LED Scriber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432545 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

LED Scriber Market Size

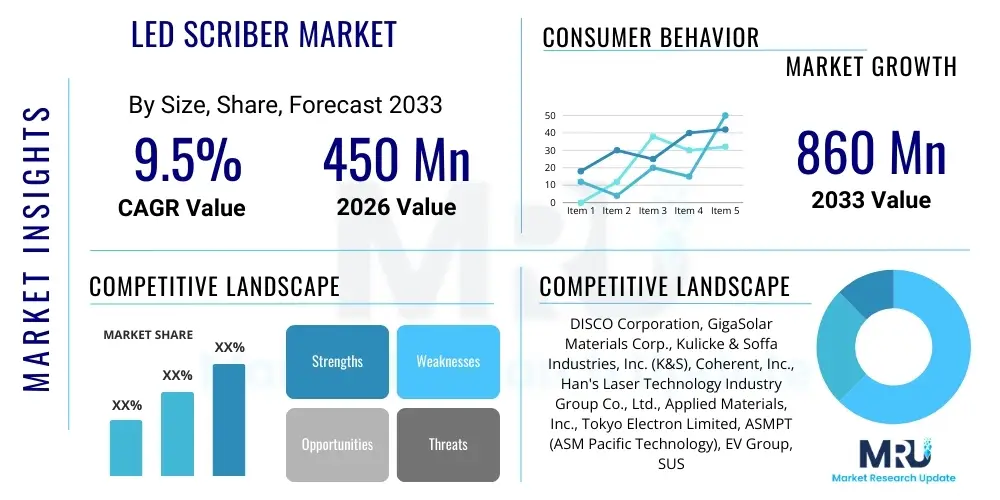

The LED Scriber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 860 Million by the end of the forecast period in 2033.

LED Scriber Market introduction

The LED Scriber Market encompasses specialized precision equipment utilized primarily for the singulation process of Light Emitting Diode (LED) wafers. Scribing is a critical, initial step in the wafer separation sequence, designed to create precise lines or trenches on the wafer surface, guiding subsequent breaking or dicing processes. These machines are essential for ensuring high yield, minimizing material waste, and achieving the required dimensions, especially in advanced manufacturing environments dealing with brittle materials like sapphire (Al2O3) or silicon carbide (SiC) substrates, commonly used for high-brightness LEDs. The core function revolves around achieving microscopic accuracy, enabling the efficient separation of individual LED chips (dies) from the intact wafer structure. The technology spectrum spans mechanical, laser-based, and increasingly sophisticated hybrid scribing solutions, with laser scribing dominating due to its non-contact nature, minimal debris generation, and superior edge quality, which is paramount for maintaining device performance and reliability, particularly in high-power applications or highly miniaturized components such as MicroLEDs. The shift towards gallium nitride (GaN) based LEDs, which are notoriously hard and challenging to process, further necessitates the adoption of advanced laser scribing techniques, including stealth dicing or ultra-short pulse (USP) lasers, which mitigate thermal damage and micro-cracking often associated with older methods. This market's trajectory is intrinsically linked to the global expansion of high-efficiency lighting, advanced display technologies, and the semiconductor industry's relentless drive toward miniaturization, demanding ever more precise and efficient manufacturing tools to handle complex materials and higher wafer throughputs efficiently.

Major applications of LED scribers are centered around the fabrication of components for general illumination, automotive lighting systems, advanced backlights for Liquid Crystal Displays (LCDs), and, critically, the burgeoning markets of MiniLED and MicroLED displays. MiniLED and MicroLED technologies, characterized by their superior contrast ratios, reduced power consumption, and increased pixel density, are transforming the display landscape for consumer electronics, including premium televisions, smartphones, and augmented reality (AR)/virtual reality (VR) devices. The exceptionally small die sizes in these next-generation displays—often less than 50 micrometers for MicroLEDs—mandate extremely accurate and damage-free separation, placing immense performance pressure on scribing equipment manufacturers. The benefits derived from utilizing high-performance LED scribers include significantly increased production yield, reduced operational costs due to lower material loss, enhanced reliability of the resulting LED chips (due to minimized structural defects), and the ability to process novel and challenging substrate materials effectively. Furthermore, modern scribers are increasingly integrated into automated production lines, incorporating sophisticated vision systems and real-time process monitoring to ensure consistency across vast batches of wafers, thus boosting overall manufacturing throughput and adherence to stringent quality standards required by tier-one electronic component suppliers globally, facilitating the transition to high-volume production of advanced LED products.

The driving factors propelling the growth of the LED Scriber Market are manifold, underpinned primarily by global regulatory shifts toward energy efficiency and sustainability, accelerating the adoption of LED lighting across commercial and residential sectors. Concurrently, the proliferation of digital devices requiring high-resolution, power-efficient displays is fueling demand for MiniLED and MicroLED components, which are heavily reliant on high-precision scribing techniques. The introduction of 5G connectivity and the expansion of the Internet of Things (IoT) ecosystem also indirectly contribute to market growth by driving the demand for advanced sensors and semiconductor components that often utilize LED technologies. Geographically, manufacturing clusters in Asia Pacific, particularly Taiwan, China, and South Korea, remain pivotal, characterized by massive investments in new fab capacity and the rapid upgrading of existing equipment to handle larger wafer sizes (e.g., 6-inch or 8-inch GaN-on-Si wafers) and higher throughput requirements. Technological innovations, such as the deployment of picosecond and femtosecond lasers, which offer unparalleled precision by ablating material before significant thermal energy transfer can occur, represent another crucial growth driver. These technological leaps enable manufacturers to overcome physical limitations associated with traditional methods, paving the way for the mass production of highly sensitive MicroLED chips essential for future display advancements and demanding the continuous replacement or upgrading of older, less precise scribing tools in the competitive semiconductor manufacturing environment.

LED Scriber Market Executive Summary

The LED Scriber Market is undergoing a rapid technological transformation, primarily driven by the transition from traditional LED chips to advanced MiniLED and MicroLED architectures, which necessitate ultra-high precision processing capabilities. Key business trends indicate a strong focus on automation and integration, with leading equipment providers developing comprehensive solutions that combine scribing, breaking, and sorting functions into single, high-throughput systems to reduce handling time and improve overall equipment effectiveness (OEE). Manufacturers are increasingly adopting advanced laser technologies, specifically ultra-fast lasers (pico- and femtosecond), which are crucial for processing brittle, expensive materials like sapphire and GaN with minimal subsurface damage and higher yields, mitigating the high cost associated with these substrates. Strategic collaborations between equipment manufacturers and material suppliers are becoming common to optimize scribing parameters for new substrate types, ensuring tool readiness for next-generation devices. Regional trends highlight the sustained dominance of the Asia Pacific region, particularly Greater China, Taiwan, and South Korea, which collectively host the vast majority of global LED manufacturing capacity and are the epicenters of MicroLED research and commercialization efforts. Government subsidies and large-scale investment in domestic semiconductor and display industries in these countries further accelerate the procurement of high-end scribing tools. Conversely, North America and Europe primarily focus on R&D, specialized high-end component manufacturing, and the development of core laser technologies, often serving as critical suppliers for the advanced optics and beam delivery systems utilized in these high-precision machines. Segment trends clearly favor Laser Scriber technology over traditional Mechanical Scriber tools, owing to superior performance metrics in precision and yield, especially within the MiniLED/MicroLED manufacturing application segment. Within technology, the fastest growth is anticipated in systems capable of processing larger wafers (8-inch) and incorporating sophisticated machine vision and artificial intelligence (AI) for real-time defect detection and automatic parameter adjustment, catering to the increasing complexity and volume demands of the modern semiconductor fabrication environment.

AI Impact Analysis on LED Scriber Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the LED Scriber Market generally focus on three key themes: improving process optimization, enabling predictive maintenance, and enhancing quality control in high-volume production. Users frequently ask how AI-driven algorithms can automatically determine the optimal laser power, speed, and focus parameters for varying wafer materials (e.g., different GaN thicknesses or sapphire grades) to maximize yield and throughput—a complex multivariate problem currently handled mostly by expert human operators. A major concern is the scalability of AI solutions, specifically whether existing tools can be retrofitted with AI capabilities or if entirely new generations of equipment are required to harvest the benefits of machine learning (ML) integration for defect classification and real-time process drift correction. There is significant expectation that AI, particularly computer vision coupled with deep learning, will revolutionize defect detection during the scribing process, moving beyond simple geometric checks to identifying subtle micro-cracks or thermal damage invisible to conventional inspection methods. Furthermore, users anticipate AI’s role in leveraging vast operational datasets from hundreds of scribing runs to anticipate equipment failure (e.g., laser source degradation, stage misalignment) before it causes costly downtime, thereby maximizing equipment uptime and minimizing scrap rates, which is crucial given the high capital cost of these precision tools and the tight margins in LED manufacturing.

- AI integration enhances real-time adaptive process control, automatically adjusting laser parameters based on wafer variability (material, thickness, internal stress).

- Predictive maintenance schedules are generated using ML models analyzing vibration, temperature, and power consumption data, reducing unplanned downtime by up to 30%.

- Deep learning algorithms significantly improve Automated Optical Inspection (AOI) systems for defect classification, particularly identifying minute subsurface damage in brittle substrates.

- AI facilitates yield optimization by correlating scribing parameters with downstream wafer break and electrical testing results, establishing optimal manufacturing recipes.

- Automated anomaly detection in vision systems reduces reliance on human operators for quality checks, ensuring consistent chip quality for MicroLED applications.

- Machine Learning is used for sophisticated thermal management during laser processing, minimizing Heat Affected Zone (HAZ) in high-power LED fabrication.

DRO & Impact Forces Of LED Scriber Market

The LED Scriber Market is primarily propelled by technological advancements in display and lighting sectors, particularly the accelerating commercialization of MiniLED and MicroLED displays, which require ultra-high precision singulation technologies to handle exceptionally small and fragile chips. The restrained factors largely revolve around the high initial capital expenditure associated with advanced laser scribing systems and the complexity of processing next-generation materials like GaN on various substrates, which demands highly specialized equipment and skilled labor. Opportunities arise from the potential for hybrid processing techniques that combine the benefits of mechanical and laser scribing, alongside the increasing adoption of automated material handling systems (AMHS) integrating scribing equipment seamlessly into large-scale fabrication plants. These dynamics create powerful impact forces, where the imperative for miniaturization and damage-free processing pushes technological limits, forcing manufacturers to invest heavily in advanced R&D to maintain competitive advantage. The balance between cost efficiency (restraint) and yield maximization (driver) dictates procurement decisions, favoring suppliers capable of demonstrating superior throughput and reliability in demanding high-volume, precision manufacturing environments.

Drivers: The fundamental driver is the pervasive adoption of LEDs across all sectors, amplified by legislative mandates globally pushing for energy efficiency, replacing older, less efficient lighting technologies. The rapid technological shift toward MicroLEDs for premium displays in consumer electronics (smartwatches, AR/VR headsets, televisions) and automotive applications is perhaps the most significant immediate catalyst, as MicroLED manufacturing cannot be reliably achieved without high-end, precision laser scribing and dicing equipment. Furthermore, the semiconductor industry’s general trend toward larger wafer sizes (e.g., moving from 4-inch to 6-inch or 8-inch GaN wafers) demands new scribing tools with larger working areas and enhanced repeatability, necessitating equipment upgrades across the installed base. The decreasing cost of high-power, short-pulse lasers also makes advanced scribing solutions more economically viable for a broader range of manufacturers, fueling the replacement cycle of older, mechanical equipment. This increasing demand is further supported by innovations in materials science, requiring scribers optimized for complex heteroepitaxial structures and highly stressed wafer layers, where standard mechanical methods introduce unacceptable levels of chipping and structural compromise.

Restraints: The primary restraint on market expansion is the substantial capital investment required for state-of-the-art laser scribing systems, which can be prohibitive for smaller manufacturers or those operating in niche markets. This high barrier to entry results in slower adoption rates in certain emerging economies. Technical complexity also poses a significant restraint; the precision required for MicroLEDs is at the limit of current manufacturing technology (sub-10 micrometer feature size), leading to complex maintenance routines, high requirements for operational expertise, and potentially high downtimes if equipment malfunctions. Furthermore, the intellectual property landscape surrounding advanced scribing methods, particularly stealth dicing and specific laser optics configurations, creates market fragmentation and high licensing costs. Environmental and safety regulations concerning high-power laser usage and the disposal of semiconductor processing byproducts also add to operational complexities and costs. Finally, market fluctuations in the broader consumer electronics sector, particularly cyclical demand changes in the smartphone and display markets, can directly impact equipment procurement schedules, introducing volatility into the capital equipment market for LED scribers, forcing suppliers to navigate complex inventory management and production planning challenges.

Opportunities: Significant growth opportunities exist in the development and commercialization of hybrid scribing technologies that leverage the speed of laser processing combined with the cost efficiency of mechanical methods for specific applications, or systems that integrate laser scribing with plasma etching for superior edge quality. The increasing demand for flexible and curved display panels requires novel scribing solutions capable of handling non-planar substrates, opening a specialized market niche. The rise of compound semiconductor manufacturing beyond traditional silicon, including advanced power electronics and RF components based on GaN and SiC, presents a major adjacent opportunity, as these materials share similar processing challenges with high-brightness LEDs. Geographically, opportunities are expanding beyond traditional APAC hubs into Southeast Asia (Vietnam, Thailand) and potentially India, as global supply chains diversify and new, cost-competitive manufacturing locations emerge. Furthermore, the integration of Industry 4.0 paradigms—specifically IoT sensors, Big Data analytics, and AI—into scribing tools offers compelling opportunities for manufacturers to provide value-added services such as subscription-based predictive maintenance and real-time process consulting, shifting the competitive focus from pure hardware sales to integrated service solutions and maximizing the total value proposition for end-users operating in highly automated fabrication environments.

Segmentation Analysis

The LED Scriber Market is segmented based on the fundamental technological approach utilized, the specific application of the resultant LED chips, and the type of end-user engaging in the manufacturing process. Segmentation by technology is crucial, differentiating between traditional, lower-cost mechanical tools and the high-precision, high-throughput Laser Scriber systems, which include advanced variants like UV, green, and ultra-short pulse (USP) lasers. Application-based segmentation underscores the shift toward high-value areas such as MicroLED/MiniLED manufacturing, which demands the highest performance, compared to standard LED wafer separation for general lighting. End-user categories reflect the structure of the manufacturing ecosystem, distinguishing between integrated device manufacturers (IDMs), specialized foundry services, and academic or industrial R&D laboratories, each having distinct requirements regarding equipment throughput, flexibility, and investment capacity. This multi-dimensional segmentation allows for precise market sizing and strategic targeting based on where technological innovation is driving the highest growth and where capital expenditure for premium equipment is concentrated.

- By Technology:

- Mechanical Scriber (Diamond Tip)

- Laser Scriber (UV Laser, Green Laser, Ultra-Short Pulse (USP) Laser)

- Hybrid Scriber

- By Application:

- LED Wafer Separation (General Illumination)

- MicroLED/MiniLED Display Manufacturing

- High-Power LED Fabrication

- General Semiconductor Processing

- By End-User:

- Semiconductor Manufacturers (IDMs and Foundries)

- LED Device Makers (Specialized Optoelectronics)

- R&D Institutions and Academia

- By Wafer Size:

- 4-inch Wafer

- 6-inch Wafer

- 8-inch Wafer and Above

Value Chain Analysis For LED Scriber Market

The value chain of the LED Scriber Market begins upstream with suppliers of critical components, predominantly high-power, precision laser sources (e.g., solid-state lasers, fiber lasers), high-accuracy motion control systems, advanced optical components (mirrors, lenses), and machine vision software developers. These upstream providers determine the core performance parameters—speed, accuracy, and reliability—of the final scribing equipment. The middle tier involves the core equipment manufacturers (OEMs) who integrate these components, develop proprietary beam delivery systems and processing algorithms, and engineer the specialized wafer handling and alignment mechanisms necessary for microscopic precision. Downstream, the distribution channel is primarily direct sales, particularly for high-end equipment, involving long sales cycles, customized installation, and extensive post-sales technical support and maintenance agreements, reflecting the high capital cost and technical complexity of the tools. Indirect channels are sometimes used for regional representation or for lower-end mechanical scribing tools, involving specialized distributors who maintain local inventory and provide immediate support. The end-users, predominantly large semiconductor foundries and specialized LED device makers, purchase these tools, and their feedback on yield rates and equipment uptime directly influences the product development cycle of the OEMs. The strong service component in the downstream segment, including spare parts supply and process optimization consulting, constitutes a significant portion of the total value derived from the market, underlining the importance of strong customer relationships and reliable global service networks.

Upstream analysis reveals that the LED Scriber market is highly reliant on a few key suppliers for high-specification laser sources, particularly femtosecond and picosecond lasers, which require highly specialized manufacturing capabilities and often originate from North America and Europe. The competitive advantage upstream often lies in laser stability, pulse width control, and cost-efficiency over time. Suppliers of high-precision granite bases and air-bearing stages are also crucial, as nanometer-level positional accuracy is non-negotiable for MicroLED processing. Consolidation in the laser component sector and the subsequent technological lead of key players introduce potential supply chain dependencies and pricing pressures on equipment OEMs. Equipment manufacturers must maintain rigorous qualification processes for these high-value components to ensure the reliability and uptime of the final system, focusing on modular designs that allow for easier component upgrades and replacements throughout the equipment's long operational lifecycle.

The downstream segment is defined by the immediate end-users: the semiconductor and optoelectronics fabrication facilities. These users demand highly customized solutions tailored to specific substrate thicknesses, material combinations (e.g., GaN-on-Si, GaN-on-Sapphire), and required throughputs. Direct distribution channels are paramount here because installation, calibration, and process recipe development require intimate technical collaboration between the OEM's application engineers and the customer's fabrication team. Indirect distribution may be leveraged in regions where the OEM lacks a substantial physical presence, utilizing technically proficient local partners to handle first-line support and manage regulatory compliance. Crucially, the long-term profitability for OEMs is increasingly tied to recurring service revenue—maintenance contracts, software updates, and consumables (e.g., optics cleaning materials)—emphasizing the importance of designing systems for high accessibility and maintainability, thereby cementing a continuous relationship with the high-capital-intensity customer base over the entire lifetime of the equipment.

LED Scriber Market Potential Customers

Potential customers for LED Scriber equipment are dominated by entities involved in the high-volume manufacturing of light-emitting devices and related compound semiconductors, requiring precise wafer singulation. The largest and most influential customer segment comprises major Integrated Device Manufacturers (IDMs) and specialized LED Foundries, predominantly located in the Asia Pacific region, including major players in Korea, Taiwan, and Mainland China. These large-scale operators require high-throughput, fully automated laser scribing systems capable of handling 6-inch and 8-inch wafers with minimal human intervention, focusing intensely on yield rates and overall cost of ownership (CoO). A rapidly growing customer segment includes companies aggressively pivoting into MiniLED and MicroLED display production, such as display panel makers and high-end consumer electronics assembly firms, who are willing to invest in the latest ultra-short pulse laser technology to achieve the necessary precision for chips often smaller than 50 micrometers. Furthermore, specialized optoelectronics manufacturers catering to niche high-reliability markets, such as aerospace, automotive lighting, and medical devices, constitute a stable customer base, prioritizing quality and long-term device performance over sheer volume. Finally, government-funded research laboratories and university cleanrooms developing next-generation compound semiconductor materials or advanced photovoltaic devices also serve as niche customers, requiring highly flexible, versatile scribing tools suitable for experimental processing and small-batch production runs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 860 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DISCO Corporation, GigaSolar Materials Corp., Kulicke & Soffa Industries, Inc. (K&S), Coherent, Inc., Han's Laser Technology Industry Group Co., Ltd., Applied Materials, Inc., Tokyo Electron Limited, ASMPT (ASM Pacific Technology), EV Group, SUSS MicroTec, Advanced Dicing Technologies (ADT), LPKF Laser & Electronics AG, MKS Instruments, Inc., Lambda Physik AG, Suzhou Delphi Laser Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Scriber Market Key Technology Landscape

The LED Scriber Market is fundamentally defined by the transition from traditional, diamond-tip mechanical scribing to sophisticated laser-based methodologies, driven by the need for higher precision and damage-free processing of hard and brittle materials. The current technology landscape is dominated by Laser Scriber systems, which utilize various wavelengths—primarily UV (355 nm) and Green (532 nm)—to achieve high absorption rates in commonly used LED substrates like sapphire. UV lasers offer high precision and minimal thermal impact but often suffer from slower throughput compared to green lasers. However, the most advanced technological frontier involves Ultra-Short Pulse (USP) lasers, specifically picosecond and femtosecond lasers. These lasers operate via a non-thermal process known as "cold ablation," where material is removed so rapidly that thermal energy transfer to the surrounding structure is negligible. This is critical for MicroLED manufacturing, as it virtually eliminates the heat-affected zone (HAZ) and reduces micro-cracking, resulting in superior edge quality and significantly improved device performance and reliability. The development of advanced beam shaping optics, including diffractive optical elements (DOEs) and spatial light modulators (SLMs), is also crucial, allowing for highly complex, customized scribe patterns and simultaneous processing across larger areas of the wafer, optimizing throughput without sacrificing precision, maintaining high manufacturing efficiency.

Further technological differentiation is emerging through the integration of proprietary software algorithms and advanced machine vision systems. These smart systems utilize high-resolution cameras and pattern recognition software to align the wafer with extremely tight tolerances (sub-micron level) before processing begins, which is a major factor in improving overall yield, especially on 8-inch wafers. Furthermore, hybrid scribing solutions represent an evolving technology segment, attempting to optimize the throughput-cost equation. These hybrid systems might utilize laser scribing for the initial separation path definition and then follow up with a controlled mechanical break or a secondary process like deep reactive-ion etching (DRIE) or wet chemical etching to complete the singulation. This approach aims to reduce the total processing time and cost while maintaining the necessary precision characteristics for specific mid-range LED applications. The shift towards manufacturing GaN-on-Si wafers (as opposed to GaN-on-Sapphire) is also influencing technology development, necessitating new scribing recipes and laser parameters optimized for the differing thermal and mechanical properties of the silicon substrate layers, further driving R&D into flexible process control systems.

Crucially, the concept of "Stealth Dicing," an advanced laser separation technique, is gaining traction. This method uses a near-infrared (NIR) laser beam focused inside the wafer volume, creating a modified layer rather than ablating the surface. The wafer is subsequently separated along this internal modification plane through a controlled breaking process. Stealth dicing offers extremely clean separation surfaces, eliminating chipping and reducing debris, which is vital for high-reliability MicroLED and sensor applications. Continuous innovation in laser power stability, repeatability, and the integration of sophisticated real-time monitoring of the scribing trench depth and width are defining the competitive landscape. Key technological investment areas include enhancing automation capabilities—allowing for seamless wafer loading, inspection, and unloading—and improving the connectivity of the scribing equipment within the broader factory automation ecosystem (Industry 4.0), enabling predictive maintenance protocols and remote diagnostic capabilities to maximize equipment availability and streamline global operations for multinational fabrication entities.

Regional Highlights

- Asia Pacific (APAC): APAC holds the undisputed majority share of the global LED Scriber Market, driven by the concentration of the world's largest LED manufacturing bases in Mainland China, Taiwan, and South Korea. These nations are the primary global centers for display panel production (LCD, OLED, MiniLED, MicroLED) and general illumination LED fabrication. Robust governmental support for semiconductor and display industries, coupled with continuous capacity expansion (new fabs) and technological modernization efforts, ensures high demand for advanced, high-throughput laser scribing equipment. China, in particular, is witnessing massive investments aimed at achieving self-sufficiency in MicroLED technology, generating immediate and sustained demand for premium scribers. The regional focus is on large-scale automation, maximizing yield, and rapid deployment of the latest USP laser technologies.

- North America: North America represents a critical hub for the research, development, and supply of core technology components, especially high-precision laser sources (femtosecond/picosecond) and advanced optical systems. While the region hosts specialized, high-margin compound semiconductor manufacturing (e.g., GaN-based power electronics), its market share for high-volume LED scribing equipment procurement is smaller compared to APAC. Demand in North America is characterized by specialized, flexible systems used in R&D, pilot lines, and the manufacturing of high-reliability components for defense and aerospace, focusing on customization and proprietary process development rather than mass production volumes.

- Europe: Similar to North America, Europe is a leader in developing cutting-edge laser technology, optics, and precision machinery (e.g., Germany, Switzerland). European companies frequently supply the critical components that are integrated into the final scribing machines assembled in Asia. The end-user market in Europe is stable but moderate, driven by specialized automotive lighting manufacturers, niche high-performance LED producers, and extensive academic research into novel semiconductor materials and advanced device structures, requiring high-end, versatile scribing solutions for low-volume, high-mix production environments.

- Middle East & Africa (MEA) and Latin America: These regions currently account for a marginal share of the global LED Scriber Market. Demand is scattered and driven primarily by general semiconductor maintenance or small-scale local assembly operations, often relying on imported, refurbished, or lower-cost mechanical scribing equipment. Growth potential exists as infrastructure development accelerates and local manufacturing of basic electronic components increases, creating long-term opportunities for entry-level and mid-range equipment suppliers as these regions look to reduce reliance on fully imported finished goods and establish local value chains in high-tech manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Scriber Market.- DISCO Corporation

- GigaSolar Materials Corp.

- Kulicke & Soffa Industries, Inc. (K&S)

- Coherent, Inc. (an II-VI company)

- Han's Laser Technology Industry Group Co., Ltd.

- Applied Materials, Inc.

- Tokyo Electron Limited (TEL)

- ASMPT (ASM Pacific Technology)

- EV Group (EVG)

- SUSS MicroTec

- Advanced Dicing Technologies (ADT)

- LPKF Laser & Electronics AG

- MKS Instruments, Inc.

- Lambda Physik AG

- Suzhou Delphi Laser Co., Ltd.

- Aachener Verfahrenstechnik Laser (AVT)

- 3D-Micromac AG

- InnoLas Laser GmbH

- CST Global Ltd.

- Synova S.A.

Frequently Asked Questions

Analyze common user questions about the LED Scriber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary technological innovation is driving the current growth of the LED Scriber Market?

The primary driver is the widespread adoption of Ultra-Short Pulse (USP) lasers (picosecond and femtosecond) which facilitate "cold ablation." This non-thermal scribing process is essential for achieving the micron-level precision and damage-free separation required for MicroLED and MiniLED chips, significantly boosting yield rates on brittle substrates like sapphire and GaN.

How do LED scribers contribute to the manufacturing yield of MiniLEDs?

LED scribers, particularly high-precision laser models, minimize chipping, micro-cracking, and subsurface damage during wafer separation. For MiniLEDs, where chip size is minimal and structural integrity is crucial, minimizing defects during the scribing phase directly maximizes the number of electrically functional dies harvested from each expensive wafer, thereby optimizing manufacturing yield and reducing waste.

Which geographical region dominates the demand and procurement of LED Scriber equipment?

The Asia Pacific (APAC) region, specifically Mainland China, Taiwan, and South Korea, dominates the market. This dominance is due to the concentration of major global LED and display panel fabrication facilities (fabs) and intense investment in MicroLED production capacity, necessitating the continuous procurement of high-throughput scribing machinery.

What is the main challenge associated with mechanical scribing methods compared to laser scribing?

Mechanical scribing introduces significant physical stress, often leading to chipping, edge defects, and micro-cracks in hard substrates like sapphire or GaN. This drastically reduces the functional yield, especially for high-brightness or high-power LEDs. Laser scribing overcomes this by offering non-contact processing and superior control over the depth and width of the scribe line.

What role does AI or Machine Learning play in modern LED scribing processes?

AI/ML is increasingly used for process optimization and quality control. AI algorithms automatically adjust laser parameters in real-time to maintain optimal performance despite wafer inconsistencies. Furthermore, sophisticated machine vision systems powered by deep learning enhance Automated Optical Inspection (AOI) to classify and identify subtle defects previously missed by traditional quality checks, improving overall operational efficiency and consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager