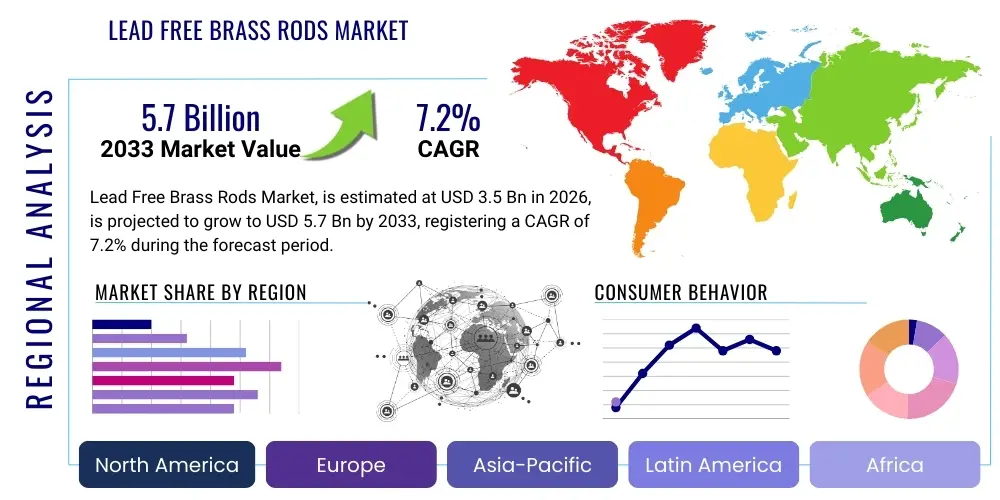

Lead Free Brass Rods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432664 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Lead Free Brass Rods Market Size

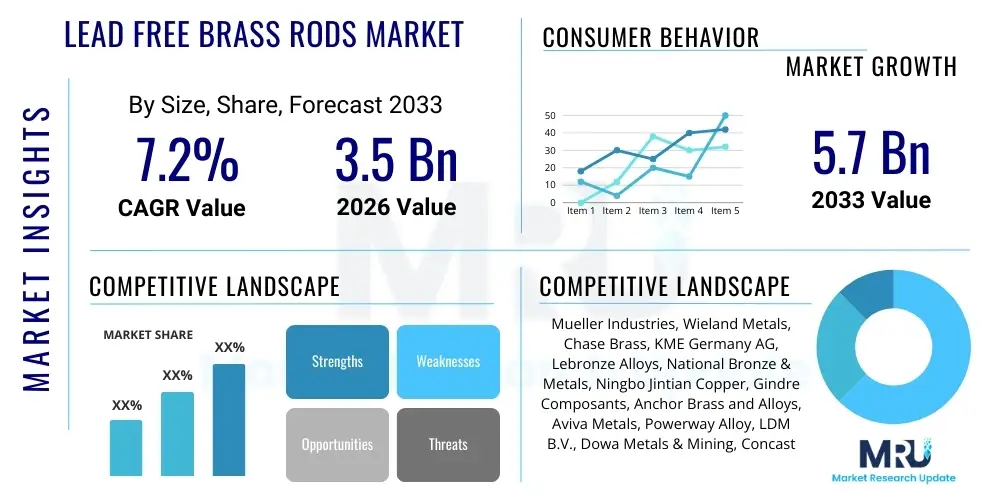

The Lead Free Brass Rods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033.

Lead Free Brass Rods Market introduction

Lead Free Brass Rods, often referred to as no-lead brass or eco-brass, are specialized metal alloys primarily composed of copper and zinc, engineered to meet stringent international regulations mandating the reduction or elimination of lead content in materials used for potable water systems, plumbing fixtures, and food contact applications. These rods typically substitute lead with benign elements such as bismuth (Bi), silicon (Si), or selenium (Se) to maintain the machinability, strength, and corrosion resistance characteristic of traditional brass, while ensuring environmental safety and public health compliance. The shift toward these advanced materials is fundamentally driven by governmental legislation, consumer preference for sustainable products, and heightened awareness regarding the neurotoxic effects of lead exposure, particularly in water infrastructure.

The product description encompasses various grades of lead-free brass, including C87850 (EcoBrass), C69300 (Bismuth Brass), and DZR (Dezincification Resistant) lead-free alloys, each tailored for specific performance requirements such as high strength, superior corrosion resistance, or enhanced machinability. Major applications span critical sectors, including plumbing and sanitary ware manufacturing (faucets, valves, fittings), automotive components (connectors, fasteners), electrical and electronic devices (switches, terminals), and general manufacturing requiring precision-machined, environmentally safe components. The versatility of these rods, available in diverse shapes such as round, hexagonal, and square profiles, allows them to be utilized in complex CNC machining processes without compromising operational efficiency or final product integrity.

The primary benefits derived from adopting lead-free brass rods include regulatory compliance, enhanced product safety, excellent mechanical properties comparable to traditional brass, and increased market differentiation for manufacturers committed to sustainability. Driving factors for market expansion include escalating urbanization, significant governmental investment in upgrading aging water infrastructure globally, and the continuous innovation in alloying technologies that improve the cost-effectiveness and performance attributes of these eco-friendly alternatives. Furthermore, increasing adoption in industrial fluid handling and heat exchange systems, where chemical inertness is vital, continues to solidify the market's growth trajectory, positioning lead-free brass as the material of choice for future engineering applications.

Lead Free Brass Rods Market Executive Summary

The Lead Free Brass Rods Market is undergoing a rapid transformation, characterized by aggressive adoption rates driven by mandatory regulatory shifts across North America and Europe, particularly concerning potable water systems. Business trends indicate a strong move toward vertical integration among major producers to control raw material supply chains (copper and zinc), alongside significant investment in specialized continuous casting and extrusion technologies required to process these newer, often harder, lead substitutes efficiently. Furthermore, there is a pronounced focus on developing high-performance, silicon-enhanced brass alloys that offer superior strength and heat resistance, broadening their applicability beyond traditional plumbing into high-stress automotive and industrial machinery components, thereby sustaining premium pricing and margin stability within this specialized materials segment.

Regionally, North America remains the primary market driver due to stringent federal mandates such as the Reduction of Lead in Drinking Water Act (RLDWA) and California’s AB 1953, creating immediate, non-negotiable demand for compliant materials. Asia Pacific (APAC), however, is poised for the highest growth rate, fueled by rapid infrastructural development, burgeoning construction activities, and the gradual implementation of stricter environmental health standards in nations like China and India. European regional trends emphasize circular economy principles, driving demand for recycled lead-free brass, placing pressure on manufacturers to integrate sophisticated metal scrap sorting and recycling processes into their production loops. The Middle East and Africa (MEA) and Latin America (LATAM) show promising growth, correlated directly with foreign direct investment in residential and commercial construction projects demanding international compliance standards.

Segment trends highlight the dominance of the Bismuth-based alloys segment, appreciated for its exceptional machinability and low toxicity, although Silicon-based alloys are gaining rapid traction due to their enhanced strength and cost-effectiveness in high-volume industrial applications. The application segment remains dominated by plumbing and sanitary installations, yet the growth rate is accelerating fastest within the industrial machinery and automotive sectors, driven by the need for compliant, durable connectors and components. Small diameter rods (less than 20mm) maintain the largest volume share, catering primarily to high-precision component manufacturing, while large diameter rods are witnessing steady growth aligned with large-scale industrial valve and pump production. These combined trends underscore a dynamic market environment where technological adaptation and regional regulatory compliance are paramount for sustained competitive advantage.

AI Impact Analysis on Lead Free Brass Rods Market

Common user questions regarding AI’s impact on the Lead Free Brass Rods Market generally revolve around how advanced analytics and machine learning can optimize the complex alloying process, improve quality control in continuous casting, and streamline predictive maintenance for specialized extrusion equipment. Users frequently inquire about the potential for AI algorithms to predict raw material price fluctuations (especially copper and zinc), optimize inventory management of high-value alloys, and accelerate the discovery of novel, higher-performing, and more cost-effective lead substitutes. The consensus theme is one of leveraging AI for efficiency gains and material science innovation, aiming to reduce production costs associated with stringent quality requirements and complex chemical compositions inherent in lead-free brass manufacturing.

- AI-driven optimization of alloy formulation, minimizing waste and ensuring precise chemical composition of lead substitutes (Bismuth, Silicon).

- Predictive maintenance analytics applied to continuous casting and drawing machinery, reducing unexpected downtime and maximizing operational uptime.

- Enhanced quality control through machine vision systems and deep learning models for defect detection during rod extrusion and surface finishing processes.

- Optimization of energy consumption in high-temperature melting and heat treatment stages using smart manufacturing frameworks.

- Supply chain resilience forecasting, using AI to predict fluctuations in copper and zinc commodity prices and optimize strategic purchasing decisions.

- Automated robotic handling systems integrated with AI for improved precision during sorting, cutting, and packaging of finished rods.

- Simulation and modeling of new lead-free alloy compositions, drastically reducing R&D cycles and time-to-market for novel materials.

DRO & Impact Forces Of Lead Free Brass Rods Market

The Lead Free Brass Rods Market is primarily driven by stringent global regulatory mandates, such as those in North America and Europe, compelling the immediate phase-out of traditional leaded brass in potable water applications, thereby guaranteeing sustained demand. However, the market faces significant restraints, notably the higher initial cost of lead-free materials due to the complexity and higher pricing of substitutes like bismuth, coupled with the need for specialized, often costlier, machining tools and production techniques required to process these new alloys without compromising throughput. Opportunities lie predominantly in developing cost-effective, high-machinability alternatives and expanding applications into non-traditional sectors such as high-performance electronics and renewable energy components, where compliance and durability are paramount. The impact forces are currently skewed strongly toward the regulatory push factor, creating high entry barriers for non-compliant materials and forcing rapid technological innovation among established manufacturers to maintain market relevance and meet increasingly complex compliance specifications across diverse geographic regions.

Segmentation Analysis

The Lead Free Brass Rods Market is rigorously segmented based on product type, alloy composition, rod diameter, and end-use application, providing a granular view of market dynamics and specialized demand pockets. Understanding these segments is crucial for manufacturers and suppliers to tailor their product offerings and strategic investments, particularly concerning regulatory compliance for specific grades. The evolution of machining technologies and the varying requirements across plumbing, automotive, and electrical sectors necessitate precise material properties, driving the fragmentation of the alloy composition segment. Furthermore, the global variance in lead-free legislation impacts regional demand patterns for specific rod diameters, with high-volume residential plumbing often demanding smaller, standardized rods, while large industrial infrastructure projects require specialized large-diameter rods for valves and pumps.

Segmentation by alloy composition is highly critical, differentiating between Bismuth-based, Silicon-based, and proprietary blended alloys. Bismuth-based alloys (e.g., C89833, C87850) typically offer the best machinability, making them preferred in high-precision, complex component manufacturing, despite their relatively higher cost. Conversely, Silicon-based alloys (e.g., C69300) are increasingly favored for their enhanced mechanical strength, dezincification resistance, and superior cost-performance ratio, finding strong adoption in demanding structural and industrial applications. This diversification allows end-users to select materials based not just on lead compliance, but also on specific operational requirements such as resistance to stress corrosion cracking or high-pressure tolerance.

The application segmentation underscores the market's dependence on the construction and infrastructure sectors. While plumbing and sanitary fixtures remain the foundation of demand, driven by ongoing urban renewal and new housing starts globally, rapid expansion in sectors like automotive components (for fluid handling and brake systems) and industrial machinery (for heat exchangers and specialized pumps) signifies diversification. The electrical and electronics segment, requiring high conductivity coupled with environmental compliance, also contributes steadily, focusing on specialized electrical connectors and switchgear where material safety is non-negotiable. This intricate segmentation structure reflects a market maturing beyond basic regulatory compliance toward sophisticated performance engineering.

- By Alloy Composition

- Bismuth-Based Brass Rods (e.g., C89833)

- Silicon-Based Brass Rods (e.g., C69300)

- Selenium-Based Brass Rods

- Proprietary Blended Alloys (e.g., Manganese, Phosphorus blends)

- By Manufacturing Process

- Continuous Cast Rods

- Extruded Rods

- Drawn Rods

- By Rod Diameter

- Small Diameter Rods (Less than 20 mm)

- Medium Diameter Rods (20 mm to 50 mm)

- Large Diameter Rods (Above 50 mm)

- By Application

- Plumbing and Sanitary Fixtures (Faucets, Valves, Fittings)

- Automotive Components (Brake Systems, Fluid Connectors)

- Electrical and Electronic Components (Connectors, Terminals)

- Industrial Machinery (Pumps, Hydraulic Systems, Heat Exchangers)

- General Manufacturing and Fasteners

Value Chain Analysis For Lead Free Brass Rods Market

The value chain for Lead Free Brass Rods begins with upstream analysis focusing on the sourcing and preparation of primary raw materials, predominantly high-purity copper and zinc, supplemented by specialized lead substitutes such as bismuth, silicon, or selenium. Due to the stringent quality requirements for lead-free compositions, raw material purity is paramount, making long-term supply agreements with specialized metal refiners crucial. The upstream segment involves complex commodity market dynamics, where volatility in copper pricing directly impacts the final cost of the brass rods. Manufacturers often engage in strategic hedging and maintain high inventory levels of primary metals to mitigate price risk. Furthermore, the input stage includes specialized scrap metal processors who provide clean, sorted brass scrap compliant with lead-free standards, crucial for optimizing production costs and promoting circularity.

The manufacturing and processing stage forms the core of the value chain, where primary melting, alloying, continuous casting, and hot extrusion occur. This stage requires significant capital expenditure in specialized machinery designed to handle the different thermal and mechanical properties of lead-free alloys, which often exhibit lower hot workability and specific requirements for lubrication and die design compared to leaded brass. Precision in this phase is vital to ensure structural integrity and dimensional accuracy. Following extrusion, rods undergo cold drawing, annealing, and final surface treatment. Quality control systems, incorporating non-destructive testing and sophisticated spectroscopic analysis, are rigorously applied at multiple points to guarantee the final product adheres strictly to lead content thresholds and mechanical specifications, fulfilling certifications like NSF/ANSI 61.

The downstream analysis focuses on the distribution channels and end-user engagement. Distribution is multifaceted, involving both direct sales to large Original Equipment Manufacturers (OEMs) in the plumbing and automotive industries and indirect sales through specialized metal distributors and wholesalers who maintain large inventories and provide value-added services like cutting, polishing, and custom packaging. Direct distribution ensures tight collaboration on technical specifications and just-in-time delivery for high-volume customers. Indirect channels, conversely, cater to small-to-medium enterprises and regional machine shops. The successful penetration of the market relies heavily on robust logistical networks and the distributor's ability to provide certified compliance documentation to the final end-users, ensuring seamless integration into complex manufacturing processes that are subject to governmental inspection and regulation.

Lead Free Brass Rods Market Potential Customers

The primary end-users and buyers of Lead Free Brass Rods are concentrated in industries where public health and environmental compliance intersect with the need for high-performance, durable metal components. Foremost among these are manufacturers specializing in plumbing, piping, and sanitary ware, including major faucet, valve, and fitting producers who must comply with lead-free mandates for all components in contact with potable water. These customers require materials with exceptional corrosion resistance (especially dezincification resistance) and high machinability to produce intricate parts efficiently. Their procurement decisions are heavily influenced by material certification (e.g., NSF/ANSI 61, UPC) and the supplier's reliability in maintaining consistent alloy composition necessary for regulatory audits.

A rapidly expanding customer base includes Original Equipment Manufacturers (OEMs) within the automotive and transportation sectors. As the industry moves toward electric vehicles and increasingly focuses on lightweighting and sustainable materials, lead-free brass rods are crucial for producing fluid connectors, sensor housings, and specialized fasteners within vehicle braking and cooling systems where thermal stability and non-toxicity are essential. These buyers seek brass grades with superior tensile strength and fatigue resistance, often customized for specific operational temperature ranges, requiring deep technical collaboration with brass rod suppliers on material engineering and processing guidelines.

Further potential customers are found in the industrial machinery and electronics fabrication segments. Industrial buyers include manufacturers of pumps, specialized hydraulic equipment, heat exchangers, and commercial fluid control systems used in chemical processing or food and beverage handling, all demanding materials that prevent contamination. In the electronics sector, manufacturers utilize lead-free brass for high-performance electrical connectors, terminals, and switchgear, valued for brass's inherent conductivity combined with its environmentally conscious profile. These customers often prioritize suppliers who can offer rods with tight dimensional tolerances and guaranteed consistency in electrical resistivity characteristics, supporting high-volume, automated production lines requiring minimal component variability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mueller Industries, Wieland Metals, Chase Brass, KME Germany AG, Lebronze Alloys, National Bronze & Metals, Ningbo Jintian Copper, Gindre Composants, Anchor Brass and Alloys, Aviva Metals, Powerway Alloy, LDM B.V., Dowa Metals & Mining, Concast Metal Products, Advance Non-Ferrous Metals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lead Free Brass Rods Market Key Technology Landscape

The manufacturing of Lead Free Brass Rods relies heavily on advanced metallurgical and processing technologies designed to handle the unique characteristics of these alloys, which often have inferior chip-breaking properties and higher friction coefficients than leaded brass. A crucial technology is specialized continuous casting, which ensures uniformity in grain structure and minimized porosity across the rod length. Manufacturers utilize customized cooling systems and inert gas shrouding during casting to prevent oxidation and ensure precise control over the solidification process. Furthermore, the development of new die materials and lubrication systems specifically formulated for silicon and bismuth-containing alloys is essential to maximize extrusion speed and die life, reducing operational costs associated with these highly demanding materials.

Another significant technological advancement lies in alloy formulation and testing. The substitution of lead necessitates the careful introduction of elements like bismuth or silicon to restore machinability and strength. Modern manufacturers employ advanced spectroscopic analysis techniques, such as Optical Emission Spectrometry (OES) and X-ray Fluorescence (XRF), to ensure the lead content remains strictly below the mandated threshold (typically 0.25% or 0.10%, depending on the regulation) and that the substitute elements are perfectly homogenized. Computational materials engineering and simulation software are increasingly utilized to predict the mechanical behavior and corrosion resistance of new alloy blends before costly physical prototyping, thereby accelerating R&D cycles and improving overall material performance predictability for diverse end-use applications.

In the downstream processing phase, the use of Computer Numerical Control (CNC) machinery optimized for lead-free materials is becoming standard. This optimization includes specialized tooling with sharp geometries, high-pressure coolant systems, and modified chip evacuation mechanisms to handle the stringy swarf produced by non-leaded brass. The transition to lead-free often requires significant investment in post-processing technologies, including advanced annealing furnaces to relieve internal stresses and enhance ductility, crucial for maintaining the required mechanical integrity in highly stressed applications like pressurized fittings. Furthermore, the integration of Industry 4.0 principles, involving real-time data monitoring of production parameters, ensures consistent quality and traceability throughout the entire manufacturing workflow, addressing the high-stakes compliance requirements faced by end-users.

Regional Highlights

North America holds a commanding share in the Lead Free Brass Rods Market, primarily driven by early and rigorous legislative enforcement, specifically the U.S. Safe Drinking Water Act (SDWA) amendments and regional statutes like California’s AB 1953. This regulatory environment mandates the use of lead-free materials in all components conveying potable water, creating stable, non-cyclical demand. The market here is characterized by high adoption rates of advanced silicon and bismuth alloys and strong relationships between material suppliers and major plumbing fixture manufacturers. The continuous need for municipal water system upgrades and replacement of older infrastructure further cements North America’s leading position in terms of market value and technological maturity.

Europe represents a highly mature market, emphasizing environmental sustainability and circular economy practices. European regulations, particularly the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) framework and regional directives on drinking water, drive consistent demand. The European market focuses heavily on DZR (Dezincification Resistant) lead-free brass, essential for managing water quality in diverse regional water chemistries. Key growth is noted in Northern and Western European countries that prioritize infrastructure longevity and recycled material content, pushing manufacturers to refine their processes for high-quality secondary lead-free alloy production, ensuring material availability meets stringent performance criteria for heating, ventilation, and air conditioning (HVAC) systems as well as domestic plumbing.

Asia Pacific (APAC) is projected to be the fastest-growing region over the forecast period. This rapid expansion is underpinned by massive governmental investments in urbanization, residential and commercial infrastructure projects in major economies such as China, India, and Southeast Asia. While regulatory standards are still evolving in some countries, increasing public awareness of lead contamination and the desire to meet international construction standards (especially in export-oriented manufacturing hubs) are accelerating the transition to lead-free brass. The sheer volume of ongoing construction and the rising affluence driving demand for high-quality, certified sanitary ware are the primary contributors to the steep upward trajectory of the APAC market.

Latin America (LATAM) and the Middle East and Africa (MEA) present emerging market opportunities. In LATAM, growth is tied to modernization efforts in sanitation and water treatment facilities, often leveraging international financing contingent on compliance with global health standards. Brazil and Mexico are key focus areas. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, the demand is fueled by ambitious mega-projects in construction and tourism (e.g., in UAE and Saudi Arabia) where materials must meet high international standards to ensure the safety and longevity of complex water systems in challenging climates, specifically demanding corrosion-resistant lead-free alloys capable of handling high temperatures and varying salinity levels in water supplies.

Overall, regional market performance is intrinsically linked to regulatory timelines. Regions with established lead-free mandates exhibit stable, high-value demand, whereas regions newly adopting or strengthening regulations present the greatest potential for volume growth. Successful market penetration globally requires suppliers to navigate complex regulatory landscapes and provide localized support for material certification and technical application guidance specific to regional infrastructure challenges.

- North America (U.S., Canada): Market leader driven by strict federal and state regulations (SDWA, AB 1953). Focus on Bismuth and Silicon alloys for plumbing and fire protection.

- Europe (Germany, UK, France): Mature market emphasizing DZR alloys and high recyclability (REACH compliance). Strong growth in industrial fluid handling and heat exchange applications.

- Asia Pacific (China, India, Japan): Highest growth rate due to infrastructure development and gradual regulatory tightening. Focus on cost-effective, high-volume production for construction and export markets.

- Latin America (Brazil, Mexico): Emerging growth tied to modernization of water infrastructure and increasing foreign investment in compliance-driven projects.

- Middle East & Africa (GCC Countries): Demand growth driven by large-scale construction projects requiring international quality and safety certifications, focusing on temperature and corrosion resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lead Free Brass Rods Market.- Mueller Industries Inc.

- Wieland Metals Inc.

- Chase Brass and Copper Company LLC

- KME Germany AG & Co. KG

- Lebronze Alloys SAS

- National Bronze & Metals Inc.

- Ningbo Jintian Copper (Group) Co., Ltd.

- Gindre Composants SAS

- Anchor Brass and Alloys

- Aviva Metals Inc.

- Powerway Alloy Material Co., Ltd.

- LDM B.V.

- Dowa Metals & Mining Co., Ltd.

- Concast Metal Products Co.

- Advance Non-Ferrous Metals Pvt. Ltd.

- Marmon/Keystone LLC

- Hoganas AB

- PMX Industries Inc.

- Diversified Metals Inc.

- Shree Extrusions Ltd.

Frequently Asked Questions

Analyze common user questions about the Lead Free Brass Rods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulations mandate the use of Lead Free Brass Rods?

The primary regulations include the U.S. Reduction of Lead in Drinking Water Act (RLDWA) and similar statutes in Canada, which limit lead content in wetted surfaces of plumbing fixtures to 0.25%. European directives, particularly those related to potable water quality, and the REACH regulation also mandate strict control over hazardous substance usage, driving market adoption.

What are the key differences in performance between Bismuth-based and Silicon-based lead-free brass alloys?

Bismuth-based alloys (e.g., EcoBrass) excel in machinability, offering chip fragmentation similar to leaded brass, but are generally more expensive. Silicon-based alloys (e.g., C69300) offer superior mechanical strength and improved dezincification resistance, making them highly suitable for structural and high-pressure industrial applications, often at a lower cost than Bismuth alternatives.

How does the higher cost of lead-free brass compare to traditional leaded brass?

Lead-free brass, particularly those using Bismuth or proprietary blends, generally carries a higher raw material and processing cost compared to traditional leaded brass. This premium is due to the higher expense of the substitute elements and the necessity for specialized manufacturing processes and tooling required to maintain machinability and structural integrity.

Which application segment holds the largest share in the Lead Free Brass Rods Market?

The Plumbing and Sanitary Fixtures application segment holds the largest market share. This dominance is driven by the immediate and mandatory need for compliance in all components designed to convey or dispense potable water, including faucets, valves, connectors, and water meters, in residential, commercial, and municipal infrastructure projects globally.

What role does advanced casting technology play in the quality of lead-free brass rods?

Advanced technologies, particularly continuous casting, are critical as they ensure a uniform internal structure and consistent chemical composition throughout the rod. This precision minimizes defects like porosity and segregation of alloying elements (like bismuth), which is vital for maintaining the required mechanical strength and ensuring the material consistently meets strict international regulatory standards for safety and performance.

Are there substitutes for lead-free brass in plumbing applications?

Yes, alternative materials include high-performance polymers (plastics), stainless steel, and certain copper alloys (like phosphor bronze). However, lead-free brass remains highly preferred due to its superior balance of corrosion resistance, durability, ease of machining, inherent antimicrobial properties, and established recycling infrastructure compared to other materials.

How is the volatility of copper prices impacting the market for lead-free brass rods?

Copper is the primary component (approximately 60% of the alloy), making the market highly sensitive to copper price volatility. Manufacturers mitigate this risk through forward contracts and price hedging strategies. Fluctuations affect final product costs, potentially slowing adoption in price-sensitive markets, although regulatory demand acts as a stabilizing force.

What is the significance of the dezincification resistance (DZR) property in lead-free brass?

Dezincification resistance is crucial, especially in regions with aggressive water chemistries. DZR lead-free brass is engineered to prevent the selective leaching of zinc, which causes component weakening and structural failure. This property is vital for ensuring the longevity and reliability of fittings and valves used in high-temperature or highly mineralized water systems.

Which region is expected to show the fastest growth rate and why?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This acceleration is driven by massive infrastructure expansion, increasing awareness and adoption of international quality standards, and the rapid pace of urbanization in key developing economies like India and China, creating vast new demand for compliant plumbing and industrial components.

How are environmental concerns influencing the manufacturing processes of brass rods?

Environmental concerns are pushing manufacturers towards cleaner production processes, including reduced energy consumption, optimization of water usage during cooling, and minimizing waste. There is a strong emphasis on increasing the recycled content of brass rods, requiring sophisticated metal sorting and remelting technologies to maintain lead-free compliance and support circular economy objectives.

What are the typical end-user specifications for small diameter lead-free brass rods?

Small diameter rods (less than 20mm) are primarily used for intricate, precision-machined components such as small fittings, fasteners, electrical pins, and sensor components. Specifications emphasize extremely tight dimensional tolerances, excellent surface finish, high mechanical strength, and, critically, superior and consistent machinability to support high-speed CNC manufacturing operations.

How does the automotive sector utilize lead-free brass rods?

The automotive sector uses lead-free brass rods for producing high-reliability fluid connectors, brake system components, solenoids, and specialized fasteners. The material is chosen for its compliance, corrosion resistance (especially against brake fluids), and thermal stability, ensuring the safety and long-term performance of vehicle fluid handling systems, particularly in modern electronic and hybrid vehicles.

What is the impact of AI on optimizing alloy formulation in this market?

AI algorithms are being deployed to analyze vast datasets related to material properties and processing parameters. This allows manufacturers to precisely model the impact of substituting elements (like Bismuth or Silicon) on overall alloy performance, optimizing the chemical composition for required strength and machinability while minimizing expensive trial-and-error R&D processes.

Which technology is crucial for ensuring low lead content compliance in the final product?

Advanced analytical technologies, specifically Optical Emission Spectrometry (OES) and X-ray Fluorescence (XRF) spectroscopy, are crucial. These techniques provide rapid and highly accurate analysis of the metal composition during and after casting, ensuring lead levels consistently meet the ultra-low thresholds mandated by regulatory bodies like NSF/ANSI 61.

What defines a proprietary blended alloy in the lead-free brass market?

Proprietary blended alloys are unique formulations developed by individual manufacturers that use a combination of substitute elements (often Silicon, Bismuth, Manganese, and sometimes Phosphorus) to achieve a specific balance of properties—typically superior machinability, higher strength, or enhanced corrosion resistance—that cannot be met by standard Bismuth or Silicon-only grades, offering a competitive advantage.

How do the manufacturing processes differ for extruded versus continuous cast rods?

Extruded rods are forced through a die under high pressure, typically yielding superior surface finish and tighter dimensional tolerances, often used for smaller diameters. Continuous cast rods are solidified in a continuous mold, resulting in a more uniform internal structure and are frequently used for producing larger diameter stock or specialized shapes before final drawing.

What are the restraints related to the machinability of lead-free brass?

Lead-free brass often produces stringy swarf during machining instead of brittle chips, leading to issues like chip entanglement, reduced tool life, and slower processing speeds. Manufacturers must compensate by using specialized CNC tooling, high-pressure coolant systems, and higher-grade alloys (like Bismuth-based ones) to maintain production efficiency comparable to traditional leaded brass.

What certifications are essential for lead-free brass rods used in drinking water applications?

The most essential certification is NSF/ANSI 61, specifically Section 8 (for brass materials) in North America, which confirms that the material does not leach harmful contaminants, including lead, into potable water above acceptable safety limits. Other crucial certifications include UPC (Uniform Plumbing Code) and various regional European approvals like DVGW.

How is the growth of smart building technology influencing demand for lead-free brass rods?

Smart building technology increases the demand for complex, durable plumbing and sensor components within automated water management and HVAC systems. Lead-free brass rods are crucial here because they offer the necessary durability, reliability, and guaranteed compliance required for long-term, low-maintenance operation in high-tech, regulated environments.

What is the role of distributors in the Lead Free Brass Rods value chain?

Distributors play a vital role in providing inventory management, logistics, and value-added services such as specialized cutting and testing. They bridge the gap between large-scale producers and diverse end-users (like regional machine shops), ensuring that certified material is readily available quickly and in required quantities, often providing crucial compliance documentation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager