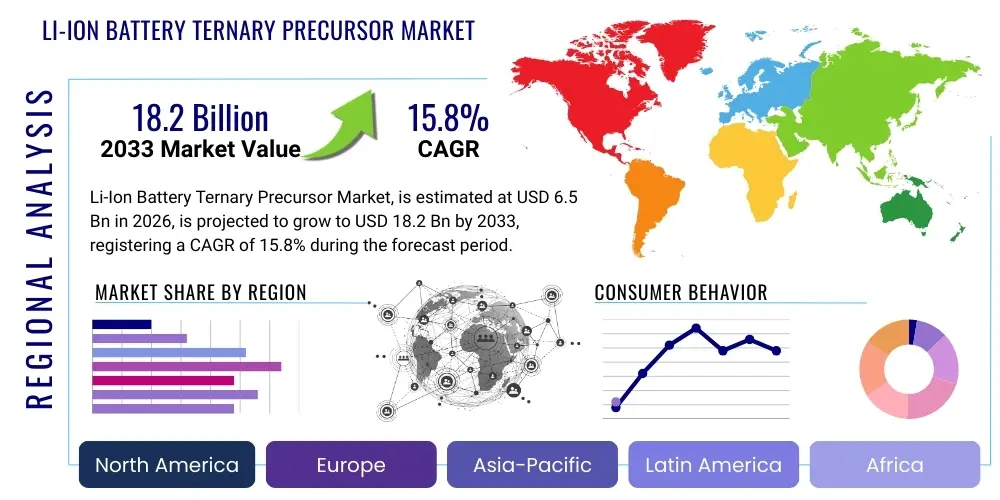

Li-Ion Battery Ternary Precursor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438985 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Li-Ion Battery Ternary Precursor Market Size

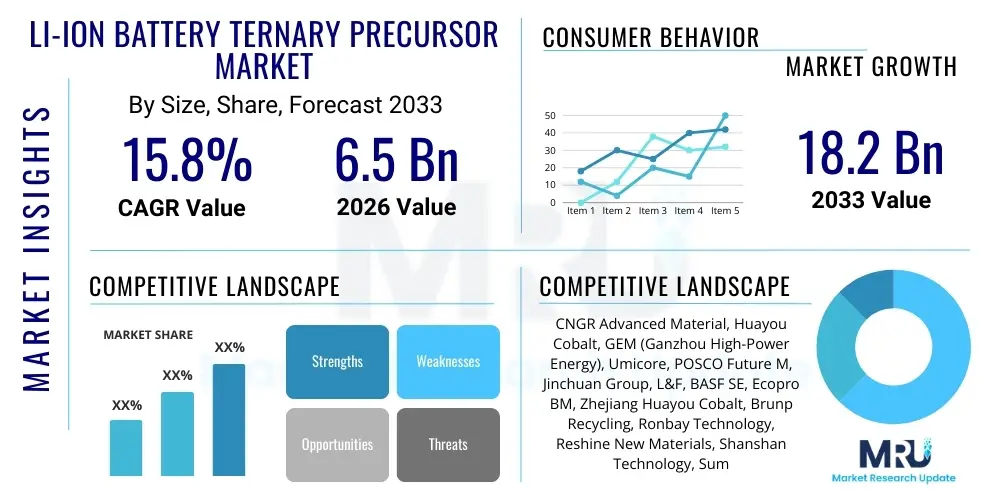

The Li-Ion Battery Ternary Precursor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033.

Li-Ion Battery Ternary Precursor Market introduction

The Li-Ion Battery Ternary Precursor Market centers on the production and distribution of nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) compounds, which serve as foundational materials for synthesizing high-performance cathode active materials (CAMs) used in lithium-ion batteries. These precursors, typically synthesized through advanced co-precipitation methods, dictate the structural integrity, energy density, and longevity of the final battery cell. The demand surge is directly correlated with the global transition towards electric vehicles (EVs) and the increasing deployment of grid-scale energy storage systems (ESS). The consistent push for higher energy density in automotive applications, aimed at extending vehicle range and reducing charging frequency, is the primary propellant for innovation and capacity expansion within this market segment, particularly favoring high-nickel content precursors such as NMC 811 and NCA.

Ternary precursors are pivotal intermediates in the lithium-ion battery supply chain, bridging raw material extraction (nickel, cobalt, manganese) and the final cathode material production. The product description emphasizes the need for high purity, uniform particle size distribution, and specific elemental ratios (e.g., 5:3:2, 6:2:2, 8:1:1) to ensure optimal electrochemical performance. Major applications span the high-volume automotive sector, where ternary batteries dominate high-end and long-range EVs; high-power consumer electronics, requiring compact and dense energy sources; and large-scale ESS installations critical for renewable energy integration and grid stability. The inherent stability and high capacity offered by ternary chemistry compared to alternatives like Lithium Iron Phosphate (LFP) solidify its market position in performance-driven applications.

The benefits derived from using advanced ternary precursors include significantly enhanced specific energy, superior power capability, and extended cycle life, directly addressing consumer and industrial requirements for reliable battery performance. Key driving factors include stringent global emission regulations mandating EV adoption, substantial government subsidies and investments in battery manufacturing gigafactories, and rapid technological advancements focused on reducing the cobalt content to mitigate cost volatility and ethical sourcing concerns. Furthermore, the growing adoption of renewable energy sources necessitates robust and efficient energy storage infrastructure, thereby creating sustained long-term demand for high-performance ternary battery precursors.

Li-Ion Battery Ternary Precursor Market Executive Summary

The Li-Ion Battery Ternary Precursor Market is characterized by intense strategic maneuvering centered around raw material security, manufacturing scale-up, and technological dominance in high-nickel chemistries. Business trends indicate a strong vertical integration strategy adopted by major players, encompassing upstream nickel processing and downstream cathode material synthesis to stabilize cost structures and secure supply chains against geopolitical risks. The market is witnessing aggressive capacity expansion, primarily concentrated in East Asia, driven by lucrative long-term supply agreements with global automotive OEMs. Crucially, the trend toward cobalt reduction (moving from NMC 532 to NMC 811 and beyond) is accelerating, pushing R&D efforts toward optimizing thermal stability in cobalt-lean materials. Sustainability and traceable sourcing, particularly concerning nickel and cobalt extraction, are becoming critical competitive differentiators, influencing procurement decisions across the value chain and fostering greater scrutiny from regulatory bodies and institutional investors. Strategic mergers, acquisitions, and joint ventures between mining companies, precursor producers, and battery cell manufacturers are prevalent mechanisms used to accelerate time-to-market for next-generation materials and secure essential raw material flows.

Regional trends are overwhelmingly dominated by the Asia Pacific (APAC) region, specifically China, South Korea, and Japan, which collectively command the majority of global production capacity and possess the technological expertise necessary for large-scale, high-quality precursor manufacturing. China, leveraging its domestic nickel processing capabilities and vast battery supply chain, remains the largest consumer and producer. However, significant government initiatives in North America and Europe, such as the US Inflation Reduction Act (IRA) and the European Green Deal, are catalyzing substantial localization efforts, aiming to build regional, resilient battery supply chains independent of Asian dominance. This shift is resulting in massive investments in new precursor and cathode material plants within these regions, although capacity build-out remains challenging due to permitting timelines and skilled labor shortages. The competitive landscape is evolving into a tripolar structure, balancing established Asian manufacturers with emerging Western and regional players focused on meeting domestic content requirements.

Segmentation trends highlight the dominance of the Electric Vehicle (EV) application segment, which accounts for the largest share of precursor consumption and drives premium pricing for high-performance grades. Within product type segmentation, the transition toward high-nickel content, specifically NMC 811 and NCA, is the most profound trend, favored for their high energy density suitable for premium long-range EVs. While NMC 532 and 622 continue to hold significant market shares in ESS and mid-range EV segments due to their superior stability and cost-effectiveness, the future growth trajectory is heavily weighted toward higher nickel formulations. Furthermore, the market for recycled precursors is gaining traction, driven by circular economy mandates and the escalating cost of virgin raw materials, though this segment remains nascent compared to primary production. Innovations in precursor particle morphology, such as single-crystal structures, are also emerging as key segment differentiators, promising improved cycling performance and longevity.

AI Impact Analysis on Li-Ion Battery Ternary Precursor Market

User queries regarding the impact of Artificial Intelligence (AI) in the Li-Ion Battery Ternary Precursor Market typically focus on three primary themes: how AI accelerates materials discovery and optimization, how it enhances manufacturing efficiency and quality control, and its role in predictive modeling for supply chain resilience and raw material sourcing. Users are keen to understand if AI can significantly reduce the notoriously long R&D cycles required to commercialize new high-performance precursor chemistries, particularly those with ultra-low cobalt content or novel particle morphologies. Concerns often revolve around the security and proprietary nature of the high-volume data required to train effective AI models in this highly specialized field, and the potential for AI to democratize material science, shifting competitive advantage from sheer manufacturing scale to predictive material informatics. Expectations are high that AI-driven process optimization will lead to substantial reductions in production costs, minimization of yield loss in complex co-precipitation synthesis, and superior batch-to-batch consistency, which is paramount for battery safety and performance validation by Tier 1 OEMs.

The application of AI and Machine Learning (ML) algorithms is fundamentally transforming the R&D and manufacturing landscape of ternary precursors. In research, AI models analyze vast experimental datasets, simulating millions of potential elemental compositions, doping strategies, and synthesis parameters (e.g., pH, temperature, stirring rate) to identify optimal precursor formulations that meet specific performance targets faster than traditional trial-and-error methods. This accelerates the commercial viability of next-generation materials, such as those exceeding 90% nickel content (NMC 9.x.x) while maintaining adequate thermal stability. Furthermore, predictive modeling is being used to characterize structure-property relationships at the atomic level, enabling precise control over particle morphology, size uniformity, and internal concentration gradients, which directly influence the battery's energy density and lifespan. This data-driven approach dramatically reduces the development timeline, offering a significant competitive edge to companies that successfully integrate these tools.

In the production environment, AI enhances operational efficiency through sophisticated process control and predictive maintenance. Machine learning algorithms continuously analyze real-time sensor data from co-precipitation reactors, drying processes, and calcination ovens to detect subtle deviations from optimal conditions, allowing for instantaneous adjustments that maximize yield and product consistency. This is especially vital given the stringent quality requirements for automotive-grade precursors, where impurities or structural inconsistencies can lead to catastrophic cell failures. Furthermore, AI contributes significantly to supply chain transparency and risk management by analyzing complex market dynamics, geopolitical forecasts, and logistics bottlenecks related to critical raw materials like nickel and cobalt. By forecasting demand fluctuations and simulating the impact of regulatory changes, AI systems provide manufacturers with preemptive insights, securing a stable and cost-effective raw material flow, thereby stabilizing the final cost of the ternary precursor product.

- Accelerated Materials Discovery: AI-driven simulations reduce R&D cycle time for high-nickel, low-cobalt, and novel doping strategies by predicting optimal synthesis parameters and crystallographic structures.

- Enhanced Manufacturing Precision: Real-time machine learning models optimize co-precipitation reactor parameters (temperature, concentration, pH) for superior particle size uniformity and minimized impurity levels.

- Predictive Quality Control: AI algorithms perform automated visual inspection and material analysis, ensuring batch-to-batch consistency and meeting stringent automotive specifications, minimizing scrap rates.

- Supply Chain Optimization: Predictive analytics forecast raw material price volatility, logistical risks, and demand shifts, enabling proactive procurement strategies for cobalt, nickel, and manganese.

- Sustainability and Traceability: AI supports ESG (Environmental, Social, and Governance) compliance by tracing the origin and monitoring the environmental impact of raw materials, ensuring responsible sourcing compliance.

DRO & Impact Forces Of Li-Ion Battery Ternary Precursor Market

The Li-Ion Battery Ternary Precursor Market is subject to powerful and often contradictory forces involving technological ambition, raw material constraints, and geopolitical pressures. Key drivers include the exponential growth in Electric Vehicle sales globally, particularly in China and Europe, which necessitates massive precursor capacity expansion. The continuous industry pursuit of higher energy density, exemplified by the transition to NMC 811 and NCA chemistries, further accelerates demand for high-quality, specialized precursors. Simultaneously, restrictive forces such as the high capital expenditure required for establishing precursor manufacturing plants, significant technological barriers related to achieving ultra-high purity and consistency, and inherent safety concerns regarding the thermal instability of high-nickel content materials act as restraints. The primary structural restraint remains the volatile and ethically challenging sourcing of critical raw materials, primarily cobalt and nickel, which subjects manufacturers to considerable price risk and supply chain scrutiny. Opportunities lie predominantly in the development of low-cobalt or cobalt-free alternatives (such as high-manganese variants), the utilization of robust battery recycling technologies to create a closed-loop supply system, and expansion into emerging markets like India and Southeast Asia, where EV adoption is just commencing but holds enormous future potential.

The impact forces within this market are substantial, reshaping corporate strategy and governmental policy. The sheer volume required by gigafactories necessitates reliable, large-scale supply contracts, favoring integrated giants with secured access to mined materials. Technological advancements are an intense competitive force; manufacturers capable of consistently producing defect-free, single-crystal NMC 811 precursors gain significant market share over those limited to less dense chemistries. Furthermore, regulatory forces, particularly those relating to EV subsidies tied to regional content requirements (like the US IRA), are powerfully altering investment flows, steering massive capital expenditures toward localized North American and European production facilities. This localization trend, while ensuring supply chain resilience for Western economies, creates structural barriers to entry for existing non-regional manufacturers and fragment the global market structure.

Moreover, environmental and social governance (ESG) factors exert considerable influence, especially concerning cobalt sourcing. Corporate buyers are increasingly demanding verifiable traceability and sustainability guarantees, driving investment into innovative mining techniques and certified supply chains. The drive for cost reduction, crucial for making EVs competitive with internal combustion engine (ICE) vehicles, acts as a continuous pressure point, forcing precursor producers to optimize synthesis routes, reduce energy consumption, and minimize material wastage. The interplay between the technological push for higher performance (high nickel) and the economic pull for lower costs (low cobalt/manganese usage) defines the strategic battlefield, with companies leveraging proprietary intellectual property in co-precipitation technology gaining dominant positions. The necessity of scale and technological sophistication ensures that the market remains concentrated among a few global leaders capable of meeting the stringent requirements of Tier 1 battery manufacturers and automotive OEMs.

Segmentation Analysis

Segmentation analysis of the Li-Ion Battery Ternary Precursor Market reveals a complex structure driven by chemical composition, application requirements, and geographical production capabilities. The market is primarily segmented by Product Type (e.g., NMC 532, NMC 811, NCA), reflecting variations in nickel, manganese, and cobalt ratios which directly impact energy density, cost, and safety characteristics. Segmentation by Application, dominated by Electric Vehicles (EVs), dictates the quality standards and volume demands placed on manufacturers. Furthermore, the market is differentiated by Form (powder or spherical granules) and End-Use Industry (Automotive, Consumer Electronics, ESS). Understanding these segments is crucial for strategic planning, as distinct precursor formulations are required for high-power (hybrid vehicles) versus high-energy (long-range passenger EVs) applications, each necessitating specialized manufacturing capabilities and supply chain focus. The shift towards higher nickel formulations defines the rapid growth segments, whereas earlier NMC types (111, 532) maintain steady demand in stability-focused sectors like fixed energy storage.

- By Product Type:

- NMC 111 (Lithium Nickel Manganese Cobalt Oxide, 1:1:1 ratio)

- NMC 532 (5:3:2 ratio)

- NMC 622 (6:2:2 ratio)

- NMC 811 (8:1:1 ratio, High Nickel)

- NCA (Lithium Nickel Cobalt Aluminum Oxide)

- Other High-Nickel variants (e.g., NMC 9.x.x)

- By Application:

- Electric Vehicles (EVs) and Plug-in Hybrid Electric Vehicles (PHEVs)

- Energy Storage Systems (ESS)

- Consumer Electronics (e.g., Smartphones, Laptops)

- Industrial Applications

- By Form:

- Powder

- Spherical Granules

- By End-Use Industry:

- Automotive Sector

- Grid Storage & Utilities

- Portable Devices & Tools

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Li-Ion Battery Ternary Precursor Market

The Li-Ion Battery Ternary Precursor value chain is characterized by multiple intensive processing steps, starting from the extraction of critical raw materials and culminating in the delivery of refined precursors to cathode active material (CAM) manufacturers. The upstream segment begins with the mining and refining of primary metals: nickel (often sourced from laterite or sulfide ores), cobalt, and manganese. Nickel refining, particularly to battery-grade nickel sulfate, is a high-cost, high-technology bottleneck. Cobalt refining, often facing ethical and supply chain security challenges, is another crucial upstream component. Producers in this stage must manage complex environmental regulations and volatile commodity pricing. Key players often engage in long-term off-take agreements or joint ventures with mining companies to secure a stable and verifiable supply of these refined sulfates, mitigating geopolitical and pricing risks inherent in mineral sourcing. The quality and purity of these metal sulfates directly influence the yield and performance of the final precursor product.

The core midstream activity involves the synthesis of the ternary precursor material itself, primarily through continuous co-precipitation processes. This step requires advanced chemical engineering expertise to control critical parameters such as particle size distribution, morphology (spherical versus single-crystal), and the homogeneous distribution of metal ions within the crystal lattice. Precursor manufacturers often compete based on their proprietary co-precipitation technology, aiming for superior product density and lower impurity levels essential for high-performance batteries. Once the precursor powder is synthesized, it is sold to cathode active material (CAM) producers (often co-located or vertically integrated), who then mix the precursor with lithium salts and subject it to high-temperature calcination to create the final lithium metal oxide cathode material (NMC or NCA). This transition from precursor to CAM marks a significant value addition step and often represents the point of sale within this market segment, although some integrated companies control the process end-to-end.

The downstream segment involves the incorporation of the cathode material into lithium-ion battery cells by cell manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI, Panasonic). These cells are then assembled into battery packs and distributed through original equipment manufacturers (OEMs), predominantly in the automotive sector. Distribution channels for precursors are predominantly direct, characterized by long-term, high-volume supply contracts between precursor manufacturers (or integrated CAM producers) and Tier 1 cell makers, ensuring rigorous quality control and stability of supply. Indirect channels are limited, primarily involving small-scale spot markets or specialized distributors catering to research institutions or niche applications. The criticality of the precursor means that direct relationships and stringent certification processes are mandatory, reinforcing the oligopolistic nature of the market where trust and proven consistency outweigh transactional flexibility. Effective logistics management for bulk chemical materials is also vital in ensuring timely delivery to global gigafactories.

Li-Ion Battery Ternary Precursor Market Potential Customers

The primary consumers and buyers of Li-Ion Battery Ternary Precursors are major manufacturers of Cathode Active Materials (CAMs) and, by extension, the world’s leading Lithium-ion Battery Cell producers. These customers demand high volumes of customized, highly pure precursor materials that meet precise specifications regarding nickel, manganese, and cobalt ratios (e.g., NMC 811, 622) and physical characteristics like tap density and particle morphology. Potential customers fall into several large, distinct categories, with the most dominant being the global tier-one battery manufacturers who supply the automotive industry. Companies like CATL, LG Energy Solution, Samsung SDI, Panasonic, and BYD represent the largest purchasers, often securing precursor supply through multi-year, multi-billion dollar contracts to fuel their sprawling global gigafactories. Their procurement decisions are driven by supply stability, consistency in performance metrics, and compliance with ethical sourcing mandates, making price less critical than guaranteed quality.

A secondary, yet rapidly growing, customer base consists of specialty battery manufacturers and integrated energy storage system providers. These customers utilize ternary precursors for non-automotive applications, including grid-scale energy storage systems (ESS) that require high stability and long cycle life for fixed installations, and manufacturers of high-end consumer electronics (e.g., premium power tools, drones, and high-performance laptops) where energy density is paramount. Companies focused on grid modernization, such as utility-scale storage integrators, are increasingly relying on high-nickel ternary chemistry for their density advantages, particularly in space-constrained applications. Although the volume demand from the ESS sector is currently lower than automotive, its growth trajectory is steep due to the accelerating global adoption of intermittent renewable energy sources, requiring robust and dense battery backups. These buyers often require customized batch sizes and slightly different performance profiles optimized for longevity over immediate peak power.

Finally, there is a consistent, albeit smaller, demand from R&D institutions, national laboratories, and smaller, specialized battery startups focused on next-generation battery technologies. These entities purchase precursors for material testing, optimization studies, and pilot production of novel cell formats (e.g., solid-state battery development, where precursors might be adapted). While not volume buyers, they are crucial for driving future technological trends and market adoption of new precursor chemistries, often requiring highly specialized and traceable research-grade materials. The overriding trend is that the precursor buyer market is consolidating, increasingly dominated by a handful of giant cell manufacturers who possess the leverage to dictate specifications, pricing, and sustainability requirements across the entire upstream supply chain, placing immense pressure on precursor producers to maintain excellence in quality control and scale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CNGR Advanced Material, Huayou Cobalt, GEM (Ganzhou High-Power Energy), Umicore, POSCO Future M, Jinchuan Group, L&F, BASF SE, Ecopro BM, Zhejiang Huayou Cobalt, Brunp Recycling, Ronbay Technology, Reshine New Materials, Shanshan Technology, Sumitomo Metal Mining, Xiamen Tungsten, Dangsheng Material, Tanaka Chemical Corporation, Optimal Solutions Co., Ltd., Green Eco-Manufacturer (GEM) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Li-Ion Battery Ternary Precursor Market Key Technology Landscape

The technological landscape of the Li-Ion Battery Ternary Precursor market is primarily defined by continuous advancements in synthesis methods, optimization of particle morphology, and novel elemental doping strategies aimed at maximizing energy density while enhancing safety and cycle life. The foundational manufacturing technology is the co-precipitation method, a precisely controlled chemical process used to produce highly uniform, spherical precursor particles. Recent innovations focus on continuous co-precipitation systems that offer superior control over reaction kinetics, leading to tighter particle size distribution and higher yield rates critical for industrial scale-up. Advanced precursor producers are also heavily investing in technology to create single-crystal precursors, which exhibit enhanced structural stability and resistance to micro-cracking during repeated charging and discharging cycles, offering significantly improved longevity, particularly beneficial for long-life EV and ESS applications. This shift requires sophisticated process control and proprietary know-how in crystallization management under high-pH conditions.

A major technological emphasis is placed on enhancing the performance of high-nickel chemistries, specifically NMC 811 and beyond (NMC 9.x.x). While high nickel content boosts energy density, it simultaneously compromises thermal stability due to increased oxygen release at elevated temperatures. To counteract this, manufacturers are employing surface modification techniques and elemental doping strategies. Surface modifications often involve coating the precursor particles with inert materials (like aluminum oxide or phosphates) to protect the reactive nickel core from direct contact with the electrolyte, reducing side reactions and suppressing capacity fade. Elemental doping, using small amounts of inactive metals (such as magnesium, aluminum, or titanium) introduced during the co-precipitation process, is utilized to stabilize the crystal lattice structure, particularly at the interface, thereby improving cycling stability and minimizing volumetric changes upon lithiation and de-lithiation. These technological improvements are crucial for gaining the approval of stringent automotive manufacturers who prioritize safety and durability.

Furthermore, technology related to high-throughput screening and digitalization is rapidly becoming standard. The utilization of AI and sophisticated material informatics tools allows for the rapid identification of optimal processing parameters and novel precursor designs, significantly reducing the time required for product development and commercialization. Parallel advancements in resource recycling technologies, such as hydrometallurgical processing, are becoming integral to the future technology landscape. These technologies enable the recovery of high-purity nickel, cobalt, and manganese sulfates from spent batteries, which can be fed directly back into the precursor production process. Developing cost-effective and environmentally friendly recycling processes is a strategic imperative, driven by both sustainability mandates and the need to secure domestic raw material supply chains, especially in regions with limited mining resources like Europe and North America. This circular economy approach ensures long-term feedstock security and enhances the overall sustainability profile of ternary battery technology.

Regional Highlights

- Asia Pacific (APAC): APAC, led by China, South Korea, and Japan, currently dominates the Li-Ion Battery Ternary Precursor Market, both in terms of production capacity and consumption. China possesses an unparalleled competitive advantage, having invested heavily in nickel processing and precursor manufacturing, supported by vast downstream battery manufacturing capacity. South Korea and Japan remain technological leaders, focusing on premium, high-quality, and complex NMC 811 and NCA precursors, supplying major global cell manufacturers (LG Energy Solution, Samsung SDI, Panasonic). The region benefits from established supply chains and governmental support focused on maintaining global battery supremacy.

- Europe: Europe is experiencing the fastest growth in precursor demand, driven by massive investments in gigafactories by both European manufacturers (e.g., BASF) and Asian players establishing local production hubs to serve the rapidly expanding domestic EV market. Regulatory pressures, notably the European Battery Regulation emphasizing sustainable and traceable sourcing, are critical determinants. The continent is actively building out its upstream and midstream capabilities to localize the supply chain, moving away from reliance on imported precursors from Asia.

- North America: North America is witnessing significant localization efforts, largely spurred by the incentives and domestic content requirements stipulated in the Inflation Reduction Act (IRA). This regulation is driving billions of dollars of investment into new precursor and cathode material facilities in the US and Canada. The region focuses heavily on securing battery-grade nickel and cobalt from allied sources and establishing vertically integrated supply chains to serve the demanding domestic automotive sector (Ford, GM, Tesla).

- Latin America & MEA (Middle East and Africa): While holding a smaller share, these regions are strategically important due to their vast raw material reserves, particularly lithium, nickel, and cobalt. The MEA region, primarily driven by investments in cobalt and nickel mining (e.g., in Africa), forms the crucial foundational layer for the global precursor supply chain. Latin America is poised for gradual growth as local EV adoption increases and countries like Chile and Argentina leverage their mineral resources to attract processing investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Li-Ion Battery Ternary Precursor Market.- CNGR Advanced Material Co., Ltd.

- Zhejiang Huayou Cobalt Co., Ltd.

- GEM (Ganzhou High-Power Energy Technology Co., Ltd.)

- Umicore N.V.

- POSCO Future M Co., Ltd.

- Jinchuan Group Co., Ltd.

- L&F Co., Ltd.

- BASF SE

- Ecopro Co., Ltd.

- Brunp Recycling Technology Co., Ltd. (Subsidiary of CATL)

- Ronbay Technology Co., Ltd.

- Reshine New Materials Co., Ltd.

- Shanshan Technology Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Xiamen Tungsten Co., Ltd.

- Tanaka Chemical Corporation

- Dangsheng Material Technology Co., Ltd.

- Optimal Solutions Co., Ltd.

- Tinci Materials (Guangzhou) Co., Ltd.

- Valence Technology Inc.

Frequently Asked Questions

Analyze common user questions about the Li-Ion Battery Ternary Precursor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary chemical compositions driving the Li-Ion Ternary Precursor market growth?

The market growth is primarily driven by high-nickel chemistries, specifically Nickel Manganese Cobalt (NMC) 811 and Nickel Cobalt Aluminum (NCA). These compositions offer the highest energy density required for long-range Electric Vehicles (EVs) and high-performance applications, leading to rapid capacity expansion in these segments.

How does the transition to high-nickel content precursors impact battery safety and stability?

High-nickel content significantly increases energy density but can reduce thermal stability due to greater oxygen release potential at high temperatures. Manufacturers mitigate this by utilizing elemental doping (e.g., Aluminum or Magnesium) and surface coatings, enhancing the structural integrity and improving the safety profile required for automotive grade batteries.

What role does the co-precipitation technology play in precursor manufacturing?

Co-precipitation is the essential synthesis method used to produce ternary precursors. It is critical for precisely controlling particle morphology (spherical or single-crystal), ensuring uniform particle size distribution, and achieving homogeneous mixing of metal ions, all of which are vital for optimal electrochemical performance and long cycle life in the final battery.

Which geopolitical factors most significantly influence the security of the ternary precursor supply chain?

Geopolitical stability is deeply influenced by the concentration of raw material sourcing (especially Cobalt and Nickel) and manufacturing capacity (predominantly in China and South Korea). Regulatory acts, such as the US IRA and EU localization mandates, are powerful geopolitical factors driving the diversification of supply chains and incentivizing regional manufacturing capacity buildup in North America and Europe.

What are the key sustainability challenges faced by the Li-Ion Battery Ternary Precursor market?

The primary challenges involve the ethical sourcing of Cobalt and the environmental impact of nickel mining. The market addresses this through stringent ESG (Environmental, Social, and Governance) audits, implementation of blockchain technology for material traceability, and significant investment in hydrometallurgical recycling processes to establish closed-loop material circulation and reduce reliance on primary mining.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager