Leather Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432178 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Leather Coatings Market Size

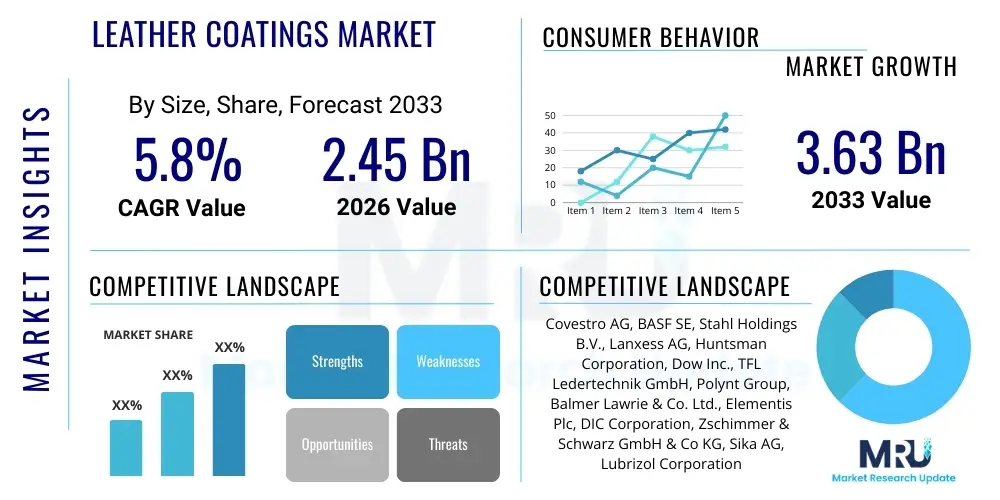

The Leather Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.45 Billion in 2026 and is projected to reach USD 3.63 Billion by the end of the forecast period in 2033. This robust growth is primarily fueled by the sustained expansion of the luxury goods and automotive sectors, particularly in emerging economies, alongside a critical shift toward sustainable and high-performance coating solutions that enhance durability and aesthetics without compromising environmental standards.

Leather Coatings Market introduction

The Leather Coatings Market encompasses a specialized segment within the chemical industry dedicated to providing protective, functional, and aesthetic finishes for various leather substrates. These coatings are essential for imparting resistance against abrasion, water, stains, heat, and UV radiation, ensuring the longevity and maintaining the premium appearance of leather products. Key raw materials involved in formulation include polyurethane dispersions, acrylic resins, nitrocellulose, and specialized additives that dictate the final properties such as gloss level, haptic feel, and flexibility. The industry is currently witnessing a significant transition from traditional solvent-borne systems to more environmentally friendly water-borne technologies, driven by stringent volatile organic compound (VOC) regulations imposed globally, particularly in Europe and North America.

Major applications of leather coatings span across critical consumer and industrial segments. The automotive interior sector represents a crucial application area, where high-performance coatings are required to meet demanding specifications for durability, lightfastness, and resistance to cleaning agents. Similarly, the footwear and apparel industries, encompassing luxury handbags, jackets, and athletic shoes, rely heavily on these coatings to achieve diverse fashion requirements while offering necessary protection from everyday wear and tear. The ongoing globalization of supply chains and the increasing consumer demand for premium, long-lasting leather goods amplify the need for innovative coating solutions that balance performance with sustainability.

The market benefits significantly from several inherent driving factors. The rising disposable incomes in Asia Pacific countries, specifically China and India, directly correlate with increased consumer spending on luxury items, boosting the demand for high-quality finished leather. Furthermore, technological advancements, such as the introduction of self-healing and antimicrobial coatings, are opening new avenues for product differentiation. These innovations allow leather manufacturers to comply with evolving performance standards and appeal to a health-conscious consumer base, thereby sustaining the market’s positive trajectory despite temporary fluctuations in raw material costs or economic downturns in specific regional markets.

Leather Coatings Market Executive Summary

The Leather Coatings Market is defined by intense competition and rapid technological evolution, with business trends pointing toward significant investment in green chemistry and advanced material development. Manufacturers are focusing on reducing the overall carbon footprint of their products, leading to a palpable shift towards bio-based raw materials and water-borne polyurethane (PUD) systems, which offer comparable performance to solvent-based alternatives but with drastically reduced VOC emissions. Strategic mergers, acquisitions, and collaborations between chemical producers and major luxury brand manufacturers are common, aimed at securing specialized formulation expertise and establishing preferred supplier status, thereby stabilizing market shares and optimizing complex, global distribution networks.

Regionally, the market dynamics are characterized by high demand concentration in Asia Pacific (APAC), which serves as the largest production hub for footwear, apparel, and automotive components. While APAC dictates volume growth, stringent regulatory environments in Europe and North America drive innovation in sustainable coatings and high-end aesthetic finishes required by luxury brands. European regulatory frameworks, such as REACH, continuously necessitate the reformulation of existing products, creating significant opportunities for companies specializing in compliant and innovative chemistries. Simultaneously, the burgeoning electric vehicle market globally is creating a niche demand for lightweight, durable, and fire-resistant leather coatings tailored for modern vehicle interiors.

Segmentation trends indicate that by resin type, polyurethane remains the dominant segment due to its excellent abrasion resistance, flexibility, and customizable haptic properties crucial for automotive and furniture applications. However, the fastest growth is anticipated in specialized segments like bio-based and nano-coatings, driven by niche demand for enhanced functional properties such as easy-clean surfaces and superior durability. Application-wise, the footwear segment historically holds the largest share, but the automotive segment is projected to exhibit the highest CAGR, primarily fueled by the increasing content of premium leather and synthetic leather materials used in mid-to-high range vehicle models globally, requiring specialized, long-lasting surface protection.

AI Impact Analysis on Leather Coatings Market

Common user questions regarding AI's impact on the Leather Coatings Market revolve around how machine learning (ML) can optimize complex coating formulations, reduce the time-to-market for new sustainable products, and enhance quality control during application processes. Users are concerned about the ability of traditional manufacturing facilities to integrate AI-driven process optimization tools and how predictive analytics might mitigate supply chain risks related to volatile raw material costs. Furthermore, there is significant curiosity regarding AI's role in simulating the long-term wear and tear performance of innovative coatings, reducing the necessity for extensive physical testing and speeding up the certification process for regulatory compliance.

AI and ML algorithms are rapidly transforming the research and development pipeline within the coatings industry. By analyzing vast datasets of chemical properties, environmental conditions, and performance metrics, AI models can precisely predict the outcome of various ingredient combinations, significantly accelerating the discovery of novel, high-performance, and sustainable leather coating formulations. This capability not only reduces material wastage in the laboratory phase but also ensures that new products immediately meet stringent performance criteria required by end-users like automotive manufacturers. The shift towards data-driven formulation management minimizes human error and shortens the lengthy cycles traditionally associated with specialty chemical product development.

Beyond R&D, AI’s operational impact is evident in predictive maintenance and enhanced manufacturing efficiency. Using sensor data collected during the coating application process (e.g., viscosity, temperature, humidity), ML models can identify and flag deviations in real-time, ensuring optimal coating thickness and curing uniformity, which is critical for achieving consistent aesthetic and protective qualities across large batches. In the supply chain, AI-powered demand forecasting helps coating manufacturers manage inventories of complex raw materials, such as specialized polyols and isocyanates, hedging against price volatility and ensuring timely supply to major production hubs in Asia, thereby offering a competitive edge through improved operational resilience.

- AI optimizes complex chemical formulation by predicting desired functional properties (e.g., abrasion resistance, flexibility) based on raw material inputs.

- Machine Learning accelerates the development of sustainable, low-VOC water-borne coating systems, drastically shortening time-to-market.

- Predictive maintenance driven by AI minimizes downtime in manufacturing processes and ensures consistent application quality.

- AI-enhanced visual inspection systems improve quality control, detecting microscopic flaws in the finished leather surface post-coating application.

- Data analytics aids in supply chain risk mitigation, forecasting raw material price fluctuations and optimizing inventory management for specialized chemicals.

- Simulation tools powered by AI reduce the need for lengthy physical aging and performance testing, speeding up regulatory compliance and product certification.

DRO & Impact Forces Of Leather Coatings Market

The Leather Coatings Market is propelled by robust global demand for high-end automotive interiors and increasing consumer preference for luxury leather goods, which necessitates superior protective and aesthetic finishes. However, the market faces significant restraints primarily due to strict global regulatory pressure concerning VOC emissions, compelling manufacturers to undertake costly and time-consuming reformulation of existing solvent-based products. Opportunities abound in the development of next-generation sustainable solutions, including bio-based materials and smart coatings that offer novel functionalities like self-cleaning or temperature regulation. These dynamic forces result in a high impact on innovation, demanding continuous technological adaptation to maintain market relevance and competitive positioning.

Key drivers include the burgeoning middle class in emerging economies, leading to higher consumption of durable and premium finished products, and continuous innovation by material science companies to produce coatings with enhanced properties such as superior UV protection and chemical resistance suitable for outdoor applications. Moreover, the shift in the fashion and luxury sectors towards faster product cycles necessitates coatings that can deliver unique textures and colors efficiently. Conversely, the high cost associated with advanced raw materials used in water-borne systems, coupled with the inherent challenge of achieving the same performance characteristics as traditional solvent-borne systems, poses a significant restraint, especially for price-sensitive manufacturers in competitive regions.

The primary opportunity lies in capitalizing on the global sustainability mandate. Developing fully circular, biodegradable, or recyclable coating systems addresses both consumer demand and regulatory compliance. Furthermore, specializing in coatings for artificial and synthetic leather (vegan leather), which is gaining traction due to ethical concerns, presents a substantial growth avenue. The overall impact of these forces is medium-to-high, characterized by intense investment in R&D to navigate regulatory hurdles while simultaneously seizing opportunities presented by sustainable and high-performance technologies, leading to significant market fragmentation based on technological superiority and compliance levels.

Segmentation Analysis

The Leather Coatings Market is comprehensively segmented based on Resin Type, Technology, Application, and End-Use Industry, providing a structured view of market dynamics and specialized product demands. Resin type classification differentiates the core chemical composition, determining the coating’s mechanical and chemical resistance properties, with polyurethane dominating due to its versatility and excellent physical characteristics. Technology segmentation highlights the operational shift toward eco-friendly processes, separating water-borne from solvent-borne systems, a crucial distinction influenced heavily by global environmental policies. The application and end-use segments define the commercial landscapes, illustrating how different sectors (like automotive versus furniture) require distinctly tailored coating solutions based on performance specifications and volume needs.

The dominance of the water-borne segment under the Technology classification reflects the industry’s response to the need for VOC reduction, positioning these systems as the future standard, despite higher initial formulation costs compared to traditional solvent-based systems. Within the end-use market, the bifurcation between finished leather (requiring top coats and base coats) and leather alternatives (requiring specialized adhesion promoters and flexibilizers) is becoming increasingly pronounced. This detailed segmentation allows stakeholders to accurately gauge investment opportunities in specific chemical formulations or end-user verticals, enabling targeted market entry and strategic product positioning across different regional regulatory environments.

- By Resin Type:

- Polyurethane (PU)

- Acrylic

- Nitrocellulose

- Protein-Based

- Others (Vinyl, Silicone)

- By Technology:

- Water-Borne

- Solvent-Borne

- Others (UV-Cured, Powder)

- By Application:

- Top Coat

- Base Coat

- Impregnation

- Finishing Agents

- By End-Use Industry:

- Footwear & Leather Goods

- Automotive

- Furniture & Upholstery

- Apparel

- Others (Industrial, Sports Goods)

Value Chain Analysis For Leather Coatings Market

The value chain for the Leather Coatings Market begins with upstream activities involving the sourcing of petrochemical derivatives and specialty chemicals, which form the foundational components of coating formulations. Key raw materials include Isocyanates (MDI/TDI), Polyols, acrylic monomers, solvents, and performance additives such as pigments, rheology modifiers, and UV stabilizers. Major global chemical giants dominate this highly capital-intensive upstream segment, influencing the pricing and availability of core ingredients. Regulatory compliance (e.g., sourcing REACH-compliant materials) is a critical factor at this stage, dictating the technical viability of the final coating product, especially for international markets.

Midstream activities involve the formulation, compounding, and manufacturing of the final coating product by specialized chemical companies. This phase is characterized by intensive R&D to tailor formulations for specific leather types (e.g., aniline, nubuck, corrected grain) and application methods (e.g., spray, roller coating). Distribution channels vary significantly; direct sales are predominant for large-volume customers like major automotive component suppliers (Tier 1), where technical support and customized solutions are essential. Indirect channels, utilizing specialized chemical distributors and agents, cater primarily to smaller tanneries and regional footwear manufacturers, providing localized inventory and smaller batch quantities efficiently.

Downstream activities include the application of coatings by tanneries and leather processors, followed by the incorporation of the finished leather into final consumer products across diverse sectors. Automotive and luxury goods manufacturers act as crucial potential customers, dictating extremely high standards for performance, color consistency, and durability. The quality of the coating directly impacts the perceived value and lifespan of the final product, establishing a high barrier to entry for new coating suppliers who lack a proven track record of consistent quality and compliance with rigorous industry standards.

Leather Coatings Market Potential Customers

Potential customers in the Leather Coatings Market are diverse, ranging from large-scale integrated tanneries that perform both tanning and finishing operations to specialized contract coating providers and major manufacturers across key end-use industries. The most significant buyers are the global automotive interior suppliers, who demand coatings optimized for extreme resistance to heat, light, and mechanical wear, often requiring certifications exceeding standard industry requirements. These buyers are typically sophisticated, focused on long-term contracts, and prioritize suppliers capable of global supply chain synchronization and continuous technical assistance.

A second crucial customer segment involves multinational footwear and apparel brands, particularly those focused on premium and athletic wear. These companies prioritize aesthetic flexibility, requiring coatings that can deliver complex haptic effects, high flexibility for dynamic movement, and resistance to water and dirt. Their purchasing decisions are highly influenced by sustainability metrics and the ability of the coating system to meet ethical sourcing standards. They often work closely with coating formulators to develop proprietary finishes, creating an opportunity for niche specialization within the coatings supply base.

Furthermore, the furniture and luxury leather goods sectors (handbags, wallets, accessories) represent substantial end-users. While furniture requires coatings that offer robust durability and cleanability for upholstery, the luxury segment demands superior depth of color, premium gloss retention, and exceptional hand-feel. These customers often seek innovative coating technologies, such as anti-scratch or self-healing films, to justify premium pricing, making them receptive to high-value, technologically advanced coating products from established and innovative chemical suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.45 Billion |

| Market Forecast in 2033 | USD 3.63 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Covestro AG, BASF SE, Stahl Holdings B.V., Lanxess AG, Huntsman Corporation, Dow Inc., TFL Ledertechnik GmbH, Polynt Group, Balmer Lawrie & Co. Ltd., Elementis Plc, DIC Corporation, Zschimmer & Schwarz GmbH & Co KG, Sika AG, Lubrizol Corporation, Clariant AG, Akzo Nobel N.V., 3M Company, Rütgers Group, KCC Corporation, CHT Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leather Coatings Market Key Technology Landscape

The technological landscape of the Leather Coatings Market is undergoing a rapid transformation, moving away from traditional solvent-borne systems towards advanced eco-friendly alternatives. Water-borne polyurethane dispersions (PUDs) represent the core technological shift, offering excellent physical properties—such as high flexibility, abrasion resistance, and chemical resistance—while significantly reducing or eliminating the use of harmful solvents, thereby meeting increasingly strict global VOC emission standards. Research is intensely focused on improving the wet-rub fastness and film formation capabilities of these PUDs to match the performance of legacy solvent systems, particularly for demanding applications like automotive upholstery.

Another major technological advancement involves UV-curable and electron-beam (EB) curable coatings. These technologies offer instant drying and curing times, drastically enhancing production efficiency and reducing energy consumption compared to conventional heat-curing methods. While traditionally used less frequently for highly flexible leather due to potential rigidity issues, advancements in low-migration photoinitiators and specialized oligomers are enabling the development of flexible, fast-curing top coats suitable for footwear and certain apparel applications. The advantage of zero-VOC formulation inherent in UV/EB technology makes it highly attractive for high-throughput finishing lines seeking optimal environmental performance.

Furthermore, nanotechnology and smart coatings are emerging as high-growth niche technologies. Nanoparticle incorporation (e.g., silica, ceramic oxides) into coating formulations imparts superior scratch resistance, increased durability, and specialized functional characteristics such as antimicrobial properties or enhanced thermal regulation, which are critical for performance apparel and specialized automotive interiors. Bio-based chemistry, utilizing renewable raw materials derived from plant oils or agricultural waste, is also a critical technology focus, aiming to achieve full sustainability and circularity within the leather finishing supply chain, addressing both regulatory pressures and growing consumer consciousness.

Regional Highlights

The Asia Pacific (APAC) region is expected to maintain its dominant position in the Leather Coatings Market, both in terms of consumption and manufacturing volume. This dominance is underpinned by the concentration of major leather processing tanneries and massive manufacturing bases for footwear, apparel, and automotive components in countries like China, India, and Vietnam. The growing middle class in these nations fuels domestic demand for premium leather goods and vehicles, simultaneously establishing APAC as the world’s leading exporter of coated leather products. While volumes are high, environmental compliance standards in certain APAC regions are rapidly increasing, driving demand for modern water-borne and compliant coating chemistries.

Europe represents the second-largest market, characterized by mature industry standards, high specialization, and the strongest regulatory pressures globally, notably through the REACH framework. European demand is driven by the production of high-value, luxury leather goods, and premium automotive brands, which require the highest quality, aesthetically pleasing, and highly durable coatings. This region is the epicenter for innovation in sustainable and low-VOC coating systems, often setting the global benchmarks for performance and eco-friendliness. Key market growth is concentrated in the polyurethane and specialized effect finish segments, catering to premium brand specifications.

North America showcases stable growth, primarily driven by the robust automotive sector and the high demand for durable, easy-to-clean leather upholstery and accessories. While production capacity for leather processing has been shifting overseas, the regional market remains a significant consumer of advanced coating formulations, particularly those emphasizing antimicrobial properties and superior resistance to wear and fading. The region’s focus on performance specifications for severe climate conditions ensures steady demand for highly specialized, protective top coats, often imported from European or Asian suppliers specializing in regulatory compliant formulations.

- Asia Pacific (APAC): Dominates manufacturing and consumption volume; driven by massive production bases for footwear, apparel, and vehicles (China, India, Vietnam).

- Europe: High regulatory pressure (REACH) driving innovation in sustainable, high-performance, water-borne systems; strong focus on luxury goods and premium automotive interiors (Germany, Italy).

- North America: Stable demand primarily from the automotive industry and high-end upholstery; emphasis on durability, UV protection, and specialized protective coatings (USA, Canada).

- Latin America (LATAM): Growth driven by regional footwear manufacturing and expansion of domestic vehicle production; Brazil is a key producer and consumer.

- Middle East & Africa (MEA): Emerging market growth linked to increasing infrastructure projects and rising luxury consumption in the GCC countries, stimulating demand for furniture and high-quality apparel leather finishes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leather Coatings Market.- Covestro AG

- BASF SE

- Stahl Holdings B.V.

- Lanxess AG

- Huntsman Corporation

- Dow Inc.

- TFL Ledertechnik GmbH

- Polynt Group

- Balmer Lawrie & Co. Ltd.

- Elementis Plc

- DIC Corporation

- Zschimmer & Schwarz GmbH & Co KG

- Sika AG

- Lubrizol Corporation

- Clariant AG

- Akzo Nobel N.V.

- 3M Company

- Rütgers Group

- KCC Corporation

- CHT Group

Frequently Asked Questions

Analyze common user questions about the Leather Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the transition from solvent-borne to water-borne leather coatings?

The primary factor is increasingly stringent global environmental regulations, particularly those limiting Volatile Organic Compound (VOC) emissions, compelling manufacturers to adopt water-borne polyurethane dispersions (PUDs) for compliance and improved sustainability profiles across end-use industries like automotive and fashion.

Which resin type currently holds the largest market share in the leather coatings segment?

Polyurethane (PU) resins hold the largest market share. This dominance is due to their superior performance characteristics, including excellent abrasion resistance, flexibility, and strong adhesion, which are essential for durable and long-lasting finished leather applications, especially in upholstery and automotive interiors.

How is the automotive industry influencing innovation in leather coatings?

The automotive sector drives innovation by demanding high-performance, specialized coatings that offer superior UV stability, heat resistance, lightfastness, and chemical resistance to withstand extreme conditions and cleaning agents, alongside requirements for advanced haptic and aesthetic finishes for premium vehicles.

What role does nanotechnology play in modern leather coating technology?

Nanotechnology, through the incorporation of specialized nanoparticles like nano-silica, enhances the functional performance of coatings, imparting superior properties such as improved scratch resistance, enhanced durability, and advanced anti-microbial features to the finished leather surface.

Which geographical region is projected to exhibit the fastest growth rate (CAGR) for leather coatings?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapid industrialization, the establishment of large-scale manufacturing hubs, and the rising disposable incomes driving domestic consumption of premium footwear, apparel, and automotive components in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager