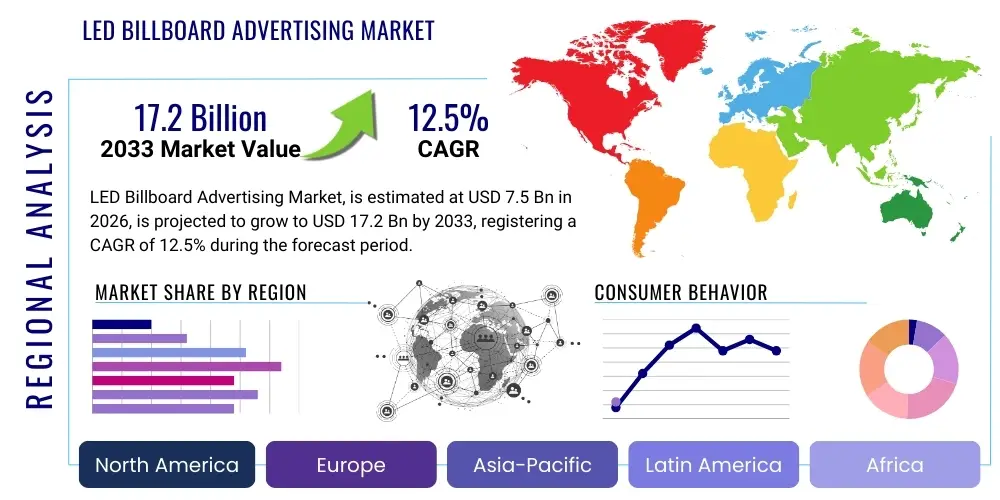

LED Billboard Advertising Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437573 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

LED Billboard Advertising Market Size

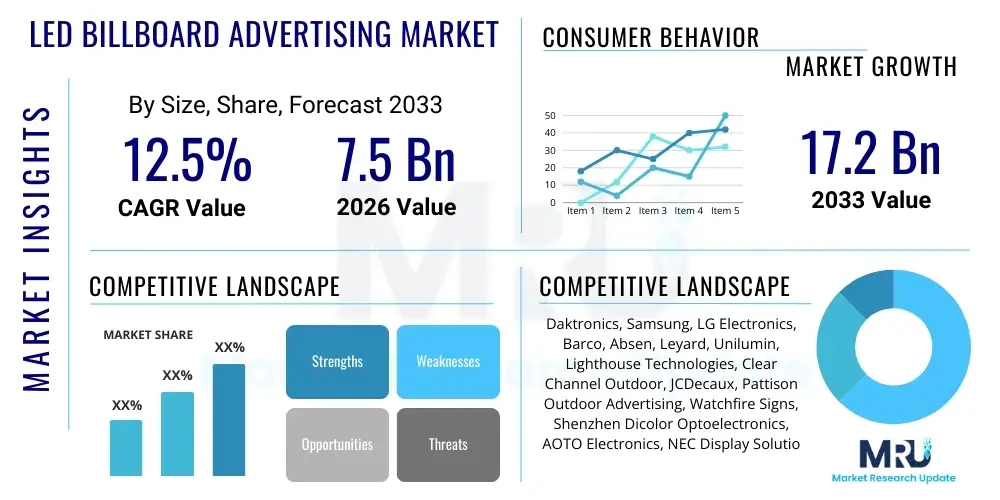

The LED Billboard Advertising Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 17.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating digitalization of Out-of-Home (OOH) advertising infrastructure globally, coupled with technological advancements resulting in higher resolution, energy-efficient LED displays. Increasing consumer exposure to urban and transit environments further solidifies the economic viability of these large-format digital displays for high-impact brand messaging and real-time content delivery.

LED Billboard Advertising Market introduction

The LED Billboard Advertising Market encompasses the deployment and maintenance of large electronic displays utilizing Light Emitting Diode technology for commercial and public communication purposes. These advanced digital billboards offer significant advantages over traditional static signage, including the ability to display dynamic content, switch advertisements instantaneously, and integrate real-time data feeds, thereby enhancing message relevance and engagement. The primary product deployed involves modular LED screens designed for outdoor longevity, high brightness, and weather resistance, typically managed through sophisticated content management systems (CMS) that allow for remote operation and scheduling.

Major applications of LED billboard advertising span across commercial sectors, targeting consumer packaged goods (CPG), automotive, entertainment, and retail industries looking for maximum visibility in high-traffic areas such as highways, central business districts, and major transit hubs. The inherent flexibility of these systems allows advertisers to execute complex, targeted campaigns, often leveraging geofencing and time-of-day segmentation to optimize message delivery. Furthermore, governments and public institutions utilize these billboards for important public service announcements (PSAs), emergency alerts, and community engagement, broadening the scope beyond purely commercial uses. The immediate benefits include enhanced recall rates, improved campaign flexibility, reduced operational costs associated with print production and installation, and the critical ability to measure audience exposure and campaign performance more accurately than legacy OOH formats.

The market is predominantly driven by the ongoing shift from static OOH to Digital Out-of-Home (DOOH), facilitated by decreasing costs of LED components and improvements in pixel density, which provide stunning visual quality even in bright daylight. Urbanization trends, particularly in emerging economies, lead to increased vehicular and pedestrian traffic, maximizing the potential audience reach of strategically positioned billboards. The convergence of OOH advertising with programmatic buying platforms is a critical driver, enabling advertisers to purchase inventory dynamically, much like online digital ads, thereby increasing efficiency and driving demand for premium digital inventory like large format LED screens.

LED Billboard Advertising Market Executive Summary

The LED Billboard Advertising Market is characterized by robust commercial trends, primarily centered on the integration of digital display technology with advanced data analytics and programmatic advertising tools. Key business trends include aggressive investment in high-resolution Micro-LED and Mini-LED technologies to improve visual quality and reduce energy consumption, alongside strategic acquisitions and partnerships between traditional OOH operators and technology providers to build comprehensive, interconnected digital networks. Advertisers are increasingly favoring dynamic creative optimization (DCO) facilitated by LED screens, allowing instantaneous changes in messaging based on external triggers like weather, traffic congestion, or inventory levels, maximizing the return on investment (ROI) from high-cost placements.

Regionally, the market exhibits strong growth in the Asia Pacific (APAC) area, propelled by rapid infrastructure development, smart city initiatives, and high population density in metropolitan regions, particularly in China and India, where high visibility advertising is essential. North America and Europe remain mature markets, focusing on upgrading existing infrastructure to higher-definition screens and integrating sophisticated audience measurement techniques, thereby commanding premium pricing. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, driven by government support for infrastructure modernization and the inflow of foreign direct investment into commercial real estate and retail developments. Competition remains fierce, with companies emphasizing network expansion, technological differentiation, and superior content management systems to secure market share across these diverse geographical landscapes.

Segment trends indicate a strong preference for larger format LED billboards (over 100 square feet) situated along major highways and primary urban thoroughfares, which guarantee high reach and frequency. In terms of technology, displays utilizing higher pixel pitch are becoming standard for close-range visibility in pedestrian areas, while durability and modularity remain critical factors across all installation types. The application segment continues to be dominated by commercial brand advertising, though the use of LED billboards for government-related public service announcements and emergency communication systems is expanding significantly, reflecting their reliability as essential public infrastructure components. Furthermore, the trend toward energy efficiency and sustainability is influencing procurement decisions, with green technology and reduced power consumption becoming key competitive differentiators within the segmentation framework.

AI Impact Analysis on LED Billboard Advertising Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the LED Billboard Advertising Market primarily revolve around three critical areas: enhanced audience targeting and personalization, automation of content delivery and optimization, and improved campaign measurement and attribution. Users seek to understand how AI can move DOOH beyond simple screen rotation to deliver hyper-contextualized messaging—questions frequently address the feasibility and regulatory implications of using real-time data (such as anonymized traffic flow, demographic data, and weather patterns) to trigger specific ads. There is high interest in AI-driven programmatic trading desks that can predict optimal times and locations for ad display to maximize viewability and engagement. Furthermore, concerns are often raised about the complexity of integrating AI algorithms into existing content management systems (CMS) and the need for standardized metrics for measuring AI-optimized campaigns compared to traditional OOH measurement methods, emphasizing a drive toward quantifiable ROI using predictive analytics.

- Real-Time Audience Segmentation: AI analyzes data (traffic, weather, demographics) to automatically segment and target specific viewer groups passing the billboard.

- Programmatic Inventory Optimization: Machine learning algorithms dynamically price and allocate inventory based on predicted demand, maximizing yield for billboard owners.

- Dynamic Creative Optimization (DCO): AI instantly adjusts creative assets (text, images, calls-to-action) in real-time to match the most relevant external conditions or viewer context.

- Predictive Maintenance: AI monitors LED panel performance, identifying potential failures before they occur, reducing downtime and maintenance costs.

- Fraud Detection and Viewability Verification: Algorithms ensure the ads are displayed correctly and are viewable by the target audience, enhancing trust in DOOH metrics.

- Automated Regulatory Compliance: AI systems automatically manage content rotation schedules to comply with local advertising regulations regarding frequency and content type.

DRO & Impact Forces Of LED Billboard Advertising Market

The market dynamics of the LED Billboard Advertising Market are shaped by a complex interplay of powerful growth drivers, necessary restraints, significant opportunities for innovation, and external impact forces. The primary driver is the accelerating digital transformation of OOH media, replacing static formats with dynamic, interactive, and highly visible digital screens, which aligns perfectly with modern advertisers’ demands for flexibility and immediate impact. This is coupled with ongoing technological breakthroughs in LED display manufacturing, leading to thinner, lighter, more durable, and significantly more energy-efficient billboards with superior contrast and brightness, lowering the total cost of ownership over the long term and making these installations feasible even in remote or power-constrained locations. The programmatic revolution in advertising profoundly impacts this sector, treating LED billboard slots as digital inventory purchasable and manageable through automated platforms, which attracts major digital advertisers seeking seamless omnichannel integration.

Conversely, significant restraints hinder uniform growth across all regions. The high initial capital expenditure (CAPEX) required for large-scale LED screen installation, infrastructure preparation, and connectivity setup remains a barrier, particularly for small-to-medium-sized OOH operators. Regulatory hurdles are a major impediment; many municipalities impose strict zoning laws, size restrictions, brightness limitations, and content duration rules to address concerns related to visual pollution, driver distraction, and energy consumption. Furthermore, the complexity of content management and the need for reliable, high-speed broadband connectivity, especially in rural or dispersed areas, present logistical and operational challenges that must be consistently managed, often requiring specialized technical expertise that adds to operational expenditures (OPEX).

Opportunities for market expansion are abundant, centered predominantly on integrating advanced technologies. The deployment of 5G infrastructure is poised to unlock truly real-time, high-definition content delivery and interactive experiences, facilitating the growth of interactive DOOH campaigns (e.g., billboards reacting to mobile interactions or social media feeds). The convergence with smart city initiatives presents an opportunity for LED billboards to serve dual functions—as advertising platforms and as essential components of urban infrastructure, capable of delivering traffic updates, air quality readings, and emergency alerts. Additionally, the development of sophisticated cross-platform measurement tools utilizing AI and computer vision represents a lucrative opportunity to provide advertisers with definitive proof of performance and audience exposure, thereby attracting larger budgets currently allocated to online display advertising. The primary impact forces influencing the market trajectory are shifts in global economic conditions affecting ad spend, rapid advancements in display technology (such as Mini/Micro LED adoption), and evolving governmental policies concerning urban infrastructure and aesthetic standards, dictating permissible display locations and formats.

- Drivers:

- High consumer demand for dynamic, flexible advertising media.

- Technological advancements reducing LED manufacturing and operational costs.

- Integration with programmatic advertising platforms.

- Increasing urbanization and infrastructure development worldwide.

- Restraints:

- High initial capital investment and complex installation logistics.

- Stringent municipal zoning and regulatory restrictions regarding size and brightness.

- Visual pollution and driver distraction concerns.

- Opportunity:

- Integration with 5G networks enabling real-time, interactive content.

- Development of advanced audience measurement and attribution models (AI/Computer Vision).

- Expansion of smart city infrastructure projects utilizing LED displays for dual purposes.

- Impact Forces:

- Global macroeconomic stability affecting corporate advertising budgets.

- Rate of adoption of next-generation display technologies (Micro-LED).

- Evolving consumer privacy regulations regarding data collection for targeting.

Segmentation Analysis

The LED Billboard Advertising Market is meticulously segmented based on critical technical and application parameters that define product functionality and deployment strategy. Segmentation by product type often focuses on the physical characteristics and technology used, such as display technology (DLP, LCD, OLED, LED), and specific pitch size (P2, P4, P6, P10, etc.), directly impacting viewing distance and clarity. The application segmentation differentiates usage based on deployment environment and purpose, including high-traffic areas like highways, specific urban centers, retail facades, and governmental use, each demanding unique structural and brightness requirements. Understanding these segments is crucial for manufacturers to tailor their production, and for OOH operators to strategically allocate inventory to maximize revenue yield and align with regulatory constraints associated with different environments.

- By Type (Pixel Pitch): Fine Pitch (P1 to P2.5), Medium Pitch (P3 to P6), Large Pitch (P7 and above)

- By Display Technology: DLP, LCD, OLED, Traditional LED, Mini LED, Micro LED

- By Location: Highway and Roadside, Urban Center (Downtown), Transit Areas (Airports, Rail Stations), Retail and Shopping Malls

- By Application/End-User: Commercial Advertising (Automotive, CPG, Retail), Government and Public Services (PSAs, Emergency Alerts), Sports and Entertainment Venues

Value Chain Analysis For LED Billboard Advertising Market

The LED Billboard Advertising Market value chain is complex and highly specialized, starting with the upstream sourcing of critical technological components and culminating in the downstream delivery of high-impact advertising campaigns. Upstream analysis focuses on the supply of raw materials and core components, particularly semiconductor chips, LED modules (diodes), driver Integrated Circuits (ICs), and structural materials like aluminum and specialized plastics. Component manufacturing is highly concentrated in East Asia, particularly China and South Korea, where major LED suppliers operate. The quality and efficiency of these upstream inputs directly determine the final performance metrics of the display, such as brightness, power consumption, and lifespan. Pricing and supply stability in this segment are highly volatile, influenced by global semiconductor shortages and material costs, necessitating robust supplier management strategies among billboard manufacturers.

The midstream of the value chain involves the design, assembly, and testing of the complete LED billboard modules and panels by specialized manufacturers. This stage is crucial for innovation, focusing on weatherproofing, thermal management, structural integrity, and integrating connectivity modules for content management systems (CMS). Downstream activities encompass the OOH operators and media agencies responsible for site selection, regulatory permitting, physical installation (which often involves significant civil engineering and large cranes), maintenance, and ultimately, the sale of advertising space. The profitability of the downstream operators hinges on securing prime locations, efficient content scheduling, and accurate audience measurement capabilities, often utilizing specialized software platforms for programmatic trading and real-time monitoring.

The distribution channel for LED billboards is primarily direct and project-based due to the customized nature and high value of the installations. Direct sales occur when OOH operators purchase displays directly from the manufacturing specialists, often involving long-term supply contracts and tailored specifications. Indirect channels primarily involve value-added resellers (VARs) or system integrators who procure displays, bundle them with software and installation services, and deliver a turn-key solution to smaller operators or businesses. Crucially, the final link in the chain involves the advertising agencies and programmatic platforms, which act as the sales interface between the OOH network inventory and the final brand advertisers. The move toward programmatic buying is rapidly shifting power in the distribution channel, demanding seamless integration between display technology providers, OOH operators, and demand-side platforms (DSPs) to facilitate efficient inventory transactions and campaign deployment.

LED Billboard Advertising Market Potential Customers

The primary consumers and end-users of the LED Billboard Advertising Market are predominantly large corporate advertisers, specialized media buying agencies, national and regional government entities, and transit or municipal authorities. Corporate advertisers, especially those in the automotive, quick-service restaurant (QSR), consumer electronics, entertainment (movie studios, streaming services), and luxury goods sectors, are the core buyers, valuing the immense visibility and high-impact nature of large LED displays located strategically in metropolitan choke points. These buyers utilize the medium for high-frequency brand awareness campaigns, product launches, and promotional events that require immediate, massive consumer reach.

Media buying agencies and OOH specialist firms act as intermediaries, consolidating demand and executing complex, multi-market campaigns on behalf of their corporate clients. Their purchasing decisions are heavily influenced by the network coverage, technological capability (such as programmatic enablement), and verifiable audience metrics provided by the billboard operators. Government and public institutions represent a stable, though less revenue-intensive, customer segment, using LED billboards for public safety announcements, infrastructure updates, emergency broadcasts, and tourism promotion. Their procurement focuses on reliability, geographic coverage for public messaging, and seamless integration with existing municipal or regional alert systems, ensuring the billboards serve as critical components of urban communication infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 17.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daktronics, Samsung, LG Electronics, Barco, Absen, Leyard, Unilumin, Lighthouse Technologies, Clear Channel Outdoor, JCDecaux, Pattison Outdoor Advertising, Watchfire Signs, Shenzhen Dicolor Optoelectronics, AOTO Electronics, NEC Display Solutions, Outfront Media, Focus Media, Media Resources Inc., Go Vision, Formetco |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Billboard Advertising Market Key Technology Landscape

The LED Billboard Advertising Market is defined by continuous technological innovation aimed at improving visual performance, reducing energy consumption, and enhancing interactive capabilities. A major shift involves the migration toward higher resolution, fine pixel pitch displays, which were once exclusive to indoor screens but are increasingly being adapted for outdoor use, particularly in urban pedestrian zones where viewers are closer to the display. This demand is satisfied by advancements in LED packaging techniques, notably Surface-Mounted Device (SMD) technology, which allows for smaller, denser pixel clusters. Crucially, the landscape is being reshaped by next-generation technologies: Mini LED and Micro LED. Mini LED offers significant improvements in contrast ratio and brightness uniformity compared to traditional SMD LEDs, while Micro LED promises revolutionary energy efficiency and pixel density, though its adoption in large-scale outdoor advertising is still nascent but accelerating.

Beyond the display panels themselves, the technological landscape is heavily reliant on sophisticated infrastructure and software. Advanced Content Management Systems (CMS) are paramount, enabling remote scheduling, real-time content modification, and integration with programmatic advertising demand-side platforms (DSPs). These CMS solutions must be robust enough to handle high-volume, high-definition video content and ensure seamless playback across potentially hundreds of geographically dispersed screens. Furthermore, the integration of sensors (e.g., light, temperature) and connectivity modules (4G/5G, Wi-Fi) is standard, allowing displays to dynamically adjust brightness based on ambient conditions and transmit operational data back to central control systems for proactive maintenance and performance auditing, optimizing both lifespan and visibility.

Finally, the evolution of audience measurement technology is a crucial aspect of the technology landscape. Traditional measurement methods are being augmented, or replaced, by computer vision and AI-driven analytics. Cameras and sensors integrated into the billboard structure, coupled with sophisticated machine learning algorithms, are used to passively and anonymously count impressions, estimate demographic profiles of the passing audience, and measure dwell time and attention span. This convergence of display hardware, robust connectivity infrastructure, and intelligent measurement software is defining the competitive advantage in the market, transforming simple electronic screens into smart media assets capable of delivering measurable and highly context-aware advertising experiences.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Trajectory: APAC is the fastest-growing and largest market for LED billboard advertising, fueled by massive infrastructure investments, government-led smart city initiatives, and extraordinarily high urbanization rates, particularly in China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs for LED components and a high concentration of market players. Cities like Shanghai, Beijing, and Mumbai are rapidly transforming their OOH environments, providing lucrative opportunities for large format digital displays in densely populated areas. Regulatory environments, while varying, often encourage the modernization of public spaces, driving the uptake of highly visible LED screens for both commercial and public communication purposes. This substantial growth is characterized by an emphasis on sheer volume and rapid deployment across developing urban landscapes.

- North America Market Maturity and Innovation Focus: North America represents a mature and technologically advanced market, holding a significant share driven by high advertising expenditure and the early adoption of programmatic DOOH trading. The focus here is less on initial installation volume and more on upgrading existing static or low-resolution digital sites to high-definition, feature-rich LED billboards capable of running complex, data-driven campaigns. Key drivers include the robust ecosystem of media agencies and the demand for sophisticated audience measurement tools (AI-driven analytics) to justify premium ad rates. Major metropolitan areas like New York, Los Angeles, and Toronto serve as critical hubs for large-format, high-impact digital spectaculars, often integrating interactive elements and real-time data feeds.

- European Market Transformation and Regulatory Constraints: Europe exhibits steady growth, primarily focused on replacing older inventory and adhering to stringent local regulations concerning aesthetics, light pollution, and energy consumption, particularly in highly protected historical city centers. Western European countries, such as the UK, Germany, and France, lead in programmatic DOOH integration, demanding strong compliance features within the CMS technologies used for billboard management. The emphasis on sustainability and energy efficiency is more pronounced in Europe than in other regions, driving demand for Mini LED and highly efficient power supplies. Southern and Eastern Europe are increasingly adopting digital billboards as part of wider infrastructure modernization efforts, but regulatory fragmentation across different nations remains a challenging restraint.

- Latin America (LATAM) and Middle East & Africa (MEA) Emerging Potential: LATAM and MEA are emerging markets offering significant long-term growth potential. In the Middle East, particularly the UAE and Saudi Arabia, large-scale infrastructural and entertainment projects (like NEOM and massive transit hubs) necessitate the deployment of cutting-edge, high-resolution LED displays. These markets benefit from substantial government investment in modern urban planning. In Latin America, economic recovery and increasing foreign investment are fueling the digitalization of OOH assets in major cities like São Paulo and Mexico City. The key challenge in both regions is the reliability of power infrastructure and high connectivity costs in less urbanized areas, necessitating robust, self-sufficient technological solutions for LED billboard deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Billboard Advertising Market.- Daktronics

- Samsung

- LG Electronics

- Barco

- Absen

- Leyard

- Unilumin

- Lighthouse Technologies

- Clear Channel Outdoor

- JCDecaux

- Pattison Outdoor Advertising

- Watchfire Signs

- Shenzhen Dicolor Optoelectronics

- AOTO Electronics

- NEC Display Solutions

- Outfront Media

- Focus Media

- Media Resources Inc.

- Go Vision

- Formetco

Frequently Asked Questions

Analyze common user questions about the LED Billboard Advertising market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth rate projection for the LED Billboard Advertising Market?

The LED Billboard Advertising Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. This substantial growth rate is underpinned by the accelerated global trend toward the digitalization of Out-of-Home (OOH) media and significant technological advancements in display efficiency and programmatic capabilities, attracting substantial investment from key advertisers seeking flexible, high-impact visibility in urban environments. The transition from static billboards to dynamic LED screens is the primary catalyst driving this forecast expansion across major world economies.

How does programmatic advertising specifically impact the ROI of LED billboards?

Programmatic advertising fundamentally enhances the Return on Investment (ROI) of LED billboards by enabling precise, data-driven targeting and dynamic inventory pricing, moving beyond bulk ad buys. Through programmatic platforms, advertisers can automatically purchase specific ad slots based on real-time triggers, such as traffic volume, weather conditions, or audience demographics captured anonymously, ensuring that the message is delivered to the most relevant audience at the optimal time. This efficiency minimizes wasted impressions, maximizes the potential engagement rate, and provides quantifiable performance data that validates the premium cost of LED inventory, ultimately improving campaign efficiency and accountability.

What major technological trends are dominating the manufacturing of new LED billboards?

The manufacturing of new LED billboards is dominated by two primary technological shifts: the adoption of next-generation display technologies and the enhancement of connectivity infrastructure. Mini LED technology is rapidly gaining traction due to its ability to offer superior contrast ratios, improved brightness uniformity, and greater energy efficiency compared to traditional SMD LEDs, making them ideal for high-impact outdoor placement. Concurrently, the integration of 5G connectivity is essential, enabling truly real-time content updates, high-definition video streaming, and the seamless functioning of integrated AI/computer vision systems for advanced audience measurement and dynamic creative optimization (DCO).

What are the key regulatory restraints affecting the deployment of LED billboards in urban centers?

Key regulatory restraints vary significantly by jurisdiction but typically include stringent zoning laws restricting billboard size, height, and location, especially near historical sites or residential areas. Municipalities impose severe restrictions on brightness levels to mitigate light pollution and address concerns about driver distraction and safety on high-speed roadways. Furthermore, content restrictions regarding duration, frequency of message rotation, and specific types of advertising (e.g., alcohol or tobacco) must be strictly adhered to. Compliance often requires sophisticated Content Management Systems (CMS) capable of automated regulatory adherence, adding complexity to the operational side of the business.

Which regional market offers the highest growth potential for LED billboard installations?

The Asia Pacific (APAC) region consistently demonstrates the highest growth potential for LED billboard installations, primarily driven by massive governmental and private sector infrastructure spending, coupled with rapid urbanization across high-density markets like China, India, and Indonesia. The region benefits from large populations, enabling maximized audience reach, and robust domestic manufacturing capabilities that keep component costs competitive. Significant investments in smart city projects and modern transportation networks are creating numerous strategic locations for large-format digital displays, making APAC the engine of global market expansion in the foreseeable future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager