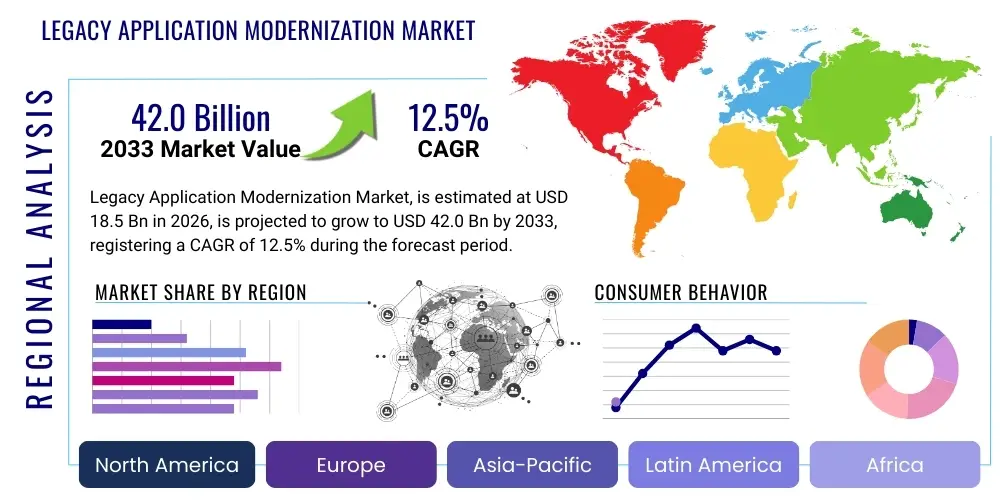

Legacy Application Modernization Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438119 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Legacy Application Modernization Market Size

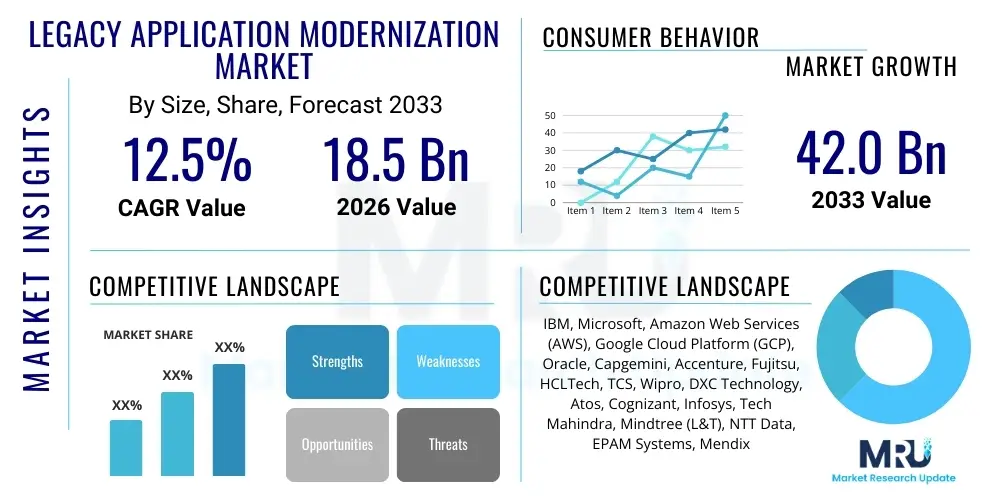

The Legacy Application Modernization Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 42.0 Billion by the end of the forecast period in 2033.

Legacy Application Modernization Market introduction

The Legacy Application Modernization (LAM) market encompasses the strategies, tools, and services utilized by enterprises to update aging software systems to contemporary computing architectures and infrastructure, typically involving cloud-native technologies. This transformation is necessitated by the need for increased agility, enhanced security protocols, improved scalability, and reduced operational costs associated with maintaining decades-old proprietary systems. Modernization strategies range from simple rehosting (lift-and-shift) to complex re-engineering and refactoring, allowing applications to leverage microservices, containerization (like Kubernetes), and serverless computing models. The primary product description involves integrated platforms and consulting services that assess, plan, execute, and manage the migration process, ensuring minimal business disruption.

Major applications of LAM services span critical business processes across various industries, including core banking systems in BFSI, patient records management in Healthcare, supply chain logistics in Retail, and tax systems in Government. The shift away from monolithic architectures towards API-driven, modular systems allows for faster feature deployment and integration with new digital channels. The benefits derived from modernization are substantial, including better performance, lower total cost of ownership (TCO), improved compliance with modern regulatory standards, and the ability to attract talent skilled in modern programming languages, thereby reducing technical debt and vendor lock-in.

Key driving factors fueling this market expansion include the accelerating pace of enterprise digital transformation initiatives, particularly the mass migration to hyperscale public clouds such as AWS, Azure, and Google Cloud Platform. Furthermore, the inherent vulnerabilities and escalating maintenance costs of legacy infrastructure, coupled with the end-of-life support for many proprietary operating systems and languages (like COBOL), compel organizations to invest heavily in modernization projects. The opportunity to unlock business value through data analytics and artificial intelligence, which often requires modern infrastructure, acts as a powerful catalyst for market growth.

Legacy Application Modernization Market Executive Summary

The Legacy Application Modernization market is experiencing robust growth driven by irreversible global business trends toward cloud-centric operations and pervasive digital customer experiences. Key business trends indicate a strong shift from traditional re-hosting approaches toward more complex, value-generating strategies such as re-platforming and refactoring, which leverage microservices architectures to maximize cloud benefits. Large enterprises, particularly those in regulated sectors like finance and insurance, are the dominant consumers of complex modernization services, aiming to enhance competitive advantage and regulatory compliance. Furthermore, the market is characterized by increasing partnerships between specialized modernization consultancies and major cloud vendors, forming integrated ecosystems that provide end-to-end transformation capabilities.

Regional trends highlight North America as the most mature market, characterized by early and aggressive adoption of modernization technologies, especially within the financial and tech sectors, often propelled by high labor costs and the need for technological superiority. Europe is also a significant market, driven primarily by stringent regulatory requirements (like GDPR) and the desire for operational efficiency within established, large organizations. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid industrialization, increasing digitization across developing economies, and significant government investments in modernizing public infrastructure and services. The demand in APAC is often geared towards adopting hybrid deployment models due to local data residency rules.

Segment trends reveal that the 'Cloud Migration' and 'Re-engineering' services segments dominate the market share, reflecting the imperative for enterprises to not just move applications, but fundamentally improve their architecture for cloud optimization. Infrastructure modernization and application portfolio rationalization services are also seeing high uptake. By deployment, the hybrid cloud segment is predicted to witness the highest CAGR, offering a pragmatic balance between utilizing public cloud elasticity and maintaining control over sensitive data on-premise. Vertically, the BFSI sector remains the largest segment due to its reliance on decades-old core systems, followed closely by the government sector, which faces immense pressure to improve public service delivery efficiency.

AI Impact Analysis on Legacy Application Modernization Market

Common user questions regarding AI's impact on Legacy Application Modernization center on whether AI tools can automate the complex process of code analysis, transformation, and testing, thereby reducing cost and risk. Users frequently inquire about the reliability of AI-driven code translation from archaic languages (e.g., COBOL, Fortran) to modern languages (e.g., Java, Python) and the level of human intervention still required. Concerns also revolve around the potential for AI tools to introduce new vulnerabilities or technical debt during automated refactoring. Overall, users expect AI to significantly accelerate the time-to-market for modernized applications and democratize access to complex modernization skills, currently scarce in the market.

- AI-driven automated code analysis accelerates the discovery phase, identifying application dependencies and complexity hotspots with greater accuracy than manual audits.

- Generative AI tools assist in code translation and conversion (COBOL to Java), reducing the manual effort required for low-level language transformation and enhancing developer productivity.

- Machine learning models optimize application portfolio rationalization by predicting the optimal modernization path (rehost, replatform, refactor) based on cost, risk, and business value metrics.

- AI-enabled testing platforms automatically generate comprehensive test cases and perform regression testing post-modernization, ensuring functional parity and reducing deployment risks.

- Predictive maintenance analytics, powered by AI, monitor the performance of newly modernized cloud-native applications, proactively identifying and resolving scalability and efficiency issues.

- Intelligent automation tools are used for infrastructure provisioning and configuration management in hybrid cloud environments, streamlining the DevOps pipeline for modernized applications.

DRO & Impact Forces Of Legacy Application Modernization Market

The market expansion is robustly driven by the imperative for digital transformation and the increasing adoption of cloud computing models, positioning these as powerful impact forces. Restraints primarily involve the high initial investment costs and the inherent organizational risks associated with migrating mission-critical applications, often resulting in prolonged decision cycles. Significant opportunities arise from the proliferation of specialized modernization toolkits, particularly those leveraging AI/ML, and the growing demand for microservices and API-centric architectures that unlock modularity and speed. These forces collectively shape the competitive landscape, emphasizing the necessity for vendors to offer flexible, outcome-based service models that mitigate perceived risks while maximizing long-term strategic value.

Key drivers include the need to overcome scalability limitations and performance bottlenecks inherent in legacy systems, especially in scenarios involving high data volume processing or rapid user growth, such as e-commerce or FinTech. Furthermore, the mounting scarcity of IT professionals skilled in maintaining decades-old proprietary codebases is forcing enterprises to modernize simply to ensure business continuity. Regulatory changes across sectors, demanding higher security standards and transparency, also compel businesses to move applications onto compliant, modern cloud platforms.

Restraints are often complex and interconnected, notably the 'spaghetti code' phenomenon where intertwined dependencies within legacy applications make extraction and modernization extremely difficult and prone to errors. Security concerns surrounding data transfer and ensuring data integrity during the migration process pose a significant hurdle. Furthermore, organizational inertia and resistance to large-scale operational change often stall projects, requiring extensive change management efforts from service providers. Opportunities are abundant in niche markets focusing on specific vertical needs, such as mainframe migration in banking or highly regulated environments requiring robust security modernization.

Segmentation Analysis

The Legacy Application Modernization market is segmented based on the type of service offered, the deployment model adopted, the size of the organization receiving the service, and the industry vertical served. This structured segmentation helps vendors tailor their offerings and pricing strategies to specific enterprise needs, ranging from quick infrastructure lifts to comprehensive architectural overhaul. The Service Type segmentation, which includes re-platforming and re-engineering, accounts for the largest revenue share as businesses prioritize deep architectural transformation over simple re-hosting to maximize cloud benefits. Cloud deployment models, especially hybrid solutions, are gaining traction due to their flexibility and ability to meet complex regulatory and performance requirements.

- By Service Type:

- Application Portfolio Assessment

- Cloud Migration

- Application Re-platforming

- Application Re-engineering/Refactoring

- Application Retiring/Replacement

- User Interface Modernization

- Post-Modernization Managed Services

- By Deployment Model:

- On-premise

- Cloud (Public, Private)

- Hybrid Cloud

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing

- Telecommunications and IT

- Energy and Utilities

Value Chain Analysis For Legacy Application Modernization Market

The value chain in the Legacy Application Modernization market is highly integrated, starting with upstream activities focused on assessment and tooling development, moving through execution (the core modernization process), and culminating in downstream services like testing and managed operations. Upstream analysis involves highly specialized consulting services where firms conduct rigorous application portfolio assessments (APAs), determining the technical debt, business value, and optimal modernization roadmap for thousands of applications. This stage heavily relies on proprietary diagnostic tools and expertise in archaic technologies. Key players at this stage include specialized consultancies and platform vendors providing automated assessment capabilities.

Midstream activities encompass the actual transformation, which involves re-platforming, re-engineering, or cloud migration. This phase relies heavily on proprietary automation tools, developer teams, and partnerships with hyperscale cloud providers (AWS, Azure, GCP). The focus here is execution speed, maintaining data integrity, and ensuring minimal downtime for critical business systems. The distribution channel for modernization services is predominantly direct, especially for large, bespoke projects, as clients require continuous, tailored engagement and deep domain expertise specific to their industry and regulatory environment.

Downstream analysis focuses on ensuring the modernized application operates effectively in its new environment. This includes rigorous quality assurance (QA) and testing, deployment via CI/CD pipelines, and continuous managed services post-go-live. Indirect distribution channels, such as system integrators (SIs) and value-added resellers (VARs) who utilize vendor tools to deliver services, are common for less complex, standardized migration projects aimed at SMEs. The long-term value creation lies in providing continuous optimization and security monitoring for the newly cloud-native applications.

Legacy Application Modernization Market Potential Customers

The primary consumers and end-users of Legacy Application Modernization services are large enterprises operating within regulated and highly competitive sectors where system performance and data security are paramount. Chief Information Officers (CIOs) and Chief Technology Officers (CTOs) within these organizations are the key buyers, driven by strategic mandates to enable digital transformation and reduce infrastructure costs. The Banking, Financial Services, and Insurance (BFSI) sector represents the most critical customer base, particularly for core banking system modernization, which involves high-stakes migration from mainframes to cloud platforms to support faster transaction processing and agile product development.

The Government and Public Sector entities constitute another significant customer segment, compelled by public demands for streamlined digital services (e-governance) and the urgent need to address aging infrastructure that poses security risks and operational inefficiency. These customers often prioritize security and compliance in their modernization efforts, favoring hybrid cloud solutions that meet data sovereignty requirements. Large manufacturing firms and telecommunications companies also rely heavily on LAM services to modernize their Enterprise Resource Planning (ERP) systems, supply chain management, and operational support systems (OSS) to enable real-time connectivity and industrial IoT initiatives.

While Large Enterprises dominate the spending, Small and Medium-sized Enterprises (SMEs) are increasingly becoming potential customers, often opting for standardized, SaaS-based re-platforming solutions or focused migration services for single applications. These SMEs are motivated by the desire to quickly transition to cost-effective, scalable cloud infrastructure without the burden of maintaining on-premise hardware. The buying decision is heavily influenced by proof of concept success, demonstrated expertise in the client's specific industry, and the vendor’s ability to guarantee data integrity and business continuity throughout the modernization lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 42.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Amazon Web Services (AWS), Google Cloud Platform (GCP), Oracle, Capgemini, Accenture, Fujitsu, HCLTech, TCS, Wipro, DXC Technology, Atos, Cognizant, Infosys, Tech Mahindra, Mindtree (L&T), NTT Data, EPAM Systems, Mendix |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Legacy Application Modernization Market Key Technology Landscape

The technology landscape for Legacy Application Modernization is heavily concentrated on cloud-native tools and advanced automation platforms designed to minimize manual coding and testing efforts. Central to this landscape is containerization technology, primarily Docker and Kubernetes, which abstracts applications from the underlying infrastructure, enabling highly portable and scalable deployments across hybrid environments. Microservices architecture, coupled with API gateways, forms the core architectural target for refactored applications, ensuring modularity, faster development cycles, and resilience. This shift requires sophisticated monitoring and tracing tools, such as Prometheus and Grafana, to manage the increased complexity of distributed systems.

A crucial technology component is the use of automated code translation and migration tools, often provided by specialized vendors or hyperscale cloud providers (e.g., AWS Migration Hub, Azure Migrate). These tools use static code analysis and pattern recognition algorithms to identify dependencies, extract business logic, and semi-automatically convert code from legacy languages into modern frameworks. Furthermore, low-code/no-code (LCNC) platforms are gaining prominence, allowing organizations to rapidly rebuild simple legacy interfaces or business processes without extensive traditional coding, speeding up the User Interface (UI) modernization segment significantly.

The evolution of DevOps practices and related tooling (Jenkins, GitLab CI, Terraform) is intrinsically linked to successful modernization, as it provides the infrastructure automation and continuous integration/continuous delivery (CI/CD) pipelines necessary to manage the deployment of frequently updated, modular applications. Security technologies, including DevSecOps integration and identity and access management (IAM) solutions designed for cloud environments, are essential layers in the technology stack, ensuring that modernized applications meet stringent enterprise security mandates from the outset, rather than being retrofitted later.

Regional Highlights

The regional analysis underscores the uneven distribution of market maturity and growth drivers across the globe, heavily influencing investment patterns and modernization strategies.

- North America: This region holds the largest market share, driven by a high concentration of technologically advanced enterprises, robust cloud adoption rates, and significant spending power, particularly in the BFSI and IT & Telecom sectors. The market here is characterized by high demand for complex, costly services like application refactoring and re-engineering to maintain competitive edge. The presence of major cloud service providers (AWS, Microsoft, Google) and leading system integrators further solidifies North America’s dominance, focusing heavily on AI-driven automation tools.

- Europe: The European market demonstrates mature adoption, propelled by rigorous regulatory environments (e.g., PSD2 in finance, GDPR) that necessitate the modernization of outdated, non-compliant systems. Western European countries, particularly the UK, Germany, and France, lead spending, often favoring a hybrid cloud approach to balance data sovereignty requirements with cloud scalability. Public sector modernization initiatives, aimed at improving e-government services, are significant contributors to market growth in this region.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This accelerated growth is fueled by rapid digital transformation across emerging economies (India, China, Southeast Asia), significant foreign investment in IT infrastructure, and government mandates supporting national digitalization efforts. While initial modernization often focuses on cost-effective rehosting, there is a swift transition toward re-platforming, particularly among large banks and telecom operators seeking to service massive, rapidly growing mobile user bases.

- Latin America (LATAM): The LATAM market is growing steadily, primarily driven by the need for operational efficiency and competitive pressure on regional banks and retailers. Challenges include fragmented infrastructure and economic volatility, but the increasing availability of localized cloud regions from global providers is lowering entry barriers, promoting the adoption of cost-effective public cloud migration strategies.

- Middle East and Africa (MEA): Growth in MEA is concentrated primarily in the Gulf Cooperation Council (GCC) countries, driven by ambitious national vision programs (e.g., Saudi Vision 2030, UAE's digital initiatives) that require massive public sector modernization and smart city development. The BFSI and Energy sectors are key consumers, investing heavily to ensure critical infrastructure is secured and future-proofed against evolving threats.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Legacy Application Modernization Market.- IBM (Focus on Mainframe and AI-driven migration tools)

- Microsoft (Azure Migration Program and Azure Modernization Toolkit)

- Amazon Web Services (AWS) (AWS Migration Hub and re-platforming services)

- Google Cloud Platform (GCP) (Focus on Anthos and hybrid architecture)

- Oracle (Cloud Infrastructure and application refactoring services)

- Capgemini (Leading global system integrator with strong modernization consulting)

- Accenture (Specializing in large-scale cloud transformation and application rationalization)

- Fujitsu (Expertise in legacy system maintenance and transition)

- HCLTech (Strong presence in infrastructure services and modernization)

- Tata Consultancy Services (TCS) (Deep domain expertise across various verticals)

- Wipro (Focus on engineering services and digital risk mitigation)

- DXC Technology (Specializing in mainframe and critical system modernization)

- Atos (Concentrating on high-security and regulated environments)

- Cognizant (Offering comprehensive digital engineering and transformation services)

- Infosys (Modernization services powered by its proprietary tools and platforms)

- Tech Mahindra (Strong capabilities in telecom and digital transformation)

- Mindtree (L&T) (Agile and cloud-native development services)

- NTT Data (Global reach with specialization in infrastructure and applications)

- EPAM Systems (High-end software engineering and platform re-architecture)

- Mendix (Low-code platform facilitating UI and workflow modernization)

Frequently Asked Questions

Analyze common user questions about the Legacy Application Modernization market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for enterprises investing in Legacy Application Modernization (LAM)?

The primary driver is the need for rapid digital transformation and migration to cloud environments to gain scalability, reduce the prohibitive operational costs associated with maintaining outdated systems, and mitigate mounting security risks from unsupported software.

Which modernization strategy offers the highest business value, and why?

Application re-engineering or refactoring offers the highest long-term business value because it fundamentally redesigns the application using modern architectures (like microservices and containers), maximizing agility, elasticity, and cloud optimization, rather than simply moving old code.

What is the biggest risk involved in a major application modernization project?

The biggest risk is business disruption and failure to maintain data integrity during migration. Projects often face complexity due to deep, undocumented application dependencies and the potential for prolonged downtime of mission-critical systems if not meticulously planned and tested.

How is Artificial Intelligence (AI) currently influencing the modernization market?

AI is primarily used to accelerate the initial phases of modernization, specifically through automated code analysis, dependency mapping, and risk assessment. Generative AI is also beginning to assist in automated code translation and generation for modern frameworks, significantly speeding up development.

Which industry vertical is the leading consumer of Legacy Application Modernization services?

The Banking, Financial Services, and Insurance (BFSI) vertical is the leading consumer, primarily driven by the urgent necessity to modernize core banking systems and mainframe applications to comply with stringent regulations and support real-time digital customer experiences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager