preparation for diagnostic procedures such as colonoscopies, and management of bowel movements in geriatric and post-operative patients. The sustained growth of this market is fundamentally driven by lifestyle factors, including poor diet, lack of physical activity, and aging populations, which collectively increase the incidence of digestive health issues globally. Furthermore, the accessibility and widespread adoption of OTC products contribute significantly to market expansion, enabling self-medication for mild to moderate symptoms.

The core product offerings within this sector are categorized based on their mechanism of action, encompassing osmotic agents (such as polyethylene glycol and lactulose), stimulant laxatives (like bisacodyl and senna), bulk-forming agents (psyllium and methylcellulose), and stool softeners (docusate sodium). Each category addresses different clinical needs, providing flexibility in treatment protocols for healthcare providers and consumers. Osmotic and bulk-forming laxatives are often recommended for long-term management due to their gentle action, while stimulants are typically reserved for short-term relief. Major applications extend beyond basic symptomatic relief to include critical care environments, management of irritable bowel syndrome with constipation (IBS-C), and drug-induced constipation, particularly associated with opioid use. The versatility of these applications ensures a stable demand base across diverse patient demographics and clinical settings.

Key driving factors fueling the market include the rising prevalence of chronic diseases like diabetes and Parkinson’s, which often lead to secondary constipation, and the accelerating trend towards preventative digestive wellness. Consumer awareness campaigns emphasizing the importance of gut health and regularity also play a crucial role in product adoption. The benefits associated with laxative use are profound, ranging from immediate symptomatic relief and improved quality of life to preventing complications associated with severe constipation, such as hemorrhoids and fissures. Continuous innovation, focusing on enhanced palatability, minimized side effects, and targeted delivery systems, remains critical for sustaining the market's positive trajectory, particularly within specialized segments like pediatric and geriatric care.

Laxatives Market Executive Summary

The Laxatives Market is characterized by robust growth, driven primarily by favorable demographic trends, particularly the expansion of the aging population globally, and increasing self-medication practices enabled by accessible OTC options. Business trends highlight a strong shift toward natural and plant-derived laxative ingredients, such as those incorporating fiber and herbal extracts, catering to the growing consumer preference for clean label, holistic wellness solutions. Major pharmaceutical companies are focusing their investment strategies on developing novel, prescription-strength agents targeting specific receptor pathways for chronic constipation (e.g., guanylate cyclase-C agonists and chloride channel activators), thereby expanding the high-value prescription segment alongside the established OTC dominance.

Regionally, North America and Europe maintain leading positions, owing to high healthcare expenditure, established regulatory frameworks, and high awareness levels regarding digestive health. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly improving access to pharmaceuticals, burgeoning middle-class populations adopting Westernized diets, and rising diagnoses of lifestyle-related GI disorders in densely populated nations like China and India. This regional dynamic necessitates tailored marketing strategies, focusing on both established brand penetration in mature markets and rapid market entry in emerging economies leveraging digital marketing channels and direct-to-consumer models.

Segment trends underscore the sustained dominance of the osmotic laxative category due to its efficacy and safety profile for chronic use, making it the preferred choice for both clinicians and consumers. Furthermore, the segmentation by distribution channel clearly indicates the significant role of retail pharmacies and drug stores, although the e-commerce segment is registering the most significant growth rate, capitalizing on consumer demand for privacy, convenience, and competitive pricing. The convergence of digital health platforms with laxative adherence tracking represents a growing trend, transforming how consumers manage their ongoing digestive care needs and creating new opportunities for personalized product recommendations and subscription services.

AI Impact Analysis on Laxatives Market

Common user questions regarding AI's impact on the Laxatives Market frequently revolve around personalized treatment efficacy, predictive diagnostics for chronic constipation, and the automation of drug discovery and supply chains. Users are particularly interested in whether AI can optimize dosing regimens based on individual patient parameters, reducing the current trial-and-error approach common in OTC settings. Key themes emerging from this analysis include the potential for AI-driven clinical trial acceleration, leading to faster development of targeted, side-effect-reduced compounds, and the application of machine learning algorithms to analyze large patient datasets to identify sub-populations most responsive to specific laxative classes. There is also significant consumer expectation regarding AI-powered digital health platforms offering proactive digestive wellness coaching and adherence reminders, moving beyond mere reactive symptom management to preventative care.

The pharmaceutical sector is leveraging AI to analyze complex biological interactions related to gut motility and the microbiome, identifying new drug targets that could lead to revolutionary treatments for motility disorders beyond traditional stimulant or osmotic mechanisms. Specifically, AI algorithms can efficiently screen thousands of compounds for potential efficacy and toxicity, dramatically cutting down the pre-clinical research timeline and associated costs. Furthermore, in manufacturing and logistics, AI-driven predictive maintenance and demand forecasting optimize production levels and distribution channels, ensuring product availability and minimizing inventory waste, thereby addressing supply chain concerns often voiced by end-users and retailers.

For the consumer experience, the integration of AI is facilitating highly sophisticated digital diagnostic tools, where individuals can input detailed symptom profiles, dietary habits, and medical history to receive immediate, evidence-based recommendations for specific laxative types or lifestyle modifications. This enhanced diagnostic precision improves patient outcomes and reduces unnecessary healthcare utilization. However, concerns regarding data privacy and the accuracy of AI-driven medical advice remain critical points for users, necessitating stringent ethical guidelines and transparent validation processes for all AI applications deployed within the laxative and broader digestive health sector.

- AI accelerates the identification of novel drug targets, particularly those regulating gastrointestinal motility.

- Machine learning algorithms enable highly personalized laxative dosing and formulation recommendations based on patient microbiome data.

- Predictive analytics optimize inventory and cold chain logistics for temperature-sensitive liquid formulations.

- AI-powered diagnostic tools enhance self-diagnosis accuracy and improve initial selection of OTC remedies.

- Virtual clinical trials utilize AI to model drug efficacy, speeding up time-to-market for new prescription treatments.

- Chatbots and digital assistants provide 24/7 adherence monitoring and proactive lifestyle coaching for chronic constipation sufferers.

DRO & Impact Forces Of Laxatives Market

The Laxatives Market is primarily driven by the increasing incidence of constipation linked to lifestyle changes, including sedentary habits and highly processed diets, coupled with the global growth in the geriatric population, which naturally experiences reduced gut motility. These fundamental demographic shifts ensure a continually expanding user base. However, the market faces significant restraints, notably the potential for misuse, dependency, and the prevalence of side effects associated with stimulant laxatives, leading regulatory bodies and consumers to favor gentler, less aggressive treatments. Opportunities abound in the development of highly targeted, microbiome-modulating laxative agents and the integration of these products into comprehensive digital wellness platforms that focus on preventative digestive health, expanding the market beyond traditional symptomatic relief into the proactive health space. These forces collectively shape the competitive landscape, pushing manufacturers toward innovation in safety and efficacy.

Key drivers include the high prescription rate of opioid medications globally, which invariably induce opioid-induced constipation (OIC), creating a specialized and high-demand niche for specific OIC treatments. Furthermore, growing consumer awareness, fueled by extensive media coverage of gut health and the human microbiome, encourages early intervention and regular use of fiber-based and osmotic products. The rapid expansion of e-commerce platforms is also a critical driver, providing discreet and convenient purchasing options, which is particularly important for sensitive health issues like constipation. This digital shift minimizes the social stigma associated with purchasing these products in traditional retail settings, boosting overall market volumes and penetration rates in previously underserved demographics.

Conversely, major restraining forces include stringent regulatory pathways for novel prescription treatments, which require extensive clinical validation and incur high development costs, potentially delaying market entry. Public perception regarding the long-term safety of certain stimulant components, often leading to a fear of dependency, compels consumers to seek alternative, natural remedies, which can fragment the market. The competitive intensity among generic and OTC brands also exerts downward pressure on pricing, affecting profit margins, especially in mature markets. The impact forces are currently skewed toward favorable dynamics, with powerful drivers related to demographics and digitalization significantly outweighing the financial and perception-based restraints, ensuring sustained moderate to high growth throughout the forecast period.

Segmentation Analysis

The Laxatives Market is comprehensively segmented based on Product Type, Application, and Distribution Channel, allowing for precise market analysis and targeted strategic planning. The segmentation by Product Type, which includes bulk-forming, osmotic, stimulant, and stool softeners, dictates the clinical utility and consumer preference, with osmotic agents currently holding the largest market share due to their widespread use and safety profile in chronic constipation management. Analyzing these segments is crucial as manufacturers strategically align their research and development efforts with the fastest-growing categories, such as novel osmotic compounds and prescription-strength agents.

Segmentation by Application reveals the significant market share dedicated to chronic idiopathic constipation (CIC) and Irritable Bowel Syndrome with Constipation (IBS-C), highlighting the need for specialized, long-term therapeutic solutions. Other critical applications, such as Opioid-Induced Constipation (OIC) and bowel preparation, although smaller in volume, represent high-value niches due to the specific formulation requirements. Understanding the application landscape helps pharmaceutical firms identify areas requiring high investment in clinical trials to validate product efficacy against specific etiologies.

Lastly, the Distribution Channel segmentation, spanning retail pharmacies, hospital pharmacies, and e-commerce platforms, reflects evolving consumer purchasing behavior. While brick-and-mortar retail remains dominant for immediate needs and OTC purchases, the e-commerce channel is the fastest-growing segment, demonstrating the increasing importance of digital visibility and direct-to-consumer models for market success. Optimization of supply chain logistics across these channels is paramount for market penetration and maximizing brand accessibility.

- By Product Type:

- Bulk-forming Laxatives (Psyllium, Methylcellulose)

- Osmotic Laxatives (Polyethylene Glycol, Lactulose, Saline Laxatives)

- Stimulant Laxatives (Bisacodyl, Senna)

- Stool Softeners (Docusate Sodium)

- Lubricant Laxatives (Mineral Oil)

- Peripherally Acting Mu-Opioid Receptor Antagonists (PAMORAs)

- Chloride Channel Activators

- Guanylate Cyclase-C (GC-C) Agonists

- By Application:

- Chronic Idiopathic Constipation (CIC)

- Opioid-Induced Constipation (OIC)

- Irritable Bowel Syndrome with Constipation (IBS-C)

- Bowel Preparation for Procedures

- Acute Constipation

- Others (Post-operative, Pregnancy-related)

- By Distribution Channel:

- Retail Pharmacies and Drug Stores

- Hospital Pharmacies

- E-commerce/Online Pharmacies

- Supermarkets and Hypermarkets

- By Patient Group:

- Adults

- Pediatrics

- Geriatrics

Value Chain Analysis For Laxatives Market

The value chain for the Laxatives Market is complex, beginning with the highly regulated sourcing of active pharmaceutical ingredients (APIs) and raw materials, such as natural fibers, specialized chemicals for osmotic agents, and synthesis of stimulant compounds. Upstream analysis involves rigorous quality control and supplier validation, particularly for natural extracts, ensuring consistency and regulatory compliance. The manufacturing stage includes specialized formulation techniques, such as microencapsulation for improved taste and targeted delivery, requiring significant capital investment in Good Manufacturing Practice (GMP) compliant facilities. Efficient raw material procurement and cost-effective synthesis are crucial upstream activities determining final product profitability.

The midstream phase focuses on production, packaging, and regulatory approval. Given the mixture of OTC and prescription products, manufacturers must navigate dual regulatory pathways, including stringent FDA and EMA approvals for prescription drugs and less demanding requirements for OTC products, although safety standards remain high. Packaging design is a strategic element, especially for OTC products, focusing on tamper resistance, ease of use (e.g., pre-measured sachets), and brand differentiation on retail shelves. Intellectual property protection for novel mechanisms of action, particularly in the prescription segment (PAMORAs, GC-C agonists), is a central competitive factor in this stage.

Downstream analysis is dominated by multi-channel distribution. Direct distribution involves supplying hospital and clinical settings for prescription use, requiring specialized logistics for controlled substances and managed care contracts. Indirect distribution relies heavily on wholesalers and large pharmacy chains (CVS, Walgreens), which manage large inventories and ensure widespread consumer accessibility. The rapidly expanding e-commerce channel shortens the traditional distribution path, enabling manufacturers to engage directly with consumers, gather actionable data on purchasing patterns, and manage brand loyalty initiatives, optimizing the final leg of the value chain through efficient fulfillment centers and targeted digital marketing campaigns.

Laxatives Market Potential Customers

The primary consumers and end-users of laxative products are diverse, spanning individuals suffering from acute and chronic digestive discomfort, patients undergoing specific medical treatments, and healthcare institutions. The largest demographic segment comprises the elderly population (geriatrics) globally, who frequently experience decreased colon motility and often consume multiple medications leading to secondary constipation. This group represents a stable and high-volume demand base for gentle, chronic-use laxatives, particularly osmotic and bulk-forming types, often requiring long-term, easy-to-administer formulations.

A rapidly growing segment includes individuals aged 30-55 suffering from Chronic Idiopathic Constipation (CIC) and lifestyle-induced bowel irregularity, driven by factors like stress, poor dietary habits, and insufficient hydration. This consumer base often utilizes OTC products and is highly responsive to marketing emphasizing natural ingredients, rapid relief, and minimal side effects, frequently utilizing digital channels for product research and purchase. Furthermore, patients with specific underlying medical conditions, such as diabetes, Parkinson's disease, or those receiving opioid therapy for chronic pain management, represent critical, high-value niches for specialized prescription treatments designed to address complex motility issues resistant to standard OTC solutions.

Institutional customers, including hospitals, surgical centers, and diagnostic clinics, constitute another significant buyer segment. These institutions regularly purchase high volumes of laxatives for pre-operative cleansing (bowel preparation before colonoscopies or abdominal surgeries) and post-operative care management. Additionally, pediatric clinics and parents of young children represent a specialized segment requiring highly palatable, safe, and specifically dosed formulations to address childhood functional constipation. Marketing strategies must therefore be highly targeted, addressing clinical efficacy for institutional buyers while focusing on convenience, safety, and natural composition for direct consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Takeda Pharmaceutical Company Limited, Bausch Health Companies Inc., AbbVie Inc., Salix Pharmaceuticals (Bausch Health), Sandoz (Novartis), Sanofi S.A., Johnson & Johnson, Pfizer Inc., Procter & Gamble (P&G), Reckitt Benckiser Group plc, Astellas Pharma Inc., Synergy Pharmaceuticals, Alfasigma S.p.A., Ferring Pharmaceuticals, Viatris Inc., Cosmo Pharmaceuticals, Mylan N.V., Teva Pharmaceutical Industries Ltd., Janssen Pharmaceuticals (J&J). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laxatives Market Key Technology Landscape

The technological landscape of the Laxatives Market is rapidly evolving, driven by the need to enhance efficacy, minimize systemic side effects, and improve patient adherence, especially for chronic conditions. One major innovation focuses on advanced drug delivery systems, such as targeted release formulations that ensure the active ingredient is released precisely in the colon rather than the upper gastrointestinal tract. This specificity reduces systemic absorption and potential adverse effects associated with certain stimulant or prescription agents. Furthermore, microencapsulation technology is widely adopted, particularly for osmotic agents like PEG, to mask unpleasant tastes, thereby significantly improving patient palatability and compliance, especially among pediatric and geriatric patient groups.

Another significant technological advancement lies in the development of novel molecular targets. Prescription drug development is moving beyond traditional mechanisms to focus on specific receptors involved in fluid secretion and motility. Examples include the synthesis of Guanylate Cyclase-C (GC-C) agonists (e.g., linaclotide) and chloride channel activators (e.g., lubiprostone), which stimulate secretion of fluid into the intestine, offering a new generation of targeted therapies for CIC and IBS-C that operate distinctly from conventional osmotic or bulk agents. The ability to modulate these specific biological pathways represents a technological leap in managing complicated chronic constipation refractory to OTC treatments.

The integration of digital health solutions represents a crucial contemporary technological trend. This involves the use of sophisticated smartphone applications and wearable devices that monitor patient bowel habits, track symptoms, and provide personalized feedback on hydration and dietary fiber intake. These technologies enhance the overall therapeutic outcome by improving patient engagement and adherence to both pharmacological and lifestyle recommendations. Moreover, advances in microbiome research and sequencing technology are leading to the development of synbiotics or specific fiber formulations designed to modulate the gut microbiota composition, positioning future laxative products as more holistic digestive health solutions rather than mere symptom relievers.

Regional Highlights

- North America (U.S. and Canada): Dominates the global Laxatives Market, attributable to the high prevalence of obesity and chronic diseases, established healthcare infrastructure, and high consumer awareness. The region shows strong demand for both advanced prescription OIC and IBS-C treatments and premium OTC products, supported by significant disposable income and rapid adoption of digital health platforms for managing digestive wellness.

- Europe (Germany, U. UK, France, Italy): Represents the second-largest market, characterized by an aging population and high per capita healthcare spending. The market here is highly regulated, favoring scientifically backed osmotic and bulk-forming agents. Western European countries exhibit a growing trend toward natural and herbal laxative products, influencing new product development strategies focused on clean sourcing and sustainability.

- Asia Pacific (APAC) (China, Japan, India, South Korea): Poised for the fastest growth due to the expanding base of middle-class consumers, increasing urbanization leading to sedentary lifestyles, and improvements in access to healthcare. China and India, in particular, offer immense growth opportunities as diagnosis rates for chronic constipation rise and the availability of branded OTC products increases through expanding retail and e-commerce networks.

- Latin America (LATAM): Exhibits consistent, moderate growth driven by improving economic conditions and increased spending on pharmaceuticals. The market typically favors cost-effective, readily available osmotic and stimulant options. Regulatory harmonization across major economies like Brazil and Mexico is crucial for market entry and sustained growth.

- Middle East and Africa (MEA): A nascent but growing market, heavily influenced by increasing healthcare investments, particularly in the Gulf Cooperation Council (GCC) countries. Market penetration is often focused on urban centers, with demand driven by Western lifestyle adoption and rising prevalence of metabolic syndromes. Challenges include fragmented distribution channels and limited consumer awareness outside primary metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laxatives Market.- Bayer AG

- Takeda Pharmaceutical Company Limited

- Bausch Health Companies Inc.

- AbbVie Inc.

- Salix Pharmaceuticals (Bausch Health)

- Sandoz (Novartis)

- Sanofi S.A.

- Johnson & Johnson

- Pfizer Inc.

- Procter & Gamble (P&G)

- Reckitt Benckiser Group plc

- Astellas Pharma Inc.

- Synergy Pharmaceuticals

- Alfasigma S.p.A.

- Ferring Pharmaceuticals

- Viatris Inc.

- Cosmo Pharmaceuticals

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Janssen Pharmaceuticals (J&J)

Frequently Asked Questions

Analyze common user questions about the Laxatives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Laxatives Market?

The market growth is fundamentally driven by global demographic shifts, specifically the rapid increase in the geriatric population prone to motility issues, coupled with rising incidence of lifestyle-related chronic constipation, and the secondary constipation associated with widespread opioid use for pain management. Enhanced consumer awareness and the convenience of e-commerce purchasing further accelerate market expansion.

Which type of laxative formulation currently holds the largest market share?

Osmotic laxatives, including polyethylene glycol (PEG) and lactulose, currently dominate the market share. This dominance is attributed to their superior safety profile, efficacy in treating chronic constipation across various age groups, and their recommendation as first-line therapy by many healthcare guidelines due to minimal risk of dependence compared to stimulant types.

How is technology impacting the development of new laxative treatments?

Technology is driving innovation through the development of targeted prescription treatments like Guanylate Cyclase-C (GC-C) agonists, which act on specific receptors for fluid secretion. Furthermore, digital health platforms and AI are being deployed for personalized dosing recommendations, symptom monitoring, and the efficient management of clinical trials, enhancing overall treatment precision and patient adherence.

What role does the Asia Pacific region play in the future market growth?

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This accelerated growth is fueled by increasing urbanization, the adoption of Westernized diets contributing to GI disorders, improving economic conditions that enable pharmaceutical access, and rising diagnosis rates in large economies like China and India.

What are the main distribution channels for laxative products?

The primary distribution channels include traditional Retail Pharmacies and Drug Stores, which remain essential for immediate OTC purchases. However, E-commerce/Online Pharmacies represent the fastest-growing segment, offering consumers discretion, convenience, and competitive pricing, significantly altering the competitive landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Saline Laxatives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Laxatives Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Prescribed Drugs, Over the Counter Drugs), By Application (Hospital use, Clinic use, Household), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Laxatives Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Bulk Forming Laxatives, Osmotic Laxatives, Stimulant Laxatives, Stool Softener Laxatives), By Application (Retail Pharmacies, Hospital Pharmacies, Drug Store, Online Pharmacies), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager