LED & OLED Displays And Lighting Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435647 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

LED & OLED Displays And Lighting Products Market Size

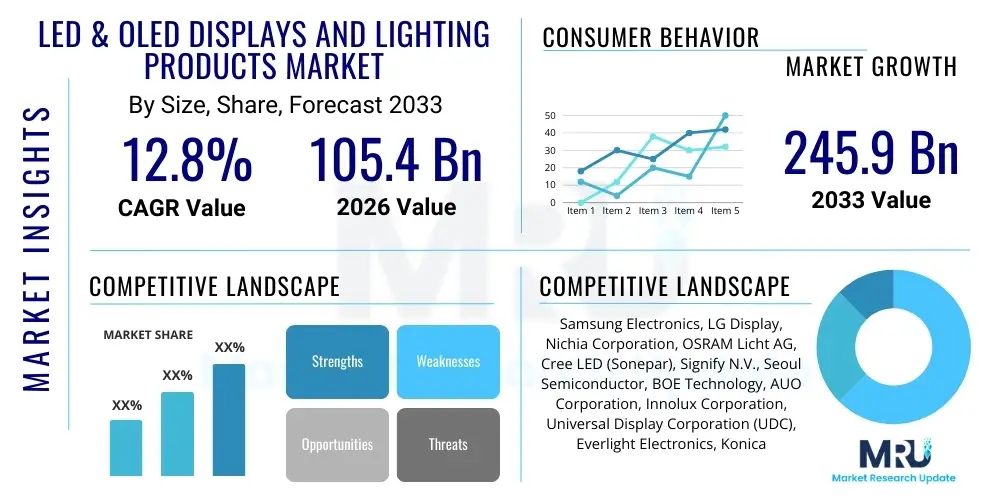

The LED & OLED Displays And Lighting Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $105.4 Billion in 2026 and is projected to reach $245.9 Billion by the end of the forecast period in 2033.

LED & OLED Displays And Lighting Products Market introduction

The LED (Light Emitting Diode) and OLED (Organic Light Emitting Diode) Displays and Lighting Products Market encompasses a broad spectrum of energy-efficient illumination and visualization technologies utilized across consumer electronics, automotive, signage, and general lighting applications. These products offer significant advantages over traditional incandescent and fluorescent technologies, primarily driven by superior energy efficiency, longer lifespan, compact form factors, and improved light quality. LED lighting has reached maturity in many general illumination sectors, while OLED technology, though more niche and premium, dominates high-end display segments dueating to its ability to produce perfect blacks, high contrast ratios, and flexible substrate capabilities. The convergence of lighting and display functionality, particularly in automotive and architectural design, is a key trend shaping market development.

Key product categories within this market include general illumination bulbs, luminaires, specialized automotive lighting, large-format commercial displays, small-to-medium sized consumer electronic screens (smartphones, tablets, wearables), and large-screen TVs. The core technological benefit lies in the solid-state nature of both LEDs and OLEDs, which minimizes energy waste associated with heat generation, leading to substantial reductions in electricity consumption and maintenance costs. Furthermore, the inherent dimmability and color controllability of these sources enable dynamic lighting environments and enhanced user experiences in smart home and commercial building management systems. High color rendering index (CRI) and low flicker rates further position these products as essential components for modern visual environments requiring precision and comfort.

The primary driving factors propelling market expansion include stringent global energy efficiency regulations mandated by various governments to reduce carbon footprints, the accelerating adoption of smart lighting infrastructure integrated with IoT platforms, and the continuous innovation in display technology, particularly the shift towards microLED and flexible OLED solutions. Major applications are concentrated in the residential and commercial sectors for lighting, and in the consumer electronics and automotive sectors for displays. The robust replacement cycle of legacy lighting systems, combined with increasing urbanization and infrastructural development in emerging economies, ensures sustained demand for these advanced light sources and displays globally.

LED & OLED Displays And Lighting Products Market Executive Summary

The global LED & OLED Displays and Lighting Products market is currently undergoing a transformative phase characterized by rapid technological diversification and intense price competition, particularly in the mature LED lighting segment. Business trends indicate a strategic pivot by major manufacturers towards high-margin, specialized product lines such as human-centric lighting, automotive matrix lighting systems, and ultra-high-definition, large-format OLED displays. Consolidation among smaller players and vertical integration by display giants to secure control over crucial supply chains, especially in OLED panel manufacturing and driver ICs, are dominant corporate strategies. Furthermore, sustainability and circular economy principles are increasingly influencing product design, focusing on modularity, recyclability, and extended product life cycles to meet escalating consumer and regulatory demands.

Regionally, the Asia Pacific (APAC) continues to assert its dominance, primarily driven by robust manufacturing capabilities in China, South Korea, and Taiwan, which account for the majority of global production capacity for both components and finished goods. Rapid infrastructural development, coupled with aggressive government initiatives promoting LED adoption in major economies like India and Southeast Asian nations, fuels regional demand. North America and Europe, while having slower growth rates in general illumination, lead the adoption of sophisticated, value-added products, including high-end OLED TVs, smart retail displays, and advanced automotive lighting features. These regions prioritize features like interoperability, connectivity, and superior optical performance, driving innovation towards premiumization rather than just volume.

Segment trends highlight the strong momentum in the OLED display segment, specifically within the premium smartphone and large-screen TV categories, largely displacing high-end LCD technology due to superior picture quality. In the lighting sector, smart and connected lighting systems are the fastest-growing sub-segment, driven by their integration into broader smart city and smart building frameworks. The transition from general-purpose LED chips to specialized semiconductor architectures, such as Mini-LED and MicroLED for displays and high-power COB (Chip-on-Board) packages for industrial lighting, reflects the market’s focus on performance optimization. The automotive segment also shows exceptional growth, moving beyond basic illumination to interactive and dynamic lighting solutions, significantly enhancing safety and aesthetic design.

AI Impact Analysis on LED & OLED Displays And Lighting Products Market

User queries regarding the impact of Artificial Intelligence (AI) on the LED & OLED market frequently revolve around three core themes: optimization of manufacturing processes, enhancement of display functionality, and the capability of AI-driven smart lighting systems. Users are concerned about how AI can lower production costs, especially for complex technologies like OLED and MicroLED, through predictive maintenance and yield rate improvement. They also seek information on how AI facilitates personalized viewing experiences, dynamic contrast adjustment, and energy efficiency in display technology, moving beyond simple automation. In the context of lighting, the primary interest lies in adaptive illumination—systems that use AI algorithms to interpret environmental data, occupant behavior, and circadian rhythm science to dynamically adjust light color, intensity, and timing for optimal health and productivity.

AI’s influence is profound, primarily streamlining complex fabrication processes where precision is paramount. In display manufacturing, machine learning algorithms are utilized for defect detection at microscopic levels, far surpassing human visual inspection. This allows for immediate process correction, significantly boosting yield rates for high-resolution panels, which is particularly critical for MicroLED adoption. Furthermore, AI optimizes material deposition techniques in OLED production, leading to improved uniformity and color accuracy across panels. This technological advancement addresses one of the major historical barriers to mass OLED adoption: cost-effective, consistent quality production.

Beyond manufacturing, AI integrates directly into the final product utility. In smart lighting, AI platforms analyze occupancy patterns, weather data, and ambient light levels in real-time to generate optimal lighting profiles, achieving maximum energy savings without compromising user comfort. For displays, AI upscaling techniques and motion processing improve image clarity and responsiveness. The future vision involves fully self-learning lighting grids that adapt not just to immediate needs but predict future requirements based on historical data, transforming lighting from a simple utility into an interactive, human-centric system that positively impacts well-being and security.

- AI-driven predictive maintenance drastically reduces downtime in high-cost display fabrication lines.

- Machine learning algorithms optimize OLED and MicroLED yield rates and material usage efficiency.

- AI enables sophisticated, real-time image processing for superior contrast and dynamic range in displays.

- Smart lighting systems utilize AI for predictive, adaptive control based on occupant behavior and circadian rhythms.

- AI enhances quality control (QC) in semiconductor packaging and optical assembly by automating defect inspection.

- Personalized lighting profiles and color tuning are achieved through localized AI inference engines in smart devices.

- Supply chain resilience and demand forecasting are improved via AI analysis of complex global market data.

DRO & Impact Forces Of LED & OLED Displays And Lighting Products Market

The market is defined by a dynamic interplay of potent growth drivers and significant technological and structural restraints, underpinned by expansive opportunities in emerging technology sectors. The primary drivers include global mandates for energy conservation, aggressive smart city development projects demanding connected lighting infrastructure, and the relentless consumer demand for thinner, flexible, and higher-resolution display devices. Conversely, high initial capital expenditure required for setting up advanced OLED and MicroLED fabrication facilities, coupled with the technical complexity of achieving mass transfer in MicroLED production, act as major restraints. The high pace of technological obsolescence also necessitates continuous, heavy investment in R&D, presenting a financial burden for smaller market participants. These opposing forces—sustainability-driven demand versus complex manufacturing economics—create a highly competitive and fluctuating market environment.

Opportunities are predominantly concentrated in niche, high-value applications. The emergence of foldable and rollable OLED displays is opening new form factors for consumer electronics, while the automotive sector offers vast potential through matrix LED headlamps, digital signage integration, and interior ambient lighting personalization. Furthermore, the specialized agricultural lighting (horticulture) sector and medical imaging display market represent significant untapped growth areas where LED and OLED technologies offer distinct performance advantages, such as specific light spectrum control and high diagnostic image fidelity. The convergence of 5G infrastructure deployment and edge computing also creates an opportunity for smarter, highly responsive displays and lighting networks, moving processing power closer to the end-user device.

The overall impact forces are overwhelmingly positive, leading to substantial market expansion. Technological innovation acts as a powerful driver, continually improving efficacy (lumens per watt) for lighting and pixel density for displays, thereby addressing competitive pressures and consumer expectations simultaneously. However, economic forces, particularly geopolitical trade tensions and fluctuations in raw material costs (e.g., rare earth elements and specialized polymers), introduce volatility, impacting the stability of profit margins across the value chain. Regulatory forces, enforcing efficiency standards and phasing out older technologies, provide a steady, external impetus for market transformation, guaranteeing a foundational level of replacement demand throughout the forecast period. The net effect is a high-growth trajectory but one characterized by periods of intense innovation and necessary adaptation.

Segmentation Analysis

The LED & OLED market is comprehensively segmented based on technology type, application, product category, and geographical region, reflecting the diversity of end-use cases and the varying maturity levels of different components. Segmentation allows stakeholders to accurately gauge demand pockets, assess competitive intensity within specific niches, and tailor product development strategies. The primary segmentation revolves around distinguishing between display products (characterized by pixel density and panel flexibility) and lighting products (defined by efficacy, color temperature, and form factor). The growing prominence of MicroLED and Mini-LED technologies necessitates granular segmentation within the display components category to track the displacement potential of existing LCD and traditional OLED panels.

Further analysis focuses heavily on the application landscape, separating mature applications like residential general illumination from high-growth sectors such as high-performance automotive lighting and specialized industrial applications (e.g., explosion-proof lighting and medical displays). The integration level also defines segmentation, distinguishing between discrete components (chips, packages, modules) and complete systems (luminaires, finished displays). This granular approach is vital because the profitability and competitive dynamics for component manufacturers (upstream) differ significantly from those for finished product integrators (downstream), especially concerning intellectual property and standardization requirements.

- By Technology:

- LED (Standard, High-Brightness, COB, Mini-LED)

- OLED (PMOLED, AMOLED, WOLED, Flexible/Foldable OLED)

- MicroLED

- Quantum Dot LED (QD-LED)

- By Application (Displays):

- Smartphones and Tablets

- Television and Monitors

- Wearable Devices

- Digital Signage and Advertising Boards

- Automotive Displays (Infotainment, Head-Up Displays)

- By Application (Lighting):

- General Illumination (Residential, Commercial, Industrial)

- Automotive Lighting (Exterior and Interior)

- Specialty Lighting (Horticulture, Medical, UV/IR)

- Backlighting Units (BLU)

- By Component:

- Chip/Die

- Package/Module

- Driver ICs and Controllers

- Substrates and Encapsulation Materials

Value Chain Analysis For LED & OLED Displays And Lighting Products Market

The value chain for LED and OLED products is complex and capital-intensive, starting with sophisticated upstream semiconductor processes and extending through global distribution channels. Upstream activities involve the synthesis of raw materials such as sapphire or silicon carbide substrates, specialized organic compounds for OLED emitters, and phosphors used to achieve specific light colors. Key processes at this stage include epitaxy—the growth of crystalline layers on wafers—and chip fabrication. This stage is characterized by high technological barriers, reliance on patented manufacturing techniques, and domination by a few specialized materials suppliers and chip foundries, primarily located in Asia. Efficiency and material purity at this stage dictate the final product performance (efficacy and color quality).

Midstream processing involves packaging and module assembly. For lighting, this means mounting the LED chip onto a package (e.g., COB or SMD) and integrating it with thermal management systems (heatsinks) and electronic components (drivers) to create a functional module or luminaire. For displays, this encompasses panel mass production, including thin-film transistor (TFT) backplane manufacturing, emitter deposition (for OLEDs), encapsulation, and final module assembly with driver integrated circuits (ICs). This stage sees intense automation and standardization, though custom display manufacturing still requires specialized techniques. Integration capabilities, such as advanced thermal management and miniaturization, are crucial differentiators at the module level.

Downstream involves distribution, retail, and installation. The distribution channel is bifurcated: direct sales channels dominate large-scale commercial and industrial projects where customization and energy audits are required (e.g., smart city contracts), ensuring close collaboration between manufacturers and facility managers. Indirect channels, including traditional electrical distributors, retail hardware stores, and e-commerce platforms, manage the high-volume, standardized consumer products (bulbs and basic fixtures). The competitive landscape in the downstream is fragmented, focusing on logistics efficiency, branding, and installer relationships. Successful companies manage a tight supply chain that links rapid design changes upstream with prompt delivery and technical support downstream.

LED & OLED Displays And Lighting Products Market Potential Customers

The potential customer base for the LED & OLED market is extremely broad, spanning multiple B2B and B2C segments due to the foundational role of these technologies in modern infrastructure and personal electronics. B2B customers represent the largest volume segment, primarily driven by large-scale infrastructure projects, including commercial real estate developers updating office spaces, governmental bodies implementing smart city initiatives, and industrial operators replacing high-bay lighting for energy efficiency gains. These customers prioritize longevity, high reliability (backed by lengthy warranties), and sophisticated integration capabilities, such as DALI or IoT platform compatibility, to ensure comprehensive building automation and control. The return on investment (ROI) derived from energy savings is the paramount purchasing driver for this cohort.

In the B2C sector, potential customers are primarily consumers seeking superior entertainment experiences and energy savings. For lighting, this includes homeowners purchasing smart bulbs and designer luminaires for home automation, driven by convenience and aesthetic appeal. For displays, the focus is on early adopters and premium buyers of cutting-edge consumer electronics—individuals purchasing high-end OLED TVs, flagship smartphones, or virtual/augmented reality (VR/AR) headsets. These buyers are driven by performance metrics such as refresh rate, color gamut, pixel density, and the thinness/flexibility of the device, often prioritizing brand reputation and technological novelty over immediate cost savings.

A rapidly expanding specialized customer base includes the automotive industry (OEMs and Tier 1 suppliers), which are increasingly integrating advanced LED matrix headlights and large-format OLED digital dashboards. Healthcare facilities are also major buyers, requiring high-CRI lighting for surgical theaters and specialized, high-resolution diagnostic displays (often OLED) where color accuracy and contrast are medically critical. Furthermore, the specialized horticulture sector represents a unique customer segment focused entirely on spectral performance, requiring tailored LED solutions to optimize plant growth cycles, driving demand for specific wavelengths rather than general illumination intensity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $105.4 Billion |

| Market Forecast in 2033 | $245.9 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Display, Nichia Corporation, OSRAM Licht AG, Cree LED (Sonepar), Signify N.V., Seoul Semiconductor, BOE Technology, AUO Corporation, Innolux Corporation, Universal Display Corporation (UDC), Everlight Electronics, Konica Minolta, Lumileds, Lite-On Technology, Acuity Brands, Panasonic Corporation, TCL Technology, Skyworth Group, Epistar Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED & OLED Displays And Lighting Products Market Key Technology Landscape

The technological landscape of the LED and OLED market is highly dynamic, driven by the pursuit of higher efficiency, increased luminosity, and miniaturization. In the display sector, traditional AMOLED (Active Matrix OLED) and WOLED (White OLED with Color Filters) dominate high-end consumer devices, but the innovation focus has rapidly shifted towards MicroLED and Quantum Dot technologies. MicroLED promises the self-emissive advantages of OLED (perfect blacks) coupled with superior brightness and longevity comparable to traditional inorganic LEDs. However, its mass production remains challenged by the "mass transfer" problem—accurately moving millions of microscopic LEDs onto a single substrate—making it currently viable mostly for very large public displays or premium niche products. Quantum Dot Enhancement Film (QDEF) technology is utilized to boost color gamut and efficiency in standard LCDs, bridging the gap between existing LCD technology and true OLED performance.

In the lighting segment, the trend leans heavily towards achieving superior spectral performance and system integration. Advancements in Chip-on-Board (COB) technology allow for greater lumen density and simpler thermal management, crucial for industrial and high-bay lighting applications. Furthermore, the development of tunable white LEDs and full-spectrum LED chips facilitates Human-Centric Lighting (HCL), which aims to mimic natural daylight patterns to influence occupant alertness and well-being. This requires precise control over color temperature (CCT) and intensity, often managed by sophisticated driver ICs and networked control systems. The emphasis is no longer just on energy saving, but on optimizing the qualitative aspects of light.

Integration technologies are also paramount. Flexible and rollable display substrates, often utilizing polyimide (PI) or flexible glass, are enabling new product categories like foldable smartphones and dynamic digital signage. For lighting, this means integrating wireless communication standards (e.g., Bluetooth Mesh, Zigbee, Wi-Fi) directly into the fixture, transforming standalone lights into nodes within an Internet of Things (IoT) network. The industry is also investing heavily in advanced semiconductor packaging techniques, such as flip-chip and vertical-chip LEDs, to improve thermal dissipation and current density, pushing the boundaries of light output while minimizing physical footprint. The ongoing maturation of manufacturing techniques, particularly using advanced lithography and chemical vapor deposition (CVD), is key to commercializing next-generation displays and light sources cost-effectively.

Regional Highlights

Regional dynamics within the LED & OLED market are sharply differentiated by manufacturing dominance versus consumption maturity. Asia Pacific (APAC) serves as the indisputable global manufacturing hub, particularly South Korea, China, and Taiwan, which control over 90% of the global OLED panel production capacity and a substantial portion of LED component manufacturing. APAC is also the largest consuming region due to immense population size, rapid urbanization, and high governmental spending on infrastructure modernization and smart city initiatives, particularly in China and India. This regional dominance is projected to continue throughout the forecast period, fueled by internal demand and export strength.

North America and Europe represent mature, high-value markets characterized by slower volume growth but rapid adoption of premium and specialized products. In these regions, the replacement cycle for standard LED lighting is reaching saturation, shifting market focus toward smart, connected lighting systems, personalized home automation, and advanced automotive applications. Strict energy regulations in the EU and high consumer discretionary spending in the US drive the demand for certified, high-quality, and technologically integrated products, often commanding higher average selling prices (ASPs). These regions lead in the adoption of emerging display form factors like foldable devices and MicroLED wall displays for residential and commercial use.

- Asia Pacific (APAC): Dominates global manufacturing (OLED/LED components); highest volume consumption due to infrastructural development; leading adopter of commercial digital signage and general illumination projects. Key countries: China, South Korea, Japan.

- North America: Strong market for high-end OLED televisions, specialized medical displays, and robust smart home lighting systems; high investment in R&D for MicroLED commercialization. Key countries: United States, Canada.

- Europe: Driven by stringent environmental regulations and high standards for quality and lifespan; rapid adoption of Human-Centric Lighting (HCL) and sophisticated automotive lighting technologies. Key countries: Germany, UK, France.

- Latin America (LATAM): Emerging growth region driven by urbanization and government initiatives to replace legacy street lighting systems with energy-efficient LEDs; price sensitivity remains a key factor. Key country: Brazil.

- Middle East and Africa (MEA): High growth potential fueled by large-scale commercial construction projects (especially in the GCC countries) and significant investment in smart city projects requiring advanced lighting and digital display infrastructure. Key country: UAE, Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED & OLED Displays And Lighting Products Market.- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- Nichia Corporation

- OSRAM Licht AG (Ams Osram)

- Signify N.V. (formerly Philips Lighting)

- Cree LED (Sonepar)

- Seoul Semiconductor Co., Ltd.

- BOE Technology Group Co., Ltd.

- Universal Display Corporation (UDC)

- AUO Corporation

- Innolux Corporation

- Everlight Electronics Co., Ltd.

- Lumileds Holding B.V.

- Acuity Brands, Inc.

- Panasonic Corporation

- TCL Technology Group Corporation

- Konica Minolta, Inc.

- Lite-On Technology Corporation

- Epistar Corporation

- Skyworth Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the LED & OLED Displays And Lighting Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in application focus between LED and OLED technology?

LED technology is predominantly focused on high-lumen, high-efficiency illumination (general and specialty lighting) and backlighting for LCD displays. OLED technology specializes in self-emissive display applications, offering superior contrast, perfect blacks, and flexibility, making it ideal for premium smartphones, high-end TVs, and rollable devices.

How is MicroLED impacting the long-term outlook for the OLED market?

MicroLED is currently viewed as a disruptive technology that, upon achieving cost-effective mass production, could eventually replace OLED in certain large-format, high-brightness applications like commercial signage and high-end residential screens, due to its enhanced lifespan and superior brightness. However, OLED maintains a strong advantage in flexibility and smaller-sized panel production for the immediate future.

What role do smart city initiatives play in driving the demand for LED lighting products?

Smart city initiatives are a critical driver, specifically pushing demand for interconnected LED street lighting systems. These systems incorporate sensors and IoT capabilities for remote monitoring, dynamic dimming, fault detection, and integrated environmental data collection, leading to massive energy savings and improved public safety management across urban centers.

What are the major challenges related to the mass adoption of flexible OLED displays?

The main challenges for flexible OLED adoption include ensuring long-term durability and reliability of the flexible substrate under repeated stress (folding/rolling), optimizing the complex manufacturing processes for encapsulation to prevent moisture ingress, and the high initial material cost associated with polyimide substrates and specialized thin-film encapsulation techniques.

Which geographical region dominates the manufacturing of LED and OLED components?

The Asia Pacific (APAC) region, specifically countries such as South Korea (OLED panels), China (LED packaging and displays), and Taiwan (chip manufacturing), holds the dominant position in the global manufacturing capacity for both LED and OLED components and finished products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager