Lepidolite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434159 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Lepidolite Market Size

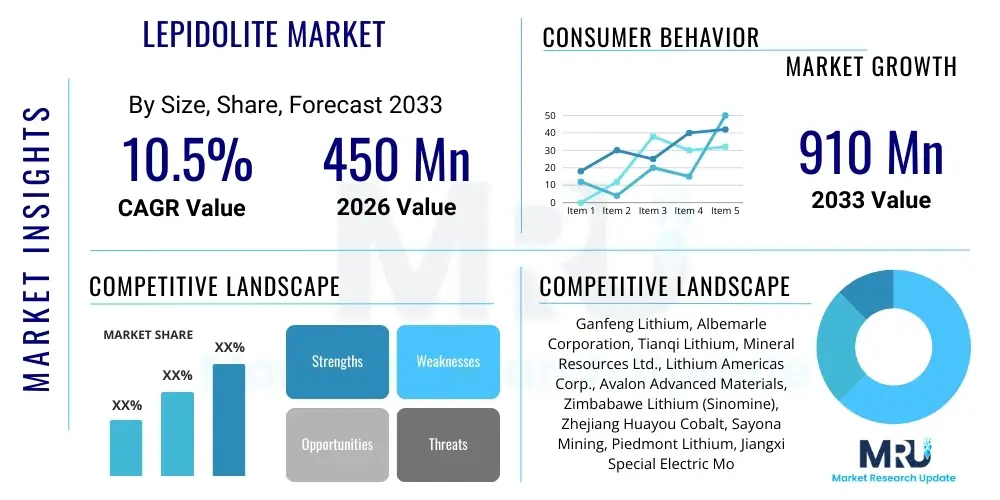

The Lepidolite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 910 Million by the end of the forecast period in 2033.

Lepidolite Market introduction

Lepidolite, chemically identified as K(Li,Al)3(Al,Si)4O10(F,OH)2, is a significant lithium-bearing mineral belonging to the mica group, distinguished by its unique crystal structure and often lilac-to-rose color. It serves as a critical, economically viable alternative source for lithium metal and compounds, fundamentally challenging the market dominance traditionally held by hard-rock spodumene and continental brine operations. The viability of lepidolite as a feedstock has surged due to geopolitical supply chain diversification efforts and continuous innovation in mineral processing metallurgy. The product description for market consideration focuses intensely on the concentration grade (Li2O percentage) of the mined ore and the concentration of critical impurities, such as fluorine and iron, which directly dictate the downstream refining complexity and overall capital expenditure (CAPEX) for conversion into battery-grade material. High-quality concentrates are increasingly prioritized by refiners to minimize energy consumption during the crucial calcination and leaching stages, thereby ensuring cost parity with other lithium sources.

Major applications of lepidolite are now overwhelmingly steered toward the renewable energy sector, primarily feeding the production of lithium precursors essential for high-performance Lithium-ion batteries. This application segment is rigorously segmented into materials required for Electric Vehicles (EVs), large-scale grid energy storage systems (ESS), and high-demand consumer electronics. Beyond the burgeoning battery market, lepidolite retains significant traditional industrial importance, particularly within the advanced ceramics and specialty glass industries. Here, it is highly valued for its fluxing capabilities, which allow for lower firing temperatures, and its ability to impart unique physical properties, such as a low coefficient of thermal expansion (CTE). This low CTE is critical for durable, heat-resistant products, including stovetops and specialized laboratory glassware. The dual utility across high-growth energy sectors and stable industrial markets contributes to the mineral's long-term market stability and resilience against single-sector demand fluctuations.

The principal driving factors underpinning the aggressive market expansion include the universal regulatory push, seen across North America, Europe, and key parts of Asia, to establish localized and secure battery supply chains. This regulatory environment is often backed by substantial financial incentives and mandates designed to reduce reliance on geographically concentrated processing hubs. Technologically, the adoption of optimized hydrometallurgical routes—moving away from outdated, high-emission processes—is significantly improving lithium recovery rates from complex lepidolite ores, making the extraction process more competitive and environmentally sustainable. Furthermore, the strategic benefit of exploiting lepidolite deposits, often found in conjunction with other valuable rare metals like rubidium and cesium, allows for enhanced project economics through co-product revenue streams. This co-product advantage helps offset the often-higher initial processing costs associated with separating lithium from its tightly bound silicate matrix, thereby solidifying its position as a strategically vital critical material.

Lepidolite Market Executive Summary

The Lepidolite Market is currently undergoing a structural transformation characterized by intense investment in processing infrastructure and critical resource acquisition. Key business trends highlight a profound acceleration in vertical integration, observed as major chemical processors and, increasingly, battery manufacturers secure long-term offtake agreements or outright ownership of lepidolite mines globally, particularly in regions like Africa and Australia. This strategic integration aims to buffer companies against the extreme volatility experienced in spot lithium prices and guarantee a stable, quality-controlled feedstock supply. Another prominent trend is the rigorous focus on minimizing the environmental footprint of processing. Companies are investing heavily in closed-loop systems, optimizing acid usage, and researching non-sulfate routes (e.g., chloride metallurgy) to comply with tightening global Environmental, Social, and Governance (ESG) standards, which are becoming non-negotiable requirements for financing and regulatory approval in key Western markets.

Regional trends reveal a strategic realignment of the global supply chain. While Asia Pacific, especially China, maintains an undisputed leadership position in refined product capacity, regulatory measures in North America (IRA) and Europe (CRMA) are effectively creating localized, self-sufficient ecosystems. These policies incentivize the development of lepidolite mining and processing within or adjacent to these economic blocks to ensure materials qualify as "domestically sourced" or "critical," commanding premium pricing and attracting massive governmental and private capital investment. This development trajectory is leading to a bifurcated market: a high-volume, cost-competitive Asian market based on efficiency, and a security-focused, premium-priced Western market centered on traceability and geopolitical compliance. This geopolitical divergence is reshaping logistics, favoring regional supply over traditional long-haul shipping routes.

Segmentation analysis demonstrates the clear dominance of the high-purity, Battery-Grade segment, particularly Lithium Hydroxide derived from lepidolite, driven by its necessity in high-nickel cathode chemistries preferred by leading EV manufacturers for longer ranges and faster charging. Although the initial ramp-up focused on Lithium Carbonate (ideal for LFP batteries), the long-term trend favors hydroxide, pushing processors to refine their techniques to achieve the necessary high purity (>99.5%) consistently. Concurrently, the often-overlooked Industrial Grade segment, servicing ceramics and glass, remains a critical steady customer base, providing consistent revenue stability even when the cyclical battery market experiences temporary slowdowns. The technological imperative across all segments is achieving consistent purity and yield while managing the specific impurities—such as fluorine, which must be extracted to prevent cathode degradation—inherent to lepidolite ore bodies, establishing robust quality assurance protocols as a central competitive differentiator.

AI Impact Analysis on Lepidolite Market

Common user inquiries concerning AI's influence on the Lepidolite market often revolve around optimizing complex mineral processing routes, predicting geological resource viability, and ensuring supply chain resilience against unforeseen global disruptions. Users are keenly interested in how machine learning can enhance the efficiency of extraction from historically challenging ore bodies, particularly regarding impurity removal (like iron and fluorine) during calcination and leaching. Key themes include predictive maintenance for heavy mining machinery, algorithmic trading strategies for managing lithium commodity price volatility, and AI-driven simulation of new hydrometallurgical workflows to reduce environmental footprint and operational expenditure. Expectations center on AI significantly accelerating the time-to-market for new lepidolite mines and improving the yield of high-purity lithium compounds, thereby increasing the overall global supply stability and securing cost competitiveness.

- AI-powered geological modeling enhances precision in identifying and quantifying high-grade lepidolite reserves, reducing exploration costs and risks associated with resource uncertainty.

- Machine learning algorithms optimize flotation circuits and chemical leaching parameters, maximizing lithium recovery yield from complex silicate matrices in real-time.

- Predictive maintenance systems utilize sensor data and deep learning to forecast equipment failure, minimizing unplanned downtime in high-capital-intensity refining plants and ensuring continuous operation.

- Advanced supply chain analytics, driven by AI, model geopolitical risks, transport logistics, and inventory management, ensuring continuous and secured delivery of concentrates to refineries.

- AI simulations accelerate the development and scale-up of sustainable, low-carbon lepidolite processing technologies, reducing reliance on conventional, high-energy and high-emission methods.

- Automated quality control using computer vision and spectroscopic data ensures consistent, ultra-high purity standards (>99.5%) required for stringent battery-grade material specifications.

DRO & Impact Forces Of Lepidolite Market

The operational landscape of the Lepidolite market is governed by a complex matrix of internal dynamics and external geopolitical forces. The primary engine of growth, the global imperative for decarbonization and the subsequent demand for energy storage, acts as a powerful, sustained driver (D). This foundational demand is supported by significant governmental policy interventions, such as investment tax credits and direct funding mechanisms, accelerating the development of the entire battery value chain. Critically, technological advancements, including proprietary acid-roasting optimizations and new low-temperature chemical processes, are actively chipping away at the historical cost disadvantages of lepidolite processing, moving it closer to cost parity with high-quality spodumene concentrates. This improved economic feasibility encourages higher levels of capital commitment into new mining projects, particularly in diverse geographical regions that offer political stability and resource abundance, further amplifying the supply side response to demand pressures.

Conversely, significant restraints (R) persist, notably the elevated complexity and capital intensity required for the chemical refinement of lepidolite. Unlike the relatively straightforward conversion of brine, lepidolite necessitates rigorous thermal and chemical treatment to break the silicate structure and leach the lithium efficiently. This complexity translates directly into high energy consumption and reliance on significant quantities of specialized reagents (e.g., sulfuric acid), leading to higher operating costs (OPEX). Furthermore, stringent environmental regulations, particularly regarding the handling and disposal of chemically active tailings and the management of fluorine emissions, impose substantial compliance costs, potentially slowing project timelines in highly regulated jurisdictions like Europe. The perceived lack of geological transparency for many emerging lepidolite deposits also poses a risk, making long-term resource planning challenging for potential investors seeking guaranteed feedstock volumes and quality consistency.

Strategic opportunities (O) are plentiful, particularly in leveraging the co-production economics inherent to many lepidolite deposits. The profitable extraction of rare alkali metals like rubidium and cesium, which are highly valued in specialized electronics, medical imaging, and nuclear applications, can significantly enhance project internal rates of return (IRR), effectively transforming a marginal lithium operation into a highly attractive multi-metal venture. Geographically, the opportunity to establish new, ethical supply sources in Africa and Europe provides a critical resilience mechanism against resource nationalization risks and trade disruptions affecting the currently dominant supply regions. This geographical diversification is a key strategic priority for battery makers globally, making new lepidolite sources strategically valuable beyond pure cost metrics. The cumulative impact forces dynamically shape market behavior, where the inelastic demand from the EV sector dictates that supply continuity and quality assurance are prioritized even over marginal cost savings, compelling investment in high-quality, traceable sources.

- Drivers (D):

- Exponential growth in global Electric Vehicle (EV) production and renewable energy storage deployment, creating persistent demand for lithium.

- Governmental subsidies and regulatory support (e.g., IRA, CRMA) incentivizing the establishment of secure, domestic lithium supply chains.

- Continuous technological improvements reducing operational complexity and enhancing the economic viability of lepidolite processing.

- Restraints (R):

- Higher energy consumption and capital expenditure required for chemically breaking down the complex lepidolite silicate structure compared to brine sources.

- Challenges in efficiently managing and removing trace impurities, such as fluorine, to consistently achieve ultra-high battery-grade purity.

- Regulatory hurdles and elevated environmental compliance costs associated with chemical leaching and tailings disposal.

- Opportunities (O):

- Economic viability enhanced through the co-production and sale of valuable byproducts like rubidium and cesium.

- Exploitation of large, untapped lepidolite reserves in Africa and Europe to diversify the global supply base and mitigate geopolitical risk.

- Development and commercialization of innovative, low-carbon processing routes that minimize waste and improve resource efficiency.

- Impact Forces:

- High, sustained demand pressure from the battery sector mandates aggressive capacity expansion.

- ESG criteria and environmental regulations enforce a transition to sustainable, low-emission processing technologies.

- Geopolitical imperative compels regionalization of refining capacity, restructuring traditional Asia-centric supply flows.

Segmentation Analysis

The Lepidolite market segmentation provides granular insight into the primary commercial pathways and end-use sectors driving revenue generation. The market is primarily segmented based on product type, which dictates the chemical compound ultimately derived from the raw mineral, and end-use application, detailing where the purified lithium product is consumed. This structured view is essential for stakeholders to target investment, optimize production mixes, and tailor marketing strategies according to the specific purity and chemical requirements of different buyer categories. The segmentation underscores the profound influence of the energy sector, particularly the requirement for high-purity, battery-grade materials, over traditional industrial uses, reflecting the mineral's critical role in global electrification efforts and the subsequent high valuation placed on refined lithium compounds.

The product segmentation generally splits between lithium carbonate and lithium hydroxide, reflecting the current state of cathode chemistry manufacturing complexity and requirements. While lithium carbonate is the established standard for lower-to-mid range energy density batteries (such as LFP), the superior thermal stability and performance attributes of lithium hydroxide in high-nickel cathode chemistries (NCM and NCA) guarantee its segment's rapid expansion and premium market status. Application segmentation highlights the overwhelming influence of the EV battery segment, which commands premium pricing and drives significant volumetric demand compared to more mature, slower-growing industrial sectors like glass and ceramics. Understanding these segments is crucial for predicting long-term price trends and the required technological investment in purity assurance across the refining supply chain.

Further analysis within the purity grade segment differentiates strictly between battery-grade materials, which require ultra-strict impurity control (often >99.5%), and industrial-grade materials, which tolerate slightly lower purity but serve high-volume manufacturing needs in specialized chemical production and fluxing agents. The severe performance consequences and regulatory scrutiny on battery components mean that investments are heavily skewed towards technological solutions that guarantee battery-grade output from the complex lepidolite matrix, necessitating meticulous management of inherent contaminants like fluorine. This focus ensures that the market's value is disproportionately concentrated within the battery segment, driving competitive advantage based on consistent material quality and long-term supply reliability.

- By Product Type:

- Lithium Carbonate

- Lithium Hydroxide

- Other Lithium Compounds (e.g., Lithium Metal, Lithium Chloride)

- By Grade:

- Battery Grade (Purity > 99.5%)

- Industrial Grade (Purity 98.0% - 99.5%)

- By Application:

- Batteries (EVs, Consumer Electronics, Grid Storage)

- Ceramics and Glass

- Metallurgy and Alloys

- Specialty Lubricants and Chemicals

Value Chain Analysis For Lepidolite Market

The Lepidolite value chain is fundamentally a sequence of capital-intensive transformations designed to upgrade a relatively low-value mineral concentrate into high-specification chemical compounds. The upstream segment initiates with rigorous geological mapping, resource definition, and the subsequent establishment of mining operations. This phase is characterized by high upfront exploration costs and regulatory complexities. Raw lepidolite ore, typically containing 1-2% Li2O, undergoes multi-stage beneficiation—crushing, grinding, and specialized flotation—to produce a concentrate ranging from 3% to 5% Li2O. Crucially, the efficiency of this beneficiation step determines the energy load and chemical cost of the midstream processing. Upstream risks primarily relate to fluctuating commodity prices affecting mining returns and prolonged permitting timelines, particularly in regions with stringent environmental protections. Key players in this stage are exploration firms and established hard-rock mining operators seeking resource longevity and geopolitical stability for feedstock supply.

The midstream is the nexus of value addition, focusing on converting the concentrate into battery-grade lithium chemicals. This stage typically involves the highly engineered processes of high-temperature calcination (roasting), followed by chemical attack (sulfuric acid or chloride leaching) to dissolve the lithium. This dissolved lithium is then purified through multiple steps of solvent extraction, ion exchange, and impurity precipitation to remove deleterious elements like iron, manganese, and fluorine, which are common in lepidolite. The outcome is technical-grade lithium salt, which must then be further refined to ultra-high purity (>99.5%) to meet battery manufacturing specifications. The choice of distribution channel at this stage is strategic: large-scale, vertically integrated processors often utilize direct channels, securing long-term supply agreements (LTAs) with cathode producers to ensure stable pricing and consistent quality feedback. Smaller processors may use indirect channels via chemical traders, leveraging their logistical expertise to reach fragmented industrial markets globally.

The downstream market is dominated by global end-users, where the refined lithium compounds are integrated into the final product. The critical downstream consumers are the major cathode active material (CAM) manufacturers (producing LCO, NMC, NCA, and LFP), who demand precise chemical and physical properties (e.g., particle size, residual moisture) of the lithium hydroxide or carbonate. The demand pull from this downstream sector dictates the purity standards and technological requirements upstream. Distribution into the battery sector is almost exclusively direct, emphasizing traceability and quality assurance throughout the supply chain, often involving audit mechanisms spanning from the chemical plant back to the mine site. Conversely, industrial applications (ceramics, specialty chemicals) often use less restrictive specifications and utilize the indirect distribution channel, prioritizing price competitiveness and volume reliability over ultra-high purity standards. The market value distribution is heavily skewed toward the midstream refining and downstream battery manufacturing segments, underscoring the necessity of technical prowess to capture maximum market share.

Lepidolite Market Potential Customers

The ecosystem of potential customers for lepidolite derivatives is stratified based on purity demands and volume requirements, with the global energy transition dictating the most lucrative segments. The foremost potential customers are the multinational conglomerates specializing in the production of cathode active materials (CAM) for lithium-ion batteries, including major players in China, South Korea, Japan, Europe, and the United States. These customers have colossal, escalating volume needs driven by global gigafactory buildouts and require a guaranteed supply of battery-grade lithium hydroxide (for high-nickel cathodes) and lithium carbonate (for LFP and established chemistries). Their purchasing criteria are exceptionally strict, prioritizing material that guarantees minimal metallic impurities (measured in parts per million) to prevent degradation and enhance the safety profile of the final battery cell. Long-term contracts, often spanning five to ten years, are the standard business model to ensure resource security for these primary buyers.

A secondary, yet robust, customer base exists within the traditional industrial manufacturing sector, particularly ceramics, glass, and specialized flux production. Companies manufacturing technical ceramics, such as those used in aerospace or high-temperature industrial furnaces, rely on lithium compounds to control thermal expansion, improve structural integrity, and enhance firing process efficiency. Similarly, specialty glass makers use lithium to lower the melting point of the batch, thereby reducing energy costs and improving the optical clarity and strength of the final product. These industrial customers typically purchase industrial-grade lithium compounds, which, while having slightly less rigorous purity demands than battery-grade materials, offer high volume stability. This segment acts as an important counterbalance to the cyclical nature of the EV market, providing consistent demand for the industrial output of lepidolite processors.

Furthermore, niche markets for derived alkali metals—rubidium and cesium—represent high-margin potential customers often ignored in standard lithium market analysis. Specialized companies involved in the medical imaging, atomic clock manufacturing, and high-tech oil and gas exploration industries are crucial buyers for these co-products. The co-extraction of these elements from lepidolite significantly enhances the overall profitability of the mining operation, providing a critical competitive edge. Overall, securing long-term customer relationships necessitates a supplier's ability to demonstrate not only chemical processing excellence and purity consistency but also a strong commitment to sustainable sourcing and transparent chain of custody, satisfying the increasingly stringent due diligence requirements of large-scale corporate purchasers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ganfeng Lithium, Albemarle Corporation, Tianqi Lithium, Mineral Resources Ltd., Lithium Americas Corp., Avalon Advanced Materials, Zimbabawe Lithium (Sinomine), Zhejiang Huayou Cobalt, Sayona Mining, Piedmont Lithium, Jiangxi Special Electric Motor Co. Ltd., Chengxin Lithium Group, European Metals Holdings, Sigma Lithium, AVZ Minerals, Core Lithium, Atlantic Lithium, Bacanora Lithium, E3 Metals Corp., Neo Lithium Corp., SQM (Sociedad Química y Minera), Livent Corporation, Pilbara Minerals, Galaxy Resources (Allkem), IGO Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lepidolite Market Key Technology Landscape

The technological evolution within the Lepidolite market is a direct response to the need for cost-effective and environmentally superior lithium extraction methods capable of handling the mineral’s complex silicate matrix and inherent impurities, primarily fluorine. The current technological baseline involves the highly endothermic, high-temperature sulfuric acid baking route, which requires precise control over calcination temperatures (often 950°C to 1100°C) to convert the lithium structure into a soluble phase. A significant portion of R&D is dedicated to optimizing this thermal step, focusing on novel rotary kiln designs and alternative energy sources to minimize carbon emissions and reduce overall energy demand. Simultaneously, advanced flotation techniques, incorporating specialized reagents and sensor-based sorting, are being implemented upstream to enhance the grade of the concentrate fed into the kiln, thereby reducing the volume of material requiring expensive chemical processing and optimizing resource utilization.

A critical shift is occurring with the exploration and commercialization of alternative hydrometallurgical technologies, specifically low-temperature chemical attack routes such as chloride leaching. Chloride metallurgy offers several competitive advantages, including lower energy requirements, better fluorine management—as lithium chloride is often easier to purify than lithium sulfate—and enhanced co-product recovery mechanisms for rubidium and cesium. However, chloride routes present challenges related to materials corrosion and specialized process equipment required to handle highly corrosive media, driving demand for advanced materials engineering. Purity achievement remains the paramount technological challenge; this involves deploying sophisticated purification trains utilizing membrane filtration, highly selective ion-exchange resins, and multi-stage crystallization processes tailored specifically to strip out trace contaminants like iron, manganese, and residual alkaline earth metals, ensuring compliance with strict battery manufacturing specifications (e.g., transition metal content below 10 ppm).

The integration of Industry 4.0 technologies, including predictive analytics, Artificial Intelligence (AI), and digital twin modeling, is fundamentally transforming plant operation efficiency. AI algorithms are now deployed to optimize flotation circuit parameters in real-time based on spectroscopic analysis of the ore, maximizing lithium recovery while minimizing reagent consumption. Digital twins allow refiners to simulate complex calcination and leaching kinetics, enabling rapid testing of new operating procedures before physical implementation, significantly reducing downtime and accelerating process optimization. Furthermore, sustainable technology development is gaining traction, focusing on minimizing the environmental burden. This includes developing processes to chemically stabilize fluorine in the tailings and researching methods to utilize the vast volume of silicate waste generated as inert fillers or precursors for sustainable building materials, aligning the market with global circular economy objectives and enhancing project viability in environmentally sensitive regions.

Regional Highlights

The geographical distribution of lepidolite resources and processing capabilities significantly influences global market dynamics, driven by varying regulatory environments and industrial maturity.

- Asia Pacific (APAC): APAC is the central pillar of the global lepidolite value chain, predominantly due to China's massive refining capacity. Chinese processors have mastered the metallurgy required for large-scale, cost-efficient conversion of lepidolite concentrates, often sourced from domestic reserves or strategic investments in Africa. The region's dominance is driven by high internal demand from the global electric vehicle manufacturing hub. Geopolitical factors necessitate further resource security, leading China to continuously expand its influence upstream globally, ensuring reliable feedstock supply to maintain its position as the world’s primary supplier of refined lithium chemicals.

- Europe: The European market is characterized by strong political will to decouple its battery supply chain from external reliance, manifested through initiatives designed to promote localized resource utilization. Countries such as Portugal and the Czech Republic hold significant lepidolite reserves, attracting attention for development. The regional focus is not solely on volume but on establishing the world's most sustainable and environmentally compliant lithium extraction and processing facilities, leveraging advanced technologies to meet strict EU environmental standards, often resulting in higher project CAPEX but ensuring market access premium in the Western bloc.

- North America: Driven by the U.S. Inflation Reduction Act (IRA), North America is prioritizing the development of secure, domestic or allied supply chains. Although lepidolite processing is currently nascent, significant investment is flowing into exploration and establishing specialized refining capacity, aimed at qualifying lithium products for federal tax credits, thus creating a premium market for locally sourced materials that meet traceability requirements.

- Middle East and Africa (MEA): Africa, particularly Zimbabwe, stands out as a crucial upstream supplier, holding globally significant reserves of hard-rock lithium, including substantial lepidolite. The region is rapidly emerging as a critical upstream supplier of concentrate, attracting considerable Chinese investment for initial mining and beneficiation, which is essential for feeding the global processing capacity. The focus remains on optimizing logistics and attracting investment for value addition within the region.

- Latin America: While Latin America is predominantly known for its brine resources (the Lithium Triangle), countries are beginning to assess and develop their hard-rock reserves, including lepidolite. The region presents opportunities for diversified mining operations, focusing on technological transfer and regulatory frameworks that encourage responsible mineral extraction to complement the existing brine output, thereby offering a broad supply portfolio to global consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lepidolite Market.- Ganfeng Lithium

- Albemarle Corporation

- Tianqi Lithium

- Mineral Resources Ltd.

- Lithium Americas Corp.

- Avalon Advanced Materials

- Zimbabawe Lithium (Sinomine)

- Zhejiang Huayou Cobalt

- Sayona Mining

- Piedmont Lithium

- Jiangxi Special Electric Motor Co. Ltd.

- Chengxin Lithium Group

- European Metals Holdings

- Sigma Lithium

- AVZ Minerals

- Core Lithium

- Atlantic Lithium

- Bacanora Lithium

- E3 Metals Corp.

- Neo Lithium Corp.

- SQM (Sociedad Química y Minera)

- Livent Corporation

- Pilbara Minerals

- Galaxy Resources (Allkem)

- IGO Limited

- AMG Advanced Metallurgical Group

- Liontown Resources

Frequently Asked Questions

Analyze common user questions about the Lepidolite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of current Lepidolite market growth?

The primary driver is the surging global demand for lithium-ion batteries, overwhelmingly fueled by the Electric Vehicle (EV) industry and large-scale grid energy storage systems. Lepidolite serves as a critical, diversified source of lithium precursor materials, ensuring supply chain resilience against geopolitical uncertainties in traditional sourcing markets.

How does lepidolite processing complexity affect its competitiveness against spodumene?

Lepidolite processing is generally more complex and capital-intensive, requiring high-temperature roasting and meticulous impurity removal (especially fluorine). However, continuous technological breakthroughs in optimized acid and chloride metallurgy are rapidly achieving cost reductions, positioning it as a highly competitive and strategically vital alternative resource.

Which geographical region dominates the refining and consumption of lepidolite products?

Asia Pacific, specifically China, dominates the refining and conversion of lithium compounds derived from lepidolite. China leverages extensive chemical processing infrastructure and strategic global mining investments to efficiently produce battery-grade lithium chemicals for the global market.

What role do technological innovations play in making lepidolite reserves viable?

Technological innovations, including AI-driven process optimization, advanced impurity management (fluorine control), and efficient hydrometallurgy, are essential. These advancements reduce operational expenditure, improve extraction yields, and guarantee the consistency of ultra-high purity (>99.5%) output required by battery manufacturers.

Is Lepidolite primarily used for Lithium Carbonate or Lithium Hydroxide production?

Lepidolite is utilized for both compounds. While it historically yielded Lithium Carbonate, modern refineries are increasingly focused on producing high-purity Lithium Hydroxide. Hydroxide is essential for high-energy-density cathodes (NMC/NCA) preferred in long-range electric vehicles, representing the faster-growing segment derived from lepidolite.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager