Legal Case Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437287 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Legal Case Management Software Market Size

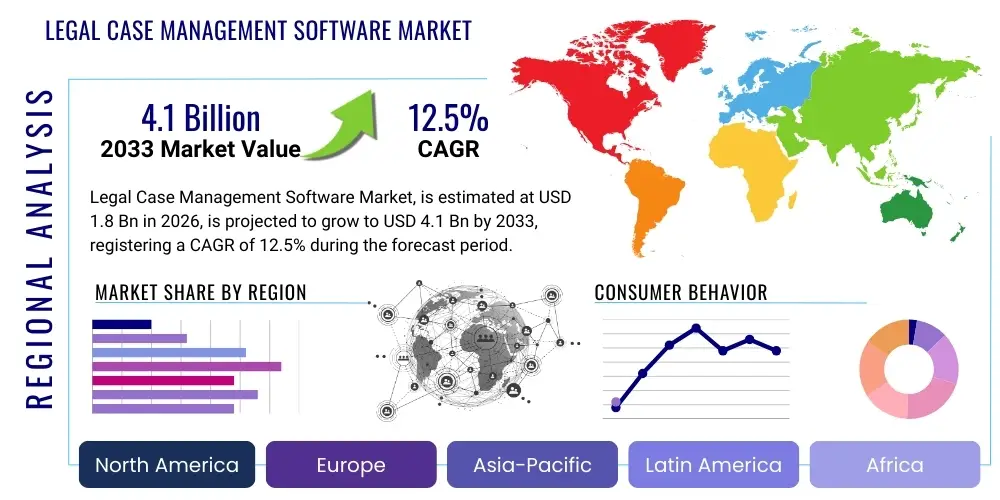

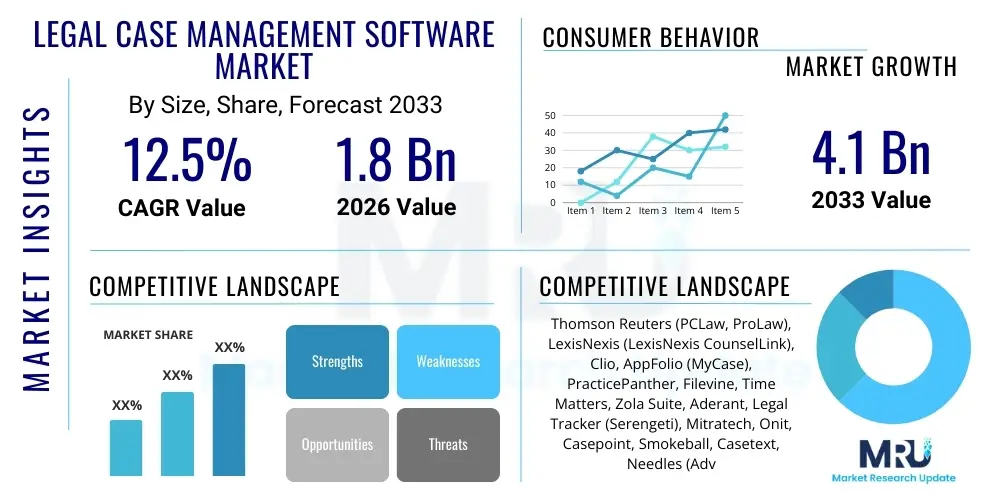

The Legal Case Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $4.1 Billion by the end of the forecast period in 2033.

Legal Case Management Software Market introduction

Legal Case Management Software (LCMS) is a specialized application designed to help law firms, corporate legal departments, and government agencies manage critical information related to specific cases, clients, documents, billing, and deadlines. This comprehensive solution centralizes data, streamlines workflows, and improves operational efficiency across various legal practices, from litigation and corporate compliance to intellectual property and regulatory affairs. The fundamental utility of LCMS lies in its ability to transform fragmented, manual processes into integrated, automated systems, thereby reducing administrative overhead and minimizing the risk of errors associated with case handling.

Major applications of LCMS span practice management, document management, time and expense tracking, client relationship management (CRM), and calendaring. Key benefits driving adoption include enhanced data security, improved regulatory compliance (especially concerning client confidentiality and jurisdictional rules), and increased billable hours realization through precise time tracking. Furthermore, these platforms provide crucial reporting and analytics capabilities, allowing legal professionals to assess case feasibility, track team performance, and optimize resource allocation based on real-time data insights.

The primary driving factors propelling the market expansion are the increasing complexity of litigation, the growing emphasis on digital transformation within the legal industry, and stringent regulatory requirements mandating efficient record-keeping. The shift from on-premise solutions to cloud-based and Software-as-a-Service (SaaS) models is further accelerating adoption, particularly among small and mid-sized law firms seeking affordable, scalable, and rapidly deployable solutions without significant upfront infrastructure investment. This technological shift is democratizing access to sophisticated case management tools, reinforcing the market’s positive growth trajectory.

Legal Case Management Software Market Executive Summary

The Legal Case Management Software (LCMS) market is undergoing rapid evolution, characterized by a fundamental shift toward cloud deployment and the integration of sophisticated analytical tools. Business trends indicate a strong move by major vendors to offer specialized modules catering to niche legal practices—such as immigration law, environmental law, and complex class actions—moving beyond generic litigation support. Law firms are prioritizing solutions that seamlessly integrate with existing enterprise resource planning (ERP) systems and financial software, driving demand for open Application Programming Interfaces (APIs) and interoperability standards. Competition is intense, focusing heavily on user experience (UX) design, mobile accessibility, and robust security certifications to protect sensitive client data.

Regionally, North America maintains market dominance due to its highly sophisticated legal infrastructure, high litigation rates, and early adoption of legal technology. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by increasing foreign direct investment, the establishment of large multinational law firms, and rapid modernization of judicial systems in countries like India, China, and Australia. Europe demonstrates mature adoption, driven primarily by GDPR compliance requirements and the need for cross-border case coordination, particularly within the European Union member states.

Segment trends reveal that the SaaS model, particularly for mid-sized firms, is the predominant growth driver, offering cost flexibility and automatic updates crucial for compliance. By component, the software segment holds the largest market share, though the services segment (including consulting, implementation, and maintenance) is expected to grow significantly as firms require expert guidance for transitioning to complex, integrated platforms. Furthermore, the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) features, such as predictive analytics for case outcomes and automated document review, represents the most significant segment transformation, positioning AI-enabled LCMS as the future standard.

AI Impact Analysis on Legal Case Management Software Market

User inquiries surrounding the impact of AI on Legal Case Management Software predominantly center on efficiency gains, cost reduction, and the potential displacement of human tasks. Key questions revolve around how AI facilitates predictive coding for e-discovery, its accuracy in predicting litigation outcomes, and the ethical implications concerning data privacy and bias in algorithmic decision-making. Users are keenly interested in practical applications, such as automated time entry, intelligent document categorization, and the use of natural language processing (NLP) to summarize complex contracts or legal precedents. The prevailing expectation is that AI will move LCMS from reactive record-keeping to proactive strategic tools, enhancing decision support rather than simply automating mundane processes.

The integration of AI modules is fundamentally reshaping the core functionality of LCMS, transitioning them into "smart" platforms. This shift is enabling legal professionals to handle significantly higher volumes of data, drastically cutting down the time spent on administrative and preliminary legal research tasks. For instance, AI algorithms can analyze historical case data to flag potential risks, identify patterns in judge rulings, and prioritize tasks based on deadlines and complexity. This infusion of intelligence transforms raw case data into strategic business intelligence, allowing law firms to improve profitability and offer clients more precise, data-backed advice. However, this adoption also raises concerns about data governance and the need for explainable AI (XAI) to maintain professional accountability.

Moreover, AI implementation is lowering the barrier to entry for complex tasks previously requiring large teams. For example, in large-scale due diligence or regulatory response, AI-powered document classification reduces human review hours by up to 80%. This increased efficiency translates directly into competitive advantages for firms utilizing these tools, pressuring traditional LCMS providers to rapidly incorporate sophisticated ML capabilities or risk market obsolescence. The long-term impact suggests a democratization of high-level legal analytics, making advanced case strategy accessible even to smaller practices through affordable, scalable SaaS platforms.

- AI-driven automation accelerates e-discovery and document review processes.

- Machine Learning enhances predictive analytics for litigation outcomes and risk assessment.

- Natural Language Processing (NLP) facilitates automated contract analysis and knowledge extraction.

- AI tools standardize and automate routine administrative tasks like time entry and client intake.

- Integration of intelligent chatbots improves client communication and initial case screening.

- AI necessitates stronger focus on data security and ethical guidelines within LCMS platforms.

DRO & Impact Forces Of Legal Case Management Software Market

The Legal Case Management Software market is shaped by a powerful interplay of technological drivers and systemic restraints, coupled with significant growth opportunities stemming from digital transformation imperatives. Drivers, such as the global mandate for digitized record-keeping and the increasing complexity of cross-jurisdictional legal matters, are compelling firms to adopt centralized systems. Restraints predominantly involve the high initial cost of transitioning legacy systems, resistance to change among senior legal professionals, and significant data security and privacy concerns inherent in cloud-based solutions. Opportunities are emerging through the expansion into emerging markets, the customization of platforms for specific regulatory environments (e.g., sector-specific compliance), and the integration of blockchain technology for immutable evidence trails.

The primary impact forces propelling market growth are the necessity for efficiency and the pressure of regulatory scrutiny. Law firms operate under tight constraints regarding billable hours and client expectations for value, making efficiency gains from LCMS indispensable. Simultaneously, global regulations like GDPR, CCPA, and regional sector-specific rules are imposing heavy burdens on data management, demanding robust, audit-ready LCMS platforms. These forces create a compelling business case for investment in sophisticated software that mitigates compliance risks while simultaneously optimizing operational performance and enhancing client experience, ensuring sustained market uptake.

Conversely, the inertia of established legal practices and the challenge of data migration represent persistent negative impact forces. Many smaller or older firms rely on established, manual, or fragmented systems, viewing the transition to an integrated LCMS as disruptive and financially prohibitive. Furthermore, vendors must continuously address sophisticated cybersecurity threats, as legal data is highly valuable and sensitive. The market’s future dynamism depends significantly on how effectively vendors can mitigate implementation complexity and security fears, offering user-friendly interfaces and robust data protection guarantees to overcome this inherent industry reluctance.

- Drivers: Growing need for workflow automation; Increasing volume and complexity of digital legal data; Global regulatory compliance mandates (e.g., GDPR, HIPAA).

- Restraints: High cost of implementation and migration for legacy systems; Data security concerns surrounding cloud deployment; Resistance to technological change among some legal professionals.

- Opportunities: Expansion into corporate legal departments; Integration of advanced analytics and AI for predictive capabilities; Development of mobile-first LCMS solutions.

- Impact Forces: Technological innovation intensity (high); Competitive rivalry (high); Threat of substitutes (low); Buyer bargaining power (medium to high due to varied pricing models).

Segmentation Analysis

The Legal Case Management Software market is segmented based on Component (Software and Services), Deployment Model (On-Premise and Cloud/SaaS), End-User (Law Firms, Corporate Legal Departments, and Government Agencies), and Practice Area (Litigation, IP Management, Bankruptcy, etc.). This segmentation provides a granular view of market dynamics, revealing differential adoption rates and preferences across various organizational sizes and operational mandates. The software component remains the core offering, yet the rapidly growing demand for specialized consulting, implementation, and managed services indicates a shift toward comprehensive, vendor-supported digital transformations rather than simple software sales.

The Deployment Model segmentation clearly indicates the industry’s shift toward cloud-based solutions. Cloud/SaaS models are highly attractive due to their lower total cost of ownership (TCO), scalability, and accessibility, making them the preferred choice for small and mid-sized law firms and increasingly for corporate legal teams prioritizing agility. Conversely, large government agencies and some highly regulated corporate entities still rely on On-Premise solutions for stringent control over data infrastructure and localized security protocols, although this segment is gradually shrinking.

End-User analysis confirms that Law Firms, particularly large and mid-sized entities, are the dominant users, driven by the need to maximize billable efficiency and client service quality. However, the Corporate Legal Departments segment is exhibiting the fastest growth. As in-house teams take on more complex litigation and regulatory matters internally, they require sophisticated LCMS tools tailored for corporate compliance, matter tracking, and internal risk management, distinct from traditional external law firm workflows. This growing corporate need represents a significant revenue opportunity for specialized LCMS providers.

- By Component: Software, Services (Consulting, Implementation, Maintenance & Support).

- By Deployment Model: On-Premise, Cloud/SaaS.

- By End-User: Law Firms (Small, Mid-sized, Large), Corporate Legal Departments, Government Agencies & Non-Profits.

- By Practice Area: Litigation, Intellectual Property (IP) Management, Bankruptcy, Criminal Defense, Family Law, Real Estate, Corporate/Commercial Law.

Value Chain Analysis For Legal Case Management Software Market

The value chain for Legal Case Management Software spans initial technology development, solution customization and deployment, and extensive post-sale support. The upstream analysis involves technology providers focusing on core capabilities such as data security protocols, database design, and the integration of third-party tools (e.g., accounting and e-discovery platforms). Key upstream activities include securing partnerships with cloud infrastructure providers (like AWS, Azure) and developing proprietary AI/ML algorithms that serve as the intelligence backbone of the LCMS. Innovation at this stage, particularly regarding scalability and seamless integration capabilities, is critical for competitive differentiation.

The downstream analysis centers on distribution, implementation, and client engagement. Distribution channels are predominantly direct sales channels for large, enterprise-level clients, often involving lengthy procurement cycles requiring detailed customization. However, indirect channels, relying on specialized legal technology consultants and value-added resellers (VARs), play a crucial role in reaching the highly fragmented small and mid-sized law firm market. Implementation services are intensive, requiring specialized legal domain knowledge to successfully migrate historical data and customize workflows to meet specific jurisdictional and practice area needs.

The service element, encompassing maintenance, technical support, and continuous feature updates, constitutes a significant portion of the downstream value proposition, especially for SaaS models which depend on high customer retention rates. Direct distribution allows vendors to maintain greater control over client relationships and receive direct feedback for product improvement, essential in this rapidly evolving sector. Conversely, leveraging indirect channels accelerates market penetration by utilizing local expertise and established relationships, particularly important in geographically diverse regions where cultural and legal practices vary significantly.

Legal Case Management Software Market Potential Customers

The primary consumers and buyers of Legal Case Management Software are highly segmented professional organizations operating within the legal framework, each with distinct needs regarding scale, security, and functionality. Law firms constitute the largest customer base, ranging from solo practitioners requiring basic cloud-based solutions to multinational corporate law firms demanding highly customized, integrated platforms capable of managing thousands of cases simultaneously across multiple jurisdictions. Small and mid-sized firms prioritize affordability, ease of use, and quick deployment (SaaS), while large firms focus on robust security, integration with complex billing systems, and advanced AI features for managing high-stakes litigation.

The rapidly growing segment of potential customers includes corporate legal departments (CLDs). As regulatory pressure increases and corporate entities bring more legal work in-house, CLDs require LCMS solutions tailored for enterprise risk management, contract lifecycle management, and internal investigation tracking. Their focus is often on integration with existing corporate IT infrastructure (such as HR and finance systems) and on modules that prioritize compliance and predictable budgeting, rather than external client billing. CLDs typically seek solutions that provide comprehensive dashboards for managing external counsel spending alongside internal matter progress.

Government agencies, including public defenders' offices, district attorneys' offices, and regulatory bodies (e.g., environmental protection agencies), form the third major customer segment. These entities prioritize strict data segregation, compliance with government security mandates (like FedRAMP in the US), and specific functionality for managing public records requests (FOIA). Their procurement processes are often lengthy and require adherence to rigorous technical specifications, generally favoring robust, often on-premise, or private cloud solutions capable of handling massive historical data archives and managing public access control effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $4.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thomson Reuters (PCLaw, ProLaw), LexisNexis (LexisNexis CounselLink), Clio, AppFolio (MyCase), PracticePanther, Filevine, Time Matters, Zola Suite, Aderant, Legal Tracker (Serengeti), Mitratech, Onit, Casepoint, Smokeball, Casetext, Needles (Advocate), MindBridge. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Legal Case Management Software Market Key Technology Landscape

The technology landscape for Legal Case Management Software is rapidly evolving, driven primarily by advancements in cloud computing, data security, and artificial intelligence. Cloud-native architectures utilizing microservices are becoming standard, enabling vendors to offer highly scalable, resilient, and multi-tenant platforms that cater to firms of all sizes. This infrastructure shift allows for continuous deployment and real-time updates, crucial for maintaining compliance with ever-changing legal standards and security protocols. Furthermore, robust API ecosystems are essential, facilitating seamless integration with third-party tools for accounting, document storage (like Dropbox or OneDrive), and specialized legal research platforms, positioning the LCMS as the central hub of a firm’s digital operations.

A critical technological focus is on enhanced data security and governance. LCMS platforms must comply with international standards such as ISO 27001 and regional privacy regulations like GDPR and CCPA. Technologies like end-to-end encryption, multi-factor authentication (MFA), and detailed audit trails are non-negotiable features. Beyond traditional security, vendors are increasingly adopting blockchain technology for specific use cases, such as creating immutable records of evidence logs, time stamps, and chain of custody, which enhances the integrity and admissibility of digital evidence in court proceedings.

Artificial Intelligence (AI) and Machine Learning (ML) represent the most transformative technologies. NLP is employed to analyze large volumes of unstructured data (emails, transcripts, documents), automating the extraction of key facts, entities, and deadlines. Predictive coding and machine learning models are applied to assess case risk, forecast outcomes based on historical data patterns, and automate the categorization of case materials. This infusion of AI transforms LCMS from mere organizational tools into proactive decision-support systems, providing lawyers with strategic insights derived from massive data sets, thus significantly reducing research time and improving overall case strategy formulation.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for Legal Case Management Software. This dominance is attributable to the high volume of litigation, the substantial presence of large multinational law firms, and the early, enthusiastic adoption of legal technology driven by competitive necessity. The market here is characterized by high levels of technological sophistication, intense competition among vendors, and strong demand for AI-driven solutions for complex e-discovery and practice management. Regulatory requirements, such as those governing data retention and client privacy, drive constant software upgrades and specialized functionality, reinforcing the region's market leadership. Cloud adoption is pervasive, though a significant segment of large corporate clients maintains on-premise infrastructure for maximum data control.

- Europe: The European market is the second largest, driven significantly by the implementation of stringent data protection regulations, notably the General Data Protection Regulation (GDPR). European law firms and corporate legal departments require LCMS solutions that offer robust data localization capabilities and comprehensive consent management features tailored to the varied rules across EU member states. The market is highly diverse, with strong uptake in the UK and Germany, focusing on integrated solutions that support multi-lingual operations and cross-border litigation management. The trend here leans heavily towards secure, scalable SaaS solutions that facilitate collaboration while ensuring rigorous compliance checks.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, driven by rapid economic development, modernization of judicial systems, and increased foreign investment leading to greater litigation complexity. Countries such as Australia, Japan, and Singapore show high maturity, mirroring North American trends. However, emerging economies like India and China are witnessing exponential growth, fueled by the rising number of mid-sized law firms and corporate entities initiating digital transformation projects. Key challenges include fragmented regulatory landscapes and the necessity for LCMS platforms to support multiple languages and complex character sets, creating specific demand for highly customizable regional solutions.

- Latin America (LATAM): The LATAM market is in an emergent phase, characterized by localized adoption focusing on core functionalities like document management and time tracking. Growth is spurred by increased efforts to combat corruption and improve judicial efficiency, particularly in countries like Brazil and Mexico. Price sensitivity remains a key factor, favoring affordable, highly scalable cloud solutions. Vendors need to address infrastructure challenges, including varying internet connectivity reliability, by offering robust offline capabilities and simple deployment models.

- Middle East and Africa (MEA): The MEA region is developing, with concentration of demand in major economic hubs like the UAE and Saudi Arabia, driven by rapid urbanization and the establishment of international business centers. Demand is highest in corporate legal departments and large regional law firms focusing on international arbitration and commercial law. Security and regional data residency laws are paramount. The market is marked by high potential but requires vendors to offer solutions compliant with region-specific governance, often requiring specialized language support (e.g., Arabic right-to-left interfaces).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Legal Case Management Software Market.- Thomson Reuters (PCLaw, ProLaw)

- LexisNexis (LexisNexis CounselLink)

- Clio

- AppFolio (MyCase)

- PracticePanther

- Filevine

- Time Matters (PCLaw)

- Zola Suite

- Aderant

- Legal Tracker (Serengeti, part of Thomson Reuters)

- Mitratech

- Onit

- Casepoint

- Smokeball

- Casetext

- Needles (Advocate)

- MindBridge

- ActionStep

- CosmoLex

- HoudiniEsq

Frequently Asked Questions

Analyze common user questions about the Legal Case Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines the primary differences between On-Premise and Cloud Legal Case Management Software?

On-Premise LCMS requires hardware installation, maintenance, and direct control over data, often preferred by highly regulated organizations requiring strict internal security protocols. Cloud/SaaS LCMS offers flexibility, lower upfront costs, automatic updates, and remote access, making it scalable and suitable for most small to mid-sized firms prioritizing operational agility and lower total cost of ownership (TCO).

How is Artificial Intelligence fundamentally transforming legal case management workflows?

AI transforms workflows by automating high-volume, low-value tasks such as document review, e-discovery, and data extraction using NLP. It enhances strategic decision-making through predictive analytics, allowing firms to forecast case outcomes, assess litigation risks, and efficiently allocate resources, moving the LCMS from a passive record system to a proactive strategy tool.

Which End-User segment is demonstrating the highest growth potential in the LCMS market?

The Corporate Legal Departments (CLD) segment is exhibiting the highest growth potential. As regulatory complexity and internal matter management increase, CLDs are rapidly adopting specialized LCMS platforms tailored for enterprise risk mitigation, compliance tracking, and managing external counsel spend, driving significant revenue growth for vendors offering corporate-specific functionalities.

What are the most significant constraints hindering widespread adoption of LCMS platforms?

The most significant constraints include the substantial initial capital investment required for large-scale enterprise solutions, the complexity and risk associated with migrating vast amounts of historical client data from legacy systems, and resistance to change among seasoned legal professionals accustomed to traditional, manual workflows.

What security standards should a leading Legal Case Management Software platform adhere to?

Leading LCMS platforms must adhere to globally recognized security standards such as ISO 27001 for information security management and comply with regional data privacy mandates like GDPR (Europe) and CCPA (North America). Essential technical requirements include multi-factor authentication (MFA), end-to-end encryption, and comprehensive, unalterable audit logging capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager