Leather Dyes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439033 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Leather Dyes Market Size

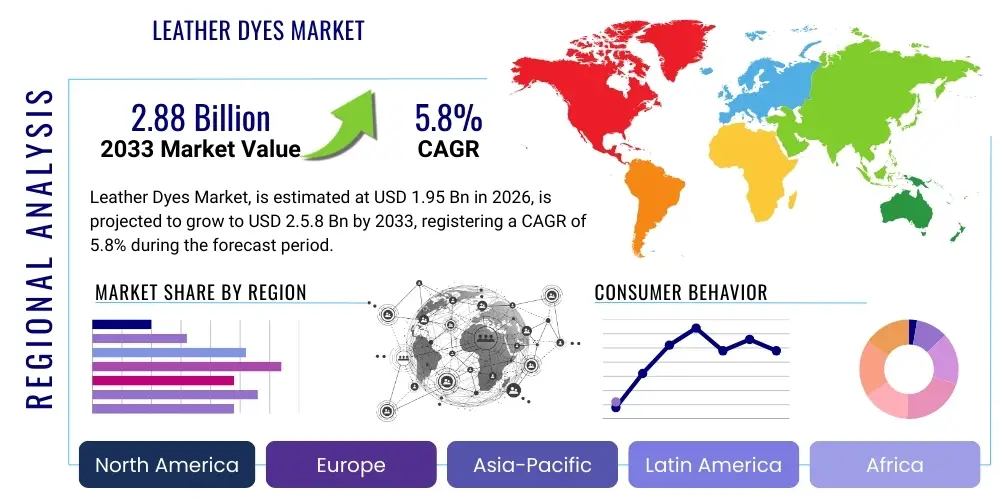

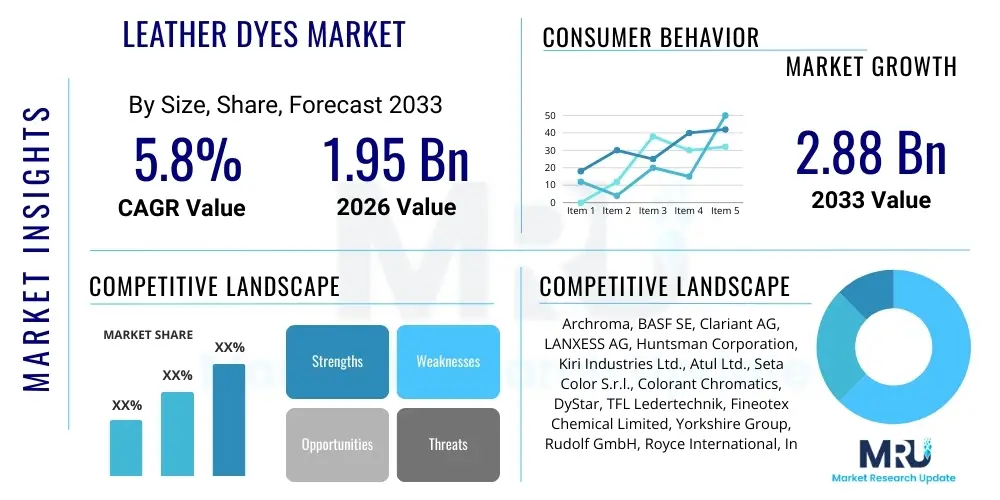

The Leather Dyes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.88 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the resilient demand for leather goods, particularly in the fashion, automotive, and furniture upholstery sectors across emerging economies.

Leather Dyes Market introduction

The Leather Dyes Market encompasses the manufacturing, distribution, and sale of chemical compounds specifically formulated to impart permanent color to tanned leather substrates. These dyes are crucial components in the leather processing industry, dictating the aesthetic appeal, color fastness, and overall quality of the final leather product. Modern leather dyes are highly sophisticated, ranging from acid and basic dyes to metal-complex and reactive dyes, each selected based on the desired shade, application method, and environmental compliance requirements. The performance attributes, such as lightfastness, thermal stability, and wet rubbing resistance, are key differentiating factors in this competitive market landscape.

Major applications of leather dyes span several high-value industries. The footwear industry remains the largest consumer, requiring dyes that offer high penetration and consistency for boots and shoes. The automotive sector, particularly premium vehicle manufacturers, utilizes specialized leather dyes that provide exceptional UV resistance and thermal stability for interior seating and trims. Furthermore, the burgeoning demand for luxury handbags, wallets, and apparel drives significant consumption of high-grade, vibrant dyes. The core benefit of these dyes is their ability to transform raw, tanned hides into visually appealing and marketable consumer products, thereby maximizing the economic value of leather materials.

Market growth is significantly driven by robust globalization of the fashion industry and the increasing purchasing power of middle-class consumers in the Asia Pacific region. Regulatory shifts favoring sustainable and eco-friendly dyeing processes, particularly the move away from heavy metal-laden dyes, are compelling manufacturers toward chrome-free and vegetable-based alternatives. Additionally, continuous innovation focused on developing dyes with enhanced technical properties, such as improved water repellency and stain resistance, further propels market expansion, ensuring leather remains a preferred material across various end-use segments.

- Product Description: Chemical substances used to color tanned animal hides, categorized primarily as acid, metal-complex, basic, and reactive dyes, tailored for stability and penetration.

- Major Applications: Footwear, Automotive Upholstery, Furniture, Apparel, and Leather Accessories.

- Benefits: Enhanced aesthetic appeal, improved color uniformity, excellent light fastness, and resistance to environmental factors (e.g., heat and moisture).

- Driving Factors: Growing global demand for luxury goods, expansion of the automotive sector, and technological advancements in eco-friendly dye formulations.

Leather Dyes Market Executive Summary

The Leather Dyes Market exhibits dynamic business trends characterized by a dual focus on sustainability and high-performance color solutions. Manufacturers are heavily investing in R&D to comply with stringent global chemical regulations, leading to a noticeable shift from traditional solvent-based dyes to water-soluble and low-toxicity alternatives. This strategic pivot ensures market access in key regulated regions like Europe and North America. Furthermore, consolidation among mid-to-large-sized dye producers aims to leverage economies of scale, optimize complex supply chains, and vertically integrate key raw material sourcing, thereby securing competitive pricing and consistent quality delivery across various consumer segments.

Geographically, Asia Pacific (APAC) dominates the market, largely due to the concentration of major leather processing hubs, especially in China, India, and Vietnam. This region is simultaneously a production center and a rapidly growing consumer base. Conversely, North America and Europe, while slower in production volume, drive innovation and demand for premium, niche dyes (e.g., highly specialized automotive interior dyes and bio-based colorants). Regional trends indicate that environmental legislation in the West accelerates the adoption of advanced dyeing technologies globally, forcing producers in the East to rapidly upgrade their process capabilities to maintain export competitiveness.

In terms of segmentation, the metal-complex dyes segment currently holds the largest market share due to their superior fastness properties and versatility across different leather types. However, the basic and acid dyes segment is experiencing moderate growth driven by cost efficiency in high-volume, standard applications. The end-use segmentation highlights footwear and automotive upholstery as the most crucial revenue generators. Future segment trends point towards significant growth in the bio-based and vegetable dye categories as consumer preference and regulatory pressures prioritize natural and biodegradable coloring agents over synthetic alternatives.

AI Impact Analysis on Leather Dyes Market

Analysis of common user questions reveals strong interest in how Artificial Intelligence (AI) can optimize the color matching process, predict supply chain disruptions for key dye intermediates, and streamline sustainable chemical formulation. Users frequently ask about AI's role in reducing variability in dye bath recipes, minimizing chemical waste, and accelerating the development of novel colorants that meet strict environmental standards. The key themes revolve around achieving precise, reproducible coloration with less resource consumption (water, energy, chemicals). Concerns often touch upon the initial high investment cost for implementing sophisticated AI-driven spectroscopic color analysis and predictive modeling systems within existing tannery infrastructure, especially for small and medium-sized enterprises (SMEs).

AI's primary influence will be felt in quality control and R&D. Machine learning algorithms are being trained on vast spectral data sets to predict the final color outcome based on leather substrate characteristics, water quality, and dye concentration, drastically reducing the need for iterative manual adjustments and laboratory tests. This precision ensures consistency, which is vital in high-end leather goods and automotive applications where color deviation is unacceptable. Furthermore, generative AI models could revolutionize dye synthesis by simulating molecular structures and predicting stability and toxicity before costly laboratory trials begin, accelerating the shift towards safer, chrome-free chemical profiles.

The integration of AI into dye inventory management and supply chain logistics offers substantial operational efficiencies. Predictive maintenance algorithms can forecast equipment failures in dyeing machinery, while sophisticated forecasting models can anticipate demand fluctuations for specific color palettes based on global fashion trends, enabling manufacturers to optimize production schedules and reduce inventory carrying costs. This holistic approach ensures better resource utilization, driving profitability while simultaneously addressing sustainability mandates increasingly imposed by major brand owners and regulatory bodies.

- AI-driven Color Matching Systems: Reduces recipe adjustment time and minimizes batch-to-batch variation, improving quality control.

- Predictive Formulation: Uses machine learning to accelerate the R&D of novel, eco-friendly dye molecules, simulating performance and toxicity.

- Supply Chain Optimization: Forecasts raw material demand and manages complex logistics of intermediates, stabilizing production costs.

- Waste Minimization: Optimizes dye bath exhaustion rates using real-time data analysis, significantly reducing chemical effluent and wastewater treatment costs.

- Automated Quality Inspection: Utilizes computer vision and deep learning to instantly detect color inconsistencies or defects on finished leather surfaces.

DRO & Impact Forces Of Leather Dyes Market

The Leather Dyes Market is primarily driven by the expanding middle-class population globally, particularly in emerging economies, leading to increased consumption of premium footwear, luxury accessories, and high-quality automobile interiors. The inherent durability and aesthetic value of leather ensure its consistent demand, translating directly into sustained consumption of specialized dyes. However, the market faces significant restraints, chiefly stemming from stringent environmental regulations, particularly regarding the use of Azo dyes and heavy metals like chromium. These regulations necessitate costly reformulations and process upgrades, raising operational complexity and compliance expenses for dye manufacturers and tanneries alike. Furthermore, the volatility in crude oil prices directly impacts the cost of petrochemical-derived dye intermediates, creating supply chain instability and margin pressure.

Significant opportunities exist in the shift towards sustainable chemistry. The demand for bio-based, vegetable, and biodegradable dyes is creating a lucrative niche for specialized manufacturers capable of delivering high-performance, non-toxic alternatives. Furthermore, technological advances, such as nano-dyes offering superior penetration and color intensity with reduced application volume, present opportunities for premium product development. The rapid expansion of the electric vehicle (EV) market also represents an indirect opportunity, as premium EVs often feature high-specification leather interiors, demanding superior heat and lightfastness properties from the dyes used, creating a high-value application segment.

The impact forces shaping the market are multifaceted. Technological forces, driven by AI and advanced spectroscopy, push for greater precision and efficiency in dyeing. Environmental forces, mandated by global treaties and consumer activism, fundamentally reshape product composition, pushing manufacturers away from historical, cheap chemistries. Economic forces, including shifting manufacturing bases and trade tariffs, influence regional cost competitiveness. Finally, competitive forces compel key players to continuously innovate in both product performance and service delivery, often through vertical integration or strategic partnerships with major tanneries, ensuring proprietary access to advanced application techniques and specialized market requirements.

Segmentation Analysis

The Leather Dyes Market segmentation offers a granular view of consumption patterns, technological preferences, and application diversity across various end-use industries. The market is broadly segmented by dye type (e.g., Acid, Basic, Metal-Complex), chemical nature (e.g., Azo-based, Phthalocyanine, Anthraquinone), physical form (Liquid, Powder), and application (e.g., Footwear, Automotive). Analyzing these segments reveals that dye selection is highly correlated with the required technical performance attributes, environmental footprint, and cost-effectiveness tailored for specific leather types (e.g., bovine, ovine, caprine).

Metal-complex dyes dominate the revenue share due to their exceptional color brilliance, excellent light fastness, and high wet fastness, making them the preferred choice for high-specification applications like automotive interiors and luxury goods, where quality assurance is paramount. The shift toward sustainable practices is notably driving the growth of natural dyes, although their scalability and range of shades currently restrict widespread adoption compared to synthetic counterparts. Form-wise, liquid dyes are increasingly favored over powder dyes in large industrial tanneries due to their ease of handling, improved dosing accuracy, and reduced dust contamination, leading to higher efficiency and better occupational health standards.

The end-use segmentation confirms the dominance of the footwear and leather accessories sectors, which rely on a vast spectrum of colors and finishes to meet seasonal fashion demands. However, the automotive upholstery segment demands the most technically demanding dyes, requiring resistance to extreme temperatures, prolonged UV exposure, and persistent abrasion. Manufacturers focusing on this niche often invest heavily in regulatory compliance testing (such as REACH and OEKO-TEX standards) to ensure their products meet the rigorous safety and durability specifications set by global vehicle manufacturers, offering a premium pricing environment for high-performance leather dyes.

- By Dye Type:

- Metal-Complex Dyes

- Acid Dyes

- Basic Dyes

- Reactive Dyes

- Direct Dyes

- Natural Dyes

- By Form:

- Liquid

- Powder

- By End-Use Industry:

- Footwear

- Automotive Upholstery

- Furniture Upholstery

- Apparel

- Accessories (Handbags, Belts, Wallets)

- By Chemical Class:

- Azo Compounds

- Phthalocyanine Compounds

- Anthraquinone Compounds

- Others (e.g., Nitroso, Xanthene)

Value Chain Analysis For Leather Dyes Market

The Leather Dyes value chain begins with the upstream sourcing of crucial intermediates, primarily derived from petrochemicals (like benzene, naphthalene, and aniline) and various inorganic salts and acids. This stage is highly influenced by global commodity markets and the capabilities of specialty chemical companies. Manufacturers of leather dyes, who sit in the middle of the chain, focus on complex chemical synthesis, milling, blending, and quality control to produce formulated products. Key competitive differentiators at this stage include proprietary synthesis routes, ability to manage heavy metal content, and achieving high purity levels for superior dye performance.

The distribution channel represents the transition of finished dyes to the end-users. Direct distribution involves large dye producers supplying directly to major global tanneries or integrated leather manufacturers who purchase in bulk and require extensive technical support. This often involves customized shade development and on-site troubleshooting. Indirect distribution involves specialized chemical distributors and agents who cater primarily to small and medium-sized tanneries, providing logistics, localized warehousing, and credit facilities. The effectiveness of the distribution channel is crucial, as tanneries often require rapid replenishment and precise color consistency.

Downstream analysis focuses on the application within tanneries and the subsequent manufacturing of end products. Tanners utilize dyes during the wet-end processes, where dye penetration and fixation are optimized for the final leather type. The final stage involves the integration of colored leather into high-value consumer goods (footwear, automotive seats, luxury bags). Feedback from these end-product manufacturers regarding color fastness, compatibility with finishing chemicals, and adherence to brand specifications drives innovation upstream. Therefore, technical support and co-development between dye suppliers and large tanneries are vital links in maximizing value extraction across the chain.

Leather Dyes Market Potential Customers

Potential customers for leather dyes are primarily categorized by their role in the leather processing lifecycle and their scale of operation. The largest and most technically demanding segment consists of Integrated Tanneries and Leather Product Manufacturers. These entities manage the entire process from raw hide to finished leather goods (e.g., major footwear brands or automotive seat suppliers). They require vast quantities of highly consistent, performance-driven dyes, often seeking long-term supply agreements and specialized R&D collaboration to achieve proprietary colors or meet stringent regulatory standards (e.g., ISO 9001, OEKO-TEX certification).

The second major customer group includes Contract Tanners and Specialized Leather Finishing Houses. These businesses perform dyeing and finishing services for smaller brands or suppliers who outsource the leather processing stage. Their purchasing decisions are highly price-sensitive but also require a diverse portfolio of dyes to meet varied client specifications. They often rely on local distributors for just-in-time inventory and technical assistance, prioritizing operational flexibility and a wide range of standard colors that offer good value proposition and reliable batch quality.

A rapidly growing customer segment is the emerging cohort of Sustainable and Craft Leather Producers. These niche users prioritize vegetable and natural dyes, often seeking certified organic or bio-based colorants to align with their ethical and environmental mandates. While their volume consumption is lower, they represent a high-margin opportunity for dye manufacturers specializing in advanced bio-chemistry. Additionally, companies involved in leather restoration and repair, while smaller in scale, represent a consistent demand source for concentrated, specialized dyes used in post-manufacturing color adjustments and maintenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archroma, BASF SE, Clariant AG, LANXESS AG, Huntsman Corporation, Kiri Industries Ltd., Atul Ltd., Seta Color S.r.l., Colorant Chromatics, DyStar, TFL Ledertechnik, Fineotex Chemical Limited, Yorkshire Group, Rudolf GmbH, Royce International, Indo Colchem Private Limited, Organic Dyes and Pigments, Standard Colors Inc., Cromatos S.r.l., Multicrom. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leather Dyes Market Key Technology Landscape

The technological landscape of the Leather Dyes Market is primarily driven by the imperative for environmental compliance and enhanced product performance. A critical area of advancement is the development and commercialization of next-generation Metal-Free Dyes, specifically formulated to achieve the fastness and color depth of traditional metal-complex dyes without the associated heavy metal burden (e.g., chromium or copper), thus facilitating easier wastewater treatment and meeting stringent ZDHC (Zero Discharge of Hazardous Chemicals) standards. These new formulations often involve complex organic chemistry and require specialized dispersing agents to ensure optimal penetration and fixation onto the collagen fiber structure of the leather.

Another pivotal technology is the widespread adoption of High-Efficiency Dyeing Processes, often facilitated by automated dosing systems and advanced computerized color measurement (CCM) instruments. These technologies minimize human error, reduce batch variation, and, crucially, optimize the exhaustion rate of the dye bath, leading to less residual dye in the effluent and significant savings in water and energy consumption. Furthermore, the exploration of Nano-Dye Technology involves synthesizing colorants at the nanoscale, offering superior diffusion properties and enhanced color intensity with lower dye usage rates compared to conventional macro-sized pigments and dyes. This advancement is particularly beneficial for achieving vivid colors on highly processed or finished leather surfaces.

The rise of bio-based and Natural Dye Extraction techniques is also reshaping the technological front. Research focuses on scalable methods to extract vibrant and stable colorants from renewable biomass (plants, microorganisms) and modify their molecular structure to ensure industrial viability—specifically, adequate lightfastness and wet fastness. While challenging due to natural variability and lower stability compared to synthetics, ongoing research into encapsulation and advanced stabilizing additives is overcoming these limitations. This push toward sustainable technology provides a crucial competitive edge in markets highly sensitive to corporate social responsibility (CSR) and green credentials.

Regional Highlights

Asia Pacific (APAC) Dominance and Growth Drivers: The APAC region is the undisputed leader in the global Leather Dyes Market, commanding the highest market share both in terms of consumption and production volume. This dominance is intrinsically linked to the geographical concentration of major leather processing and manufacturing industries, especially in China, India, Vietnam, and Pakistan. These countries serve as global hubs for the production of footwear, apparel, and leather accessories, catering to international brands. The primary driver here is the availability of low-cost labor, enabling high-volume production, combined with rapidly expanding domestic markets fueled by increasing discretionary income. Specifically, the Chinese automotive market’s sheer size necessitates substantial supplies of high-quality dyes for vehicle upholstery. However, the region is rapidly evolving under pressure from local environmental protection laws, particularly in China, which now require sophisticated effluent treatment and a shift towards cleaner, imported dye technologies, presenting opportunities for specialized suppliers.

North America (NA) Focus on Premiumization and Regulation: The North American market, comprising the U.S. and Canada, is characterized by high demand for premium, performance-oriented leather dyes, predominantly utilized in the luxury automotive and high-end furniture upholstery segments. While manufacturing volumes are lower compared to APAC, the value generated per unit of dye is high. Market dynamics are heavily influenced by the stringent regulatory environment, notably the Toxic Substances Control Act (TSCA) in the U.S., driving a strong preference for non-hazardous and VOC-free liquid dye formulations. U.S. tanneries prioritize suppliers who can guarantee compliance and provide rapid technical support for specialized applications like aircraft or marine leather interiors, where fire resistance and UV stability are critical non-negotiables. Innovation in sustainable leather alternatives also indirectly affects the market, pressuring traditional dye producers to prove the environmental superiority of their chemical processes.

European Market Innovation and Sustainability Mandates: Europe is a mature but highly influential market, setting global benchmarks for dye sustainability and technological compliance, primarily through the REACH regulation (Registration, Evaluation, Authorisation, and Restriction of Chemicals). The European market exhibits strong demand for advanced metal-complex dyes and increasingly, vegetable and bio-based alternatives, particularly from Italy, which remains a key center for high-fashion leather goods and specialized tanning expertise. The trend is strongly toward the circular economy, meaning dye producers must focus not only on non-toxicity but also on the recyclability and biodegradability of their chemical compounds. The automotive sector in Germany and France drives substantial demand for specialized leather finishes and corresponding dyes that meet rigorous OEM specifications regarding thermal stability and low odor emissions, ensuring Europe remains a critical testbed for next-generation dyeing solutions.

Latin America (LA) Recovery and Domestic Consumption: The Latin American market, anchored by Brazil and Mexico, demonstrates substantial potential, driven by robust domestic beef production, which provides a steady supply of raw hides. Brazil, in particular, has a globally recognized tanning industry. Market growth here is largely dependent on macroeconomic stability and international trade flows, especially exports of leather footwear and finished hides. The demand profile typically favors cost-effective, readily available acid and basic dyes for high-volume, standard applications. However, increasing exports to North America and Europe compel local tanneries to slowly adopt more advanced, compliant dye chemistries, creating a transitional market environment where technical support and locally relevant supply chain solutions are crucial for market entry and sustained success.

Middle East and Africa (MEA) Emerging Potential and Infrastructure: The MEA region represents the smallest but fastest-growing market, albeit from a lower base. Growth is concentrated in countries with established livestock sectors (e.g., Ethiopia, South Africa, and parts of the Middle East) or those investing heavily in infrastructure and domestic manufacturing capabilities. The market is primarily price-sensitive, with basic dye types dominating consumption. The primary challenge is the nascent regulatory infrastructure and high reliance on imported finished dyes and technical expertise. Opportunities lie in establishing local formulation centers to reduce logistics costs and introducing simplified, robust dye systems suitable for regions with variable water quality and limited access to highly sophisticated treatment plants, focusing on stable and compliant entry-level chemical solutions.

- Asia Pacific (APAC): Market leader driven by high-volume footwear and apparel production in China and India; increasing regulatory compliance costs are spurring demand for advanced, cleaner dye imports.

- Europe: Innovation hub mandated by REACH; strong demand for high-performance, sustainable, chrome-free, and bio-based dyes, particularly in Italian and German luxury sectors.

- North America: Focus on premium automotive and high-end furniture upholstery; stringent TSCA compliance drives preference for specialized, low-VOC liquid formulations and technical support.

- Latin America (LATAM): Growth centered in Brazil and Mexico; volume-driven market requiring cost-effective solutions, slowly transitioning to higher compliance dyes to boost export capabilities.

- Middle East & Africa (MEA): Emerging market with high growth potential; demand is currently focused on basic dye chemistry, with opportunities for establishing localized formulation and distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leather Dyes Market.- Archroma

- BASF SE

- Clariant AG

- LANXESS AG

- Huntsman Corporation

- Kiri Industries Ltd.

- Atul Ltd.

- Seta Color S.r.l.

- Colorant Chromatics

- DyStar

- TFL Ledertechnik

- Fineotex Chemical Limited

- Yorkshire Group

- Rudolf GmbH

- Royce International

- Indo Colchem Private Limited

- Organic Dyes and Pigments

- Standard Colors Inc.

- Cromatos S.r.l.

- Multicrom

Frequently Asked Questions

Analyze common user questions about the Leather Dyes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Leather Dyes Market?

The market growth is primarily fueled by the robust expansion of the global footwear and automotive upholstery industries, particularly in Asia Pacific. Increased consumer spending on luxury leather goods and the consistent demand for high-performance, durable colorants are key drivers. Furthermore, regulatory shifts promoting eco-friendly dyeing technologies create new specialized market opportunities.

How do environmental regulations like REACH impact the leather dyes industry?

Regulations such as REACH (Europe) and ZDHC standards significantly restrict the use of hazardous substances, particularly Azo dyes and heavy metals like chromium. This regulatory pressure mandates manufacturers to invest heavily in R&D to formulate safer, metal-free, and biodegradable dye alternatives, increasing production costs but also driving innovation toward sustainable chemistry.

Which type of leather dye holds the largest market share globally?

Metal-Complex Dyes currently dominate the market share. They are preferred across high-value applications, such as automotive and luxury goods, due to their superior performance characteristics, including excellent light fastness, wet fastness, and overall color brilliance and stability compared to other dye classes.

What role does Artificial Intelligence (AI) play in modern leather dyeing processes?

AI is increasingly used to optimize quality control and formulation efficiency. AI-driven color matching systems analyze spectral data to predict precise dye recipes, reducing batch variation, minimizing chemical waste, and accelerating the time-to-market for new shades while adhering strictly to high consistency standards.

Which region represents the most significant growth potential for leather dye consumption?

Asia Pacific (APAC), led by countries like China, India, and Vietnam, exhibits the highest growth potential. This is attributed to the concentration of global leather manufacturing capacities and rapidly rising domestic consumer demand for finished leather products, driving massive volume consumption of dyes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager