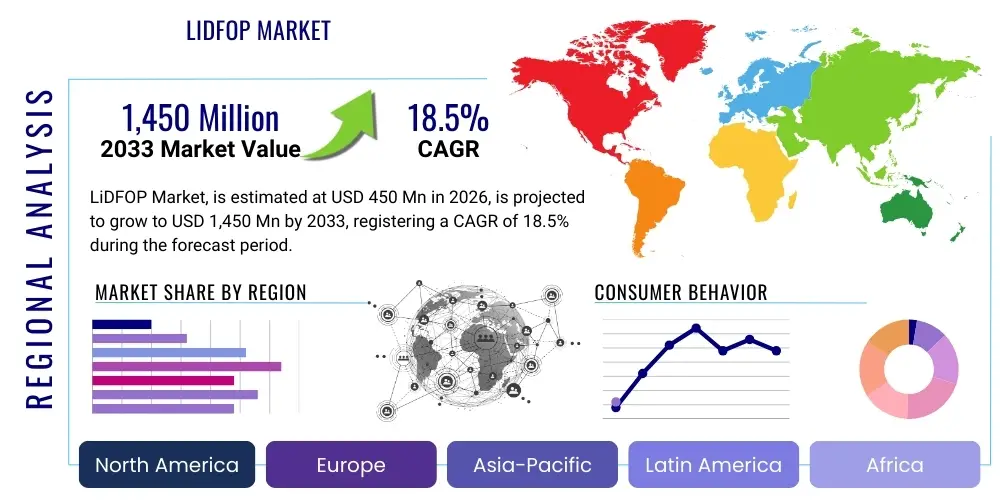

LiDFOP Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438532 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

LiDFOP Market Size

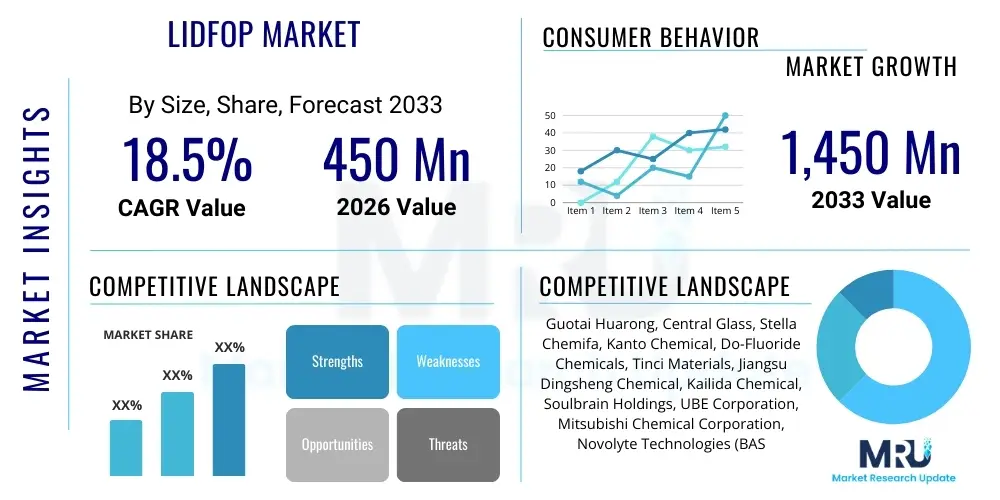

The LiDFOP Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,450 Million by the end of the forecast period in 2033. This significant growth trajectory is primarily fueled by the accelerating global transition towards electric mobility and the subsequent demand for high-performance, stable, and safer lithium-ion batteries (LIBs). LiDFOP (Lithium Difluoro(oxalato)phosphate) has emerged as a crucial functional electrolyte additive, particularly vital for stabilizing high-voltage cathode materials, which are increasingly adopted by major battery manufacturers to improve energy density and range.

The valuation reflects the increasing volume adoption of LiDFOP, driven not just by new battery production but also by material science advancements that mandate superior electrolyte stability. High-voltage systems (above 4.3V) often suffer from severe interfacial degradation and gas generation; LiDFOP effectively mitigates these challenges by forming a robust and highly protective solid-electrolyte interphase (SEI) layer on the anode and stabilizing the cathode surface. As battery capacities continue to increase, the proportional requirement for high-purity functional additives like LiDFOP scales up, cementing its status as a high-value chemical commodity within the energy storage ecosystem.

LiDFOP Market introduction

The LiDFOP market is defined by the production and distribution of Lithium Difluoro(oxalato)phosphate, a specialized lithium salt utilized predominantly as a functional additive in non-aqueous electrolytes for lithium-ion batteries. Its primary function is to enhance the electrochemical performance, safety, and cycle life of batteries, particularly those operating under high-voltage conditions (e.g., Nickel-Manganese-Cobalt (NMC) 811 or higher voltage spinel cathodes). LiDFOP works by participating in the formation of a robust and stable SEI layer on the graphite or silicon-based anode surface during the initial charge cycles. This protective layer suppresses continuous electrolyte decomposition and lithium plating, which are major factors contributing to capacity fade and thermal runaway.

The product, known for its high solubility in conventional organic carbonate solvents, offers multiple benefits, including improved compatibility with high-capacity cathode materials, enhanced thermal stability, and reduced impedance growth upon extended cycling. Major applications span the electric vehicle (EV) sector, where stringent performance and lifespan requirements necessitate premium additives, consumer electronics (smartphones, laptops) demanding high energy density, and rapidly expanding stationary grid storage systems requiring extreme longevity and safety. Key driving factors include the global push for electrification, technological shifts towards higher energy density battery chemistries, and regulatory pressures emphasizing battery safety and longevity, positioning LiDFOP as a core component in the future of energy storage technology.

LiDFOP Market Executive Summary

The LiDFOP market is characterized by robust growth, propelled by macro business trends favoring electric mobility and grid modernization. Business trends indicate significant capacity expansion among specialized fine chemical producers, particularly in East Asia, to meet the skyrocketing demand from Tier 1 battery manufacturers. Strategic collaborations between chemical suppliers and major EV OEMs are intensifying, focusing on securing supply chains for high-purity salts and optimizing synthesis routes to reduce production costs. Pricing stability is a critical factor, closely tied to the volatility of raw material inputs and the complexity of purification processes required for battery-grade material. Technological innovation is concentrating on developing derivatives of LiDFOP or optimizing its combination with other additives to create synergistic effects that further boost battery performance and reduce reliance on expensive high-nickel cathodes.

Regionally, Asia Pacific (APAC) dominates the market, serving as the global manufacturing hub for lithium-ion batteries, with China, Japan, and South Korea leading both production capacity and consumption of LiDFOP. North America and Europe are exhibiting the highest relative growth rates, driven by substantial government subsidies (e.g., Inflation Reduction Act in the US, Green Deal Industrial Plan in the EU) aimed at localizing battery and component manufacturing, thereby creating new, localized demand centers for LiDFOP. Segment trends show that the application in Electric Vehicle (EV) batteries represents the largest and fastest-growing segment, demanding the highest purity specifications. Simultaneously, there is an observable trend in grid storage applications favoring LiDFOP for its contribution to enhancing the longevity and reliability of large-scale storage installations, ensuring stable performance over decades of use.

AI Impact Analysis on LiDFOP Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the LiDFOP market frequently revolve around its potential to accelerate the discovery of novel electrolyte formulations, optimize complex chemical synthesis processes, and enhance manufacturing quality control. Common questions address whether AI can predict the optimal concentration of LiDFOP for specific cathode/anode pairs, how machine learning can shorten R&D cycles for derivative salts, and the role of digital twins in maximizing yield and minimizing defects in large-scale LiDFOP production. These inquiries reflect a strong interest in leveraging AI to overcome the material science challenges inherent in producing high-purity, structurally complex battery chemicals and integrating them efficiently into high-throughput battery lines.

AI is poised to fundamentally reshape the LiDFOP market value chain, shifting the focus from traditional empirical research to data-driven materials informatics. By analyzing vast datasets pertaining to electrochemical cycling performance, thermal properties, and structural characteristics, AI algorithms can rapidly screen potential new LiDFOP analogs or synergistic additive combinations that enhance performance beyond current limits. Furthermore, in the manufacturing domain, AI-driven process control uses real-time sensor data from reactors and purification units to dynamically adjust parameters, ensuring extremely tight purity tolerances essential for battery-grade material, thereby significantly increasing throughput and reducing waste, offering a distinct competitive advantage to early adopters.

- AI accelerates the discovery and design of next-generation electrolyte additives, reducing R&D timeframes by predicting molecular stability and electrochemical compatibility.

- Machine learning algorithms optimize the complex, multi-step synthesis pathways of LiDFOP, improving reaction yields and lowering production costs through predictive process adjustments.

- Digital twins and AI-powered monitoring systems enhance quality control in manufacturing, ensuring ultra-high purity (>99.9%) LiDFOP crucial for high-performance battery applications.

- Predictive analytics aids battery manufacturers in determining the ideal LiDFOP concentration based on specific battery chemistry (e.g., cathode loading, electrolyte composition) for maximized cycle life.

- AI modeling simulates the formation of the Solid-Electrolyte Interphase (SEI) layer influenced by LiDFOP, optimizing battery formation protocols and enhancing long-term stability.

DRO & Impact Forces Of LiDFOP Market

The LiDFOP market is fundamentally shaped by powerful synergistic forces: robust market drivers stemming from global electrification targets and technological imperatives for higher energy density; key restraints centered around cost and synthesis complexity; and significant opportunities arising from emerging battery technologies and supply chain localization efforts. The primary drivers are the exponential growth in Electric Vehicle (EV) adoption and the widespread shift among battery OEMs toward high-voltage cathode materials (e.g., >4.3V NMC), which critically rely on functional additives like LiDFOP for operational stability and safety. However, the high manufacturing cost and complicated, multi-stage synthesis and purification required to achieve battery-grade purity pose significant restraints, often leading manufacturers to rely on lower-cost, albeit less effective, alternatives in lower-performance batteries. Opportunities exist in the development of LiDFOP derivatives compatible with emerging anode materials (like silicon or lithium metal) and in its potential application within solid-state electrolyte formulations to improve interface stability and ionic conductivity.

The interplay of these forces creates a complex market dynamic. The impact force of regulatory safety standards (e.g., UN 38.3, UL 1642) pushes manufacturers toward using superior stabilizing additives, mitigating the restraint posed by high material cost in safety-critical applications like passenger EVs. Furthermore, geopolitical forces advocating for localized battery supply chains globally introduce immediate opportunities for non-Asian manufacturers to establish LiDFOP production capacity near major gigafactories in North America and Europe. This shift balances the current concentration of manufacturing and intellectual property in APAC. The overall market momentum is strongly positive, driven by the irreversible global commitment to sustainable energy and the technical necessity of LiDFOP in achieving next-generation battery performance specifications.

Segmentation Analysis

The LiDFOP market segmentation provides a granular view of demand distribution based on purity level, specific chemical function, and end-use application, which directly influences pricing and product specifications. Purity is paramount, distinguishing ultra-high purity battery-grade material, mandatory for premium EV and energy storage systems, from industrial-grade material used potentially in research or specialized non-battery chemical processes. The functional segmentation divides the market based on LiDFOP's role—either as a primary electrolyte component (though less common than LiPF6) or, more frequently, as a functional additive designed to stabilize the electrode-electrolyte interface. The application segment, the most commercially significant, highlights the dominance of the electric vehicle market, which dictates stringent performance criteria and volume requirements, followed by consumer electronics and large-scale stationary storage systems.

- By Purity Level:

- Battery Grade (>99.9%)

- Industrial/Research Grade

- By Function:

- Electrolyte Additive (Primary stabilizer for high-voltage systems)

- Primary Electrolyte Salt (Limited use)

- By Application:

- Electric Vehicles (EVs, PHEVs, HEVs)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (ESS, Grid Storage)

- Industrial and Specialized Batteries

Value Chain Analysis For LiDFOP Market

The LiDFOP value chain is highly specialized, beginning with the rigorous synthesis of precursor chemicals and culminating in integration into non-aqueous electrolytes used by battery manufacturers. The upstream segment involves the production of critical raw materials, primarily including lithium sources (e.g., Lithium Fluoride, Lithium Carbonate), phosphorus oxychloride derivatives, and various organic acids such as Oxalic Acid. The complexity arises in the multi-step chemical synthesis, where precursor materials are reacted under highly controlled, anhydrous conditions to yield crude LiDFOP. This segment is characterized by high technical barriers and strict reliance on specialized chemical expertise, which often limits the number of global suppliers capable of producing the necessary precursor intermediates efficiently.

The midstream phase focuses on purification and refining, which is arguably the most crucial step, transforming the crude product into battery-grade LiDFOP (typically >99.9% purity). Trace impurities must be meticulously removed as they severely degrade battery performance. Following purification, the material is dried, packaged under inert atmosphere due to its sensitivity to moisture, and prepared for distribution. The distribution channel is often indirect, involving specialized chemical distributors or trading houses that handle the complex logistics of high-purity, moisture-sensitive battery components. Direct sales often occur between Tier 1 LiDFOP manufacturers and large electrolyte producers, who subsequently formulate the final liquid electrolyte product that is supplied to battery cell manufacturers (the downstream end-users).

Downstream analysis centers on the electrolyte manufacturers (e.g., UBE, Soulbrain, Mitsubishi Chemical), who dissolve LiDFOP, often in synergy with the primary salt (LiPF6) and other minor additives, into solvent mixtures (e.g., EC, DMC, DEC). The ultimate end-users are the Li-ion battery cell producers (e.g., CATL, LG Energy Solution, Panasonic), who integrate the formulated electrolyte into their various battery designs for deployment across EVs, consumer devices, and grid storage. The success of LiDFOP hinges entirely on the stringent quality control standards maintained throughout the value chain, from raw material sourcing to final electrolyte formulation, ensuring consistent electrochemical performance.

LiDFOP Market Potential Customers

Potential customers for LiDFOP are predominantly situated within the advanced energy storage ecosystem, where the performance and longevity of lithium-ion batteries are paramount. The primary end-users are large-scale lithium-ion battery cell manufacturers (OEMs), who require substantial volumes of high-purity LiDFOP as a crucial electrolyte additive for their high-end product lines, especially those aimed at the electric vehicle market. These customers value suppliers capable of providing stable quality, high capacity, and a secure global supply chain. Secondary customer groups include specialized electrolyte formulation companies that purchase LiDFOP along with solvents and other salts to create tailored electrolyte blends before selling them to cell producers.

Furthermore, research institutions and pilot-scale battery developers represent a niche but important customer segment, focusing on utilizing LiDFOP to test next-generation battery chemistries, including those incorporating silicon anodes or operating at ultra-high voltages. The shift in the automotive industry toward 800V architectures and fast-charging capabilities necessitates materials like LiDFOP that can withstand higher stress, making automotive battery divisions and their suppliers the most lucrative segment for bulk purchases of battery-grade material, driving specification requirements and long-term contracts. The customer base is highly concentrated, with a small number of global battery giants consuming the majority of the world's high-purity LiDFOP output, requiring bespoke technical support and stringent quality assurance documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,450 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Guotai Huarong, Central Glass, Stella Chemifa, Kanto Chemical, Do-Fluoride Chemicals, Tinci Materials, Jiangsu Dingsheng Chemical, Kailida Chemical, Soulbrain Holdings, UBE Corporation, Mitsubishi Chemical Corporation, Novolyte Technologies (BASF), Merck KGaA, Xuancheng Liwei Chemical, Foshan Jintian Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LiDFOP Market Key Technology Landscape

The technology landscape for the LiDFOP market primarily revolves around advanced chemical synthesis, sophisticated purification methodologies, and integration techniques within complex electrolyte formulations. The synthesis of LiDFOP is technically challenging, often employing solvent-based reaction routes that require meticulous control over temperature, pressure, and atmospheric conditions (typically high-purity inert gas) to prevent hydrolysis or side reactions. Key patented technologies focus on achieving high yield while minimizing the formation of detrimental byproducts, particularly focusing on optimizing the reaction between lithium fluoride, phosphorus derivatives, and oxalic acid structures. Manufacturers continuously invest in catalyst research and process intensification to make the synthesis more cost-effective and environmentally benign, aiming to scale up production capacity efficiently to meet surging battery demand.

Crucially, the subsequent purification phase involves highly technical, proprietary solvent extraction and recrystallization methods necessary to attain the requisite battery-grade purity (>99.9%). The presence of even minor metallic impurities or water content can catastrophically compromise battery performance, making advanced analytical techniques (e.g., ICP-MS, Karl Fischer titration) and continuous process monitoring essential technological requirements. Recent advancements include developing highly specialized drying and packaging technologies to maintain the salt’s anhydrous state during storage and transport. Furthermore, R&D is heavily focused on creating synergistic electrolyte systems, where LiDFOP is combined optimally with other functional additives (like FEC or LiBOB) and high-concentration lithium salts to maximize performance across different battery chemistries and operational voltages, leveraging computational chemistry and machine learning for rapid formula optimization.

Regional Highlights

The LiDFOP market exhibits significant regional disparities, primarily driven by the geographical concentration of lithium-ion battery manufacturing capacity and the supportive regulatory environments promoting electric mobility.

- Asia Pacific (APAC): APAC is the unequivocal global leader in the LiDFOP market, accounting for the largest market share in terms of both production and consumption. Countries like China, South Korea, and Japan host the majority of the world's gigafactories and leading electrolyte producers. China, in particular, dominates the supply chain, possessing significant indigenous capacity for LiDFOP synthesis and precursor production. This dominance is sustained by favorable governmental policies, massive industrial scale, and early adoption of advanced battery technologies, making the region the epicenter for innovation and volume output.

- North America: North America is projected to be the fastest-growing region, driven by substantial domestic investments under initiatives like the Inflation Reduction Act (IRA), aimed at localizing the EV supply chain. The region is seeing rapid construction of new gigafactories by major OEMs and joint ventures, creating an immediate, localized need for high-performance battery materials, including LiDFOP. This localized demand is spurring new manufacturing investments in the US and Canada, reducing reliance on long-distance imports and focusing on high-quality, traceable materials compliant with regional content requirements.

- Europe: Europe is a critical growth region, fueled by stringent EU carbon emission targets and the rapid expansion of electric vehicle sales. The region is actively building a robust domestic battery manufacturing ecosystem (the "Battery Belt") to secure its automotive future. Demand for LiDFOP here is centered on supporting high-end European EV models that demand superior range and safety, pushing European chemical suppliers and joint venture partners to establish local synthesis and purification facilities to ensure supply resilience and meet complex regulatory and sustainability standards.

- Latin America & Middle East and Africa (MEA): These regions currently hold smaller market shares but are poised for gradual growth, particularly driven by emerging localized EV markets (especially in Brazil and Mexico) and increasing deployment of utility-scale renewable energy storage projects. While production capacity remains limited, consumption is growing as global battery manufacturers establish assembly operations or as local utilities invest heavily in grid modernization projects requiring robust, long-lasting battery chemistries where LiDFOP stabilization is highly beneficial.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LiDFOP Market.- Guotai Huarong

- Central Glass Co., Ltd.

- Stella Chemifa Corporation

- Kanto Chemical Co., Inc.

- Do-Fluoride Chemicals Co., Ltd.

- Tinci Materials Technology Co., Ltd.

- Jiangsu Dingsheng Chemical Co., Ltd.

- Kailida Chemical Co., Ltd.

- Soulbrain Holdings Co., Ltd.

- UBE Corporation

- Mitsubishi Chemical Corporation

- Novolyte Technologies (BASF SE)

- Merck KGaA

- Xuancheng Liwei Chemical Co., Ltd.

- Foshan Jintian Chemical Co., Ltd.

- Shandong Sinocera Functional Material Co., Ltd.

- Sichuan Guoli Chemical Co., Ltd.

- Arkema Group

- Dai-ichi Kogyo Seiyaku Co., Ltd. (DKS)

- Hubei Hongyuan Pharmaceutical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the LiDFOP market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is LiDFOP and why is it essential for high-voltage batteries?

LiDFOP (Lithium Difluoro(oxalato)phosphate) is a functional lithium salt additive used in lithium-ion battery electrolytes. It is essential for high-voltage systems (>4.3V) because it forms a stable Solid-Electrolyte Interphase (SEI) layer on the anode and stabilizes the cathode surface, effectively suppressing electrolyte decomposition, reducing impedance growth, and significantly enhancing battery cycle life and thermal safety.

Which application segment drives the highest demand for LiDFOP?

The Electric Vehicle (EV) application segment drives the highest demand for LiDFOP. EVs require batteries with maximum energy density, long cycle life, and inherent safety, all of which are substantially improved by the inclusion of high-purity LiDFOP in the electrolyte formulation, especially when utilizing high-nickel cathode chemistries.

What are the primary challenges restraining the widespread adoption of LiDFOP?

The primary restraints include the high production cost associated with its complex, multi-step chemical synthesis, and the stringent requirement for ultra-high purity (>99.9%). The technical difficulty in achieving battery-grade specifications and maintaining anhydrous conditions throughout handling limits the number of qualified suppliers and increases the final material cost compared to standard electrolyte additives.

How is the LiDFOP market influenced by regional manufacturing trends?

The LiDFOP market is highly influenced by regional battery manufacturing trends. Asia Pacific (APAC), particularly China, dominates both production and consumption due to its concentration of gigafactories. However, localization efforts in North America and Europe, supported by massive governmental incentives, are rapidly increasing localized demand and spurring new domestic LiDFOP production capacity in these regions.

How does LiDFOP compare to traditional electrolyte salts like LiPF6?

LiDFOP is typically used as an additive, not a primary salt like LiPF6. While LiPF6 provides high ionic conductivity, it struggles with stability at high voltages and elevated temperatures. LiDFOP excels in stabilizing the electrode interfaces and extending the life of high-voltage cells where LiPF6 alone is insufficient, making them complementary components in premium electrolyte formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager