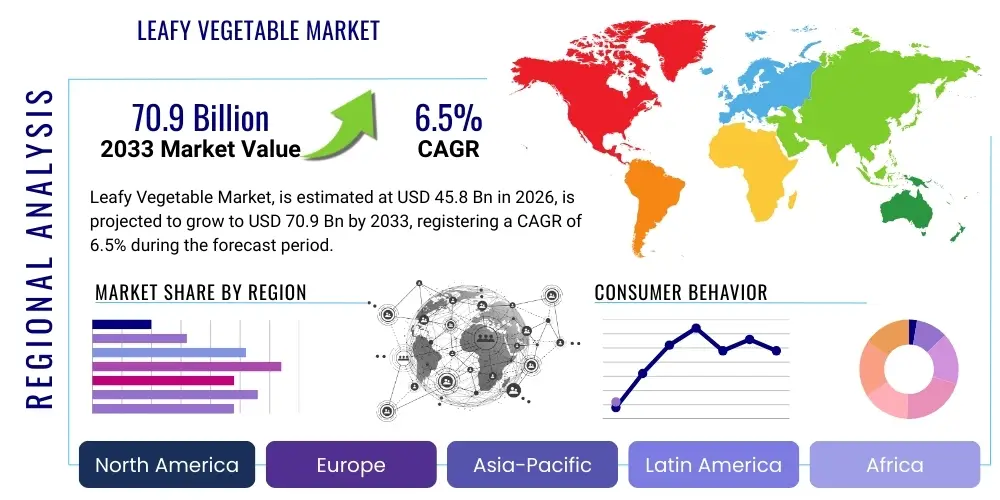

Leafy Vegetable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437731 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Leafy Vegetable Market Size

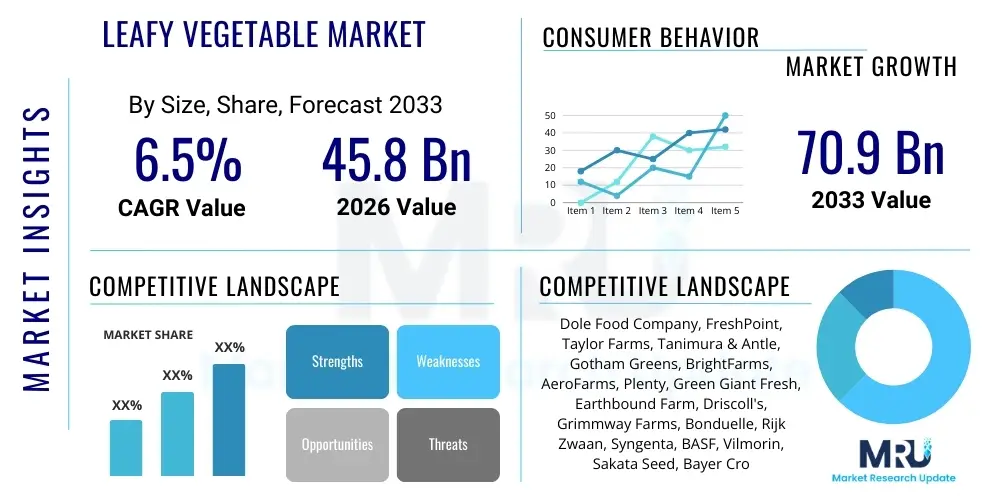

The Leafy Vegetable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.8 billion in 2026 and is projected to reach USD 70.9 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by escalating consumer awareness regarding the health benefits associated with nutrient-dense green foods, coupled with significant advancements in controlled environment agriculture (CEA) technologies such as hydroponics and vertical farming. The increased demand for year-round availability of fresh produce, minimizing seasonal volatility, strongly supports this market expansion, particularly in urban and densely populated regions globally.

Leafy Vegetable Market introduction

The Leafy Vegetable Market encompasses the production, distribution, and consumption of various plant leaves consumed as vegetables, including but not limited to lettuce, spinach, cabbage, kale, arugula, and Swiss chard. These products form a critical component of global dietary patterns, valued for their high vitamin, mineral, and fiber content, directly addressing rising health and wellness trends worldwide. Major applications span fresh consumption in salads, utilization in the expansive food service industry (restaurants, institutional catering), and incorporation into processed foods like ready-to-eat meals, juices, and frozen products. The inherent low-calorie nature and perceived nutritional density of leafy greens position them as essential commodities in modern food systems.

Key benefits driving market adoption include disease prevention capabilities, attributed to high levels of antioxidants and phytochemicals, and their role in promoting digestive health. Furthermore, the convenience factor associated with pre-washed, pre-cut, and packaged leafy greens has significantly enhanced consumer uptake, aligning with busy modern lifestyles. Product innovation, focusing on heirloom varieties, specialty greens, and genetically optimized strains offering improved shelf life and nutrient profiles, further stimulates market demand and diversifies consumer choice. The sector is characterized by intense competition regarding quality, freshness, and traceability across complex supply chains.

Driving factors supporting the continuous expansion of this market involve rapid urbanization leading to higher disposable incomes and subsequent preference for high-value foods, regulatory support promoting sustainable agricultural practices, and technological breakthroughs. Specifically, the necessity to conserve water and maximize yield per unit area has catapulted the adoption of advanced cultivation techniques like vertical farming, which not only ensures production stability regardless of external climate conditions but also reduces transportation distances, thereby lowering the carbon footprint and enhancing freshness for metropolitan consumers. This confluence of consumer push and technological pull solidifies the market's positive outlook.

Leafy Vegetable Market Executive Summary

The Leafy Vegetable Market exhibits dynamic business trends driven by the rapid industrialization of agriculture and a critical pivot towards sustainable sourcing. Business models are increasingly integrating technology, favoring investments in automation, robotics for harvesting, and sophisticated cold chain logistics to minimize post-harvest losses, which historically have been significant in fresh produce. Consolidation among large agricultural enterprises and strategic partnerships between technology providers and traditional farms are reshaping the competitive landscape. Furthermore, the market is experiencing strong traction for certified organic and locally sourced produce, reflecting a growing consumer preference for transparent and environmentally responsible supply chains. This shift necessitates higher traceability standards and robust quality control throughout the value chain, compelling market players to invest heavily in data management systems.

Regionally, Asia Pacific (APAC) stands out as a high-growth market, attributed to its massive population base, increasing penetration of organized retail, and rising awareness of Western dietary habits integrating more fresh salads and green consumption. North America and Europe, while mature, lead in adopting high-tech agriculture, particularly vertical farming, which addresses land scarcity and year-round demand for niche and specialty greens. These regions prioritize food safety standards and stringent regulations regarding pesticide residues, influencing cultivation methods. Emerging economies in Latin America and the Middle East & Africa (MEA) present untapped opportunities, driven by infrastructural improvements in irrigation and cold storage, though hindered slightly by initial high investment costs for advanced agricultural setups.

Segmentation trends highlight the dominance of conventional leafy vegetables in terms of volume, primarily due to lower costs, yet the organic segment is projected to record the highest CAGR, spurred by premium pricing power and strong consumer demand for residue-free products. Among distribution channels, organized retail (supermarkets and hypermarkets) remains the cornerstone for purchasing fresh greens, offering convenience and consistent quality. However, the online retail segment is expanding rapidly, especially for specialty and farm-to-table models, leveraging efficient delivery logistics. Lettuce and spinach continue to command the largest market shares by type, but the demand for nutrient-dense specialty greens like kale and microgreens is increasing disproportionately across all major consuming geographies, indicating a shift towards functional food consumption.

AI Impact Analysis on Leafy Vegetable Market

User queries regarding AI's influence in the leafy vegetable sector frequently revolve around optimization capabilities, specifically concerning precision irrigation, pest and disease identification, and yield forecasting accuracy under controlled environment agriculture (CEA). Consumers and industry stakeholders alike seek assurance regarding how AI can enhance food safety, minimize resource consumption (water, energy), and improve crop quality consistency. Key concerns often focus on the initial capital expenditure required for AI infrastructure integration and the need for specialized labor to manage these advanced systems. The overarching expectation is that AI will revolutionize the growing process, moving from reactive farming to predictive, autonomous cultivation, thereby stabilizing prices and supply year-round, regardless of external environmental pressures, which is crucial for high-value, perishable crops.

The application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamentally transforming operational efficiency within the leafy vegetable industry, particularly in large-scale commercial farms and sophisticated vertical farms. AI systems analyze vast datasets collected from sensors, drones, and camera systems to generate actionable insights regarding plant health, nutritional uptake, and microclimate control. This enables hyper-precision adjustments to environmental parameters such as light spectrum, humidity levels, and nutrient delivery rates, ensuring optimal growth conditions and maximizing biomass accumulation. The resulting efficiency gains translate directly into reduced operational costs, lower environmental impact, and superior product consistency, addressing major pain points in traditional farming.

Furthermore, AI plays a pivotal role in supply chain management and inventory optimization. By integrating ML models with real-time logistical data, growers and distributors can accurately predict demand fluctuations, minimize waste from spoilage, and optimize routing for faster delivery to retail points. This predictive capability is vital for perishable goods like leafy greens, substantially extending marketable shelf life and enhancing customer satisfaction through guaranteed freshness. The long-term impact of AI is expected to democratize high-efficiency farming techniques, making CEA systems more economically viable globally and further cementing the market's dependence on data-driven decision-making processes.

- Enhanced Precision Agriculture: AI optimizes water, nutrient, and pesticide usage based on real-time plant and soil analysis.

- Automated Disease and Pest Detection: Machine vision algorithms rapidly identify early signs of pathogens, minimizing crop loss and chemical intervention.

- Yield Prediction Accuracy: ML models forecast harvest volumes with high reliability, improving planning and market pricing strategies.

- Robotics and Automation Control: AI drives autonomous planting, harvesting, and sorting robots, reducing labor costs and manual handling contamination risks.

- Optimized Energy Use in CEA: Algorithms fine-tune lighting schedules and climate control for maximum energy efficiency in vertical farms.

- Supply Chain Traceability: Blockchain integrated with AI enhances tracking of produce from farm to fork, ensuring food safety compliance.

DRO & Impact Forces Of Leafy Vegetable Market

The dynamics of the Leafy Vegetable Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the overall impact forces shaping its trajectory. The primary driver is the pervasive global trend towards healthy eating, fueled by rising non-communicable diseases and increasing medical consensus on the protective effects of vegetable-rich diets. This consumer-led demand for nutritious, fresh produce provides sustained growth momentum. Coupled with this is the technological push from controlled environment agriculture, offering scalable, climate-resilient solutions. However, the market faces significant restraints, chiefly the inherent perishability of leafy greens, leading to substantial post-harvest losses (a major financial drain), and the high operational and initial capital costs associated with advanced indoor farming systems, posing barriers to entry for smaller players. Furthermore, maintaining stringent food safety standards across international supply chains presents ongoing logistical and regulatory challenges.

Opportunities for market stakeholders primarily lie in geographical expansion into underserved emerging markets, developing proprietary, high-yielding seed varieties resistant to common pathogens, and specializing in high-value niche products such as microgreens and rare, exotic leafy types. The development of advanced packaging technologies (Modified Atmosphere Packaging - MAP) that substantially extend shelf life represents a crucial opportunity to mitigate spoilage losses. Furthermore, integrating circular economy principles, such as utilizing food waste for compost or biogas and optimizing resource recycling in hydroponic systems, offers a pathway toward operational sustainability and regulatory compliance, thereby increasing profitability and consumer appeal. These opportunities require substantial R&D investment but promise superior returns and market differentiation.

The impact forces driving the market are overwhelmingly positive, dominated by demographic shifts and technological innovation. Consumer education regarding nutritional benefits and the convenience revolution driven by ready-to-eat and pre-packaged formats exert strong upward pressure (Driver Impact). Conversely, environmental volatility (climate change impacting traditional farming) and escalating input costs (labor, energy, water) act as persistent restraining forces. The combined effect of these forces suggests a sustained transformation towards high-tech, localized production, focusing heavily on quality control and efficient logistics. Successfully navigating the high capital requirements for CEA infrastructure while maintaining competitive pricing remains the critical factor determining long-term success and market share gains, especially in densely competitive regions like North America and Western Europe.

Segmentation Analysis

The Leafy Vegetable Market is highly segmented based on intrinsic factors such as product type, method of cultivation, and extrinsic factors like distribution channel and end-use application. Analyzing these segments provides critical insights into consumer preferences, technological adoption rates, and key revenue streams. The dominance of traditional leafy greens like lettuce and spinach dictates baseline market volume, but specialized and high-margin varieties are accelerating growth. The shift towards organic farming methods, driven by health consciousness and environmental concerns, significantly influences pricing strategies and supply chain structures. Understanding the intersectionality of these segments, particularly the rapid growth of high-tech production methods feeding specialized distribution channels, is crucial for developing targeted market penetration strategies and optimizing product portfolios for maximum profitability and resilience across diverse geographic regions.

- By Type

- Lettuce (Romaine, Iceberg, Butterhead, Leaf)

- Spinach

- Cabbage (Green, Red, Savoy)

- Kale

- Arugula

- Microgreens and Sprouts

- Others (Swiss Chard, Collard Greens, Bok Choy)

- By Category

- Organic

- Conventional

- By Distribution Channel

- Supermarkets and Hypermarkets

- Food Service/HORECA

- Online Retail

- Traditional Markets and Farmers Markets

- By Cultivation Method

- Open Field Farming

- Controlled Environment Agriculture (CEA)

- Hydroponics

- Aeroponics

- Aquaponics

- Vertical Farms

Value Chain Analysis For Leafy Vegetable Market

The value chain for leafy vegetables begins with upstream activities centered on genetic development, seed production, and the manufacturing of essential agricultural inputs like specialized fertilizers, growth media, and energy-efficient lighting systems required for CEA. Seed companies and agricultural chemical firms form the initial backbone, heavily investing in R&D to enhance yield, disease resistance, and desirable nutritional profiles. The cultivation stage, whether open-field or controlled environment, involves significant operational costs related to labor, water management, pest control, and climate management. Efficiency at this stage, particularly through automation and predictive analytics, determines the raw product quality and cost structure passed down the chain. Specialized CEA providers are increasingly dominating the upstream technological supply, offering integrated hardware and software solutions to growers.

Midstream processes focus intensively on post-harvest handling, processing, and logistics, which are crucial due to the highly perishable nature of the product. This includes rapid cooling (hydro-cooling or vacuum cooling), washing, sanitization, cutting, and specialized packaging (often using MAP technology to inhibit respiration). Processing centers often function as centralized hubs, maintaining rigorous hygiene and cold chain standards to ensure regulatory compliance and maximize shelf life. Direct distribution occurs primarily through large-scale logistics providers specializing in refrigerated transport, connecting farms directly to retail distribution centers or food service providers. Maintaining temperature integrity throughout this phase is paramount to retaining freshness and market value.

The downstream analysis focuses on the final sales and consumption points. Distribution channels are varied: direct channels include farm-to-consumer models (e.g., farmers markets, subscription boxes), offering premium freshness and traceability. Indirect channels, which represent the bulk of sales, involve organized retail (supermarkets/hypermarkets) and the vast food service sector (restaurants, cafeterias). Supermarkets leverage high volume, consistent supply, and consumer trust, while online retail is growing rapidly, driven by convenience and the ability to offer specialized or hyper-local produce often grown in urban vertical farms. The market is highly price-sensitive at the retail level, requiring careful management of margins across the entire value chain to absorb high production and logistical costs.

Leafy Vegetable Market Potential Customers

The primary end-users and buyers of leafy vegetables encompass a broad spectrum ranging from individual consumers to massive commercial enterprises. Household consumption, driven by health consciousness and convenience, constitutes the foundational demand segment. These buyers prioritize product freshness, ease of preparation (e.g., pre-washed salads), certified origin (organic labels), and variety. Retail outlets, particularly large national and international supermarket chains, act as critical intermediaries, purchasing huge volumes to supply this consumer demand. Their purchasing decisions are heavily influenced by supplier capacity to meet stringent quality assurance, volume consistency, and competitive pricing across diverse geographical locations.

The food service industry (HORECA - Hotels, Restaurants, and Catering) represents another highly lucrative and demanding customer segment. Chefs and institutional buyers require consistent quality, specific cuts, and reliable year-round supply for menu planning, making them major purchasers of bulk and processed leafy greens. The growth of fast-casual dining, which heavily relies on fresh ingredients for salads and wraps, further cements this sector’s importance. Specialized food processors, involved in manufacturing convenience foods such as ready-made salads, frozen mixes, green juices, and baby food, form a significant segment that demands standardized raw materials meeting strict processing and microbiological specifications.

Emerging potential customers include institutional buyers such as hospitals, schools, and corporate cafeterias, which are increasingly emphasizing healthy, locally sourced, and high-quality ingredients as part of wellness initiatives. Furthermore, specialized health food stores and online delivery platforms focusing on organic and gourmet produce are rapidly expanding their customer base, creating niche opportunities for premium growers. The common thread across all major customer segments is the increasing requirement for transparency regarding cultivation practices, guaranteed food safety, extended shelf life, and demonstrable commitment to environmental sustainability, often tracked via digital traceability platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 70.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dole Food Company, FreshPoint, Taylor Farms, Tanimura & Antle, Gotham Greens, BrightFarms, AeroFarms, Plenty, Green Giant Fresh, Earthbound Farm, Driscoll's, Grimmway Farms, Bonduelle, Rijk Zwaan, Syngenta, BASF, Vilmorin, Sakata Seed, Bayer Crop Science, Living Greens Farm |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leafy Vegetable Market Key Technology Landscape

The technological landscape of the leafy vegetable market is rapidly evolving, moving away from traditional agrarian methods towards high-density, resource-efficient systems. Central to this transformation is Controlled Environment Agriculture (CEA), which includes hydroponics (growing plants in mineral nutrient solutions), aeroponics (growing plants in an air or mist environment), and especially vertical farming. Vertical farms, which stack crops in vertically inclined layers within controlled indoor environments, utilize LED lighting customized for specific crop growth cycles and sophisticated climate control systems. These technologies allow for precise control over every variable affecting plant development, leading to faster growth cycles, higher yield densities, and the complete elimination of weather-related risks, thereby ensuring consistent, year-round production critical for urban food security initiatives.

Beyond cultivation techniques, the implementation of advanced automation and data management technologies is paramount. Robotics is increasingly deployed for labor-intensive tasks such as planting, transplanting, harvesting, and packaging, reducing reliance on manual labor and minimizing the risk of contamination. Furthermore, the integration of the Internet of Things (IoT) sensors and Artificial Intelligence (AI) provides real-time monitoring of nutrient levels, pH, temperature, and humidity. This data is processed by machine learning algorithms to automate decision-making processes, leading to optimal resource allocation (water and nutrients) and early detection of potential stress factors, enhancing overall crop resilience and operational efficiency across large-scale facilities.

Crucially, advancements in seed genetics and specialized packaging contribute significantly to market competitiveness. Seed companies are developing Non-GMO strains optimized for CEA environments, focusing on attributes like compact growth structure, rapid maturation, and prolonged post-harvest freshness. Concurrently, packaging innovation, such as Modified Atmosphere Packaging (MAP) and active packaging materials embedded with antimicrobial agents, is critical for extending the extremely limited shelf life of leafy greens. These technological convergences—from genetic enhancement to precise cultivation and extended preservation—are collectively lowering production uncertainties and delivering a higher-quality, more consistent product to consumers globally.

Regional Highlights

North America maintains a robust position in the leafy vegetable market, characterized by high consumer awareness regarding health and wellness, resulting in strong demand for organic and specialty greens like kale and microgreens. The region, particularly the United States and Canada, leads in the adoption and investment in high-tech solutions such as large-scale vertical farms (e.g., in proximity to major metropolitan areas like New York and Chicago) to mitigate climate challenges and supply chain distances. Stringent food safety regulations compel producers to invest heavily in advanced traceability and sanitation technologies, positioning the region as a leader in product quality and convenience-focused packaging solutions, especially the highly profitable pre-washed, bagged salad segment.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid urbanization, substantial growth in disposable income, and the expansion of modern retail infrastructure (supermarkets and convenience stores) replacing traditional wet markets. Countries like China, India, and Japan are witnessing a significant dietary shift, incorporating more Western-style fresh salads and raw vegetables. While traditional open-field farming still dominates in volume, capital investments in CEA, particularly in Singapore, South Korea, and China, are accelerating rapidly to overcome limited arable land and ensure food security in dense urban centers. Local varieties and cultural preferences for certain greens (e.g., bok choy, Chinese cabbage) contribute significantly to regional market diversity and volume.

Europe demonstrates mature consumption patterns with a strong emphasis on sustainability and local sourcing. Regulatory frameworks, particularly the EU’s Farm to Fork strategy, push the market towards organic certification and reduced pesticide use. Western European countries like Germany, the Netherlands, and the UK are major consumers, driving innovation in efficient greenhouse technology and distribution logistics across the continent. The Netherlands, in particular, is a global hub for high-tech horticulture research and seed development. Latin America and the Middle East & Africa (MEA) represent emerging markets where demand growth is significant, constrained only by developing infrastructure, inconsistent energy supply, and the initial high investment required for climate-controlled agriculture necessary to cope with severe regional environmental stresses, such as heat and water scarcity.

- North America: Leads in CEA technology adoption, high demand for bagged salads and organics, strong focus on food safety and traceability systems.

- Europe: Driven by sustainability mandates, focus on local sourcing, advanced greenhouse technology, and high penetration of organic certifications.

- Asia Pacific (APAC): Fastest-growing region, expansion of modern retail, increasing middle-class income, and major investments in urban vertical farms (especially in China and Southeast Asia).

- Latin America: High growth potential, driven by dietary changes and improving cold chain logistics infrastructure in key agricultural hubs like Brazil and Mexico.

- Middle East and Africa (MEA): Significant demand due to arid climate conditions driving necessity for climate-controlled indoor farming, often supported by government food security programs (e.g., UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leafy Vegetable Market.- Dole Food Company

- FreshPoint

- Taylor Farms

- Tanimura & Antle

- Gotham Greens

- BrightFarms

- AeroFarms

- Plenty

- Green Giant Fresh

- Earthbound Farm

- Driscoll's

- Grimmway Farms

- Bonduelle

- Rijk Zwaan

- Syngenta

- BASF

- Vilmorin

- Sakata Seed

- Bayer Crop Science

- Living Greens Farm

Frequently Asked Questions

Analyze common user questions about the Leafy Vegetable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the organic leafy vegetable segment?

The primary driver is escalating consumer concern regarding the long-term health effects of pesticide residues and a growing preference for agricultural products perceived as environmentally sustainable. This drives premiumization, attracting higher margins for certified organic growers and stimulating investment in organic cultivation methods globally.

How does Controlled Environment Agriculture (CEA) impact the seasonality of leafy greens?

CEA, including vertical farms and advanced greenhouses, completely eliminates seasonality by providing optimal, artificial growing conditions year-round. This technology ensures a consistent supply of fresh leafy vegetables, regardless of external weather conditions or climate change variability, stabilizing availability and pricing in urban markets.

What are the biggest restraints faced by the Leafy Vegetable Market?

The foremost restraints include the extreme perishability of the products, which results in high post-harvest losses and increased logistical costs (cold chain necessity). Additionally, the high initial capital investment required for adopting advanced technological solutions like robotics and vertical farming infrastructure poses a significant barrier to entry.

Which technology is most crucial for extending the shelf life of pre-packaged leafy greens?

Modified Atmosphere Packaging (MAP) is the most crucial technology. MAP adjusts the internal gas composition within the packaging (typically reducing oxygen and increasing carbon dioxide) to slow down the metabolic respiration rate of the harvested leaves, significantly delaying spoilage, maintaining texture, and extending marketable shelf life.

What role does the Asia Pacific region play in the future growth of the leafy vegetable industry?

The Asia Pacific region is forecast to exhibit the highest growth rate, driven by rapid urbanization, expanding organized retail infrastructure, and increasing per capita consumption of fresh produce due to higher disposable incomes and the adoption of Western dietary trends. Investment in CEA is critical here to address limited arable land and massive population density.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager