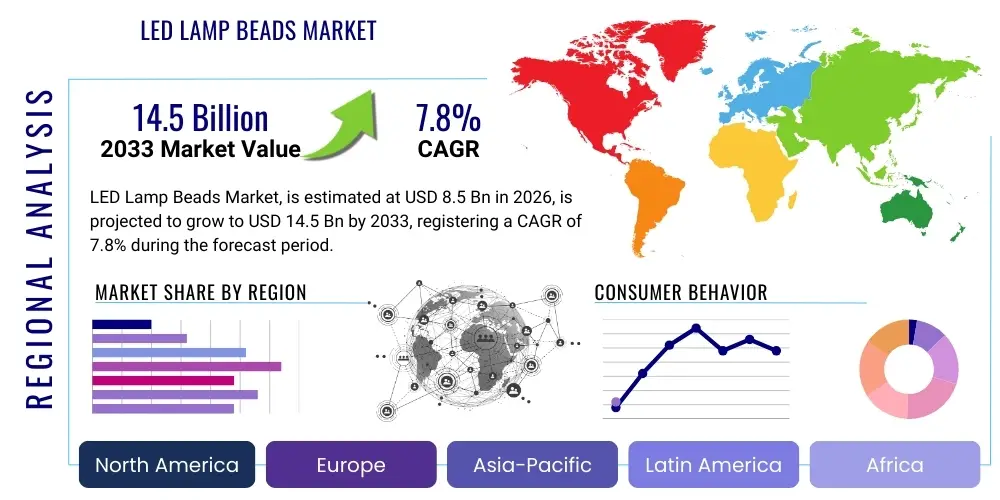

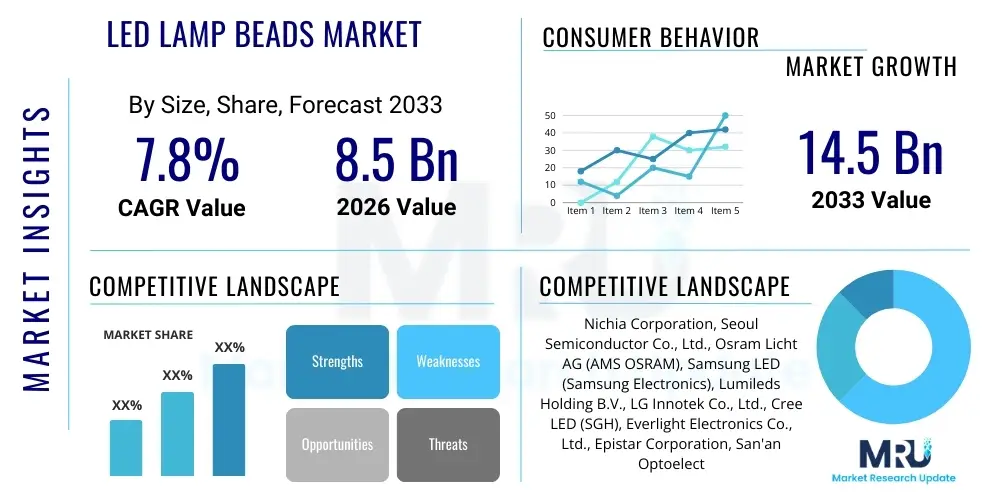

LED Lamp Beads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435791 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

LED Lamp Beads Market Size

The LED Lamp Beads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 14.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global transition toward highly energy-efficient lighting solutions across residential, commercial, and industrial sectors, alongside the burgeoning demand for high-performance displays and advanced automotive lighting systems that require superior light output and reliability. The consistent decrease in the manufacturing cost per lumen, coupled with significant improvements in luminous efficacy and component lifespan, makes LED lamp beads the unequivocally preferred choice over traditional incandescent, fluorescent, and even early-generation LED technologies, cementing the market’s robust growth trajectory over the next decade as infrastructure modernization accelerates globally and regulatory pressures intensify for energy savings.

LED Lamp Beads Market introduction

The LED Lamp Beads Market encompasses the sophisticated ecosystem involved in the manufacturing, distribution, and critical application of light-emitting diode (LED) components, which function as the core semiconductor engines responsible for generating light within any LED-based system. These essential components are typically minute semiconductor chips, often based on gallium nitride (GaN) technology, encapsulated in durable resin or advanced ceramic packaging materials. They produce coherent light when an electric current is passed through the p-n junction, exhibiting characteristics such as superior energy efficiency, remarkably extended operational lifespans often exceeding 50,000 hours, and a compact size that allows for immense design flexibility. The continuous technological breakthroughs, particularly the refinement of advanced packaging technologies like flip-chip design, Chip-on-Board (COB) modules, and the emerging field of MicroLEDs, are continually pushing performance boundaries, making LED beads suitable for highly demanding and specialized applications that require extreme precision, intensity, and robust thermal management, such as state-of-the-art medical imaging equipment, high-definition large-format external displays, and sophisticated automotive matrix headlamps.

Major applications of LED lamp beads span a vast and diverse range of sectors, starting with foundational general illumination—covering everything from indoor residential downlights and office panel lighting to large-scale outdoor street lighting and complex architectural illumination schemes. Beyond general lighting, they are integral to backlighting units (BLUs) for liquid crystal display (LCD) screens in televisions and monitors, and form the backbone of modern automotive lighting systems, including high-beam headlamps, signal lights, and ambient interior lighting, where reliability under vibration and temperature stress is paramount. Furthermore, specialized market niches such as high-intensity signage, industrial machine vision systems, and crucially, horticultural lighting (grow lights) are increasingly dependent on precisely engineered LED components. The inherent benefits of LED technology—including instant start-up capability, minimal waste heat generation, exceptional color rendering index (CRI), and inherent dimmability—have made these components indispensable in modern engineering design, prompting widespread industry adoption as manufacturers across various sectors seek to enhance product quality and meet evolving consumer demands for sustainable technology solutions.

Key driving factors propelling this substantial market expansion include the overarching global commitment to decarbonization and dramatic energy savings, often enforced through stricter governmental energy efficiency mandates and utility rebate programs designed to accelerate the phase-out of legacy lighting. This is strongly supported by rapid global urbanization, which necessitates extensive new construction and upgrades to existing lighting infrastructure, particularly in developing economies. Continuous technological innovation is another critical impetus, focusing intensely on achieving higher lumen output per watt (efficacy) and improving the fundamental reliability and stability of the LED chips, thereby perpetually lowering the total cost of ownership for end-users. Additionally, the explosive demand from the consumer electronics industry for ever-thinner, brighter, and higher-resolution displays, particularly high-end smartphones, premium televisions, and emerging augmented reality (AR) devices which utilize advanced backlighting and MicroLED screens, provides significant and sustained market momentum. Manufacturers are actively investing in next-generation materials like quantum dots to further improve color gamut and efficiency, securing future competitive advantages.

LED Lamp Beads Market Executive Summary

The LED Lamp Beads Market is positioned for robust and sustained growth, driven by a confluence of rigorous energy efficiency standards and rapid technological advancements in semiconductor lighting components and packaging. Current business trends illustrate a distinct strategic pivot toward ultra-miniaturization and achieving exceptionally high power density, exemplified by the aggressive development and prototyping of MicroLED technology, which is expected to fundamentally disrupt the high-end display market within the forecast period. Leading industry participants are actively pursuing strategies of deep vertical integration, aiming to establish comprehensive control over the entire supply chain—from the initial epitaxial wafer production (the most IP-sensitive stage) to the final, specialized packaging and testing processes. This vertical control strategy is critical for optimizing production costs, maintaining stringent quality consistency, and, most importantly, insulating operations against the increasingly volatile global supply chain for critical raw materials such as rare earth phosphors and sapphire substrates. Furthermore, strategic market consolidation through targeted mergers and acquisitions remains a persistent trend, primarily focused on acquiring specialized intellectual property, securing key material supplier relationships, and rapidly accessing high-growth, underserved regional markets, particularly in emerging industrializing nations.

From a geographical perspective, the Asia Pacific (APAC) region continues its historic dominance, acting as the global powerhouse for both high-volume LED component manufacturing and primary consumption, anchored by the massive industrial capabilities of nations including China, Taiwan, South Korea, and Japan. This region is critical to global supply, benefiting from vast, scalable manufacturing ecosystems and favorable governmental policies supporting electronics production. Conversely, North America and Europe function as advanced, mature markets characterized by exceptionally high adoption rates for premium, connected, and highly specialized LED lighting systems, emphasizing sophisticated features like dynamically tunable white light, human-centric lighting (HCL) capabilities, and superior color fidelity necessary for professional and high-value applications. Regional dynamics are significantly shaped by localized policy environments; for instance, the European Union's focus on sustainable product design and mandated product longevity drives demand for extremely high-reliability components, while rapid infrastructure deployment in APAC prioritizes cost-effectiveness and mass scalability, leading to distinct and competitive market requirements across these major geographies.

A detailed analysis of segment trends reveals that high-power LED beads are experiencing accelerated adoption in infrastructure and automotive sectors due to their necessity in high-lumen, durable applications like modern street lighting and vehicle headlamps. Concurrently, mid-to-low power LED beads remain the foundational volume segment, dominating general illumination and the massive consumer electronics backlighting sector. While general lighting retains the largest overall market share by volume, the fastest and most transformative growth rates are concentrated in highly specialized application segments. This includes the massive expansion of horticultural lighting, driven by the global shift towards efficient controlled environment agriculture (CEA), and the exponential increase in demand for UV-C LEDs, fueled by enhanced public health consciousness and the necessity for sophisticated air and surface disinfection systems across various public and commercial spaces, presenting substantial long-term, high-margin opportunities for technologically advanced component suppliers.

AI Impact Analysis on LED Lamp Beads Market

A comprehensive examination of common stakeholder questions regarding the influence of Artificial Intelligence (AI) on the LED Lamp Beads Market crystallizes several high-priority thematic areas: the use of AI to drastically enhance manufacturing precision and yield, the deployment of machine learning for robust component reliability prediction, and the leveraging of sophisticated algorithms to power intelligent, adaptive light control systems. Users are keenly interested in understanding exactly how AI tools can be integrated into notoriously sensitive processes, such as Multi-Wafer Epitaxy (MOCVD) and microscopic chip-dicing, to minimize process variation and maximize defect-free output, a persistent challenge in high-volume production. Furthermore, the capacity of machine learning models to analyze real-world operational data to accurately predict the specific component failure rates and long-term lumen degradation (lumen maintenance) of high-value LED installations is a major concern for systems integrators seeking to guarantee product warranties and maintenance schedules. Developers are particularly focused on how AI facilitates the creation of truly sophisticated adaptive lighting solutions that move far beyond simple sensor triggers, automatically adjusting color temperature, spectral composition, and intensity in real-time based on detailed data inputs concerning occupancy, ambient light spectrum, circadian rhythm requirements, and explicit user preferences, thus delivering genuine personalized illumination experiences across environments.

The integration of AI acts as a fundamental transformation agent for both the supply-side manufacturing protocols and the demand-side application sophistication within the LED lamp beads ecosystem. On the manufacturing front, AI-powered Quality Control (QC) systems are now utilizing advanced computer vision and deep learning architectures to execute instant and non-destructive identification of microscopic defects in LED chips, including crystalline irregularities and passivation layer flaws, which were previously impossible to detect consistently at high production speeds. This capability not only results in a substantial reduction of expensive scrap material but also ensures superior product consistency across vast production batches, which is absolutely vital for meeting the tight color and brightness binning specifications demanded by high-end customers. Moreover, complex AI models are being used extensively in the computer-aided design (CAD) and simulation phases, allowing manufacturers to rapidly optimize the precise material composition, internal chip geometry, and complex thermal stack-up designs, effectively maximizing luminous efficacy and optimizing heat dissipation characteristics well before any physical prototype is ever fabricated, significantly condensing the traditional product development timeline and saving substantial R&D resources.

Looking at the application dimension, AI is the indispensable engine driving the next generation of highly intelligent and connected lighting systems. Sophisticated machine learning algorithms are designed to aggregate and process enormous datasets—sourced from integrated environmental sensors, network-wide occupancy mapping, energy consumption profiles, and user interaction feedback—to construct highly dynamic and optimized light scenes that actively contribute to enhanced productivity, mood elevation, and overall human well-being, commonly referred to as Human-Centric Lighting (HCL). This technological paradigm shift redefines the LED lamp bead; it is no longer merely a light source, but rather a crucial, networked data acquisition and transmission point embedded within a complex intelligent infrastructure. The advanced functional requirements enabled by AI significantly amplify the demand for extremely high-quality, reliable, and communication-enabled LED components. This necessitates that manufacturers enforce stricter production tolerances, integrate sophisticated control electronics directly into the component packaging architecture, and ensure standardized communication compatibility across diverse operating conditions to support seamless integration into broad IoT and smart building frameworks globally.

- AI optimizes complex epitaxial growth (MOCVD) parameters and wafer processing sequences, substantially enhancing material purity and achieving maximum yield rates.

- Machine Learning (ML) models analyze long-term operational data to predict precise LED component degradation profiles and potential failure points, thereby enabling proactive maintenance schedules for large installations.

- Advanced deep learning algorithms accelerate microscopic visual inspection, instantly identifying minute crystalline and bonding defects during high-throughput manufacturing (Computer Vision QC).

- AI-driven intelligent lighting systems create sophisticated, autonomously adaptive Human-Centric Lighting (HCL) environments based on real-time sensory data and occupant behavioral analysis.

- Predictive algorithms enable dynamic and preventative thermal management by anticipating and mitigating detrimental heat accumulation in ultra-dense LED arrays, preserving performance metrics and component lifespan.

- Generative AI tools are increasingly utilized to assist in optimizing the complex optical design of LED fixtures, achieving superior light distribution patterns while minimizing necessary energy input for specific tasks.

- AI integration within IoT gateways facilitates high-level control, real-time diagnostics, and remote reconfiguration of vast, geographically distributed commercial and municipal LED lighting networks.

- Advanced predictive analytics aids manufacturers in optimizing inventory levels, managing supply chain complexity, and accurately forecasting demand for specific LED chip types based on evolving market trends and seasonal fluctuations.

- AI-enhanced binning processes utilize complex cluster analysis to sort chips with unprecedented precision, dramatically improving color consistency (CCT) and brightness uniformity across various production batches.

DRO & Impact Forces Of LED Lamp Beads Market

The LED Lamp Beads Market is fundamentally shaped by a dynamic and powerful confluence of Drivers, Restraints, and Opportunities (DRO), which collectively exert substantial impact forces defining its trajectory and competitive structure. The most dominant driver remains the overwhelming economic and environmental necessity for aggressive energy conservation globally, underpinned by strict, mandatory governmental phase-out schedules for all inefficient lighting technologies (like fluorescent and incandescent bulbs) and ambitious national energy consumption reduction targets established by international climate accords. This foundational driver is strongly amplified by unrelenting technological advancements focused on significantly increasing the component’s luminous efficacy (lumens per watt) and successfully extending the product’s guaranteed operational lifespan, perpetually improving the financial return on investment (ROI) calculation for consumers and large-scale industrial end-users. The global, irreversible transition toward deeply integrated intelligent and connected lighting systems, which require reliable, high-specification LED components as their core building blocks, further solidifies and intensifies the long-term demand structure for advanced lamp beads across all major economic sectors.

Despite these powerful drivers, market expansion faces notable restraints that complicate profitability and deployment scalability. A primary hurdle remains the significantly high initial capital expenditure (CapEx) associated with specialized, cutting-edge LED applications, particularly the massive financial investment required for the fabrication plants and complex intellectual property needed to successfully scale MicroLED display production. A second critical restraint involves the persistent volatility and potential scarcity of essential raw material inputs, including crucial rare earth elements utilized in high-performance phosphors and specialized substrates (e.g., gallium nitride precursors and synthetic sapphire wafers). Such supply chain vulnerabilities, often exacerbated by geopolitical tensions, can lead directly to disruptive supply shortages and unpredictable material price fluctuations, challenging production planning. Furthermore, the inherent lack of truly universal standardization across critical performance criteria, such as thermal management protocols, fine color consistency specifications (the 'binning' dilemma), and the verifiable substantiation of product lifespan claims within an intensely fragmented and highly competitive manufacturing landscape, continues to pose adoption uncertainty and necessitates complex quality vetting by sophisticated system integrators.

Conversely, the market is rich with significant, high-growth opportunities arising directly from technological breakthroughs and emerging socio-economic demands. The swift and robust commercialization of Ultra-Violet (UV) LEDs, especially the shorter wavelength UV-C spectrum for rapid air and surface disinfection and sterilization, represents a massive and resilient market potential, heavily catalyzed by heightened global hygiene standards and infectious disease prevention protocols post-pandemic. Secondly, the rapid global expansion of Controlled Environment Agriculture (CEA) necessitates the large-scale deployment of highly specialized, spectrally tuned horticultural LEDs, offering manufacturers high-margin, stable growth avenues that are substantially differentiated from the competitive general lighting sector. Additionally, ongoing technological leaps in advanced packaging techniques, such as Chip Scale Packaging (CSP) and next-generation Wafer-Level Packaging (WLP), promise continued cost reduction and further component miniaturization. These advancements are opening doors for LED integration into entirely new product categories, including flexible screens, smart textiles, advanced medical diagnostics, and enhanced projection systems. Overall, the collective impact forces are strongly weighted toward positive, long-term, and expansive growth, contingent primarily on the industry’s ability to consistently mitigate raw material sourcing risks and continuously deliver products that meet increasingly stringent performance and reliability metrics.

Segmentation Analysis

The LED Lamp Beads Market is meticulously segmented across multiple dimensions, including input power consumption, sophisticated packaging technology utilized, constituent material science, and diverse end-use application areas, providing vital granular insights into current market dynamics, regional demand structures, and profitable specialized areas. The fundamental segmentation based on power rating is critical, as it directly correlates with the final application: low-power segments (< 0.5W) are predominantly found in indicators and standard consumer electronics backlighting, while high-power beads (> 3W) are absolutely essential for durable, high-intensity requirements like outdoor architectural lighting and advanced automotive functional systems. The technological evolution in packaging techniques—which includes Surface Mount Devices (SMD), Chip-on-Board (COB), and the cutting-edge Chip Scale Package (CSP)—represents a major point of differentiation, with technologies competing vigorously based on their capacity for efficient thermal management, total system cost effectiveness, and ease of automated integration into the final manufactured product, compelling manufacturers to invest ceaselessly in advanced assembly automation and precise quality control infrastructure.

Material segmentation, which primarily encompasses the base semiconductor substrate (e.g., sapphire, silicon) and the formulation of the critical phosphor system used to convert blue light into white or other colors, is the determinant factor for defining critical performance characteristics, such as the achievable Color Rendering Index (CRI) and the overall luminous efficiency. While Gallium Nitride (GaN) remains the undisputed foundational material for producing high-efficiency blue and white LEDs, intensive research into next-generation alternatives, including Silicon Carbide (SiC) and novel compound semiconductors like Gallium Arsenide (GaAs) for specific infrared (IR) and UV wavelengths, is continuously driving advanced innovation. The persistent manufacturing complexity inherent in achieving highly consistent and precise color binning across high-volume production requires state-of-the-art metrology equipment and highly sophisticated material science expertise among the dominant market leaders. Understanding the nuanced performance variations and supply chain specifics related to these material-centric segment dynamics is absolutely essential for companies targeting premium and high-specification lighting markets.

From an application perspective, general illumination—driven by massive global volume replacement demand and new construction—maintains the largest overall market share. However, the most compelling opportunities for revenue growth are emerging within specialized, high-tech sectors. The automotive segment is experiencing dramatic growth, particularly with the widespread adoption of adaptive matrix headlamps and extensive interior ambient lighting systems, which require thousands of highly reliable, minute, individually controllable LED components. Similarly, the specialized horticultural sector demands customized, narrow-band spectral LEDs, leading to rapid market expansion. The increasing global penetration of smart devices, along with the development of flexible and wearable electronics, also elevates the importance of high-efficiency, ultra-thin LEDs for display backlighting and indicator functions. This broad and diversified application landscape underpins the market's stability and resilience, ensuring that growth momentum is distributed across several independent, resilient sectors, effectively insulating the overall market from potential slowdowns or volatility specific to any single end-use area, and demanding comprehensive technological agility from suppliers.

- By Power Consumption:

- Low Power (< 0.5W): Used in indicators, mobile devices, and display backlights.

- Mid Power (0.5W to 3W): Dominant in general residential and commercial lighting applications.

- High Power (> 3W): Essential for demanding applications like automotive headlamps, street lighting, and industrial high-bay fixtures, prioritizing thermal stability.

- By Type of Packaging:

- Surface Mount Device (SMD) LEDs: The most common, highly versatile, and cost-effective packaging type for general use.

- Chip-on-Board (COB) LEDs: Preferred for high-density light output and superior thermal management in floodlights and specialized fixtures.

- Through-Hole LEDs: Older technology, still used for simple indicators and basic signage requiring mechanical robustness.

- Chip Scale Package (CSP) LEDs: Highly advanced, compact, and efficient, critical for backlighting and automotive matrix systems due to small size and minimal thermal resistance.

- Integrated LEDs (e.g., Module LEDs): Pre-assembled systems simplifying integration for fixture manufacturers, offering standardized performance metrics.

- By Application:

- General Lighting (Residential, Commercial, Industrial, Outdoor): The core volume driver for the market, driven by replacement and new construction.

- Backlighting Units (BLUs) for Displays: Crucial for LCD televisions, monitors, smartphones, and tablets, demanding uniformity and thin profiles.

- Automotive Lighting (Interior and Exterior): High-reliability segment including headlamps, tail lamps, and sophisticated ambient interior lighting systems.

- Specialty Lighting (Horticultural, UV-C Disinfection, Medical): High-margin applications requiring precise spectral tuning and verified performance.

- Signage and Indicators: Including digital display boards, traffic signals, and notification lights.

- By End-Use Industry:

- Consumer Electronics (Smartphones, TVs, Wearables)

- Automotive (OEMs and Aftermarket)

- Construction and Real Estate (Commercial and Residential infrastructure)

- Healthcare and Medical Devices (Surgical lights, sterilization equipment)

- Agriculture (Controlled Environment Agriculture/Vertical Farms)

Value Chain Analysis For LED Lamp Beads Market

The value chain characterizing the LED Lamp Beads Market is inherently complex, characterized by several highly specialized tiers, beginning with the highly capital-intensive upstream supply of critical raw materials and extending through sophisticated midstream manufacturing processes to widely distributed downstream application markets. Upstream activities are dominated by specialized chemical and materials companies responsible for producing the foundational semiconductor wafers, which serve as the substrate (typically sapphire, silicon carbide, or increasingly silicon) and the precise, ultra-pure chemicals required for the epitaxial growth of the light-emitting layers (GaN, InGaN, AlGaInP). This initial phase demands immense capital expenditure, highly proprietary manufacturing techniques, and tightly protected intellectual property (IP). Key challenges at the upstream level center on securing a stable, non-volatile supply chain for rare earth phosphors necessary for the precise color conversion process and maintaining cost-effective production scaling while guaranteeing the exceptional purity and consistency of the epi-wafers, which fundamentally dictates the quality of the final light output and the achievable efficiency of the component.

The midstream segment is dedicated to the core processes of fabrication and sophisticated packaging. Fabrication involves epitaxy (the delicate growth of semiconductor layers), photolithography, wafer processing (including metallization and electrical testing), and finally, chip processing (dicing the wafer into individual, minute chips). The subsequent packaging phase transforms the bare LED chip into a usable, thermally robust lamp bead format (e.g., SMD, COB, CSP). This packaging process is absolutely vital, as it manages the component's critical thermal dissipation path, optimizes the light output beam pattern through specialized optics, and ensures the mechanical protection and electrical connection of the fragile chip. Downstream operations involve the intricate process of market distribution and application integration. Direct distribution models are commonly utilized for high-volume, performance-critical customers, such as global automotive tier-one suppliers or major OEM manufacturers of industrial lighting fixtures, where performance specifications are highly customized and complex long-term contractual agreements necessitate close, technical collaboration and quality traceability between the component manufacturer and the end-product assembler to optimize both integration ease and final system performance under stress.

The indirect distribution network plays a vital role in reaching secondary and tertiary markets, utilizing a tiered structure of specialized regional distributors, electronic component wholesalers (like Digi-Key or Mouser), and increasingly, robust online commercial marketplaces, catering primarily to small-to-midsize enterprises (SMEs), regional repair and maintenance sectors, and specialized custom lighting integrators. The selection of the optimal distribution channel significantly influences factors such as the product's time-to-market speed, regional pricing stability, and the level of available post-sale technical support and warranty coverage. A notable evolutionary trend is the accelerating market shift toward pre-integrated LED modules and complete smart lighting sub-systems. This trend is effectively shortening the traditional long distribution chain, as system integrators are increasingly sourcing sophisticated, tested modules directly from high-tier manufacturers rather than procuring and assembling individual lamp beads. This consolidation emphasizes the growing importance of value-added module production capabilities within the midstream segment and simultaneously diminishes the market role of traditional, component-focused resellers and distributors, necessitating strategic re-evaluation of market engagement models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 14.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nichia Corporation, Seoul Semiconductor Co., Ltd., Osram Licht AG (AMS OSRAM), Samsung LED (Samsung Electronics), Lumileds Holding B.V., LG Innotek Co., Ltd., Cree LED (SGH), Everlight Electronics Co., Ltd., Epistar Corporation, San'an Optoelectronics Co., Ltd., Toyoda Gosei Co., Ltd., Stanley Electric Co., Ltd., Dominant Opto Technologies Sdn. Bhd., Lite-On Technology Corp., Kingbright Electronic Co., Ltd., Shenzhen Refond Optoelectronics Co., Ltd., Guangzhou Hongli Zhihui Group Co., Ltd., Foshan NationStar Semiconductor Co., Ltd., BDO LED (Bright Display Optoelectronics), Plessey Semiconductors Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Lamp Beads Market Key Technology Landscape

The technological landscape of the LED Lamp Beads Market is defined by a relentless pace of innovation, with core R&D efforts concentrated on significantly elevating luminous efficacy, optimizing component thermal management capabilities, and enabling extreme component miniaturization for high-density integration across diverse platforms. A fundamental and pervasive technological shift involves the mass adoption of advanced packaging methods, most notably Chip Scale Package (CSP) and the emerging Wafer-Level Packaging (WLP). CSP technology effectively eliminates traditional bulky components like lead frames and bonding wires, resulting in an exceptionally small physical footprint, vastly improved direct thermal dissipation pathways, and a reduced overall system assembly cost. This technological approach is crucial for achieving the stringent requirements of next-generation applications, particularly in enabling the ultra-thin backlighting units necessary for premium display panels and the complex, tightly packed, highly effective automotive matrix lighting systems, where maximizing light output within minimal physical volume is a non-negotiable design constraint. Furthermore, sophisticated advancements are continually being made in epitaxial growth methodologies, such as refining Metal-Organic Chemical Vapor Deposition (MOCVD) processes to ensure the creation of highly uniform, high-quality Gallium Nitride (GaN) semiconductor layers, which directly correlate to the ultimate efficiency, stability, and longevity of the final light-emitting component.

Another area receiving immense focus and capital investment is the rigorous development and phased commercialization of MicroLED technology. While this technology is currently navigating complex, high-cost manufacturing challenges, predominantly related to the precise mass transfer and effective defect management of microscopic chips, MicroLEDs represent a substantial leap forward. They are poised to deliver unprecedented performance, offering extraordinary brightness levels, near-perfect contrast ratios (true black), and incredibly fast pixel response times, positioning them as the inevitable successor to both existing OLED and traditional LCD technologies in the highest-tier display applications, including large public screens, premium wearables, and crucial head-mounted augmented reality (AR) devices. The inherent engineering difficulty of accurately handling and placing chips that measure only a few micrometers in size is actively stimulating radical innovation in high-precision robotics, advanced machine vision systems, and specialized alignment and bonding equipment. Simultaneously, the pursuit of superior light quality necessitates parallel innovation in phosphor chemistry. New compositions involving specialized rare earth and even non-rare earth alternatives are being intensely developed to achieve exceptional Color Rendering Indices (CRI > 95) and precise, dynamically configurable color temperatures (tunable white), which are essential requirements for professional fields such as film production lighting, surgical environments, and sophisticated human-centric lighting (HCL) installations that are designed to optimize biological and visual performance.

Efficient and reliable thermal management technology is perhaps the most critical determinant of both the longevity and sustained performance stability of high-power LED lamp beads, making it a major continuous focus area for technological advancement. The necessity of handling increasingly high power densities in constrained spaces drives the demand for intrinsically efficient heat dissipation solutions, which are frequently engineered directly into the component's packaging architecture. This involves the use of advanced, highly thermally conductive materials, often specialized ceramic or metallic substrates, and the utilization of complex flip-chip architectures that drastically minimize the physical thermal resistance path from the semiconductor junction to the external heat sink. Crucially, the fundamental convergence of LEDs with the broader Internet of Things (IoT) ecosystem necessitates the integration of miniaturized sensors and advanced communication protocols directly at the component or module level. This integration empowers the lamp bead to function as a smart data node, transmitting continuous, real-time diagnostic information regarding its operating junction temperature, light output degradation stability, and immediate network connectivity status. This capability is vital for enabling sophisticated predictive maintenance, ensuring high operational uptime, and facilitating the complex, multi-variable control features demanded by modern smart city infrastructure and next-generation commercial building automation projects, fundamentally redefining the technological capabilities expected from a standard LED component.

Regional Highlights

The global LED Lamp Beads Market exhibits substantial variations across major geographical regions concerning manufacturing scale, predominant consumption patterns, underlying growth drivers, and preferred technological adoption rates. These differences necessitate tailored market strategies for global key players.

- Asia Pacific (APAC): APAC is undeniably the global manufacturing hub for LED components, anchored by the industrial capabilities of China, South Korea, Taiwan, and Japan. It commands the largest global market share, driven by unprecedented production capacity, scalable low-cost supply chains, and massive domestic consumption across general lighting and the consumer electronics sector (especially displays and mobile devices). Future growth is heavily dependent on continued investment in next-generation manufacturing (e.g., MicroLED lines) and robust infrastructure modernization programs across the region.

- North America: This region is characterized by exceptionally high adoption rates for premium, specialized, and highly connected smart lighting solutions. The North American market emphasizes superior quality, seamless integration with IoT platforms, and widespread implementation of Human-Centric Lighting (HCL) methodologies. Key growth drivers include stringent national and state-level energy efficiency regulations, significant corporate investment in sustainable building design, and substantial public sector expenditure on advanced smart city infrastructure projects, creating sustained demand for reliable, high-performance, and network-enabled LED components.

- Europe: The European market is highly regulated, placing intense focus on long-term sustainability, product longevity, and adherence to circular economy principles (e.g., EcoDesign requirements). This regulatory environment drives substantial demand for premium-quality, repairable LED modules with verified, extended lifespans and excellent thermal stability. Europe is a leader in advanced automotive lighting technology, sophisticated architectural illumination, and early-stage large-scale adoption of UV-C disinfection technologies in public transport and medical settings, prioritizing technological quality and environmental compliance over volume.

- Latin America (LATAM): LATAM represents a major emerging growth frontier, primarily driven by rapid urbanization trends and extensive government-mandated initiatives aimed at replacing inefficient, older municipal and industrial lighting with modern, energy-saving LED streetlights. The market is traditionally highly sensitive to initial cost, often favoring dependable mid-power and low-cost solutions, but the technological sophistication of demand is steadily increasing as regional economic stability improves and foreign direct investment in infrastructure accelerates, particularly in major economies like Mexico, Brazil, and Argentina.

- Middle East and Africa (MEA): Growth in the MEA region is strongly underpinned by vast, ongoing construction and real estate development mega-projects (particularly in the GCC member states) and high baseline energy consumption rates, making the deployment of highly energy-efficient LED lighting crucial for massive operational cost savings. The market demands robust, high-power industrial and outdoor LEDs specifically engineered and tested to maintain performance stability under severe, sustained high-ambient-temperature conditions, necessitating component manufacturers to provide components with exceptionally effective, verifiable thermal management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Lamp Beads Market, assessing their financial performance, strategic initiatives, product portfolios, and regional footprint, highlighting their role in shaping the competitive landscape and technological direction of the industry.- Nichia Corporation

- Seoul Semiconductor Co., Ltd.

- Osram Licht AG (AMS OSRAM)

- Samsung LED (Samsung Electronics)

- Lumileds Holding B.V.

- LG Innotek Co., Ltd.

- Cree LED (SGH)

- Everlight Electronics Co., Ltd.

- Epistar Corporation

- San'an Optoelectronics Co., Ltd.

- Toyoda Gosei Co., Ltd.

- Stanley Electric Co., Ltd.

- Dominant Opto Technologies Sdn. Bhd.

- Lite-On Technology Corp.

- Kingbright Electronic Co., Ltd.

- Shenzhen Refond Optoelectronics Co., Ltd.

- Guangzhou Hongli Zhihui Group Co., Ltd.

- Foshan NationStar Semiconductor Co., Ltd.

- BDO LED (Bright Display Optoelectronics)

- Plessey Semiconductors Ltd.

- Sharp Corporation

- Lextar Electronics Corporation

Frequently Asked Questions

Analyze common user questions about the LED Lamp Beads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the accelerating demand for LED Lamp Beads?

The central driver is the pervasive and globally mandated shift toward superior energy efficiency and long-term sustainability. Aggressive governmental regulations worldwide are forcing the retirement of inefficient lighting, making technologically advanced LED components, which offer dramatically lower operational costs and extended lifecycles, the only viable, high-ROI solution for all new and upgraded commercial, residential, and industrial infrastructure.

How will the introduction of MicroLED technology change the display segment?

MicroLED technology is anticipated to fundamentally revolutionize the high-end display market, specifically targeting large-format displays, high-resolution televisions, and critical AR/VR devices. Although current manufacturing costs are high, MicroLEDs deliver vastly superior performance metrics, including peak brightness, infinite contrast ratios, and extreme pixel density, positioning them to eventually replace both established OLED and LCD backlighting technologies in premium applications.

Which geographical region holds the dominant position in global LED manufacturing and supply?

The Asia Pacific (APAC) region, spearheaded by manufacturing powerhouses like China, Taiwan, and South Korea, maintains the dominant position globally. This region benefits from unmatched, large-scale production capacities, highly optimized supply chain efficiencies, and strategic long-term government support for the optoelectronics sector, ensuring it remains the primary source for LED components worldwide.

What is the practical application of Artificial Intelligence (AI) in contemporary LED production?

AI is strategically implemented to significantly enhance both yield and quality in manufacturing. Specialized AI-powered computer vision systems perform instant, non-destructive inspection of microscopic LED chips and wafers, accurately identifying crystalline defects that traditional methods miss. This dramatically improves production consistency, optimizes the critical process of color binning, and ultimately lowers component manufacturing scrap rates.

Besides general lighting, what are the most promising high-growth application segments for specialized LEDs?

The most lucrative high-growth segments are Ultra-Violet (UV-C) LEDs for robust air and surface sterilization and disinfection, a sector fueled by heightened public hygiene demands; and high-efficiency Horticultural Lighting (Grow Lights), which is essential for the sustainable, energy-optimized operation of rapidly expanding Controlled Environment Agriculture (CEA) and indoor vertical farming operations globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager