License Plate Recognition (LPR) Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433460 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

License Plate Recognition (LPR) Cameras Market Size

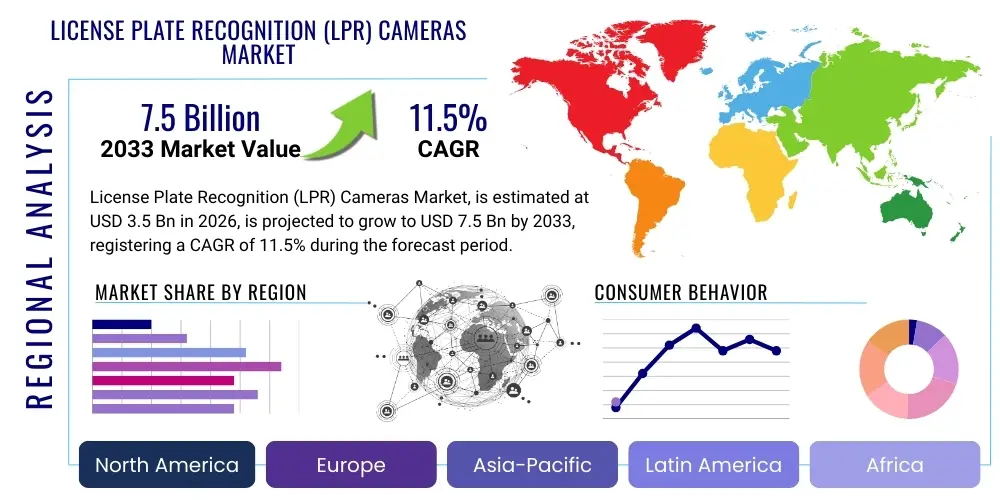

The License Plate Recognition (LPR) Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

License Plate Recognition (LPR) Cameras Market introduction

The License Plate Recognition (LPR) Cameras Market encompasses the development, manufacturing, and deployment of specialized hardware and software systems designed to automatically capture, read, and store license plate information from vehicles. These systems leverage advanced optical character recognition (OCR) and image processing technologies tailored specifically for dynamic, high-speed environments. Historically confined primarily to high-security installations and border control, LPR technology has evolved significantly, integrating with sophisticated backend database management systems and real-time surveillance networks. The core product offering includes dedicated LPR cameras (both fixed and mobile units), infrared illuminators, and integrated processing units capable of handling diverse lighting and weather conditions, making them indispensable tools for law enforcement and traffic management globally.

Major applications for LPR cameras span critical infrastructure security, toll collection, parking management, and smart city initiatives focused on urban mobility and traffic violation enforcement. In security contexts, LPR systems are vital for tracking stolen vehicles, monitoring entry/exit points in sensitive areas, and identifying vehicles associated with criminal activities. The benefits derived from rapid LPR deployment include enhanced operational efficiency, reduced manual intervention in data recording, and significant improvements in public safety outcomes. Furthermore, the convergence of LPR technology with cloud computing platforms allows for centralized data access and scalable operations across vast geographical areas, enabling proactive rather than purely reactive security measures.

Driving factors propelling market expansion include increasingly stringent government mandates related to public safety and counter-terrorism measures, particularly in developed economies. The global proliferation of smart city projects, which prioritize automated monitoring and efficient resource allocation, provides a massive impetus for LPR system integration. Technological advancements, such as high-resolution sensors and deep learning algorithms, have drastically improved recognition accuracy, even under challenging circumstances like high traffic density or poor visibility, thus increasing end-user confidence and adoption rates across municipal and commercial sectors alike.

License Plate Recognition (LPR) Cameras Market Executive Summary

The License Plate Recognition (LPR) Cameras market is experiencing robust growth, driven by the indispensable need for enhanced public safety infrastructure and the continuous global investment in smart city projects. Key business trends indicate a definitive shift toward AI-powered edge processing capabilities within LPR cameras, reducing latency and reliance on centralized servers, thereby optimizing deployment costs and increasing data throughput efficiency. Strategic mergers and acquisitions are common as large surveillance technology providers seek to integrate specialized LPR vendors to offer complete, end-to-end intelligent traffic solutions. Regulatory standards, especially concerning data privacy (such as GDPR), are shaping product design, pushing manufacturers to develop anonymization and secure data handling features, leading to higher complexity but greater trustworthiness in governmental procurement processes.

Regionally, North America and Europe maintain dominance due to established security protocols and high deployment rates in infrastructure monitoring and law enforcement. However, the Asia Pacific (APAC) region is projected to register the fastest growth, primarily fueled by massive infrastructure development in countries like China and India, where traffic management and tolling modernization are primary governmental focus areas. The rapid urbanization across Southeast Asia also demands scalable surveillance solutions, positioning APAC as the most dynamic region for new LPR deployments. Latin America and MEA are focused on leveraging LPR for combating high rates of vehicle theft and improving border security, presenting significant opportunities, especially for mobile LPR solutions.

Segment trends highlight the dominance of fixed LPR systems in terms of installed base, largely utilized for access control and highway monitoring. However, the mobile LPR segment, mounted on police vehicles, is exhibiting superior growth due to its flexibility and effectiveness in real-time crime prevention and tracking. Based on component type, the software and services segment is growing faster than the hardware segment, reflecting the market’s pivot towards sophisticated analytics, cloud-based data storage, and subscription models for maintenance and real-time updates. The end-user analysis confirms law enforcement and traffic management agencies remain the largest consumers, though the commercial sector (parking, logistics, retail security) is rapidly increasing its market share.

AI Impact Analysis on License Plate Recognition (LPR) Cameras Market

Users are intensely focused on how Artificial Intelligence (AI) and deep learning algorithms are transforming the accuracy, speed, and versatility of LPR systems, frequently asking about the transition from traditional Optical Character Recognition (OCR) to neural network-based pattern recognition. Common questions revolve around the system’s ability to handle non-standard plates, foreign scripts, damaged plates, and high-speed vehicle capture in adverse weather. Furthermore, stakeholders are concerned about the integration of LPR data with broader AI-driven surveillance platforms, specifically regarding predictive policing capabilities and object recognition beyond just the license plate, such as vehicle make, model, and color classification. The summary of user expectations centers on the need for highly reliable systems that minimize false positives and negatives, offer robust edge processing for instantaneous decision-making, and comply with evolving data ethics and privacy regulations while maintaining high operational efficiency.

AI’s influence is pushing the LPR market toward cognitive computing solutions. Deep learning models are capable of training on enormous datasets, allowing LPR systems to adapt dynamically to diverse environmental factors—including unusual fonts, complex plate designs used in different jurisdictions, and extreme glare or shadows—which traditionally hampered performance. This shift from simple image capture to intelligent video analytics fundamentally redefines the product, moving it from a specialized camera to an intelligent sensor capable of making contextual inferences. For instance, AI algorithms can distinguish between legitimate traffic flow and suspicious activity, triggering alerts based on complex behavioral patterns, not just plate reads.

Moreover, AI is critical for optimizing the operational lifespan and maintenance of LPR infrastructure. Predictive maintenance algorithms analyze camera performance metrics, temperature fluctuations, and image quality degradation patterns to schedule necessary maintenance preemptively, minimizing downtime and operational costs for large-scale deployments, such as city-wide surveillance networks or extensive highway toll systems. This operational sophistication, driven by AI, guarantees higher service availability and data integrity, making AI integration a prerequisite for next-generation LPR platform adoption across governmental and private sectors.

- AI enhances LPR accuracy across challenging conditions (speed, weather, plate damage) by leveraging deep convolutional neural networks.

- Edge AI processing minimizes latency, enabling real-time alerts and instantaneous data analysis without constant server communication.

- Integration of LPR with vehicle classification (make, model, color) and behavioral analytics for predictive security applications.

- AI-driven data anonymization techniques ensure compliance with GDPR and other stringent data privacy regulations.

- Optimization of data storage and search capabilities through AI indexing of vast video and license plate databases.

DRO & Impact Forces Of License Plate Recognition (LPR) Cameras Market

The LPR market is strongly propelled by global governmental focus on security and smart infrastructure modernization, yet it faces significant headwinds primarily related to technological integration complexities and pervasive data privacy concerns. The primary drivers include escalating instances of vehicular crime and the mandatory adoption of electronic toll collection (ETC) systems worldwide. Opportunities arise particularly in emerging markets where smart city development is nascent and requires holistic surveillance implementation. Conversely, restraints involve high initial deployment costs for sophisticated network infrastructure and the continuous challenge of ensuring high read accuracy against counterfeit or obscured license plates. The overall impact forces suggest that regulatory pressure regarding both security implementation and data protection will be the main determinant shaping market growth trajectory and technological innovation over the forecast period.

The fundamental drivers are rooted in geopolitical stability requirements and economic efficiency needs. Governments globally are allocating substantial budgets for critical infrastructure protection, making LPR a baseline security requirement for airports, ports, government buildings, and urban centers. Economically, the move toward cashless and automated tolling systems mandates the use of highly accurate LPR systems to ensure revenue collection and reduce traffic congestion. This intersection of security necessity and economic optimization forms a powerful, non-cyclical driver for sustained market growth. Additionally, the replacement cycle for older, less accurate LPR systems provides continuous market opportunities, especially as legacy systems fail to meet modern requirements for integration with centralized intelligent transportation systems (ITS).

However, the ethical and legal complexities surrounding mass surveillance technology act as potent restraints. Public opposition and legislative efforts focused on curtailing government monitoring capabilities require manufacturers to invest heavily in secure data handling protocols, encryption, and auditability features, increasing product cost and development time. Furthermore, the interoperability challenge—ensuring seamless data exchange between disparate LPR systems utilized by different police agencies or spanning different international borders—remains a technical hurdle. Despite these restraints, the opportunity landscape is wide, focusing on leveraging LPR in niche commercial applications like inventory management in large logistics yards or consumer behavior tracking in high-end retail parking facilities, offering diversification beyond traditional government use.

Segmentation Analysis

The License Plate Recognition (LPR) Cameras Market is comprehensively segmented across several key dimensions, providing clarity on market dynamics based on technology type, deployment mode, component, application, and end-user. The segmentation is crucial for understanding specific regional adoption patterns and identifying high-growth sub-markets, such as AI-enabled software solutions. Technological segmentation reflects the evolution from traditional infrared systems to integrated IP-based smart cameras, while deployment modes differentiate between fixed infrastructure and mobile police vehicle installations. This granular analysis facilitates targeted marketing strategies and product development efforts tailored to distinct vertical requirements, such as the stringent performance criteria needed for high-speed highway monitoring versus the cost-sensitivity of commercial parking management solutions.

- By Component:

- Hardware (LPR Cameras, Frame Grabbers, Triggers)

- Software (LPR Algorithms, Backend System, Cloud Platforms, Analytics Tools)

- Services (Installation, Maintenance, Consulting)

- By Type of Camera:

- Fixed LPR Cameras

- Mobile LPR Cameras (Vehicle-mounted)

- Portable LPR Cameras

- By Application:

- Traffic Management and Enforcement (Speeding, Red Light, Bus Lane)

- Security and Surveillance (Border Control, Critical Infrastructure)

- Tolling and Electronic Payment Systems

- Parking Management and Access Control

- Others (Retail Security, Logistics, Inventory Management)

- By End-User:

- Government and Law Enforcement Agencies

- Defense and Homeland Security

- Transportation and Logistics

- Commercial Organizations (Parking Facilities, Corporate Campuses)

- By Technology:

- Infrared (IR) Based LPR

- Color Camera Based LPR

- AI and Deep Learning Based LPR

Value Chain Analysis For License Plate Recognition (LPR) Cameras Market

The Value Chain for the LPR Cameras Market begins with the upstream suppliers who provide specialized components, including high-resolution image sensors (CCD/CMOS), infrared illuminators, and high-performance processing chips necessary for edge computing. These component suppliers are critical as the accuracy and speed of the LPR system are directly tied to the quality of the optical and computational hardware. The subsequent stage involves the primary manufacturers who integrate these components, develop proprietary OCR algorithms and AI software, and assemble the final camera units and associated backend systems. Strong intellectual property around recognition software provides significant competitive differentiation at this stage.

The midstream focuses on system integration, customization, and distribution. Given the unique regulatory and technological requirements across different geographies (variations in license plate formats, infrastructure standards), local system integrators play a vital role in tailoring the core LPR products to meet specific client needs, particularly for large governmental contracts. Distribution channels are generally mixed; direct sales are preferred for large-scale governmental or defense projects where customization and security protocols are paramount. In contrast, indirect channels, utilizing specialized security distributors and IT infrastructure resellers, cater more effectively to the smaller commercial and retail market segments.

Downstream analysis highlights the crucial role of deployment and post-sale services. Successful LPR implementation requires expert installation, calibration, and rigorous testing to ensure optimal recognition accuracy in real-world conditions. Furthermore, recurring revenue streams are heavily reliant on maintenance contracts, software updates, and data analytics services, which ensure the longevity and effectiveness of the deployed systems. The final customers (end-users) benefit directly from the operational efficiencies and enhanced security provided by the integrated LPR solution, completing the value cycle through continuous system utilization and data feedback for algorithm improvement.

License Plate Recognition (LPR) Cameras Market Potential Customers

The primary consumers of License Plate Recognition (LPR) cameras are governmental bodies, constituting the largest and most strategically important end-user segment due to the scope and scale of required deployments. Law enforcement agencies (federal, state, and local police departments) utilize LPR for monitoring stolen vehicles, tracking suspects, and conducting surveillance. Simultaneously, municipal traffic departments employ these systems extensively for automated traffic enforcement (red light, bus lane, speed enforcement) and real-time congestion management within Intelligent Transportation Systems (ITS) frameworks. The scale of required deployment in this sector necessitates robust, highly secure, and integrated network solutions.

The secondary, yet rapidly expanding, customer base is found within the commercial and private sector, primarily focused on access control and specialized security needs. Parking facility operators (both municipal and private lots, airports, and large corporate parking garages) rely on LPR for automated entry, ticketless parking, and revenue assurance. Logistics and transportation companies utilize LPR for streamlined fleet management, checkpoint monitoring within large distribution centers, and tracking goods movement. These commercial customers prioritize cost-effectiveness, ease of integration with existing property management systems, and high reliability for continuous 24/7 operation.

A third emerging customer segment includes critical infrastructure operators, such as utility companies, nuclear facilities, and key data centers, where perimeter security and controlled access are non-negotiable mandates. Here, LPR systems are often coupled with biometric security and extensive video analytics platforms to create layered security protocols. These customers demand extremely high accuracy, redundant systems, and compliance with stringent industry-specific security certifications, placing a premium on vendors offering specialized, ruggedized hardware and highly reliable software solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Security Systems, 3M Company, Kapsch TrafficCom, Axis Communications, Genetec, Tattile S.R.L., Q-Free ASA, ARH Inc., Vivotek Inc., HIKVISION Digital Technology Co. Ltd., Dahua Technology Co. Ltd., Siemens AG, Jenoptik AG, PIPS Technology (A Sensys Gatso Group Company), Leonardo S.p.A., Conduent, Elsag North America, Neology Inc., Teledyne FLIR LLC, and PlateSmart Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

License Plate Recognition (LPR) Cameras Market Key Technology Landscape

The technology landscape of the LPR market is defined by rapid advancements in imaging components, processing capabilities, and algorithm sophistication. The current trajectory sees a fundamental shift from reliance on generic surveillance cameras retrofitted with LPR capabilities to purpose-built smart cameras incorporating high-speed Global Shutter CMOS sensors optimized for vehicle movement. Infrared (IR) illumination remains a critical component, enabling 24/7 capture regardless of natural lighting conditions, though modern systems often use adaptive IR technology to prevent glare and overexposure. The crucial technological differentiator is the embedded system-on-chip (SoC) architecture, which facilitates powerful edge processing, allowing LPR capture and OCR analysis to occur locally on the device before transmission, greatly reducing network bandwidth requirements and overall latency for real-time alerting.

The core technological innovation driving market growth is the widespread adoption of AI and deep learning frameworks within LPR software. Traditional LPR relied on fixed, rule-based algorithms (Optical Character Recognition) sensitive to variations in font, spacing, and angle. Contemporary LPR systems use deep Convolutional Neural Networks (CNNs) trained on millions of diverse plate images, dramatically improving accuracy rates for non-standardized or partially obscured plates, foreign language characters, and varying reflective qualities. This robust AI backbone enables features such as simultaneous vehicle make and model recognition, directional tracking, and even the ability to infer license plate characteristics based on partial visual data, transforming raw image data into actionable intelligence.

Furthermore, cloud-native architectures and API-driven system integration are defining the future landscape. Modern LPR data platforms offer secure, scalable storage and centralized management, crucial for multi-jurisdictional cooperation and large-scale smart city deployments. Technology providers are increasingly offering LPR-as-a-Service (LPRaaS) models, bundling hardware, software updates, maintenance, and cloud storage into a subscription offering. This trend minimizes the upfront capital expenditure for end-users, broadens market accessibility, and ensures that systems are perpetually updated with the latest AI algorithms and security patches, guaranteeing long-term operational resilience and competitive advantage.

Regional Highlights

- North America: This region holds a leading position in the LPR market, characterized by high adoption rates across law enforcement, homeland security, and sophisticated highway tolling systems. The U.S. market is highly mature, driven by significant federal and state investments in high-security infrastructure and ITS modernization. The emphasis here is on interoperability and advanced analytics, particularly integrating LPR data into multi-agency crime databases. Strict regulatory environments, though posing compliance challenges, also ensure a high standard for data security and product quality, favoring established vendors.

- Europe: Europe represents a robust market, marked by stringent regulatory oversight, particularly the General Data Protection Regulation (GDPR), which mandates specific privacy-preserving features in LPR systems. Countries in Western Europe (UK, Germany, France) are primary adopters for traffic enforcement and urban surveillance, focusing on highly precise, low-false-positive rate systems. Eastern European nations are investing heavily in modernizing border security and toll infrastructure, offering high growth potential, especially for hybrid fixed and mobile systems designed for cross-border traffic monitoring.

- Asia Pacific (APAC): APAC is forecast to be the fastest-growing region, driven by explosive urbanization and massive investments in smart cities, particularly in China, India, Japan, and South Korea. China leads in deployment volume, fueled by government-mandated surveillance projects and expansive highway networks requiring electronic toll systems. The key driver is infrastructural development and the integration of LPR into centralized governmental control platforms. Challenges include highly fragmented domestic markets and varied license plate standards, requiring adaptable software solutions.

- Latin America (LATAM): The LATAM market growth is predominantly driven by the urgent need to combat high rates of vehicle theft and improve security in major metropolitan areas. Governments are prioritizing the rapid deployment of LPR technology in key choke points and high-crime corridors. Brazil and Mexico are leading the adoption, primarily utilizing systems for police surveillance and parking security. The market favors cost-effective, ruggedized systems capable of operating reliably in diverse climates and environments with varying levels of infrastructure stability.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the GCC nations, spurred by major infrastructure projects (e.g., smart city developments in the UAE and Saudi Arabia) and a substantial focus on internal security and critical national infrastructure protection (oil and gas facilities, major ports). African nations are slowly adopting LPR for border management and revenue assurance in tolling, though market penetration remains lower than in other regions. The segment demands high-performance LPR integrated into comprehensive command and control centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the License Plate Recognition (LPR) Cameras Market.- Bosch Security Systems

- 3M Company

- Kapsch TrafficCom

- Axis Communications

- Genetec

- Tattile S.R.L.

- Q-Free ASA

- ARH Inc.

- Vivotek Inc.

- HIKVISION Digital Technology Co. Ltd.

- Dahua Technology Co. Ltd.

- Siemens AG

- Jenoptik AG

- PIPS Technology (A Sensys Gatso Group Company)

- Leonardo S.p.A.

- Conduent

- Elsag North America

- Neology Inc.

- Teledyne FLIR LLC

- PlateSmart Technologies

- Avigilon Corporation

- Adaptive Recognition

- Hanwha Techwin

- Motorola Solutions (through various acquisitions)

Frequently Asked Questions

Analyze common user questions about the License Plate Recognition (LPR) Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the major growth in the LPR market?

Market growth is primarily driven by increasing governmental investments in Intelligent Transportation Systems (ITS), the mandatory requirement for automated electronic toll collection (ETC) globally, and rising security concerns necessitating real-time surveillance for public safety and critical infrastructure protection. The integration of advanced AI further enhances LPR system reliability, boosting adoption.

How does AI technology affect the accuracy and deployment of LPR systems?

AI significantly enhances accuracy by using deep learning algorithms (CNNs) to recognize diverse, damaged, or non-standardized license plates under poor visibility, far surpassing traditional OCR. AI also facilitates edge processing, allowing rapid, decentralized analysis directly on the camera, optimizing bandwidth use and reducing response time for real-time applications.

Which segment of the LPR market is expected to show the highest CAGR?

The Software and Services component segment is projected to exhibit the highest CAGR. This growth is fueled by the transition towards subscription-based LPR-as-a-Service (LPRaaS) models, the demand for sophisticated AI-driven analytics, and the need for continuous software updates and secure cloud integration for data management.

What is the primary restraint challenging the widespread adoption of LPR technology?

The most significant restraint is navigating complex data privacy regulations, such as GDPR and CCPA, which govern the collection and storage of personal location data derived from license plate readings. High infrastructure costs for large-scale, interconnected LPR networks also present a substantial barrier to entry for many municipal and commercial entities.

Why is the Asia Pacific region becoming a critical growth hub for LPR cameras?

APAC’s rapid growth is directly linked to immense infrastructure investment and rapid urbanization, particularly in China and India. Large-scale governmental smart city initiatives and the development of extensive modern toll road networks require scalable LPR technology for traffic management and automated revenue assurance, positioning APAC as the largest consumer of new installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager