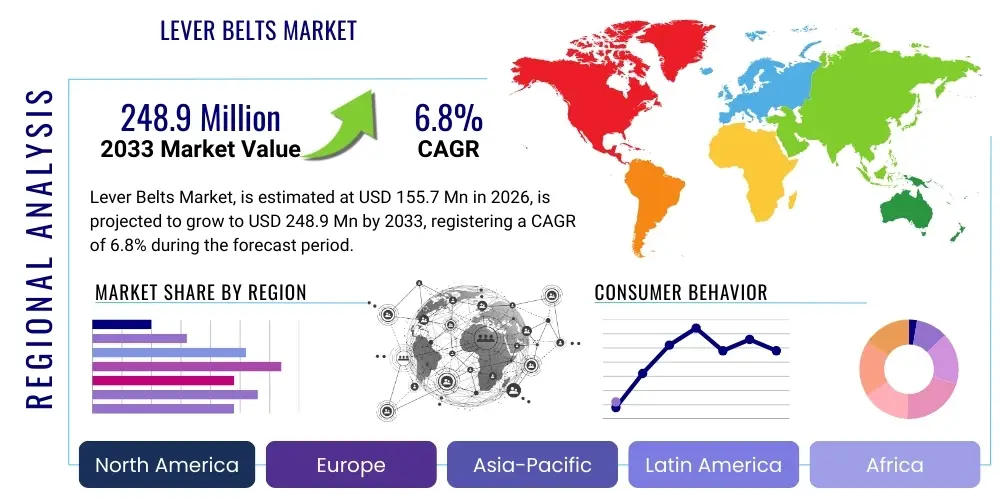

Lever Belts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436869 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Lever Belts Market Size

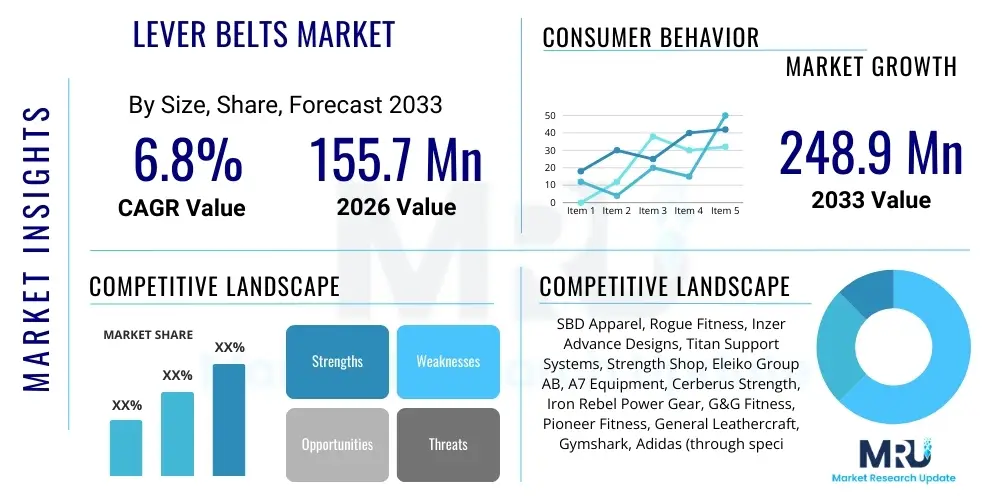

The Lever Belts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 155.7 Million in 2026 and is projected to reach USD 248.9 Million by the end of the forecast period in 2033.

Lever Belts Market introduction

The Lever Belts Market encompasses the production, distribution, and sale of specialized weightlifting and fitness belts characterized by a quick-locking lever mechanism. These belts are primarily used in strength sports, such as powerlifting, strongman competitions, and heavy-duty gym training, to provide enhanced core stability and intra-abdominal pressure (IAP). This superior stability helps lifters protect the spine during maximal effort lifts, including squats, deadlifts, and overhead presses, thereby improving performance and reducing the risk of injury. The construction typically involves high-quality, durable materials, predominantly thick leather (10mm to 13mm), designed to withstand extreme tension and usage cycles typical of competitive lifting environments.

Product descriptions for lever belts emphasize their structural integrity and ease of use, distinguishing them significantly from traditional prong or buckle belts. The quick-release lever mechanism allows users to tighten the belt to maximum pressure instantly and release it just as quickly, which is crucial for safety and comfort between sets. Major applications span competitive powerlifting, where compliance with specific federation rules (e.g., IPF standards for thickness and width) drives demand, and general high-intensity fitness, where athletes seek maximum lumbar support. The premium pricing of lever belts reflects the specialized materials, precision engineering of the lever system, and strict quality control necessary to ensure product safety and longevity.

The market is predominantly driven by the surging global popularity of strength sports and the professionalization of powerlifting. As more individuals engage in heavy resistance training and seek measurable performance gains, the demand for specialized, high-performance gear like lever belts increases. Furthermore, growing consumer awareness regarding proper biomechanics and injury prevention in lifting contributes substantially to market expansion. The longevity and durability of these products, often backed by lifetime warranties from manufacturers, solidify their positioning as essential investments for dedicated strength athletes, ensuring consistent replacement and upgrade cycles within the consumer base.

Lever Belts Market Executive Summary

The Lever Belts Market is experiencing robust growth fueled by favorable business trends, particularly the expansion of competitive fitness and strength training facilities globally. Key business trends include the shift towards e-commerce as the dominant distribution channel, enabling specialized manufacturers to reach niche international markets directly, bypassing traditional brick-and-mortar retail constraints. Additionally, there is a strong trend toward customization and material innovation, with high-end brands focusing on sustainable leather sourcing, refined lever mechanisms made from aerospace-grade alloys, and personalized aesthetic options, driving up the Average Selling Price (ASP) in the premium segment. Strategic alliances between manufacturers and professional athletes or major lifting federations also serve as powerful marketing and validation tools, directly influencing consumer purchasing decisions.

Regionally, North America and Europe currently dominate the market due to the established infrastructure for powerlifting and bodybuilding, high disposable income, and strong participation rates in strength sports. However, the Asia Pacific region, particularly countries like China, India, and Australia, is poised for the fastest growth. This acceleration is driven by rapid urbanization, increasing middle-class income, and the adoption of Western fitness culture, leading to significant investment in commercial gym facilities and specialized equipment. Governments and health organizations in these regions are increasingly promoting physical fitness, which indirectly boosts demand for essential strength training accessories. The Middle East and Latin America are also emerging as key growth areas, albeit starting from a smaller base, due to developing fitness industries.

In terms of segment trends, the 13mm thickness segment holds a significant market share, favored by elite and competitive powerlifters for maximum support, while the 10mm segment remains popular among beginners and general fitness enthusiasts seeking a balance of support and flexibility. Material segmentation indicates a steady demand for genuine leather products due to their superior durability, though synthetic or hybrid materials are gaining traction, particularly in entry-level products or belts focused on specialized training applications. The application segment remains dominated by competitive powerlifting, yet the growing intersection between Cross-Training and heavy lifting continues to broaden the demand base for versatile, quick-adjusting lever belts.

AI Impact Analysis on Lever Belts Market

User inquiries regarding AI's impact on the Lever Belts Market primarily center on three areas: how AI can optimize product design for better biomechanical fit, the role of AI in supply chain efficiency and material procurement, and the potential for AI-driven personalized training regimens that recommend specific gear. Users are concerned about whether AI-optimized designs will necessitate frequent product iteration and whether personalized sizing recommendations driven by AI body scans will become standard. The key themes revolve around optimization—optimizing manufacturing precision, optimizing inventory based on predictive demand modeling derived from fitness trends, and optimizing the customer experience through customized recommendations. Expectations are high that AI will primarily enhance B2B operations (supply chain, quality control) and B2C marketing (personalization and demand forecasting) rather than radically altering the fundamental mechanical design of the leather belt itself.

- AI-driven predictive demand modeling optimizes inventory levels for seasonal fitness trends and major powerlifting events, minimizing stockouts and obsolescence.

- Integration of AI in Computer-Aided Design (CAD) software allows for precise simulation of stress points and material fatigue, leading to safer, more durable lever mechanisms.

- Machine learning algorithms analyze vast datasets of user biomechanics (e.g., lifting style, body measurements) to offer highly personalized sizing and thickness recommendations, reducing returns.

- AI enhancement of quality control systems using computer vision to detect microscopic flaws in leather hides and lever assembly, ensuring compliance with strict manufacturing standards.

- Automation in manufacturing processes, guided by AI, improves the efficiency of cutting, stitching, and assembly, reducing labor costs and shortening lead times.

- Personalized marketing content generation using AI to target strength athletes with relevant product features based on their specific training goals (e.g., raw lifting vs. equipped lifting).

- Optimization of global logistics and supply chain routes via AI, reducing shipping costs and increasing transparency for the procurement of specialized leather and metal components.

DRO & Impact Forces Of Lever Belts Market

The dynamics of the Lever Belts Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate market direction and growth velocity. The primary driver is the global proliferation of organized strength sports and fitness movements, which fundamentally validates the necessity of specialized equipment for safety and performance gains. This is coupled with effective restraints, most notably the high initial cost barrier for premium lever belts compared to simpler prong alternatives, which can deter casual gym users. Opportunities emerge through technological advancements in material science, allowing for lighter yet equally supportive synthetic options, and the expansion into untapped emerging markets across Asia and Latin America. These elements collectively establish an environment where external impact forces, such as regulatory changes in competitive lifting federations or fluctuations in raw material prices, exert significant influence on profitability and market competitiveness.

Specific drivers include the increasing global awareness and acceptance of weight training as a crucial component of overall health, supported by fitness influencers and social media platforms that showcase high-level lifting using professional gear. The inherent safety benefit provided by consistent core stabilization during heavy lifts remains a cornerstone of consumer demand, particularly among athletes progressing to heavier weights. Furthermore, the longevity and high residual value of premium leather lever belts, often purchased as a long-term investment, support continued demand even during economic downturns, as athletes prioritize durability over recurring low-cost purchases. Marketing efforts focusing on performance enhancement and injury mitigation resonate strongly with the target demographic, solidifying the market’s steady growth trajectory, especially within the dedicated powerlifting community.

Conversely, significant restraints hinder market potential, including the substantial volatility in the price of high-grade, full-grain leather, a key raw material, which directly impacts production costs and final retail prices. Counterfeit products and low-quality imitations pose a constant threat, undermining brand trust and introducing competition based purely on lower price points, often at the expense of safety and durability. Additionally, the market faces saturation in developed countries like the US and Canada, where many dedicated lifters already own a belt, shifting focus from initial purchase to replacement cycles. The key opportunities lie in innovating the core mechanism—developing lighter, stronger, and more user-friendly levers—and diversifying product offerings to appeal to adjacent sports like strongman and functional fitness, which have slightly different needs regarding belt flexibility and profile. External impact forces, such as shifts in consumer preference towards minimalist training or changes in competitive lifting standards (e.g., allowed belt width), necessitate continuous market monitoring and rapid product adaptation.

- Drivers:

- Rising global participation in powerlifting, Olympic weightlifting, and competitive strongman events.

- Increased emphasis on safety and injury prevention in heavy resistance training.

- Endorsements and promotional activities by professional athletes and fitness influencers.

- Growing disposable income dedicated to specialized fitness equipment in developed and emerging economies.

- Restraints:

- High manufacturing costs associated with premium, durable materials (full-grain leather and precision metal levers).

- Availability of lower-cost, inferior quality substitutes and counterfeit products in the market.

- Market penetration challenges due to the niche nature of the product, limiting appeal to professional lifters.

- Fluctuations in the global supply chain and pricing of raw materials.

- Opportunity:

- Development of advanced, lighter composite materials that maintain required rigidity and support.

- Expansion of distribution channels, particularly through targeted e-commerce platforms and global direct-to-consumer models.

- Customization and personalization options (e.g., color, engraving, bespoke sizing) driving premium sales.

- Penetration into fast-growing Asian and Latin American fitness markets.

- Impact Forces:

- Regulatory changes within major powerlifting federations impacting allowable belt specifications (width, thickness).

- Consumer health trends focusing on functional movement vs. maximal lifting.

- Currency exchange rate volatility affecting import/export profitability for international brands.

- Advancements in biomechanics research influencing optimal belt usage techniques and design requirements.

Segmentation Analysis

The Lever Belts Market is comprehensively segmented based on product characteristics, material composition, primary application, and distribution channel, providing a granular view of consumer preferences and market dynamics. Segmentation by thickness (10mm, 13mm, and specialized) reveals a clear divide between users prioritizing maximum rigidity (13mm) necessary for competitive lifting and those seeking greater comfort and versatility (10mm). Material segmentation highlights the dominance of premium leather, valued for its unmatched durability and ability to mold to the user's torso over time, contrasting with newer synthetic and hybrid options that offer reduced break-in periods and lower cost. Analyzing these segments is critical for manufacturers to tailor their product lines, optimize pricing strategies, and target specific athletic demographics effectively.

The application-based segmentation (Powerlifting, Olympic Weightlifting, General Fitness) demonstrates that while powerlifting remains the largest and most demanding segment in terms of specification compliance, general fitness and hybrid training modules are rapidly contributing to volume growth. Olympic weightlifting, characterized by explosive movements, often requires a slightly different belt profile or quick-release mechanism, influencing specialized design choices. Furthermore, the distribution channel segmentation provides insight into market accessibility, where the shift to online retail and direct manufacturer platforms has decentralized purchasing, offering consumers wider choices and better price discovery compared to reliance solely on specialty sporting goods stores.

Understanding the intersections of these segments is vital for strategic positioning. For instance, a manufacturer targeting competitive powerlifters in Europe will focus heavily on 13mm genuine leather belts that are IPF-approved and distributed via specialized online strength equipment retailers. Conversely, a brand aiming for the growing Asian general fitness market might prioritize 10mm synthetic or suede options marketed through large e-commerce marketplaces with emphasis on comfort and quick shipping. This detailed segmentation not only informs product development cycles but also dictates regional marketing spend and supply chain prioritization, ensuring resources are allocated to the highest potential growth areas within the global market landscape.

- By Thickness:

- 10mm Lever Belts

- 13mm Lever Belts

- Specialized/Custom Thickness (e.g., wider, unique taper)

- By Material:

- Genuine Leather (Full Grain/Suede)

- Hybrid/Composite Materials

- Synthetic Leather

- By Application:

- Competitive Powerlifting

- Olympic Weightlifting

- Strongman/Cross-Training

- General Strength Training

- By Distribution Channel:

- Online Retailers (E-commerce Platforms)

- Specialty Sporting Goods Stores

- Direct Manufacturer Sales (D2C)

- Wholesale/Gym Supply Contracts

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Lever Belts Market

The value chain for the Lever Belts Market begins with upstream activities focused on the sourcing and processing of specialized raw materials. This predominantly involves acquiring high-quality full-grain cowhide leather, which is subject to rigorous tanning and finishing processes to ensure the required stiffness, durability, and aesthetics. Simultaneously, the manufacturing of the lever mechanism—a critical component defining the product—requires precision metal casting or CNC machining, typically involving steel or specialized alloys. Upstream suppliers hold significant bargaining power due to the strict quality requirements for both the leather and the metal lever, making consistent, high-quality sourcing a key competitive differentiator for belt manufacturers. Quality control at this stage is paramount, as defects in either the leather or the lever mechanism compromise the product's safety rating.

Midstream activities encompass the actual manufacturing, assembly, and branding of the belts. This involves sophisticated processes such as high-precision cutting, stitching (often multi-ply nylon or Kevlar thread for maximum strength), embossing of logos, and the meticulous assembly and testing of the lever mechanism onto the leather strap. Manufacturers strategically manage direct versus indirect distribution channels. Direct channels (D2C e-commerce) allow manufacturers to capture higher margins, control branding, and gather direct customer feedback, which is crucial for product iteration. Indirect channels involve partnerships with wholesale distributors or large online marketplaces (like Amazon or specialized fitness aggregators), facilitating wider market reach but often reducing profit margins due to intermediary costs.

Downstream activities focus on reaching the end-user, primarily competitive athletes and fitness enthusiasts. This stage relies heavily on marketing, particularly digital outreach, influencer endorsements, and participation in major strength sports expos. Specialty sporting goods stores offer a vital touchpoint where customers can physically examine the belt's quality and fit before purchase, providing an essential tactile experience that online purchasing lacks. However, online retail dominates, driven by convenience and the ability to compare specifications across niche brands globally. Effective logistics, customer service regarding sizing, and warranty management are the final, crucial elements in the value chain that build brand loyalty and sustain long-term market presence.

Lever Belts Market Potential Customers

The primary customers for Lever Belts are high-commitment athletes engaged in resistance training where maximal spinal stability is required. This segment includes professional and amateur powerlifters who necessitate 13mm IPF-compliant belts for competition and rigorous training cycles, strongman competitors requiring flexible yet sturdy support, and dedicated bodybuilders focused on heavy foundational movements. These individuals view the lever belt not merely as an accessory but as a performance-enhancing, safety-critical investment, leading to inelastic demand for premium, durable products. This core demographic prioritizes quality, brand reputation, and strict adherence to specifications over price point, often leading to immediate adoption of new, improved lever technologies.

The secondary customer base comprises advanced general fitness enthusiasts, serious gym-goers, and Cross-Training athletes who regularly incorporate heavy compound lifts into their routines. While this group may often opt for the more comfortable 10mm thickness, they still seek the convenience and speed of the lever mechanism compared to traditional buckles. This segment is highly price-sensitive compared to competitive lifters but represents a much larger volume potential. Their purchasing decisions are heavily influenced by online reviews, social media trends, and accessibility through major e-commerce platforms. Manufacturers often target this segment with slightly simplified designs and a wider range of colors/aesthetic options.

Furthermore, commercial gyms, specialized training centers, and institutional buyers (such as university athletic departments) represent significant bulk purchasers. These institutions buy belts for shared usage, emphasizing durability, sanitization ease, and general fit across various users. While they may not require the most premium custom options, they demand robustness and long-term warranties. Targeting these institutional customers requires specialized B2B sales teams and robust distribution logistics capable of handling large-volume orders and providing ongoing maintenance support, ensuring a consistent revenue stream separate from direct consumer sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.7 Million |

| Market Forecast in 2033 | USD 248.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SBD Apparel, Rogue Fitness, Inzer Advance Designs, Titan Support Systems, Strength Shop, Eleiko Group AB, A7 Equipment, Cerberus Strength, Iron Rebel Power Gear, G&G Fitness, Pioneer Fitness, General Leathercraft, Gymshark, Adidas (through specialized fitness lines), Rehband. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lever Belts Market Key Technology Landscape

The technology landscape for the Lever Belts Market is primarily concentrated on material science and precision engineering of the core mechanical components. The most significant technological aspect is the continuous refinement of the lever mechanism itself. Modern levers often utilize sophisticated alloys (such as specialized aluminum or high-grade steel) manufactured using CNC machining to ensure extremely tight tolerances. This precision minimizes slippage, maximizes security under tension, and guarantees the quick-release functionality operates flawlessly even after years of high-stress use. Innovations focus on developing interchangeable levers, self-locking features, and multi-prong lever systems that provide enhanced fine-tuning adjustments, moving beyond the traditional fixed-hole configuration. These advancements enhance both user experience and competitive safety standards.

Material technology plays an equally critical role. While traditional full-grain leather remains the gold standard, manufacturers are increasingly integrating hybrid and composite materials to address constraints such as the long break-in period and high cost of leather. Research is ongoing into synthetic fibers and multi-layered polyurethane structures that can mimic the rigidity and supportive characteristics of thick leather while offering lighter weight, greater moisture resistance, and reduced maintenance. The technology surrounding the curing and finishing of leather has also evolved, employing proprietary processes to make the material optimally stiff immediately upon purchase, reducing the traditional weeks-long "break-in" phase required for older belt styles, thereby enhancing consumer satisfaction and usability right out of the box.

Furthermore, technology is being applied to the production process itself. Advanced laser cutting and automated industrial stitching machines utilize computerized patterns to ensure perfect dimensional consistency and alignment, vital for meeting strict federation sizing requirements (e.g., maximum 4-inch width). Traceability technologies, such as embedded RFID or QR codes, are also emerging, allowing premium brands to combat counterfeiting and provide detailed provenance information about the leather and metal components to discerning consumers. These technological investments streamline manufacturing, enhance quality assurance, and ultimately justify the premium pricing associated with high-performance lever belts in the marketplace.

Regional Highlights

- North America (NA): Dominates the global market share, driven by a deeply ingrained strength training culture, high consumer spending on specialized fitness equipment, and the presence of major powerlifting and fitness industry hubs. The region benefits from high-profile domestic manufacturers and strong regulatory bodies (like USAPL), which standardize equipment requirements, sustaining demand for certified, premium lever belts. The prevalence of large-scale commercial gym chains and specialized performance facilities ensures wide product adoption and consistent replacement demand.

- Europe: Represents the second-largest market, characterized by strong powerlifting traditions, particularly in Scandinavian countries, the UK, and Germany. European consumers prioritize quality, durability, and ethical sourcing, favoring premium brands known for high-specification materials and environmentally conscious production processes. The market growth is stable, supported by increasing participation in amateur strength competitions and robust e-commerce infrastructure facilitating cross-border sales of niche equipment.

- Asia Pacific (APAC): The fastest-growing regional market, propelled by escalating urbanization, rising disposable incomes, and the rapid expansion of modern fitness center infrastructure, particularly in Tier 1 and Tier 2 cities in China, India, and Southeast Asia. While synthetic and lower-cost options currently capture a significant share of the entry-level market, demand for high-end, brand-recognized lever belts is accelerating as competitive lifting becomes formalized and accepted across the region.

- Latin America (LATAM): An emerging market with high potential, showing promising growth in countries like Brazil, Mexico, and Argentina. Growth is stimulated by increasing health consciousness and the influence of international fitness trends, though market penetration is often constrained by economic volatility and higher import duties, which impact the final consumer price. Local manufacturing is underdeveloped, making this region heavily reliant on imports from NA and Europe, creating opportunities for strategic distribution partnerships.

- Middle East & Africa (MEA): This region is characterized by nascent but rapidly expanding luxury fitness sectors, especially in the GCC countries (UAE, Saudi Arabia). The market is small but exhibits high demand for premium, imported goods due to a preference for globally recognized brands. Growth is dependent on government investments in sports infrastructure and rising interest in strength-based personal training, targeting high-net-worth individuals who demand the highest quality fitness gear.

North America Market Analysis

The North American Lever Belts Market holds the dominant position globally, primarily due to the maturity of the strength sports industry and the strong presence of influential brands and professional training facilities. This market is characterized by consumers who are highly knowledgeable about biomechanics and equipment specifications, often seeking 13mm thickness belts that comply with major federation standards (IPF, USAPL). The consumer base exhibits low price elasticity for premium products, meaning athletes are willing to invest significantly in high-quality, warrantied gear, leading to higher average transaction values compared to other regions.

Key drivers in North America include the cultural prominence of bodybuilding and powerlifting, effective marketing campaigns utilizing highly recognized athletes, and the dense ecosystem of specialized equipment retailers, both online and physical. Furthermore, the strong patent protection for innovative lever mechanisms encourages domestic manufacturers to invest heavily in Research and Development, fostering a culture of technological improvement. The market is highly competitive, dominated by established domestic players who utilize direct-to-consumer (D2C) models coupled with rapid fulfillment capabilities, setting a high standard for customer service and product delivery across the continent.

However, the market also faces saturation challenges in certain demographic segments. Future growth in NA will rely less on new user acquisition and more on strategic product differentiation, driving replacement cycles through technological upgrades (e.g., self-adjusting levers, composite materials) and aesthetic customization. The rise of hybrid fitness methodologies (like functional strength training) presents an opportunity for manufacturers to introduce 10mm or custom-tapered belts that offer flexibility without sacrificing the core supportive function, broadening the appeal beyond traditional competitive powerlifters.

Europe Market Analysis

The European market is robust and mature, anchored by strong competitive cultures in countries like the UK, Germany, and the Nordic nations. The demand profile in Europe often leans towards quality and ethical manufacturing, with a growing segment of consumers prioritizing belts made from sustainably sourced leather and produced under strict European labor standards. The market is somewhat fragmented, with strong local brands competing alongside major international players, necessitating tailored marketing strategies to respect diverse national preferences and regulatory environments.

Distribution across Europe is complex due to various national taxes and logistics requirements, but sophisticated e-commerce networks have largely overcome these hurdles. Specialty online retailers and direct sales by manufacturers are crucial, providing pan-European access to niche gear. A key trend in Europe is the focus on standardized performance equipment, driven by the strong influence of the European Powerlifting Federation (EPF) and associated national bodies, ensuring consistent demand for certified, high-end 13mm belts that meet rigorous quality checks.

Opportunities for expansion lie in Eastern Europe, where the strength sports movement is gaining momentum alongside improving economic conditions. Manufacturers must adapt their logistics to handle VAT complexities and offer localized customer support and product information. The emphasis on high-quality craftsmanship means that European consumers are often less reactive to price wars and more loyal to brands that can demonstrate exceptional durability and superior design integrity, positioning premium products favorably in this region.

Asia Pacific (APAC) Market Analysis

The Asia Pacific region is the engine of future market growth for lever belts, characterized by exponential increases in gym memberships, fitness spending, and participation in competitive strength sports. Countries like China, India, and South Korea are witnessing massive demographic shifts towards adopting Western-style fitness, creating a huge potential consumer base, especially among younger populations entering the workforce with increased disposable income.

Currently, the market often sees high volume in the entry-level and mid-range segments, dominated by local manufacturers and imported synthetic options due to price sensitivity. However, as local powerlifting federations grow in prominence and competitive standards rise, the demand for certified, premium leather lever belts (13mm) is increasing rapidly. This shift presents a major opportunity for international premium brands to establish market dominance, leveraging their global reputation for quality and safety to overcome domestic price competition.

Distribution is overwhelmingly reliant on large national e-commerce platforms (like Tmall or Flipkart) and domestic social media marketing tailored to regional communication styles. Strategic partnerships with local fitness celebrities and established gym chains are essential for building brand recognition quickly. Challenges include navigating diverse regulatory landscapes, logistics complexities across archipelagos and large landmasses, and effectively managing brand protection against frequent instances of intellectual property infringement and counterfeit production.

Latin America (LATAM) and Middle East & Africa (MEA) Market Analysis

LATAM and MEA represent developing yet strategically important markets for lever belts. In Latin America, countries such as Brazil and Mexico have large, enthusiastic fitness populations, but market growth is often volatile due to economic instability and high barriers to entry for imported goods. Consumers in this region seek high-value products, balancing quality with affordability. The market typically lags North America in adopting the latest, highest-priced innovations, focusing instead on reliable, proven models. Localized assembly or manufacturing might prove strategically advantageous to mitigate import tariffs and logistics costs.

The Middle East (specifically the GCC) shows strong potential for premium product sales. The culture of luxury consumption extends to high-end fitness equipment, with consumers often seeking globally recognized, top-tier brands (e.g., SBD, Rogue). Demand is concentrated in major urban centers and supported by significant governmental and private investment in world-class sports facilities. The market is less price-sensitive than LATAM, focusing instead on brand prestige and rapid access to the latest equipment releases. The smaller market size is offset by the higher average selling price achieved per unit.

In both regions, digital marketing is crucial, but personalized engagement is key. In MEA, outreach often relies on high-net-worth individual endorsements, while in LATAM, engagement centers around local fitness communities and accessible pricing strategies. Overall, achieving sustained growth requires manufacturers to establish robust, regionally managed supply chains that can navigate the unique geopolitical and economic complexities of these diverse territories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lever Belts Market.- SBD Apparel

- Rogue Fitness

- Inzer Advance Designs

- Titan Support Systems

- Strength Shop

- Eleiko Group AB

- A7 Equipment

- Cerberus Strength

- Iron Rebel Power Gear

- G&G Fitness

- Pioneer Fitness

- General Leathercraft

- Gymshark

- Adidas (through specialized fitness lines)

- Rehband

Frequently Asked Questions

Analyze common user questions about the Lever Belts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of choosing a lever belt over a prong belt?

The primary benefit of a lever belt is the instant, precise locking and quick-release mechanism. This allows athletes to achieve maximum abdominal pressure immediately before a lift and release the tension instantly after completion, enhancing safety and comfort between intense sets, which is superior to the slower adjustment of prong belts.

What is the difference between 10mm and 13mm lever belts and which thickness is best for competitive powerlifting?

13mm belts offer maximum rigidity and support, favored by competitive powerlifters and strongmen for maximal lifts (squat and deadlift). 10mm belts offer high support with slightly more flexibility, preferred by general fitness users or those who prioritize a faster break-in period and greater comfort for dynamic movements.

Are lever belts permitted in major powerlifting competitions?

Yes, most major powerlifting federations, including the IPF (International Powerlifting Federation), permit lever belts provided they meet specific criteria regarding width (typically 4 inches) and thickness (usually 13mm maximum), and adhere to branding regulations specified by the governing body.

How does the material used in lever belts affect performance and durability?

Genuine full-grain leather is the dominant material, prized for its unmatched stiffness, durability, and ability to conform to the body over time. Synthetic or hybrid materials are often lighter and cheaper but may not offer the same longevity or high level of rigid support required for truly maximal lifts.

What are the key factors driving the projected growth in the Lever Belts Market?

The key drivers include the rising global participation in competitive strength sports, increased consumer awareness of injury prevention requiring specialized gear, and enhanced distribution capabilities through targeted e-commerce platforms, particularly in rapidly expanding Asian markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager