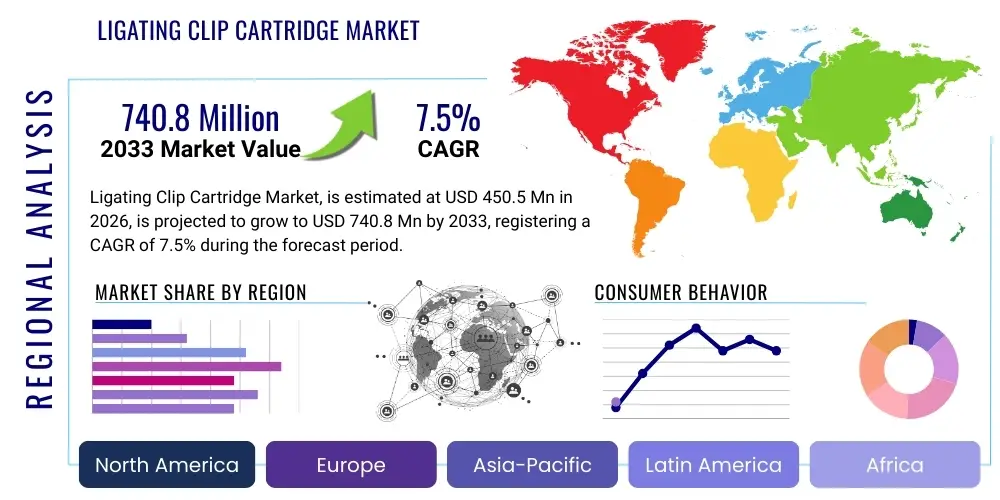

Ligating Clip Cartridge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438107 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Ligating Clip Cartridge Market Size

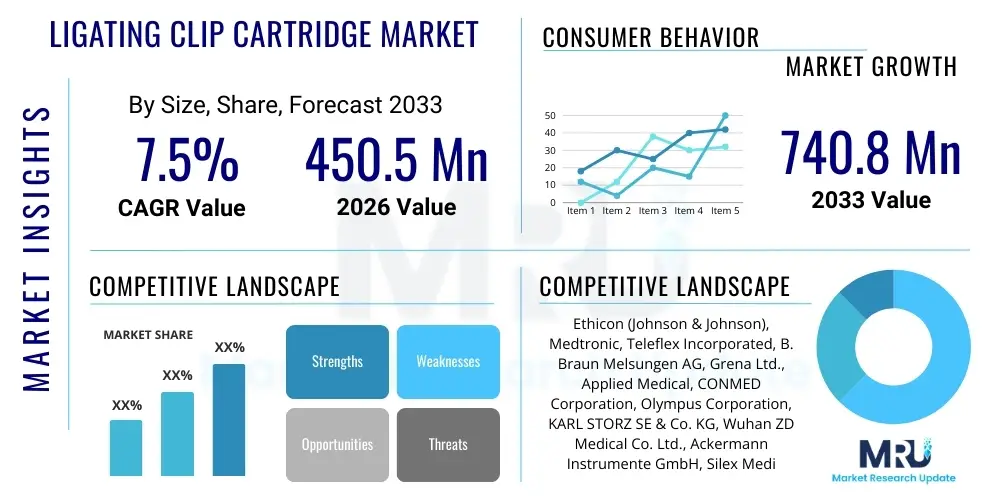

The Ligating Clip Cartridge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 740.8 Million by the end of the forecast period in 2033.

Ligating Clip Cartridge Market introduction

The Ligating Clip Cartridge Market is fundamentally driven by the escalating demand for minimally invasive surgical procedures globally, specifically laparoscopic and endoscopic interventions. Ligating clips, delivered via cartridges, are essential surgical tools used for the occlusion of vessels, ducts, or tissue structures during various surgical operations, ensuring hemostasis and secure closure. These clips offer a superior alternative to traditional suture methods in terms of speed, reliability, and reduced surgical trauma, which directly contributes to faster patient recovery times and lower incidence of post-operative complications. The cartridges themselves ensure sterile, efficient, and rapid deployment of the clips, optimizing workflow in operating rooms and supporting high-volume surgical centers.

Major applications of ligating clip cartridges span across a broad spectrum of surgical disciplines, including general surgery (such as cholecystectomy and appendectomy), gynecological procedures, urological surgeries, and cardiothoracic applications. The primary benefit derived from using pre-loaded cartridges is the enhanced safety profile during critical phases of the operation, providing consistent clip deployment force and ensuring the mechanical integrity of the occlusion. Furthermore, the advent of specialized clip materials, such as non-absorbable titanium and increasingly common bioabsorbable polymers, caters to diverse surgical needs, ranging from temporary vessel closure to permanent structural reinforcement. The choice between materials often dictates the clinical outcome and long-term patient follow-up requirements.

Key factors driving market expansion include the global aging population, which inherently requires more surgical interventions for chronic diseases, and the continuous technological advancements in laparoscopic instrumentation. The increasing prevalence of lifestyle diseases necessitating bariatric and gastrointestinal surgeries, which rely heavily on precise ligation, further propels demand. Additionally, strong institutional support for healthcare infrastructure development in emerging economies, coupled with favorable reimbursement policies in developed regions encouraging the shift towards minimally invasive techniques, cements the growth trajectory of the Ligating Clip Cartridge Market through the forecast period. Standardization of surgical practices and extensive training programs for surgeons also enhance the adoption rate of these sophisticated clip delivery systems.

Ligating Clip Cartridge Market Executive Summary

The Ligating Clip Cartridge Market exhibits robust growth, primarily fueled by significant business trends focusing on product innovation, particularly the development of advanced polymer clips that offer absorbability and reduced artifact visibility in post-operative imaging. Strategic mergers, acquisitions, and partnerships aimed at expanding global distribution networks, especially into high-growth markets like China and India, characterize current business activities. Furthermore, leading manufacturers are heavily investing in integrating smart technology into ligating systems, offering better visualization and feedback mechanisms to the surgeon, thereby enhancing procedural safety and efficiency. The shift towards disposable, pre-loaded cartridges minimizes sterilization requirements and maximizes operational throughput, reflecting a key business imperative across major healthcare systems.

Regionally, North America maintains its dominance due to high healthcare expenditure, the presence of major industry players, and the early adoption of advanced surgical technologies, including robotic-assisted surgery where specialized clips are often utilized. However, the Asia Pacific region is poised to register the highest CAGR, driven by improving access to advanced medical care, rapid expansion of hospital infrastructure, and a substantial increase in surgical volumes. Governments in APAC are increasingly prioritizing healthcare quality improvement, which translates into higher procurement rates for sophisticated surgical consumables. European markets show stable growth, influenced by stringent regulatory frameworks ensuring product quality and a high penetration rate of laparoscopic procedures across countries like Germany, France, and the UK.

Segment trends reveal that the Polymer Ligating Clips segment is accelerating faster than the traditional metal (titanium) clips segment, attributed to their bioabsorbable nature and reduced interference with subsequent diagnostic procedures like MRI or CT scans. By application, general surgery remains the largest revenue contributor, although specialties such as gynecology and urology are demonstrating impressive utilization growth. Furthermore, the segmentation by end-user highlights that hospitals, particularly high-volume surgical centers, account for the largest market share, driven by bulk purchasing agreements and the necessity of maintaining extensive inventory to support diverse surgical schedules. Ambulatory Surgical Centers (ASCs) are rapidly emerging as a critical growth segment, favored for their cost-efficiency and specialized focus on outpatient procedures.

AI Impact Analysis on Ligating Clip Cartridge Market

Common user questions regarding AI's impact on the Ligating Clip Cartridge Market generally revolve around how artificial intelligence can enhance procedural safety, optimize clip placement, and improve inventory management within surgical settings. Users seek clarity on whether AI-powered robotic systems will fundamentally change the design requirements for clip delivery mechanisms and if AI can predict the precise number and type of clips required for complex surgeries, thereby minimizing waste and cost. The key themes emerging from this analysis focus on AI’s potential role in optimizing surgical workflow, providing real-time decision support for surgeons concerning ligation site selection, and improving the logistical efficiency of consumable supply chains. Concerns often relate to the cost of integrating such systems and the need for standardized data protocols to train reliable AI models in diverse surgical environments.

The influence of AI extends beyond simple automation; it involves sophisticated data processing that can significantly refine the use of ligating clip cartridges. AI models, trained on millions of surgical videos and outcomes data, can provide predictive analytics during live procedures, suggesting the optimal clip size and placement location based on real-time tissue dynamics, vessel thickness, and surrounding anatomical structures. This analytical capability minimizes the risk of improper ligation, a major concern in minimally invasive surgery, and ensures maximal clip efficiency. Such precision reduces surgical time and enhances patient safety outcomes, directly impacting the perceived value and adoption rate of advanced clip delivery systems.

Furthermore, AI-driven solutions are crucial in managing the complex logistics inherent in surgical consumables. AI algorithms can analyze historical usage patterns, surgical schedules, and inventory levels to forecast demand for specific cartridge types with high accuracy. This proactive inventory management reduces stockouts of critical supplies and minimizes expiration waste, which is a substantial cost factor for large hospital networks. The integration of AI into supply chain platforms also enables better traceability of specific batches and faster recall procedures if required, solidifying the market's transition towards digitally optimized operational frameworks.

- AI-driven pre-operative planning optimizes clip sizing and quantity prediction, reducing surgical waste.

- Real-time visual processing via AI enhances robotic and laparoscopic systems, guiding surgeons to optimal vessel ligation points.

- AI algorithms improve surgical workflow efficiency by integrating clip deployment data with overall procedural timelines.

- Predictive maintenance for reusable ligating appliers and associated hardware is enabled by machine learning, ensuring device reliability.

- Automated inventory management systems, utilizing AI, optimize stock levels of various clip cartridge types across hospital networks.

- Enhanced surgeon training platforms use AI simulation to teach precise and efficient clip usage techniques.

- Data aggregation and analysis using AI facilitate faster post-market surveillance and performance tracking of new clip materials and designs.

DRO & Impact Forces Of Ligating Clip Cartridge Market

The Ligating Clip Cartridge Market is dynamically influenced by a synergistic combination of drivers, restraints, and opportunities. The core driver is the sustained global surge in minimally invasive surgery (MIS), which inherently requires efficient and reliable hemostasis solutions like clip cartridges, coupled with continuous technological advancements in clip materials and applicator designs that improve procedural outcomes. Simultaneously, the market faces significant restraints, primarily stemming from the high upfront cost of advanced laparoscopic instrumentation required to deploy these clips and the increasingly stringent regulatory approval processes that slow down the introduction of novel materials, particularly in developed economies. However, ample opportunities exist in the expansion into emerging geographical markets and the development of cost-effective, high-performance bioabsorbable clips, offering a balance between clinical efficacy and economic feasibility for healthcare providers worldwide.

The key driving forces include favorable reimbursement scenarios for complex laparoscopic procedures, increased awareness among both surgeons and patients regarding the benefits of MIS (such as reduced pain and quicker recovery), and the growing geriatric population requiring surgical interventions for age-related conditions. The impact force of these drivers is substantial, fostering a high demand environment where manufacturers are incentivized to enhance production capacity and innovate. Additionally, the standardization of surgical protocols across international borders encourages the widespread adoption of reliable, standardized consumable products like ligating clip cartridges, reinforcing their market penetration. The continuous push toward reducing operating room time, a critical metric for hospital efficiency, also highlights the value proposition of rapid clip deployment systems.

Conversely, significant restraining forces include intense pricing pressure resulting from the presence of numerous regional and local manufacturers offering cheaper alternatives, which challenges the profitability margins of large multinational corporations. Furthermore, the risk of clip migration or misplacement, though rare, necessitates continuous training and remains a clinical concern that some surgeons mitigate by defaulting to traditional suturing in extremely complex cases. The primary opportunity lies in capitalizing on the growing demand for specialty clips tailored for specific, complex procedures, such as vascular or thoracic surgery, and establishing strong clinical evidence demonstrating superior long-term outcomes of advanced polymer clips over metal variants. Addressing these opportunities through strategic research and development ensures sustained market leadership and value creation.

Segmentation Analysis

The Ligating Clip Cartridge Market is comprehensively segmented based on material, application, end-user, and geography, allowing for precise market analysis and strategic targeting. The segmentation by material—primarily distinguishing between titanium clips and polymer (absorbable and non-absorbable) clips—is crucial, as clinical requirements dictate the material choice, influencing pricing and adoption trends. The shift towards polymer clips represents a significant market dynamic, driven by their biocompatibility and MRI compatibility. Analyzing these segments helps stakeholders understand the changing preferences of surgical professionals and align their product portfolios accordingly to maximize relevance and market share in key therapeutic areas.

Further granularity is provided through application segmentation, which encompasses general surgery, cardiovascular surgery, urological procedures, and gynecological procedures. General surgery, particularly abdominal procedures like hernia repair and cholecystectomy, historically constitutes the dominant segment due to the high volume of procedures performed globally. However, high-value, complex surgeries in cardiovascular and urological fields often require specialized, premium clips, contributing significantly to revenue growth and technological advancement within the cartridge delivery systems. This detailed breakdown highlights specific niches where intensive marketing and product customization yield high returns.

The end-user segmentation, focusing on Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics, reflects the evolving landscape of healthcare delivery. Hospitals, being the primary location for complex and emergency surgeries, hold the majority market share. However, the rapidly expanding ASC sector offers substantial potential for market growth due to their focus on cost-effective, high-turnover outpatient procedures. Understanding the procurement processes and volume requirements of each end-user type is essential for developing tailored sales and distribution strategies that optimize market penetration across all levels of the healthcare infrastructure.

- By Material Type:

- Non-Absorbable Clips (Titanium Clips, Stainless Steel Clips)

- Absorbable Clips (Polymer Clips, Polydioxanone Clips)

- By Clip Size:

- Small Clips

- Medium Clips

- Medium-Large Clips

- Large Clips

- Extra-Large Clips

- By Application:

- General Surgery (Cholecystectomy, Appendectomy, Colorectal Surgery)

- Gynecology and Urology

- Cardiovascular Surgery

- Other Applications (Thoracic Surgery, Orthopedic Surgery)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Research and Academic Institutes

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Ligating Clip Cartridge Market

The Value Chain for the Ligating Clip Cartridge Market begins with sophisticated upstream activities focused on raw material procurement, primarily surgical-grade titanium alloys and advanced medical-grade polymers. This stage requires rigorous quality control and specialized material science expertise, as the bio-compatibility and mechanical strength of the final clip are critically dependent on the quality of these inputs. Key upstream participants include specialized chemical companies and metal alloy suppliers who must adhere to strict regulatory standards for medical device components. Manufacturing involves highly automated precision engineering for forming the clips and assembling them into the sterile, rapid-deployment cartridges, often requiring cleanroom environments to ensure product safety and sterility before distribution.

The midstream activities encompass the manufacturing, quality assurance, and packaging processes. Efficiency in manufacturing, particularly minimizing waste in polymer molding and metal stamping, is essential for profitability. Distribution channels, both direct and indirect, form the critical link to downstream users. Direct distribution is typically employed for large institutional clients and national healthcare systems, allowing manufacturers greater control over inventory management and pricing. Conversely, indirect channels involve working through established regional and national medical device distributors and wholesalers, which is vital for penetrating fragmented markets and reaching smaller clinics or ambulatory surgical centers effectively.

Downstream activities center on the end-users—hospitals and surgical facilities—and the utilization phase. Sales and marketing strategies heavily rely on clinical evidence and surgeon training to drive adoption. Post-sale activities include technical support for the reusable clip appliers and continuous collection of feedback regarding cartridge performance, deployment mechanics, and material longevity. The strong relationship between manufacturers and the surgical community is paramount, as procurement decisions are heavily influenced by surgeon preference and long-term clinical data, making targeted educational outreach a critical component of the downstream value chain.

Ligating Clip Cartridge Market Potential Customers

The primary end-users and buyers of ligating clip cartridges are institutional healthcare providers engaged in high-volume surgical procedures, particularly those specializing in minimally invasive techniques across various disciplines. The largest segment of potential customers includes large private and public multi-specialty hospitals that maintain extensive operating rooms and require a continuous, high-volume supply of diverse clip sizes and materials to support their complex surgical calendars. These institutions prioritize reliability, sterilization assurance, and integration capability with existing laparoscopic equipment, making them the cornerstone buyers for premium cartridge systems and long-term supply contracts.

A rapidly growing segment of potential customers comprises Ambulatory Surgical Centers (ASCs) and specialized outpatient surgical clinics. These facilities, focusing predominantly on elective and routine minimally invasive procedures, seek cost-effective yet high-quality consumable solutions. ASCs are increasingly becoming preferred sites for procedures like cholecystectomy and hernia repair, driving demand for disposable, easy-to-use ligating clip cartridges that minimize turnaround time and operational costs. For manufacturers, tailoring product bundles and pricing models specifically to the volume and logistical constraints of ASCs presents a significant growth opportunity.

Furthermore, academic and research hospitals represent critical potential customers, not only due to their high patient volume but also because they serve as key opinion leaders (KOLs) and early adopters of innovative clip technologies. These institutions often engage in clinical trials and comparison studies, and their purchasing decisions influence smaller regional hospitals. Targeting these academic centers with cutting-edge products, such as next-generation bioabsorbable polymer clips and intelligent delivery systems, is crucial for establishing long-term market credibility and accelerating the diffusion of new technologies across the surgical community globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 740.8 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ethicon (Johnson & Johnson), Medtronic, Teleflex Incorporated, B. Braun Melsungen AG, Grena Ltd., Applied Medical, CONMED Corporation, Olympus Corporation, KARL STORZ SE & Co. KG, Wuhan ZD Medical Co. Ltd., Ackermann Instrumente GmbH, Silex Medical Inc., Kangji Medical Holdings Limited, Purple Surgical, Laks Surgical Private Limited, KLS Martin Group, Genicon, Inc., J&J Medical Devices, Hangzhou Kangji Medical Instrument Co., Ltd., Changzhou Haida Medical Equipment Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ligating Clip Cartridge Market Key Technology Landscape

The technology landscape for the Ligating Clip Cartridge Market is defined by continuous innovation focused on improving clip security, ease of deployment, and biological compatibility. A primary technological focus involves the evolution of clip material from traditional titanium—known for its strength and biocompatibility—to advanced absorbable polymers (such as PGLA, polydioxanone, and polyglycolide). This shift is critical as polymer clips offer temporary ligation that dissolves over time, eliminating the long-term presence of foreign bodies and allowing for subsequent procedures like MRI without artifact interference. Manufacturers are investing heavily in polymer chemistry research to ensure these bioabsorbable clips maintain sufficient tensile strength during the critical healing period while demonstrating predictable degradation profiles.

Another significant technological advancement centers on the design of the clip applier and the cartridge interface. Modern cartridges incorporate innovative loading mechanisms that facilitate rapid, one-handed clip delivery, which is essential in time-critical surgical scenarios. Key innovations include multi-fire appliers that hold multiple cartridges or incorporate automatic clip advancement mechanisms, enhancing surgical efficiency significantly. Furthermore, specialized clip geometries, such as non-slip internal serrations or chevron shapes, are being developed to improve tissue grasping and prevent clip slippage under high pressure, a common complication in vascular ligation. These precision engineering efforts are critical for maintaining the high standards required for patient safety in minimally invasive surgery.

Digital integration and connectivity represent the emerging frontier in clip cartridge technology. Some high-end surgical systems are incorporating smart cartridges equipped with RFID tags or optical readers that automatically communicate critical information (such as clip size, remaining count, and expiration date) to the robotic or laparoscopic console. This technology reduces human error in inventory selection and ensures optimal clip utilization during surgery. Future advancements are expected to integrate AI feedback loops directly into the applier mechanism, potentially adjusting the deployment force based on real-time tissue resistance detected by sensors, thereby optimizing the ligation security and minimizing the risk of tissue trauma during deployment.

Regional Highlights

- North America (U.S., Canada): North America is characterized by high market maturity, high per capita healthcare spending, and rapid adoption of robotic surgery systems, which frequently utilize specialized ligating clips. The US drives the majority of the regional revenue due to the presence of key market players, extensive reimbursement coverage for minimally invasive procedures, and a high volume of complex surgeries. The emphasis on quick patient turnover and technological superiority ensures continuous demand for premium, multi-fire cartridge systems and advanced polymer clips.

- Europe (Germany, U.K., France): Europe represents a stable market driven by robust public healthcare systems and stringent regulatory standards (MDR compliance), fostering trust in established, high-quality brands. Germany and the UK are leading contributors, showing high rates of laparoscopic procedures across general, gynecological, and urological surgery. Market growth is sustained by an aging population and government initiatives promoting minimally invasive techniques to reduce healthcare burdens and optimize recovery times.

- Asia Pacific (China, Japan, India): APAC is projected to be the fastest-growing region, fueled by rapidly improving healthcare infrastructure investment, burgeoning medical tourism, and a large, untapped patient pool. China and India, in particular, are experiencing massive surgical volume growth. While pricing sensitivity remains a factor, increasing patient disposable income and the adoption of Western surgical techniques are driving the demand for both cost-effective and premium ligating clip cartridges, favoring local manufacturing growth and strategic partnerships.

- Latin America (Brazil, Argentina): The Latin American market exhibits moderate growth, influenced by economic volatility but supported by necessary advancements in medical infrastructure, particularly in urban centers like Brazil and Mexico. The adoption of laparoscopic procedures is increasing, but market penetration is constrained by limited access to advanced equipment in rural areas and currency fluctuations impacting import costs for high-end cartridges. Local manufacturers are gaining prominence by offering competitive pricing structures.

- Middle East and Africa (MEA): MEA presents a growing, yet highly fragmented market. The GCC countries (Saudi Arabia, UAE) drive regional growth due to significant governmental investment in world-class healthcare facilities, resulting in high demand for the latest surgical consumables. However, market development in Africa is slower, constrained by economic challenges and inadequate healthcare infrastructure, though surgical volumes are gradually increasing, generating demand primarily for essential, reliable, and cost-effective titanium clip cartridges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ligating Clip Cartridge Market.- Ethicon (Johnson & Johnson)

- Medtronic

- Teleflex Incorporated

- B. Braun Melsungen AG

- Grena Ltd.

- Applied Medical

- CONMED Corporation

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Wuhan ZD Medical Co. Ltd.

- Ackermann Instrumente GmbH

- Silex Medical Inc.

- Kangji Medical Holdings Limited

- Purple Surgical

- Laks Surgical Private Limited

- KLS Martin Group

- Genicon, Inc.

- J&J Medical Devices

- Hangzhou Kangji Medical Instrument Co., Ltd.

- Changzhou Haida Medical Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ligating Clip Cartridge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Ligating Clip Cartridge Market?

The primary driver is the accelerating global shift towards Minimally Invasive Surgery (MIS), particularly laparoscopic procedures, which necessitate reliable, rapid hemostasis provided by standardized ligating clip cartridges to ensure patient safety and efficiency.

How do polymer ligating clips differ from traditional titanium clips, and which material segment is growing faster?

Polymer clips are typically bioabsorbable, meaning they dissolve in the body over time, reducing foreign body reaction and eliminating MRI/CT artifacts, whereas titanium clips are permanent. The polymer (absorbable) clip segment is currently demonstrating a faster growth rate due to these clinical advantages.

Which geographical region is expected to show the highest Compound Annual Growth Rate (CAGR) for ligating clip cartridges?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR, driven by significant expansion in healthcare infrastructure, increasing surgical volumes, and rising adoption of advanced surgical technologies across major economies like China and India.

What role does Artificial Intelligence (AI) play in the future of ligating clip cartridge deployment?

AI is set to enhance deployment by integrating with robotic surgery to provide real-time guidance for optimal clip placement, improve pre-operative planning for precise clip size selection, and optimize hospital inventory management for cartridges, minimizing waste and errors.

What are the main segments used to analyze the Ligating Clip Cartridge Market?

The market is primarily segmented by Material Type (Absorbable vs. Non-Absorbable), Application (General Surgery, Urology, Cardiology), Clip Size (Small, Medium, Large), and End-User (Hospitals, Ambulatory Surgical Centers), reflecting diverse operational requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager