Leather Tanning Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435854 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Leather Tanning Market Size

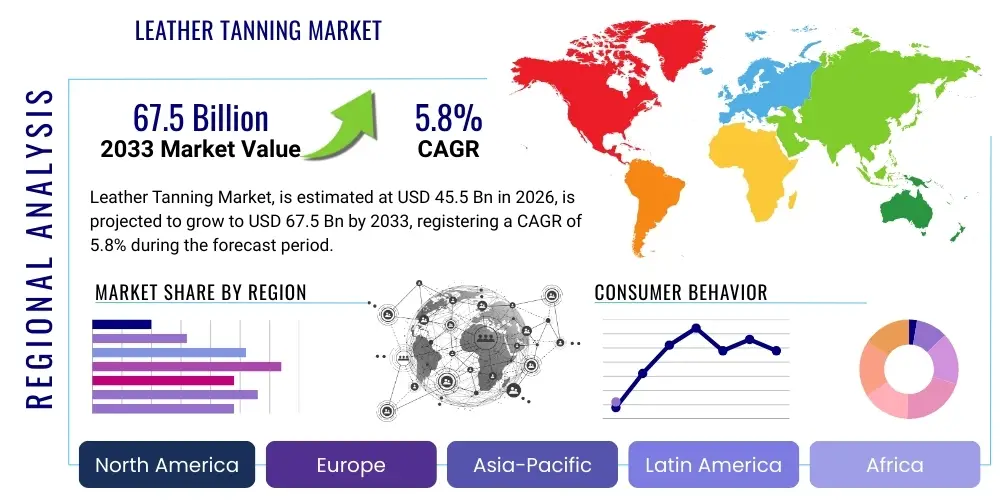

The Leather Tanning Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 67.5 Billion by the end of the forecast period in 2033.

Leather Tanning Market introduction

The Leather Tanning Market encompasses the industrial processes required to convert raw animal hides and skins—primarily sourced as by-products from the meat industry—into durable, flexible, and chemically stable leather. This transformation involves critical chemical and mechanical steps, including preparation (soaking, liming, unhairing), tanning (stabilizing the collagen structure), and finishing (dyeing, drying, coating). The resultant leather serves as a fundamental material for diverse consumer goods, driven primarily by the footwear, apparel, automotive, and luxury goods sectors. Market growth is structurally linked to global population expansion, rising disposable incomes in emerging economies, and the inherent durability and aesthetic appeal of natural leather, despite increasing competition from synthetic alternatives and sustainable material innovations.

Product descriptions within this market are defined by the tanning method employed, notably chrome tanning, vegetable tanning, and aldehyde tanning. Chrome tanning remains the most prevalent method due to its speed, low cost, and superior resulting leather properties (softness, resistance to heat and water). However, heightened environmental scrutiny concerning chromium effluents drives significant investment into chrome-free and sustainable tanning processes, such as bio-based and synthetic options. Major applications span high-end automotive upholstery, where durability and luxury are paramount, to mass-market footwear and fashion accessories, necessitating large-scale, cost-effective production techniques that adhere to international compliance standards like REACH and ZDHC (Zero Discharge of Hazardous Chemicals).

The core benefits of tanned leather include its superior strength, permeability to air (breathability), unique tactile quality, and longevity compared to most synthetic substitutes. Key driving factors stimulating market expansion include the sustained demand for premium leather goods, particularly in Asia Pacific’s burgeoning middle class, and technological advancements focusing on reducing the environmental footprint of tanning operations. These advancements include water recycling systems, solvent-free finishing chemicals, and automated drum processes that enhance efficiency and consistency. Furthermore, the push towards circular economy models reinforces the value proposition of leather as a durable, natural material derived from waste stream resources, supporting long-term market stability.

Leather Tanning Market Executive Summary

Global business trends in the Leather Tanning Market are characterized by intense regulatory pressure, especially in established tanning regions like Europe, which necessitates continuous investment in eco-friendly processes and waste management infrastructure. There is a discernible trend of manufacturing capacity shifting from historically dominant regions, such as Western Europe, towards the Asia Pacific region, primarily China, India, and Brazil, due to lower operational costs, proximity to growing consumer markets, and less stringent environmental enforcement (though compliance requirements are rapidly rising globally). Consolidation is occurring among specialized chemical suppliers and large-scale tanneries to streamline the supply chain and achieve economies of scale, particularly important for securing long-term contracts with major automotive and luxury brand manufacturers who demand traceability and high ethical standards.

Regional trends indicate that Asia Pacific holds the dominant market share, driven by robust domestic consumption and its role as the world's primary manufacturing hub for finished leather products (footwear, garments). North America and Europe, while decreasing in tanning volume, remain critical centers for technological innovation, chemical development, and high-value, specialized leather production for luxury and niche automotive markets, focusing heavily on sustainability certifications. Latin America, particularly Brazil, is a significant player, benefiting from abundant raw hide supply derived from its substantial beef industry, leading to strong export-oriented tanning operations, albeit facing international criticism regarding deforestation and sustainable sourcing practices, which tanneries are actively working to mitigate through certification schemes.

Segment trends highlight the persistent dominance of the footwear application segment, followed closely by the upholstered furniture and automotive interior markets, which demand specialized, high-performance leather. The chrome tanning segment continues to lead in volume but is facing increasing pressure from the vegetable and synthetic tanning segments, which are projected to experience higher CAGRs, reflecting the industry's pivot toward sustainability and compliance. Within raw material segmentation, cattle hide retains the largest share due to its availability and versatility. Successful market navigation requires tanneries to maintain dual capabilities: highly efficient chrome-based production for cost-sensitive markets, and sophisticated, certified chrome-free production for premium and environmentally conscious brands, ensuring flexibility across diverse end-use requirements.

AI Impact Analysis on Leather Tanning Market

Common user questions regarding AI's impact on leather tanning primarily revolve around how machine learning can optimize traditionally manual and chemical-intensive processes, ensuring greater batch consistency, reducing chemical waste, and improving material grading accuracy. Users frequently inquire about the feasibility of predictive maintenance for heavy machinery (drums, splitters), the application of computer vision for automated defect detection on raw hides, and the potential for AI algorithms to optimize chemical recipes in real-time based on fluctuating raw material characteristics. The collective expectation is that AI will drive efficiency, reduce environmental footprint, and elevate product quality standards, thereby addressing the dual pressures of cost control and regulatory compliance that plague traditional tanneries.

- AI-driven Predictive Maintenance: Utilizing sensor data from tanning drums and finishing equipment to anticipate mechanical failures, minimizing costly downtime and improving overall equipment effectiveness (OEE) through scheduled servicing.

- Automated Quality Grading: Deployment of computer vision and deep learning models to scan raw hides and finished leather for defects (scars, stretch marks, grain variations), providing rapid, consistent, and objective grading superior to manual inspection.

- Chemical Recipe Optimization: Machine learning algorithms analyze historical batch data, raw hide properties (moisture, thickness), and desired outcomes to dynamically adjust tanning liquor concentrations, reducing chemical usage and ensuring optimal collagen fixation.

- Supply Chain Traceability: AI platforms enhance blockchain implementation by processing vast amounts of metadata—from farm sourcing to finished product—ensuring verifiable and transparent tracking of ethical and sustainable leather origins.

- Wastewater Management Optimization: AI systems monitor and model complex wastewater treatment parameters (pH, COD, heavy metal concentrations) in real-time, optimizing biological and chemical treatment stages for maximum effluent purification efficiency and compliance.

- Process Automation Control: Integration of advanced control systems utilizing AI to manage drying cycles, temperature regulation, and drumming rotation speed, resulting in minimized energy consumption and uniform material characteristics across production runs.

- Demand Forecasting and Inventory Management: Predictive models analyze fashion trends, retail sales data, and application requirements to optimize inventory levels of specific types of tanned leather (e.g., automotive vs. footwear), reducing waste and storage costs.

DRO & Impact Forces Of Leather Tanning Market

The market dynamics of the Leather Tanning Industry are governed by a complex interplay of environmental regulations (Restraints), sustained demand from luxury goods (Drivers), and the urgent need for sustainable chemical innovations (Opportunities). Drivers include the inherent high quality and durability of natural leather, coupled with the robust growth in automotive interiors and high-end fashion sectors, especially in emerging Asian markets. Restraints largely center on the environmental burden of traditional tanning, including significant water consumption, complex effluent management (especially chrome discharge), and the high cost of compliance with strict international standards like REACH and ZDHC, which disproportionately affect smaller tanneries. Opportunities arise from the transition to chrome-free tanning methods, the development of bio-based tanning agents, implementation of circular economy principles (e.g., zero liquid discharge facilities), and the increasing consumer willingness to pay a premium for certified, sustainable leather products, offering significant scope for technological differentiation and market expansion.

Impact forces dictate the direction of technological investment and regulatory response. The critical impact force driving change is the stringent global focus on environmental, social, and governance (ESG) criteria. Brand owners (the downstream manufacturers) exert immense pressure on tanneries to provide verifiable traceability and environmentally compliant leather, forcing the adoption of expensive, state-of-the-art effluent treatment plants and certified sourcing mechanisms. Additionally, the fluctuating price and availability of raw hides, which are intrinsically linked to the volatile meat processing industry, serve as a significant cost impact force, requiring tanneries to employ advanced inventory risk management strategies. The combined effect of these forces pushes the industry toward consolidation, automation, and the specialization in sustainable leather processing to maintain global competitiveness and long-term viability against competing synthetic materials.

Segmentation Analysis

The Leather Tanning Market is extensively segmented across multiple dimensions, including the type of hide used, the tanning method employed, the specific chemical used, and the final application of the finished leather product. This stratification allows tanneries to specialize in specific value chains—from mass-produced cowhide for standard footwear to highly specialized exotic hides for luxury handbags—each demanding distinct chemical processes and finishing techniques. The market's complexity reflects the diverse requirements of end-user industries, where stringent performance specifications regarding durability, color fastness, flame resistance, and tactile properties mandate highly differentiated tanning outputs. Understanding these segment dynamics is crucial for both chemical suppliers and tanneries to align production capabilities with market demand and navigate the evolving regulatory landscape which favors certain tanning chemicals and processes over others.

- By Raw Material:

- Cattle Hide (Cow and Bovine)

- Sheep and Goat Skin

- Pig Skin

- Exotic Hides (Reptile, Ostrich)

- By Tanning Method:

- Chrome Tanning (Wet-Blue)

- Vegetable Tanning (Natural Tannins)

- Aldehyde Tanning (Wet-White)

- Synthetic Tanning (Resin Tannins)

- Combination Tanning

- By Tanning Chemical:

- Chromium Sulfate

- Natural Vegetable Tannins (Mimosa, Quebracho)

- Glutaraldehyde

- Synthetic Polymeric Agents

- Heavy Metal Salts (Zirconium, Aluminum)

- By Application:

- Footwear (Uppers, Soles, Linings)

- Apparel (Garments, Gloves)

- Automotive Interiors (Upholstery, Trim)

- Furniture/Upholstery (Home and Office)

- Leather Goods (Bags, Wallets, Belts)

- Others (Industrial, Military)

Value Chain Analysis For Leather Tanning Market

The Leather Tanning Market value chain begins upstream with the sourcing of raw hides and skins, which are predominantly by-products of the meat and dairy industries. This intrinsic link makes the supply of raw material highly susceptible to fluctuations in agricultural cycles, animal health regulations, and global meat consumption patterns. Key upstream activities involve preserving raw hides, typically through salting or chilling, and transportation to the tanneries. The subsequent stage involves the chemical supply industry, where specialized manufacturers provide essential reagents such as chromium salts, synthetic tanning agents, dyes, fatliquors, and finishing chemicals. Efficiency in the upstream segment relies heavily on immediate preservation techniques to prevent microbial degradation and maintain the quality of the raw hide before processing commences.

The core tanning process constitutes the middle segment of the value chain, where tanneries convert raw hides into crust or finished leather. Tanners are categorized based on their specialization: slaughterhouse tanneries (processing green hides), wet-blue producers (selling semi-finished chrome-tanned leather), and commission tanners (processing customer-owned hides). Downstream analysis focuses on the distribution channels that move finished leather to manufacturers. Distribution is often segmented: Direct sales are common for large, specialized tanneries securing contracts with major automotive or luxury brands that demand high degrees of customization and traceability. Indirect channels involve trading companies, agents, and local distributors who serve smaller manufacturers, providing a diverse inventory of standard leather types across regional markets.

The downstream customers are the manufacturers of finished leather goods—footwear brands, apparel houses, furniture makers, and automotive component suppliers (Tier 1 suppliers). The power within the value chain is increasingly shifting towards these large, brand-owning manufacturers, particularly in the luxury and automotive sectors, as they dictate strict quality specifications, environmental compliance mandates (e.g., chemical usage restrictions), and pricing pressure. The transition from physical agents to e-commerce platforms and digital inventory management systems is gradually altering traditional distribution channels, enabling more transparent pricing and faster sourcing of specialized leather types, impacting the competitive dynamics between tanneries and intermediaries.

Leather Tanning Market Potential Customers

Potential customers for the Leather Tanning Market are defined by industries that rely on durable, high-quality, and aesthetically pleasing materials for manufacturing consumer and industrial products. The largest end-user segment is the footwear industry, which purchases vast quantities of tanned leather, primarily cowhide and goat skin, for use in boots, shoes, and sandals, demanding materials that offer flexibility, breathability, and resistance to abrasion. This segment is highly sensitive to price fluctuations and seasonal trends. The second major category is the leather goods segment, encompassing manufacturers of luxury handbags, wallets, belts, and small accessories. These buyers often prioritize premium quality, specific tactile feel, and rigorous brand certification, leading to higher demand for vegetable-tanned or highly specialized chrome-free leathers.

The automotive upholstery sector represents a high-value, albeit volume-constrained, customer segment. Automotive buyers demand exceptional performance characteristics, including high durability, flame retardancy, UV resistance, and minimal volatile organic compound (VOC) emissions, often requiring specialized, closed-loop supply agreements with tanneries. The furniture and upholstery market also constitutes a substantial buyer group, requiring large pieces of defect-free leather suitable for sofas and seating. These customers often balance quality requirements with cost efficiency, leading to significant demand for corrected grain and slightly thicker hides suitable for heavy-duty application.

In addition to these primary segments, niche end-users include manufacturers of industrial safety equipment (gloves, protective clothing), specialized military and tactical gear (holsters, straps), and equestrian supplies (saddles, bridles). These buyers have highly specialized performance requirements focused on specific metrics like tear strength and chemical resistance. Tanneries targeting these segments must often comply with unique industry standards (e.g., military specifications) and ensure consistent material performance that withstands extreme operational conditions, establishing long-term relationships based on highly customized production runs and consistent quality assurance protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 67.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gruppo Mastrotto S.p.A., JBS Couros, TATA International Limited, Whitehouse Leathers, ISA TanTec, Eagle Ottawa (Inteva Products), Seton AutoLeather, PrimeAsia Leather Corp., Bader GmbH, Hermes Cuirs Pr cieux, Pieles de Barcelona S.L., Dani S.p.A., Kings International, Xingye Leather Technology Co., Ltd., Elmo Leather, Zhejiang Huahai Leather Co., Ltd., Scottish Leather Group, Al-Khaznah Tannery, TFL Group, Lanxess AG (Specialty Chemicals) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leather Tanning Market Key Technology Landscape

The modern Leather Tanning Market is rapidly integrating advanced technologies primarily aimed at enhancing sustainability, efficiency, and product consistency, moving away from historically polluting methods. A major technological focus is on resource efficiency, specifically water management. This involves the implementation of sophisticated Zero Liquid Discharge (ZLD) systems, which use combinations of ultrafiltration, reverse osmosis, and evaporative crystallization to recycle up to 95% of process water. Furthermore, chemical recovery systems, such as those designed to precipitate and reuse chromium sulfate from spent tanning liquors, are becoming standard practice in regions with strict effluent limitations. The transition to enzymatic processes for traditionally chemical-heavy stages, like unhairing and bating, is also gaining traction, reducing the reliance on highly corrosive chemicals and minimizing the resultant sludge volume, thereby improving the overall environmental profile of the tannery.

In terms of tanning chemistry, the development and commercialization of high-performance chrome-free alternatives represent a pivotal technological shift. Innovations include new generations of aldehyde, titanium, and bio-based polymeric tanning agents (often referred to as 'wet-white' or 'wet-green' processes) that produce leather suitable for demanding applications like baby shoes and automotive interiors while being fully free of heavy metals and easily biodegradable. Concurrently, automation technology is transforming the mechanical operations. Computer-controlled processing drums utilize PLC (Programmable Logic Controller) and SCADA (Supervisory Control and Data Acquisition) systems to precisely regulate parameters such as temperature, pH, chemical dosing rate, and rotation speed, minimizing human error and ensuring highly reproducible batch quality, which is critical for meeting the consistent specifications required by global brands.

Finishing technologies are also seeing significant innovation, moving towards sustainable and high-performance coatings. The traditional use of solvent-based finishes is being phased out in favor of water-based polyurethane (PU) and acrylic finishes, significantly reducing Volatile Organic Compound (VOC) emissions, which is a key regulatory concern in regions like Europe and North America. Furthermore, digital printing technologies are being utilized for pattern application, offering flexibility in design and reducing the waste associated with traditional embossing methods. The integration of advanced scanning and imaging systems, coupled with AI analytics, is enabling precise defect mapping and cutting optimization during the final stages, maximizing material yield from each hide and reducing overall operational waste, cementing technology as the primary driver for competitive advantage and environmental compliance in the sector.

Regional Highlights

Regional dynamics in the Leather Tanning Market reflect a global polarization between areas focused on high-volume, cost-effective production and regions concentrating on high-value, sustainable innovation.

- Asia Pacific (APAC): APAC dominates the market both in raw hide processing volume and downstream manufacturing of finished products, driven primarily by China, India, and Vietnam. This region benefits from lower labor costs and large domestic consumer bases. However, regulatory oversight is rapidly increasing, forcing substantial investments in modern effluent treatment facilities to meet international export standards, particularly in provinces catering to European and North American brand requirements. India, specifically, is seeing rapid expansion in specialized tanning (vegetable tanned leather) catering to the global luxury goods market.

- Europe: Europe remains the global benchmark for high-quality, specialized, and sustainable leather production, despite decreased overall processing volume due to high operating costs and stringent environmental directives (e.g., EU Industrial Emissions Directive, REACH). Countries like Italy, Spain, and Germany specialize in luxury, high-performance automotive, and fine footwear leathers, focusing heavily on chrome-free, low-VOC, and certified traceability processes, commanding premium prices through quality and compliance differentiation.

- North America: The North American market is characterized by strong consumer demand, particularly in the automotive and high-end furniture sectors, but low domestic tanning volume. The region is a significant importer of finished and semi-finished leather. Domestic tanneries focus on niche, high-specification leathers and maintain stringent environmental controls. Innovation is focused on advanced chemical substitution and providing verifiable supply chain transparency to demanding domestic brand partners.

- Latin America (LATAM): Brazil is the powerhouse of the LATAM leather industry, benefiting from its vast cattle population and proximity to the raw hide source. Brazilian tanneries are major global exporters, primarily specializing in bovine hide suitable for footwear and furniture. The region faces significant pressure regarding deforestation and sustainable sourcing, pushing major industry players to adopt rigorous sustainability certifications (e.g., Leather Working Group) to protect export markets in Europe and the U.S.

- Middle East and Africa (MEA): This region is characterized by a mix of traditional tanning methods and emerging industrialization. Countries in North Africa and parts of the Middle East have long histories of leather craftsmanship. The market is slowly developing modern industrial capacity, often targeting regional apparel and local footwear markets. Economic constraints and political instability often limit the capital investment required for adopting advanced, sustainable processing technologies, though selective high-end production geared toward exotic skins exists.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leather Tanning Market.- Gruppo Mastrotto S.p.A.

- JBS Couros

- TATA International Limited

- Whitehouse Leathers

- ISA TanTec

- Eagle Ottawa (Inteva Products)

- Seton AutoLeather

- PrimeAsia Leather Corp.

- Bader GmbH

- Hermes Cuirs Pr cieux

- Pieles de Barcelona S.L.

- Dani S.p.A.

- Kings International

- Xingye Leather Technology Co., Ltd.

- Elmo Leather

- Zhejiang Huahai Leather Co., Ltd.

- Scottish Leather Group

- Al-Khaznah Tannery

- TFL Group (Chemical Supplier)

- Lanxess AG (Specialty Chemicals)

Frequently Asked Questions

Analyze common user questions about the Leather Tanning market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the adoption of chrome-free tanning methods?

The shift to chrome-free tanning (Wet-White or Vegetable) is primarily driven by stringent environmental regulations concerning the disposal of chromium III and VI in wastewater effluent, coupled with strong consumer and brand demands for highly sustainable, heavy-metal-free products, particularly in the automotive and baby product sectors.

How do global ESG mandates affect operational costs for tanneries?

ESG mandates significantly increase operational costs by requiring substantial capital investment in advanced wastewater treatment facilities (e.g., ZLD systems), specialized chemical substitutions, verified raw material sourcing, and comprehensive traceability software to prove environmental and ethical compliance to downstream brand partners.

Which application segment holds the largest market share in the Leather Tanning Industry?

The footwear segment consistently holds the largest volume share, utilizing tanned leather for uppers, linings, and specific sole components. However, the automotive interior segment typically commands the highest value per square foot due to demanding performance specifications (durability, fire safety, UV resistance).

What role does Artificial Intelligence play in modern leather tanning facilities?

AI is increasingly utilized for optimizing resource management, including predictive chemical dosing, real-time control of drum processes, and automated visual inspection of hides for defect detection, which enhances consistency, minimizes waste, and improves yield optimization across production batches.

Is the supply of raw hide stable, or is it subject to external volatility?

The supply of raw hide is highly volatile as it is a byproduct of the meat industry; availability fluctuates based on global meat consumption, agricultural cycles, animal disease outbreaks, and trade policies, directly impacting raw material pricing and requiring tanneries to implement robust commodity risk management strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager