Legged Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438910 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Legged Robot Market Size

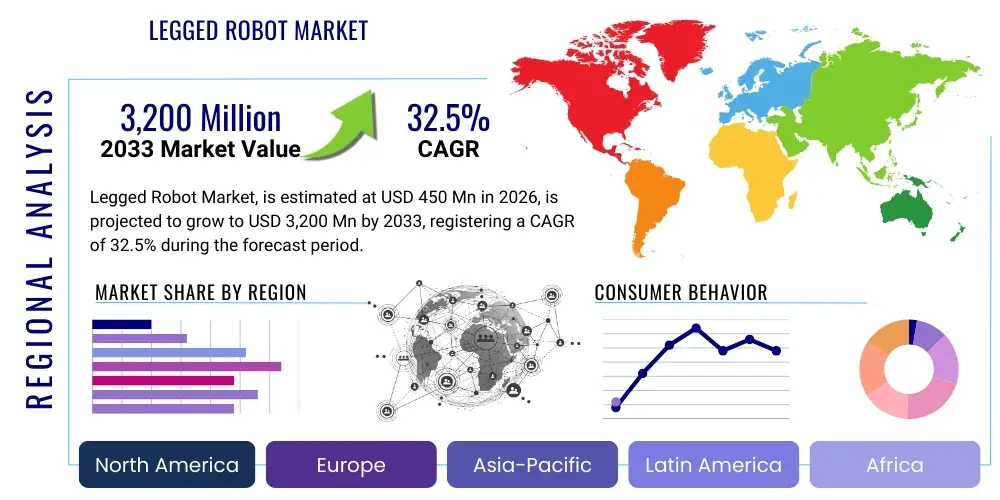

The Legged Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 32.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 3,200 Million by the end of the forecast period in 2033.

Legged Robot Market introduction

The Legged Robot Market encompasses the design, manufacturing, and deployment of robotic systems utilizing articulated limbs for locomotion, mimicking biological walking patterns such as bipedal, quadrupedal, and hexapedal gaits. These advanced robots are fundamentally distinguished by their superior mobility and ability to traverse highly complex, unstructured terrains—environments inaccessible to traditional wheeled or tracked autonomous vehicles. Key product differentiators include advanced dynamic stability algorithms, high power-to-weight ratio actuators, and sophisticated sensor fusion capabilities (LiDAR, visual inertial odometry, force sensors) that enable real-time adaptation to changing ground conditions, slopes, and obstacles, making them indispensable for applications requiring operation outside controlled industrial settings.

Major applications driving market traction include infrastructure inspection in hazardous environments (e.g., nuclear facilities, oil and gas pipelines), search and rescue operations following natural disasters, military reconnaissance, and last-mile logistics in urban areas where stairs and uneven sidewalks pose significant challenges. The unique ability of legged robots to manage dynamic interactions with the environment, execute complex maneuvers like stair climbing, and maintain balance under external perturbations positions them as the next evolutionary step in mobile robotics. Furthermore, their deployment in research and development remains crucial, pushing the boundaries of biomechanics, artificial intelligence, and sophisticated control theory, ultimately lowering the barriers to entry for commercial adoption.

The primary driving factor sustaining the rapid expansion of this market is the increasing global demand for automation solutions that can operate autonomously and reliably in dynamic, unpredictable settings, often too dangerous or remote for human personnel. This demand is acutely felt in sectors such as defense, energy, and infrastructure maintenance. Simultaneously, significant advancements in key enabling technologies, specifically in high-density batteries, powerful embedded processors capable of executing complex AI models (such as deep reinforcement learning for locomotion planning), and precision actuation systems (e.g., series elastic actuators), have substantially improved the performance, energy efficiency, and cost-effectiveness of these sophisticated machines, paving the way for large-scale commercialization.

Legged Robot Market Executive Summary

The Legged Robot Market is entering a critical phase of commercial maturation, transitioning from high-cost academic prototypes to robust, deployable industrial assets. Current business trends emphasize the shift toward service-based robotics (RaaS) models, minimizing the initial capital expenditure for end-users, alongside a strong focus on modular designs that allow for diverse payload integration and application customization. Geographically, North America leads in R&D and defense spending, while the Asia Pacific region is rapidly accelerating adoption, particularly in manufacturing inspection and intra-logistics within complex factory floors. European markets focus heavily on safety certification and ethical integration, driven by stringent regulatory frameworks aimed at ensuring safe human-robot collaboration.

Key segment trends reveal quadrupedal robots dominating the market share due to their inherent stability, ease of scaling, and proven utility in inspection and monitoring roles across critical infrastructure. Bipedal systems, while representing a smaller segment, are seeing intense investment driven by the aspiration for human-centric manipulation and navigation capabilities, critical for applications in retail, household assistance, and human-like interaction. The industrial sector remains the dominant end-user, primarily leveraging quadruped robots for remote asset management and environmental monitoring, yielding significant returns on investment by preventing costly downtime and improving worker safety in hazardous zones.

Technological advancement is heavily concentrated on enhancing autonomy through sophisticated AI integration, focusing specifically on improved situational awareness, predictive maintenance capabilities, and advanced gait planning optimization for energy conservation. This technological push, combined with competitive pricing pressures resulting from mass production scaling, is expected to democratize access to legged robotics over the forecast period. The market trajectory indicates a strong positive outlook, underscored by continuous venture capital funding into emerging manufacturers and strategic partnerships between traditional industrial players and specialized robotics firms, further solidifying the foundational infrastructure necessary for widespread commercial acceptance.

AI Impact Analysis on Legged Robot Market

Common user questions regarding AI's influence on the Legged Robot Market frequently revolve around performance enhancement, specifically querying how AI enables robots to maintain balance under extreme duress, efficiently navigate novel environments, and manage power consumption optimally. Users often express concerns regarding the ethical implications of autonomous decision-making in critical defense or search-and-rescue scenarios, alongside expectations that advanced Artificial Intelligence, particularly Deep Reinforcement Learning (DRL), will be the key differentiator separating robust commercial systems from less adaptive prototypes. The consensus highlights that users expect AI to transition legged robots from mere remote-controlled platforms to truly autonomous entities capable of interpreting complex sensory data, predicting system failures, and dynamically optimizing physical behaviors, thereby vastly expanding their operational envelope and reliability.

The infusion of AI, particularly sophisticated sensor fusion algorithms and Machine Learning (ML) models, has fundamentally transformed the locomotion capabilities of legged robots. Traditional control methods relied on precise kinematic and dynamic models, which often failed when encountering unexpected terrain properties or external forces. AI, conversely, allows the robot's control system to learn optimal gaits and recovery maneuvers directly from experience or simulation, enabling superior dynamic stability and resilience. This paradigm shift means robots can now autonomously adapt their walking styles—transitioning smoothly between walking, trotting, running, and bounding—based on instantaneous feedback regarding ground friction, payload changes, and slope angles, a capability essential for deployment in unpredictable real-world settings.

Furthermore, AI is crucial for higher-level tasks beyond mere movement, governing mission planning, object recognition, and complex decision-making. Utilizing neural networks for visual perception (identifying obstacles, recognizing target objects) and probabilistic planning, AI enables legged robots to perform complex missions autonomously, such as creating detailed 3D maps of a disaster site or performing multi-stage inspections without continuous human intervention. This advanced cognitive capability drastically reduces operational costs, enhances the speed of data collection, and ultimately maximizes the value proposition of legged robot technology across industrial and governmental applications, driving exponential market growth in autonomous platforms.

- AI enhances dynamic stability and recovery from external perturbations using Model Predictive Control (MPC) refined by Reinforcement Learning (RL).

- Deep Reinforcement Learning (DRL) optimizes gait selection and energy efficiency across varied and unstructured terrain types.

- Machine Vision and Sensor Fusion (LiDAR, cameras) enable advanced situational awareness and autonomous navigation (SLAM).

- Predictive maintenance algorithms powered by ML analyze motor currents and joint health to anticipate component failure, increasing operational uptime.

- AI facilitates complex, high-level task planning and coordination for multi-robot systems in integrated logistics and monitoring operations.

DRO & Impact Forces Of Legged Robot Market

The Legged Robot Market is propelled by substantial technological drivers and significant investment opportunities, yet faces considerable hurdles relating to cost, complexity, and energy efficiency. The dominant market drivers center around the imperative for enhanced automation in unstructured, hazardous environments where traditional wheeled or tracked robots are ineffective. The increasing maturity of integrated sensor technologies, coupled with the exponential rise in processing power required for advanced controls, facilitates the continuous development of robust, reliable systems. Conversely, market growth is constrained by the persistently high initial capital investment required for these sophisticated systems, coupled with ongoing challenges related to battery energy density, which limits operational endurance in field deployments, necessitating frequent recharging or complex power management strategies.

Opportunities for market expansion are vast, particularly within the nascent sectors of service robotics (delivery, retail assistance) and consumer applications, driven by advancements in miniaturization and reduced manufacturing costs through economies of scale. Furthermore, the integration of advanced networking technologies like 5G and future 6G networks offers opportunities for real-time remote control and enhanced data exchange, mitigating connectivity issues in remote operational zones. The competitive landscape is shaped by powerful impact forces: the technological advancement force, demanding continuous improvement in battery technology and AI robustness; the regulatory force, increasingly focusing on safety standards and ethical deployment guidelines, particularly in civilian environments; and the economic force, dictating that total cost of ownership (TCO) must decrease significantly to encourage widespread adoption across small and medium-sized enterprises (SMEs).

The interplay of these forces defines the market dynamics. Strong governmental and defense sector investments act as a stabilizing driver, funding core research and providing large initial procurement contracts, which subsidize commercial development. However, the restraint posed by high cost limits immediate widespread commercial adoption outside of high-value industrial inspection niches. Successfully capitalizing on the opportunity involves addressing the energy storage restraint directly, as improved battery life will instantly increase the utility and addressable market size for autonomous field operations. The ongoing balance between performance requirements and economic viability remains the primary determining factor for the market trajectory over the forecast period.

Segmentation Analysis

The Legged Robot Market segmentation provides a crucial framework for understanding the diverse applications and technological maturity levels within the industry. The primary segmentation dimensions include the type of locomotion mechanism (bipedal, quadrupedal, hexapedal), the application domain (inspection, defense, logistics, research), and the end-user industry (industrial, commercial, government/defense). Quadrupedal systems currently dominate the market, primarily due to their superior static and dynamic stability, making them ideal for carrying heavy payloads and performing robust inspection tasks in demanding industrial environments such as construction sites and power plants. Bipedal robots, while representing a lower volume, are central to ongoing innovation aimed at achieving human-centric tasks and navigating environments designed for humans.

The application segmentation highlights inspection and monitoring as the largest segment, driven by strict regulatory requirements in critical infrastructure sectors like oil and gas, utilities, and chemicals, where remote operations improve worker safety and efficiency. Logistics and warehousing represent the fastest-growing application segment, focusing on automation for internal transportation, inventory management, and last-mile delivery over mixed terrains. The defense and security segment remains a vital early adopter, utilizing legged platforms for reconnaissance, surveillance, and explosive ordnance disposal (EOD) in tactical and often compromised operational theaters, relying heavily on the robot's ability to navigate steep slopes and rubble.

From an end-user perspective, the industrial sector, encompassing manufacturing, energy, and construction, accounts for the largest share, driven by tangible ROI linked to reduced downtime and increased data fidelity. The government and defense sector sustains high-value demand, focusing on highly customized, rugged systems designed for extreme conditions. The academic and research segment, while not the largest buyer, is critical for defining future technological breakthroughs and acting as a proving ground for next-generation locomotion control algorithms, sensor integration, and advanced human-robot interaction interfaces, ensuring a continuous pipeline of innovation for commercial products.

- By Type:

- Quadruped Robots

- Biped Robots

- Hexapod and Multi-Legged Robots

- By Application:

- Inspection and Monitoring

- Logistics and Warehousing

- Search and Rescue

- Defense and Security

- Research and Development

- By End-User:

- Industrial (Energy, Construction, Manufacturing)

- Commercial (Retail, Healthcare, Service)

- Government and Defense

- Research and Academic Institutions

Value Chain Analysis For Legged Robot Market

The value chain for the Legged Robot Market is intricate and highly reliant on specialized technology providers in the upstream segment. Upstream activities involve the procurement of highly advanced components, including high-torque, precision actuators (often custom-designed), sophisticated sensory inputs (LiDAR, high-resolution cameras, inertial measurement units - IMUs, and force/torque sensors), and powerful embedded processing units (GPUs/FPGAs) necessary for real-time control and AI processing. The reliance on these specialized, often proprietary components creates significant bargaining power for upstream suppliers who possess niche manufacturing capabilities and advanced material science expertise crucial for minimizing robot weight while maximizing strength and power output.

The midstream segment involves design, system integration, and manufacturing, where core robotics companies develop proprietary control software, dynamic gait algorithms, and robotic operating system (ROS) implementations, integrating the disparate hardware components into a coherent, functional robotic platform. This phase is characterized by intense intellectual property (IP) protection, particularly around locomotion control and AI-driven stability systems. Quality control and rigorous testing under various environmental stressors are critical at this stage to ensure robustness and reliability before deployment. Successful midstream firms excel in achieving a favorable balance between rugged hardware design and highly adaptive, efficient software architecture, which is a significant barrier to entry for new competitors.

Downstream activities focus on market penetration, encompassing distribution channels, deployment, and post-sales support, including maintenance, repair, and operation (MRO) services. Distribution channels utilize a hybrid approach: direct sales are common for large government and defense contracts, ensuring close control over specifications and integration. Indirect channels, involving specialized technology integrators and regional value-added resellers (VARs), are increasingly used to penetrate industrial and commercial markets, offering regional support and customized payload integration. As the market matures, the provision of remote monitoring and software updates, often bundled under the Robotics-as-a-Service (RaaS) model, is becoming a primary revenue stream, shifting the value realization toward continuous service delivery and data analytics rather than a singular hardware sale.

Legged Robot Market Potential Customers

Potential customers for legged robots span critical infrastructure operators, governmental agencies, logistics providers, and research institutions, all unified by a requirement for mobile automation in non-standardized or hazardous environments. Primary end-users in the industrial sector, such as energy companies (oil & gas, nuclear power), chemical manufacturers, and construction firms, utilize these robots for crucial inspection tasks like detecting gas leaks, checking structural integrity in difficult-to-reach areas, and performing routine data logging under conditions unsafe for human personnel. These customers prioritize robustness, reliability, environmental sealing (IP ratings), and integration capabilities with their existing supervisory control and data acquisition (SCADA) systems, viewing legged robots as sophisticated mobile sensors that reduce operational risk and insurance costs.

The government and defense sectors represent another cornerstone of demand, requiring highly agile platforms for reconnaissance, border patrol, urban warfare support, and disaster relief. Military buyers prioritize off-road mobility, covert operation capabilities (low acoustic signature), payload capacity for diverse equipment (communication relays, EOD tools), and extreme temperature tolerance. Procurement decisions in this segment are typically high-value and long-term, focused less on initial cost and more on mission success rates and survivability in harsh, unpredictable conflict zones or remote monitoring assignments, making them ideal early adopters of cutting-edge technology.

In the commercial sector, major players in warehousing, e-commerce, and logistics are emerging as rapidly growing customers. While wheeled AGVs handle flat floor transportation, legged robots are sought for managing mixed-floor environments, traversing ramps, stairs, and cluttered pathways within massive distribution centers or performing last-mile deliveries across urban obstacles. Furthermore, leading academic institutions and corporate R&D laboratories constitute a continuous customer base, procuring advanced legged platforms for simulation, testing new control algorithms, and rapid prototyping of future robotic applications. These customers are driven primarily by the need for open, highly configurable platforms that support advanced software development and scientific inquiry into complex motion and biomechanics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 3,200 Million |

| Growth Rate | 32.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Dynamics, Agility Robotics, Unitree Robotics, Ghost Robotics, ANYbotics, Deep Robotics, LimX Dynamics, OPNOUS, Xiaomi, Samsung, General Dynamics, Lockheed Martin, Kawada Robotics, Sarcos Technology and Robotics, Honda, Hyundai Motor Group, DJI, Toyota Research Institute, Ekso Bionics, Engineered Arts |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Legged Robot Market Key Technology Landscape

The core technological landscape underpinning the Legged Robot Market is defined by the synergistic integration of advanced mechanical design, precision electrical engineering, and sophisticated computational control systems. Central to this is the development of high-performance actuators, such as custom brushless DC motors integrated with sophisticated gearbox designs and crucial force sensing capabilities, often utilizing Series Elastic Actuators (SEAs). These specialized actuators are essential for achieving the required high power density, rapid response times, and intrinsic compliance necessary for dynamic stability, allowing the robot to absorb impacts and interact safely with complex, often uncertain, physical environments without mechanical failure or loss of balance, a critical requirement distinguishing legged systems from fixed or wheeled industrial robots.

Control algorithms represent the intellectual property cornerstone of this market, primarily relying on advanced techniques such as Whole-Body Control (WBC) and Model Predictive Control (MPC). WBC orchestrates the simultaneous movements of all joints and the base to achieve specific tasks while maintaining balance and managing contact forces. MPC provides the capability for the robot to look ahead computationally, predicting future ground contacts and dynamic stability margins based on sensor input, allowing for rapid, proactive adjustments to gait and stance, which is fundamental for traversing highly uneven terrain at speed. This reliance on predictive control and optimization ensures dynamic maneuverability and energy efficiency, enhancing operational endurance.

Furthermore, the sensor suite and perception stack are crucial enablers of autonomy. Modern legged robots leverage sensor fusion derived from high-frequency Inertial Measurement Units (IMUs), LiDAR systems for long-range environmental mapping, and Visual Inertial Odometry (VIO) for highly accurate localization even in GPS-denied environments. The fusion of this data, processed by powerful on-board processors running complex Simultaneous Localization and Mapping (SLAM) algorithms, enables the robots to navigate fully autonomously, avoid collisions, and generate detailed 3D representations of their surroundings. Continuous advancement in sensor resolution, processing efficiency (edge computing), and robustness under environmental interference (dust, smoke) remains paramount for expanding the functional reliability of these platforms across harsh operational theaters.

Regional Highlights

- North America: This region dominates the global market share, primarily due to substantial investment in robotics research and development, particularly by governmental agencies (e.g., DARPA) and major technology corporations. The U.S. remains the epicenter for innovation in dynamic control, AI integration, and the commercialization of specialized quadruped platforms for defense, security, and critical infrastructure inspection (e.g., oil and gas pipelines). A strong ecosystem of startups, venture capital funding, and leading academic robotics programs ensures continued technological leadership and early adoption of high-cost, high-performance systems.

- Europe: Characterized by a strong emphasis on industrial automation, high safety standards, and collaborative robotics (cobots). European demand is driven largely by inspection and maintenance requirements in the highly regulated manufacturing and energy sectors. Countries like Germany and Switzerland are key hubs, focusing particularly on modularity, robust engineering for long-term use, and strict adherence to human-robot interaction safety protocols, positioning the region as a leader in industrial service applications and standardized deployment methodologies.

- Asia Pacific (APAC): Expected to exhibit the fastest growth rate over the forecast period, fueled by aggressive government investments in smart manufacturing initiatives and rapid adoption in logistics and warehousing, particularly in China, South Korea, and Japan. APAC benefits from robust manufacturing capabilities, facilitating the faster scaling and mass production of components, leading to more cost-effective solutions. The region is also focusing heavily on consumer and service robotics, with large conglomerates like Xiaomi and Samsung exploring applications in personal assistance and retail environments, driving down the overall price point.

- Latin America (LATAM) and Middle East & Africa (MEA): These emerging regions show increasing adoption, largely confined to high-value extraction industries (mining, energy) and government-backed infrastructure projects. Adoption is often driven by the need for remote monitoring in isolated or hazardous locations, such as deep-sea exploration support or desert pipeline inspection. While market penetration is currently lower due to infrastructural limitations and lower initial R&D spending, the RaaS model is proving instrumental in overcoming high upfront investment barriers, promising steady future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Legged Robot Market.- Boston Dynamics

- Agility Robotics

- Unitree Robotics

- Ghost Robotics

- ANYbotics

- Deep Robotics

- LimX Dynamics

- OPNOUS

- Xiaomi

- Samsung

- General Dynamics

- Lockheed Martin

- Kawada Robotics

- Sarcos Technology and Robotics

- Honda

- Hyundai Motor Group

- DJI

- Toyota Research Institute

- Ekso Bionics

- Engineered Arts

Frequently Asked Questions

Analyze common user questions about the Legged Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of legged robots over wheeled or tracked robots?

The primary advantage is superior mobility in unstructured, three-dimensional terrains, including stairs, rubble, steep slopes, and highly cluttered indoor environments. Legged locomotion allows for dynamic stability control and discrete footholds, enabling navigation through complex obstacles that are impassable for traditional mobile platforms, significantly expanding the operational envelope for inspection and logistics.

Which industry currently drives the highest commercial demand for legged robot platforms?

The industrial sector, specifically critical infrastructure operators in energy (oil and gas, utilities) and manufacturing, drives the highest commercial demand. These end-users leverage quadruped robots for routine inspection, environmental monitoring, and asset management in hazardous areas to improve safety compliance and prevent costly operational downtime.

What role does Artificial Intelligence (AI) play in the latest generation of legged robots?

AI, particularly Deep Reinforcement Learning (DRL) and Model Predictive Control (MPC), is fundamental for autonomy. AI algorithms enable real-time dynamic balancing, optimizing complex gaits for energy efficiency, advanced sensor fusion for localization and mapping (SLAM), and sophisticated mission planning in unpredictable, real-world operational scenarios.

What are the main restraints hindering the rapid widespread adoption of legged robots?

The main restraints include the high initial capital expenditure (system cost), the complexity of maintenance and integration, and persistent limitations in battery energy density, which restricts the operational duration and payload capacity needed for extensive field missions, thereby limiting the total return on investment for small to medium enterprises.

Is the Robotics-as-a-Service (RaaS) model becoming prevalent in the Legged Robot Market?

Yes, the RaaS model is increasingly prevalent, especially in emerging markets and for non-defense commercial applications. RaaS minimizes the initial prohibitive investment barrier by allowing customers to pay for operational time and data deliverables, thus accelerating adoption rates and enabling continuous software and hardware upgrades managed directly by the robot manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager