Leuprolide Acetate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432122 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Leuprolide Acetate Market Size

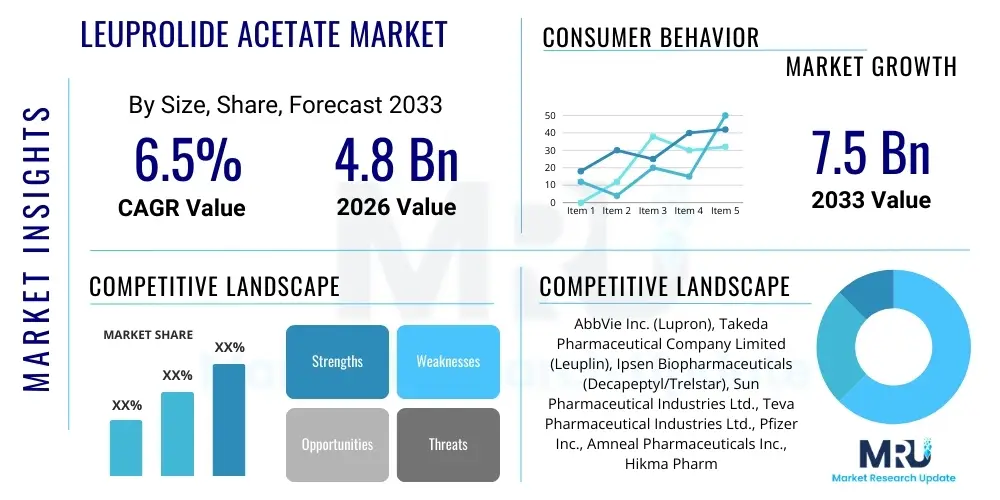

The Leuprolide Acetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global incidence of hormone-sensitive cancers, particularly prostate cancer and breast cancer, coupled with the increasing adoption of highly effective long-acting depot formulations that enhance patient compliance and therapeutic outcomes. The strategic shift towards personalized medicine and improved diagnostic capabilities also contributes significantly to market valuation.

Leuprolide Acetate Market introduction

Leuprolide Acetate, a synthetic nonapeptide analog of gonadotropin-releasing hormone (GnRH), acts as an agonist that initially stimulates the pituitary gland, followed by sustained downregulation leading to chemical castration, making it highly effective in hormone-dependent conditions. The primary mechanism involves inhibiting the release of luteinizing hormone (LH) and follicle-stimulating hormone (FSH), thereby suppressing gonadal steroidogenesis. This critical pharmacological action positions leuprolide acetate as a cornerstone therapy for prostate cancer, endometriosis, uterine fibroids, and central precocious puberty (CPP). Its versatility and established efficacy across multiple therapeutic areas solidify its foundational role in endocrinology and oncology.

The product is predominantly administered via subcutaneous or intramuscular injection, available in various formulations, including daily, monthly, three-monthly, and six-monthly depot systems. The shift towards long-acting formulations represents a major developmental focus, offering superior convenience and improved quality of life for patients requiring chronic treatment. These sustained-release technologies leverage complex polymer matrices (often PLGA-based) to ensure consistent drug release over extended periods, minimizing peak-and-trough plasma concentrations and maximizing therapeutic benefits while reducing the healthcare burden associated with frequent clinical visits. This technological innovation is key to expanding market penetration.

Major applications of leuprolide acetate are concentrated in oncology and gynecology. Benefits include effective tumor regression in advanced prostate cancer, significant relief from pain and symptoms associated with endometriosis, and effective management of precocious puberty, preventing premature physical development. Driving factors for market growth include the aging population globally, leading to higher prevalence of prostate cancer, advancements in drug delivery systems ensuring better bioavailability and lower side effects, and rising awareness about early diagnosis and therapeutic interventions for chronic hormone-sensitive disorders. Furthermore, supportive regulatory pathways for generic and biosimilar versions are increasing accessibility and affordability in developing regions.

Leuprolide Acetate Market Executive Summary

The Leuprolide Acetate market exhibits robust growth, characterized by strong demand derived from the high prevalence of hormone-sensitive cancers, particularly in geriatric populations across developed economies. Current business trends emphasize the development and commercialization of complex generics and biosimilars, intensely focusing on depot formulations that challenge the dominance of originator brands. Strategic collaborations between pharmaceutical firms and advanced drug delivery technology providers are defining the competitive landscape, aiming to create novel, ultra-long-acting versions (e.g., once-yearly injections). Furthermore, expanding clinical indications, such as potential use in certain types of breast cancer treatments and pediatric endocrinology, are opening new revenue streams, balancing the competitive pressure from emerging oral GnRH antagonists.

Regionally, North America maintains the largest market share due to high healthcare expenditure, established reimbursement policies, and the rapid uptake of premium long-acting formulations. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to increasing healthcare infrastructure investment, a large patient pool, improved diagnosis rates, and the growing accessibility of essential medicines due to favorable government initiatives in countries like China and India. Europe follows a steady growth trajectory, driven by effective cancer screening programs and the launch of multiple biosimilar products, which enhance market dynamics through price competition and broadened patient access.

Segment trends indicate that the prostate cancer application segment continues to dominate the market by revenue, reflecting the high disease burden and established standard of care involving GnRH agonists. Simultaneously, the three-month and six-month depot formulation segments are experiencing rapid volume growth, driven by physician preference for treatments that maximize patient adherence and minimize administrative burden for healthcare providers. The subcutaneous route of administration is gaining traction over intramuscular injection dueide to reduced pain and improved self-administration possibilities in certain jurisdictions, representing a key area for technological differentiation among market players seeking sustainable competitive advantages.

AI Impact Analysis on Leuprolide Acetate Market

User queries regarding AI's influence in the Leuprolide Acetate domain primarily revolve around three axes: optimizing drug discovery processes, enhancing personalized treatment planning (dosing and timing), and streamlining clinical trial logistics for new long-acting formulations. Users are concerned about whether AI can predict non-responders to GnRH therapy, thus reducing unnecessary treatment cycles, and if machine learning algorithms can accelerate the development of complex generic depot systems, potentially lowering manufacturing costs and accelerating time-to-market. The consensus expectation is that AI will primarily serve as a powerful tool in pharmacovigilance and adherence monitoring, predicting patient compliance based on historical behavioral data and tailoring communication strategies to maintain therapeutic effectiveness in chronic care settings.

The initial impact of Artificial Intelligence is manifesting in predictive modeling for patient stratification. By analyzing vast datasets encompassing genetic markers, hormonal profiles, and co-morbidity records, AI algorithms can identify subsets of patients who are most likely to benefit optimally from leuprolide acetate therapy versus those who might require alternative or combination treatments, leading to significantly optimized resource allocation and reduced instances of treatment failure. Furthermore, AI-driven solutions are being utilized in complex chemistry, manufacturing, and controls (CMC) processes, especially in formulating highly precise polymer-drug blends necessary for achieving the sustained-release profiles characteristic of depot injections, thereby enhancing batch consistency and quality control.

In the clinical research sphere, AI facilitates highly efficient trial site selection and patient recruitment for studies validating new leuprolide formulations, shortening development timelines which are crucial in the competitive pharmaceutical market. Data analysis pipelines powered by machine learning accelerate the interpretation of phase III trial results, enabling faster regulatory submission and approval processes. Although AI is not directly involved in the production of the raw API (Active Pharmaceutical Ingredient), its influence on optimizing manufacturing yield, managing supply chain complexity, and ensuring the stability of temperature-sensitive biologicals creates significant operational leverage for companies operating in the leuprolide acetate space.

- AI-enhanced prediction of treatment response rates and patient stratification.

- Optimization of complex depot formulation design parameters using machine learning.

- Streamlining of global clinical trial patient recruitment and site management.

- Development of personalized dosing regimens based on real-time patient data monitoring.

- Improved supply chain efficiency and cold chain logistics management using predictive analytics.

- Acceleration of pharmacovigilance by analyzing adverse event data patterns globally.

DRO & Impact Forces Of Leuprolide Acetate Market

The Leuprolide Acetate Market is shaped by a strong interplay of growth drivers and mitigating restraints, creating a dynamic environment where strategic innovation is paramount. Primary drivers include the global increase in age-related diseases like prostate cancer and the expanding applications in pediatric endocrinology and gynecology. Opportunities are significant, largely centered around the development of needle-free or advanced injectable systems, such as biodegradable implants offering superior patient compliance and market differentiation. Conversely, the market faces notable restraints, including the patent expiration of key products, leading to intense generic and biosimilar competition, and the emergence of non-peptide oral GnRH antagonists which offer a viable, non-injectable alternative, potentially disrupting established market share and revenue stability. These forces collectively dictate pricing pressures and influence R&D investment strategies.

Drivers: The increasing success of public health campaigns promoting early cancer screening contributes significantly to higher diagnosis rates, translating directly into increased prescriptions for leuprolide acetate. Furthermore, the proven efficacy and long-term safety profile of GnRH agonists, especially in conditions requiring prolonged endocrine suppression such as advanced prostate cancer, cement their preferential usage among oncologists. Technological drivers, specifically improvements in polymer science enabling depot injections with sustained release up to six months, drastically enhance patient adherence, a crucial factor in therapeutic success, thereby reinforcing the market's positive trajectory. Global population growth and increased access to specialized oncological care in emerging economies further amplify demand.

Restraints: The most significant restraint is the intellectual property cliff. As originator drug patents expire, the market experiences an influx of cheaper generics and biosimilars, leading to rapid price erosion, which impacts the profitability of established market leaders. Another constraint is the logistical challenge associated with the cold chain management required for peptide-based injectables, complicating distribution in rural or underdeveloped regions. Moreover, patient apprehension regarding injectable therapies and the potential for injection site reactions, coupled with the systemic side effects inherent to hormone suppression (e.g., bone density loss, hot flashes), occasionally lead patients and physicians to explore alternative therapeutic options, including surgical alternatives or newer oral medications.

Opportunities: Key opportunities lie in the development of combination therapies where leuprolide acetate is used synergistically with novel hormonal agents (NHAs) to achieve enhanced clinical outcomes in metastatic castration-resistant prostate cancer (mCRPC). Furthermore, exploring novel, non-invasive delivery technologies, such as transdermal patches or oral stable peptide formulations, represents a high-potential avenue for market expansion and competitive advantage. The largely untapped market for pediatric and adolescent indications, requiring specialized lower doses and unique delivery devices, offers niche growth prospects. Strategic market penetration into the highly lucrative Chinese and Indian markets, by securing local manufacturing and distribution partnerships, presents a major opportunity for global market players.

Impact Forces: The overarching impact force is the regulatory environment. Strict regulatory scrutiny on complex generic depot formulations necessitates extensive bioequivalence studies, raising R&D costs but ensuring product quality. Payer pressure and reimbursement dynamics significantly impact product uptake; formulations offering better compliance and lower overall healthcare costs (by reducing hospital visits) are favored. Competitive intensity remains high due to the entry of large pharmaceutical companies focusing on biosimilar development, forcing established players to innovate continuously on delivery mechanisms and patient support programs rather than relying solely on API innovation. Finally, patient advocacy groups play an increasing role, pushing for accessible, patient-friendly formulations, influencing both prescribing patterns and market development priorities.

Segmentation Analysis

The Leuprolide Acetate market is meticulously segmented based on application, formulation, and distribution channel, reflecting the diverse clinical needs and market access strategies employed across the globe. Understanding these segments is crucial for effective strategic planning and resource allocation. The market landscape is predominantly defined by oncology, specifically prostate cancer, which dictates the highest volume and value of prescriptions, contrasted with smaller, highly specialized segments like Central Precocious Puberty (CPP). Formulation type, particularly the duration of action (e.g., 1-month vs. 6-month depot), is the primary determinant of pricing and patient convenience, influencing competitive positioning among manufacturers.

Segmentation by application highlights the therapeutic diversity of leuprolide acetate, ranging from major chronic conditions to acute, niche requirements. While prostate cancer remains the financial cornerstone, gynecological applications (endometriosis, uterine fibroids) provide significant volume stability, often targeting younger patient demographics. The continuous innovation in sustained-release technologies has blurred the lines between standard and premium products, emphasizing time-release profiles as a critical segmentation factor. Furthermore, the distinction between hospital pharmacy sales and retail pharmacy distribution is increasingly relevant, driven by the shift towards home healthcare and self-administration of certain formulations.

- By Application:

- Prostate Cancer

- Endometriosis

- Uterine Fibroids (Myoma)

- Central Precocious Puberty (CPP)

- Breast Cancer (Hormone Receptor-Positive)

- Others (e.g., IVF preparatory treatments)

- By Formulation Type:

- 1-Month Depot (Monthly Injection)

- 3-Month Depot

- 4-Month Depot

- 6-Month Depot (Semi-annual Injection)

- Daily Injection (Short-acting)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Leuprolide Acetate Market

The value chain for the Leuprolide Acetate market begins with the complex upstream activities involving the synthesis of the highly specialized nonapeptide API. This stage demands sophisticated chemical manufacturing expertise and stringent quality control, as the purity and stability of the peptide are critical for therapeutic efficacy and successful depot formulation. Key upstream players include specialized Active Pharmaceutical Ingredient (API) manufacturers, often based in India and China, who supply the raw material under rigorous contract manufacturing agreements. Ensuring a stable, high-quality supply chain for this sensitive peptide is a constant challenge, influenced by regulatory compliance requirements (cGMP) and geopolitical stability.

The core midstream activity involves formulation development, where the API is combined with complex biodegradable polymers (like PLGA) to create the sustained-release depot injectable systems. This is a crucial step that differentiates premium products based on the accuracy and duration of drug release. Manufacturers invest heavily in R&D here to secure competitive advantages through proprietary microencapsulation technologies and customized injection devices. Licensing agreements for advanced delivery systems often form part of this stage. Downstream activities focus on packaging, logistics, and distribution, which are complicated by the mandatory cold chain requirements necessary to maintain the peptide's integrity until it reaches the patient.

Distribution channels are categorized into direct and indirect methods. Direct distribution involves manufacturers supplying large hospital systems or specialized oncology clinics, often for immediate patient administration under clinical supervision. Indirect distribution primarily relies on specialized pharmaceutical wholesalers and distributors who manage complex logistics, inventory, and regulatory requirements before supplying retail pharmacies and smaller clinics. The rising trend of biosimilars is putting pressure on distribution margins, requiring high-volume, low-cost logistics solutions. Ultimately, the effectiveness of the value chain is measured by the timely and reliable delivery of these life-saving, temperature-sensitive pharmaceuticals to the end-user, prioritizing specialized oncology and endocrinology practices.

Leuprolide Acetate Market Potential Customers

The primary customers and end-users of Leuprolide Acetate are diverse, spanning multiple medical specialties and patient demographics, necessitating highly targeted marketing and sales strategies. The most significant customer base comprises oncology centers and specialized urology clinics, which treat the high volume of advanced prostate cancer patients. These institutions often purchase large volumes directly or through Group Purchasing Organizations (GPOs), valuing reliable supply, proven clinical efficacy data, and robust patient support services provided by the manufacturers. Institutional buying decisions are heavily influenced by formulary inclusion, overall cost-effectiveness, and the availability of preferred long-acting depot formulations that improve clinical workflows.

Another crucial customer segment includes gynecological and fertility clinics. Leuprolide acetate is widely used to manage conditions like endometriosis and uterine fibroids, and as an adjunct in assisted reproductive technologies (ART), such as in vitro fertilization (IVF). These practitioners focus on minimizing patient side effects and maximizing treatment predictability. Pediatric endocrinologists represent a specialized, albeit smaller, customer segment, utilizing the drug for the management of Central Precocious Puberty (CPP). For this group, precise, often low-dose, formulations and user-friendly administration devices (suitable for children) are paramount, driving demand for specific single-use pre-filled systems.

Finally, governmental healthcare organizations and major private insurance payers act as indirect, but highly influential, customers. Their reimbursement policies determine patient access and physician prescribing habits. Payers often favor biosimilar or generic versions when bioequivalence is proven, exerting constant downward pressure on pricing. Manufacturers must demonstrate superior patient outcomes and cost-effectiveness data, particularly for premium, six-month formulations, to secure favorable coverage decisions. Ultimately, the patient, although not the direct purchaser, remains the core focus, and adherence rates influence the long-term success of the product in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AbbVie Inc. (Lupron), Takeda Pharmaceutical Company Limited (Leuplin), Ipsen Biopharmaceuticals (Decapeptyl/Trelstar), Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Amneal Pharmaceuticals Inc., Hikma Pharmaceuticals PLC, Dr. Reddy’s Laboratories Ltd., Qilu Pharmaceutical Co. Ltd., Endo International plc, Sanofi S.A., Ferring Pharmaceuticals, Varian Medical Systems (A Siemens Healthineers Company), Accord Healthcare, Sandoz (Novartis division), Fresenius Kabi, Hetero Drugs, Cipla Ltd., and Polypeptide Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leuprolide Acetate Market Key Technology Landscape

The technological evolution within the Leuprolide Acetate market is overwhelmingly concentrated on enhancing drug delivery systems to improve patient convenience, minimize injection frequency, and ensure consistent therapeutic release kinetics. The foundational technology is based on polymer-based microencapsulation, predominantly using Poly(lactic-co-glycolic acid) (PLGA). This technology allows the drug to be embedded within biodegradable polymer microspheres, which slowly degrade upon injection, releasing the leuprolide acetate consistently over periods ranging from one month to six months. Advanced manufacturers are continuously optimizing the molecular weight and copolymer ratio of PLGA to fine-tune the release profiles, aiming for zero-order kinetics to avoid the initial burst release and subsequent trough periods, thereby ensuring stable endocrine suppression.

A major area of technological focus involves developing ultra-long-acting formulations, such as annual or semi-annual implants, utilizing alternative biocompatible matrices or novel hydrogel technologies. These systems aim to further reduce the frequency of clinic visits, which is highly desirable for elderly patients undergoing long-term treatment. Furthermore, technology is being applied to the injection devices themselves. Innovations include pre-filled syringes with auto-injectors designed for easier self-administration (where regulations permit), reducing the need for specialized training and minimizing injection anxiety. These devices often incorporate safety mechanisms to ensure complete drug delivery and proper disposal, addressing both patient compliance and healthcare waste management concerns.

The emergence of biosimilars is also driving process technology improvements. Generic manufacturers must demonstrate not only chemical equivalence but also strict bioequivalence and clinical similarity to the reference drug, particularly concerning the complex depot release mechanism. This necessitates the use of advanced analytical techniques, such as mass spectrometry and chromatography, to precisely characterize the microspheres and their dissolution properties. Successfully navigating these technological hurdles is essential for high-volume, cost-effective manufacturing of complex generics, ensuring market stability while broadening access to therapy across global health systems.

Regional Highlights

The global market for Leuprolide Acetate exhibits distinct regional variations driven by differing healthcare expenditure levels, demographic profiles, disease prevalence, and regulatory landscapes. North America, encompassing the United States and Canada, remains the largest revenue generator. This dominance is underpinned by a high prevalence of prostate cancer, sophisticated cancer screening programs leading to early diagnosis, widespread adoption of premium, long-acting formulations, and robust insurance coverage that facilitates access to expensive specialty pharmaceuticals. The competitive environment is fierce, characterized by strong brand loyalty but increasing pressure from authorized generics and biosimilars.

Europe represents a mature market, segmented by national healthcare policies and drug pricing mechanisms. Western European countries (Germany, France, UK) show steady demand, supported by well-established healthcare systems and standardized treatment protocols for oncology. The recent introduction of biosimilars across the EU has been pivotal in managing costs, driving volume growth but tempering overall revenue expansion. Eastern Europe, while smaller, offers significant untapped potential due to improving healthcare access and standardization.

Asia Pacific (APAC) is projected to be the fastest-growing region. This explosive growth is fueled by massive patient populations in China and India, rapidly improving oncology care standards, increased disposable income, and government initiatives aimed at reducing the burden of chronic diseases. While penetration of high-cost, 6-month formulations is still lower than in the West, localized manufacturing and strategic partnerships are making leuprolide acetate more accessible. Latin America and the Middle East & Africa (MEA) are emerging markets experiencing moderate growth, constrained primarily by inconsistent reimbursement policies and reliance on imported products, although demand in specialized clinics is consistently rising.

- North America: Market leader; High incidence of prostate cancer; Favorable reimbursement for premium depot formulations; Strong presence of originator companies.

- Europe: Stable growth; Driven by national cancer strategies; Significant impact from biosimilar market penetration; Strict regulatory environment.

- Asia Pacific (APAC): Highest CAGR; Large patient pool in China and India; Improving healthcare infrastructure; Increasing adoption of standardized hormonal therapy.

- Latin America: Emerging market; Growth influenced by expanding private healthcare sector; Challenges related to complex regulatory approvals and product importation.

- Middle East and Africa (MEA): Niche market; Demand concentrated in wealthy Gulf Cooperation Council (GCC) countries; Growth linked to medical tourism and specialized cancer centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leuprolide Acetate Market.- AbbVie Inc. (Lupron)

- Takeda Pharmaceutical Company Limited (Leuplin)

- Ipsen Biopharmaceuticals (Decapeptyl/Trelstar)

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Amneal Pharmaceuticals Inc.

- Hikma Pharmaceuticals PLC

- Dr. Reddy’s Laboratories Ltd.

- Qilu Pharmaceutical Co. Ltd.

- Endo International plc

- Sanofi S.A.

- Ferring Pharmaceuticals

- Varian Medical Systems (A Siemens Healthineers Company)

- Accord Healthcare

- Sandoz (Novartis division)

- Fresenius Kabi

- Hetero Drugs

- Cipla Ltd.

- Polypeptide Group

Frequently Asked Questions

Analyze common user questions about the Leuprolide Acetate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Leuprolide Acetate Market?

The Leuprolide Acetate Market is projected to exhibit a CAGR of 6.5% between 2026 and 2033, driven by the increasing global prevalence of hormone-sensitive cancers and the continuous development of long-acting depot formulations that improve patient adherence.

Which application segment currently holds the largest market share for Leuprolide Acetate?

The Prostate Cancer application segment dominates the market share due to the high global incidence of the disease, established treatment protocols favoring GnRH agonists, and the widespread adoption of long-term therapeutic regimens using multi-month depot injections.

How do biosimilars impact the long-term profitability of the Leuprolide Acetate Market?

The introduction of biosimilars intensifies price competition, particularly for high-volume, established formulations (1-month and 3-month depots). While this increases market access and overall volume, it exerts significant downward pressure on average selling prices, impacting the long-term revenue streams of originator brands.

What are the key technological advancements driving demand in this market?

Key technological advancements center on sustained-release drug delivery systems, primarily PLGA-based microencapsulation, which allow for three-month and six-month injection intervals. These innovations significantly enhance patient compliance and clinical workflow efficiency, representing a core competitive differentiator.

Which geographical region is anticipated to experience the fastest market growth rate?

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This acceleration is attributed to rapidly expanding healthcare infrastructure, rising awareness about cancer diagnosis, and the large, underserved patient populations in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager