LEO Satellite Constellation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440517 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

LEO Satellite Constellation Market Size

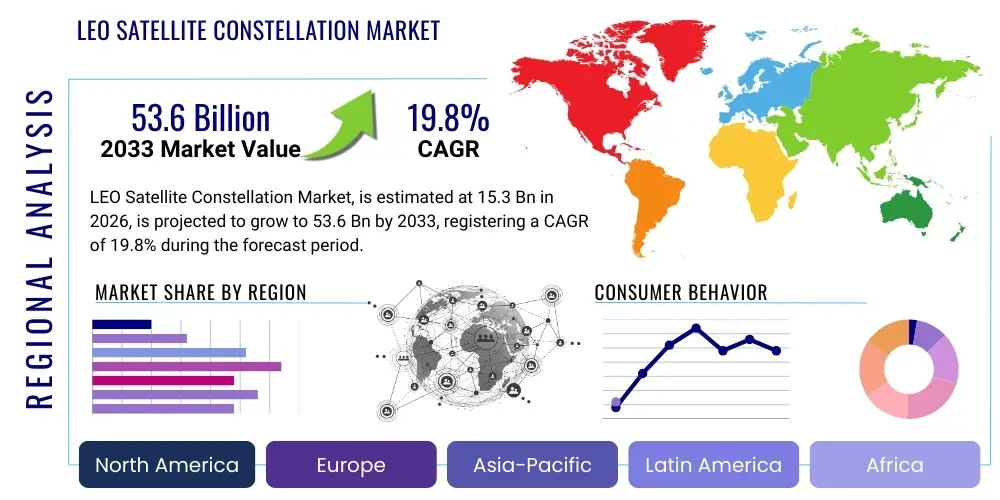

The LEO Satellite Constellation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.8% between 2026 and 2033. The market is estimated at USD 15.3 billion in 2026 and is projected to reach USD 53.6 billion by the end of the forecast period in 2033.

LEO Satellite Constellation Market introduction

The Low Earth Orbit (LEO) Satellite Constellation Market is experiencing unprecedented growth, driven by a global surge in demand for ubiquitous, high-speed, and low-latency internet connectivity. These constellations, comprising hundreds to thousands of small, interconnected satellites orbiting at altitudes typically between 500 and 2000 kilometers, offer a transformative solution to overcome the limitations of traditional geostationary satellites and terrestrial infrastructure. The primary product in this market encompasses the design, manufacturing, launch, and operation of these advanced satellite networks, along with the provision of associated ground infrastructure and end-user terminals. Key players are rapidly deploying these systems to deliver internet access, Internet of Things (IoT) connectivity, and a myriad of data services to previously unserved or underserved regions across the globe.

Major applications of LEO satellite constellations span a wide array of sectors, including consumer broadband internet for residential and mobile users, enterprise connectivity for businesses operating in remote locations, and critical infrastructure support for governmental and defense organizations. Additionally, these constellations are pivotal for machine-to-machine (M2M) communication, asset tracking, agricultural monitoring, maritime and aeronautical communications, and remote sensing for environmental monitoring and disaster response. The inherent benefits of LEO systems, such as significantly reduced signal latency due to their closer proximity to Earth, enhanced global coverage, and the ability to dynamically manage network traffic, make them highly attractive for emerging digital applications that demand real-time data exchange and seamless connectivity.

Driving factors for this burgeoning market include the escalating global demand for reliable broadband access, particularly in rural and remote areas where fiber optic or cellular networks are impractical or uneconomical to deploy. The proliferation of IoT devices and the growing need for M2M communication across diverse industries are also fueling adoption. Furthermore, advancements in satellite miniaturization, reusable rocket technology, and sophisticated ground station networks have drastically reduced the cost of launching and operating these constellations, making large-scale deployment economically viable. Government initiatives aimed at bridging the digital divide and increasing national connectivity, coupled with robust private sector investment, are further accelerating market expansion and technological innovation within the LEO satellite constellation ecosystem.

LEO Satellite Constellation Market Executive Summary

The LEO Satellite Constellation Market is poised for significant expansion, characterized by dynamic business trends, substantial regional growth, and evolving segmentation strategies. A dominant business trend involves the intense competition among a few mega-constellation operators vying for global market share, leading to rapid innovation in satellite design, launch capabilities, and ground segment technologies. There is a clear shift towards vertically integrated business models, where companies manage everything from satellite manufacturing to service delivery, enhancing efficiency and control over the entire value chain. Strategic partnerships and mergers are also prevalent, enabling operators to pool resources, expand geographical reach, and mitigate the substantial capital expenditure required for constellation deployment. Furthermore, the market is witnessing the emergence of specialized LEO services beyond just broadband, including dedicated IoT networks and high-precision earth observation, catering to niche enterprise and governmental demands.

Regionally, North America continues to be a leading innovator and investor, housing several of the largest LEO constellation projects and benefiting from strong government backing and private sector funding for space technology. Europe is also a significant player, with concerted efforts from the European Space Agency (ESA) and various national governments to develop independent LEO capabilities and foster a competitive ecosystem, particularly in secure communication and earth observation. The Asia Pacific (APAC) region is projected to experience the fastest growth, driven by massive untapped markets for internet connectivity in countries like India, China, and Southeast Asian nations, coupled with increasing government investments in space infrastructure. Latin America, the Middle East, and Africa (MEA) represent critical growth opportunities as these regions seek cost-effective solutions to enhance connectivity and digital inclusion, making them prime targets for LEO service expansion.

Segmentation trends indicate a diversified market moving beyond generic connectivity. The application segment is seeing robust growth in dedicated services for IoT and M2M communications, as industries like logistics, agriculture, and smart cities increasingly rely on global, real-time data. The end-user segment is expanding beyond direct-to-consumer broadband to encompass a strong focus on enterprise, maritime, aviation, and government/defense clients, who require highly reliable and secure communication links. Furthermore, advancements in ground segment technology, including compact and cost-effective user terminals and sophisticated network management systems, are crucial for broader adoption, highlighting the importance of this component segment. The services segment is evolving to include not just raw connectivity but also value-added offerings like managed services, data analytics, and integration with existing terrestrial networks, reflecting a maturation of market offerings.

AI Impact Analysis on LEO Satellite Constellation Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize the operational efficiency, network management, and service delivery of LEO satellite constellations. Common questions revolve around AI's role in optimizing satellite maneuvers to avoid collisions, enhancing the processing of vast amounts of data generated by earth observation satellites, and enabling more resilient and adaptive network architectures. There is significant interest in AI-driven predictive maintenance for constellation components, autonomous mission planning, and the dynamic allocation of bandwidth to meet fluctuating user demands. Concerns also emerge regarding the security implications of AI in space systems and the ethical considerations of autonomous decision-making in critical infrastructure. Overall, users expect AI to be a cornerstone for achieving higher performance, lower operational costs, and greater adaptability in the complex LEO satellite ecosystem, while also being mindful of potential risks.

- AI-powered autonomous navigation and collision avoidance systems significantly enhance constellation safety and operational longevity by predicting and executing precise orbital adjustments.

- Machine learning algorithms optimize network resource allocation, dynamically routing traffic and managing bandwidth to maximize throughput and minimize latency across the constellation in real-time.

- AI facilitates advanced predictive maintenance for satellites and ground infrastructure, identifying potential failures before they occur, thereby reducing downtime and extending equipment lifespan.

- Deep learning techniques are employed for on-board data processing and analytics, enabling faster insights from earth observation data and reducing the need to downlink raw, uncompressed information.

- AI-driven ground segment operations enhance efficiency, automate complex tasks like beamforming and gateway management, and improve the overall resilience and self-healing capabilities of the network.

- Enhanced cybersecurity measures leverage AI to detect and mitigate potential threats to satellite systems and ground networks, safeguarding critical communication infrastructure.

- AI contributes to the optimization of satellite manufacturing processes and design, leading to more efficient, cost-effective, and higher-performing spacecraft.

DRO & Impact Forces Of LEO Satellite Constellation Market

The LEO Satellite Constellation Market is shaped by a confluence of powerful drivers, inherent restraints, promising opportunities, and dynamic impact forces. A primary driver is the accelerating global demand for high-speed, low-latency internet access, especially in remote and rural areas that lack adequate terrestrial infrastructure. This demand is further amplified by the proliferation of IoT devices requiring ubiquitous connectivity for M2M communication and asset tracking across diverse industries. Technological advancements in satellite miniaturization, reusable launch vehicles, and phased array antenna technology have drastically reduced the cost of deployment and operation, making large-scale constellations economically viable. Additionally, increasing government and defense sector reliance on secure and resilient satellite communication for national security and strategic operations provides a consistent demand impetus. The competitive landscape, with major players aggressively deploying and expanding their constellations, also acts as a strong driver for innovation and market growth.

Despite these strong drivers, the market faces significant restraints. The enormous capital expenditure required for developing, launching, and maintaining large constellations presents a substantial barrier to entry for new players and ongoing financial pressure for existing ones. Regulatory hurdles, including spectrum allocation, orbital slot coordination, and international licensing agreements, are complex and vary across jurisdictions, potentially slowing down deployment and service commercialization. The escalating problem of space debris poses a long-term threat to the operational safety and sustainability of LEO constellations, necessitating costly mitigation strategies and raising concerns about environmental impact. Furthermore, cybersecurity risks are paramount, as these extensive networks become critical infrastructure, making them attractive targets for malicious actors seeking to disrupt communications or steal sensitive data. The high complexity of integrating satellite services with existing terrestrial networks also presents technical challenges.

Opportunities within the LEO satellite constellation market are abundant and diverse. Untapped markets in developing regions and remote geographies offer immense potential for providing essential connectivity, bridging the global digital divide and fostering economic growth. The development of specialized services tailored for specific enterprise needs, such as high-precision agriculture, maritime logistics, autonomous vehicles, and real-time environmental monitoring, presents significant revenue streams beyond general broadband. The evolution towards direct satellite-to-cellular connectivity for unmodified smartphones, as pioneered by some players, represents a transformative opportunity to expand market reach dramatically. Continued innovation in ground segment technology, including more compact and affordable user terminals, will further democratize access. Furthermore, the potential for LEO constellations to serve as backhaul for 5G and future 6G networks, and to enable resilient communication during natural disasters or infrastructure failures, highlights their strategic importance and future growth prospects. The synergy between AI and LEO operations is also a key opportunity to enhance efficiency and develop new capabilities.

The impact forces influencing the LEO Satellite Constellation Market are multifaceted, stemming from technological evolution, geopolitical shifts, economic dynamics, and environmental considerations. Rapid technological advancements, particularly in satellite manufacturing, launch systems, and onboard processing, continually redefine market capabilities and competitive advantage. Geopolitical tensions can influence national space policies, international collaborations, and the security implications of satellite networks, impacting market access and regulatory frameworks. Economic factors such as global interest rates, investment capital availability, and consumer disposable income directly affect the pace of constellation deployment and service adoption. Environmental concerns, particularly regarding space debris and light pollution, exert pressure on operators to adopt sustainable practices and influence public perception. The interplay of these forces dictates the pace and direction of market development, influencing investment decisions, technological priorities, and regulatory landscapes. The evolving regulatory environment, particularly around orbital slot allocation and frequency spectrum management, remains a critical external impact force that can either accelerate or constrain market growth.

Segmentation Analysis

The LEO Satellite Constellation Market is segmented across various dimensions to provide a comprehensive understanding of its intricate structure and diverse offerings. These segmentations allow for a granular analysis of market dynamics, identifying key areas of growth, competition, and technological focus. By dissecting the market based on its core components, the types of services delivered, the applications they serve, and the diverse end-users who benefit from them, a clearer picture emerges of where value is created and consumed. This systematic categorization helps stakeholders, from investors to policymakers, to better assess market potential, tailor strategies, and innovate effectively within this rapidly evolving space. Each segment represents a distinct facet of the LEO constellation ecosystem, from the foundational hardware to the ultimate service delivery, contributing uniquely to the market's overall trajectory and competitive landscape.

- By Orbit Type:

- Polar Orbit

- Inclined Orbit

- By Application:

- Broadband Internet

- Internet of Things (IoT) & Machine-to-Machine (M2M) Communication

- Earth Observation & Remote Sensing

- Navigation & Positioning Augmentation

- Military & Government Communication

- Others (e.g., Space Tourism Communication, Scientific Research)

- By End-User:

- Commercial (Enterprise, Residential, Maritime, Aviation)

- Government & Defense

- Telecommunication Providers

- By Component:

- Satellites (Small Satellites, CubeSats, Micro/Mini Satellites)

- Launch Services (Dedicated Launch, Rideshare Launch)

- Ground Segment (Antennas, Gateway Stations, User Terminals, Network Management Systems)

- By Service:

- Connectivity Services (Data, Voice, Video)

- Managed Services

- Value-Added Services (e.g., Data Analytics, Cybersecurity)

Value Chain Analysis For LEO Satellite Constellation Market

The value chain for the LEO Satellite Constellation Market is a complex and highly integrated ecosystem, encompassing several critical stages from upstream manufacturing to downstream service delivery. At the upstream end, the value chain begins with research and development, materials sourcing, and the manufacturing of individual satellite components, including transponders, antennas, solar arrays, and propulsion systems. This phase also involves the design, assembly, and testing of the satellites themselves, often leveraging advanced robotics and automation to produce hundreds or thousands of identical units efficiently. Key players in this stage are specialized aerospace manufacturers and component suppliers who focus on miniaturization, cost-effectiveness, and reliability. This segment requires significant investment in advanced engineering capabilities and robust supply chain management to ensure the timely and quality production of spacecraft.

Midstream activities primarily involve launch services and orbital deployment. This crucial phase includes the design and manufacturing of launch vehicles, mission planning, and the actual launch operations to place satellites into their designated LEO orbits. Advances in reusable rocket technology have significantly reduced launch costs, making large-scale constellation deployment more economically feasible. Once in orbit, the satellites require initial commissioning and in-orbit testing. Following deployment, the focus shifts to establishing and maintaining the ground segment infrastructure, which comprises gateway stations, ground antennas, network operation centers, and user terminals. These elements are vital for communicating with the satellites, managing network traffic, and providing the interface for end-users to access the services. The efficiency and global distribution of ground stations directly impact the overall performance and reach of the constellation.

Downstream analysis focuses on the delivery of services to end-users and the various distribution channels employed. Service provision includes offering broadband internet connectivity, IoT/M2M communication, earth observation data, and specialized enterprise solutions. Direct distribution channels involve constellation operators directly selling services to consumers, businesses, or government entities through their own sales and marketing teams, online platforms, or dedicated sales networks. This approach allows operators to maintain full control over the customer experience and branding. Indirect distribution channels involve partnerships with telecommunication providers, mobile network operators (MNOs), value-added resellers (VARs), and system integrators. These partners leverage their existing customer bases, terrestrial infrastructure, and local market expertise to extend the reach of LEO satellite services, often bundling them with other offerings. The choice of distribution strategy depends on target markets, regulatory environments, and the overall business model of the LEO constellation operator, with a growing trend towards hybrid models that combine direct customer engagement with strategic partnerships to maximize market penetration.

LEO Satellite Constellation Market Potential Customers

The potential customer base for the LEO Satellite Constellation Market is incredibly diverse, spanning across various sectors and demographics, united by the need for reliable, high-performance, and globally accessible connectivity. At the forefront are residential consumers, particularly those residing in rural, remote, or underserved urban areas where traditional terrestrial broadband infrastructure is either nonexistent, unreliable, or prohibitively expensive. These individuals seek an alternative solution for internet access for education, entertainment, telecommuting, and basic communication. As LEO services mature, mobile users, including travelers, campers, and those in areas with poor cellular coverage, also represent a significant and growing segment, especially with the advent of direct-to-cell satellite connectivity capabilities.

Beyond individual consumers, a substantial portion of the market comprises enterprise and commercial customers. This includes maritime and aviation industries requiring continuous, high-speed connectivity for operations, logistics, and passenger services across vast, remote expanses. Industries such as oil and gas, mining, construction, and agriculture, often operating in challenging environments, are prime candidates for LEO connectivity to support IoT applications, remote monitoring, and secure communication. Small and medium-sized businesses (SMBs) in remote locations, as well as large corporations seeking resilient backup communication systems or expansion into new geographies, also form a critical customer segment. Telecommunication providers and mobile network operators (MNOs) are also potential customers, looking to LEO constellations for backhaul solutions, network extension into unserved areas, or to enhance the resilience of their existing terrestrial networks.

Furthermore, government and defense agencies represent a core and high-value customer segment for LEO satellite constellations. These entities require secure, resilient, and ubiquitous communication capabilities for military operations, disaster response, public safety, border control, and intelligence gathering. LEO constellations offer advantages in terms of low latency, global coverage, and the potential for a distributed, resilient network less vulnerable to single points of failure. Scientific researchers, environmental monitoring organizations, and humanitarian aid groups also benefit from the global data collection and communication capabilities offered by LEO platforms. Ultimately, any entity or individual requiring reliable, low-latency communication or data services in areas where terrestrial infrastructure is inadequate or absent is a potential customer for the burgeoning LEO satellite constellation market, underscoring its broad applicability and transformative potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.3 billion |

| Market Forecast in 2033 | USD 53.6 billion |

| Growth Rate | 19.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SpaceX (Starlink), OneWeb, Amazon (Project Kuiper), Telesat, Iridium Communications Inc., Viasat Inc., Eutelsat S.A., Boeing, Lockheed Martin Corporation, Thales Alenia Space, Airbus S.A.S., Sierra Nevada Corporation, Maxar Technologies Inc., Planet Labs Inc., Capella Space, SES S.A., Hughes Network Systems (EchoStar), AST SpaceMobile Inc., Kepler Communications Inc., Sateliot. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LEO Satellite Constellation Market Key Technology Landscape

The LEO Satellite Constellation Market is fundamentally driven by a rapidly evolving and innovative technology landscape, encompassing advancements across satellite design, launch systems, and ground infrastructure. At the core are breakthroughs in small satellite manufacturing, enabling the production of compact, powerful, and cost-effective spacecraft in large quantities. This includes miniaturization of components, use of commercial off-the-shelf (COTS) parts, and modular designs that facilitate rapid assembly and testing. Advanced propulsion systems, such as electric propulsion (e.g., Hall-effect thrusters, ion thrusters), are crucial for orbital maneuvering, station-keeping, and de-orbiting at the end of a satellite's lifespan, contributing to sustainable space operations. The integration of high-throughput communication payloads, often incorporating software-defined radios (SDRs) and phased array antennas, allows for flexible beamforming and dynamic allocation of bandwidth to meet varying user demands across different geographies. These technologies are essential for delivering high-speed, low-latency connectivity to a global user base.

Inter-satellite links (ISLs) represent another critical technological advancement, enabling satellites within a constellation to communicate directly with each other via laser or radio frequency links without needing to relay data through a ground station. This significantly reduces latency, expands network coverage, and enhances the overall resilience and self-sufficiency of the constellation, creating a true mesh network in space. On the ground segment, innovations in user terminal technology are pivotal for widespread adoption. This includes the development of flat-panel, electronically steerable antennas that are more compact, affordable, and easier to install than traditional parabolic dishes, making LEO services accessible to a broader range of consumers and enterprises. Advanced gateway stations with sophisticated tracking and handover capabilities are also essential for seamless communication between the space and terrestrial networks, managing the immense data traffic and ensuring reliable service delivery.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is becoming a cornerstone of LEO constellation operations. AI algorithms are employed for autonomous constellation management, optimizing orbital maneuvers, predicting and preventing collisions, and dynamically managing network resources to maximize efficiency and minimize downtime. AI also plays a crucial role in processing the vast amounts of data generated by earth observation satellites, extracting actionable insights quickly and efficiently. Cybersecurity technologies, including advanced encryption, intrusion detection systems, and secure communication protocols, are paramount to protect these critical networks from cyber threats. The continuous evolution of these technologies, from materials science to advanced software algorithms, ensures that LEO satellite constellations remain at the forefront of global connectivity and data services, constantly pushing the boundaries of what is possible in space-based communication and observation.

Regional Highlights

- North America: This region stands as a dominant force in the LEO Satellite Constellation Market, driven by pioneering companies like SpaceX and Amazon's Project Kuiper, along with significant government and defense investment. The U.S. government's emphasis on national security space programs and broadband initiatives fuels extensive research, development, and deployment. The presence of a mature aerospace industry, robust private capital, and a strong demand for advanced connectivity across diverse geographies—from urban centers to vast rural areas—positions North America at the forefront of innovation and commercialization.

- Europe: Europe is rapidly advancing its LEO capabilities, with the European Space Agency (ESA) and various national governments investing heavily in independent satellite communication and earth observation programs. Companies like OneWeb and Telesat, with significant European involvement and partnerships, are key players. The region's focus on secure communications, environmental monitoring, and bridging its own digital divide drives substantial market growth. Collaborative efforts and robust regulatory frameworks are fostering a competitive and innovative environment.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for LEO satellite constellations, primarily due to immense untapped demand for internet connectivity in populous countries like India, China, and Indonesia. Governments across the region are investing in space infrastructure to boost economic development and digital inclusion. Emerging domestic players, coupled with international partnerships, are accelerating the deployment of LEO services, particularly for remote communities, disaster management, and critical national infrastructure.

- Latin America: This region represents a significant growth opportunity for LEO satellite services, particularly in providing connectivity to remote and geographically challenging areas where terrestrial infrastructure is scarce. The demand for reliable internet for agriculture, education, and healthcare is high, attracting international LEO operators. While domestic capabilities are still developing, strategic partnerships with global players are crucial for expanding market penetration and addressing the pervasive digital divide across the continent.

- Middle East and Africa (MEA): The MEA region is a critical market for LEO constellations due to its large areas with limited terrestrial connectivity and a high demand for digital transformation across industries. Governments and private entities are increasingly recognizing the strategic importance of satellite internet for economic development, public safety, and enhancing communication resilience. International LEO operators are actively targeting this region to provide broadband access, support oil and gas operations, and facilitate agricultural advancements, making it a key area for future expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LEO Satellite Constellation Market.- SpaceX (Starlink)

- OneWeb

- Amazon (Project Kuiper)

- Telesat

- Iridium Communications Inc.

- Viasat Inc.

- Eutelsat S.A.

- Boeing

- Lockheed Martin Corporation

- Thales Alenia Space

- Airbus S.A.S.

- Sierra Nevada Corporation

- Maxar Technologies Inc.

- Planet Labs Inc.

- Capella Space

- SES S.A.

- Hughes Network Systems (EchoStar)

- AST SpaceMobile Inc.

- Kepler Communications Inc.

- Sateliot

Frequently Asked Questions

Analyze common user questions about the LEO Satellite Constellation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are LEO satellite constellations and how do they differ from traditional satellites?

LEO satellite constellations are networks of hundreds to thousands of satellites orbiting closer to Earth (500-2000 km) than traditional geostationary (GEO) satellites (36,000 km). This closer proximity enables significantly lower latency, better signal strength, and near-global coverage, making them ideal for high-speed internet and real-time data applications.

What are the primary applications of LEO satellite constellations?

The main applications include global broadband internet access for consumers and enterprises, Internet of Things (IoT) and machine-to-machine (M2M) communication, earth observation and remote sensing, navigation system augmentation, and secure military and government communications, particularly in remote or underserved areas.

What challenges does the LEO satellite constellation market face?

Key challenges include the immense capital investment required for deployment, complex regulatory hurdles for spectrum and orbital slots, the growing concern over space debris and collision risks, and cybersecurity threats to protect vital communication infrastructure. Integrating with existing terrestrial networks also presents technical complexities.

How will LEO constellations impact global internet connectivity?

LEO constellations are poised to revolutionize global internet connectivity by providing high-speed, low-latency broadband to currently unserved or underserved rural and remote areas worldwide. They aim to bridge the digital divide, foster economic growth, and offer resilient communication alternatives, enhancing global digital inclusion and access.

Which key technologies are driving the LEO satellite constellation market?

Critical technologies include advanced small satellite manufacturing, reusable launch vehicles, sophisticated ground segment infrastructure (e.g., flat-panel user terminals), inter-satellite links (ISLs) for in-space communication, and the integration of Artificial Intelligence for autonomous network management and data processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager