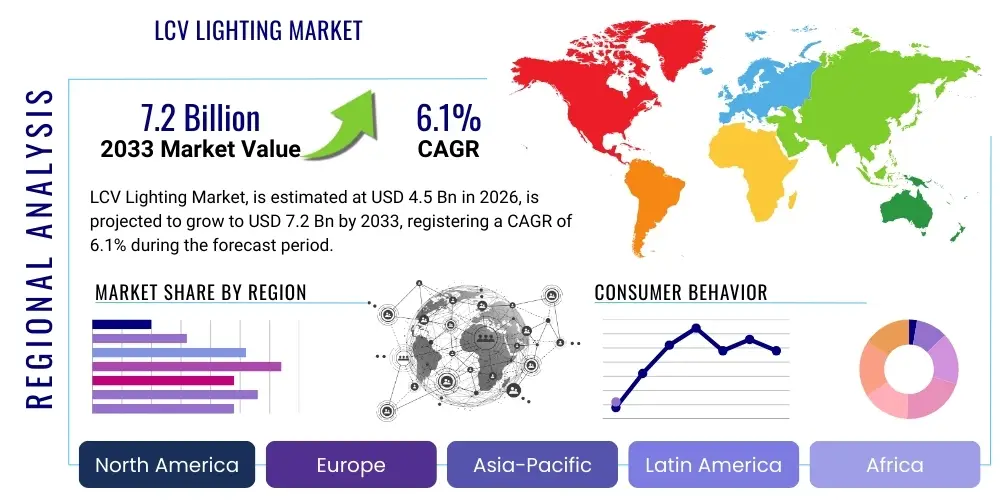

LCV Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436211 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

LCV Lighting Market Size

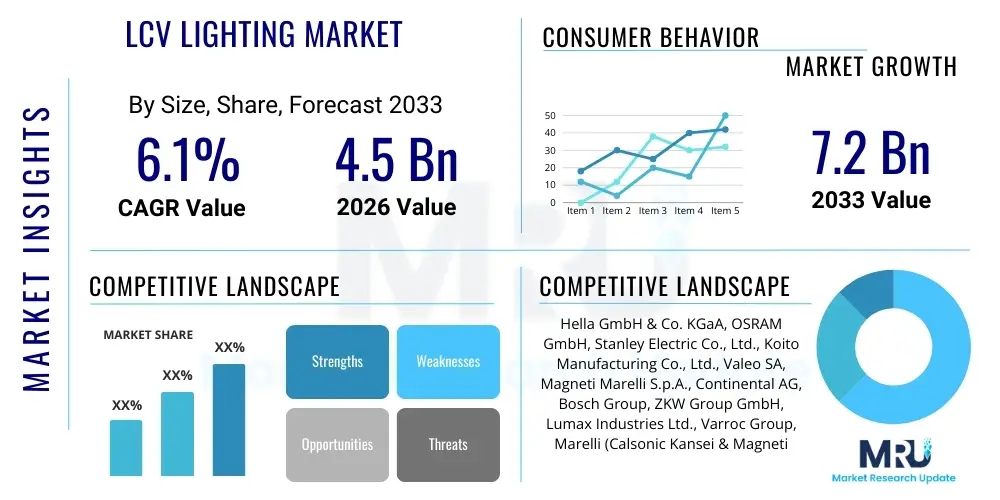

The LCV Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

LCV Lighting Market introduction

The Light Commercial Vehicle (LCV) Lighting Market encompasses all external and internal illumination systems designed for vehicles primarily used for transporting goods or passengers on commercial routes, such as vans, pickups, and chassis cabs. These advanced lighting systems are critical for ensuring operational safety, regulatory compliance, and enhancing vehicle aesthetics and functionality. Products range from essential external components like high-performance LED headlamps, adaptive beam technologies, and integrated signaling lights (turn signals, brake lights) to sophisticated internal cabin lighting designed for driver comfort and utility during long working hours. The increasing integration of smart lighting and connectivity features is transforming this segment, moving beyond traditional halogen systems towards energy-efficient and durable LED solutions. The core application areas include safety illumination, operational visibility, and design integration across fleet vehicles, delivery vans, and specialized utility vehicles.

The primary driving factors for market expansion include stringent global safety regulations, particularly mandates concerning visibility and daytime running lights (DRL), coupled with the rising global production and sale of LCVs, especially in emerging economies driven by the booming e-commerce and logistics sectors. Furthermore, technological advancements leading to the cost reduction and performance improvement of LED and OLED technologies are accelerating the transition away from conventional lighting sources. These new lighting systems offer significant benefits, including superior longevity, reduced power consumption, immediate light output, and enhanced design flexibility, which automotive manufacturers are leveraging to differentiate their models and improve total cost of ownership (TCO) for fleet operators. The shift towards autonomous and semi-autonomous LCVs further necessitates highly reliable, adaptive lighting solutions capable of communicating with advanced driver-assistance systems (ADAS) and providing sophisticated environmental feedback, thus driving innovation and market value.

Product descriptions within this market focus heavily on durability and resistance to vibration and harsh operating environments typical of commercial use. Key components include front lighting modules (high and low beams, fog lights), rear lighting clusters (stop, tail, reverse lights), and auxiliary safety lighting (side markers, clearance lamps). Major applications span last-mile delivery vehicles, mobile workshops, construction site transport, and refrigerated transport vans. The benefit proposition is centered on reducing accident rates through improved visibility, decreasing maintenance costs due to longer component lifespan, and meeting the demanding aesthetic and functional requirements of modern commercial fleets, ultimately boosting efficiency and driver acceptance. The inherent robustness of LED technology—providing superior resistance to vibration, extended operational lifespan, and significantly reduced energy consumption—is the primary catalyst making it the standard choice for fleet managers aiming to minimize vehicle downtime and optimize the Total Cost of Ownership (TCO).

LCV Lighting Market Executive Summary

The LCV Lighting Market is undergoing a rapid evolution characterized by fundamental shifts in material science and electronic integration, primarily propelled by the worldwide transition to LED technology. Business trends reveal a concentrated effort by Tier 1 suppliers to vertically integrate component manufacturing and software development to offer comprehensive, integrated lighting solutions that synchronize with the vehicle's electrical architecture and ADAS systems. Strategic partnerships between lighting suppliers and major LCV Original Equipment Manufacturers (OEMs) are crucial, focusing on joint development projects for next-generation adaptive and intelligent lighting systems. Furthermore, sustainability initiatives are influencing sourcing decisions, with manufacturers prioritizing materials that reduce weight and are recyclable, contributing to overall vehicle efficiency and reducing the environmental footprint of LCV production. The aftermarket segment is also witnessing robust growth, driven by fleet operators upgrading existing halogen systems to more efficient LED alternatives to realize immediate operational cost savings.

Regional trends indicate that Europe and North America currently hold significant market shares due to strict regulatory frameworks mandating advanced safety features and high consumer adoption rates of premium LCV models featuring sophisticated lighting technology. However, the Asia Pacific region, particularly China and India, is projected to exhibit the fastest growth trajectory, fueled by explosive growth in e-commerce, expansion of urban logistics infrastructure, and increasing manufacturing capacity for LCVs within these geographies. Government investments in infrastructure and the corresponding demand for reliable transport solutions are driving the volume sales of LCVs, subsequently increasing the demand for compliant and high-quality lighting components. The standardization of vehicle safety features across various national markets in APAC is a critical factor unifying market requirements and simplifying supply chain logistics for global suppliers, making the region a focal point for future investment and capacity expansion. This necessitates better training and technical support for independent repair facilities, ensuring that the benefits of advanced lighting are maintained throughout the vehicle's operational lifecycle.

Segment trends underscore the dominance of the external lighting segment, driven primarily by headlamps adopting matrix and digital light processing (DLP) technologies that allow for dynamic beam shaping and targeted illumination, minimizing glare for oncoming traffic while maximizing driver visibility. By technology, LEDs are the undisputed leading segment, rapidly displacing halogen bulbs across all applications due to their inherent advantages in energy efficiency, lifespan, and packaging flexibility. Within the application segmentation, the OEM sector maintains the largest share, reflecting the continuous introduction of new vehicle platforms with advanced lighting installed as standard equipment. However, the service and replacement market remains vital, especially for older fleet vehicles that require durable, cost-effective replacement parts, ensuring that the total lifecycle value proposition of LED lighting remains attractive to cost-sensitive commercial operators. The increasing complexity of lighting systems necessitates sophisticated electronic control and integration within the vehicle's main network architecture.

AI Impact Analysis on LCV Lighting Market

User inquiries regarding Artificial Intelligence (AI) in LCV lighting primarily revolve around its role in enhancing safety, personalization, and predictive maintenance. Common questions focus on how AI algorithms can interpret real-time sensor data (from cameras, LiDAR, and radar) to instantaneously adjust headlight beam patterns (Adaptive Driving Beams, ADB) to changing road conditions, weather, and traffic, which users believe will significantly reduce nocturnal accident rates. There is also substantial interest in AI's capacity to diagnose impending failures in complex lighting arrays, moving maintenance from reactive to predictive models, thereby minimizing vehicle downtime for commercial fleets. Furthermore, users are keen on understanding how AI facilitates Human-Machine Interface (HMI) optimization within the cabin, using ambient and functional lighting to communicate critical information or warnings to the driver non-verbally, managing driver fatigue, and customizing the light environment based on biometric inputs or operational requirements.

The application of AI extends significantly into the manufacturing and supply chain of LCV lighting components. AI-driven quality control systems are being deployed to inspect complex LED matrices and optical elements during production, ensuring defect rates are minimized and achieving higher levels of reliability that are critical for commercial vehicles operating under heavy utilization schedules. Optimization of beam projection and pattern generation is increasingly performed using machine learning models, allowing designers to quickly iterate complex optical designs that meet rigorous regulatory standards globally. This accelerates the product development cycle. The primary concern among users remains the cost and complexity of integrating these advanced AI systems into the often price-sensitive LCV segment, alongside cybersecurity risks associated with networked, smart lighting components that are integrated into the vehicle's CAN bus architecture. Protecting the integrity of the vehicle's lighting and signaling systems is paramount, driving the need for robust software authentication and encryption within the Electronic Control Units that govern light behavior.

Consequently, the future market outlook suggests that AI will transition LCV lighting from passive illumination devices to active, intelligent sensory inputs. This shift involves lighting systems acting as integrated sensors and communicators, projecting information onto the road surface (e.g., navigation markers, speed warnings) or interacting directly with autonomous driving stacks. AI algorithms analyze data streams from road signs, road curvature, and pedestrian movement to preemptively adjust light intensity and spread. This high degree of adaptivity and predictive functionality is essential for Level 3 and higher autonomous driving LCVs, where robust, reliable environmental perception is paramount, positioning AI as a fundamental enabler of future commercial mobility technologies, contributing substantially to enhanced safety and operational predictability in complex logistics scenarios. The software component of LCV lighting has thus become a crucial differentiator, determining the speed, precision, and reliability of the illumination functionality.

- AI-enabled Adaptive Driving Beams (ADB) enhance real-time beam pattern optimization based on environmental sensor data.

- Predictive Maintenance algorithms utilize operational data to forecast potential failures in LED drivers or modules, minimizing fleet downtime.

- Integration with ADAS provides enhanced environmental awareness, utilizing lighting as an active communication tool for autonomous systems.

- AI-driven optimization accelerates the design and testing phases of new optical systems and light distribution patterns.

- Cabin lighting HMI leverages AI to manage driver comfort, monitor fatigue, and convey critical safety alerts through subtle light cues.

DRO & Impact Forces Of LCV Lighting Market

The dynamics of the LCV Lighting Market are shaped by a confluence of accelerating drivers (D), persistent restraints (R), significant opportunities (O), and potent impact forces. Key drivers include the global proliferation of e-commerce necessitating extensive last-mile delivery fleets, which directly increases the LCV population requiring robust lighting solutions. Simultaneously, mandatory regulatory changes, such as those imposed by UNECE regulations for advanced front lighting systems and stricter safety standards in high-growth markets like India and Brazil, compel OEMs to adopt premium, high-performance lighting technology. These regulatory requirements elevate the baseline safety and functionality of lighting systems, thereby increasing the average selling price and market penetration of LEDs across all LCV categories. Furthermore, the inherent benefits of LED technology—including superior energy efficiency, extended operational life translating to reduced TCO for fleet managers, and enhanced design flexibility—continue to drive adoption as a fundamental competitive advantage in the commercial transport sector.

However, market growth faces notable restraints, primarily related to the high initial capital investment required for implementing advanced lighting systems, such as Matrix LEDs or adaptive lighting, especially in cost-sensitive LCV segments. Although the long-term operational costs are lower, the upfront expenditure can deter smaller fleet operators or manufacturers focused on entry-level models. Another significant restraint is the thermal management complexity associated with high-intensity LED systems; effective heat dissipation is crucial for maintaining LED longevity, and integrating these cooling solutions adds to system complexity and overall weight. Furthermore, the market faces challenges related to standardization, as integrating diverse proprietary ADAS systems with third-party lighting software necessitates complex and costly integration efforts, slowing down widespread adoption of universal smart lighting solutions. The need for specialized servicing expertise and diagnostic tools for complex LED modules also acts as a practical restraint in the aftermarket.

Opportunities for growth are vast, particularly stemming from the accelerating trend toward vehicle electrification (e-LCVs), where the superior energy efficiency of LED lighting is paramount for maximizing battery range. The development of intelligent and connected lighting systems that communicate with Smart City infrastructure presents a substantial avenue for innovation, enabling V2X communication through exterior lights (Li-Fi applications). Moreover, penetrating emerging markets with customized, durable, and highly cost-effective LED retrofit kits for older LCV fleets represents a lucrative aftermarket opportunity. The potential for integrating OLED technology into high-end LCVs offers new possibilities for design freedom, uniform illumination, and reduced depth, providing aesthetic differentiation and enhanced brand identity. These technological advancements create a strong forward pull for market expansion and value creation, specifically targeting the improvement of light intensity and longevity under harsh commercial operating conditions.

The primary impact forces shaping the market are the rapid pace of technological obsolescence, where new generations of LED chips and optical systems quickly replace older designs, necessitating continuous R&D investment, and the powerful influence of fleet management operational costs. Fleet operators prioritize reliability and TCO above novel features, meaning that the performance-to-price ratio of lighting solutions heavily dictates purchasing decisions. Government regulations relating to vehicle safety and environmental performance (e.g., weight reduction mandates) act as forceful external pressures, guiding the speed and direction of technological adoption across all major global production hubs. The transition to autonomous driving capabilities is arguably the most transformative impact force, compelling lighting systems to evolve into multifunctional, sensor-integrated components capable of high-reliability environmental perception. The interplay of these forces ensures that only highly resilient and technologically advanced solutions succeed in the competitive LCV environment.

Segmentation Analysis

The LCV Lighting Market is meticulously segmented across various critical dimensions, including technology type, application area, product category, and distribution channel, providing comprehensive insights into market dynamics and growth pockets. Technological segmentation highlights the dramatic shift from traditional incandescent and halogen bulbs, which are rapidly becoming obsolete, to modern, high-efficiency lighting sources. LED technology dominates this landscape due to its superior performance characteristics, including instantaneous illumination, extended lifespan, and substantial energy savings, making it the default choice for both OEM installations and aftermarket replacements, particularly appealing to cost-conscious fleet managers. While Halogen lamps retain a niche presence in extremely price-sensitive replacement markets, advanced technologies like OLEDs and Laser lighting are beginning to penetrate premium LCV segments, primarily for aesthetic and ultra-high-performance signaling applications, though their high cost currently restricts widespread commercial deployment. Understanding these technological shifts is crucial for manufacturers developing future product roadmaps that prioritize both performance and lifecycle cost optimization.

The segmentation by product category clearly demarcates the market into exterior lighting (which accounts for the largest revenue share) and interior lighting. Exterior lighting encompasses all safety-critical functions, including headlamps (high/low beam), signaling lamps (turn, brake, position), and auxiliary lamps (fog, DRL). The complexity and integration requirements of modern exterior lighting, particularly those incorporating adaptive beam technologies and advanced sensors, drive its significant market valuation. Interior lighting, while smaller in volume, is growing in importance as LCV designers focus on driver comfort, utility, and safety. This segment includes dashboard illumination, dome lights, reading lamps, and cargo bay lighting, with a growing trend towards ambient, mood-setting, and task-specific LED strips that enhance the working environment for drivers who spend extended periods on the road. The utility of the cargo area lighting is particularly critical for maximizing operational efficiency during loading and unloading activities in low-light conditions, demanding robust and high-lumen output designs that can withstand physical impact.

Furthermore, the segmentation by vehicle type (Vans, Pickups, Chassis Cabs, etc.) is vital, as lighting requirements and regulatory compliance levels differ significantly based on the LCV's size, intended usage profile, and payload capacity. Distribution channel segmentation (OEM vs. Aftermarket) reflects the two distinct sales pathways, with OEM sales driven by new vehicle production volume and technological adoption, while the aftermarket is governed by vehicle longevity, replacement cycles, and fleet maintenance strategies. The aftermarket provides essential volume for standardized replacement modules and significant opportunity for LED retrofit kits, capitalizing on the desire of fleet owners to upgrade existing vehicles to meet modern efficiency standards without incurring the full cost of new vehicle procurement. Analyzing these segments provides a clear framework for targeted marketing and strategic resource allocation across different market verticals, ensuring suppliers meet the varied needs for reliability, cost, and technological sophistication across the entire LCV operational spectrum.

- Technology: Halogen, Xenon (HID), LED, OLED, Laser.

- Product Type: Exterior Lighting (Headlamps, Tail Lamps, Fog Lamps, Signal Lamps, DRLs), Interior Lighting (Dome Lights, Dashboard Lights, Reading Lights, Cargo Bay Lights).

- Vehicle Type: Light-Duty Vans, Pickup Trucks, Mini-Trucks/Chassis Cabs, Utility Vehicles.

- Distribution Channel: OEM (Original Equipment Manufacturer), Aftermarket.

- Application: Safety Illumination, Styling and Design, Operational Utility.

Value Chain Analysis For LCV Lighting Market

The value chain for the LCV Lighting Market is inherently complex, starting with upstream activities involving raw material procurement and highly specialized component manufacturing. The upstream segment is dominated by suppliers of critical materials such as advanced polymers and polycarbonate materials for lenses and housing, semiconductor components (LED chips and integrated circuits), and electronic control units (ECUs). Major specialized suppliers focus on producing high-efficiency LED modules, thermal management solutions (e.g., heat sinks), and precise optical components (reflectors, lenses). This segment requires intense R&D investment to maintain technological leadership, particularly concerning light output efficiency, chromaticity stability, and miniaturization of components. Strategic sourcing of high-quality, durable materials is crucial because LCV lighting components must withstand extreme vibrations and environmental stresses typical of commercial use, necessitating strict adherence to automotive-grade quality standards like IATF 16949, ensuring reliability throughout the product lifecycle.

The midstream phase involves Tier 1 lighting system manufacturers who aggregate these specialized components, integrating them into complex, functional lighting modules (e.g., full LED headlamps or rear light clusters). These Tier 1 suppliers (e.g., Hella, Koito, Valeo) engage in significant engineering activities, including thermal design, electrical integration, and software development for advanced functions like adaptive lighting and diagnostics. Distribution channels play a vital role in connecting these manufacturers to the final consumer. The direct channel involves the sale of complete systems directly to LCV OEMs for assembly line integration. This channel is characterized by long-term contracts, stringent quality requirements, and collaborative design processes, often involving co-development early in the vehicle platform creation. The indirect channel serves the aftermarket, involving independent distributors, wholesalers, and specialized parts retailers who supply fleet maintenance operators and independent repair shops with replacement units and upgrade kits. The efficiency and geographic reach of the indirect channel are paramount for minimizing vehicle downtime in commercial operations, demanding robust logistics management.

Downstream activities center around the end-users: LCV fleet operators and vehicle owners. These stakeholders are primarily concerned with the total cost of ownership (TCO), reliability, ease of maintenance, and compliance with operational safety standards. Servicing and maintenance are critical downstream activities. Since LCVs operate intensively, component lifespan and ease of replacement directly impact profitability. Consequently, the value chain is optimized to ensure a robust supply of high-quality, standardized replacement parts through the aftermarket. The direct feedback loop from fleet maintenance teams regarding component longevity and performance informs upstream design improvements, often leading to iterative improvements in thermal management and sealing technologies. The effectiveness of the overall value chain relies heavily on seamless collaboration and information exchange, particularly regarding inventory management and logistics, ensuring that complex, proprietary lighting systems can be serviced effectively throughout the vehicle's commercial life, providing necessary technical documentation and certified training to maintenance personnel.

LCV Lighting Market Potential Customers

The core customer base for the LCV Lighting Market primarily consists of two major groups: Original Equipment Manufacturers (OEMs) and Fleet Operators/Service Providers. OEMs, including major global automotive groups specializing in commercial vehicles (e.g., Ford Commercial, Mercedes-Benz Vans, Volkswagen Commercial Vehicles, and emerging Chinese LCV manufacturers), represent the largest volume purchasers, demanding large quantities of technologically advanced, custom-designed lighting modules that integrate seamlessly with their vehicle platforms. These customers prioritize supply chain reliability, compliance with strict regulatory standards (e.g., ECE R48/R123), and the ability of the lighting system to contribute to vehicle design and overall brand identity. They require partners capable of providing integrated solutions, including the necessary software and control electronics, emphasizing high initial quality and zero defect tolerance during mass production, necessitating rigorous validation testing prior to deployment.

The second substantial customer group comprises fleet operators—such as logistics companies (Amazon, FedEx, DHL), rental agencies, utility companies, and construction businesses—who purchase lighting components primarily through the aftermarket distribution channels for maintenance, repair, and upgrade purposes. For these commercial customers, the purchasing decision is fundamentally driven by TCO metrics. They seek components offering maximum durability, extended warranty coverage, ease of installation, and exceptional energy efficiency, particularly critical for electric LCV fleets where every watt saved translates into extended operational range. There is a strong demand from this segment for robust, standardized LED replacement and retrofit kits that offer superior performance compared to legacy halogen systems, allowing them to modernize their existing vehicle assets cost-effectively and minimize operational expenditure related to frequent bulb replacements, thus maximizing vehicle utilization rates.

Furthermore, specialized secondary customer segments include regulatory bodies and safety organizations whose mandates and testing requirements indirectly dictate market demand, forcing manufacturers to innovate. Independent repair garages and specialized body shops also constitute important customers within the indirect distribution channel, requiring readily available, quality-certified replacement parts. As LCVs continue to integrate complex ADAS features, the potential customer base expands to include technology integrators who require lighting components that can function as sophisticated sensor platforms, capable of high-speed data transmission and environmental interaction. Targeting these diverse customer segments requires a multifaceted strategy that addresses high-volume OEM contractual requirements while simultaneously ensuring effective, cost-efficient distribution and support for the geographically dispersed aftermarket consumer base, requiring flexible pricing and inventory management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella GmbH & Co. KGaA, OSRAM GmbH, Stanley Electric Co., Ltd., Koito Manufacturing Co., Ltd., Valeo SA, Magneti Marelli S.p.A., Continental AG, Bosch Group, ZKW Group GmbH, Lumax Industries Ltd., Varroc Group, Marelli (Calsonic Kansei & Magneti Marelli), Denso Corporation, Samvardhana Motherson Automotive Systems Group, North American Lighting Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LCV Lighting Market Key Technology Landscape

The LCV lighting technology landscape is defined by the rapid maturation and integration of Solid-State Lighting (SSL), primarily LED technology, which has fundamentally redefined performance parameters in the commercial vehicle sector. The shift is centered on improving light efficiency, reliability, and functionality. Key technological advancements include Matrix LED systems and Adaptive Driving Beam (ADB) technology. Matrix LEDs utilize an array of individually controllable light sources, often numbering over 100, managed by sophisticated software and sensors to dynamically shape the light beam. This allows the system to maximize illumination on the road without dazzling oncoming drivers or preceding vehicles, a critical safety enhancement for LCVs frequently operating in varied urban and rural environments. The integration of high-definition cameras and sophisticated ECUs is essential for processing real-time environmental data necessary to execute these dynamic beam adjustments instantly, requiring high-speed processing and robust software architecture.

Beyond external lighting, internal component advancements are equally impactful. High-performance LED drivers are crucial for ensuring the longevity and stable performance of LED chips, managing power fluctuations and heat generation effectively. Thermal management solutions, including advanced heat sinks and phase-change materials, are critical components, especially as LED light density increases. Furthermore, the burgeoning field of connectivity is leveraging lighting systems for Vehicle-to-Everything (V2X) communication. Visible Light Communication (VLC), or Li-Fi, uses LED exterior lights to transmit data, offering potential applications for autonomous platooning, infrastructure communication, and data exchange between commercial vehicles. This integration transforms the lighting unit from a mere source of illumination into an active, data-transmitting device, preparing LCVs for the era of smart logistics and connected fleets, simultaneously demanding increased focus on cybersecurity within the integrated electronics.

Looking forward, Organic Light Emitting Diodes (OLEDs) represent a niche but expanding technology, offering unparalleled design flexibility, ultra-thin profiles, and homogenous light distribution without the need for complex optics. While currently expensive, OLEDs are primarily used in high-end LCV signaling and aesthetic applications, providing distinct brand differentiation. Laser lighting, while providing exceptionally high intensity and long throw distance, remains largely restricted to concept vehicles or extremely premium commercial models due to cost and regulatory hurdles, though its potential for enhanced visibility in severe weather conditions is highly attractive. Overall, the market is characterized by software-defined lighting, where the physical components are standardized, but the functionality and performance are dictated by embedded algorithms and real-time data processing, driving innovation towards safety and connectivity, necessitating strong partnerships between traditional hardware suppliers and software specialists.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Momentum: The APAC region is poised to maintain its position as the largest and fastest-growing market for LCV lighting, primarily driven by China and India. This expansive growth is a direct result of unprecedented urbanization, rapid industrialization, and massive investment in logistics infrastructure fueled by the explosive growth of e-commerce. The high volume of LCV production in countries like China, both for domestic consumption and export, creates enormous demand for lighting components. While the market initially focused on cost-effective halogen solutions, increasingly stringent government regulations on vehicle safety and fuel efficiency are rapidly accelerating the adoption of mandatory LED lighting systems across new LCV platforms. This regulatory push, combined with a growing consumer demand for feature-rich, modern vehicles, ensures sustained, high-volume market expansion, requiring localized R&D efforts to meet varied regulatory standards across sub-regions.

- European Market Leadership in Technology and Regulation: Europe holds a strong position in terms of market value and technological innovation, largely due to early adoption of comprehensive safety standards such as those mandated by the UNECE. European OEMs were pioneers in implementing Daytime Running Lights (DRL) and complex Adaptive Front-lighting Systems (AFS) and Matrix LED technology in commercial fleets, viewing lighting as a primary safety differentiator. The focus here is not just on volume, but on sophistication and quality, driving demand for premium, integrated lighting solutions that meet strict environmental (e.g., lightweighting) and safety compliance requirements. Furthermore, the strong push toward fleet electrification (e-LCVs) in major EU nations further favors high-efficiency LED technologies to conserve battery power, demanding high-performance thermal management solutions within the lighting modules to ensure longevity.

- North American Stability and High Aftermarket Activity: The North American market (dominated by the US and Canada) is characterized by a high demand for large pickup trucks and specialized utility vehicles, requiring robust, powerful lighting systems optimized for varied environmental conditions and long-haul usage. While technological adoption of advanced systems like ADB has historically been slower due to regulatory divergence from UNECE standards, the recent modernization of Federal Motor Vehicle Safety Standards (FMVSS) is expected to unlock rapid innovation in intelligent headlamp technology. The aftermarket segment in North America is particularly robust, driven by extensive vehicle longevity and the continuous need for high-quality, durable replacement parts and performance upgrade kits for fleets operating heavy-duty cycles, making product durability and easy availability key commercial differentiators.

- Latin America and MEA Emerging Opportunities: Latin America and the Middle East & Africa (MEA) represent significant future growth opportunities, although current market adoption is concentrated in basic and mid-range lighting solutions. Growth in LATAM is tied to economic recovery and infrastructure investment, increasing the sales of essential utility LCVs. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is experiencing increased LCV demand driven by large-scale construction projects and logistics diversification. As vehicle parc expands and regulatory environments mature, the transition towards mandatory LED adoption and higher safety standards is anticipated, offering a fertile ground for Tier 2 and Tier 3 suppliers focusing on durable, cost-optimized LED replacement modules suitable for challenging climatic conditions, such as high heat and dust exposure, demanding highly resilient sealing technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LCV Lighting Market.- Hella GmbH & Co. KGaA

- OSRAM GmbH

- Stanley Electric Co., Ltd.

- Koito Manufacturing Co., Ltd.

- Valeo SA

- Magneti Marelli S.p.A. (Now Marelli)

- Continental AG

- Bosch Group

- ZKW Group GmbH

- Lumax Industries Ltd.

- Varroc Group

- North American Lighting Inc. (NAL)

- Denso Corporation

- Grupo Antolin

- Motherson Sumi Systems Limited

- Federal-Mogul Corporation (Tenneco)

- Flex-N-Gate Corporation

- Samvardhana Motherson Automotive Systems Group

- Ichikoh Industries, Ltd.

- Foshan Lighting Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the LCV Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the widespread adoption of LED technology in LCVs?

LED adoption is primarily driven by three factors: superior energy efficiency, which is vital for electric LCV range and reducing fuel consumption; greatly extended lifespan, minimizing maintenance costs and vehicle downtime for commercial fleets; and stringent global regulatory mandates requiring enhanced visibility and safety features, which LEDs enable through advanced functionality like Adaptive Driving Beams (ADB).

How do LCV lighting systems contribute to Total Cost of Ownership (TCO) for fleet operators?

LCV lighting systems significantly reduce TCO, predominantly through the longevity of LED components, which drastically lowers replacement frequencies and labor costs compared to traditional halogen bulbs. Furthermore, the lower power draw reduces alternator load, marginally improving fuel efficiency or extending the battery range in e-LCVs, leading to long-term operational savings by minimizing unscheduled vehicle service visits.

What role does Artificial Intelligence (AI) play in the future of LCV lighting?

AI is crucial for enabling next-generation safety features, specifically by managing and instantaneously adjusting complex Matrix LED systems based on real-time road conditions and sensor data. AI also facilitates predictive maintenance by monitoring component health, and supports V2X communication and autonomous driving perception through highly adaptive, intelligent illumination strategies, turning lights into active sensors.

Which geographical region exhibits the fastest growth potential for the LCV Lighting Market?

The Asia Pacific (APAC) region, led by major manufacturing hubs in China and India, is forecasted to demonstrate the fastest growth. This is attributed to massive increases in LCV production volumes driven by the booming e-commerce logistics sector, coupled with evolving regulatory frameworks that are mandating the integration of safer, more advanced lighting technologies for both domestic use and global export standards compliance.

What is the difference between OEM and Aftermarket LCV lighting distribution?

OEM (Original Equipment Manufacturer) distribution involves sales directly to vehicle assembly lines for new vehicle integration, focusing on customized, high-specification products that adhere to strict platform requirements. Aftermarket distribution involves selling replacement units and upgrade kits through wholesalers and retailers to maintenance shops and fleet operators, prioritizing standardization, availability, and cost-effectiveness for existing vehicles requiring repair or efficiency upgrades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager