Leather Wallet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431343 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Leather Wallet Market Size

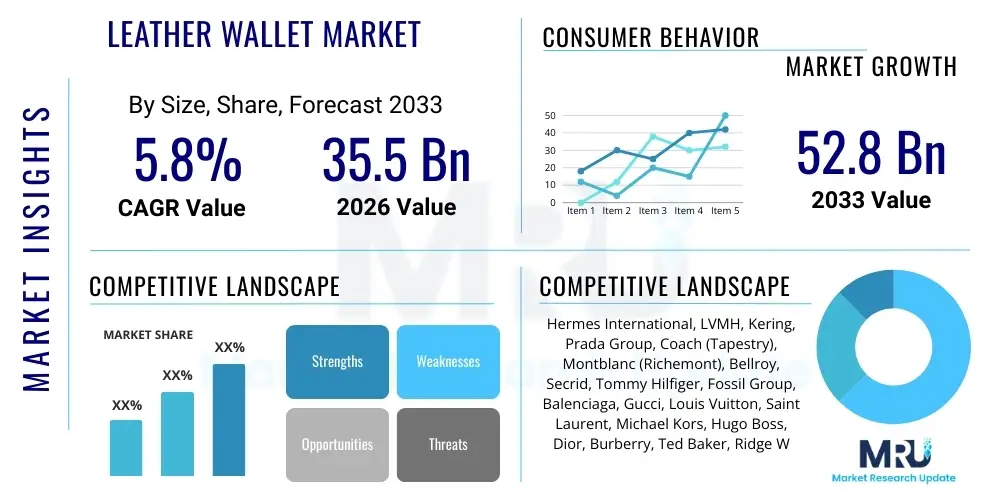

The Leather Wallet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 52.8 Billion by the end of the forecast period in 2033. This substantial expansion is driven by increasing disposable income globally, especially in emerging economies, coupled with persistent demand for high-quality, durable, and luxury personal accessories. The transition towards premiumization and the integration of technological features like RFID protection are primary factors bolstering market valuation and steady growth across diverse geographical regions. The market’s resilience is rooted in the leather wallet’s dual function as a necessity for organization and a significant fashion statement, continually adapting to new consumer lifestyles and trends.

Leather Wallet Market introduction

The Leather Wallet Market encompasses the global production, distribution, and sale of personal organizational accessories crafted primarily from natural hides or specialized synthetic alternatives designed to mimic genuine leather textures and durability. This market caters to diverse consumer needs, offering products ranging from traditional bi-fold and tri-fold wallets to modern, minimalist cardholders and highly functional travel organizers. Product descriptions emphasize material quality, craftsmanship, durability, and aesthetic appeal, often incorporating branding that signifies status or fashion consciousness. Major applications include storing currency, identification documents, payment cards, and essential receipts, serving as both a functional tool and a crucial fashion accessory in daily life. The inherent benefits of leather wallets—such as longevity, aesthetic aging (patina), perceived status, and tactile quality—continue to position them favorably against alternative materials. Driving factors for market growth include rising urbanization, expanding luxury goods consumption among the middle class, continuous innovation in design (e.g., smart wallets, specialized pockets), and the strong cultural tradition associated with gifting leather goods, particularly during professional milestones and festive seasons. The sustainability movement also influences material sourcing and manufacturing processes, pushing brands towards ethical and traceable leather supply chains.

Leather Wallet Market Executive Summary

The Leather Wallet Market is currently characterized by robust business trends focusing heavily on product diversification, technological integration, and sustainable sourcing strategies. Major manufacturers are prioritizing the development of slim-profile and minimalist wallets to cater to younger consumers who favor cashless transactions, simultaneously integrating RFID-blocking technology as a standard security feature against digital theft. Segment trends indicate a substantial surge in demand for cardholders over traditional bulky wallets, especially within developed markets, while genuine leather maintains its dominance in the premium and luxury tiers due to unmatched perceived quality and brand heritage. However, the synthetic/vegan leather segment is experiencing accelerated growth, driven by ethical consumerism and cost-effectiveness, appealing strongly to environmentally conscious buyers. Regionally, the Asia Pacific (APAC) stands out as the fastest-growing region, fueled by rapid economic expansion, increasing youth disposable income, and the strong presence of gifting traditions. North America and Europe remain key revenue hubs, marked by mature markets that command high average selling prices, particularly for designer and branded merchandise, although saturation necessitates constant innovation in design and marketing to maintain momentum against rising competition from direct-to-consumer (DTC) digital brands.

AI Impact Analysis on Leather Wallet Market

User questions regarding AI's impact on the Leather Wallet Market commonly revolve around themes of personalized design recommendations, predictive inventory management, enhanced supply chain transparency, and the potential displacement of traditional craftsmanship through automated production techniques. Consumers and industry stakeholders are keen to understand how AI can tailor wallet features (size, compartments, material mix) based on individual digital spending habits and lifestyle profiles, moving beyond simple demographic segmentation. There is significant interest in using AI for demand forecasting to minimize overstocking of specific styles, improving the efficiency of high-cost genuine leather utilization. Furthermore, concerns often surface about maintaining the integrity and artistry of luxury leather goods when automation is introduced, focusing on whether AI-driven design processes can genuinely replicate the subtle aesthetics and quality checks traditionally performed by master artisans. The overarching expectation is that AI will primarily optimize backend logistics, enhance personalized customer experience through digital platforms, and drive material innovation, rather than fundamentally altering the product's core utility, which remains intrinsically physical and tactile. Users expect AI to reduce lead times for custom orders and offer immersive virtual try-on experiences for high-end designer pieces.

- AI-driven personalized product recommendations based on consumer spending patterns and historical preferences.

- Optimized inventory management and predictive demand forecasting, reducing material waste and improving genuine leather allocation efficiency.

- Enhanced supply chain visibility and traceability using AI analytics to verify ethical and sustainable leather sourcing.

- Implementation of computer vision AI for automated quality control inspection during the manufacturing process, ensuring consistency in stitching and finishing.

- Utilization of generative AI tools for accelerated conceptual design creation, suggesting novel compartment configurations and aesthetic styles.

- Improved customer service through AI chatbots providing instant support regarding material care, warranty claims, and styling advice.

DRO & Impact Forces Of Leather Wallet Market

The dynamics of the Leather Wallet Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces influencing future growth trajectories. Key Drivers include the consistent demand for status symbols and luxury accessories, the necessity of personal organization tools in increasingly complex urban environments, and the rising consumer affluence enabling higher spending on branded leather goods. However, the market faces significant Restraints, notably the shift towards digital payments and cashless societies, which reduces the perceived necessity of carrying large physical wallets for cash and coins, alongside volatile raw material prices for genuine leather and stringent environmental regulations impacting tanning and dyeing processes. Opportunities are abundant in the integration of smart technology (NFC, GPS tracking), the expanding market for sustainable and cruelty-free synthetic leather alternatives (often supported by strong celebrity and influencer endorsements), and exploiting emerging markets, particularly across Southeast Asia and Latin America, where economic development fuels first-time luxury purchases. The primary Impact Forces are the rapid digitization of finance, challenging the wallet's traditional function, and the overwhelming consumer shift towards ethical and environmental responsibility, compelling manufacturers to overhaul centuries-old supply chains and adopt transparent manufacturing practices to maintain brand loyalty and long-term viability.

Analyzing the constraints further reveals that the leather industry is often associated with high environmental impact, particularly concerning water usage and chemical effluent from tanneries, which acts as a considerable restraint, prompting intense scrutiny from regulatory bodies and consumer groups. This regulatory pressure forces companies to invest heavily in certified eco-friendly processing technologies, adding to operational costs but simultaneously creating market differentiation opportunities for brands that achieve recognized sustainable certifications. Moreover, the prevalence of counterfeit products, particularly in emerging markets, erodes the market share of established luxury brands and undermines consumer trust in premium leather goods, requiring significant investment in anti-counterfeiting measures like blockchain tracing and unique digital authentication methods embedded within the product itself. The opportunity landscape is notably broadened by personalization and customization services, enabled by advanced manufacturing techniques, allowing consumers to design bespoke items with personalized embossing, choice of hardware, and unique material combinations, thereby justifying premium price points and fostering deep brand engagement beyond standard product offerings, catering to a niche but highly profitable segment of discerning consumers.

The enduring appeal of leather as a durable, aesthetically pleasing material, which develops a unique patina over time, continues to anchor the market despite technological disruptions. This inherent longevity and the association with timeless style serve as powerful underlying drivers, especially in the luxury segment where replacement cycles are intentionally slow and appreciation of craftsmanship is paramount. Conversely, the market’s vulnerability to shifting fashion trends, particularly the cyclical move towards minimalist aesthetics, constantly challenges manufacturers to innovate their product dimensions and functionalities without compromising material quality or brand identity. The balance between technological integration (like integrated power banks or tracking tiles) and maintaining traditional artisan quality defines the competitive edge in the modern leather wallet landscape. Successfully navigating these forces—digitization versus tradition, luxury quality versus sustainable ethics—is critical for achieving sustainable revenue growth through the forecast period, positioning brands that embrace innovation alongside heritage favorably against competitors focusing solely on cost reduction or mass-market appeal.

Segmentation Analysis

The Leather Wallet Market is highly segmented based on critical characteristics such as product type, material, distribution channel, and end-user, reflecting the diverse consumer preferences and purchasing power across global markets. Product segmentation is crucial, distinguishing between classic designs, modern minimalist styles, and highly specialized travel accessories. The material segment highlights the ongoing tension between traditional genuine leather—preferred for its quality and status—and rapidly evolving synthetic/vegan alternatives driven by ethical and cost considerations. Distribution channels further segment the market based on accessibility and brand experience, differentiating between high-touch physical retail (specialty stores) and convenience-driven e-commerce platforms. Understanding these segments is paramount for strategic planning, enabling companies to tailor manufacturing volumes, marketing messages, and price points to target specific consumer cohorts effectively, ensuring optimal market penetration and maximizing return on investment across the product portfolio, particularly as digital channels increasingly influence purchasing decisions across all consumer demographics.

- By Product Type

- Bi-fold Wallets: Traditional, highest volume category, optimized for cash and cards.

- Tri-fold Wallets: Offers maximum storage and compartmentalization, popular in older demographics.

- Card Holders/Slim Wallets: Fastest-growing segment, favored by younger, cashless consumers prioritizing minimal bulk.

- Travel Wallets/Passport Holders: Specialized segment for organizing travel documents, often incorporating enhanced security features.

- Clutches and Wristlets: Combines wallet function with small handbag utility, particularly popular in the women's segment.

- By Material

- Genuine Leather: Includes Cowhide, Sheepskin, Exotic Leathers (e.g., Crocodile, Ostrich); dominates the luxury and premium segments.

- Synthetic/Vegan Leather: Includes Polyurethane (PU) and Microfiber Leather; driven by sustainability trends and lower cost points.

- Hybrid Materials: Combines leather with metals (aluminum for RFID protection) or high-tech fabrics for enhanced durability and functionality.

- By Distribution Channel

- Online Retail: E-commerce websites, brand-specific platforms, and major online marketplaces; offers convenience and price transparency.

- Offline Retail:

- Specialty Stores/Exclusive Boutiques: Key channel for luxury and designer brands, focusing on brand experience and personalized service.

- Department Stores: Offers a wide variety of brands and price points, acting as a crucial intermediary for established mid-to-high-end brands.

- Supermarkets/Hypermarkets: Focuses on entry-level and mass-market non-genuine leather products.

- By End-User

- Men: Larger market share, focusing on functionality, durability, and traditional designs.

- Women: Growing segment, prioritizing aesthetic design, color variety, and combination products (wallet/clutch).

- Unisex: Increasingly popular segment, emphasizing minimalist, neutral designs and brand-agnostic utility.

Value Chain Analysis For Leather Wallet Market

The value chain for the Leather Wallet Market begins with upstream analysis, focusing on the sourcing and processing of raw materials. This phase involves acquiring raw hides from livestock (cow, goat, sheep) and subsequent complex operations at tanneries, where hides are treated, colored, and finished to produce usable leather sheets, a process critical for determining the final product's quality, texture, and environmental footprint. The quality of this upstream component directly influences the premium positioning of the final product. Following material preparation, the midstream phase involves design, cutting, stitching, and finishing, often combining advanced automated machinery for precision cutting with skilled artisanal labor for detailed hand-stitching and quality checks, especially in luxury manufacturing. Efficiency in this segment depends heavily on lean manufacturing practices and expertise in handling delicate leather materials to minimize waste and ensure consistent branding elements like embossing and hardware integration. The complexity of the global leather supply chain, involving multiple international transfers between slaughterhouses, tanneries, and manufacturing hubs, necessitates robust logistics management to maintain quality and minimize lead times for fashionable goods.

Downstream analysis focuses on the movement of finished goods to the consumer through various distribution channels. Direct channels, such as brand-owned e-commerce platforms and exclusive retail boutiques, allow manufacturers maximum control over pricing, brand experience, and direct customer data collection, often targeting the high-end luxury consumer seeking bespoke services and guaranteed authenticity. Indirect channels include wholesale distribution through department stores, multi-brand specialty retailers, and large-scale online marketplaces (Amazon, Zalando). These indirect partnerships are vital for achieving high market penetration, accessing broader customer bases, and streamlining logistics for mass-market and mid-range products, although they involve relinquishing some control over the final presentation and pricing strategy. The choice of distribution strategy often determines the brand's visibility and perceived value, requiring careful management of channel conflicts and pricing parity to ensure sustainable growth across diverse retail landscapes, particularly in regions where luxury consumption heavily relies on physical storefront presence for assurance of product authenticity and quality.

Effective management of the value chain is increasingly leveraging digital tools to enhance transparency and responsiveness. Technology, such as blockchain, is being piloted by several premium brands to trace the leather from the farm to the final product, addressing growing consumer concerns about ethical sourcing and animal welfare, adding verifiable value at the upstream stage. Furthermore, the downstream logistics are optimized using AI-powered routing and inventory platforms, ensuring that seasonal collections reach global points of sale simultaneously, crucial for synchronizing marketing campaigns and maintaining global brand image consistency. The distribution landscape is evolving rapidly with the rise of social commerce and personalized fulfillment, where the last-mile delivery experience—how the luxury item is packaged and delivered—becomes an integral part of the product experience, often requiring bespoke packaging and high-touch delivery services to justify the premium cost associated with designer leather wallets, linking the physical product back to its high-quality, traceable origins. This holistic view of the value chain ensures efficiency while upholding the brand promise of quality and ethical responsibility.

Leather Wallet Market Potential Customers

Potential customers for the Leather Wallet Market are broadly categorized into specific end-user segments based on demographic and psychographic profiles, extending far beyond simple gender divisions. The core customer base comprises working professionals (aged 25-55) who require durable, functional accessories that reflect professional stature and personal style, often favoring bi-fold or slim profile wallets in classic colors (black, brown). This segment values material longevity and brand reputation, often leading to purchases from established luxury or premium business accessory brands like Montblanc or Coach. A rapidly growing segment includes millennials and Gen Z consumers (18-30) who are heavily influenced by minimalist aesthetics and sustainable practices. These younger buyers prioritize cardholders or smart wallets, often choosing synthetic leather or hybrid materials, and making purchasing decisions predominantly through direct-to-consumer (DTC) websites and social media influencers, valuing convenience, ethical provenance, and innovative security features like rapid card access mechanisms and RFID protection over pure storage capacity. Another key demographic is the high-net-worth individual, primarily seeking exclusivity and customization, purchasing exotic leather wallets or limited-edition designer pieces, often through exclusive specialty boutiques, where the wallet serves as a visible marker of wealth and discerning taste, emphasizing unparalleled craftsmanship and bespoke details.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 52.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hermes International, LVMH, Kering, Prada Group, Coach (Tapestry), Montblanc (Richemont), Bellroy, Secrid, Tommy Hilfiger, Fossil Group, Balenciaga, Gucci, Louis Vuitton, Saint Laurent, Michael Kors, Hugo Boss, Dior, Burberry, Ted Baker, Ridge Wallet |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leather Wallet Market Key Technology Landscape

The Leather Wallet Market’s technology landscape is primarily defined by innovations focused on enhancing security, functionality, and manufacturing precision, rather than wholesale digital transformation of the product itself. A critical technology is Radio-Frequency Identification (RFID) blocking material, which is now almost ubiquitous in mid-to-high-end wallets, designed to protect contactless cards from unauthorized scanning and digital theft. This security feature is a direct response to the increasing proliferation of contactless payment methods globally, becoming a standard expectation for consumers seeking peace of mind regarding their financial data integrity. Furthermore, advancements in specialized tanning and leather finishing techniques, including water-resistant coatings and vegetable-based tanning agents, are crucial technological improvements aimed at improving the material’s durability, lifespan, and environmental profile, addressing both quality perception and sustainability mandates. Precision manufacturing, utilizing laser cutting and sophisticated automated stitching machines, ensures highly accurate dimensional consistency and enables complex designs, which is vital for maintaining the high standards demanded by luxury brands and facilitating efficient production of minimalist, slim-profile designs where tolerance for error is minimal.

Beyond material and security, the concept of "smart wallets" represents the cutting edge of technological integration. These products incorporate miniaturized electronics such as Bluetooth trackers (often compatible with major ecosystem tracking apps like Apple Find My or proprietary solutions), integrated power banks for charging small devices, and rapid-access card mechanisms using mechanical ejection systems. While smart wallets currently represent a niche segment, their technological complexity requires specialized manufacturing and expertise in integrating delicate circuitry within traditional leather frameworks without compromising the material’s aesthetic or feel. The supply chain technology is equally important; the deployment of blockchain and advanced ERP systems ensures end-to-end traceability of genuine leather, verifying the ethical sourcing and processing history, which is essential for premium branding and compliance with international regulations on material sourcing. These technological shifts are compelling traditional leather goods manufacturers to forge partnerships with tech firms and invest in internal engineering expertise to remain competitive against digitally native accessory startups that prioritize smart functionality and security.

The convergence of material science and digital functionality is driving future market growth. For instance, the development of synthetic leathers derived from biological sources (e.g., mushroom or fruit waste) requires sophisticated biotechnological processes, fundamentally altering the upstream supply chain dynamics and appealing powerfully to the eco-conscious luxury buyer. In the manufacturing phase, 3D scanning and augmented reality (AR) are increasingly used during the design iteration process, allowing designers to visualize and rapidly prototype new compartment structures and aesthetic elements, significantly reducing the time-to-market for new collections. This emphasis on rapid iteration is vital in the fashion accessory space, where seasonal trends demand speed and precision. The overall technological landscape dictates that successful market players must balance the traditional value proposition of fine leather craftsmanship with modern demands for digital security, environmental accountability, and optimized functional utility, ensuring the leather wallet remains a relevant and advanced personal accessory in an increasingly digital world.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Trajectory: The APAC region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, establishing itself as the principal engine for global market expansion. This explosive growth is underpinned by several macro-economic factors, including the unprecedented rise in middle-class disposable incomes, particularly in populous countries like China, India, and Southeast Asian nations. These consumers are increasingly transitioning from functional, unbranded wallets to branded leather goods as an accessible entry point into the luxury market. Furthermore, strong cultural practices, such as the tradition of gifting high-quality leather accessories during festivals and professional achievements, significantly boosts market volume. Manufacturers are focusing on localized product offerings, tailoring designs to regional preferences—for instance, incorporating larger currency slots for specific Asian currencies and offering vibrant color palettes beyond the traditional European black and brown. The market is highly competitive, seeing intense activity from both established European luxury houses expanding their retail footprint and aggressive local manufacturers leveraging deep understanding of domestic consumer trends and effective localized digital marketing strategies to capture market share through both online and burgeoning modern physical retail channels, ensuring that investments in distribution logistics and high-end store environments keep pace with consumer expectations for a premium purchasing experience. This dynamic environment necessitates continuous portfolio refreshment and strategic pricing to appeal to the region's highly fragmented yet rapidly unifying consumer base.

- North America Market Maturity and Technology Adoption: North America represents a mature and highly profitable market, characterized by sophisticated consumer preferences and a high adoption rate of technological integration within personal accessories. While volume growth may be slower compared to APAC, the average selling price (ASP) remains significantly high, driven by strong demand for premium and designer brands and the early and enthusiastic adoption of functional innovations. The market is undergoing a structural shift driven by the "minimalist movement" and the dominance of digital payments; consequently, sales of traditional bulky wallets are declining, replaced by a massive surge in slim cardholders and highly functional minimalist wallets, often equipped with integrated RFID protection and sometimes Bluetooth tracking technology. E-commerce penetration is extremely high in this region, influencing brand success through sophisticated digital marketing, influencer collaborations, and direct-to-consumer sales models, which allows smaller, digitally native brands like Ridge Wallet and Bellroy to effectively compete with legacy luxury brands by emphasizing utility and smart design. Sustainability and ethical sourcing are significant purchasing factors for a large segment of the North American consumer base, compelling both domestic and international brands to provide transparent supply chain narratives and sustainable material alternatives, driving innovation in vegan and traceable genuine leather offerings to maintain relevance among environmentally conscious, high-spending cohorts.

- European Market for Heritage and Luxury: Europe remains the bedrock of the global leather goods industry, dominated by heritage brands and characterized by a consumer base that values unparalleled craftsmanship, historical brand legacy, and genuine material quality. The market is primarily concentrated in Western Europe (France, Italy, Germany, UK), serving as the global manufacturing and design hub for luxury leather accessories, setting global trends for aesthetics and quality standards. The demand is heavily skewed towards genuine leather, with a strong preference for full-grain materials and artisanal finishing, often viewed as lifetime investments rather than temporary fashion items. While European consumers are slower to adopt extreme smart wallet technology compared to North America, they demand high levels of security, making subtle RFID integration a standard feature. The regulatory environment in Europe, particularly concerning chemical use in tanning (REACH regulations), significantly impacts the supply chain, forcing producers to adopt stricter environmental standards, which paradoxically enhances the quality and traceability of European-made leather goods, further reinforcing their premium positioning. Retail strategies emphasize exclusive boutiques and flagship stores located in fashion capitals, providing an immersive brand experience crucial for maintaining the luxury perception and justifying high price points, with online sales serving primarily as a channel for product discovery and convenience for established customers, rather than the primary point of conversion for high-value items.

- Latin America (LATAM) Market Potential and Economic Sensitivity: The LATAM region presents an attractive long-term growth opportunity, characterized by large, aspirational consumer populations and developing retail infrastructure, though the market is significantly sensitive to macroeconomic instability and currency fluctuations. Countries like Brazil and Mexico are leading the demand, driven by a growing middle class that views leather accessories as aspirational status symbols. The preference leans towards mid-range to premium genuine leather products, reflecting a cultural appreciation for durable, well-made goods. Local production is strong, catering to price-sensitive segments, while international brands compete fiercely in major urban centers through franchising and department store presence, focusing on luxury positioning to justify import costs and duties. Challenges include complex logistics, high taxes on imported luxury goods, and a persistent informal market presence, which requires sophisticated distribution and anti-counterfeiting measures. As economic stability improves and e-commerce infrastructure matures, the region is expected to mirror the APAC trend of accelerating demand for branded, high-quality accessories, providing substantial potential for volume expansion, particularly within the mid-market price segment.

- Middle East and Africa (MEA) Focus on High-End Luxury: The MEA region is segmented by significant wealth disparities, resulting in a highly dualistic market structure. The Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar) are major consumers of high-end and ultra-luxury leather wallets, driven by high per capita incomes and a culture that values overt displays of wealth and brand exclusivity. Demand here focuses on exotic materials, bespoke personalization, and the latest collections from leading European luxury houses, often purchased through opulent flagship stores in major metropolitan centers like Dubai and Riyadh. The rest of the MEA market, particularly in North and South Africa, is largely dominated by mass-market and locally produced leather goods, often prioritizing functionality and affordability. However, increasing digital penetration and rising economic status in key African urban hubs are slowly opening avenues for mid-range international brands. The primary drivers in the GCC are tourism, high spending power, and a strong culture of gifting, making the region crucial for maintaining the high-margin revenue streams of global luxury conglomerates, requiring specialized retail strategies that emphasize personalized service and exclusive access to limited-edition items.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leather Wallet Market.- Hermes International

- LVMH

- Kering

- Prada Group

- Coach (Tapestry)

- Montblanc (Richemont)

- Bellroy

- Secrid

- Tommy Hilfiger

- Fossil Group

- Balenciaga

- Gucci

- Louis Vuitton

- Saint Laurent

- Michael Kors

- Hugo Boss

- Dior

- Burberry

- Ted Baker

- Ridge Wallet

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Leather Wallet Market?

The Leather Wallet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This growth is primarily fueled by rising consumer disposable incomes, particularly in the Asia Pacific region, and continuous product innovation focusing on security features like RFID blocking and minimalist designs.

How is the shift towards cashless transactions affecting the demand for leather wallets?

While the overall necessity for large, high-capacity wallets (for cash and coins) has decreased due to digital payments, the market is adapting by seeing explosive growth in slim cardholders and minimalist wallets. These products maintain the luxury aesthetic and organization function while catering to card-centric lifestyles, effectively offsetting potential declines in traditional wallet styles.

Which geographical region exhibits the fastest growth potential in the Leather Wallet Market?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market segment. Rapid economic expansion, coupled with an increasing number of young professionals entering the middle class and engaging in luxury consumption, drives high volume growth, making it a critical strategic focus for major manufacturers.

What is the significance of RFID-blocking technology in modern leather wallets?

RFID-blocking technology is now a near-standard feature in mid-to-high-end leather wallets, signifying the integration of digital security into physical accessories. It protects contactless payment cards and identification documents from unauthorized electronic scanning and data theft, addressing a key consumer concern in a digitally reliant society.

Are synthetic and vegan leather alternatives posing a substantial threat to genuine leather market dominance?

Synthetic and vegan leather alternatives are growing rapidly, driven by ethical consumerism and favorable pricing, and are highly competitive in the mass and mid-market segments. While genuine leather retains dominance in the luxury sector due to perceived quality and heritage, the shift towards sustainable materials presents a significant long-term opportunity for non-animal-derived product segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager