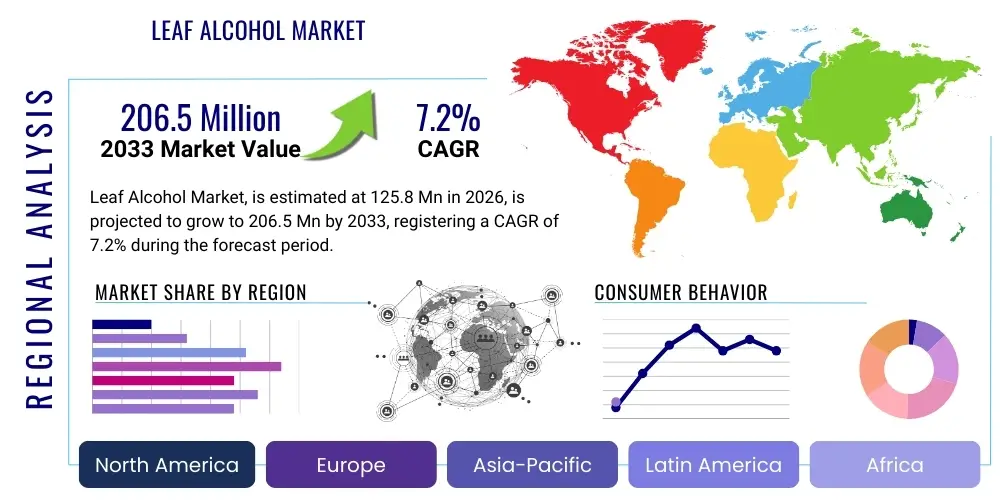

Leaf Alcohol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439362 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Leaf Alcohol Market Size

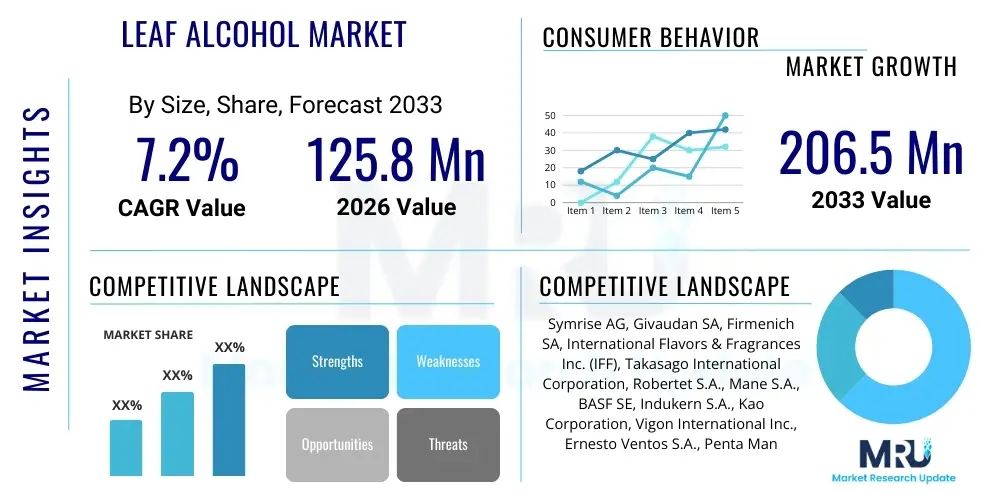

The Leaf Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 125.8 million in 2026 and is projected to reach USD 206.5 million by the end of the forecast period in 2033.

Leaf Alcohol Market introduction

The Leaf Alcohol market, primarily encompassing (Z)-3-Hexen-1-ol, represents a crucial segment within the global aroma chemicals industry, distinguished by its characteristic fresh green, grassy scent. This naturally occurring compound is found in a wide variety of green plants, including tea leaves, tomatoes, and various herbs, contributing significantly to their characteristic fresh aroma. Its distinct olfactive profile makes it highly sought after in numerous applications, ranging from sophisticated perfumery and cosmetic formulations to the creation of authentic flavor profiles in the food and beverage industry. The demand for natural and nature-identical ingredients continues to fuel its market expansion.

Major applications of Leaf Alcohol span across the fragrance, flavor, and pharmaceutical sectors. In fragrances, it is a foundational note, imparting freshness and realism to floral, green, and fruity compositions, often used in perfumes, soaps, detergents, and personal care products. Within the flavor industry, it contributes to natural green notes in beverages, confectionery, and savory products, enhancing the sensory experience. Its benefits include its ability to impart a highly realistic green character, its versatility in blending with other aroma compounds, and its perceived natural origin, which aligns with growing consumer preferences for clean label and natural ingredients. The market is primarily driven by the increasing consumer inclination towards natural and premium fragrances, the expanding global food and beverage industry, and continuous innovation in product development requiring authentic green notes.

Leaf Alcohol Market Executive Summary

The Leaf Alcohol market is experiencing robust growth driven by evolving consumer preferences for natural and sustainable ingredients across diverse end-use industries. Key business trends indicate a strong focus on enhancing extraction efficiencies, developing cost-effective synthesis methods, and expanding application portfolios, especially in premium fragrance and gourmet food segments. Companies are investing in research and development to optimize purity and stability, ensuring the compound meets stringent quality standards required by international regulatory bodies. Furthermore, strategic partnerships and collaborations across the value chain, from raw material suppliers to end-product manufacturers, are becoming prevalent to secure supply and foster innovation, addressing both demand volatility and product authenticity concerns.

Regionally, the market exhibits dynamic growth, with Asia Pacific emerging as a significant growth engine due to the rapidly expanding personal care and processed food sectors, coupled with increasing disposable incomes and urbanization. North America and Europe, while mature, continue to hold substantial market shares, primarily driven by their established fragrance and flavor industries and a strong consumer demand for natural products. These regions are also witnessing a shift towards sustainable sourcing and production practices, influencing market dynamics. Segment-wise, the fragrance application segment remains the largest consumer of Leaf Alcohol, propelled by the constant demand for fresh and green notes in fine fragrances and functional perfumery. However, the flavor segment is projected to demonstrate considerable growth, stimulated by the rising trend for natural and authentic taste profiles in food and beverages, further diversifying the market landscape.

AI Impact Analysis on Leaf Alcohol Market

The integration of Artificial Intelligence (AI) is poised to significantly transform various facets of the Leaf Alcohol market, addressing common user questions about efficiency, sustainability, and innovation. Users frequently inquire about how AI can optimize the complex extraction and purification processes of Leaf Alcohol, traditionally resource-intensive, or how it can help in predicting market demand fluctuations to manage supply chains more effectively. There is also considerable interest in AI's role in discovering new, more sustainable sources or production methods for Leaf Alcohol, and how it might aid in quality control, ensuring consistent purity and olfactive profiles. These inquiries highlight a collective expectation that AI will bring about enhanced operational efficiency, improved product quality, greater sustainability, and accelerated innovation within the Leaf Alcohol industry.

- AI-driven optimization of raw material sourcing and cultivation, improving yield and reducing waste.

- Predictive analytics for market demand and supply chain management, ensuring efficient inventory and distribution.

- Enhanced quality control through AI-powered spectroscopy and chromatography, guaranteeing purity and consistency.

- Accelerated discovery of novel enzymatic synthesis pathways or bio-fermentation methods for sustainable production.

- Process optimization in extraction and purification, leading to reduced energy consumption and operational costs.

- Identification of new applications and synergistic blends through AI-powered aroma compound analysis.

- Automated monitoring of production parameters, minimizing human error and maximizing output.

- Personalized fragrance and flavor creation through AI algorithms analyzing consumer preferences.

DRO & Impact Forces Of Leaf Alcohol Market

The Leaf Alcohol market is influenced by a complex interplay of drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. A primary driver is the escalating consumer preference for natural and nature-identical ingredients across personal care, food, and beverage sectors, fueling demand for authentic green notes. The expansion of the global fragrance and flavor industry, particularly in emerging economies, further propels market growth as Leaf Alcohol is a fundamental component in myriad formulations. Additionally, continuous innovation in product development aiming for unique and sophisticated aroma profiles contributes significantly to its market momentum. These forces collectively create a positive demand environment for Leaf Alcohol, positioning it as a key ingredient in sensory-driven products.

However, the market also faces considerable restraints, including the inherent volatility of raw material prices, as the availability and cost of green plant matter can fluctuate due to seasonal variations and climate change. Limited natural supply and the complexities of extraction processes, which can be energy-intensive and yield-sensitive, pose significant challenges to scaling production. Furthermore, intense competition from synthetic alternatives, which offer cost advantages and consistent supply, can sometimes constrain the market share of natural Leaf Alcohol. Stringent regulatory frameworks pertaining to the use of aroma chemicals in different applications across various regions also add to the operational complexities and compliance costs for manufacturers. These factors necessitate continuous strategic adjustments and technological advancements to maintain competitiveness.

Despite these challenges, substantial opportunities exist for market expansion. The increasing focus on sustainable and green chemistry practices opens avenues for developing more efficient and eco-friendly extraction or synthesis methods. Research and development into novel applications, particularly in niche segments such as nutraceuticals, pharmaceuticals, and specialty agrochemicals, could unlock new revenue streams. Moreover, the rising demand for premium and luxury products globally, where consumers are willing to pay a premium for natural and high-quality ingredients, presents a significant growth opportunity. Investment in advanced biotechnological approaches for bio-fermentation also holds promise for ensuring a stable and sustainable supply of nature-identical Leaf Alcohol, mitigating dependency on traditional agricultural sources and addressing environmental concerns.

Segmentation Analysis

The Leaf Alcohol market is extensively segmented to reflect the diverse applications, purity levels, and sources of this versatile aroma chemical, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for stakeholders to tailor production, marketing, and distribution strategies effectively. The market is primarily bifurcated by application, highlighting its widespread use across various industries, and by purity, reflecting the different grades required for specific end-uses. Further segmentation by source acknowledges the distinction between naturally extracted and synthetically derived forms, addressing consumer demand for naturalness and industry requirements for cost-effectiveness and supply stability. These distinctions allow for a comprehensive analysis of market drivers and growth opportunities within each specific category.

- By Purity:

- 95% Purity

- 98% Purity

- 99% Purity and Above

- By Application:

- Fragrance

- Fine Fragrances

- Personal Care Products (Soaps, Shampoos, Lotions)

- Home Care Products (Detergents, Air Fresheners)

- Flavor

- Food Products (Confectionery, Dairy, Baked Goods)

- Beverages (Soft Drinks, Alcoholic Beverages)

- Pharmaceuticals

- Agrochemicals

- Other Industrial Uses

- Fragrance

- By Source:

- Natural Extraction (from green leaves, plants)

- Synthetic/Biotechnological (via enzymatic synthesis, fermentation)

- By Form:

- Liquid

- Encapsulated Powder

Value Chain Analysis For Leaf Alcohol Market

The value chain for the Leaf Alcohol market commences with upstream activities centered around the sourcing and processing of raw materials. This primarily involves the cultivation and harvesting of green plant biomass, such as specific leaves and herbs known to contain high concentrations of (Z)-3-Hexen-1-ol. Suppliers of these botanical raw materials, often agricultural enterprises or specialized botanical extract companies, form the initial link. For synthetically or biotechnologically produced Leaf Alcohol, upstream activities involve sourcing basic chemical precursors or developing microbial strains for fermentation. The quality and sustainability of these upstream inputs are critical as they directly impact the final product's purity, yield, and cost, emphasizing the importance of robust agricultural practices and efficient initial processing techniques.

Moving downstream, the value chain encompasses the sophisticated processes of extraction, purification, and formulation. Manufacturers specializing in aroma chemicals perform the critical steps of extracting Leaf Alcohol from the raw biomass using methods like steam distillation or solvent extraction, followed by rigorous purification to achieve desired purity levels. For synthetic routes, this involves complex chemical synthesis or fermentation processes. These refined ingredients are then supplied to various downstream industries. The primary downstream consumers include fragrance houses, flavor manufacturers, and companies in the personal care, food and beverage, and pharmaceutical sectors, where Leaf Alcohol is incorporated as a key ingredient to impart specific sensory attributes. These entities often engage in further blending and formulation to create end-consumer products, driving significant value addition.

Distribution channels for Leaf Alcohol are multi-faceted, involving both direct and indirect routes to market. Direct channels include manufacturers selling directly to large-scale industrial customers or major fragrance and flavor houses, often facilitated by long-term supply contracts. This approach allows for closer relationships, tailored solutions, and greater control over product delivery and technical support. Indirect channels involve a network of specialized distributors and agents who cater to smaller manufacturers, niche markets, or provide regional warehousing and logistics support. These intermediaries play a crucial role in market penetration, especially in regions where direct sales might not be cost-effective or practical. Both direct and indirect distribution strategies are vital for ensuring widespread availability and efficient market access, adapting to the diverse needs of the global customer base for Leaf Alcohol.

Leaf Alcohol Market Potential Customers

The potential customers for Leaf Alcohol are diverse and span across multiple industries, all seeking its distinctive fresh green aroma profile for their product formulations. The primary end-users are within the fragrance industry, including fine fragrance houses that develop perfumes and colognes, as well as manufacturers of functional perfumery products such as soaps, detergents, fabric softeners, and personal care items like shampoos, lotions, and deodorants. These customers value Leaf Alcohol for its ability to impart a natural, verdant, and uplifting note, enhancing the overall sensory experience and perceived naturalness of their products. The demand from this segment is consistently high, driven by consumer desire for fresh and appealing scents in everyday items.

Another significant customer base resides within the food and beverage industry, where Leaf Alcohol is utilized by flavor houses to create or enhance natural green and fruity profiles in various products. This includes confectionery, dairy products, baked goods, and a wide array of beverages, both alcoholic and non-alcoholic. Manufacturers in this sector use Leaf Alcohol to provide authentic and fresh taste sensations, contributing to the perceived quality and natural origin of their food and drink offerings. The rising trend towards clean label and natural ingredients further solidifies the demand from this segment, as consumers increasingly scrutinize ingredient lists.

Beyond the core fragrance and flavor sectors, Leaf Alcohol finds potential customers in niche applications within the pharmaceutical and agrochemical industries. In pharmaceuticals, it can be explored for its potential therapeutic properties or as an excipient. In agrochemicals, it might be used as a component in certain formulations or as a natural insect attractant/repellent. Additionally, research institutions and specialty chemical manufacturers also represent potential customers, using Leaf Alcohol for R&D purposes, new product development, or in specialized industrial processes. These varied applications underscore the compound's versatility and broad appeal to industries seeking to leverage its unique chemical and sensory attributes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.8 Million |

| Market Forecast in 2033 | USD 206.5 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Symrise AG, Givaudan SA, Firmenich SA, International Flavors & Fragrances Inc. (IFF), Takasago International Corporation, Robertet S.A., Mane S.A., BASF SE, Indukern S.A., Kao Corporation, Vigon International Inc., Ernesto Ventos S.A., Penta Manufacturing Company, Zibo Aolunda Chemical Co. Ltd., Nanjing Chemsun Bio-Tech Co. Ltd., Zhejiang NHU Co. Ltd., Guangzhou Fangyuan Chemical Co. Ltd., Xiamen Bestally Chemical Co. Ltd., Natural Aromas Pty Ltd., Capua 1880 S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leaf Alcohol Market Key Technology Landscape

The technological landscape of the Leaf Alcohol market is continuously evolving, driven by the dual objectives of enhancing production efficiency and ensuring product authenticity and sustainability. Traditional methods primarily involve solvent extraction and steam distillation from natural plant sources like green leaves, where optimizing yields and minimizing environmental impact are key technological challenges. Advances in these conventional processes include the adoption of green chemistry principles, utilizing more eco-friendly solvents and energy-efficient distillation techniques. Furthermore, sophisticated analytical technologies such as Gas Chromatography-Mass Spectrometry (GC-MS) are indispensable for quality control, ensuring the purity and consistent olfactive profile of the extracted Leaf Alcohol, which is critical for its high-value applications in fragrance and flavor.

More recently, significant technological innovation has centered around biotechnological approaches, offering promising alternatives to traditional natural extraction. Enzymatic synthesis and microbial fermentation technologies are gaining traction for producing nature-identical Leaf Alcohol. These methods leverage biological catalysts or microorganisms to convert readily available precursors into Leaf Alcohol, often resulting in higher yields, reduced processing costs, and a more sustainable production footprint. This approach mitigates the dependency on agricultural raw material availability and reduces the environmental impact associated with large-scale cultivation and extraction. Furthermore, advancements in genetic engineering are enabling the development of engineered microbes that can produce Leaf Alcohol more efficiently, paving the way for scalable and environmentally sound manufacturing.

Beyond core production, the Leaf Alcohol market also benefits from technological advancements in product formulation and delivery. Encapsulation technologies, for instance, are employed to enhance the stability, longevity, and controlled release of Leaf Alcohol in various end products, particularly in personal care and home care items. Microencapsulation protects the volatile compound from degradation and ensures a sustained release of its fresh green notes. Additionally, advancements in sensory evaluation and digital perfumery tools are aiding formulators in creating increasingly complex and appealing compositions that effectively utilize Leaf Alcohol's unique profile. The convergence of these processing, analytical, and formulation technologies is crucial for meeting the dynamic demands of the global Leaf Alcohol market and ensuring its continued growth and innovation.

Regional Highlights

- North America: A mature market characterized by high consumer spending on premium personal care products and processed foods. The region exhibits strong demand for natural and clean-label ingredients, driving the adoption of Leaf Alcohol in fragrances and flavors. Innovation in product development and a well-established R&D infrastructure contribute to sustained market growth.

- Europe: A leading region in the global fragrance and flavor industry, with a strong emphasis on natural, sustainable, and organic ingredients. Strict regulatory frameworks often encourage high-purity and naturally sourced Leaf Alcohol. Countries like France, Germany, and the UK are major consumers due to their thriving cosmetics and food sectors.

- Asia Pacific (APAC): The fastest-growing market for Leaf Alcohol, driven by rapid urbanization, increasing disposable incomes, and the expanding personal care, food, and beverage industries in countries like China, India, and Japan. Rising awareness regarding natural ingredients and the burgeoning middle-class population are key growth drivers.

- Latin America: Demonstrates steady growth fueled by a rising demand for convenience foods, beverages, and personal care products. Local manufacturers are increasingly incorporating natural aroma chemicals, including Leaf Alcohol, to cater to evolving consumer preferences and international market trends.

- Middle East and Africa (MEA): An emerging market with significant potential, particularly in the perfumery sector, which traditionally values unique and natural fragrance components. Economic diversification and increasing investment in consumer goods manufacturing are stimulating demand for specialty aroma ingredients like Leaf Alcohol.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leaf Alcohol Market.- Symrise AG

- Givaudan SA

- Firmenich SA

- International Flavors & Fragrances Inc. (IFF)

- Takasago International Corporation

- Robertet S.A.

- Mane S.A.

- BASF SE

- Indukern S.A.

- Kao Corporation

- Vigon International Inc.

- Ernesto Ventos S.A.

- Penta Manufacturing Company

- Zibo Aolunda Chemical Co. Ltd.

- Nanjing Chemsun Bio-Tech Co. Ltd.

- Zhejiang NHU Co. Ltd.

- Guangzhou Fangyuan Chemical Co. Ltd.

- Xiamen Bestally Chemical Co. Ltd.

- Natural Aromas Pty Ltd.

- Capua 1880 S.p.A.

Frequently Asked Questions

What is Leaf Alcohol and its primary uses?

Leaf Alcohol, chemically known as (Z)-3-Hexen-1-ol, is a naturally occurring aroma compound found in green plants. Its primary uses are in the fragrance industry to impart fresh, green, and grassy notes to perfumes, personal care products, and household items, and in the flavor industry for natural green profiles in food and beverages.

How is Leaf Alcohol produced, and what are the main sources?

Leaf Alcohol is predominantly produced through natural extraction from green plant biomass, such as specific leaves and herbs, using methods like steam distillation or solvent extraction. Increasingly, it is also synthesized biotechnologically via enzymatic synthesis or microbial fermentation to produce a nature-identical compound, offering sustainable alternatives.

What are the key factors driving the growth of the Leaf Alcohol market?

The market growth is primarily driven by increasing consumer demand for natural and nature-identical ingredients in fragrances and flavors, the expansion of the global personal care and food & beverage industries, and continuous innovation in product development requiring authentic green notes for sophisticated formulations.

What challenges does the Leaf Alcohol market face?

Key challenges include the volatility of raw material prices due to seasonal and environmental factors, limited natural supply, competition from cost-effective synthetic alternatives, and stringent regulatory frameworks that impact production and application across different regions.

Which regions are key contributors to the Leaf Alcohol market?

North America and Europe are established markets with strong demand from their fragrance and flavor industries. Asia Pacific is a rapidly growing region, driven by expanding consumer goods sectors, while Latin America and the Middle East & Africa are emerging markets with increasing adoption of natural aroma ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager