Lead Nitrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434117 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Lead Nitrate Market Size

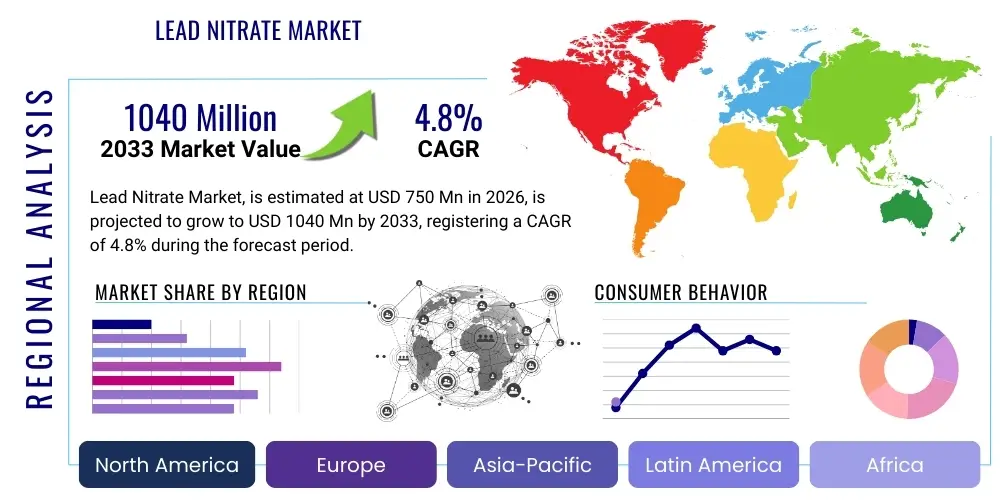

The Lead Nitrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1040 Million by the end of the forecast period in 2033.

Lead Nitrate Market introduction

Lead nitrate (Pb(NO3)2) is a highly soluble inorganic compound predominantly utilized in diverse industrial applications, acting as a crucial precursor in the manufacture of specialized chemicals and materials. As a strong oxidizing agent and heavy metal salt, its unique chemical properties make it indispensable in sectors requiring high purity and specific reaction mechanisms. The compound is typically manufactured through the reaction of lead oxide or lead metal with nitric acid, leading to crystalline solid formation. The high demand for lead nitrate is intrinsically linked to the expanding global mining industry, particularly froth flotation processes, and the growth of advanced materials manufacturing.

Major applications of lead nitrate span across mining, specialized explosives, pyrotechnics, and the production of stabilizers for plastics and coatings. In the mining sector, it functions primarily as a depressant or activator, essential for separating minerals like molybdenite and galena during the froth flotation technique, significantly improving the yield and purity of concentrates. Beyond mining, its utility in traditional industries like match manufacturing and in niche fields such as photographic chemicals and specialized glass production underscores its versatility. The benefits derived from its use include enhanced processing efficiency in mineral extraction and the provision of specific stabilizing properties in polymer formulations, ensuring material longevity and performance under various environmental conditions.

The primary driving factors propelling the Lead Nitrate Market include the robust expansion of the global mineral extraction industry, especially in emerging economies focusing on base metal production. Furthermore, increasing regulatory focus on optimizing mining efficiency and reducing waste, where lead nitrate plays a critical role in selective flotation, contributes significantly to market demand. Technological advancements in chemical synthesis aimed at producing higher purity lead nitrate, suitable for increasingly sensitive electronic and optical applications, are also stimulating market growth. The ongoing research into novel uses, such as its potential role in advanced battery technologies or specialized catalysts, suggests sustained long-term expansion for this industrial chemical.

Lead Nitrate Market Executive Summary

The Lead Nitrate Market is characterized by a moderate growth trajectory, fundamentally driven by sustained demand from the base metal mining sector and stabilizing polymer industries. Current business trends indicate a critical focus on supply chain resilience, particularly concerning the sourcing of high-purity lead precursors and adherence to evolving international chemical safety standards. Manufacturers are investing in process optimization, transitioning towards more energy-efficient production methods to mitigate rising input costs and comply with stringent environmental regulations, which are becoming paramount in developed markets. This necessitates continuous process innovation to maintain competitive pricing while ensuring product quality meets the high specifications demanded by end-users, especially those in sophisticated mineral processing facilities.

Regionally, the Asia Pacific (APAC) region dominates the consumption landscape, primarily due to the extensive presence of large-scale mining operations in countries such as China, Australia, and India, coupled with rapid growth in their automotive and construction sectors utilizing lead nitrate derivatives. North America and Europe, while having mature mining markets, exhibit stable demand driven by stringent quality requirements and specific applications in electronics and defense-related pyrotechnics. Key segments witnessing accelerated growth include the mining application segment, reflecting global resource exploration activities, and the industrial chemicals segment, spurred by the need for effective stabilizers and oxidizing agents in various manufacturing processes. The market structure remains moderately consolidated, with key players focusing on establishing long-term supply agreements and expanding distribution networks to capture emerging market opportunities.

Segmentation trends highlight the dominance of the powder form of lead nitrate due to its ease of handling and high reactivity in mineral processing and chemical synthesis. However, specialized crystal forms catering to specific industrial or laboratory applications are also seeing niche growth. Within the application segments, the usage in explosives and pyrotechnics remains a significant, albeit tightly regulated, revenue stream, while the application in dyeing and printing is stabilizing. The market's future performance is heavily reliant on global commodity prices for base metals, as these directly influence the profitability and operational scope of the mining industry, which constitutes the largest end-use sector for lead nitrate globally.

AI Impact Analysis on Lead Nitrate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Lead Nitrate Market primarily revolve around operational efficiency, predictive maintenance, and optimizing chemical processes. Users frequently ask if AI can reduce reliance on lead nitrate by enabling alternative, more selective mineral separation techniques, or conversely, if AI can optimize the dosage of lead nitrate in flotation circuits to minimize consumption and environmental impact. There is also significant interest in how machine learning algorithms can predict future demand fluctuations based on complex commodity market data, inventory levels, and geopolitical events affecting lead supply chains. Key concerns focus on the integration cost of AI-driven systems into existing, often traditional, mining and chemical plants, and the security implications of utilizing real-time process data. The overarching expectation is that AI will primarily serve as an optimization tool, enhancing process safety and efficiency rather than fundamentally replacing the chemical compound itself, which is defined by immutable chemical properties.

AI's primary influence is observed in the optimization of complex chemical manufacturing and utilization processes. In the production phase, AI models are being deployed to monitor reaction parameters such as temperature, pressure, and concentration in real-time, predicting batch quality and yield consistency. This advanced predictive capability significantly reduces off-specification material and energy wastage, leading to cost savings and ensuring the high purity required for specialized applications like photographic chemicals or stabilizers. By applying machine learning to multivariate process data, manufacturers can achieve tighter control over crystallization and filtration, critical steps in achieving the fine particle size distribution and chemical purity characteristic of premium lead nitrate products.

Within end-user applications, particularly in froth flotation at mining sites, AI algorithms process continuous sensor data (e.g., pH, pulp density, particle size analysis) to dynamically adjust the precise dosing of lead nitrate, acting as a depressant or activator. This precision dosing, facilitated by AI-driven control loops, ensures maximum mineral recovery while minimizing the excess use of reagents, directly addressing environmental compliance and operational expenditure reduction goals. Furthermore, AI contributes to supply chain management by predicting logistical bottlenecks and raw material price volatility, allowing key market players to proactively secure lead feedstock and optimize storage strategies, thus guaranteeing a stable supply of lead nitrate to downstream consumers during periods of market instability.

- AI-driven optimization of froth flotation reagent dosage, minimizing lead nitrate consumption.

- Predictive maintenance schedules for lead nitrate production equipment, reducing unplanned downtime.

- Machine learning models for analyzing global commodity prices and forecasting lead feedstock availability.

- Enhanced quality control through real-time monitoring of crystallization processes during manufacturing.

- Simulation of new chemical synthesis pathways to develop specialized, higher-purity lead nitrate variants.

- Automation of inventory management and logistics, improving responsiveness to sudden shifts in mining demand.

- Use of deep learning for rapid identification and mitigation of safety risks in high-hazard production environments.

DRO & Impact Forces Of Lead Nitrate Market

The dynamics of the Lead Nitrate Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. Key drivers include the consistent growth of the global mining industry, particularly the demand for base metals like copper, lead, and zinc, where lead nitrate is crucial for efficient recovery. Simultaneously, advancements in specialized pyrotechnics and the sustained requirement for effective heat stabilizers in the PVC industry also provide underlying market stability. However, the market faces significant restraints, primarily stemming from the inherent toxicity of lead compounds, leading to stringent environmental regulations (such as REACH in Europe) and rising public health concerns, necessitating costly compliance measures and investment in advanced waste treatment technologies. These opposing forces—essential industrial utility versus strict environmental controls—create a challenging yet evolving market landscape.

The primary opportunities for market expansion lie in the development and commercialization of new applications, specifically in advanced chemical synthesis and materials science. Research into using lead nitrate as a precursor for specific functional materials, such as specialized ceramics or in niche pharmaceutical intermediates, presents avenues for diversification beyond traditional bulk chemical uses. Furthermore, the opportunity to develop high-purity, environmentally sensitive lead nitrate products (e.g., encapsulated or stabilized forms) that minimize occupational exposure and environmental leakage offers a competitive advantage to manufacturers focusing on innovation. Regulatory pressures, while acting as a restraint, simultaneously create an opportunity for companies that can demonstrate superior environmental stewardship and transparency in their manufacturing and disposal processes, thereby gaining preferential access to highly regulated and profitable markets.

The cumulative Impact Forces are currently tilted towards cautious growth. While industrial demand remains robust and inelastic in the short term—as few cost-effective, high-performance substitutes exist for its role in mineral flotation—the long-term threat of substitution due to regulatory tightening is significant. Manufacturers must navigate increasing operational costs associated with safety protocols and waste management while capitalizing on the indispensable nature of the compound in specific high-value applications. The primary impact forces thus compel continuous investment in cleaner production technologies and strict adherence to international shipping and handling regulations for hazardous materials, ensuring that market growth is sustainable and compliant with global environmental goals.

Segmentation Analysis

The Lead Nitrate Market is comprehensively segmented based on its physical Form, the purity level or Grade of the compound, and the diverse Applications where it is utilized across various industrial sectors. This segmentation provides a granular view of market dynamics, highlighting areas of high demand concentration and niche growth opportunities. The segmentation by Form primarily differentiates between the traditional crystalline or powdered material and specialized solutions, reflecting variations in end-user handling requirements and processing ease. Understanding these segments is crucial for manufacturers to tailor product offerings, packaging, and logistical strategies to meet precise customer specifications across different geographies and industry requirements.

The segmentation by Grade is critical, as the purity level dictates the suitability of the lead nitrate for specific high-value or sensitive applications. Technical Grade material generally serves the bulk industrial sectors like mining and PVC stabilization, while higher purity grades, often designated as Analytical or Reagent Grade, are mandated for use in laboratory research, specialized electronics, and pyrotechnic formulations requiring minimal impurities. The application segmentation, which encompasses the largest drivers, includes mining, dyes and printing, explosives/pyrotechnics, and other niche industrial uses. The dominance of the mining segment underscores its profound influence on overall market volume and pricing structures, while growth in the "Others" category, including specialized coatings and photography, signals emerging technological shifts.

Analyzing these segments reveals that while the bulk of volume remains in Technical Grade powder for flotation purposes, the highest profitability margins often reside within the high-purity grades required for specialized chemical synthesis and regulated defense applications. Strategic market players, therefore, often employ a diversified portfolio strategy, ensuring capacity for high-volume technical production while maintaining specialized lines for premium, low-volume grades. Future market success will depend on correctly anticipating shifts in mining activity and proactively addressing regulatory mandates that might favor specific purity grades or physical forms designed for enhanced safety and reduced environmental exposure.

- By Form:

- Powder/Crystalline

- Solution

- By Grade:

- Technical Grade

- Analytical/Reagent Grade

- High Purity Grade

- By Application:

- Mining (Froth Flotation, Molybdenum Separation)

- Explosives and Pyrotechnics

- Dyeing and Printing

- Stabilizers for PVC and Polymers

- Chemical Synthesis (Intermediates)

- Others (Photography, Specialized Glass, Electroplating)

- By End-Use Industry:

- Metallurgy and Mining

- Chemical Manufacturing

- Plastics and Coatings

- Defense and Aerospace

- Textiles

Value Chain Analysis For Lead Nitrate Market

The Lead Nitrate Value Chain begins with the upstream sourcing of primary raw materials, predominantly high-purity metallic lead or lead oxide, alongside nitric acid. The security and stability of the lead supply are paramount, as lead mining and refining are subject to significant global commodity price fluctuations and increasingly strict environmental standards regarding smelting and emissions. Manufacturers of lead nitrate must establish robust, long-term relationships with lead refiners and nitric acid producers to ensure consistent quality and competitive pricing. The conversion process itself involves dissolving the lead source in nitric acid, followed by filtration, evaporation, and crystallization steps to produce the final, desired form and grade of lead nitrate. Efficiency in these chemical synthesis stages is a primary determinant of operational profitability.

Mid-stream activities focus on the actual manufacturing, quality assurance, and bulk packaging of the finished lead nitrate product. Due to the hazardous nature of the chemical, stringent safety protocols, specialized corrosion-resistant equipment, and highly regulated packaging standards (e.g., UN certification) are essential cost components. Distribution channels are highly specialized, often relying on dedicated logistics providers trained in handling hazardous materials (Hazmat). These channels include both direct sales to major industrial end-users, such as large mining corporations or multinational chemical conglomerates, and indirect distribution through chemical distributors and regional agents who serve smaller manufacturers, laboratories, and niche consumers across various geographic markets.

Downstream analysis highlights the crucial role lead nitrate plays in various industrial processes. The largest end-use sector, mining, utilizes it directly in their flotation circuits, requiring large, reliable deliveries. Other downstream users include specialized chemical manufacturers that incorporate lead nitrate as a stabilizer or precursor in their proprietary formulations for PVC, paints, or electronic components. The effectiveness of the overall value chain relies heavily on seamless coordination between production, specialized hazardous material logistics, and adherence to end-user purity specifications, especially given the sensitivity of mining operations to reagent quality. Direct distribution is favored for large, predictable orders, while indirect channels provide the necessary market penetration for localized or specialized demand.

Lead Nitrate Market Potential Customers

The primary potential customers for the Lead Nitrate Market are concentrated within industries that rely on its specific chemical properties as an oxidizing agent, selective depressant, or heavy metal source for synthesis. The most significant customer base resides within the global mining and metallurgy sector, particularly companies involved in the extraction and processing of complex sulfide ores, such as those containing molybdenum, lead, and zinc. These customers are heavy consumers of Technical Grade lead nitrate for optimizing froth flotation processes, aiming for maximum efficiency and selective separation of valuable minerals from waste material. Their purchasing decisions are driven by reagent performance, supply reliability, and cost-effectiveness relative to overall mineral recovery rates.

A second major customer segment includes manufacturers of specialized chemical products, notably those involved in the production of PVC stabilizers, high-performance coatings, and specific ceramic components. These customers often require Analytical or High Purity Grade lead nitrate to ensure the integrity and stability of their final products, where impurities could significantly compromise performance or regulatory compliance. Furthermore, the defense and aerospace industries represent a critical, though highly specialized and regulated, customer base, utilizing lead nitrate in the manufacturing of high-energy pyrotechnic devices, primers, and specialized explosive compositions, demanding the utmost consistency and purity.

Other potential customers include academic and industrial research laboratories that use the chemical as a reagent in various experimental setups, as well as companies specializing in textile dyeing and printing, where lead nitrate acts as a mordant to fix dyes. The procurement needs of these diverse customer groups range from bulk commercial quantities (mining) to smaller, highly specified laboratory quantities, necessitating a flexible and diversified supply chain strategy focused on both volume capacity and stringent quality certification. Targeting companies with high operational requirements in regulated markets, demonstrating superior safety compliance, is key to securing high-value contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1040 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nihon Kasei Co. Ltd., Merck KGaA, VWR International, Inc., ProChem, Inc., Shepherd Chemical Company, Noah Technologies Corporation, Alfa Aesar (Thermo Fisher Scientific), American Elements, TIB Chemicals AG, GFS Chemicals, Inc., Sigma-Aldrich (Merck), Universal Industrial Products, Inc., Reagents, Inc., Avantor Performance Materials, Pvt. Ltd., Otto Chemie Pvt. Ltd., Parchem fine & specialty chemicals, Haihang Industry Co., Ltd., Henan Lead Zinc Industry Co., Ltd., Changsha Yutong Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lead Nitrate Market Key Technology Landscape

The key technology landscape in the Lead Nitrate Market centers predominantly around enhancing production efficiency, achieving ultra-high purity levels, and implementing advanced pollution control measures. Traditional manufacturing technology involves the straightforward dissolution and crystallization method. However, modern competitive technology focuses on continuous process optimization using specialized reactors and advanced control systems (often integrated with AI) to ensure uniform crystal size distribution and minimize batch variations. Crucial technological advancements include the deployment of membrane filtration and ion exchange techniques during the purification stage, which are necessary to strip trace metallic impurities, thereby meeting the exacting specifications of the high-purity and analytical grade segments required by sensitive applications like electronics and laboratory reagents.

Furthermore, technology is vital in addressing the environmental constraints associated with lead usage. Manufacturers are increasingly adopting closed-loop systems for water and acid recirculation to minimize waste generation and reduce operational impact. Advanced wastewater treatment technologies, including chemical precipitation followed by specialized heavy metal adsorption resins, are now standard requirements for compliant production facilities. These technologies not only reduce the environmental footprint but also enhance resource efficiency by recovering and reusing valuable reagents, improving the overall cost structure and sustainability profile of lead nitrate production.

In the end-use market, especially in mining, the adoption of sophisticated sensing and monitoring technology is crucial. Modern flotation plants use spectroscopic analysis, particle imaging technology, and distributed control systems (DCS) to monitor the pulp chemistry in real time. This technological integration allows for the precise, automatic adjustment of lead nitrate dosage based on ore variability, significantly enhancing recovery rates and reducing reagent overuse. The convergence of chemical engineering excellence, real-time analytics, and environmental mitigation technologies defines the current competitive landscape for leading market participants.

Regional Highlights

The Lead Nitrate Market exhibits pronounced regional variations driven primarily by the geographic distribution of mining activities, industrial manufacturing bases, and the severity of regional environmental regulations.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for lead nitrate globally. This dominance is attributed to the extensive presence of key mining countries such as China, Australia, and India, which are major global producers of base metals (copper, zinc, lead, and molybdenum). The continuous high demand for lead nitrate in froth flotation processes, coupled with robust growth in the region's PVC, electronics, and construction sectors, fuels consumption. Regulatory frameworks in many developing APAC nations, while strengthening, are often less restrictive than in Western economies, allowing for high volume manufacturing and application usage.

- North America: The North American market is mature and characterized by high levels of technological sophistication and stringent environmental controls enforced by agencies like the EPA. Demand remains stable, primarily driven by specialized, high-efficiency mining operations and the use of lead nitrate in niche, high-value applications such as defense pyrotechnics and aerospace components, where high purity is non-negotiable. Manufacturers focus on compliance and providing superior purity grades.

- Europe: The European market is highly constrained by rigorous environmental legislation, particularly the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations, which impose strict controls on lead compounds. Consequently, market growth is slow, and end-users often seek substitutes or demand exceptional clarity on compliance and safety documentation. Consumption is mainly confined to essential applications like necessary chemical synthesis and specialized industrial uses where substitution is technologically or economically prohibitive.

- Latin America (LATAM): LATAM is a significant consumer market, driven by its expansive and resource-rich mining industry, particularly in countries like Chile, Peru, and Brazil. Market dynamics are heavily influenced by global commodity cycles and foreign investment in large-scale mineral extraction projects. The demand is predominantly for Technical Grade lead nitrate, making price sensitivity a key regional factor.

- Middle East and Africa (MEA): The MEA region represents an emerging market, driven by sporadic, high-capital mining ventures and infrastructural development. While smaller in consumption volume compared to APAC, the region offers potential long-term growth as resource exploration and chemical manufacturing capabilities expand, particularly in South Africa and specific Gulf Cooperation Council (GCC) states diversifying their industrial base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lead Nitrate Market.- Nihon Kasei Co. Ltd.

- Merck KGaA

- VWR International, Inc.

- ProChem, Inc.

- Shepherd Chemical Company

- Noah Technologies Corporation

- Alfa Aesar (Thermo Fisher Scientific)

- American Elements

- TIB Chemicals AG

- GFS Chemicals, Inc.

- Sigma-Aldrich (Merck)

- Universal Industrial Products, Inc.

- Reagents, Inc.

- Avantor Performance Materials, Pvt. Ltd.

- Otto Chemie Pvt. Ltd.

- Parchem fine & specialty chemicals

- Haihang Industry Co., Ltd.

- Henan Lead Zinc Industry Co., Ltd.

- Changsha Yutong Chemical Co., Ltd.

- Central Drug House (P) Ltd.

Frequently Asked Questions

Analyze common user questions about the Lead Nitrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the current demand for Lead Nitrate?

The primary application driving demand is its use as a crucial chemical reagent in the froth flotation process within the mining industry. Lead nitrate acts as an activator or depressant, essential for the efficient separation and recovery of base metals, notably molybdenum and specific sulfide ores, significantly enhancing overall mineral concentrate purity and yield.

How do global environmental regulations, such as REACH, affect the Lead Nitrate Market?

Environmental regulations, particularly REACH in Europe and similar stringent standards globally, significantly restrain market growth by increasing manufacturing, handling, and disposal costs due to lead toxicity. These rules mandate high safety standards, extensive documentation, and drive continuous industry efforts to find lower-impact chemical alternatives for non-essential applications, though substitution remains challenging in core uses like flotation.

Which geographical region holds the largest market share for Lead Nitrate consumption?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is due to the concentration of major base metal mining operations, particularly in countries like China and Australia, combined with robust industrial expansion requiring lead nitrate for stabilizers and chemical synthesis.

What are the key differences between Technical Grade and High Purity Grade Lead Nitrate?

Technical Grade is produced in bulk for high-volume industrial uses like mining, where minor impurities are tolerable. High Purity Grade, conversely, undergoes rigorous purification (often using advanced filtration) to remove trace metals, making it suitable for sensitive applications such as specialized pyrotechnics, electronics precursors, and analytical laboratory standards, commanding a significantly higher price point.

Are there viable substitutes for Lead Nitrate in mineral flotation processes?

While the industry actively researches less toxic substitutes, particularly for specific depressant roles, a universally viable, cost-effective substitute for lead nitrate across all complex sulfide ore flotation types does not currently exist. Its performance characteristics in activating or depressing specific minerals are hard to match without compromising recovery rates, thus solidifying its indispensable status in high-efficiency mining operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager