Leather and Allied Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434224 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Leather and Allied Products Market Size

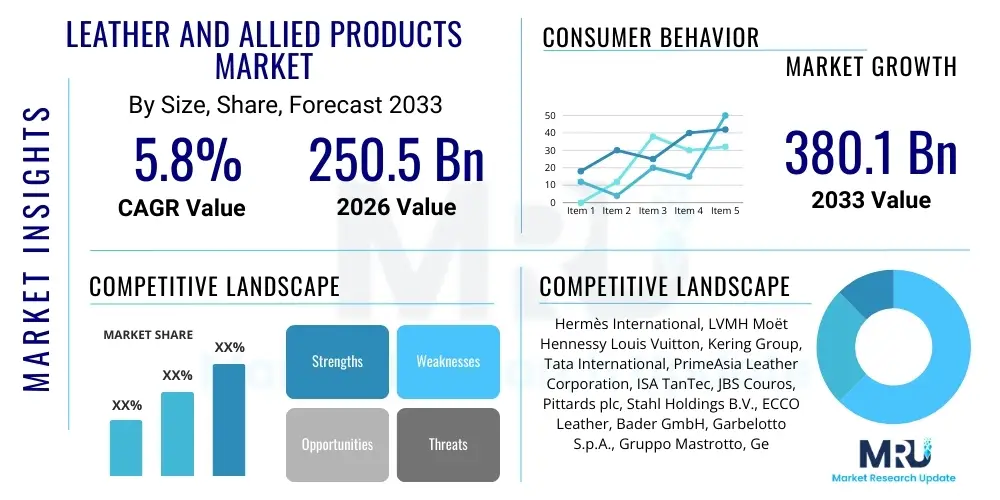

The Leather and Allied Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $250.5 Billion in 2026 and is projected to reach $380.1 Billion by the end of the forecast period in 2033.

Leather and Allied Products Market introduction

The Leather and Allied Products Market encompasses the entire lifecycle of leather goods, ranging from raw hide processing (tanning and finishing) to the manufacturing and distribution of final products such as footwear, apparel, accessories (bags, wallets, belts), and upholstery. This industry is characterized by a high degree of fragmentation at the processing level and significant brand consolidation at the retail level. Global demand is fundamentally driven by rising disposable incomes in emerging economies, evolving fashion trends that prioritize durable and luxury items, and continuous innovation in leather processing techniques, particularly those related to sustainability and chemical reduction.

Key products within this market include bovine leather used predominantly for automotive interiors and high-end goods, sheep and goat leather favored for fine garments and linings, and exotic leathers which occupy niche, high-value segments. The primary applications span consumer goods, automotive manufacturing, and specialized industrial sectors requiring durable, high-tensile material. The inherent benefits of leather—durability, aesthetic appeal, breathability, and timeless luxury—sustain its competitive edge against synthetic alternatives, although synthetic substitutes are increasingly challenging market share due to cost efficiency and environmental pressure.

The market is significantly driven by urbanization and the corresponding increase in discretionary spending on lifestyle products. Furthermore, the shift towards sustainable and traceable sourcing, driven by stringent European regulations and heightened consumer awareness regarding animal welfare and environmental impact, is reshaping supply chain dynamics. Technological advancements in tanning, such as chromium-free and vegetable tanning methods, are critical factors influencing future market acceptability and growth, pushing manufacturers to invest heavily in eco-friendly processes to meet both regulatory standards and consumer ethical demands.

Leather and Allied Products Market Executive Summary

The Leather and Allied Products Market is undergoing a rapid transition influenced by sustainability mandates and technological integration across the value chain. Business trends indicate a strong move toward transparent supply chains, leveraging blockchain technology to authenticate product provenance and ensuring compliance with global environmental, social, and governance (ESG) standards. High-end brands are focusing on customization and direct-to-consumer (D2C) models to enhance profitability and capture brand loyalty, while mass-market players prioritize operational efficiency through automation in cutting and stitching processes. The shift from fast fashion toward durable, classic leather goods also represents a pivotal commercial trend driving investment in quality material and artisan training.

Regionally, Asia Pacific (APAC) remains the dominant manufacturing hub, particularly for mass-market footwear and accessories, supported by lower labor costs and established tannery clusters. However, consumption growth is accelerating fastest in North America and Europe, driven by a post-pandemic surge in luxury spending and strong demand for premium vehicle leather interiors. Latin America, particularly Brazil and Argentina, plays a crucial role as a major supplier of high-quality raw hides, although these regions are also facing increasing scrutiny regarding deforestation and ethical sourcing practices, impacting their export dynamics to stringent markets like the European Union.

Segment trends reveal that the Footwear segment continues to hold the largest market share, but the Accessories segment (especially luxury handbags and wallets) exhibits the highest projected growth rate due to high margins and constant product innovation cycles. Within processing, the adoption of sustainable tanning chemicals and water recycling systems is mandatory for survival, differentiating environmentally compliant suppliers from traditional operations. Furthermore, the growth of vegan leather alternatives, though not traditional leather, is influencing pricing strategies and forcing conventional leather manufacturers to improve the ethical footprint of their core products to maintain competitive relevance in an increasingly conscientious consumer landscape.

AI Impact Analysis on Leather and Allied Products Market

Common user inquiries concerning AI’s influence on the Leather and Allied Products Market typically revolve around operational efficiency, ethical sourcing verification, and demand forecasting. Users frequently question how AI algorithms can optimize the grading of raw hides, improve yield during the cutting process, and identify quality defects that human inspectors might miss. Furthermore, there is significant interest in AI's role in predictive maintenance for complex tanning machinery and in enhancing supply chain resilience through advanced logistics and inventory management. The key themes summarized from user concerns focus on the integration cost of AI solutions, the retraining required for existing workforce, and the potential for AI to aid in traceability, ensuring that materials are sourced ethically and sustainably, which is critical for meeting stringent international import regulations.

AI’s deployment is poised to revolutionize several critical stages of leather production. In the upstream segment, computer vision and machine learning are being used to analyze raw hide characteristics, such as thickness variation and defect severity, leading to more accurate value assignment and optimized resource allocation. Downstream, AI algorithms are analyzing real-time sales data, social media trends, and geopolitical factors to generate highly precise demand forecasts, allowing brands to minimize inventory risk, reduce waste associated with overproduction, and align seasonal collections more effectively with fast-changing consumer preferences globally. This application of advanced analytics shifts the industry from reactive production to proactive, data-driven manufacturing, enhancing both profitability and sustainability outcomes across the entire ecosystem.

The integration extends into consumer-facing applications, where AI-powered virtual try-on tools for footwear and accessories are improving the online shopping experience, reducing return rates, and providing valuable data back to design teams regarding fit and style preferences. For leather treatment, AI is optimizing chemical usage in tanning vats by monitoring pH levels, temperature, and material absorption in real-time, resulting in consistent leather quality while significantly reducing environmental discharge. The strategic adoption of these AI tools is no longer a competitive advantage but increasingly a necessity for manufacturers seeking operational excellence and demonstrating commitment to sustainability reporting.

- AI-Powered Defect Detection: Enhances quality control in raw hide grading and finished leather inspection.

- Optimized Cutting Patterns: Machine learning algorithms minimize material waste in automated cutting systems.

- Predictive Demand Forecasting: Analyzes market data to improve inventory management and minimize overstocking.

- Supply Chain Traceability: Uses blockchain combined with AI analytics to verify ethical sourcing and provenance.

- Smart Tanning Processes: Optimizes chemical dosage and process parameters for consistency and environmental compliance.

- Personalized Customer Experience: Drives targeted marketing and virtual fitting experiences for D2C sales.

DRO & Impact Forces Of Leather and Allied Products Market

The dynamics of the Leather and Allied Products Market are dictated by a complex interplay of internal growth drivers, external constraints, and emerging opportunities, all significantly influenced by regulatory impact forces. Growth is fundamentally propelled by rising global wealth, particularly in Asia, leading to increased purchasing power for premium goods, coupled with the enduring perceived value and longevity of genuine leather products. However, the market faces considerable restraints, primarily the intense scrutiny regarding environmental pollution from tanning operations, the high cost and volatility of raw hide prices, and the powerful advocacy for synthetic and vegan alternatives driven by animal welfare concerns. These forces compel industry players toward innovation in sustainable chemistry and efficient manufacturing practices.

The most substantial opportunities lie in developing and scaling up sustainable leather processing technologies, such as bio-based tanning agents and closed-loop water systems, which allows tanneries to comply with stringent European REACH regulations and attract environmentally conscious brand partnerships. Furthermore, expanding into high-growth, specialized segments, such as performance leather for technical applications (e.g., aerospace, protective wear) and luxury automotive upholstery, offers higher margins and reduced exposure to fast fashion volatility. The strategic impact of these factors means that companies that invest proactively in verifiable sustainable practices and digital traceability will gain significant market share, while those relying on conventional, pollutant processes face increasing financial and regulatory risks.

Impact forces are heavily weighted toward regulatory bodies and consumer ethics. The European Union’s push for deforestation-free supply chains and enhanced transparency regarding animal sourcing fundamentally impacts major hide exporters globally, demanding robust certification standards. Consumer demand for customization, coupled with supply chain disruptions experienced during global crises, reinforces the necessity for flexible, regionalized manufacturing capabilities. This combination of strict governance and ethical consumer preference forces continuous innovation, making sustainability not just an operational choice but a core competitive differentiator in the modern leather industry landscape.

Segmentation Analysis

The Leather and Allied Products Market is segmented based on fundamental criteria including raw material source (bovine, ovine, caprine, etc.), product type (footwear, apparel, accessories, upholstery), and distribution channel (offline and online retail). This granular breakdown allows for precise targeting of market strategies, identifying niche areas of rapid growth, such as performance leather in the footwear segment or sustainable, chrome-free leather used in high-end automotive interiors. Segmentation analysis reveals significant differences in margin and growth rates, with luxury accessories maintaining premium pricing, while the volume-driven footwear sector focuses heavily on cost efficiencies and large-scale manufacturing capacity, often concentrated in Asian manufacturing hubs.

- By Raw Material Source:

- Bovine Hides and Skins (Cattle, Calf)

- Ovine Hides and Skins (Sheep)

- Caprine Hides and Skins (Goat)

- Exotic Hides and Skins (Crocodile, Snake, etc.)

- Other Sources

- By Product Type:

- Footwear (Dress Shoes, Casual, Boots, Sandals)

- Apparel (Jackets, Gloves, Skirts)

- Accessories (Handbags, Wallets, Belts, Luggage)

- Upholstery (Automotive, Furniture)

- Others (Industrial, Sports Goods)

- By Tanning Process:

- Chrome Tanning

- Vegetable Tanning

- Aldehyde Tanning (Chrome-Free)

- Others (Synthetic)

- By End-Use Industry:

- Fashion and Apparel

- Automotive

- Furniture and Interior Design

- Sports and Others

Value Chain Analysis For Leather and Allied Products Market

The value chain for the Leather and Allied Products Market is notably complex, beginning with the upstream supply of raw hides, which is intrinsically linked to the global meat production industry. Upstream analysis involves abattoirs and hide collectors, where the quality and preservation methods (salting, curing) are critical determinants of the final leather grade. Price volatility at this stage is high, influenced by commodity markets and geopolitical stability. Key strategic challenges involve securing traceable, high-quality raw materials that adhere to animal welfare and deforestation mandates set by major importing nations, pushing tanneries to form closer, often digitalized, partnerships with suppliers.

The midstream processing stage, dominated by tanneries, involves transforming raw hides into finished leather through soaking, liming, tanning, and finishing processes. This stage adds significant value through chemical treatment, color application, and texturization. The choice of tanning method (e.g., chrome vs. vegetable) fundamentally impacts environmental footprint and cost. Tanners must manage stringent environmental regulations, particularly concerning wastewater treatment and chemical disposal. Downstream, manufacturers transform the finished leather into consumer products—footwear, apparel, and accessories—a labor-intensive process requiring high-precision cutting, stitching, and assembly. Automation technologies, such as robotic cutting arms and specialized sewing machines, are becoming essential for cost efficiency in high-volume production facilities.

The distribution channel is dichotomous, encompassing both direct and indirect sales methods. Indirect distribution relies heavily on wholesalers, distributors, and established brick-and-mortar retail networks, particularly for mass-market and mid-range goods. Direct distribution, driven by digitalization, includes branded D2C e-commerce platforms and flagship stores, allowing luxury brands to control the customer experience and capture higher margins. The prominence of third-party e-commerce giants and specialized leather goods marketplaces signifies the growing importance of digital channels, requiring efficient global logistics capabilities and robust digital marketing strategies tailored to regional consumer preferences and regulatory compliance regarding import duties and product certification.

Leather and Allied Products Market Potential Customers

The primary consumers and end-users of leather and allied products are highly diversified, segmented across consumer demographics and industrial applications. In the consumer sphere, the key buyers include high-net-worth individuals driving the luxury accessories and bespoke footwear market, where product exclusivity, heritage, and traceable sourcing are paramount. Middle-income consumers form the largest volume base, driving demand for everyday footwear, belts, and mid-range handbags, often valuing durability and affordability. These consumers are increasingly influenced by sustainable branding and look for certification labels indicating ethical production practices and material safety.

Industrially, the automotive sector represents a substantial end-user, utilizing vast quantities of high-specification, fire-retardant, and abrasion-resistant leather for car seats, steering wheels, and interior paneling. Original Equipment Manufacturers (OEMs) demand long-term supply agreements and strict adherence to specific color and finish consistency across global production sites. The furniture industry is another major buyer, particularly for high-end residential and commercial upholstery, where natural grain quality and long lifespan are essential selling points. Furthermore, specialized industrial sectors, including military and protective gear manufacturers, require specific types of robust, performance-grade leather for specialized applications.

The rise of customization and personalized products means that potential customers increasingly interact directly with manufacturers or specialized artisans, often bypassing traditional retail intermediaries. Brands are targeting younger, digitally native consumers through social media collaborations and limited-edition drops, focusing on accessories and casual footwear that blend traditional leather craftsmanship with modern design aesthetics. Successful engagement with these diverse customer segments necessitates clear communication regarding product provenance, material performance characteristics, and adherence to global sustainability standards, making transparency a critical factor in purchase decision-making.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.5 Billion |

| Market Forecast in 2033 | $380.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hermès International, LVMH Moët Hennessy Louis Vuitton, Kering Group, Tata International, PrimeAsia Leather Corporation, ISA TanTec, JBS Couros, Pittards plc, Stahl Holdings B.V., ECCO Leather, Bader GmbH, Garbelotto S.p.A., Gruppo Mastrotto, Genesco Inc., adidas AG, Nike Inc., Prada S.p.A., Ferragamo S.p.A., PVH Corp., Tandy Leather, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leather and Allied Products Market Key Technology Landscape

The technological landscape of the Leather and Allied Products Market is characterized by intense focus on minimizing environmental impact and maximizing material utilization. Advancements are predominantly seen in chemical engineering and process automation. In chemical treatment, the shift away from conventional chromium sulfate tanning, which generates toxic sludge, towards safer alternatives like glutaraldehyde and vegetable-based tannins, is critical. Furthermore, process innovations include developing closed-loop water treatment and recycling systems, significantly reducing the industry’s high water consumption footprint and enabling zero liquid discharge (ZLD) facilities, which are highly attractive to global brands committed to stringent environmental metrics.

Manufacturing efficiency is being revolutionized by precision engineering tools. Computer-Aided Design (CAD) and Computer Numerical Control (CNC) cutting machines equipped with high-definition scanners are optimizing hide usage by analyzing the skin’s contours and flaws, minimizing material waste which is a significant cost factor. Robotics and automation are also being applied in labor-intensive areas such as material handling, stacking, and repetitive tasks like stitching and finishing, particularly in large-scale footwear and apparel production facilities. This automation addresses rising labor costs and ensures consistent quality output across production batches, which is essential for global supply chain reliability and scalability.

Digital technologies, particularly Internet of Things (IoT) sensors and blockchain, are transforming supply chain management and product transparency. IoT sensors deployed in tanning vats provide real-time monitoring of chemical concentrations and temperature, ensuring optimal processing conditions and reducing batch failure rates. Crucially, blockchain technology offers immutable ledgers for tracing the origin of raw hides, verifying ethical sourcing, and providing consumers with confidence regarding product authenticity and sustainability claims. This technological integration enhances operational performance and serves as a powerful compliance tool, meeting the growing global demand for verified ethical and sustainable production throughout the leather ecosystem.

Regional Highlights

The global market for leather and allied products exhibits distinct geographical consumption and production patterns, driven by regional economic growth, regulatory frameworks, and cultural consumption habits. Asia Pacific (APAC) holds the largest market share primarily due to its concentration of manufacturing capacity, particularly in China, India, and Vietnam, which serve as global production hubs for footwear and mass-market accessories. Rapid urbanization and increasing disposable incomes in countries like India and Southeast Asia are also fueling domestic consumption, shifting the region's profile from purely an exporter to a massive consumer market. The focus in APAC remains on capacity expansion coupled with slow, but increasing, adoption of sustainable processing methods driven by export market demands.

Europe represents a crucial region characterized by high consumption of premium and luxury leather goods, driven by established fashion houses and a strong cultural affinity for quality craftsmanship. The region also hosts leading technical innovators in tanning and finishing chemicals. European markets are characterized by extremely stringent environmental regulations, such as REACH, pushing regional tanneries to pioneer chrome-free and water-efficient processing. North America, another major consumption powerhouse, displays strong demand for luxury accessories, high-performance footwear, and automotive leather interiors, with a market dynamic heavily influenced by consumer trends and rapid e-commerce penetration. The focus here is on brand authenticity, swift delivery, and seamless omnichannel retail experiences.

Latin America is critical as a major supplier of raw hides, with Brazil and Argentina being globally significant producers. However, these regions face ongoing challenges related to sustainability reporting, particularly concerning livestock raising practices and their links to deforestation. Middle East and Africa (MEA) represent a growing, though smaller, consumption market, focusing heavily on imported luxury goods and traditional leather crafts. Economic diversification efforts in the Gulf countries and rising consumer bases in select African nations are generating new opportunities for finished goods imports and specialized luxury retail, though regional political instability and trade barriers present operational challenges for large multinational corporations seeking robust market penetration.

- Asia Pacific (APAC): Dominates global production volume, fueled by established manufacturing clusters (China, India, Vietnam). Rapid growth in domestic consumption driven by burgeoning middle class. Focus on mass-market footwear and accessories manufacturing.

- Europe: Leading consumer of luxury leather goods and home to major fashion houses. Strict regulatory environment (REACH) mandates innovation in sustainable and chrome-free tanning technologies. Strong demand for traceable, high-quality, specialty leather products.

- North America: High consumption of premium automotive leather, brand-name accessories, and technical footwear. Market growth supported by advanced e-commerce infrastructure and strong consumer purchasing power for durable goods.

- Latin America: Major global source of raw bovine hides (Brazil, Argentina). Market dynamics heavily influenced by commodity pricing and increasing pressure from importing markets regarding sustainable and ethical livestock management practices.

- Middle East & Africa (MEA): Emerging market for luxury imports. Growth potential in specialty leather goods and apparel, particularly in economically developed nations in the GCC region. Local production is centered around traditional craft techniques and specific niche markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leather and Allied Products Market.- Hermès International

- LVMH Moët Hennessy Louis Vuitton

- Kering Group

- Tata International

- PrimeAsia Leather Corporation

- ISA TanTec

- JBS Couros

- Pittards plc

- Stahl Holdings B.V.

- ECCO Leather

- Bader GmbH

- Gruppo Mastrotto

- Genesco Inc.

- adidas AG

- Nike Inc.

- Prada S.p.A.

- Ferragamo S.p.A.

- PVH Corp.

- Tandy Leather, Inc.

- Wolverine World Wide, Inc.

Frequently Asked Questions

Analyze common user questions about the Leather and Allied Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth in the sustainable leather market segment?

Growth in sustainable leather is primarily driven by rigorous international environmental regulations (like EU directives), increased corporate social responsibility mandates from major luxury brands, and rising consumer demand for ethically sourced and environmentally verified products, particularly those processed using chrome-free or vegetable tanning methods.

How significant is the competition from synthetic and vegan leather alternatives?

Competition is significant, particularly in the fast-fashion footwear and accessories sectors where cost is a major factor. While traditional leather maintains dominance due to durability and breathability, plant-based and laboratory-grown alternatives are gaining traction, compelling conventional producers to improve their environmental transparency and product quality differentiation.

What role does technology play in improving leather supply chain traceability?

Technology, specifically blockchain and advanced sensor integration (IoT), plays a crucial role in establishing verifiable traceability. These systems create immutable digital records tracking raw hides from the farm/abattoir through the tannery to the final product, ensuring compliance with ethical sourcing and regulatory standards, particularly deforestation mandates.

Which geographical region leads in the production of finished leather goods?

The Asia Pacific region, specifically China, India, and Vietnam, currently leads the global production of finished leather goods, dominating the volume-based manufacturing of footwear, apparel, and mass-market accessories, leveraging established industrial infrastructure and competitive labor costs.

What are the main challenges facing tanneries regarding environmental compliance?

The main challenges for tanneries include the safe disposal of toxic waste, specifically chrome-laden sludge, and managing high water consumption. Compliance requires substantial investment in advanced wastewater treatment facilities, chemical substitution (moving away from chromium), and adopting closed-loop recycling systems to achieve zero liquid discharge standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager