LED Flashlight Bulb Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431912 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

LED Flashlight Bulb Market Size

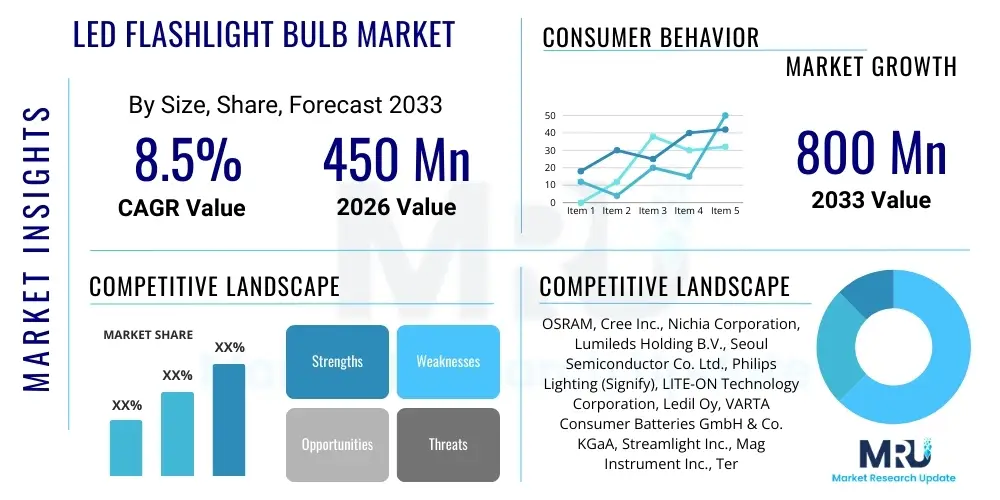

The LED Flashlight Bulb Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

LED Flashlight Bulb Market introduction

The LED Flashlight Bulb Market encompasses the manufacturing, distribution, and sale of light-emitting diode (LED) based replacement bulbs and integrated units specifically designed for flashlights, ranging from small consumer models to high-powered tactical and industrial lighting equipment. LED technology offers significant advantages over traditional incandescent or halogen bulbs, primarily centered on enhanced energy efficiency, superior longevity, and increased brightness (lumens per watt). The market is characterized by continuous innovation in thermal management systems and driver circuitry necessary to maximize LED performance in battery-operated, compact devices.

The primary applications of these sophisticated lighting solutions span across consumer recreation, home emergency kits, tactical operations (military and law enforcement), industrial inspection, and search and rescue missions. The robust nature of LED technology, which lacks the fragile filaments of older bulbs, ensures higher shock resistance and reliability, crucial factors in demanding professional environments. Furthermore, the ability of LEDs to produce various color temperatures and focused beams through optimized lens assemblies enhances their utility across diverse operational requirements, driving widespread adoption across both private and public sectors globally.

Key benefits driving the market growth include the substantial reduction in battery consumption, extending the operational runtime of flashlights, and the significantly longer lifespan of the bulbs, drastically reducing the need for replacements. Major market drivers stem from stringent energy efficiency regulations globally, the decreasing cost of high-performance LED chips, and the increasing demand for reliable, durable, and extremely bright portable lighting equipment in emerging economies and developed industrial sectors. The shift from outdated incandescent technology to efficient LED alternatives represents a fundamental modernization trend within the portable lighting industry.

LED Flashlight Bulb Market Executive Summary

The LED Flashlight Bulb Market is experiencing dynamic business trends characterized by intense competition among manufacturers focusing on maximizing luminous efficacy and minimizing heat generation through advanced material science and engineering. A critical business trend involves the integration of smart features, such as programmable brightness settings, memory modes, and USB-rechargeable battery management systems, moving the product from a simple light source to a sophisticated electronic accessory. Furthermore, strategic partnerships between LED chip producers and flashlight assembly companies are crucial for maintaining supply chain efficiency and accelerating the deployment of cutting-edge component technology, thereby influencing market pricing and availability.

Regionally, the market is spearheaded by robust growth in the Asia Pacific (APAC) region, driven by extensive manufacturing capabilities, rapid industrialization, and the massive consumer base demanding affordable, high-quality lighting solutions. North America and Europe maintain a strong market presence, largely dominated by demand for premium, tactical, and specialty industrial LED flashlight bulbs that command higher price points due to superior performance characteristics and certifications. Regulatory standards favoring energy efficiency further bolster market penetration in developed economies, while infrastructural gaps in developing nations necessitate reliable, battery-operated lighting, fueling steady growth in those regions.

Segment trends highlight the dominance of high-lumen bulbs (above 500 lumens) in terms of value, catering primarily to security and professional applications. However, the largest volume segment remains the mid-range consumer and household replacement market, emphasizing cost-effectiveness and standardized form factors (like PR base and E10). Within the technology segment, chip-on-board (COB) LEDs are gaining traction due to their ability to provide uniform, high-density light output, while advancements in semiconductor materials, such as gallium nitride (GaN), promise further breakthroughs in efficiency and longevity, driving segmentation based on technological architecture and thermal performance.

AI Impact Analysis on LED Flashlight Bulb Market

User inquiries regarding AI's impact on the LED flashlight bulb market frequently center on how artificial intelligence can optimize the complex manufacturing processes, enhance product performance predictability, and streamline supply chain management for highly specialized components. Key themes emerging from these questions involve the application of machine learning (ML) in thermal management system design—where AI simulates heat dissipation under various operational loads to perfect heatsink geometry and material composition—and the use of predictive analytics for quality control during high-volume production of sensitive semiconductor components. Users also express interest in how AI could lead to 'smart' flashlight systems, potentially adjusting beam patterns or color temperature dynamically based on ambient conditions or user intent detected via integrated sensors, optimizing light output for extended battery life and functional efficiency, though this advanced integration remains nascent in most commercial products.

- AI optimizes LED chip binning and selection, ensuring consistent color temperature and lumen output across production batches, enhancing overall product quality control.

- Machine learning algorithms are employed in predictive maintenance within high-precision automated assembly lines, minimizing downtime and reducing manufacturing costs for complex driver circuits.

- AI-driven simulation tools accelerate the R&D process, allowing engineers to quickly model and test hundreds of thermal management and optical lens designs to achieve optimal light distribution and efficiency.

- Predictive supply chain analytics, often utilizing AI, enhance inventory forecasting for critical components like specialized substrates and phosphors, mitigating risks associated with component shortages.

- Future integration may involve AI-powered smart features that dynamically regulate current draw based on real-time battery voltage and temperature, maximizing both bulb life and runtime efficiency.

DRO & Impact Forces Of LED Flashlight Bulb Market

The market dynamics are governed by a robust interplay of driving forces centered on technological superiority and energy efficiency, counterbalanced by restrictive factors related to standardization challenges and pricing pressures, while substantial opportunities exist in emerging industrial applications and smart device integration. Drivers include the global mandate for energy conservation, the decreasing cost-to-lumen ratio of high-performance LEDs, and the continuous innovation leading to extremely high-output (UHO) bulbs suitable for demanding professional use. Restraints primarily involve the high initial capital investment required for manufacturing advanced thermal management systems and the complexity of ensuring backward compatibility with a vast installed base of older, non-standardized flashlight hosts. Opportunities are significantly present in the smart lighting sector, where connectivity features are increasingly demanded, and in specialized markets such as intrinsically safe (explosion-proof) lighting for oil, gas, and mining industries. The impact forces are predominantly driven by competitive rivalry, emphasizing differentiation through patented thermal technology and superior warranties, alongside the bargaining power of buyers who demand high lumen output and extreme durability at competitive prices, mandating continuous efficiency improvements from manufacturers.

Segmentation Analysis

The LED Flashlight Bulb Market is comprehensively segmented based on product type, technology, application, and distribution channel, allowing for a granular analysis of consumer behavior and industrial demand patterns. Segmentation by product type differentiates between standard replacement bulbs designed for existing flashlight bodies and integrated bulb modules that incorporate advanced driver electronics and specialized optics for optimal performance. The technological segmentation focuses on the differences between standard discrete LEDs, Chip-on-Board (COB) technology, and highly efficient Chip-Scale Package (CSP) LEDs, each offering distinct advantages in terms of light density, thermal performance, and manufacturing simplicity. Application-based segmentation separates high-volume consumer markets from stringent professional and tactical sectors, which demand superior durability, specific spectrum outputs, and high ingress protection ratings. This structured analysis is essential for identifying specific growth pockets and tailoring product development strategies to meet diverse end-user expectations across various operational environments.

- By Product Type:

- Replacement LED Bulbs (Standard Form Factors)

- Integrated LED Modules (Advanced Optics & Drivers)

- By Technology:

- Standard Discrete LEDs

- Chip-on-Board (COB)

- Chip-Scale Package (CSP)

- Filament LED Technology (Niche)

- By Application:

- Consumer & Household Use

- Tactical & Law Enforcement

- Industrial & Maintenance (Inspection, Safety)

- Outdoor & Recreation (Camping, Hiking)

- Military & Defense

- By Lumen Output:

- Low Lumen (Below 100 Lumens)

- Mid Lumen (100 - 500 Lumens)

- High Lumen (500 - 1500 Lumens)

- Ultra High Output (Above 1500 Lumens)

- By Distribution Channel:

- Online Retail & E-commerce

- Specialty Stores & Dealers

- Hypermarkets & Supermarkets

- Industrial Suppliers (B2B)

Value Chain Analysis For LED Flashlight Bulb Market

The value chain for the LED Flashlight Bulb Market begins with upstream activities involving the sourcing and processing of raw materials, specifically high-purity semiconductor substrates (e.g., sapphire or silicon carbide), rare earth phosphors necessary for color conversion, and specialized metals for thermal management components like copper and aluminum alloys. The critical phase in the upstream segment is LED chip manufacturing, which involves epitaxial growth, wafer processing, and precision die bonding. Key players in this stage are large semiconductor companies specializing in solid-state lighting components, whose technological breakthroughs directly dictate the efficiency and cost structure of the final product. Efficiency gains at this foundational level are paramount, as they determine the final heat output and luminous efficacy that can be achieved within the compact confines of a flashlight host.

Midstream activities involve the assembly of the LED chip into a functional bulb unit, which includes mounting the LED onto a metallic core printed circuit board (MCPCB), integrating the necessary driver electronics (DC-DC converters, current regulators), and applying advanced optics such as total internal reflection (TIR) lenses or reflectors for beam shaping. This manufacturing stage requires high precision in thermal interface material application and encapsulation to ensure durability and prevent premature failure due to heat or shock. Distribution channels link manufacturers to end-users and are bifurcated into direct and indirect routes. Direct distribution often caters to large industrial, governmental, or military clients requiring specialized bulk orders and long-term contracts, emphasizing customization and technical support.

Indirect distribution relies heavily on retail networks, encompassing hypermarkets, specialized outdoor equipment stores, and, most importantly, the rapidly growing e-commerce platforms. E-commerce platforms facilitate wider market reach and competitive pricing, making them the preferred channel for standard replacement bulbs and high-volume consumer products. Downstream activities involve end-user consumption and post-sales services, including warranty fulfillment and technical guidance. The effectiveness of the downstream segment is highly dependent on brand reputation and the quality perception associated with the bulb's longevity and performance, especially in mission-critical applications where failure is unacceptable. Optimized distribution minimizes inventory costs and accelerates market responsiveness, crucial for maintaining a competitive edge in a fast-evolving technological landscape.

LED Flashlight Bulb Market Potential Customers

Potential customers for LED flashlight bulbs are highly diversified, encompassing a vast spectrum from individual consumers seeking reliable home lighting solutions to major governmental and industrial entities requiring robust, high-performance illumination tools. The consumer segment, a major volume driver, typically purchases replacement bulbs for existing flashlights or integrated modules for recreational activities such as camping, hiking, and general household emergency preparedness. These buyers prioritize ease of installation, moderate price points, and reliable, standard lumen outputs (100 to 500 lumens). The increasing awareness of energy efficiency and the desire for extended battery life are significant factors influencing the purchase decisions within this broad demographic.

The business-to-business (B2B) and institutional segments represent the high-value market, primarily constituted by professional end-users where flashlight functionality is mission-critical. This includes law enforcement agencies and military units demanding tactical bulbs with extreme brightness, specific beam throw capabilities, and enhanced infrared or specialized color outputs. Industrial customers, particularly those in the construction, mining, maintenance, and utility sectors, require intrinsically safe (IS) certified bulbs that can operate safely in hazardous, explosive environments, focusing on durability, heat management, and specific certification compliance rather than initial cost.

Furthermore, the maintenance, repair, and operations (MRO) sector consistently drives demand for specialty LED bulbs utilized in inspection tasks, such as aerospace maintenance and quality control, where consistent light spectrum and high color rendering index (CRI) are essential for accurate material assessment. Government agencies, including disaster relief organizations and public works departments, form another key customer group, prioritizing bulk purchases of highly reliable, long-lasting bulbs for large-scale emergency response kits and prolonged field operations. These professional customers exhibit lower price sensitivity compared to general consumers but require stringent performance specifications, extended warranties, and verified longevity data, fueling the demand for premium, technologically advanced LED solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OSRAM, Cree Inc., Nichia Corporation, Lumileds Holding B.V., Seoul Semiconductor Co. Ltd., Philips Lighting (Signify), LITE-ON Technology Corporation, Ledil Oy, VARTA Consumer Batteries GmbH & Co. KGaA, Streamlight Inc., Mag Instrument Inc., TerraLUX Inc., Klarus Lighting Technology Co. Ltd., Coast Products, SureFire LLC, Fenixlight Limited, Nitecore (Sysmax Industry Co. Ltd.), Peli Products S.L.U., Energizer Holdings Inc., Shenzhen Qianjin Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Flashlight Bulb Market Key Technology Landscape

The technological landscape of the LED Flashlight Bulb Market is highly dynamic, primarily driven by innovations in thermal management, optical engineering, and driver electronics designed to extract maximum performance from compact battery sources. A critical technology focus is the advancement of LED packaging, particularly the migration toward Chip-Scale Package (CSP) LEDs. CSP technology eliminates the traditional ceramic or plastic housing, allowing the LED chip to be mounted directly onto the heat dissipation substrate. This reduction in packaging material significantly lowers thermal resistance, enabling higher operating currents and, consequently, greater lumen output in smaller physical footprints, which is essential for high-power flashlight applications. Furthermore, advancements in specialized phosphors are continuously optimizing the light spectrum, allowing manufacturers to offer bulbs with very high Color Rendering Index (CRI) values crucial for inspection tasks, or specific spectrum outputs required for tactical or niche agricultural applications.

Another pivotal area is the refinement of driver circuitry. Modern LED flashlight bulbs incorporate sophisticated electronic drivers that perform functions far beyond simple current regulation. These include constant current regulation (CCR) circuits that ensure stable brightness output regardless of battery voltage fluctuations, crucial for professional users, and specialized Pulse Width Modulation (PWM) techniques for efficient dimming and mode selection. High-efficiency buck-boost converters are now standard, maximizing the utility of various battery chemistries (e.g., Li-ion, alkaline) across a wide voltage range while minimizing parasitic draw when the flashlight is off. These electronic enhancements contribute significantly to the perceived quality and functional versatility of the LED bulb module, distinguishing premium products from standard replacements.

Thermal management technology remains the single most challenging yet crucial aspect of high-power LED bulb design. Technologies like vapor chambers, heat pipes, and advanced thermal interface materials (TIMs) are being adapted from larger electronics cooling systems to manage the intense heat generated by ultra-high-output LEDs concentrated in small volumes. Effective heat sinking, often achieved through precision-machined aluminum or copper heatsinks integrated directly into the bulb module, is necessary to prevent junction temperature overshoot, which can lead to rapid lumen depreciation and premature failure. Continued innovation in metallic alloys and phase-change materials for heat dissipation is expected to further push the boundaries of achievable lumen output and lifespan within the constraints of portable flashlight designs, sustaining the market's trajectory towards increased power density and operational reliability.

Regional Highlights

North America represents a mature yet high-value market, characterized by strong demand for specialized, high-end tactical and industrial LED flashlight bulbs. The region, particularly the United States, drives innovation in ruggedization, high-lumen output (often exceeding 1500 lumens), and compliance with specific military and federal safety standards. Consumers are willing to invest in premium brands offering advanced features like proprietary thermal regulation and lifetime warranties. The rapid adoption of high-efficiency lighting in corporate, utility, and governmental sectors ensures consistent demand for sophisticated LED replacement modules designed for extreme performance and longevity. Stringent occupational safety regulations further mandate the use of certified intrinsically safe LED lighting in high-risk industrial environments, sustaining growth in this specialized segment.

Asia Pacific (APAC) is the undisputed leader in terms of market volume and is rapidly increasing its share in market value, driven by widespread manufacturing capabilities in countries like China, South Korea, and Taiwan, which serve as global production hubs for LED components and finished products. The region benefits from massive domestic demand, fueled by urbanization, infrastructure development, and a large consumer base shifting from traditional lighting to energy-efficient LED alternatives. Price sensitivity remains high in the general consumer segment, encouraging manufacturers to focus on cost-effective, high-volume production models, but the rapid industrial and construction growth is simultaneously boosting the demand for high-quality, professional-grade inspection and safety lighting solutions, diversifying the regional market landscape.

Europe exhibits stable and sustained growth, emphasizing energy efficiency, sustainability, and adherence to rigorous European Union (EU) standards regarding material safety and disposal. The European market shows a strong preference for high-CRI bulbs and aesthetically integrated modules, particularly in the outdoor recreation and specialty inspection sectors. Countries like Germany and the UK contribute significantly to the tactical and professional markets due to established law enforcement and industrial maintenance requirements. Furthermore, regulatory support and consumer environmental awareness accelerate the phase-out of remaining incandescent technologies, securing a stable replacement market for advanced LED flashlight bulbs.

Latin America and Middle East & Africa (MEA) are emerging markets demonstrating significant growth potential. Latin America's growth is tied to infrastructural investments and expanding consumer access to modern retail channels, facilitating the penetration of imported and locally assembled LED products. The MEA region, particularly the GCC countries and South Africa, sees high demand driven by the oil and gas industry, necessitating explosion-proof (EX-rated) and highly durable LED flashlight bulbs for safety compliance in hazardous areas. Furthermore, challenges in stable power supply across parts of Africa elevate the importance of reliable, long-lasting battery-powered LED solutions for emergency and domestic use, positioning these regions as key growth vectors for the mid-to-long term forecast period.

- North America: Dominant market for premium, tactical, and ultra-high-output (UHO) LED bulbs, driven by professional end-users and stringent performance standards.

- Asia Pacific (APAC): Leading market in volume, characterized by robust manufacturing bases, massive consumer adoption, and growing industrial demand for mid-range and high-performance solutions.

- Europe: Focus on energy efficiency, adherence to strict environmental standards, and strong uptake in specialty sectors like outdoor recreation and professional inspection.

- Latin America (LATAM): Growth propelled by infrastructure development and increasing retail accessibility of cost-effective, energy-efficient LED replacement options.

- Middle East & Africa (MEA): Significant demand originating from the oil and gas sector for intrinsically safe (IS) certified bulbs and general need for reliable portable lighting solutions due to inconsistent power grids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Flashlight Bulb Market.- OSRAM GmbH (Subsidiary of ams AG)

- Cree Inc. (Now Wolfspeed, focusing on core chip technology)

- Nichia Corporation

- Lumileds Holding B.V.

- Seoul Semiconductor Co. Ltd.

- Philips Lighting (Signify N.V.)

- LITE-ON Technology Corporation

- Ledil Oy (Optical solutions provider)

- VARTA Consumer Batteries GmbH & Co. KGaA

- Streamlight Inc.

- Mag Instrument Inc.

- TerraLUX Inc.

- Klarus Lighting Technology Co. Ltd.

- Coast Products

- SureFire LLC

- Fenixlight Limited

- Nitecore (Sysmax Industry Co. Ltd.)

- Peli Products S.L.U.

- Energizer Holdings Inc.

- Shenzhen Qianjin Technology Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the LED Flashlight Bulb market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of replacing incandescent flashlight bulbs with LEDs?

The primary advantage of converting to LED flashlight bulbs is drastically increased energy efficiency and longevity. LEDs consume significantly less battery power while providing superior lumen output, often resulting in 10x longer battery life and bulb lifespans that can exceed 50,000 hours, virtually eliminating the need for frequent bulb replacement.

Are LED flashlight bulbs standardized for compatibility with older flashlight models?

Compatibility is a key concern; however, many manufacturers produce LED replacement bulbs designed with standardized bases, such as PR-base or screw-in E10/E12 formats, specifically to retrofit older incandescent or halogen flashlights, although ensuring compatibility with the host flashlight's voltage and thermal tolerance is crucial for optimal performance.

How does thermal management influence the performance and lifespan of high-lumen LED bulbs?

Effective thermal management, utilizing integrated copper or aluminum heatsinks and advanced thermal interface materials, is critical because excessive heat rapidly degrades LED performance (lumen depreciation) and reduces lifespan. High-lumen bulbs require superior thermal design to dissipate heat efficiently, maintaining junction temperatures below critical limits for sustained brightness and reliability.

Which segment of the LED flashlight bulb market is experiencing the fastest technological growth?

The tactical and industrial application segment is experiencing the fastest technological growth, focusing on ultra-high-output (UHO) bulbs, specialized beam geometries using TIR optics, and compliance with intrinsically safe (IS) certifications, driving innovation in advanced thermal solutions and integrated programmable driver electronics.

What is a Chip-Scale Package (CSP) LED and why is it important for the market?

A Chip-Scale Package (CSP) LED is a technology where the size of the LED package is equivalent to the size of the LED chip itself, offering zero packaging resistance. This is vital for the market as it enables higher power density and better thermal transfer in compact flashlight modules, resulting in brighter, more efficient, and smaller replacement bulbs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager