Life Sciences and Laboratory Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435076 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Life Sciences and Laboratory Equipment Market Size

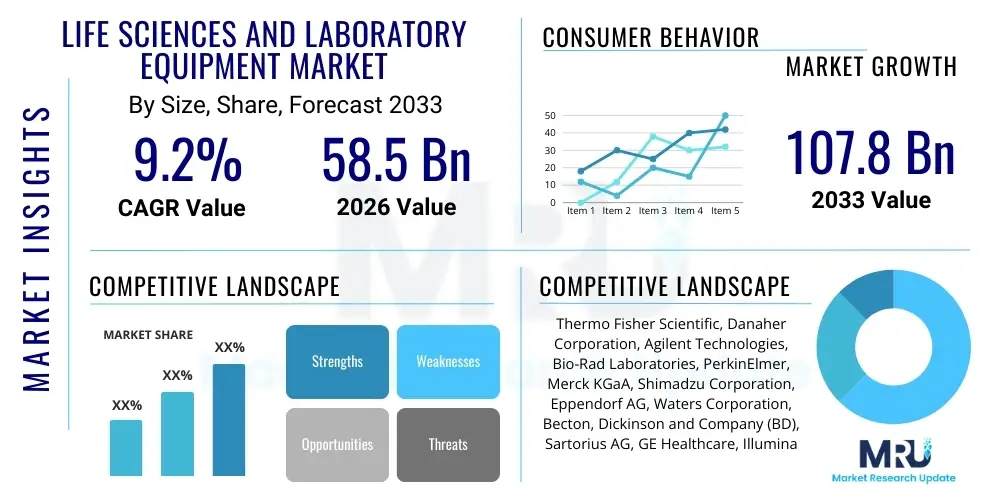

The Life Sciences and Laboratory Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at $58.5 Billion in 2026 and is projected to reach $107.8 Billion by the end of the forecast period in 2033.

Life Sciences and Laboratory Equipment Market introduction

The Life Sciences and Laboratory Equipment Market encompasses a broad spectrum of sophisticated instruments, reagents, consumables, and software utilized extensively in research, diagnostics, and pharmaceutical development across academic institutions, biotechnology firms, hospitals, and government agencies. This equipment is foundational to modern biological, chemical, and medical science, enabling highly precise measurements, sample preparation, analytical testing, and visualization necessary for breakthroughs in genomics, proteomics, drug discovery, and personalized medicine. Key product categories range from high-throughput screening systems and mass spectrometers to basic tools like centrifuges, microscopes, and pipettes, all critical for maintaining the accuracy and efficiency of complex scientific workflows. The rapid expansion of biological knowledge and the increasing global focus on health security, including pandemic preparedness and chronic disease management, serve as continuous catalysts for market innovation and adoption.

Market growth is intrinsically linked to global healthcare spending, the proliferation of biotech startups, and significant public and private investment into fundamental scientific research, particularly in areas requiring advanced genomic sequencing and cell analysis. The shift toward precision medicine necessitates specialized equipment capable of handling minute samples and generating massive amounts of actionable data, driving demand for automated laboratory systems and sophisticated bioinformatics tools that integrate seamlessly with analytical hardware. Furthermore, the stringent regulatory environment in drug development, which demands robust quality control and verifiable results, solidifies the reliance on certified, high-performance laboratory instrumentation. Equipment manufacturers are constantly innovating to improve throughput, reduce sample volumes, enhance data quality, and lower operational costs, thereby maximizing laboratory efficiency.

Major applications of life sciences and laboratory equipment span basic research (understanding disease mechanisms), clinical diagnostics (identifying biomarkers), drug discovery (target validation and compound screening), and quality assurance (biomanufacturing). The benefits derived from this market include accelerated research timelines, enhanced accuracy in medical diagnoses, reduced variability in experimental results, and the ability to scale complex biological experiments. Key driving factors include the aging global population and corresponding rise in chronic diseases, increased R&D expenditure by pharmaceutical companies focusing on biologics and novel therapies, and technological advancements such as miniaturization, automation, and the integration of artificial intelligence (AI) for complex data interpretation and experimental design optimization.

Life Sciences and Laboratory Equipment Market Executive Summary

The global Life Sciences and Laboratory Equipment Market is characterized by robust growth, driven primarily by technological convergence—specifically the blending of advanced analytical instrumentation with sophisticated computational capabilities. Business trends highlight a pronounced move toward fully integrated, multi-modal systems that offer end-to-end solutions, moving beyond standalone instruments. Strategic mergers, acquisitions, and partnerships are prevalent as market leaders seek to consolidate product portfolios, acquire specialized technological capabilities (especially in software and bioinformatics), and expand geographic footprints into high-growth emerging economies. Furthermore, sustainability and efficiency are emerging business imperatives, leading to the development of eco-friendly reagents and energy-efficient instruments, aligning with growing global environmental, social, and governance (ESG) standards required by investors and academic institutions.

Regionally, North America maintains its dominance due to high R&D budgets, the strong presence of major pharmaceutical and biotechnology companies, and extensive government funding for academic research, particularly in genomic and personalized medicine initiatives. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare infrastructure, substantial foreign investment in local biomanufacturing facilities (especially in China and India), and governmental policies prioritizing domestic drug discovery and development. Europe remains a significant market, propelled by strong academic research networks and robust funding mechanisms like the European Union’s Horizon Europe program, focusing on advanced diagnostics and therapeutic development, though facing competitive pressure from rapid innovation cycles in the US and APAC.

In terms of segmentation trends, the Instruments segment continues to hold the largest market share, specifically driven by demand for advanced mass spectrometry, high-content screening (HCS) systems, and next-generation sequencing (NGS) platforms. Within consumables and reagents, the adoption of specialized cell culture media, molecular biology kits, and high-purity chromatographic columns is soaring due to the expansion of cell and gene therapy manufacturing and bioprocessing. The end-user segments reflect high investment from the Pharmaceutical and Biotechnology sector, which constantly requires cutting-edge tools to accelerate drug pipelines, followed closely by academic and research institutes, which are crucial early adopters of foundational and exploratory technologies. The integration of advanced software, crucial for managing the voluminous data generated by modern equipment, is rapidly becoming a core component of overall laboratory infrastructure investment.

AI Impact Analysis on Life Sciences and Laboratory Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the Life Sciences and Laboratory Equipment Market consistently center on themes of automation, data interpretation, predictive maintenance, and accelerating discovery timelines. Users frequently ask how AI can optimize experimental design (reducing wasteful iterations), whether AI-driven analytical software will replace traditional human data analysis, and which specific laboratory processes are most likely to be fully automated using machine learning (ML). Furthermore, there is significant interest in understanding AI's role in processing the massive, complex datasets generated by high-throughput instruments like sequencers and mass spectrometers, and how AI integration affects the purchasing decisions for new laboratory hardware, often favoring systems that are inherently AI-compatible or feature embedded ML algorithms for real-time quality control and data validation.

The integration of AI and Machine Learning (ML) is fundamentally transforming the operational paradigm of life science laboratories, shifting the focus from manual execution and repetitive analysis to intelligent data generation and hypothesis testing. AI algorithms are now deployed to optimize instrument performance by analyzing calibration data and predicting potential hardware failures, thereby dramatically improving equipment uptime and overall laboratory efficiency—a critical factor for high-cost, high-throughput instruments. Beyond operational maintenance, AI drives advanced applications such as automated image analysis in microscopy, high-dimensional data reduction in flow cytometry, and predictive modeling for molecular interactions, allowing researchers to extract deeper biological insights from complex assays than previously possible, reducing the time required for target identification and validation.

This transformative impact of AI is fostering a new generation of laboratory equipment—smart instrumentation—that natively incorporates ML capabilities for self-optimization and autonomous operation. For instance, robotic systems guided by AI can manage complex liquid handling and plate preparation protocols, adapting parameters in real-time based on intermediate results, minimizing human error, and accelerating throughput in drug screening campaigns. The demand for AI-compatible hardware is thus acting as a significant market driver, compelling equipment manufacturers to invest heavily in developing sophisticated software interfaces and validated algorithms that not only acquire data but also analyze and visualize findings instantly, effectively making the laboratory equipment ecosystem more intelligent and responsive to research demands.

- AI optimizes experimental parameters, reducing the need for costly iterative trials and accelerating research cycles.

- Machine learning enables predictive maintenance of high-value laboratory instruments, maximizing uptime and operational longevity.

- AI-driven software processes complex high-throughput data (e.g., NGS, mass spec) faster and more accurately than manual methods.

- Enhanced automation through robotics and computer vision allows for fully autonomous sample handling and screening processes.

- Artificial intelligence supports personalized medicine by interpreting multi-omics data to identify novel biomarkers and therapeutic targets.

- AI accelerates compound design and virtual screening in drug discovery, improving the quality of leads entering the wet lab phase.

DRO & Impact Forces Of Life Sciences and Laboratory Equipment Market

The market is predominantly driven by significant increases in global R&D expenditure, particularly within the biotechnology and pharmaceutical sectors which are heavily focused on developing novel biological drugs, gene therapies, and cellular therapies that demand advanced, specialized equipment for manufacturing and quality control. Concurrently, the accelerating prevalence of chronic and infectious diseases worldwide necessitates continuous investment in enhanced diagnostic tools and rapid research capabilities to understand disease mechanisms and develop effective treatments. These factors are compounded by technological progress, including the convergence of microfluidics, nanotechnology, and advanced imaging techniques, which enable greater precision and miniaturization of laboratory processes, thereby increasing the efficiency and throughput of complex analytical tasks. The governmental and private funding influx into genomic research and precision medicine initiatives further solidifies this upward trajectory.

Restraints in the market largely revolve around the high initial capital investment required for state-of-the-art laboratory equipment, such as high-resolution mass spectrometers or fully automated robotic screening systems, making accessibility challenging for smaller research institutions or developing economies. Furthermore, the complexity associated with operating and maintaining these sophisticated instruments necessitates highly skilled personnel, leading to workforce training and retention challenges. Strict regulatory hurdles and time-consuming approval processes for new diagnostic tools and research methodologies, particularly in established markets like the US and EU, can slow down the adoption rate of cutting-edge technologies. Moreover, the cyclical nature of academic research funding can introduce volatility into certain segments of the equipment market.

Opportunities for sustained market expansion lie in the unmet demand for point-of-care diagnostics and portable laboratory systems, especially crucial in resource-limited settings, driving innovation toward smaller, cheaper, and faster analytical devices. The burgeoning field of biomanufacturing, encompassing vaccine production and regenerative medicine, requires scalable, compliant, and continuous bioprocessing equipment, representing a significant long-term growth avenue. The market can also capitalize on the transition towards digitalization and laboratory information management systems (LIMS), providing value-added services such as cloud-based data storage, AI-driven analytics, and remote troubleshooting, thereby enhancing equipment utilization and data integrity across globally dispersed research networks. The increasing focus on clinical proteomics and metabolomics also presents fresh opportunities for specialized equipment tailored for complex biomarker identification.

Segmentation Analysis

The Life Sciences and Laboratory Equipment Market is segmented across multiple dimensions—Product, Technology, End-User, and Application—each reflecting distinct demand dynamics and technological maturity levels. This granular segmentation is essential for understanding where investment is concentrated and how technological innovations are diffusing across the scientific community. The Product segmentation, encompassing Instruments, Consumables & Reagents, and Services, reveals a consistent trend where consumables and reagents, driven by repetitive purchase cycles necessary for daily lab operations, contribute substantially to recurring revenue streams, even though high-value instruments often dictate the overall capabilities of a laboratory setup. The continuous introduction of specialized kits and high-purity reagents tailored for novel assays, such as spatial transcriptomics or single-cell analysis, drives segment growth.

Technology segmentation highlights the prevalence and evolution of foundational and cutting-edge techniques. Core technologies like chromatography, spectroscopy, and basic sample preparation remain pervasive, yet the most rapid growth is observed in advanced technologies like Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), and advanced microscopy, driven by the increasing need for high-resolution, high-throughput molecular analysis. The End-User analysis clearly identifies the Pharmaceutical and Biotechnology companies as the primary revenue generators due to their massive investment capacity and the regulatory mandate for rigorous testing in drug development, followed closely by academic institutions that serve as critical drivers of foundational research and early adoption of pioneering instrumentation.

Furthermore, Application segmentation, covering areas such as Drug Discovery, Diagnostics, and Academic Research, dictates the specific functional requirements for equipment. The Drug Discovery segment demands speed, automation, and scalability (high-throughput screening), while Diagnostics emphasizes accuracy, regulatory compliance, and ease of use (clinical chemistry analyzers, immune-analyzers). Understanding these specific needs allows manufacturers to tailor their product offerings, bundling instruments with specialized software and optimized reagent protocols, maximizing their market penetration and generating synergistic value for laboratory users focused on specialized research fields like oncology, neurosciences, or infectious disease surveillance.

- Product: Instruments (Spectroscopy, Chromatography, Centrifuges, Microscopes, Liquid Handling Systems, Sequencers), Consumables & Reagents (Kits, Media, Buffers, Solvents, Antibodies), Services (Maintenance, Calibration, Validation, Software Support).

- Technology: Chromatography (HPLC, GC), Spectroscopy (Mass Spectrometry, NMR), PCR and qPCR, Flow Cytometry, Next-Generation Sequencing (NGS), Microarray, Cell Culture Techniques, Automated Liquid Handling.

- End-User: Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Hospitals and Diagnostic Laboratories, Government Agencies, Contract Research Organizations (CROs), Food and Agriculture Testing Laboratories.

- Application: Drug Discovery and Development, Clinical Diagnostics, Academic Research, Forensic Science, Bioprocessing and Manufacturing, Environmental Testing.

Value Chain Analysis For Life Sciences and Laboratory Equipment Market

The value chain for the Life Sciences and Laboratory Equipment Market is complex, spanning raw material sourcing, sophisticated manufacturing, distribution logistics, and post-sale support. The upstream analysis begins with the suppliers of highly specialized components, including precision optics, advanced sensors, microprocessors, and high-purity chemical compounds required for reagents and calibrators. A critical aspect of this upstream segment is the reliance on highly specialized component providers, often necessitating rigorous quality control and long-term supplier relationships to ensure the reliability and standardization of the final instruments. Innovation at this stage, such as the development of novel microfluidic chips or faster detection technologies, directly influences the performance capabilities of the final equipment and dictates competitive advantage.

The core manufacturing stage involves the assembly, integration, and stringent testing of complex instruments, often requiring ISO-certified environments and deep expertise in electrical, mechanical, and software engineering. Manufacturers also play a pivotal role in designing proprietary reagents and consumables that are specifically optimized for their instruments, creating a closed-system advantage that fosters customer loyalty and ensures consistent performance. This stage is heavily influenced by intellectual property protections and regulatory compliance (e.g., FDA approval for diagnostic tools), adding significant barriers to entry. The emphasis on software development for data processing and LIMS integration has now positioned software engineering as an equally critical manufacturing component alongside physical hardware production.

The downstream analysis focuses on the distribution channels, which are segmented into direct sales, utilized primarily for high-value, complex instrumentation requiring expert installation and technical training, and indirect channels (distributors, resellers), preferred for routine consumables and lower-cost equipment, especially in geographically fragmented markets. The distribution network must be capable of handling delicate and often temperature-sensitive products, maintaining cold chains for reagents. Post-sales services, including maintenance contracts, software updates, calibration, and application support, constitute a crucial revenue stream and a determinant of customer satisfaction. Direct and indirect distribution channels often overlap, with indirect partners serving as crucial localized service providers, extending the reach of multinational manufacturers into specialized research clusters and smaller diagnostic labs.

Life Sciences and Laboratory Equipment Market Potential Customers

The primary consumers and buyers of Life Sciences and Laboratory Equipment are concentrated within sectors requiring rigorous, reproducible analytical capabilities for either fundamental research or regulated clinical/manufacturing purposes. Pharmaceutical and Biotechnology companies represent the single largest customer segment, driving demand for high-throughput screening systems, large-scale bioreactors, advanced mass spectrometry platforms for compound identification, and sophisticated quality control instrumentation. Their purchasing decisions are dictated by the need to accelerate drug pipelines, comply with stringent regulatory requirements (like GMP), and scale up biomanufacturing capabilities for monoclonal antibodies and emerging cell and gene therapies, requiring massive investment in state-of-the-art integrated systems.

Academic and Government Research Institutions form the foundation of the market, serving as key purchasers of core laboratory infrastructure such as basic analytical instruments (microscopes, centrifuges), genomic sequencers, and specialized cell biology equipment for exploratory research. While their budgets are often driven by grant cycles and public funding, they are typically the earliest adopters of experimental or pioneering technologies. Their demand focuses on flexibility, precision, and the ability to handle a diverse range of research applications. The long-term relationship between manufacturers and academic centers, often involving collaborative research or donation programs, influences the future technological landscape.

Hospitals and Clinical Diagnostic Laboratories constitute a rapidly growing customer base, driven by the expansion of personalized medicine, increasing demand for fast and accurate disease diagnostics, and the need for high-volume automation in clinical chemistry and hematology. These end-users prioritize instruments certified for clinical use (IVD certified), emphasizing reliability, high throughput, and seamless integration with existing hospital information systems (HIS) and Laboratory Information Management Systems (LIMS). Other important customer segments include Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs), which purchase broad equipment portfolios to support outsourced R&D activities for pharmaceutical clients, and environmental/forensic laboratories requiring specialized analytical tools for contaminant detection and sample analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $58.5 Billion |

| Market Forecast in 2033 | $107.8 Billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, Merck KGaA, Shimadzu Corporation, Eppendorf AG, Waters Corporation, Becton, Dickinson and Company (BD), Sartorius AG, GE Healthcare, Illumina, Roche Diagnostics, Bruker Corporation, Mettler-Toledo International, QIAGEN, Sysmex Corporation, F. Hoffmann-La Roche Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Life Sciences and Laboratory Equipment Market Key Technology Landscape

The technology landscape of the Life Sciences and Laboratory Equipment Market is characterized by a relentless drive towards higher throughput, increased resolution, and enhanced automation, fundamentally shaping how scientific research and clinical diagnostics are conducted. Next-Generation Sequencing (NGS) and third-generation sequencing platforms remain pivotal, moving beyond traditional genomic sequencing into clinical applications, driving demand for faster, more accurate, and lower-cost sequencing instruments and specialized library preparation kits. Similarly, advanced mass spectrometry (MS), particularly high-resolution MS integrated with chromatography (LC-MS/MS), has become indispensable in proteomics, metabolomics, and impurity analysis in biopharma, pushing manufacturers to develop systems offering greater sensitivity and capability for intact protein analysis and complex mixture separation.

Furthermore, the market is undergoing a significant transformation fueled by digitalization, exemplified by the proliferation of automated liquid handling systems and laboratory robotics, which minimize manual intervention and increase the reliability of complex assays like high-throughput screening (HTS) and cell culture maintenance. Microfluidics technology, which allows for the precise manipulation and analysis of minute fluid volumes, is gaining traction, leading to the development of "lab-on-a-chip" devices that dramatically reduce reagent consumption, accelerate reaction times, and enable highly parallelized experimentation crucial for single-cell analysis and personalized diagnostic applications. This miniaturization trend is making sophisticated testing more portable and accessible outside traditional central laboratory settings.

Crucially, the convergence of hardware with robust bioinformatics and data management software forms the backbone of the modern laboratory ecosystem. Technologies focused on data integrity, storage, and analysis—such as advanced Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELNs), and cloud computing solutions—are now integral components of the equipment purchase decision. The rise of sophisticated imaging technologies, including high-content screening (HCS) microscopy and cryo-electron microscopy (Cryo-EM), continues to advance structural biology and cellular analysis, demanding powerful computing resources and integrated image analysis software, ensuring that future technological advancements are inextricably linked to both physical engineering precision and computational innovation.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Life Sciences and Laboratory Equipment Market, reflecting variations in R&D expenditure, regulatory frameworks, disease burden, and healthcare infrastructure maturity. North America, specifically the United States, commands the largest market share globally. This dominance is attributed to massive private and public investment in cutting-edge biotechnological research, the high concentration of major pharmaceutical and biotechnology headquarters, and favorable regulatory pathways (e.g., FDA fast-track approvals) that encourage the rapid adoption of advanced instruments like single-cell sequencers and sophisticated clinical diagnostics. The robust venture capital funding directed toward life sciences startups further ensures a continuous demand cycle for innovative laboratory tools.

The Asia Pacific (APAC) region is poised for the most rapid growth throughout the forecast period, driven primarily by expanding government initiatives aimed at modernizing healthcare systems, increasing investment in local drug manufacturing (biologics), and a rapidly growing scientific talent pool in countries like China, India, Japan, and South Korea. China, in particular, is heavily investing in state-of-the-art academic and industrial research parks, increasing its procurement of high-value analytical instruments to reduce reliance on Western drug development. The rising prevalence of chronic diseases and the need for localized production of vaccines and biosimilars are key factors accelerating the deployment of new laboratory facilities and equipment purchases across the region.

Europe represents a mature and technologically advanced market, supported by strong academic research funding (e.g., through the EU's research programs) and established pharmaceutical companies. Key markets such as Germany, the UK, and France maintain high standards for laboratory quality and drive demand for automated and high-precision equipment necessary for complex diagnostics and biomanufacturing. While facing stricter regulatory hurdles (e.g., IVDR compliance), European laboratories remain crucial adopters of innovation, particularly in areas like personalized medicine and advanced cell therapy research. Latin America and the Middle East & Africa (MEA) currently represent smaller markets but offer significant long-term growth potential as healthcare infrastructure improves, supported by increasing external investment and governmental efforts to control endemic and infectious diseases requiring better diagnostic capabilities.

- North America: Dominant market share due to high R&D funding, strong presence of biotech giants, and rapid adoption of high-throughput sequencing and automation technologies.

- Asia Pacific (APAC): Fastest growing market driven by government investment in healthcare infrastructure, expansion of domestic biomanufacturing, and growing academic research capabilities in China and India.

- Europe: Mature market characterized by robust academic research, stringent quality standards, and high demand for precision equipment for advanced diagnostics and bioprocessing in countries like Germany and the UK.

- Latin America: Emerging growth driven by increasing healthcare expenditure and modernization of clinical laboratories, focusing on accessible diagnostic equipment.

- Middle East and Africa (MEA): Growth centered on addressing infectious disease burden and diversifying economies through investment in localized pharmaceutical production and medical research centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Life Sciences and Laboratory Equipment Market.- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Merck KGaA

- Shimadzu Corporation

- Eppendorf AG

- Waters Corporation

- Becton, Dickinson and Company (BD)

- Sartorius AG

- GE Healthcare

- Illumina, Inc.

- Roche Diagnostics (A division of F. Hoffmann-La Roche Ltd.)

- Bruker Corporation

- Mettler-Toledo International Inc.

- QIAGEN N.V.

- Sysmex Corporation

- Hitachi High-Tech Corporation

- Tecan Group Ltd.

Frequently Asked Questions

Analyze common user questions about the Life Sciences and Laboratory Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological advancements are currently driving innovation in laboratory equipment?

Key technological drivers include the integration of Artificial Intelligence (AI) for advanced data analysis and predictive maintenance, the expansion of Next-Generation Sequencing (NGS) into clinical diagnostics, the miniaturization of assays via microfluidics (lab-on-a-chip), and the widespread adoption of laboratory automation and robotics to enhance throughput and reduce human error in high-content screening.

How does the shift toward personalized medicine affect the demand for life science equipment?

Personalized medicine necessitates highly precise, sensitive, and high-throughput instruments capable of analyzing complex biological samples, specifically driving exponential demand for advanced genomic sequencing platforms, mass spectrometry for biomarker identification (proteomics/metabolomics), and digital pathology equipment required for tailored therapeutic decision-making and patient stratification.

Which end-user segment contributes the most significantly to market revenue?

The Pharmaceutical and Biotechnology Companies segment generates the largest revenue share due to their massive R&D budgets allocated for drug discovery, clinical trials, and biomanufacturing scale-up. This sector requires continuous investment in cutting-edge, high-cost analytical instruments and high volumes of specialized reagents to maintain regulatory compliance and accelerate product development pipelines.

What are the primary challenges faced by the Life Sciences and Laboratory Equipment Market?

The main challenges include the prohibitively high initial capital expenditure required for sophisticated instruments, which restricts adoption in certain regions; the necessity for highly specialized technical expertise to operate and maintain complex systems; and managing stringent regulatory approval processes for new diagnostic and research methodologies, which can delay market entry.

Is the Asia Pacific (APAC) region expected to outperform other regions in market growth?

Yes, the APAC region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by substantial government initiatives to improve healthcare access, significant foreign direct investment in local biopharma manufacturing, and rapidly growing academic research output, particularly in countries like China and India, increasing the baseline demand for modern laboratory infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager