Licensed Sports Merchandise Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432687 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Licensed Sports Merchandise Market Size

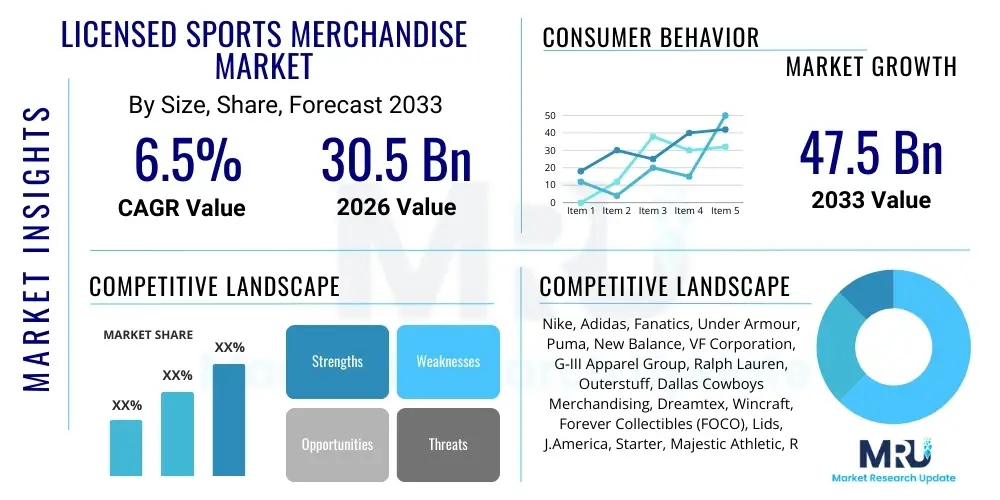

The Licensed Sports Merchandise Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 30.5 billion in 2026 and is projected to reach USD 47.5 billion by the end of the forecast period in 2033.

Licensed Sports Merchandise Market introduction

The Licensed Sports Merchandise Market encompasses the sale of products bearing the trademarks, logos, and intellectual property (IP) of professional sports leagues, teams, and individual athletes. This market includes a vast array of consumer goods, primarily spanning apparel (jerseys, hats, t-shirts), accessories (keychains, flags), footwear, collectibles, and digital assets (video games, NFTs). These products are authorized via formal licensing agreements between the IP owner (licensor) and the manufacturer/retailer (licensee), ensuring brand integrity and generating royalty revenue for sports organizations. The core value proposition of this market lies in connecting fans emotionally with their favorite teams or idols, transforming intangible loyalty into tangible consumer products.

Major applications of licensed sports merchandise revolve around consumer fandom, celebratory events, and casual wear. Apparel, particularly replica and authentic jerseys, remains the cornerstone of the market, driven by league-wide marketing initiatives and the frequent rotation of new team designs and player transfers. Furthermore, the expansion into adjacent categories like home goods, specialized collectibles, and performance-driven accessories demonstrates the market's maturity and diversification potential. A significant shift is the increasing importance of digital licensing, particularly in the realm of video games and emerging virtual merchandise, broadening the addressable market beyond traditional physical retail.

Driving factors for sustained market growth include the rising popularity of global sports leagues such as the English Premier League (EPL), NBA, NFL, and Formula 1, coupled with significant increases in sports media viewership across streaming platforms. The benefits derived by stakeholders are substantial: teams and leagues secure predictable, high-margin royalty streams, manufacturers gain access to established, highly emotional brand equity, and consumers satisfy their identity needs through product ownership. However, success hinges on effective inventory management, rapid response to performance trends (known as "hot market" events), and navigating the complexities of intellectual property protection against counterfeiting.

Licensed Sports Merchandise Market Executive Summary

The Licensed Sports Merchandise Market is characterized by robust growth, primarily fueled by the digitalization of distribution channels and the globalization of major sports leagues. Business trends indicate a consolidation among key market players, notably licensing powerhouses such as Fanatics, which continues to expand its comprehensive vertical commerce model, integrating manufacturing, distribution, and retail under a unified platform. A major structural trend is the increasing prioritization of direct-to-consumer (DTC) strategies by both licensors (teams/leagues) and licensees to capture higher margins and obtain granular consumer data, allowing for highly personalized product offerings and marketing campaigns. Inventory flexibility and supply chain resilience, often managed through on-demand manufacturing technologies, are becoming critical differentiators in this fast-paced, trend-driven sector.

Regional trends highlight North America as the dominant market, driven by the massive consumer base and institutionalized popularity of the "Big Four" professional sports (NFL, MLB, NBA, NHL). However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, particularly in markets like China and India, propelled by burgeoning interest in soccer (European leagues) and basketball (NBA), alongside the rapid rise of local esports franchises. Europe maintains strong regional relevance, dominated by football club merchandise, with increasing licensing sophistication aimed at generating year-round sales outside of traditional match days. The Middle East and Latin America are also emerging as critical expansion territories, linked closely to major global sporting events like the FIFA World Cup and Olympic Games.

Segment trends underscore the enduring dominance of the Apparel category, though the Accessories and Collectibles segments are experiencing accelerated growth due to the influence of Gen Z consumers and the collecting culture amplified by social media. Within distribution, the Online Retail segment is undeniably outpacing traditional brick-and-mortar sales, commanding a premium for speed, accessibility, and the ability to drop limited-edition products efficiently. Furthermore, specialized licensing segments, particularly those tied to Esports and women's professional sports, are moving from niche status to mainstream focus, forcing licensing managers to adapt product lines to cater to diverse and rapidly evolving fan demographics, emphasizing gender-neutral and sustainable merchandise options.

AI Impact Analysis on Licensed Sports Merchandise Market

User inquiries regarding the impact of AI on the Licensed Sports Merchandise Market frequently center on personalization, supply chain efficiency, and intellectual property protection. Common questions relate to how AI can predict jersey sales based on player performance, optimize inventory levels to avoid surplus or stockouts during major events, and how generative AI might be used to design unique, limited-edition fan gear. Concerns often revolve around the ethical use of fan data and the potential for AI-driven automation to disrupt traditional design and manufacturing jobs. Users highly anticipate AI's role in creating hyper-personalized retail experiences and protecting licensed IP from sophisticated counterfeiters utilizing machine learning for replication.

- AI-driven Predictive Analytics: Forecasting demand for specific player jerseys, team successes, and regional merchandise popularity to minimize inventory risk and maximize profit margins.

- Hyper-Personalization: Utilizing machine learning algorithms to recommend unique merchandise combinations or custom designs based on individual fan purchase history, social media activity, and preferred consumption channels.

- Optimized Supply Chain & Fulfillment: Employing AI for route optimization, warehouse management, and enabling localized, on-demand manufacturing to shorten lead times, particularly for "hot market" celebratory merchandise.

- Counterfeit Detection and IP Protection: Deploying machine vision and AI-powered monitoring systems to scan online marketplaces and social media for unauthorized use of licensed logos and trademarks, ensuring brand exclusivity.

- Generative Design: Using AI tools to rapidly iterate on design concepts for new apparel lines and logos, speeding up the creative process while ensuring compliance with league or team brand guidelines.

DRO & Impact Forces Of Licensed Sports Merchandise Market

The market dynamics are governed by a robust interplay of drivers, structural restraints, and emerging opportunities, all amplified by critical impact forces related to consumer behavior and technological adoption. Primary drivers include the massive global viewership and increased commercialization of professional sports, the rise of esports as a legitimate licensing category, and the critical shift toward e-commerce, which allows licensees to reach global fan bases instantly. These drivers create a compelling environment for investment and product innovation, particularly in expanding global footprints. Conversely, the market faces significant restraints, chiefly high royalty costs that compress licensee margins, the persistent challenge of counterfeiting which dilutes brand value, and the inherent volatility of demand tied directly to team performance and cultural trends, making long-term forecasting difficult.

Opportunities for expansion are abundant, centered on untapped regional markets, especially Southeast Asia and Africa, and the development of new product lines targeting specific demographics, such as high-end luxury collaborations or specialized merchandise for women's sports leagues. The rapid technological advancement in direct-to-garment printing and 3D printing enables the efficient production of custom, low-volume merchandise, supporting a shift towards mass customization. Furthermore, the integration of Non-Fungible Tokens (NFTs) and virtual merchandise licensing represents a high-growth opportunity, allowing teams and leagues to monetize digital fan engagement and unlock entirely new revenue streams that complement physical sales.

The primary impact forces influencing the market trajectory include the rapid consolidation of retail distribution, where major players exert significant influence over pricing and shelf space, and the increasing consumer demand for sustainability and ethical sourcing. Teams and leagues are facing escalating pressure from fans to partner with licensees that demonstrate strong environmental, social, and governance (ESG) commitments, affecting partnership viability. Furthermore, the reliance on mega-star athletes for merchandise sales creates vulnerability; player retirement or controversy can instantly impact millions in planned revenue. Consequently, successful strategies must balance capitalizing on current athlete popularity with establishing enduring, evergreen team brand merchandise.

Segmentation Analysis

The Licensed Sports Merchandise Market is extensively segmented across Product Type, Distribution Channel, End User, and Sports Type, reflecting the diversity of consumer interests and purchasing behaviors globally. The segmentation strategy is crucial for both licensors, who aim to maximize brand penetration across various consumer touchpoints, and licensees, who need to specialize their manufacturing and distribution capabilities. Analysis reveals that segmentation enables tailored marketing efforts; for instance, targeting the 'Kids' End User segment with 'Toys & Games' and 'Accessories' is often achieved via dedicated specialty retail and family entertainment centers, while 'Men's Apparel' sales are heavily concentrated in online retail platforms and team stores, showcasing the need for multi-channel differentiation based on segment needs.

The largest segment remains Apparel, encompassing official jerseys, training wear, and fan apparel, which consistently generates the highest revenue due to its high price point and frequent replacement cycle driven by new seasons and player movements. However, the Accessories and Collectibles segments are experiencing the most rapid growth, attributed to lower entry pricing and the collectability culture fostered by social media platforms and specialized enthusiast communities. The distinction between physical and digital goods is increasingly blurring, particularly under the Product Type segment, where video games and associated digital wearables now command a significant portion of total licensing revenue, forcing traditional manufacturers to consider digital IP rights alongside physical production capabilities.

Distribution Channel segmentation emphasizes the continued shift towards digital platforms. Online Retail provides unparalleled reach, 24/7 accessibility, and the capacity for flash sales and limited drops, which are essential for maximizing the hype around successful sports teams. Conversely, Offline Retail, particularly specialty stores and dedicated team stores at venues, remains critical for providing authentic, high-touch fan experiences and facilitating immediate, high-volume transactions during game days. Strategic segmentation across all dimensions allows businesses to optimize their inventory geographically, align product complexity with channel capability, and ultimately cater to the full spectrum of fan loyalty, from the casual consumer seeking a low-cost accessory to the devoted collector willing to invest heavily in authenticated memorabilia.

- Product Type:

- Apparel (Jerseys, T-shirts, Hoodies, Hats)

- Footwear

- Accessories (Keychains, Flags, Bags, Watches)

- Toys & Games (Video Games, Board Games, Figurines)

- Collectibles & Memorabilia (Signed Items, Trading Cards, NFTs)

- Home Goods & Others

- Distribution Channel:

- Online Retail (E-commerce Platforms, Team Websites, Third-Party Marketplaces)

- Offline Retail (Specialty Stores, Department Stores, Supermarkets/Hypermarkets, Team Stores/Stadium Shops)

- End User:

- Men

- Women

- Kids

- Sports Type:

- Football (Soccer)

- Basketball (NBA)

- Baseball (MLB)

- American Football (NFL)

- Ice Hockey (NHL)

- Esports

- Others (Motor Sports, Golf, Tennis, etc.)

Value Chain Analysis For Licensed Sports Merchandise Market

The value chain for licensed sports merchandise is complex and highly regulated, starting with intellectual property creation (the league/team/athlete) and concluding with consumer retail. Upstream analysis focuses on the acquisition of raw materials, primarily textiles and manufacturing components. This stage involves significant due diligence regarding ethical sourcing and sustainability, especially for apparel manufacturers who must adhere to stringent quality and labor standards set by major licensors like the NFL or FIFA. Key activities here include design conceptualization, material procurement, and initial production planning. Efficiency in this phase directly impacts the final cost structure and compliance with rapidly changing consumer expectations regarding ethical production.

Midstream activities involve the core licensing negotiation and the manufacturing process. The licensing step is critical, involving detailed royalty structures, territorial rights, and quality control mandates. Manufacturers (licensees) then convert raw materials into finished licensed products. This requires high-speed, flexible manufacturing capabilities, often leveraging advanced printing technologies like direct-to-garment (DTG) to manage demand volatility associated with sporting outcomes. Distribution channels are then activated, categorized primarily into Direct and Indirect routes. Direct distribution involves the licensor or major licensee selling directly through their own e-commerce sites or stadium stores, capturing maximum margin and critical consumer data. Indirect distribution relies on wholesalers, third-party retailers (e.g., Walmart, Amazon), and regional distributors, offering wider market penetration.

Downstream analysis centers on retail execution and fan engagement. Key distribution channel effectiveness hinges on inventory placement and marketing synchronization with sports events. Direct channels provide immediacy and control over pricing and brand presentation, essential for premium and limited-edition items. Indirect channels maximize volume and reach. The modern value chain also includes a crucial loop for anti-counterfeiting measures and digital IP management (for video games and NFTs). Effective channel management, coupled with real-time sales data feedback, allows the entire chain to react quickly to "hot market" demand surges, ensuring profitable and timely delivery of authentic merchandise to the global fan base.

Licensed Sports Merchandise Market Potential Customers

Potential customers for licensed sports merchandise are highly diverse, spanning various age, income, and geographical segments, united primarily by their emotional connection and loyalty to a specific sport, team, or athlete. The primary end-users or buyers fall into three main categories: Dedicated Fans, Casual Consumers, and Collectors/Enthusiasts. Dedicated Fans, forming the core revenue base, purchase high-value items like authentic jerseys and season tickets, prioritizing brand authenticity and quality. They often buy merchandise as an expression of identity and commitment, driving consistent sales regardless of team performance.

Casual Consumers represent a broader, more opportunistic segment, often purchasing lower-priced items like accessories, t-shirts, or home goods. Their purchases are typically event-driven (e.g., attending a game, celebrating a championship) or gift-oriented. This segment is highly responsive to price promotions and widely available distribution through mass-market retailers. Furthermore, the rising influence of lifestyle and fashion trends means that team apparel often crosses over into general streetwear, attracting non-traditional sports viewers who value the aesthetics or cultural significance of a team's brand.

The specialized segment of Collectors and Enthusiasts focuses on high-value, limited-edition, or autographed memorabilia, including physical trading cards, game-worn gear, and now, digital collectibles like NFTs. These buyers are driven by investment potential, scarcity, and historical significance. The expansion of the market into Esports has also introduced a digitally native end-user base that highly values in-game items, branded peripherals, and licensed digital content, shifting the focus towards instantaneous, low-friction digital transactions, which represents a significant area for future growth and monetization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 30.5 billion |

| Market Forecast in 2033 | USD 47.5 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike, Adidas, Fanatics, Under Armour, Puma, New Balance, VF Corporation, G-III Apparel Group, Ralph Lauren, Outerstuff, Dallas Cowboys Merchandising, Dreamtex, Wincraft, Forever Collectibles (FOCO), Lids, J.America, Starter, Majestic Athletic, Riot Games, WWE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Licensed Sports Merchandise Market Key Technology Landscape

The technological landscape of the Licensed Sports Merchandise Market is rapidly evolving, driven by the necessity for speed, customization, and efficient inventory management in a fast-fashion, high-demand environment. Key enabling technologies include advanced digital printing techniques, such as Direct-to-Garment (DTG) and dye-sublimation, which allow for rapid, low-volume production runs. This is critical for capitalizing on "hot market" events, where speed-to-market is paramount, enabling licensees to bypass traditional mass production lead times. Furthermore, sophisticated Product Lifecycle Management (PLM) software is essential for managing complex licensing agreements, ensuring design compliance, and tracking royalty payments across thousands of SKUs and multiple geographic regions, thereby maintaining operational integrity and efficiency.

E-commerce and logistics technologies form another fundamental layer of the modern market structure. The deployment of advanced warehouse automation, robotics, and integrated inventory management systems facilitates rapid global fulfillment, which is crucial for serving international fan bases. Data analytics, leveraging Big Data derived from fan engagement platforms and point-of-sale systems, is arguably the most impactful technology, enabling precision marketing and highly accurate demand forecasting, mitigating the risk of overstocking or missing sales opportunities for trend-sensitive products. These analytical tools help identify emerging micro-trends, such as regional preferences for specific colorways or apparel styles.

Looking ahead, emerging technologies such as 3D printing are gaining traction for bespoke collectibles and accessories, enabling true one-off customization. More transformatively, blockchain technology is increasingly utilized for two primary functions: securing the authenticity of high-value physical memorabilia through digital certificates and enabling the creation and secure transaction of Non-Fungible Tokens (NFTs) representing digital licensed assets. This fusion of physical and digital technologies is expanding the definition of "merchandise" and creating entirely new high-margin revenue streams that demand sophisticated digital rights management capabilities.

Regional Highlights

- North America: Dominates the global market share, largely due to the established infrastructure and mass commercialization of major leagues (NFL, NBA, MLB, NHL). The region is characterized by high consumer spending power, deep-rooted fan culture, and the rapid adoption of e-commerce for merchandise purchasing. The market is mature but continually refreshed by technological advancements in customization and fulfillment.

- Europe: The second-largest market, primarily driven by the colossal demand for football (soccer) club merchandise (Premier League, La Liga, Bundesliga, Serie A). Licensing strategies here are highly focused on cross-border sales and engaging younger demographics through specialized fashion collaborations. Growth is also being seen in motorsports licensing (Formula 1).

- Asia Pacific (APAC): Exhibits the highest CAGR during the forecast period. Growth is fueled by increasing disposable incomes in countries like China, India, and Southeast Asia, coupled with the rising popularity of international sports (NBA and European Football). This region is a crucial focus for Esports merchandise expansion and localization of product offerings.

- Latin America (LATAM): Growth is tied heavily to the passion for football (soccer) and local team leagues, often necessitating localized distribution strategies and managing challenges related to pricing sensitivity and regulatory environments. Mexico and Brazil are the key revenue generators in this region.

- Middle East and Africa (MEA): Emerging market characterized by substantial investment in global sporting events (e.g., FIFA World Cup, regional football tournaments). Demand is concentrated around major international events, driving temporary but high-volume sales. The UAE and Saudi Arabia are pivotal hubs for luxury sports brand distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Licensed Sports Merchandise Market.- Nike

- Adidas

- Fanatics

- Under Armour

- Puma

- New Balance

- VF Corporation (Vans/The North Face licensing)

- G-III Apparel Group

- Ralph Lauren

- Outerstuff

- Dallas Cowboys Merchandising

- Dreamtex

- Wincraft

- Forever Collectibles (FOCO)

- Lids

- J.America

- Starter

- Majestic Athletic (now part of Fanatics)

- Riot Games

- WWE

Frequently Asked Questions

Analyze common user questions about the Licensed Sports Merchandise market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market growth for Licensed Sports Merchandise?

Market growth is primarily driven by the increasing globalization and viewership of major professional sports leagues (NBA, EPL, NFL), the rapid expansion of direct-to-consumer (DTC) e-commerce channels, and the rising commercialization and consumer acceptance of Esports merchandise.

Which product segment dominates the Licensed Sports Merchandise Market?

The Apparel segment, including authentic and replica jerseys, hats, and fan wear, consistently dominates the market in terms of revenue share due to high consumer demand, higher price points, and frequent product rotation tied to seasonal updates and player movements.

How is technology, specifically AI, changing the licensing industry?

AI is transforming the industry through advanced predictive analytics for demand forecasting, enabling precise inventory control, and facilitating hyper-personalization of product recommendations, thereby reducing stockouts during peak demand and optimizing supply chain efficiency.

What are the main regional growth opportunities for sports licensing?

The Asia Pacific (APAC) region offers the highest growth opportunities, particularly in countries with expanding middle classes like China and India, driven by growing interest in international sports and significant investment in localized licensing partnerships.

What challenges does the Licensed Sports Merchandise Market face?

Key challenges include combating the pervasive threat of counterfeiting, managing volatile demand tied to team performance, and navigating high royalty fees imposed by licensors, which often compress profit margins for manufacturers and retailers.

What role do NFTs and digital collectibles play in licensed sports merchandise?

NFTs (Non-Fungible Tokens) and digital collectibles allow leagues and teams to monetize digital fan engagement, offering exclusive virtual assets, secured by blockchain technology, which complement physical merchandise sales and appeal strongly to modern collectors.

Who are the key stakeholders in the licensing value chain?

The key stakeholders are Licensors (sports leagues, teams, athletes, and IP holders), Licensees (manufacturers like Fanatics or Nike), Distributors, and Retailers (both online and offline), all working under formalized agreements to produce and distribute branded goods.

How important is sustainability in purchasing licensed sports products?

Sustainability and ethical sourcing are increasingly critical, particularly among younger consumers. Licensors are demanding that manufacturers adhere to stringent ESG (Environmental, Social, and Governance) standards, influencing partnership decisions and product material choices.

Which distribution channel is growing fastest in this market?

The Online Retail distribution channel is growing the fastest, offering global reach, 24/7 accessibility, and the capability for efficient limited-edition product drops, often leveraging integrated logistics systems for rapid, direct-to-consumer fulfillment.

Beyond apparel, what product types are seeing increased demand?

Beyond apparel, there is increased demand for Accessories (e.g., specialized peripherals, fashion collaborations) and Collectibles, driven by the nostalgia market, scarcity pricing strategies, and the integration of digital rights management for authentication.

What is 'hot market' merchandise?

'Hot market' merchandise refers to products released immediately following a major sports event, such as a championship win or record-breaking performance, requiring extremely short lead times and rapid distribution to capitalize on immediate consumer excitement.

How do major events impact the market?

Major global events like the Olympics or the FIFA World Cup create massive, temporary surges in demand, generating significant licensing revenue for host nations and participating teams, requiring licensees to manage complex, temporary supply chain demands.

What challenges are unique to the Esports merchandise segment?

Esports merchandise challenges include the rapid obsolescence of team branding due to frequent roster changes, the need for highly specialized product categories (e.g., gaming peripherals), and catering to a globally dispersed, digitally-native consumer base.

How is customization affecting manufacturing processes?

Customization, driven by technology like DTG printing, allows manufacturers to efficiently produce personalized products (e.g., custom name and number jerseys) in smaller batches, supporting a shift from mass production to mass customization and enhancing consumer engagement.

What is the typical royalty structure in licensed sports merchandise?

Royalty structures typically range from 8% to 20% of the wholesale selling price, varying based on the strength of the IP, the product category (apparel is usually higher), and the geographic territory covered by the licensing agreement.

How is consumer data used in licensed merchandise?

Consumer data, gathered primarily through DTC channels, is used for advanced segmentation, behavioral analysis, optimizing targeted advertising campaigns, and informing product development decisions to align offerings with proven consumer preferences.

Why is the North American market dominant?

North America is dominant due to the deeply embedded cultural significance of its four major professional sports leagues, high levels of disposable income, sophisticated retail infrastructure, and aggressive league commercialization efforts that maximize fan monetization.

What are the differences between authentic and replica jerseys?

Authentic jerseys are identical to those worn by players, featuring high-quality performance materials and tailored fits, resulting in a higher price point. Replica jerseys use more affordable materials, offer a looser fit, and are designed for general fan wear.

How do licensing agreements protect brand integrity?

Agreements mandate strict quality control standards, material specifications, and design guidelines that licensees must adhere to. This ensures that every product bearing the team or league logo meets the established brand quality and protects the integrity of the intellectual property.

What is the significance of women's sports in the licensed merchandise market?

Women's sports leagues (e.g., WNBA, NWSL) are becoming a significant growth vector. Increased investment and media coverage drive higher demand for specialized, gender-appropriate merchandise and apparel, moving beyond traditional male-centric product lines.

What are the latest trends in sports collectibles?

The latest trends include the integration of digital authentication technology for physical goods, the rise of serialized trading cards, and the explosive growth and acceptance of premium digital collectibles and video game licensing assets among younger collectors.

How do supply chain disruptions affect the market?

Supply chain disruptions, such as material shortages or shipping delays, can be particularly damaging in this market because product demand is highly time-sensitive. Delays mean missing the narrow window of opportunity around major championships or player announcements.

What is AEO in the context of licensed merchandise content?

Answer Engine Optimization (AEO) ensures that online content about licensed merchandise, such as product descriptions or market analysis, is structured to directly answer user queries, improving visibility in search results and generative AI outputs by focusing on clear, concise information blocks.

Which sports category generates the most global merchandise revenue?

Globally, Football (Soccer) generates the most merchandise revenue, driven by the immense worldwide following of leagues like the English Premier League (EPL) and the UEFA Champions League, resulting in broad cross-border sales.

Why is the role of Fanatics important in market consolidation?

Fanatics is crucial due to its vertical integration strategy, controlling the entire process from manufacturing and logistics to e-commerce and retail operations, allowing them to gain massive market share, dictate speed-to-market, and manage large-scale licensing rights effectively.

How does apparel licensing differ from video game licensing?

Apparel licensing involves physical product manufacturing, inventory management, and high capital investment. Video game licensing involves digital asset rights, software integration, and recurring revenue models, focusing on digital rights management rather than physical logistics.

What is the role of social media in driving merchandise sales?

Social media platforms are vital for creating product hype, launching limited-edition drops, and facilitating influencer marketing by athletes, directly impacting consumer purchasing decisions and creating viral demand for specific licensed products.

What are the key considerations for entering the LATAM licensed merchandise market?

Key considerations include managing currency volatility, navigating complex import duties and tariffs, ensuring localized product pricing strategies, and focusing heavily on the deeply rooted cultural importance of national and regional football teams.

How are licensing businesses using data to improve product lines?

Businesses use transactional data and behavioral insights to identify underserved segments (e.g., specialized fan categories), test new product concepts rapidly, and optimize sizing, colorways, and material choices before committing to large-scale production runs.

What growth percentage is projected for the Licensed Sports Merchandise Market?

The Licensed Sports Merchandise Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, demonstrating stable, high single-digit expansion.

How do small teams or leagues access licensing opportunities?

Smaller teams or leagues typically utilize specialized licensing agencies or enter into localized agreements with regional manufacturers, often focusing on niche products or geographic exclusivity to manage risk and build brand recognition before seeking large national partners.

What is meant by the term "mass customization" in this market?

Mass customization refers to the ability to produce goods tailored to individual consumer preferences (e.g., custom prints or engravings) at high volumes and relatively low costs, often enabled by digital manufacturing technologies like advanced printing and 3D printing.

How is the market addressing the environmental impact of textile production?

The market is addressing environmental concerns by increasing the use of recycled materials, investing in supply chain transparency, and promoting sustainable manufacturing practices, driven by consumer demand for eco-friendly fan apparel.

Which company is a dominant apparel licensor in North America?

Nike and Fanatics are dominant apparel licensors in North America, with Nike often holding rights for high-end performance apparel and footwear, while Fanatics specializes in speed-to-market fan apparel and broad distribution rights across major leagues.

What security measures are used against online counterfeiting?

Security measures include deploying AI-powered bots to monitor e-commerce platforms, utilizing digital watermarking and blockchain certification, and conducting aggressive legal enforcement against unauthorized sellers to protect the licensed intellectual property.

Why is the accessories segment growing rapidly?

The accessories segment is growing rapidly because it offers lower-cost entry points for casual fans, benefits from impulse buying, and includes high-margin items like specialized tech gear, flags, and branded lifestyle products.

What influence does player endorsement have on merchandise sales?

Player endorsement is a major influence, as consumer interest is often highly concentrated around superstar athletes. High-profile endorsements or personal branding deals can dramatically increase sales for specific apparel lines and signature products.

How are offline retail stores remaining relevant in the digital age?

Offline retail remains relevant by providing immersive, authentic fan experiences, facilitating immediate purchases during game days (stadium stores), and serving as vital pickup and return points for online orders, integrating physical and digital commerce.

What are the forecast market values for 2026 and 2033?

The market is estimated at USD 30.5 billion in 2026 and is forecasted to reach USD 47.5 billion by the end of the forecast period in 2033, indicating robust expansion driven by global fan base growth.

How does league centralized licensing differ from team decentralized licensing?

League centralized licensing (like the NFL) manages IP rights across the entire league for broader consistency and efficiency, while decentralized team licensing allows individual clubs more control over specialized, local partnerships, tailoring products to specific fan needs.

Why is supply chain speed critical in this market?

Supply chain speed is critical because demand is highly temporal; maximizing sales requires products to be on shelves or delivered immediately following a victory or major announcement, avoiding lost revenue due to delayed gratification or obsolescence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager