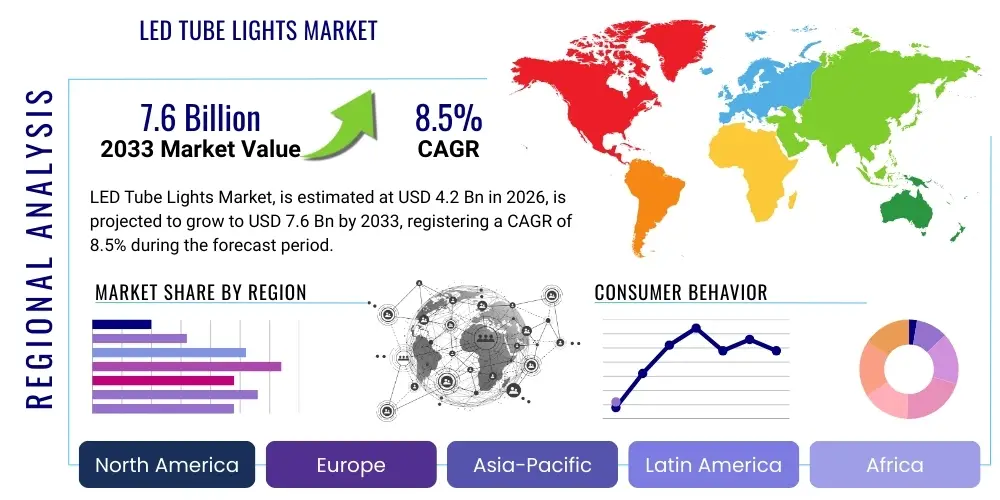

LED Tube Lights Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435388 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

LED Tube Lights Market Size

The LED Tube Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

LED Tube Lights Market introduction

The LED Tube Lights Market encompasses the global sales and distribution of linear light-emitting diode (LED) lamps designed to replace conventional fluorescent tube lights, primarily T8 and T12 formats. These products are characterized by superior energy efficiency, extended operational lifespan, reduced maintenance requirements, and environmental sustainability due to the absence of mercury. LED tube lights utilize solid-state lighting technology, offering immediate full illumination and improved light quality compared to traditional gaseous discharge lamps. This transition is heavily influenced by global regulatory mandates phasing out inefficient lighting technologies and corporate sustainability initiatives aimed at lowering operational carbon footprints.

Major applications for LED tube lights span a wide array of sectors, including commercial real estate (offices, retail spaces), industrial facilities (warehouses, manufacturing plants), institutional buildings (hospitals, schools), and infrastructure projects (subway stations, parking garages). The primary benefit driving adoption is the substantial reduction in electricity consumption—often 50% or more compared to fluorescent equivalents—which translates directly into significant cost savings over the product’s lifespan. Furthermore, the longevity of LED tubes, typically rated for 50,000 hours or more, drastically reduces the frequency and cost associated with lamp replacement and disposal.

The market is primarily driven by escalating energy prices globally, coupled with governmental incentives, subsidies, and strict efficiency standards pushing for rapid migration toward energy-efficient lighting solutions. The ongoing retrofitting trend in established economies, replacing millions of aging fluorescent fixtures with LED alternatives, provides consistent demand. Technological advancements, such as the integration of smart lighting controls (IoT capabilities) directly into tube fixtures and improvements in efficacy (lumens per watt), further enhance the value proposition and accelerate market penetration across all key end-user segments.

LED Tube Lights Market Executive Summary

The global LED Tube Lights Market is experiencing robust expansion, fundamentally driven by the accelerating global transition towards energy efficiency and sustainable infrastructure development. Current business trends indicate a shift toward sophisticated product offerings, specifically plug-and-play (Type A) and universal (Type C) tubes that simplify installation and compatibility across diverse existing ballasts, thereby reducing retrofit barriers. Key manufacturers are focusing on maximizing luminous efficacy while minimizing initial unit cost to gain market share in highly price-sensitive industrial and commercial procurement channels. Furthermore, consolidation among key players and strategic partnerships aimed at strengthening supply chain resilience, particularly concerning critical semiconductor components and driver technology, define the competitive landscape.

Regionally, Asia Pacific (APAC) continues to dominate the market in terms of volume, attributed to massive governmental infrastructure projects in countries like China and India, coupled with rapid urbanization and industrial growth. However, North America and Europe lead in terms of technology adoption and average selling price (ASP), driven by stringent energy efficiency regulations (e.g., EU Ecodesign directives) and high corporate investments in smart building management systems. Emerging markets in Latin America and the Middle East and Africa (MEA) represent high-growth potential, buoyed by new construction activity and increasing awareness of long-term operational cost benefits associated with LED lighting.

Segment trends reveal that the direct-replacement segment (plug-and-play tubes) holds substantial market share due to ease of installation, although the ballast-bypass (Type B) segment is gaining traction, particularly in new installations and large-scale renovations, offering maximum energy savings and reliability. By application, the commercial segment (office spaces and retail) remains the largest consumer, but the industrial sector, requiring high-lumen output and durable lighting solutions for challenging environments, is exhibiting the highest Compound Annual Growth Rate (CAGR). The shift toward tubes offering adjustable color temperature (CCT) and dimming capabilities is also a notable trend enhancing product differentiation.

AI Impact Analysis on LED Tube Lights Market

User inquiries regarding the impact of Artificial Intelligence on the LED Tube Lights Market frequently center on themes of energy optimization, predictive maintenance, and the integration of lighting into broader smart building ecosystems. Users often ask how AI algorithms can modulate light output in real-time based on occupancy patterns, ambient daylight levels, and energy grid load fluctuations to achieve maximum efficiency (AEO focus: 'AI energy optimization in lighting'). Key concerns revolve around data privacy when utilizing integrated sensors and the cost-effectiveness of deploying AI-enabled controls compared to traditional occupancy sensors. Expectations include systems capable of automated fault detection in lighting circuits, optimizing maintenance schedules, and providing granular energy consumption reports on a per-fixture basis.

The practical integration of AI is primarily realized through the advanced processing of sensor data captured by interconnected LED tube light networks (IoT lighting). AI models analyze vast quantities of data related to occupancy, temperature, time of day, and specific tasks performed in a space. This allows for dynamic tuning of light levels and color temperatures (Human-Centric Lighting - HCL), maximizing occupant comfort, productivity, and health while simultaneously achieving up to 30% additional energy savings beyond the inherent efficiency of the LED source itself. This capability transforms the LED tube from a simple light source into a smart data node contributing to overall building intelligence.

Furthermore, AI significantly enhances the service life and operational reliability of LED lighting installations. By monitoring parameters like current draw, junction temperature, and output degradation, AI algorithms can predict imminent component failures within the driver or tube array. This predictive maintenance capability allows facility managers to replace specific components proactively before failure occurs, avoiding unexpected downtime and optimizing labor scheduling. This capability is particularly critical in industrial and institutional settings where uninterrupted operation is mandatory and access to fixtures for replacement is complex or expensive.

- AI optimizes energy consumption via predictive dimming based on learned occupancy patterns and ambient light inputs.

- Predictive maintenance algorithms use operational data to forecast tube or driver failure, minimizing costly unplanned outages.

- AI-driven Human-Centric Lighting (HCL) adjusts color temperature and intensity to synchronize with circadian rhythms, boosting occupant wellness.

- Data analytics derived from smart LED networks inform space utilization studies and facility management optimization.

- Integration with Building Management Systems (BMS) allows AI to coordinate lighting functions with HVAC and security systems for cohesive operation.

- Enhanced cybersecurity measures are being developed to protect the growing network of interconnected lighting nodes from external threats.

DRO & Impact Forces Of LED Tube Lights Market

The dynamics of the LED Tube Lights Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and associated Impact Forces. The primary market driver remains the imperative for global energy conservation, underpinned by governmental phase-out mandates for conventional fluorescent lighting, which creates a massive, mandatory replacement market. Coupled with this is the escalating environmental consciousness leading corporations and consumers alike to prioritize sustainable solutions, leveraging the low energy consumption and mercury-free composition of LED technology. This powerful combination of regulation and economic incentive provides consistent momentum.

Key restraints tempering growth include the relatively high initial acquisition cost of high-quality LED tubes compared to legacy fluorescent technology, which can pose a hurdle for small and medium-sized enterprises (SMEs) with limited capital expenditure budgets. Furthermore, incompatibility issues arising from diverse fluorescent fixture designs—including various ballast types (electronic vs. magnetic) and wiring configurations—can complicate retrofitting projects, sometimes requiring costly professional intervention or fixture replacement, thereby increasing the total cost of ownership in the short term. Market saturation in developed commercial sectors also slows volume growth in specific geographies.

Significant opportunities arise from the proliferation of smart lighting technology, allowing manufacturers to integrate IoT capabilities (sensors, wireless connectivity) directly into tube fixtures, transforming them into valuable data collection platforms. The untapped potential of the industrial sector, particularly in high-bay applications requiring specialized, durable, high-lumen LED tube equivalents, presents a massive growth avenue. Furthermore, the standardization of installation and communication protocols (e.g., Zhaga, DALI) will streamline integration, unlock new revenue streams from lighting-as-a-service (LaaS) models, and accelerate penetration across global infrastructure projects.

- Drivers: Mandatory phase-out of fluorescent lamps, substantial operational energy savings, declining LED manufacturing costs, and long product life reducing maintenance costs.

- Restraints: High initial investment cost (CAPEX), perceived complexity of retrofitting existing fixtures, and market competition from alternative LED fixture formats (e.g., linear high-bay fixtures).

- Opportunities: Integration of smart lighting controls (IoT/BMS compatibility), expansion into specialized industrial environments (cold storage, hazardous locations), and emerging markets penetration.

- Impact Forces: Technological advancements in efficacy (Lumens per Watt), stringent global energy efficiency regulations (high positive impact), and raw material price volatility (moderate negative impact).

Segmentation Analysis

The LED Tube Lights Market segmentation provides critical insights into market dynamics, identifying specific high-growth areas based on product characteristics, installation type, application, and geographical scope. Analyzing these segments is essential for strategic planning, resource allocation, and targeted product development. The market is broadly segmented based on the tube type, distinguishing between those requiring ballast compatibility and those designed for direct line voltage, reflecting the varying needs of retrofit and new construction projects.

Further granularity in segmentation involves categorizing tubes based on length (e.g., 2-foot, 4-foot, 8-foot) and wattage/lumen output, addressing the functional requirements of different spaces—from low-intensity ambient lighting in offices to high-intensity illumination in industrial warehouses. The segmentation by application clearly defines end-user demands, where the commercial segment prioritizes aesthetics and integration with smart systems, while the industrial segment demands rugged durability and resistance to challenging environmental conditions, such as dust, moisture, or extreme temperatures.

This structured analysis reveals that Type B (Ballast Bypass/Direct Wire) tubes are projected to gain significant market share over the forecast period due to their reliability and ability to deliver maximum energy savings by eliminating ballast losses. Simultaneously, the T8 tube format continues to dominate sales volume globally due to the existing immense installed base of T8 fluorescent fixtures across commercial and institutional buildings, confirming the importance of backward compatibility in the immediate market future.

- By Tube Type:

- Type A (Plug-and-Play / Ballast Compatible)

- Type B (Ballast Bypass / Direct Wire)

- Type C (External Driver)

- Type A+B (Hybrid)

- By Length:

- 2 Feet

- 4 Feet

- 8 Feet

- Other Lengths (e.g., 5 Feet, 6 Feet)

- By Application/End-Use:

- Commercial (Office Buildings, Retail, Hospitality)

- Industrial (Warehouses, Manufacturing Facilities, Cold Storage)

- Residential (Garages, Basements)

- Institutional (Hospitals, Schools, Government Buildings)

- By Wattage/Lumen Output:

- Low Wattage (< 15W)

- Medium Wattage (15W - 25W)

- High Wattage (> 25W)

- By Distribution Channel:

- Direct Sales

- Retail / Wholesale

- Online Channels

Value Chain Analysis For LED Tube Lights Market

The value chain for the LED Tube Lights Market begins with upstream activities involving the sourcing and processing of critical raw materials, predominantly semiconductors (LED chips/diodes), driver components (capacitors, ICs), polycarbonate or glass materials for the housing, and thermal management materials (aluminum heat sinks). The efficacy and cost structure of the final product are heavily dependent on the efficiency and stability of these upstream suppliers, particularly those providing high-quality LED chips from major technology hubs in Asia. Strategic relationships with raw material providers and component manufacturers are crucial for maintaining a competitive edge and mitigating supply chain risk associated with material shortages or geopolitical instability.

The midstream focuses on manufacturing and assembly, encompassing the integration of the LED array, driver, thermal unit, and tube housing. This stage is characterized by significant investment in automated assembly lines and rigorous quality control testing to ensure compliance with global safety and performance standards (e.g., UL, CE, RoHS). Differentiation at this stage involves proprietary driver technology development, optimizing thermal dissipation, and enhancing light quality metrics like Color Rendering Index (CRI) and color consistency (macadam ellipse). The efficiency of manufacturing processes directly impacts the final unit cost and gross margins.

Downstream analysis covers distribution and end-user engagement, primarily channeled through three main avenues: direct sales to large commercial and industrial clients, wholesale distribution via electrical wholesalers and contractors, and retail channels (including e-commerce) catering to smaller businesses and residential users. The indirect channel, dominated by electrical distributors, remains the most voluminous route to market, necessitating robust logistics and inventory management. Sales effectiveness hinges on professional electrical contractors and Energy Service Companies (ESCOs) who act as key influencers and installers, driving adoption through large-scale retrofit projects.

LED Tube Lights Market Potential Customers

The primary potential customers for LED tube lights are entities focused on maximizing operational efficiency and minimizing long-term maintenance costs across large, continuously operated facilities. The largest segment is the Commercial sector, encompassing multi-story office complexes, large-scale retail chains, and hospitality venues, where lighting accounts for a substantial portion of the electricity bill. These end-users typically prioritize products offering dimming, smart control integration, and high light quality (CRI) to enhance the working or shopping environment.

The Industrial segment, including manufacturing plants, logistics warehouses, and specialized environments like cold storage facilities, represents customers demanding robust, high-output lighting that can withstand dust, vibration, and temperature extremes. Their purchasing decisions are highly weighted toward durability (IP ratings), lumen maintenance, and the total cost of ownership (TCO) calculated over a long lifespan, often favoring direct-wire (Type B) solutions for maximum reliability.

Institutional buyers, such as public and private schools, universities, and healthcare facilities (hospitals and clinics), represent a stable customer base driven by long-term governmental budgeting cycles and mandates for environmental responsibility. These clients require reliable, standardized products (often 4-foot T8 equivalents) that meet specific safety certifications and offer flicker-free operation essential for patient comfort and learning environments. Procurement for these entities is frequently managed through large, centralized contracts and ESCO partnerships focusing on turnkey energy efficiency upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), GE Current (a Daintree Company), OSRAM, Cree Lighting, Hubbell Lighting, Acuity Brands, Feit Electric, Opple Lighting, Eaton Corporation, LITE-ON Technology Corporation, Ledvance, MaxLite, Panasonic Corporation, Toshiba Lighting & Technology, Seoul Semiconductor. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Tube Lights Market Key Technology Landscape

The technological landscape of the LED Tube Lights Market is primarily defined by continuous innovation in maximizing luminous efficacy (Lm/W), improving thermal management, and enhancing compatibility with existing infrastructure. Advancements in LED chip technology, particularly the shift toward higher-efficiency mid-power LEDs and chip-on-board (COB) solutions, are crucial for driving down power consumption while increasing light output. Furthermore, manufacturers are heavily investing in proprietary driver integrated circuits (ICs) that enhance power factor correction, reduce harmonic distortion, and ensure stable operation across varying voltage inputs, thereby increasing product reliability and life expectancy significantly.

A major focus remains on smart integration capabilities. The market is moving toward embedded wireless communication technologies, such as Bluetooth Mesh, Zigbee, and Wi-Fi, allowing LED tubes to become interconnected nodes within a robust Internet of Things (IoT) network. This integration facilitates granular control, including scheduling, dimming, and real-time monitoring through centralized Building Management Systems (BMS). The adoption of standardized communication protocols like DALI (Digital Addressable Lighting Interface) is critical for ensuring interoperability between different brands of fixtures, sensors, and control interfaces, simplifying complex installation projects.

Material science and engineering play a vital role in thermal performance. Effective heat dissipation is essential to prevent premature LED degradation. Innovations include optimized aluminum heat sinks and advanced thermal polymers that draw heat away from the LED junction. Additionally, the development of specialized optical materials and diffusing covers ensures high light transmission efficiency while minimizing glare (UGR compliance). Finally, there is a steady evolution in driverless AC-LED technology, aiming to reduce component count and simplify manufacturing, though reliability concerns in high-heat environments continue to be a subject of ongoing research and development.

Regional Highlights

Regional dynamics play a crucial role in shaping the LED Tube Lights Market, reflecting differences in energy policies, infrastructure development rates, and consumer awareness. Asia Pacific (APAC) dominates the global market, both in production capacity and consumption volume. This leadership is attributed to the presence of major LED manufacturing hubs in China and South Korea, which allows for competitive pricing and high export volumes. Domestically, large-scale urbanization, coupled with aggressive governmental programs promoting energy efficiency (especially in India and Southeast Asia), fuels massive demand for cost-effective replacement and new installation tubes in commercial and residential sectors. The high rate of new construction activity in APAC ensures continuous demand growth.

North America (NA) represents a mature yet high-value market, characterized by strict energy efficiency standards and a strong preference for high-quality, long-warranty products. The replacement cycle for existing fluorescent lighting in major commercial and institutional buildings drives the majority of sales. NA companies are leaders in adopting sophisticated smart lighting systems, integrating LED tubes with advanced IoT platforms for demand-side energy management and Human-Centric Lighting applications. Regulatory bodies, such as the Department of Energy (DOE) and state-level incentives, ensure steady movement toward high-efficacy, premium-priced products, favoring Type B and external driver solutions.

Europe stands out due to its stringent regulatory environment, notably the Ecodesign Directive and related regulations phasing out inefficient lighting products. This regulatory pressure has created an accelerated, mandatory shift toward LED tube adoption. European markets exhibit a strong preference for sustainable and circular economy principles, leading to demand for products with standardized, replaceable components (e.g., Zhaga standards) and long serviceability. Germany, the UK, and France are key consumers, investing heavily in retrofitting public infrastructure and achieving ambitious carbon reduction targets, thereby driving the demand for high-performance and connected LED tubes.

Latin America (LATAM) and the Middle East and Africa (MEA) are recognized as high-potential emerging markets. LATAM's growth is driven by expanding industrialization and commercial development in countries like Brazil and Mexico, coupled with government initiatives addressing historically high energy costs. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is undergoing massive construction booms (e.g., smart city projects in Saudi Arabia and UAE), where LED lighting is mandated for all new public and private developments to meet sustainability goals. While pricing sensitivity remains high in these regions, the long-term TCO benefits of LED tubes are increasingly recognized, driving significant volume growth in the forecast period.

- Asia Pacific (APAC): Dominates manufacturing and volume consumption; driven by rapid industrialization, urbanization, and government energy savings mandates in China, India, and ASEAN countries.

- North America (NA): High-value market focused on premium, smart lighting integration; stringent energy standards (DLC, Energy Star) favor advanced Type B and IoT-enabled tubes in commercial retrofits.

- Europe: Growth propelled by accelerated regulatory phase-out of fluorescent lamps (Ecodesign Directive); high adoption of DALI and smart building protocols, focusing on sustainability and circularity.

- Latin America (LATAM): Emerging market growth driven by industrial expansion and the need to mitigate high local electricity tariffs, leading to high adoption rates in commercial facilities.

- Middle East and Africa (MEA): Significant growth potential tied to large-scale infrastructure projects, new city construction, and government efforts to diversify economies and enhance energy efficiency in line with national sustainability visions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Tube Lights Market.- Signify (Philips Lighting)

- GE Current (a Daintree Company)

- OSRAM (AMS-OSRAM)

- Acuity Brands

- Cree Lighting

- Hubbell Lighting

- Eaton Corporation

- LEDVANCE

- Opple Lighting

- Panasonic Corporation

- Toshiba Lighting & Technology Corporation

- Feit Electric

- MaxLite

- LITE-ON Technology Corporation

- Nichia Corporation

- Sylvania Lighting

- Zumtobel Group

- Dialight

- Samsung Electronics (Lighting Division)

- Seoul Semiconductor

Frequently Asked Questions

Analyze common user questions about the LED Tube Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of LED tube lights over traditional fluorescent tubes?

The primary advantages are superior energy efficiency (consuming 50-70% less power), significantly longer lifespan (up to 50,000 hours compared to 10,000-20,000 hours), reduced maintenance costs, and environmental safety due to the complete absence of mercury. Additionally, LED tubes offer instant-on light and improved light quality.

Should I choose Type A (Plug-and-Play) or Type B (Ballast Bypass) LED tubes for a retrofit project?

Type B (Ballast Bypass/Direct Wire) tubes are generally recommended for new installations and large-scale retrofits as they offer maximum energy savings and reliability by eliminating the need for the existing, aging fluorescent ballast, which often fails before the tube. Type A (Plug-and-Play) tubes offer the easiest installation but retain the existing ballast, which still consumes power and can eventually fail, requiring replacement.

How is the integration of IoT and smart controls impacting the LED Tube Lights Market?

IoT integration is transforming LED tubes into smart data points, enabling dynamic control features such as scheduling, dimming, and color temperature adjustment based on occupancy and daylight harvesting. This functionality enhances energy optimization beyond the inherent efficiency of the LED, provides data for facility management, and supports sophisticated Human-Centric Lighting strategies.

Which geographical region exhibits the highest growth potential for LED tube light adoption?

The Asia Pacific (APAC) region, specifically emerging economies like India and Southeast Asia, exhibits the highest growth potential in terms of volume consumption. This is driven by rapid industrialization, large infrastructural development projects, high electricity tariffs, and robust government mandates promoting the replacement of conventional lighting technologies.

What are the key technical specifications to consider when purchasing a replacement LED tube light?

Key technical specifications include luminous efficacy (Lumens per Watt), which measures energy efficiency; the required compatibility type (Type A, B, or C); the Color Rendering Index (CRI), ideally 80 or higher for good color fidelity; and the reported lifespan (L70 rating). Additionally, checking for necessary safety certifications (UL, CE) is crucial for reliable operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- LED Tube Lights Market Statistics 2025 Analysis By Application (Commerical Use, Residential Use), By Type (T5, T8), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- LED Tube Lights Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (2 foot, 4 foot, 8 foot), By Application (Dimmable, Undimmable), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager