Leaf Vacuums and Blowers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435731 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Leaf Vacuums and Blowers Market Size

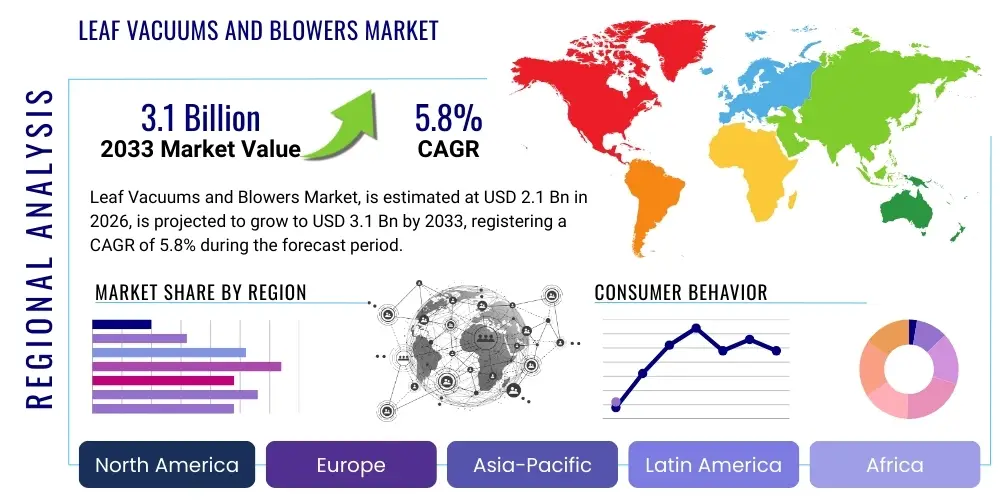

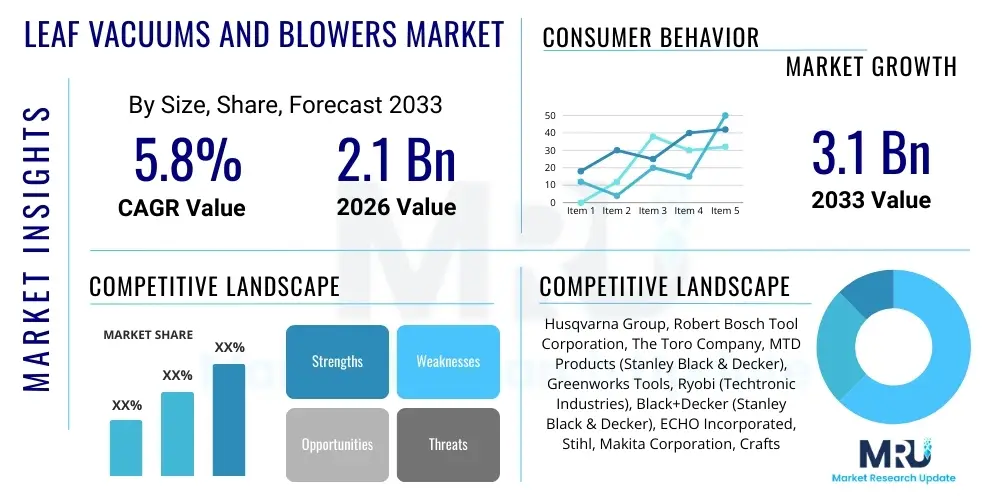

The Leaf Vacuums and Blowers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Leaf Vacuums and Blowers Market introduction

The Leaf Vacuums and Blowers Market encompasses various outdoor power equipment designed for landscape maintenance, primarily focused on clearing debris such as leaves, grass clippings, and small twigs from yards, sidewalks, and driveways. These tools significantly reduce manual labor and time required for cleanup, driving their widespread adoption across residential, commercial, and municipal sectors. The product portfolio includes handheld blowers, backpack blowers, walk-behind vacuum/mulchers, and combined blower-vacuum units, differentiated primarily by their power source—corded electric, battery-powered (cordless), or gasoline (internal combustion engine). Technological advancements, particularly in lithium-ion battery technology, have propelled the growth of the cordless segment, offering portability and reduced noise pollution while maintaining substantial power output comparable to traditional gasoline models.

Major applications of leaf blowers and vacuums span professional landscaping services, golf courses, parks and recreation departments, and individual home owners seeking efficient property management solutions. The growing urbanization and maintenance of manicured green spaces globally necessitate efficient debris management tools. Furthermore, the inherent benefits of these products, such as mulching capabilities that reduce debris volume for easier disposal or composting, enhance their value proposition. The market also sees differentiation based on airflow (CFM) and airspeed (MPH), catering to different application scales, from light residential tasks to heavy-duty commercial clearing operations. This diversity ensures that specialized equipment is available for specific environmental and operational demands.

Key factors driving market expansion include increasing consumer disposable income dedicated to home and garden care, stringent regulations promoting noise reduction (favoring electric/battery models), and rapid infrastructural development requiring maintained green surroundings. The shift towards sustainable and ergonomic yard care solutions is a significant accelerator. Additionally, the replacement cycle for gasoline-powered equipment, often spurred by consumer desire for less maintenance and zero emissions, feeds into the growth of the electric segments. Seasonal demands, particularly during the autumn months in temperate climates, ensure sustained sales volume and inventory turnover for manufacturers and retailers globally, stabilizing the revenue stream within this sector.

Leaf Vacuums and Blowers Market Executive Summary

The Leaf Vacuums and Blowers Market is currently experiencing a dynamic shift, characterized by the accelerating transition from traditional gasoline-powered equipment towards battery-operated, cordless models. This trend is driven by consumer preferences for reduced noise, lower maintenance, and environmental sustainability, significantly shaping business strategies focused on developing higher voltage (e.g., 40V, 80V) platforms that offer prolonged runtimes and professional-grade performance. Key business trends include aggressive mergers and acquisitions among major tool manufacturers to consolidate market share and integrate complementary battery technologies, alongside strategic partnerships with retailers and e-commerce platforms to enhance distribution reach and visibility. Furthermore, competitive pricing strategies, particularly in the mid-range consumer segment, are crucial for market penetration in densely populated suburban areas.

Regionally, North America and Europe remain the dominant markets due to high levels of homeownership, extensive lawn care culture, and early adoption of environmental regulations restricting noise and emissions, which favors electric alternatives. The Asia Pacific region, particularly China and India, is emerging as a high-growth area, fueled by rapid urbanization, increasing per capita spending on home maintenance, and the introduction of advanced, affordable electric equipment. Regional trends also reflect differing segment preferences; for instance, professional landscapers in North America show a strong demand for powerful backpack models, while European consumers often prioritize lighter, multipurpose handheld units suitable for smaller urban gardens. Regulatory alignment across the EU concerning machinery safety and noise standards continues to influence product design and market entry strategies.

Segment trends underscore the supremacy of the electric segment, projected to capture the largest market share, with lithium-ion batteries being the foundational technology. Within the power source segmentation, cordless technology is outpacing corded electric units due to superior mobility, positioning it as the primary growth driver for residential users. By application, the commercial landscaping segment is witnessing significant investment in robust, high-performance battery platforms, often utilizing shared battery systems across multiple tools (e.g., blowers, trimmers, chainsaws). Manufacturers are increasingly focusing on feature differentiation, such as variable speed controls, metal impellers for enhanced mulching durability, and advanced ergonomic designs, positioning these characteristics as key purchase influencers across all major market segments.

AI Impact Analysis on Leaf Vacuums and Blowers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Leaf Vacuums and Blowers Market primarily revolve around automation, predictive maintenance, and operational efficiency improvements for professional users. Common questions include whether AI can optimize battery life and charging cycles, how smart sensors can enhance performance based on debris density, and the potential for fully autonomous leaf clearing robotics. Users are particularly concerned with how AI integration might increase equipment cost while expecting substantial benefits in labor reduction and task precision. The consensus expectation is that AI will not fundamentally change the core mechanical function but will revolutionize accessory components and fleet management systems, turning traditional landscaping tools into smart, connected devices capable of self-diagnosis and optimized operation.

The current application of AI in this domain is highly focused on optimizing the power delivery and resource utilization of battery-powered systems. AI-driven algorithms embedded in Battery Management Systems (BMS) analyze usage patterns and external factors (like ambient temperature and workload intensity) to dynamically adjust power output, thereby maximizing runtime and prolonging the overall lifespan of the lithium-ion battery packs. This predictive capability moves beyond simple power conservation, offering landscapers data insights into the most efficient way to complete routes and manage their fleet. Furthermore, machine learning models are beginning to analyze sensor data from sophisticated commercial backpack blowers to predict potential mechanical failures (e.g., motor strain, bearing wear) before they occur, allowing for preventative maintenance scheduling rather than reactive repair.

Looking forward, the evolution of AI integration points towards enhanced user experience and fully autonomous solutions. For high-end professional walk-behind vacuums and future robotic lawn care devices, visual recognition AI is essential for differentiating between leaves/debris and fragile landscape elements (e.g., small plants, decorative stones), ensuring targeted and safe operation. This technology allows for dynamic path planning and optimized clearing patterns based on real-time environmental conditions, offering unparalleled efficiency gains for commercial operations managing vast areas. While full robotic adoption is nascent, the application of smart diagnostics and operational optimization is becoming a standard feature in premium market offerings, cementing AI's role as an enabler of efficiency and durability.

- Enhanced Battery Management Systems (BMS) for optimal charge and discharge cycles, extending tool lifespan.

- Predictive maintenance analytics using embedded sensors to forecast mechanical failures in motors and impellers.

- Integration of smart features (e.g., GPS tracking, operational logging) for commercial fleet management efficiency.

- Potential development of autonomous robotic leaf clearing systems utilizing visual recognition AI for path optimization.

- Dynamic power adjustment based on real-time debris load and ground surface analysis to conserve energy.

DRO & Impact Forces Of Leaf Vacuums and Blowers Market

The Leaf Vacuums and Blowers Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the primary impact forces dictating market evolution. The predominant driver is the rapid consumer acceptance and regulatory push favoring environmentally friendly electric and battery-powered equipment, fueled by significant improvements in battery technology that close the performance gap with gasoline models. Simultaneously, the market faces strong headwinds, particularly the high initial purchase cost of premium, high-voltage battery systems and the inherent range anxiety associated with electric models, especially for large commercial applications requiring extended runtimes. These restraints necessitate innovative solutions, driving manufacturers to explore opportunities in developing standardized battery platforms and fast-charging infrastructure to enhance user convenience and scalability.

Driving forces center on global urbanization and the corresponding increase in demand for aesthetically pleasing and well-maintained outdoor spaces, necessitating efficient debris management tools for residential and commercial property owners alike. The ergonomic superiority of battery units—being lighter, quieter, and producing zero direct emissions—is a crucial pull factor, particularly in densely populated areas where noise pollution regulations are becoming stricter. Opportunities lie prominently in emerging economies where penetration rates are lower, and consumer awareness regarding modern gardening tools is growing. Furthermore, specialized market niches, such as heavy-duty industrial vacuum systems for specialized cleanups (e.g., construction sites or large parking lots), offer potential for diversification beyond standard leaf clearing applications. Investment in multi-tool battery systems represents a significant strategic opportunity for manufacturers to capture greater market share across the entire outdoor power equipment spectrum.

However, the industry must contend with several significant restraining factors. The reliance on globally fragmented supply chains for crucial components, particularly lithium and semiconductor chips for battery management, introduces vulnerability to geopolitical and logistical disruptions. The relatively short product lifespan compared to some other consumer durables, alongside intense price competition, particularly from Asian manufacturers specializing in entry-level corded products, pressure profit margins for established brands. The ultimate impact force is the regulatory environment: stricter emission standards (for remaining gasoline units) and noise ordinances in key developed markets act as a continuous catalyst, accelerating the shift towards electric solutions and forcing rapid innovation in motor and fan design to improve efficiency and minimize acoustic output.

Segmentation Analysis

The Leaf Vacuums and Blowers Market is comprehensively segmented based on Power Source, Product Type, Application, and Distribution Channel, allowing for a granular understanding of consumer behavior and technological adoption across various demographics and operational needs. The segmentation highlights the market's fundamental bifurcation between high-performance, professional-grade equipment and accessible, consumer-focused tools. Power Source segmentation—Gasoline, Corded Electric, and Cordless Battery—remains the most critical factor, influencing price, noise level, and portability. The segmentation analysis confirms the sustained dominance of battery-powered tools due to continuous technological improvements that address historical limitations related to power and runtime, making them viable across both residential and lighter commercial applications.

Segmentation by Product Type differentiates between the functionality and operational modality of the equipment. Handheld models appeal primarily to residential users and those needing maximum maneuverability, whereas backpack units are crucial for professional landscapers requiring extended operation periods and superior power output for clearing large areas or heavy, wet debris. Walk-behind blower/vacuum models, often incorporating advanced mulching capabilities and larger collection bags, cater specifically to maintenance crews for large estates or municipal grounds where high volume debris processing is necessary. Analyzing these segments helps stakeholders tailor product development and marketing efforts to the specific ergonomic and performance requirements of each user group, maximizing market penetration.

The Application segmentation—Residential vs. Commercial/Professional—reveals distinct purchasing drivers. Residential buyers prioritize ease of use, low noise, and affordability, often preferring lighter, multipurpose blower/vacuum combinations. Conversely, commercial users demand durability, power (high CFM/MPH ratings), long battery life (or efficient gasoline engines), and comprehensive warranty support due to the intensive daily usage cycles. The distribution channel analysis further reveals how products reach these diverse customer bases, with retail stores dominating the residential segment and specialized professional dealerships and online B2B channels playing a crucial role in supplying the commercial sector with premium equipment and necessary parts/services.

- By Power Source

- Gasoline Powered

- Corded Electric

- Cordless (Battery) Electric

- Low Voltage (<= 20V)

- Medium Voltage (40V - 60V)

- High Voltage (> 60V)

- By Product Type

- Handheld Blowers/Vacuums

- Blower Only

- Blower/Vacuum/Mulcher Combo

- Backpack Blowers

- Gasoline Backpack

- Electric Backpack

- Walk-Behind Blowers and Vacuums

- Self-Propelled

- Push Models

- Handheld Blowers/Vacuums

- By Application

- Residential

- Commercial/Professional Landscaping

- Municipalities and Parks

- Golf Courses

- Private Commercial Grounds

- By Distribution Channel

- Online Retail

- Offline Retail

- Home Improvement Stores (Big Box Retailers)

- Specialty Dealers and Equipment Stores

- Hardware Stores

Value Chain Analysis For Leaf Vacuums and Blowers Market

The value chain for the Leaf Vacuums and Blowers Market begins with the upstream suppliers of raw materials and core components. This stage is critical, involving the procurement of plastics (polymers) for housing and fan components, metals (aluminum and steel) for motor casings and internal components, and, most crucially, advanced components like lithium-ion battery cells, electric motors (brushless DC motors being preferred), and gasoline engines (small two-stroke or four-stroke). The complexity of managing the supply of sophisticated electronics, particularly chips and control boards necessary for battery management systems (BMS), heavily influences production costs and lead times. Upstream efficiency and stability are paramount, as volatility in metal or lithium prices directly impacts the final product cost, necessitating strong long-term contracts with key component suppliers.

The midstream involves the manufacturing and assembly process, dominated by major original equipment manufacturers (OEMs) who focus on design, quality control, and branding. This phase includes the precision molding of plastic parts, motor assembly, final product integration, and rigorous testing for safety and performance (e.g., noise levels, CFM output). Logistics and warehousing play a crucial role here, managing seasonal inventory peaks driven by high demand during the fall and spring cleanup cycles. Manufacturers often employ sophisticated just-in-time (JIT) systems to manage the assembly of product variations across different power platforms (gasoline, corded, cordless) efficiently while maintaining stringent compliance with regional safety and environmental certifications.

The downstream activities involve distribution and sales, leading to the end-user. Distribution channels are varied, involving direct and indirect models. Indirect channels, such as big-box retailers (Home Depot, Lowe's), specialist hardware stores, and general e-commerce platforms (Amazon, dedicated manufacturer websites), facilitate broad access for residential consumers. Direct channels, including professional equipment dealerships and authorized service centers, are essential for catering to commercial customers who require specific advice, specialized parts, maintenance services, and reliable warranty support. Post-sale services, including maintenance, repair, and parts replacement, constitute a vital part of the value chain, ensuring customer loyalty and maximizing the operational lifespan of the equipment, particularly for high-investment professional units.

Leaf Vacuums and Blowers Market Potential Customers

Potential customers for leaf vacuums and blowers span a wide spectrum, categorized primarily into residential users and commercial or professional entities, each exhibiting distinct purchasing behaviors and product requirements. The largest volume segment consists of residential homeowners, particularly those residing in suburban areas with moderate to large yards and significant tree coverage. These customers prioritize ease of use, maneuverability, storage capacity, and competitive pricing, overwhelmingly favoring cordless electric handheld units for routine maintenance. Their purchasing decisions are often influenced by retail promotions, brand recognition, and positive online reviews, seeking reliable tools that minimize the labor intensity of seasonal yard work and adhere to local neighborhood noise guidelines.

The second major group comprises commercial and professional landscaping contractors who represent the highest value segment in terms of average transaction size and frequency of purchase. These entities rely on rugged, high-performance equipment, typically requiring gasoline or high-voltage (e.g., 60V+) backpack blowers and industrial walk-behind vacuums capable of continuous, heavy-duty operation for multiple hours daily. Their purchasing drivers are focused entirely on durability, power output (CFM/MPH), extended runtime, and comprehensive fleet management features, including shared battery platform compatibility and accessible service networks. Municipalities, park maintenance departments, educational institutions, and corporate campuses also fall within this professional bracket, often purchasing equipment in large tenders based on rigorous performance specifications and long-term reliability guarantees.

A growing niche of potential customers includes specialized maintenance services and property management firms that manage multi-unit housing complexes, golf courses, and large commercial grounds. These buyers often require highly specialized equipment, such as heavy-duty mulching vacuums capable of processing pine needles or dense wet leaves, or quiet electric equipment specifically mandated for use during non-standard hours or in noise-sensitive environments like hospitals or retirement communities. As environmental awareness increases, even large industrial facilities are becoming potential customers for specialized blowers used for cleaning workshops, warehouses, and outdoor storage areas, moving beyond purely seasonal leaf clearing applications to encompass general debris management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Husqvarna Group, Robert Bosch Tool Corporation, The Toro Company, MTD Products (Stanley Black & Decker), Greenworks Tools, Ryobi (Techtronic Industries), Black+Decker (Stanley Black & Decker), ECHO Incorporated, Stihl, Makita Corporation, Craftsman (Stanley Black & Decker), Karcher SE & Co. KG, Snow Joe LLC, Sun Joe, Worx (Positec Tool Corporation), Earthwise, Kobalt (Lowe's), DeWalt (Stanley Black & Decker), Poulan Pro, Billy Goat Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leaf Vacuums and Blowers Market Key Technology Landscape

The technology landscape of the Leaf Vacuums and Blowers Market is currently dominated by advancements in electric motor design and lithium-ion battery chemistry, which are driving performance parity with, and often superiority over, traditional combustion engines. The widespread adoption of Brushless DC (BLDC) motors represents a fundamental technological shift. BLDC motors offer higher efficiency, reduced heat generation, and significantly longer operational lifespan compared to brushed motors, enabling manufacturers to deliver high CFM (Cubic Feet per Minute) and MPH (Miles Per Hour) specifications critical for effective debris clearing, all within a compact and lightweight electric housing. This motor technology is central to the success of premium cordless handheld and backpack blowers, allowing for optimized power delivery that maximizes battery utilization under varying loads.

The second critical pillar of innovation is the continuous evolution of lithium-ion battery packs. Manufacturers are focusing on higher energy density cells (e.g., 21700 cell formats) to increase total Wh capacity without drastically increasing the pack size or weight, addressing the traditional constraint of runtime. Furthermore, intelligent Battery Management Systems (BMS) are integrated into these packs, incorporating microprocessors that monitor cell temperature, voltage, and current flow to ensure safety, rapid charging capabilities, and optimized discharge curves. Fast-charging technology, reducing recharge times significantly, is crucial for commercial users who rely on quick turnaround between jobs. The market is also seeing the maturation of multi-voltage platforms, allowing the same battery pack to power different tools across a manufacturer's ecosystem, providing flexibility and cost savings for end-users.

Beyond power systems, technological advancements are also evident in aerodynamic design and noise reduction strategies. Manufacturers are utilizing advanced Computational Fluid Dynamics (CFD) modeling to refine impeller shapes, fan housing geometry, and nozzle design. These efforts aim to maximize air throughput and velocity while simultaneously minimizing acoustic output and energy consumption, critical for meeting stringent international noise abatement standards (especially in urban environments). For vacuum models, durable mulching systems, often featuring metal impellers instead of plastic, are becoming standard in higher-end equipment, enhancing debris reduction rates and extending the equipment's lifespan under heavy use, appealing directly to the performance demands of professional users.

Regional Highlights

- North America: Dominance and High Adoption of Cordless Technology

North America, particularly the United States and Canada, stands as the largest and most mature market for leaf vacuums and blowers globally. This dominance is attributed to a high rate of homeownership, a strong culture of DIY yard maintenance, and significant commercial landscaping activity. The region is characterized by an accelerated adoption curve for high-voltage (40V and above) cordless electric tools, driven by consumer willingness to invest in premium equipment and increasingly strict local noise ordinances (e.g., California’s zero-emission mandates). Demand is highly seasonal, peaking in the fall, and the market structure favors major home improvement retail chains and specialty dealers. Manufacturers focus heavily on performance specifications (CFM and MPH) and shared battery platforms to cater to the professional segment, which requires fleet-level consistency and reliability.

- United States: Largest consumer base; rapid regulatory shift favoring electric models.

- Canada: Strong preference for durable, high-power units capable of handling heavy, wet debris due to climate.

- Europe: Focus on Noise Reduction and Compact Design

The European market is highly sensitive to noise pollution regulations and environmental directives, making it a powerful driver for electric and battery-powered product innovation. Countries like Germany, the UK, and France exhibit a strong preference for smaller, lighter handheld units suitable for densely packed urban gardens and smaller private properties. Corded electric models still maintain significant market share due to the lower cost and smaller property sizes in many European cities, although cordless technology is rapidly gaining ground, especially in professional sectors. The market structure emphasizes energy efficiency (kWh usage) and low acoustic output, often positioning products based on compliance with stringent EU safety and environmental standards.

- Germany and UK: High purchasing power and focus on premium, low-noise battery equipment.

- Nordic Countries: Early adoption of sustainable and zero-emission solutions across municipal and private applications.

- Asia Pacific (APAC): Emerging Growth and Affordability Focus

The APAC region is the fastest-growing market, primarily driven by rapid urbanization, increasing disposable income, and the subsequent rise in demand for residential and commercial property maintenance services. While the adoption rate of specialized leaf blowers is lower compared to North America and Europe, the sheer scale of infrastructural development and population density presents immense potential. The market is highly price-sensitive, with entry-level corded and small gasoline units currently dominating. However, China and Japan are leading the shift towards cordless technology, driven by domestic manufacturing capabilities and governmental initiatives promoting green technologies. The key challenge is educating consumers on the benefits and differentiating features of high-performance modern blowers over traditional manual sweeping methods.

- China: Major manufacturing hub and growing domestic consumption of electric gardening tools.

- Japan: High demand for compact, precise, and extremely quiet electric tools due to small land plots and dense residential areas.

- Latin America, Middle East, and Africa (LAMEA): Nascent Market Development

LAMEA markets represent significant long-term growth potential, though currently characterized by lower penetration rates. In Latin America, gasoline-powered units still hold a substantial share, particularly in commercial agriculture and large estate maintenance, due to fewer regulations and cost sensitivities. The Middle East, particularly the UAE and Saudi Arabia, sees high demand for professional-grade equipment used in large-scale park and city beautification projects, often requiring robust equipment capable of operating in high heat and dusty conditions. African markets are developing, with initial demand concentrated in commercial cleaning and infrastructural maintenance projects. Growth here is dependent on stable economic conditions, reliable electricity access, and the expansion of organized retail and professional service sectors.

- Brazil and Mexico: Large agricultural and commercial sectors driving demand for powerful, durable units.

- UAE and Saudi Arabia: Focus on high-performance commercial equipment for extensive landscape maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leaf Vacuums and Blowers Market.- Husqvarna Group

- Robert Bosch Tool Corporation

- The Toro Company

- MTD Products (now part of Stanley Black & Decker)

- Greenworks Tools

- Ryobi (Techtronic Industries)

- Black+Decker (Stanley Black & Decker)

- ECHO Incorporated

- Stihl

- Makita Corporation

- Craftsman (Stanley Black & Decker)

- Karcher SE & Co. KG

- Snow Joe LLC

- Sun Joe

- Worx (Positec Tool Corporation)

- Earthwise

- Kobalt (Lowe's)

- DeWalt (Stanley Black & Decker)

- Poulan Pro

- Billy Goat Industries

Frequently Asked Questions

Analyze common user questions about the Leaf Vacuums and Blowers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift from gasoline to electric leaf blowers?

The primary factor driving the shift is the rapid technological advancement in lithium-ion battery technology, which now offers cordless tools comparable power to gasoline models, combined with zero direct emissions, reduced noise pollution, and minimal maintenance requirements, appealing to both residential users and complying with increasingly stringent environmental regulations.

How is the performance of a leaf blower typically measured?

Leaf blower performance is primarily measured using two metrics: Cubic Feet per Minute (CFM), which represents the volume of air moved, and Miles Per Hour (MPH), which measures the speed of the airflow. High CFM is essential for moving large volumes of dry debris over wide areas, while high MPH is critical for dislodging heavy, wet, or stuck debris.

What are the key differences between handheld, backpack, and walk-behind leaf vacuums and blowers?

Handheld units offer maximum portability and are ideal for residential tasks; backpack units provide greater power and extended runtime for commercial users handling large spaces; and walk-behind models are industrial-grade equipment designed for high-volume collection, mulching, and clearing of extensive areas like large parking lots or municipal parks.

Which power source segment is projected to grow the fastest through 2033?

The Cordless (Battery) Electric power source segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) through 2033. This growth is underpinned by continuous innovation in battery lifespan, increased voltage options (e.g., 60V+ platforms), and the convenience of platform sharing across multiple outdoor power equipment tools by major manufacturers.

What role does noise regulation play in the Leaf Vacuums and Blowers Market?

Noise regulations, particularly in urban areas of North America and Europe, play a crucial role as a market constraint for noisy gasoline models and a key driver for the adoption of quieter electric and battery-powered alternatives. Strict decibel limits in specific regions compel manufacturers to invest heavily in noise-reducing aerodynamic and motor technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager