LFA-Based Cardiac Marker Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437259 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

LFA-Based Cardiac Marker Market Size

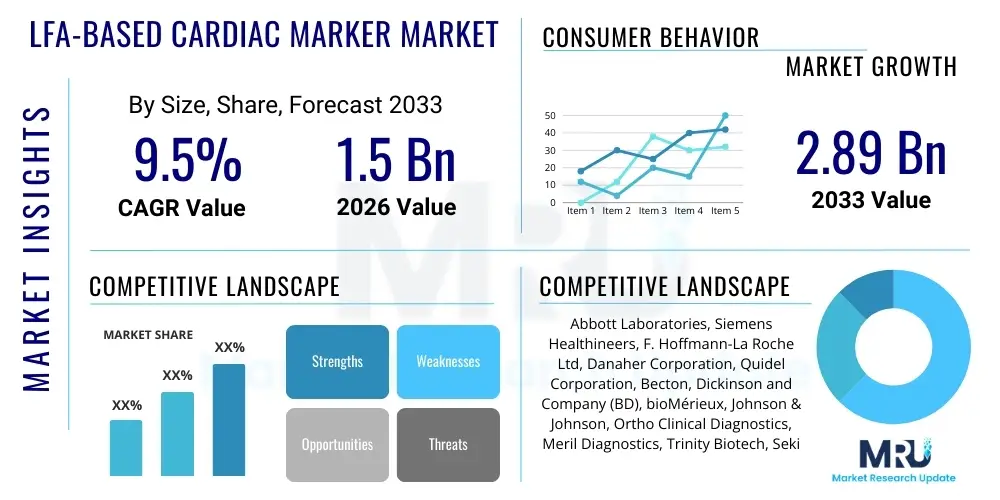

The LFA-Based Cardiac Marker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.89 Billion by the end of the forecast period in 2033.

LFA-Based Cardiac Marker Market introduction

The LFA-Based Cardiac Marker Market encompasses diagnostic devices utilizing Lateral Flow Assay (LFA) technology for the rapid detection and quantification of critical biomarkers associated with cardiac distress, primarily Acute Coronary Syndrome (ACS) and heart failure. These markers include cardiac Troponin I (cTnI), cardiac Troponin T (cTnT), Creatine Kinase Myocardial Band (CK-MB), Myoglobin, and B-type Natriuretic Peptide (BNP). LFA technology offers significant advantages in point-of-care testing (POCT) environments due to its simplicity, speed, low cost, and minimal requirement for specialized infrastructure or trained personnel, making it highly suitable for emergency settings, remote clinics, and even home use.

The core product in this market involves test strips or cartridges that provide qualitative or semi-quantitative results within minutes, dramatically accelerating the decision-making process for clinicians dealing with suspected myocardial infarction. Major applications span hospital emergency departments (EDs), intensive care units (ICUs), private cardiology clinics, and increasingly, ambulatory care settings. The immediacy of results provided by LFA-based systems is crucial in cardiology, where time-to-diagnosis directly correlates with patient outcomes and survival rates. Furthermore, the development of high-sensitivity LFA platforms is continually bridging the performance gap between POCT devices and traditional laboratory-based immunoassays, enhancing the diagnostic utility of these rapid tests.

Key driving factors propelling market expansion include the escalating global prevalence of cardiovascular diseases (CVDs), which remain the leading cause of mortality worldwide. Coupled with this epidemiological burden is the growing demand for decentralized healthcare solutions and enhanced patient monitoring capabilities outside the central laboratory. The benefits of LFA technology—portability, ease of use, and quick turnaround time—make it indispensable in resource-limited settings and during critical triage. Regulatory approvals and technological integration, particularly linking these devices with electronic health records (EHRs) and telehealth platforms, further solidify the market's growth trajectory, offering streamlined workflow and improved clinical efficiency in cardiac assessment.

LFA-Based Cardiac Marker Market Executive Summary

The LFA-Based Cardiac Marker Market demonstrates robust growth driven by the shift towards decentralized diagnostics and the urgent necessity for rapid, reliable cardiac assessment. Business trends indicate a strong focus on strategic mergers, acquisitions, and collaborations between established diagnostics firms and emerging biotechnology companies specializing in nanotechnology and enhanced immunoassay chemistries to improve assay sensitivity, particularly for high-sensitivity cardiac Troponin detection. Competitive differentiation is increasingly centered on multiplex testing capabilities, enabling simultaneous screening for multiple cardiac biomarkers on a single LFA strip, thereby improving diagnostic specificity and comprehensive patient profiling. Furthermore, the commercialization pipeline shows a clear emphasis on integrating digital components, such as connectivity modules and reader devices with sophisticated data interpretation algorithms, to standardize results and minimize user error across varied clinical settings.

Regionally, North America maintains market leadership, largely due to high healthcare expenditure, established clinical guidelines favoring rapid cardiac assessment protocols, and the presence of major industry players engaged in continuous innovation. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare infrastructure, rising awareness regarding cardiovascular health, and substantial unmet medical needs in densely populated emerging economies like China and India. European markets are characterized by stringent regulatory environments but exhibit high adoption rates for advanced POCT technologies, supported by universal healthcare systems actively seeking cost-effective and efficient diagnostic tools. The regional landscape highlights a bifurcated growth model: maturity and high value in developed markets, juxtaposed with rapid volume expansion and infrastructure build-out in emerging territories.

Segment trends underscore the dominance of Troponin I and T assays, recognized globally as the gold standard for myocardial injury detection, driving the highest revenue share within the product segment. Technology-wise, colloidal gold nanoparticle assays still constitute a significant volume, but fluorescence-based and magnetic bead-based LFAs are gaining substantial traction due to their enhanced sensitivity and quantitative accuracy, aligning closer to central laboratory performance metrics. Application segmentation shows hospitals and emergency departments as the primary consumers, yet the home care and remote monitoring segment is poised for accelerated growth, reflecting the increasing acceptance of self-testing and telemedicine, particularly in managing chronic conditions like heart failure.

AI Impact Analysis on LFA-Based Cardiac Marker Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the diagnostic accuracy and operational utility of LFA-based cardiac marker testing, specifically focusing on overcoming the inherent limitations of LFA devices related to semi-quantitative results and reliance on visual interpretation. Key concerns revolve around the integration feasibility of AI algorithms with simple, low-cost LFA reader devices, the potential for AI-driven risk stratification in emergency settings, and the regulatory pathway for AI-enabled diagnostic interpretation. Users seek validation that AI can standardize readings across different operators and improve the signal-to-noise ratio in borderline cases, transforming LFA from a purely screening tool into a more robust quantitative diagnostic instrument in resource-constrained environments.

The integration of AI, particularly machine learning (ML) models, is set to revolutionize the way LFA-based cardiac marker results are interpreted and utilized in clinical workflows. AI algorithms can be embedded within the imaging systems of handheld LFA readers to perform highly accurate quantitative analysis of the test and control lines, correcting for variations in lighting, background noise, and reagent application. This sophisticated image processing dramatically improves the consistency and precision of results, minimizing the subjectivity associated with human visual assessment. Furthermore, AI can utilize time-series data from sequential LFA tests to analyze biomarker kinetics, offering real-time insights into the progression or resolution of cardiac injury, which is critical for dynamic risk stratification in ACS patients.

Beyond technical interpretation, AI algorithms are being deployed to enhance the operational efficiency and clinical decision support system associated with LFA testing. By integrating test results with patient demographic data, vital signs, and clinical history (accessible through POCT connectivity platforms), AI can calculate the probability of ACS or heart failure and provide personalized recommendations regarding subsequent diagnostic steps or immediate treatment protocols, aligning results with established clinical pathways like the accelerated diagnostic protocols for chest pain. This transformation elevates the LFA device beyond a simple screening tool, positioning it as an integral, intelligent component of a comprehensive cardiovascular triage system, particularly beneficial in high-throughput or low-resource settings where specialist expertise might be limited.

- AI-powered image recognition enhances the quantitative accuracy of LFA results, reducing inter-operator variability.

- Machine Learning models facilitate real-time risk stratification by integrating biomarker levels with comprehensive patient data.

- AI integration supports optimized workflow management and speeds up the implementation of clinical guidelines in emergency departments.

- Predictive maintenance algorithms can monitor the performance and calibration status of LFA reader devices, ensuring reliability.

- Natural Language Processing (NLP) helps in standardizing the documentation and reporting of POCT results into Electronic Health Records (EHRs).

DRO & Impact Forces Of LFA-Based Cardiac Marker Market

The market dynamics are governed by a robust demand for speed and accessibility in cardiac diagnostics, tempered by the necessity for performance equivalence with laboratory standards. Drivers include the rising global incidence of cardiovascular diseases (CVDs) and the overwhelming clinical shift towards rapid, decentralized testing models, recognizing that timely diagnosis significantly improves patient outcomes. Opportunities arise from technological advancements, specifically the successful commercialization of high-sensitivity Troponin LFAs, which meet current clinical standards, alongside the massive untapped potential in emerging economies where POCT represents the most feasible diagnostic solution. Conversely, restraints involve the persistent challenge of achieving laboratory-grade sensitivity and specificity in a low-cost LFA format, coupled with stringent regulatory scrutiny regarding the equivalence claims of POCT devices compared to centralized testing methodologies. These factors collectively define the strategic landscape, compelling manufacturers to invest heavily in sensor chemistry and digital integration to overcome existing technological bottlenecks.

Drivers: The most significant driver is the increasing global prevalence of Acute Coronary Syndrome (ACS) and chronic heart failure. As populations age and lifestyle-related risks proliferate, the need for immediate diagnostic tools in primary care settings and emergency response teams becomes paramount. LFA technology is uniquely positioned to fulfill this need by providing results within minutes, dramatically reducing the door-to-treatment interval. Furthermore, governments and healthcare organizations globally are prioritizing health outcomes and operational efficiency, favoring POCT solutions that alleviate congestion in central laboratories and streamline patient flow in overburdened emergency departments. The increasing investment in digital health infrastructure also drives adoption, as modern LFA devices offer seamless connectivity for data transfer and remote monitoring.

Restraints: Despite technological advances, the primary restraint remains the perceived or actual lack of analytical sensitivity and precision of standard LFAs compared to benchmark central laboratory immunoassays, particularly for measuring extremely low concentrations of biomarkers required for early diagnosis of ACS using high-sensitivity markers. Regulatory bodies often impose rigorous requirements to prove clinical equivalence, which can be time-consuming and expensive. Furthermore, quality control and standardization across diverse POCT environments present operational challenges, including potential issues related to operator training, storage conditions, and calibration drift, leading to concerns about the reliability of results obtained outside controlled laboratory environments. The variability in sample quality (e.g., whole blood versus plasma) also adds a layer of complexity.

Opportunities: Major growth opportunities stem from the potential for multiplexing cardiac panels, allowing clinicians to screen for various markers simultaneously, thereby increasing diagnostic yield and reducing the overall cost per panel. The vast, underserved markets in Asia Pacific, Latin America, and Africa offer substantial volume growth potential as healthcare access expands. Moreover, the integration of LFA platforms with advanced digital health technologies, including telemedicine and remote patient monitoring systems, creates new service delivery models. Developing ultra-high sensitivity LFA systems using novel nanomaterials (e.g., quantum dots, magnetic nanoparticles) that can effectively compete with benchtop analyzers represents a core opportunity for technological leapfrogging in the coming decade.

- Drivers:

- Rising incidence and prevalence of cardiovascular diseases globally.

- Increasing demand for rapid, actionable Point-of-Care Testing (POCT) in emergency settings.

- Cost-effectiveness and simplicity of LFA technology compared to centralized laboratory equipment.

- Focus on decentralized healthcare models and improved time-to-treatment metrics.

- Restraints:

- Limitations in sensitivity and precision compared to laboratory-based high-sensitivity assays.

- Stringent regulatory requirements for demonstrating clinical equivalence and reliability in non-laboratory settings.

- Challenges related to standardization, quality control, and operator proficiency in diverse POCT environments.

- Competition from established, highly accurate centralized diagnostic platforms.

- Opportunities:

- Development and commercialization of multiplex LFA assays capable of simultaneous multi-marker detection.

- Significant market penetration potential in emerging economies with developing healthcare infrastructures.

- Integration of LFA readers with digital health platforms, telemedicine, and AI for enhanced data analysis and decision support.

- Advancements in detection technology (fluorescence, magnetic beads) to achieve ultra-high sensitivity.

Segmentation Analysis

The LFA-Based Cardiac Marker Market is comprehensively segmented based on product type, technology, application, and geographic region, reflecting the diversity of clinical needs and technological implementations across the global healthcare spectrum. The segmentation analysis provides a granular view of market dynamics, highlighting areas of high growth and technological maturity. The product type segment is dominated by assays detecting cardiac Troponin (cTnI and cTnT), given their established role as the definitive indicators of myocardial necrosis. However, assays for heart failure biomarkers such as BNP and NT-proBNP are exhibiting accelerated growth, driven by the need for monitoring chronic cardiac conditions outside the acute care environment.

Technologically, the market is shifting towards advanced detection methods, moving beyond traditional colorimetric colloidal gold nanoparticles. While gold-based tests remain popular for their low cost, fluorescence and magnetic-based LFA technologies are commanding higher market value due to their ability to provide highly sensitive, quantitative results. Fluorescence immunoassays (FIA) and time-resolved fluoroimmunoassays (TRFIA) allow for signal amplification, significantly lowering the limit of detection (LOD), which is crucial for high-sensitivity cardiac marker testing. The application landscape is heavily concentrated in hospitals, specifically emergency rooms and ICUs, where rapid triage is essential, yet the increasing regulatory acceptance of LFA devices for primary care and home monitoring is creating lucrative opportunities for smaller, portable readers and self-testing kits.

Geographically, market segmentation confirms North America’s leading position, attributable to sophisticated healthcare systems and high patient awareness. Nonetheless, strategic focus is increasingly directed toward the Asia Pacific region, characterized by its rapid infrastructure development and large addressable patient population struggling with rising rates of CVDs. Understanding these segment trends is vital for market players to tailor their product offerings, whether focusing on low-cost, high-volume products for developing markets or high-precision, quantitative fluorescence-based systems for regulated, high-spending regions, ensuring optimal resource allocation and competitive positioning within the diverse global marketplace.

- By Product Type:

- Troponin I and T Assays

- CK-MB Assays

- Myoglobin Assays

- B-type Natriuretic Peptide (BNP) and NT-proBNP Assays

- D-Dimer and other Fibrinolysis Markers

- By Technology:

- Colloidal Gold Nanoparticle-Based LFA

- Fluorescence Immunoassay (FIA)-Based LFA

- Magnetic Nanoparticle-Based LFA

- Other Advanced Detection Methods (e.g., Quantum Dots)

- By Application:

- Hospital Emergency Departments

- Intensive Care Units (ICUs) and Critical Care

- Ambulatory Surgical Centers and Clinics

- Home Care and Patient Self-Testing

- By End User:

- Hospitals

- Diagnostic Laboratories

- Physician Offices and Clinics

- Home Settings

Value Chain Analysis For LFA-Based Cardiac Marker Market

The value chain for the LFA-Based Cardiac Marker Market begins with the sourcing and purification of highly specific biological raw materials, including monoclonal antibodies, cardiac marker antigens, and advanced signaling reporters (such as colloidal gold or fluorescent dyes). Upstream activities involve intensive research and development focused on optimizing antibody performance—ensuring high affinity and minimal cross-reactivity—which dictates the final assay sensitivity and specificity. Key suppliers in this stage include specialized biochemical companies and custom antibody developers. The quality and stability of these raw materials are critical, as they directly impact the manufacturability and shelf life of the final LFA strip. Managing this upstream complexity requires robust supply chain management, intellectual property protection related to proprietary binding pairs, and rigorous quality assurance protocols for component stability.

The core manufacturing process involves component integration, including membrane lamination, reagent dispensing, drying, and precise strip cutting, followed by assembly into cartridges or cassettes. Direct channel distribution primarily targets large institutional buyers like hospital groups, regional health networks, and governmental procurement bodies, leveraging direct sales forces and highly specialized logistics networks to manage large-volume, sensitive shipments. Indirect distribution, crucial for market reach, relies on a network of regional distributors and third-party logistics (3PL) providers, particularly in geographically dispersed or emerging markets. These intermediaries manage local inventory, provide localized technical support, and navigate complex local regulatory and customs requirements, ensuring product availability at various points of care, from major urban hospitals to remote rural clinics.

Downstream activities focus on device deployment, clinical training, and post-sale technical support, particularly crucial for POCT devices which are often used by non-laboratory trained personnel. The final consumption stage is heavily influenced by clinician acceptance, adherence to established clinical guidelines (e.g., European Society of Cardiology or American Heart Association guidelines for Troponin testing), and favorable reimbursement policies. The efficiency of the distribution channel—whether direct or indirect—is vital in ensuring that LFA tests reach the point of need quickly, supporting critical clinical workflows. Successful value chain management requires constant collaboration between raw material suppliers, high-volume manufacturers, digital technology providers (for reader integration), and distribution partners to maintain product quality, cost-effectiveness, and rapid market penetration.

LFA-Based Cardiac Marker Market Potential Customers

The primary end-users and buyers of LFA-based cardiac marker products are institutions and professionals requiring immediate, actionable diagnostic data for patients presenting with symptoms suggestive of acute cardiac events. Hospitals constitute the largest customer segment, driven by the high volume of critical care needs in Emergency Departments (EDs) and Intensive Care Units (ICUs). In these settings, the speed of LFA tests is non-negotiable for rapid triage, ruling in or ruling out myocardial injury efficiently, thereby optimizing resource utilization and minimizing patient wait times. Hospital systems prioritize LFA solutions that offer high reliability, ease of integration with existing POCT management systems, and increasingly, quantitative accuracy comparable to central laboratory benchmarks.

Secondary, yet rapidly expanding, customer segments include decentralized diagnostic laboratories and specialized cardiology clinics. These entities utilize LFA tests primarily for routine monitoring of chronic conditions, such as B-type Natriuretic Peptide (BNP) testing for heart failure management, where immediate results support quick medication adjustments or follow-up scheduling. These customers value portability and user-friendliness, often purchasing handheld readers that allow for testing in satellite clinics or mobile healthcare units. The adoption is also driven by cost considerations, as LFA offers a significantly lower cost per test compared to operating sophisticated benchtop analyzers for low-to-moderate volume testing.

A burgeoning potential customer base resides within the home care and remote patient monitoring sector, comprising both professional home healthcare providers and individual patients engaged in self-testing for chronic cardiac conditions. While regulatory approval for home-use cardiac marker testing remains challenging, the demand for simplified, non-invasive diagnostic tools for heart failure management (e.g., BNP monitoring) is substantial. These end-users require products that are highly robust, require minimal training, and offer secure, accurate data transmission capabilities, positioning the market for significant volume growth in consumer-facing diagnostic solutions optimized for chronic disease surveillance and management outside traditional clinical settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.89 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Siemens Healthineers, F. Hoffmann-La Roche Ltd, Danaher Corporation, Quidel Corporation, Becton, Dickinson and Company (BD), bioMérieux, Johnson & Johnson, Ortho Clinical Diagnostics, Meril Diagnostics, Trinity Biotech, Sekisui Diagnostics, Alfa Scientific Designs, Inc., ACON Laboratories, Inc., Eurolyser Diagnostica GmbH, Chembio Diagnostics, Inc., Guangzhou Wondfo Biotech Co., Ltd., Shenzhen New Industries Biomedical Engineering Co., Ltd. (SNIBE), Lifescan, Inc., AccuBioTech Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LFA-Based Cardiac Marker Market Key Technology Landscape

The technological evolution within the LFA-Based Cardiac Marker market is characterized by ongoing efforts to increase sensitivity and facilitate quantitative analysis while preserving the fundamental advantages of speed and portability. Traditional colorimetric LFAs, utilizing colloidal gold nanoparticles, form the baseline technology, valued for their simplicity and cost-effectiveness, making them highly prevalent in high-volume screening and resource-limited settings. However, the limitation of traditional LFA is its semi-quantitative nature and lower sensitivity thresholds, which often fall short of the precision required for detecting the low concentrations associated with early myocardial injury, particularly when compared to high-sensitivity cardiac Troponin assays used in central laboratories. This gap has necessitated significant technological innovation focused on signal enhancement and reader device sophistication.

The shift towards next-generation LFAs is driven by advanced reporter technologies such as Fluorescence Immunoassays (FIA) and assays utilizing magnetic nanoparticles. FIA-based systems employ fluorophores that emit a quantifiable signal when excited by a light source within a dedicated reader. This conversion to an optical signal allows for precise quantification of the target cardiac marker concentration, bridging the performance gap with laboratory analyzers and enabling the use of high-sensitivity clinical cut-offs. Magnetic bead-based LFAs offer another pathway to improved detection limits by utilizing magnetic properties for signal amplification and purification steps, enhancing specificity and reducing matrix effects that can interfere with traditional detection methods, providing a more robust and reliable result in complex biological samples like whole blood.

Beyond the core assay chemistry, the key technology landscape involves sophisticated reader systems and digital connectivity. Modern LFA readers are integrating microprocessors, highly sensitive optical sensors, and proprietary algorithms to accurately interpret the reaction lines, automatically calculate the marker concentration, and perform quality checks. Furthermore, these readers are increasingly equipped with wireless communication capabilities (Wi-Fi, Bluetooth) to instantly transmit quantitative results to hospital information systems (HIS), laboratory information systems (LIS), or cloud-based platforms. This integration supports centralized oversight of POCT performance, ensuring regulatory compliance, simplifying patient data management, and facilitating rapid clinical intervention based on standardized, quantified cardiac marker results, ultimately transforming LFA devices into networked diagnostic tools.

Regional Highlights

The global LFA-Based Cardiac Marker Market exhibits significant regional variation in adoption rates, technological sophistication, and underlying disease burden. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to high healthcare expenditure, established clinical pathways that mandate rapid cardiac marker testing in emergency settings, and the presence of numerous key industry players who drive continuous innovation in POCT technology. The widespread adoption of high-sensitivity cardiac Troponin testing guidelines and robust regulatory frameworks facilitating the approval of advanced POCT devices contribute significantly to the region's market value. Furthermore, sophisticated healthcare infrastructure allows for seamless integration of LFA reader systems into existing hospital IT networks.

Europe represents the second-largest market, characterized by advanced healthcare systems focused on cost-efficiency and quality patient care. Countries such as Germany, the UK, and France show high adoption of LFA technology, particularly in remote and primary care settings, driven by favorable government policies promoting decentralized diagnostics. The European market places a strong emphasis on clinical validation and standardization, leading to high acceptance of quantitative, fluorescence-based LFA systems that meet stringent performance criteria. However, regulatory harmonization efforts within the European Union (EU) may introduce temporary delays or complexities in product launches, although the overall trend favors accessible, rapid diagnostics.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally throughout the forecast period. This rapid expansion is driven by the massive and increasing prevalence of cardiovascular diseases, coupled with substantial improvements in healthcare accessibility and infrastructure investment, particularly in populous nations like China and India. The inherent simplicity and low cost of LFA devices make them ideal diagnostic tools for widespread deployment in rural and semi-urban areas where centralized laboratory facilities are scarce. Market players are strategically focusing on APAC, developing tailored, high-volume, low-cost LFA solutions to capture the enormous potential patient base and meet the escalating demand for basic and rapid cardiac diagnostics.

- North America: Market leader due to high adoption of advanced POCT, strong regulatory support for high-sensitivity cardiac markers, and robust emergency healthcare infrastructure.

- Europe: Second largest market, focusing on health system efficiency and the integration of quantitative LFA solutions into primary care and ambulance services.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising CVD prevalence, rapid healthcare infrastructure development, and high suitability of LFA for resource-constrained environments.

- Latin America (LATAM): Growing market characterized by increasing investment in public healthcare and reliance on cost-effective LFA solutions for basic cardiac screening and triage.

- Middle East and Africa (MEA): Emerging market segment showing steady growth, particularly in the Gulf Cooperation Council (GCC) countries due to high prevalence of metabolic syndrome and cardiac risk factors, driving demand for rapid diagnostics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LFA-Based Cardiac Marker Market.- Abbott Laboratories

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd

- Danaher Corporation (Beckman Coulter)

- Quidel Corporation

- Becton, Dickinson and Company (BD)

- bioMérieux

- Johnson & Johnson

- Ortho Clinical Diagnostics

- Meril Diagnostics

- Trinity Biotech

- Sekisui Diagnostics

- Alfa Scientific Designs, Inc.

- ACON Laboratories, Inc.

- Eurolyser Diagnostica GmbH

- Chembio Diagnostics, Inc.

- Guangzhou Wondfo Biotech Co., Ltd.

- Shenzhen New Industries Biomedical Engineering Co., Ltd. (SNIBE)

- Lifescan, Inc.

- AccuBioTech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the LFA-Based Cardiac Marker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of LFA-Based Cardiac Marker testing over traditional lab tests?

LFA-Based testing offers immediate results (typically within 10-15 minutes), high portability, and simplicity of use, enabling crucial Point-of-Care Testing (POCT) in emergency rooms, ambulances, and remote clinics. This speed is vital for reducing the time-to-diagnosis for Acute Coronary Syndrome (ACS) patients, directly improving clinical outcomes, and reducing operational burdens on central laboratories.

How does the sensitivity of LFA compare to high-sensitivity cardiac Troponin laboratory assays?

Traditional colloidal gold LFAs generally possess lower sensitivity compared to centralized high-sensitivity cardiac Troponin (hs-cTn) assays, limiting their utility for early rule-out protocols. However, newer generation LFA technologies utilizing fluorescence, magnetic nanoparticles, or quantum dots are specifically designed to achieve performance metrics closer to hs-cTn standards, allowing for reliable quantitative and highly sensitive cardiac marker detection at the point of care.

Which cardiac biomarkers are most commonly detected using LFA technology?

The most commonly detected cardiac biomarkers using LFA technology are cardiac Troponin I (cTnI) and cardiac Troponin T (cTnT), which are the gold standards for myocardial injury diagnosis. Additionally, LFA panels frequently include Creatine Kinase Myocardial Band (CK-MB), Myoglobin, and B-type Natriuretic Peptide (BNP), the latter being critical for diagnosing and managing acute and chronic heart failure conditions.

What role does digitalization play in the future growth of the LFA-Based Cardiac Marker Market?

Digitalization, including Artificial Intelligence (AI) and connectivity, is pivotal for future growth. Digital LFA readers provide quantitative results, minimize human interpretation errors, and connect seamlessly to Electronic Health Records (EHRs). This integration enhances data standardization, facilitates centralized quality control oversight of decentralized testing, and supports advanced AI-driven clinical decision support for efficient patient triage and risk stratification.

What are the major regulatory challenges faced by LFA-Based Cardiac Marker manufacturers?

Manufacturers face rigorous regulatory hurdles, particularly in demonstrating clinical equivalence and non-inferiority against established, highly accurate centralized diagnostic methods. Regulatory agencies demand robust clinical evidence confirming the device's reliability, consistency, and accuracy when used by non-laboratory personnel in varied POCT settings, often necessitating complex and costly clinical trials to validate performance claims.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager