Lead Clippers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435756 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Lead Clippers Market Size

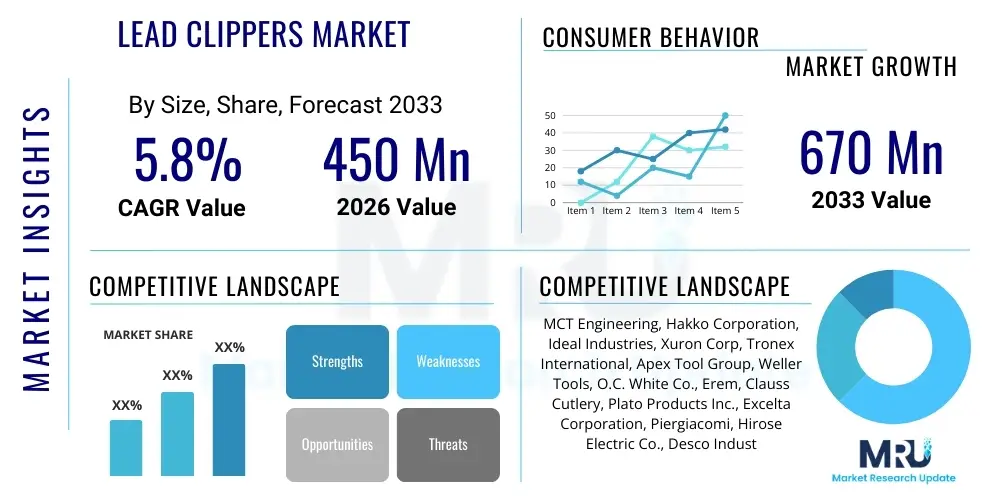

The Lead Clippers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Lead Clippers Market introduction

The Lead Clippers Market encompasses the global trade and utilization of specialized tools designed for precisely cutting and trimming lead wire, terminals, and excessive lead material, particularly within the electronics assembly and battery manufacturing sectors. These devices are crucial for ensuring high-quality solder joints, accurate component placement, and preventing short circuits by removing excess material after soldering processes, especially in Through-Hole Technology (THT) applications. The market segmentation primarily revolves around the degree of automation—ranging from manual hand tools used for low-volume or repair work to sophisticated automatic and robotic systems integrated into high-speed production lines.

Product descriptions typically emphasize precision, durability, and ergonomic design, particularly for manual and semi-automatic models, while automatic clippers focus on speed, repeatability, and integration capability with automated conveyance systems. Major applications are concentrated in the production of Printed Circuit Boards (PCBs), where lead management is critical for operational safety and final product reliability. Furthermore, the growth of renewable energy infrastructure and electric vehicles (EVs) drives demand, as specialized clippers are essential in the precise assembly of high-capacity battery packs where safety and consistent termination quality are paramount.

The primary benefits of adopting advanced lead clipping solutions include enhanced production efficiency, reduction in material waste, and significant improvement in the quality control of electrical assemblies. Driving factors for market expansion include the global resurgence of interest in industrial automation, stringent quality standards imposed by international regulatory bodies (especially in aerospace and automotive electronics), and the continuous scaling of electronics manufacturing in emerging economies. The necessity for precise lead management to prevent component stress and ensure long-term device stability solidifies the lead clipper as a non-negotiable tool in modern high-reliability manufacturing environments.

Lead Clippers Market Executive Summary

The global Lead Clippers market exhibits steady growth, primarily fueled by robust activity in the automotive electronics, industrial automation, and energy storage sectors. Business trends indicate a strong shift towards automated clipping solutions, driven by major manufacturing hubs in Asia Pacific seeking to improve throughput and reduce labor costs associated with manual processes. Key market players are focusing on developing high-precision, low-maintenance automatic clippers capable of handling diverse lead materials and thicknesses, catering specifically to miniaturization trends in PCB design and the increasing complexity of battery cell interconnections. Mergers, acquisitions, and strategic partnerships centered on software integration and robotic handling systems are defining the competitive landscape, aiming to offer holistic assembly solutions rather than just standalone tooling.

Regionally, Asia Pacific (APAC) dominates the market share due to its entrenched position as the world's leading electronics manufacturing hub, particularly China, South Korea, and Taiwan. However, North America and Europe demonstrate a higher adoption rate of fully automatic and specialized clippers, reflecting an emphasis on high-mix, low-volume production and stricter quality assurance protocols mandated by the defense and medical device industries. The regional disparity highlights different investment priorities: volume optimization in APAC versus high reliability and automation fidelity in Western markets. The increasing electrification of the transportation sector worldwide serves as a major regional driver, necessitating specialized equipment for handling large-scale lead-acid and lithium-ion battery terminals.

Segment trends confirm that the Automatic Lead Clippers segment is expanding fastest, largely displacing manual operations in large-scale assembly lines. Application-wise, the Electronics Manufacturing segment remains the largest consumer, but the Battery Assembly segment is experiencing the most dynamic growth, reflecting global investment in grid storage and EV production. Innovations in material science are also influencing the market, leading to the development of blades and cutting mechanisms optimized for diverse metal alloys now commonly used as lead substitutes or connectors. The overall market trajectory suggests sustained momentum, contingent upon the continued adoption of Industry 4.0 principles across global manufacturing operations.

AI Impact Analysis on Lead Clippers Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Lead Clippers market frequently center on two main themes: predictive maintenance and integration into smart manufacturing ecosystems. Users are keen to understand how AI algorithms can monitor the operational health of complex automatic clipping machines, predicting blade wear and scheduling maintenance proactively to minimize downtime. Furthermore, common questions address how AI-driven vision systems can improve clipping accuracy, identify microscopic defects in lead termination immediately post-cut, and optimize the clipping path based on real-time component variation. The expectation is that AI will move the process from simple mechanical execution to intelligent, adaptive precision processing, particularly in high-reliability applications where manual inspection is prone to error.

The key themes emerging from this analysis involve the transition from reactive tooling replacement to predictive resource management. Manufacturers expect AI to analyze vibration data, current draw, and clipping cycle times to determine optimal operational parameters, thereby extending equipment lifespan and ensuring consistent cut quality across millions of cycles. Concerns often relate to the cost and complexity of retrofitting existing equipment with AI sensors and connectivity tools necessary for data collection and integration into centralized manufacturing execution systems (MES). Overall, users anticipate that AI will serve as the intelligence layer, enabling fully automated, zero-defect clipping processes critical for advanced PCB and battery assembly.

Ultimately, the influence of AI on the Lead Clippers market is poised to be transformative, shifting the value proposition of automatic clippers from merely functional tools to integrated, intelligent nodes within the smart factory. This transition will elevate the competitive edge of manufacturers who adopt these technologies, offering unparalleled levels of precision, throughput, and operational transparency that traditional mechanical systems cannot match. The future of the market is deeply intertwined with the successful deployment of machine learning for process optimization and fault detection.

- AI-driven Predictive Maintenance: Monitoring machine vibration and wear patterns to forecast blade replacement needs, minimizing unexpected downtime in high-volume production.

- Enhanced Quality Control (QC): AI-powered vision systems analyzing post-clipping images for microscopic material defects and ensuring terminal height compliance.

- Adaptive Process Optimization: Utilizing machine learning to dynamically adjust clipping force and speed based on material hardness and ambient operating conditions.

- Integration with MES/SCADA: Providing real-time operational data on clipping efficiency and quality metrics directly to centralized manufacturing management systems.

- Robotic Path Planning: Optimizing the movement and trajectory of robotic arms utilizing automatic clippers for complex, high-density PCB layouts.

DRO & Impact Forces Of Lead Clippers Market

The dynamics of the Lead Clippers market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. A primary driver is the accelerating trend of miniaturization and complexity in electronic devices, necessitating extremely precise and consistent lead termination that only high-quality automated clippers can reliably provide. This is coupled with the massive global push toward electrification in the automotive and utility sectors, which demands robust equipment for assembling sophisticated battery packs. Conversely, significant restraints include the high initial capital expenditure required for fully automated clipping and handling systems, making entry difficult for smaller manufacturers, alongside the rising adoption of Surface Mount Technology (SMT) which inherently reduces the need for traditional through-hole lead trimming, thus posing a long-term challenge to the core THT clipping segment.

Opportunities for growth are vast, particularly in developing smart, connected clipping tools that integrate seamlessly with Industry 4.0 ecosystems, offering capabilities like remote monitoring, diagnostics, and AI-driven process optimization. Furthermore, specialization in exotic material clipping—such as copper alloy terminals or specific battery connectors—presents a high-value niche opportunity distinct from standard PCB applications. The major impact forces governing the market include stringent regulatory requirements regarding product safety and reliability in critical applications like medical and aerospace devices, which mandates the use of certified, high-precision tools to eliminate potential failure points stemming from poor lead termination. Economic factors, such as volatile raw material costs (especially for high-durability blade materials) and global supply chain disruptions, also exert constant pressure on pricing and lead times.

Ultimately, the market’s trajectory is heavily influenced by the balance between technological necessity and economic viability. While the technological demand for precision is rising due to smaller, more powerful devices, the economic barriers to entry for advanced automation remain high. Companies that successfully navigate these forces by offering cost-effective, highly reliable, and easily integrated automated solutions, while simultaneously capitalizing on the booming demand from battery manufacturing, are best positioned for sustained growth and market leadership in the coming decade. The shift towards higher-reliability requirements serves as a crucial underlying force demanding process excellence in lead management.

Segmentation Analysis

The Lead Clippers Market is broadly segmented based on the mechanism of operation, the specific application area, and the geographical distribution. The operational segmentation (Manual, Semi-Automatic, Automatic) reflects the varying degrees of production scale and labor costs across different manufacturing environments globally. While manual clippers remain essential for rework and small-batch production, the increasing global trend toward mass production and quality consistency drives the accelerating adoption of automatic systems, which offer superior repeatability and throughput capabilities. This segmentation is crucial for vendors designing product portfolios that address niche markets versus high-volume assembly lines.

The application-based segmentation (Electronics Manufacturing, Battery Assembly, Automotive, Aerospace) highlights the diverse end-use requirements for lead clipping precision. Electronics Manufacturing, particularly PCB assembly, constitutes the foundational and largest segment, but specialized segments like Battery Assembly are poised for explosive growth due to the global energy transition. Each application segment imposes unique material and tolerance requirements; for instance, aerospace components require ultra-high precision and comprehensive documentation, driving demand for technologically advanced and verified clipping solutions. Understanding these specific application needs allows manufacturers to tailor features such as blade material, cutting geometry, and integration protocols.

Geographically, market segmentation provides crucial insights into regional consumption patterns, regulatory environments, and manufacturing maturity. Asia Pacific leads in overall volume due to centralized electronics production, whereas North America and Europe lead in the adoption of premium, fully automated, and robotic clipping solutions designed for high-reliability, low-mix production environments. Successful market penetration strategies must account for these regional nuances, optimizing distribution channels and service networks accordingly to address localized demand effectively.

- By Type:

- Manual Lead Clippers

- Semi-Automatic Lead Clippers

- Automatic Lead Clippers

- By Application:

- Electronics Manufacturing (PCB Assembly)

- Battery Assembly (EV and Energy Storage)

- Automotive Industry (Beyond general electronics)

- Aerospace and Defense

- Medical Devices

- Others (e.g., Industrial Control Systems)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France)

- Asia Pacific (China, Japan, India)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Lead Clippers Market

The value chain for the Lead Clippers market begins with upstream analysis, which involves the sourcing of raw materials, primarily specialized high-speed tool steel, carbide, and durable plastics for housing and ergonomic grips. The quality and purity of these materials are paramount, as the cutting edge of clippers must withstand repeated stress and abrasion from diverse lead materials without premature dulling or failure. Key upstream activities include metallurgy research, precision forging, and specialized heat treatment processes necessary to achieve the requisite hardness and toughness for the blades. Suppliers specializing in high-performance alloys therefore exert significant influence on the overall cost structure and quality output of the final product.

Midstream activities involve the core manufacturing processes: precision machining and assembly. This stage includes highly specialized CNC grinding of the cutting blades, often utilizing proprietary geometries, followed by the integration of mechanical and electronic components (for automated systems, including motors, sensors, and control PCBs). Quality control at this stage is intensive, focusing on dimensional accuracy, cutting force calibration, and functional testing under simulated production loads. The complexity of assembly increases exponentially for automatic clippers, requiring specialized electro-mechanical engineers and highly standardized clean room environments to ensure reliability.

Downstream analysis covers distribution and end-user engagement. Distribution channels typically involve a mix of direct sales (especially for large, custom automatic clipping systems), specialized industrial equipment distributors, and online marketplaces for manual and replacement parts. Direct engagement allows manufacturers to provide customized training, integration services, and maintenance contracts, which are critical value-adds for complex automated solutions. The distribution efficiency and quality of after-sales service directly impact customer satisfaction and market penetration, particularly in regions with high demands for continuous operational uptime, such as the automotive industry. Potential customers include contract manufacturers, original equipment manufacturers (OEMs) in electronics and battery sectors, and dedicated industrial repair facilities.

Lead Clippers Market Potential Customers

Potential customers and end-users of Lead Clippers span across various high-value manufacturing sectors where precision termination of conductors and leads is mandatory for product integrity. The largest segment of buyers consists of Electronics Contract Manufacturers (ECMs) and Original Equipment Manufacturers (OEMs) specializing in Printed Circuit Board (PCB) assembly utilizing Through-Hole Technology (THT). These companies require vast quantities of manual, semi-automatic, and automatic clippers to handle the lead preparation phase before soldering or the post-solder trimming of excess leads to prevent component damage or short circuits in the final device.

A rapidly expanding customer base is found within the Battery Assembly sector, particularly manufacturers involved in electric vehicle (EV) battery packs and large-scale industrial energy storage solutions. These applications necessitate highly specialized, robust clippers designed to handle thicker terminals and unique busbar geometries with high precision and reliability. The focus here is on ensuring optimal conductivity and safety, driving demand for high-end, customized automatic solutions integrated into robotic assembly lines. The stringent safety requirements in battery manufacturing mean these customers prioritize quality, durability, and comprehensive service agreements over purely cost-driven decisions.

Other key customer segments include aerospace and defense contractors, who demand the highest possible standards of quality assurance and traceability for every cut, relying almost exclusively on certified, high-precision automated systems. Similarly, manufacturers of medical devices, where component failure can have severe consequences, represent a significant, albeit smaller, segment emphasizing zero-defect production facilitated by advanced clipping technology. Industrial control systems manufacturers, who produce robust equipment designed for harsh environments, also constitute a stable customer segment requiring durable and reliable lead trimming capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MCT Engineering, Hakko Corporation, Ideal Industries, Xuron Corp, Tronex International, Apex Tool Group, Weller Tools, O.C. White Co., Erem, Clauss Cutlery, Plato Products Inc., Excelta Corporation, Piergiacomi, Hirose Electric Co., Desco Industries, Vigor Technology, JBC Tools, OK International, Techcon Systems, Kenwood Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lead Clippers Market Key Technology Landscape

The technological landscape of the Lead Clippers market is dominated by advancements in materials science, automation integration, and precision engineering. A crucial technological element is the development and application of specialized blade materials, such as high-carbon stainless steels and tungsten carbide alloys, treated with proprietary coatings (e.g., Titanium Nitride or Diamond-Like Carbon, DLC) to enhance durability and reduce friction. These material innovations are necessary to maintain a sharp edge for extended periods, especially when cutting tougher, non-traditional lead materials now common in high-density electronic assemblies. The emphasis on material longevity directly addresses one of the primary operational challenges: minimizing downtime associated with blade replacement and re-calibration.

In the automated segment, the technology focuses heavily on robotics and sophisticated vision systems. Automatic Lead Clippers are increasingly integrated into six-axis robotic arms or specialized X-Y gantries, utilizing advanced servo motors for precise movement control. High-resolution machine vision systems (incorporating AI for defect detection, as discussed previously) are standard for verifying lead presence, component height, and ensuring the clipping occurs exactly at the desired point without damaging the PCB or adjacent components. Furthermore, modular design principles are key, allowing manufacturers to quickly swap out clipping heads and feeder mechanisms to accommodate different board sizes or component types, enhancing production flexibility in high-mix environments.

A burgeoning technological trend involves the incorporation of sensor technologies for process monitoring and data collection. Automated clippers are being equipped with force sensors, thermal monitoring systems, and vibration analyzers to gather real-time data on the cutting process. This data is critical for implementing predictive maintenance protocols and ensuring full traceability of the assembly process, aligning with strict quality management systems (QMS) required by aerospace and medical device manufacturers. The continuous improvement of firmware and connectivity standards (such as EtherCAT or OPC UA) ensures these devices are future-proof and compatible with sophisticated industrial IoT (IIoT) platforms, further cementing the role of technology in driving market competitiveness.

Regional Highlights

The Lead Clippers market displays distinct growth and adoption patterns across major global regions, reflecting localized manufacturing strengths and regulatory requirements. Asia Pacific (APAC) holds the undisputed largest market share, driven primarily by China, South Korea, and Taiwan, which serve as global epicenters for electronics manufacturing and mass production. The immense volume of Printed Circuit Board (PCB) assembly taking place in this region creates an enormous baseline demand for all types of clippers, though there is a discernible trend toward aggressive investment in high-speed, automated clipping lines to maintain competitive labor costs and high throughput capacity. India and Southeast Asian nations are emerging as rapid growth centers, capitalizing on supply chain diversification efforts, which translates directly into increasing demand for assembly line equipment, including lead clippers.

North America and Europe represent mature markets characterized by stringent quality standards, high labor costs, and a significant presence of highly specialized industries (aerospace, defense, medical devices, and high-end automotive). In these regions, market growth is focused less on volume and more on value, driving the demand for advanced, fully automatic, and robotic clipping solutions that offer exceptional precision, full process traceability, and seamless integration with existing factory automation systems. Furthermore, Europe, particularly Germany, is a leader in industrial automation and precision engineering, leading to a strong local market for advanced semi-automatic and specialized manual tools designed for ergonomic excellence and low-mix, high-value production runs. The rising demand for electric vehicle manufacturing facilities across both continents is a core driver for specialized battery terminal clipping technology.

Latin America (LATAM) and the Middle East & Africa (MEA) currently represent smaller but developing markets. LATAM's growth is tied mainly to localized automotive and consumer electronics assembly, with demand centered on cost-effective semi-automatic solutions. MEA, particularly in the UAE and Saudi Arabia, shows potential due to nascent governmental initiatives aimed at diversifying industrial bases and investing in technology infrastructure, including basic electronics assembly. However, growth in both regions is often constrained by high import duties and a reliance on imported technology and technical expertise. Suppliers targeting these regions must prioritize robust, easily maintainable equipment with comprehensive localized support structures.

- Asia Pacific (APAC): Dominates market volume; driven by China, South Korea, and Taiwan as global manufacturing hubs. Characterized by high adoption of high-speed automatic clippers for mass production. Emerging growth in India and Vietnam.

- North America: Focus on high-reliability sectors (Aerospace, Medical, Defense). High demand for fully automated, robotic, and smart clipping systems integrated with AI-driven QC. Significant growth driver from EV battery assembly facilities.

- Europe: High emphasis on precision engineering, ergonomic manual tools, and certified equipment for critical applications. Strong adoption of Industry 4.0 principles, driving demand for data-logging and traceable clipping processes.

- Latin America (LATAM): Growth tied to domestic automotive and consumer goods assembly; focused primarily on semi-automatic and basic automated solutions, prioritizing cost efficiency.

- Middle East & Africa (MEA): Nascent market primarily driven by infrastructure development and government-backed industrialization projects; reliance on robust, imported equipment with long operational life.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lead Clippers Market.- MCT Engineering (Specialized Automatic Solutions)

- Hakko Corporation (Strong presence in Manual and Semi-Automatic tools)

- Ideal Industries (Focus on industrial and electrical solutions)

- Xuron Corp (Known for precision ergonomic cutters)

- Tronex International (High-quality hand tools for electronics)

- Apex Tool Group (Diverse portfolio, global reach)

- Weller Tools (Strong brand recognition in soldering and assembly tools)

- O.C. White Co. (Assembly tools and visual inspection equipment)

- Erem (Precision pliers and cutters, recently acquired by Weller)

- Clauss Cutlery (Historical presence in cutting tools)

- Plato Products Inc. (Focus on specialized electronic assembly cutters)

- Excelta Corporation (High-precision tools for critical environments)

- Piergiacomi (European manufacturer of PCB tooling)

- Hirose Electric Co. (Components manufacturer with specialized tooling lines)

- Desco Industries (Industrial equipment and control solutions)

- Vigor Technology (Automation and precision machinery supplier)

- JBC Tools (Known for high-end soldering and rework tools)

- OK International (Industrial soldering and fluid dispensing)

- Techcon Systems (Precision fluid dispensing and associated tooling)

- Kenwood Electronics (Indirect supplier in the electronics ecosystem)

Frequently Asked Questions

Analyze common user questions about the Lead Clippers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Automatic Lead Clippers?

The primary factor is the increasing need for high-volume production consistency and precision in electronics manufacturing and battery assembly. Automatic clippers significantly reduce labor costs, eliminate human variability, and ensure component leads are trimmed to exact specifications, crucial for quality control and preventing short circuits in high-density PCBs.

How is the adoption of Surface Mount Technology (SMT) impacting the Lead Clippers Market?

SMT adoption acts as a restraint on the traditional Through-Hole Technology (THT) segment of the market, reducing the need for traditional lead clipping. However, specialized lead clippers are still essential for hybrid PCBs, final assembly components, and, increasingly, in the specialized cutting and preparation of battery terminals and heavy-gauge wiring, creating new high-value niches.

What materials are commonly used for high-durability lead clipper blades?

High-durability blades are typically constructed from high-carbon tool steel or specialized tungsten carbide alloys. These materials often undergo proprietary heat treatments and are coated with hard, friction-reducing surfaces, such as Titanium Nitride (TiN) or Diamond-Like Carbon (DLC), to ensure exceptional longevity and consistent cutting performance across millions of cycles.

Which geographical region dominates the consumption of Lead Clippers?

Asia Pacific (APAC) dominates the consumption of Lead Clippers in terms of sheer volume. This is due to the region housing the world’s largest electronics manufacturing ecosystem, particularly centralized in countries like China, Taiwan, and South Korea, which drives massive demand for both manual and highly automated clipping equipment.

What role does AI play in modern Lead Clipping systems?

AI is increasingly used to enhance system intelligence by enabling predictive maintenance—forecasting blade wear and required servicing—and by powering advanced machine vision systems for real-time quality control. AI ensures that cuts are optimized, defects are immediately identified, and operational uptime is maximized within sophisticated manufacturing environments.

Why is the Battery Assembly segment showing significant growth potential?

The Battery Assembly segment is expanding rapidly due to the global transition towards electric vehicles (EVs) and large-scale renewable energy storage solutions. These applications require robust, high-precision clipping tools for preparing and trimming thicker lead and copper alloy terminals and busbars, necessitating specialized, often customized, automatic clipping machinery.

What are the key concerns regarding the integration of automated clippers into existing production lines?

The primary concerns involve the high initial capital investment required for robotic systems, the complexity of integrating the clipper control software with legacy Manufacturing Execution Systems (MES), and the need for specialized technical expertise to maintain and calibrate the high-precision automated equipment effectively.

How do aerospace and medical device requirements affect lead clipper technology?

These critical sectors mandate the highest level of quality assurance and process traceability. This drives demand for automated clippers equipped with sophisticated sensors and data logging capabilities, ensuring every cut meets exact tolerances and that the entire trimming process can be fully documented and verified for regulatory compliance and safety.

What is the difference between Manual and Semi-Automatic Lead Clippers?

Manual clippers are handheld tools reliant entirely on operator dexterity and force, used primarily for low-volume or rework. Semi-Automatic clippers typically utilize a pneumatic or electric assist mechanism to perform the cutting action, reducing operator fatigue and increasing consistency, though the component still needs to be manually positioned by the user.

Are specialized clippers necessary for handling lead-free solder connections?

Yes, specialized clippers are necessary. Lead-free solder materials often have different mechanical properties, generally being harder and requiring different cutting geometries and more durable, hardened blade materials to ensure a clean, stress-free cut without causing microfractures or premature dulling of the tool.

What is the role of ergonomics in the design of manual lead clippers?

Ergonomics is vital for manual clippers, as poor design can lead to repetitive strain injuries (RSI) in assembly line workers. Designs focus on non-slip grips, lighter materials, spring-loaded opening mechanisms, and optimized handle shapes to minimize force exertion and fatigue during high-volume manual operation.

What are the primary upstream challenges faced by lead clipper manufacturers?

Upstream challenges primarily revolve around securing consistent, high-quality sourcing of specialized raw materials, specifically high-grade tool steels and carbide alloys required for blade manufacturing. Volatility in global metal commodity prices and ensuring rigorous heat treatment standards also pose consistent challenges.

How does the value chain transition from upstream to downstream activities?

The transition occurs after the precision machining and assembly (midstream). The downstream focuses on getting the final product to the customer, involving inventory management, complex logistics, establishment of distribution networks (direct and through specialized industrial suppliers), and provision of critical after-sales support and spare parts.

In which regional market is the investment in robotics for lead clipping most pronounced?

Investment in robotics and fully integrated automated clipping systems is most pronounced in North America and Europe. This is driven by high labor costs, a focus on extremely high quality assurance, and the necessary integration of clipping processes into sophisticated, robot-centric factory automation systems typical of aerospace and high-end automotive production.

What is meant by process traceability in the context of automatic lead clipping?

Process traceability refers to the automated recording and archiving of data related to every clipping cycle, including parameters like time, date, force applied, and QC verification results (often via vision systems). This ensures that manufacturers can verify the quality of every component termination for audit purposes, especially in highly regulated industries.

Are lead clippers used exclusively for lead (Pb) materials?

No, the term "Lead Clippers" is historical, originating from lead-based solder. Modern clippers are used for a variety of conductive materials, including copper, nickel, tin alloys, and various metal terminals, particularly in battery assembly and through-hole technology, often optimized for lead-free compositions.

What is the projected Compound Annual Growth Rate (CAGR) for the Lead Clippers market?

The Lead Clippers market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between the forecast years of 2026 and 2033, demonstrating steady expansion driven by automation and specialized application demand.

How significant is component miniaturization as a market driver?

Component miniaturization is a highly significant driver. As PCBs become denser and components smaller, the tolerance for error in lead trimming shrinks drastically. This necessitates the use of more precise, often automated, clipping tools capable of making clean, accurate cuts without causing mechanical stress to the adjacent small components or the board itself.

What distinguishes the clipping requirements for the Automotive Industry?

The automotive industry requires clippers that can handle a wide range of component sizes, including robust terminals for power electronics, alongside standard PCB leads. Emphasis is placed on extreme reliability, vibration resistance, and compliance with automotive quality standards (like IATF 16949), often driving demand for durable automatic equipment.

Where do most manufacturers source the key technological components for automatic clippers?

Key technological components, such as high-precision servo motors, advanced machine vision cameras, and proprietary control systems (PLCs/Industrial PCs), are typically sourced globally from specialized industrial automation and robotics suppliers in regions like Japan, Germany, and the United States, reflecting the high technology content of these systems.

How does labor availability influence the shift towards automated clipping solutions?

Labor availability is a critical factor. In regions with high labor costs (North America, Western Europe) or increasing difficulty in finding skilled assembly labor, manufacturers are rapidly transitioning to fully automated clipping systems to maintain production capacity and quality consistency, minimizing reliance on manual intervention.

What impact do environmental regulations have on the design of lead clippers?

While the clippers themselves are tools, environmental regulations (such as RoHS and REACH) mandate the shift toward lead-free solder and components, which are often mechanically harder. This necessitates constant R&D into specialized blade materials and geometries to effectively cut these harder alloys, thereby driving technological evolution in the market.

What defines a "high-mix, low-volume" production environment, and how does it affect clipper choice?

A high-mix, low-volume environment involves producing many different product types in small batches. This favors the adoption of modular, easily programmable semi-automatic or robotic clipping systems that can be quickly reconfigured for different component layouts, rather than fixed, high-throughput dedicated automatic lines.

How do specialized coatings improve blade longevity?

Coatings like Diamond-Like Carbon (DLC) or Titanium Nitride (TiN) significantly reduce the coefficient of friction between the blade and the material being cut, minimizing wear and heat generation. This greatly extends the lifespan of the cutting edge, reducing the frequency of costly blade replacement and associated production downtime.

Which type of clipper segment is expected to show the highest CAGR during the forecast period?

The Automatic Lead Clippers segment is projected to show the highest Compound Annual Growth Rate (CAGR). This acceleration is directly linked to global trends in Industry 4.0, increased capital investment in factory automation, and the rising demand for high-reliability, zero-defect manufacturing processes, particularly in APAC and the advanced Western markets.

What potential opportunities exist for market penetration in the Middle East and Africa (MEA)?

Market penetration opportunities in MEA are driven by governmental efforts to diversify economies through industrialization, including establishing domestic electronics assembly and maintenance facilities. Vendors can capitalize by offering robust, reliable, and easily maintainable semi-automatic solutions supported by comprehensive, localized service agreements.

How important is ergonomic design for semi-automatic lead clippers?

Ergonomic design remains highly important for semi-automatic clippers because, although the cutting mechanism is assisted, the operator is still responsible for component positioning and repeated tool handling. Good ergonomics prevent operator fatigue, improve consistency, and reduce the risk of workplace injuries, thereby enhancing overall efficiency.

What role do distribution channels play in the sale of complex automatic clipping systems?

For complex automatic systems, direct sales channels are crucial. Direct engagement allows manufacturers to provide bespoke consulting, system integration planning, specialized technical training, and tailored post-sales maintenance contracts, which are essential services for high-capital equipment purchases.

What is a primary restraint related to the cost structure of the Lead Clippers market?

The high initial capital expenditure required for sophisticated, multi-axis automatic clipping and handling systems serves as a significant restraint, particularly for Small and Medium Enterprises (SMEs) or manufacturers in developing regions who may prefer manual or basic semi-automatic alternatives.

How are advancements in firmware affecting the functionality of automatic clippers?

Advancements in firmware allow automatic clippers to incorporate more sophisticated control algorithms, enabling finer adjustments to cutting speeds and forces, enhancing communication protocols for IIoT integration, and facilitating remote diagnostics and software updates, dramatically improving machine adaptability and performance.

Why are manufacturers investing heavily in developing customized clipping solutions for battery assembly?

Battery assembly requires specialized equipment because the leads and terminals involved are often thicker, made of different alloys (e.g., copper or aluminum), and require exceptionally precise cuts to ensure optimal electrical connection and thermal management. Standard PCB clippers are not robust or precise enough for these high-power applications, necessitating customization.

What is the significance of the base year 2025 in the market report?

The base year 2025 serves as the latest full calendar year for which comprehensive, consolidated historical data is analyzed and validated, providing the critical foundation and reference point from which the subsequent seven-year forecast (2026-2033) is extrapolated and modeled.

Besides cutting, what is another critical function of specialized lead clippers in electronics assembly?

Another critical function is component stress reduction. High-quality clippers, especially those designed with shear cutting mechanisms, ensure that the cutting force is not transferred to the component body or the delicate solder joint, preventing micro-cracks or damage that could lead to premature device failure.

How do global supply chain disruptions affect the Lead Clippers market?

Supply chain disruptions primarily affect the market by increasing the lead time for specialized components (like high-performance controllers and specialized steel), leading to production delays for automatic clippers, and potentially increasing the overall cost due to inflated logistics and raw material prices.

Which application segment holds the largest current market share?

The Electronics Manufacturing (PCB Assembly) segment currently holds the largest market share. This segment serves as the historical core of the market, generating the highest overall volume demand for lead trimming tools used in the assembly of consumer electronics, computers, and general industrial controls.

What is the future outlook for Manual Lead Clippers?

The outlook for Manual Lead Clippers is stable but not high-growth. While they are being phased out in mass production, they maintain essential demand in critical low-volume niches such as R&D prototyping, field repair and service work, and small-scale custom assembly where the cost of automation is prohibitive.

What distinguishes the Lead Clippers segment for the Aerospace industry?

The Aerospace segment demands absolute precision and extreme reliability. Clippers used here must be certified, often operate within controlled environments, and usually incorporate features like integrated force monitoring and data logging to meet rigorous documentation and non-destructive testing requirements, justifying a premium price point.

In the Value Chain, who are the key influencers in the upstream segment?

Key influencers in the upstream segment are specialized metallurgical companies and high-performance alloy suppliers. Their ability to deliver consistent quality, purity, and innovative proprietary blade materials directly dictates the performance characteristics and manufacturing costs of the final clipper product.

How is the concept of Industry 4.0 applied to the Lead Clippers Market?

Industry 4.0 principles are applied through the development of smart, interconnected automatic clippers that communicate operational data via the Industrial Internet of Things (IIoT). This enables features such as centralized remote monitoring, autonomous diagnostics, and dynamic process adjustments based on real-time feedback from the factory floor.

What is the projected market value for the Lead Clippers market by 2033?

The Lead Clippers market is projected to reach a market value of USD 670 Million by the end of the forecast period in 2033, reflecting substantial growth from the estimated 2026 valuation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager