Light Industrial Conveyor Belts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433941 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Light Industrial Conveyor Belts Market Size

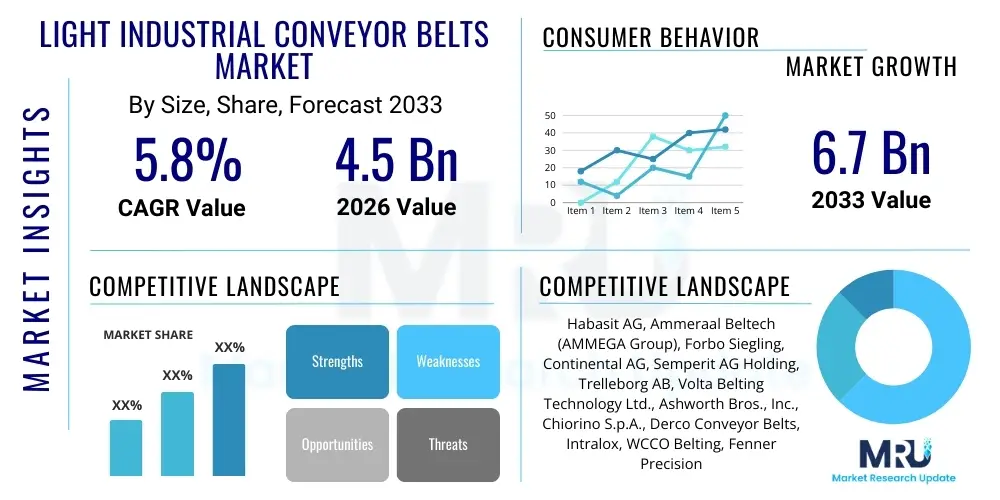

The Light Industrial Conveyor Belts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Light Industrial Conveyor Belts Market introduction

The Light Industrial Conveyor Belts Market encompasses a crucial segment of the material handling industry, supplying specialized belts primarily used in applications requiring lightweight, non-abrasive, or moderately paced transport of goods. These systems are foundational components in sectors such as food processing, packaging, pharmaceuticals, postal and parcel logistics, and retail distribution centers. Unlike heavy-duty belts designed for mining or bulk construction materials, light industrial belts prioritize precision, hygiene, low energy consumption, and high flexibility. Common materials utilized include Polyurethane (PU), Polyvinyl Chloride (PVC), rubber, and various specialized fabrics, chosen based on resistance requirements (oil, chemical, temperature) and sanitary standards. The increasing global focus on automation and efficient warehouse operations is fundamentally driving the demand for these tailored conveyor solutions, particularly as e-commerce fulfillment centers rapidly scale operations worldwide, demanding faster, more reliable, and lower-maintenance material transfer capabilities. The adaptability of these belts to incline, decline, and curved transfers makes them indispensable across a variety of complex manufacturing and sorting workflows.

A key attribute of light industrial conveyor belts is their ability to integrate seamlessly with sophisticated sorting and scanning technologies, enhancing operational throughput and inventory accuracy. These belts are often engineered for quick installation and minimal downtime, appealing significantly to industries that operate continuous production cycles. Furthermore, the rising trend toward modular material handling systems favors light conveyor belt designs that can be easily reconfigured or replaced to meet changing production demands. The operational benefits extend beyond simple transportation; they contribute significantly to workplace safety by reducing manual handling and lifting tasks, thereby minimizing injury rates and associated costs. Regulatory standards, particularly those concerning food contact (FDA/EU regulations) and cleanroom environments (pharmaceuticals), necessitate the use of specific high-grade materials (e.g., hygienic thermoplastic elastomers), ensuring that material science advancements remain a pivotal driver in market differentiation and growth.

Light Industrial Conveyor Belts Market Executive Summary

The Light Industrial Conveyor Belts Market is poised for robust expansion, primarily fueled by the exponential growth in the e-commerce sector and the corresponding need for automated logistics and sorting facilities. Business trends indicate a strong shift towards intelligent conveying systems that incorporate sensors, IoT capabilities, and predictive maintenance features, allowing end-users to maximize uptime and operational efficiency. Manufacturers are increasingly focusing on developing sustainable and hygienic belting solutions, particularly oil-resistant and FDA-approved materials, to meet stringent industry standards in food and beverage processing. The competitive landscape is characterized by moderate consolidation, with major players investing heavily in R&D to enhance belt longevity, reduce friction losses, and offer customized tracking and guidance systems suitable for high-speed applications. The drive for lower total cost of ownership (TCO) is prompting the adoption of energy-efficient motor systems and lighter, yet more durable, belt materials.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, propelled by massive industrialization, the proliferation of manufacturing hubs (especially in China and India), and aggressive investments in modernizing supply chain infrastructure across Southeast Asia. North America and Europe, while mature, are witnessing significant replacement demand driven by automation upgrades in existing facilities and stringent energy efficiency mandates, pushing adoption of advanced, low-friction synthetic belts. Segment trends reveal that PVC and PU belts continue to dominate the market due to their cost-effectiveness and versatility, but specialized materials like high-performance elastomeric and modular plastic belts are gaining traction in demanding environments such as deep-freeze storage and high-temperature packaging lines. The logistics and warehousing segment remains the largest consumer, but the pharmaceutical and cleanroom sector represents the fastest-growing niche, requiring ultra-precise and contaminant-free conveying solutions.

AI Impact Analysis on Light Industrial Conveyor Belts Market

User inquiries regarding AI's influence typically revolve around predictive maintenance capabilities, optimal routing algorithms, and quality control automation within material handling systems. Users are keen to understand how AI-driven sensors can forecast belt failure, calculate remaining useful life, and schedule preventative interventions, thereby minimizing expensive operational downtime. Furthermore, questions frequently arise about AI integration into complex sorting systems, optimizing the speed and trajectory of light items on the belt to maximize throughput during peak demand periods (e.g., holiday seasons in e-commerce). The prevailing expectation is that AI will move the market beyond simple mechanical replacement cycles to a data-informed asset management approach, reducing labor dependency for routine inspections and enhancing overall system reliability and energy consumption profiles through dynamic speed adjustments based on real-time load assessment.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration, temperature, and current draw data from motors and bearings to anticipate belt failure or tracking issues before they result in downtime.

- Optimized Throughput: AI-powered sorting systems dynamically adjust belt speed and item spacing to maximize conveyance efficiency based on variable load and destination requirements.

- Automated Quality Control: High-speed camera systems combined with machine vision AI detect minute defects, improper positioning, or foreign objects on conveyed items, significantly improving quality assurance in food and pharma industries.

- Energy Efficiency Management: AI systems optimize motor power consumption by dynamically adjusting speeds based on real-time inventory flow and system friction measurements.

- Robotic Integration Enhancement: AI improves the synchronization between robotic pick-and-place units and the conveyor belt movement, ensuring precise item transfer and placement.

- Design Optimization: Machine learning assists in simulating various material and geometry configurations to design belts with superior wear resistance and lower friction characteristics.

DRO & Impact Forces Of Light Industrial Conveyor Belts Market

The Light Industrial Conveyor Belts Market is shaped by powerful driving forces centered on rapid automation adoption, especially within the e-commerce and logistics sectors, which demand high-speed, reliable, and space-efficient handling solutions. Simultaneously, stringent regulatory requirements, particularly regarding hygiene and food safety (mandating HACCP compliance), act as significant market drivers for specialized, easy-to-clean belts. However, the market faces restraints, primarily the high initial capital investment required for installing complex automated conveyor systems and the persistent volatility in raw material costs (e.g., petrochemical derivatives used in PVC and PU), which affects profitability and pricing stability. Opportunities abound in the development of modular and IoT-enabled systems, offering manufacturers the chance to provide scalable solutions and recurring revenue through maintenance and data services. Impact forces, such as the global push for sustainable manufacturing, are compelling companies to innovate with biodegradable or recyclable belt materials, fundamentally altering product lifecycles and material procurement strategies.

Segmentation Analysis

Segmentation analysis of the Light Industrial Conveyor Belts Market provides crucial insights into differentiated demand patterns based on material type, product structure, end-use application, and specific regional requirements. The dominance of segments like PVC and PU is attributable to their favorable balance of cost, flexibility, and chemical resistance, making them suitable for the majority of packaging and warehouse applications. Conversely, the high growth rate observed in specialized elastomer and silicone belts reflects the increasing complexity and stringent standards within niche markets, notably pharmaceuticals and high-temperature processing. Understanding these segment dynamics is vital for market players to tailor their product portfolios—for instance, focusing on standardized flat belts for general logistics versus specialized curved or troughed belts for complex production lines, thereby optimizing manufacturing efforts and distribution channels.

- By Material Type:

- Polyvinyl Chloride (PVC)

- Polyurethane (PU)

- Rubber

- Elastomer & Silicone

- Fabric/Textile

- By Product Type:

- Flat Belts

- Modular Belts (Plastic/Metal)

- Cleated Belts

- Curved Belts

- Timing Belts

- By Application/End-Use Industry:

- Food Processing and Packaging

- Pharmaceuticals and Healthcare

- E-commerce, Logistics, and Warehouse Automation

- Automotive (Light Assembly)

- Textile and Printing

- Tobacco and Agriculture

Value Chain Analysis For Light Industrial Conveyor Belts Market

The value chain for light industrial conveyor belts begins with intensive upstream activities focused on securing raw materials, primarily polymers (PVC, PU resins), synthetic fibers (polyester, nylon), and specialized chemicals and additives crucial for enhancing properties like friction, heat resistance, and anti-static capability. Supplier negotiations and long-term contracts for bulk polymer procurement are critical, as raw material price volatility directly impacts manufacturing costs and profitability. Manufacturers must possess advanced compounding and fabric treatment capabilities to produce high-quality base materials that meet specific application standards (e.g., non-toxic for food contact). Investment in continuous vulcanization and sophisticated extrusion technology represents a significant portion of capital expenditure in the upstream segment. Strategic alliances with chemical suppliers to develop next-generation, sustainable, or biodegradable polymer compounds offer a competitive advantage and help mitigate dependency on traditional petrochemical sources.

The manufacturing and midstream segment involves the transformation of raw materials into finished conveyor belts, including processes such as weaving, coating, calendaring, and splicing. High-precision machinery is required for achieving uniform thickness, tensile strength, and precise tracking capabilities, particularly for high-speed automated systems. Quality control at this stage is paramount, involving rigorous testing for abrasion resistance, chemical stability, and dimensional accuracy. Distribution channels are highly fragmented, relying heavily on specialized industrial distributors and system integrators. Direct sales are typically reserved for large, customized projects or Original Equipment Manufacturers (OEMs) who integrate belts into their machinery (e.g., packaging machines). Indirect distribution leverages regional dealers who provide localized inventory, cutting, splicing, and installation services, which are critical for maintaining customer relationships and providing rapid maintenance support, minimizing end-user operational downtime.

Downstream activities involve the installation, maintenance, and eventual replacement of the conveyor belts at the end-user location. System integrators play a vital role, often bundling the belt purchase with the entire conveyor frame, motor drives, and control systems. Post-sale services, including 24/7 technical support, on-site splicing, and belt cleaning solutions, are essential components of the downstream offering and represent a recurring revenue stream. The trend towards predictive maintenance, often supported by IoT sensors embedded near the belt line, is transforming the service segment, allowing providers to proactively manage asset health. Customer feedback loops at this stage are crucial for informing upstream R&D efforts, ensuring that new products address persistent issues such as edge wear, belt mistracking, and hygienic cleaning challenges in challenging environments like deep-freeze logistics or wet food processing facilities.

Light Industrial Conveyor Belts Market Potential Customers

The primary customer base for light industrial conveyor belts is broadly diversified across all sectors involved in manufacturing, sorting, packaging, and distribution of consumer goods. High-volume end-users include third-party logistics (3PL) providers and large-scale e-commerce giants, such as Amazon, Alibaba, and regional fulfillment centers, which rely on thousands of meters of high-speed belts for sorting parcels and packages efficiently. The rapid expansion of quick commerce (Q-commerce) platforms and micro-fulfillment centers within urban areas is creating a strong, decentralized demand for compact, flexible conveying solutions. Furthermore, the global food and beverage industry represents a constantly evolving customer segment, requiring frequent upgrades to meet increasingly strict food contact safety standards and to accommodate new processing methods, such as flash freezing or high-pressure pasteurization, which necessitate specialized belt material resistance.

Other significant buyers include Original Equipment Manufacturers (OEMs) of packaging machinery (e.g., shrink wrappers, carton sealers), who incorporate these belts directly into their equipment sold globally. The pharmaceutical and medical device manufacturing sector represents a high-value, though smaller, customer segment, demanding sterile, non-shedding belts suitable for cleanroom environments and precise indexing applications. This segment prioritizes material traceability and compliance over immediate cost savings. The overarching characteristic among all potential customers is the drive towards automation; whether it is a small manufacturing facility installing its first automated line or a multinational corporation upgrading its global distribution network, the need for reliable, low-maintenance material handling infrastructure ensures sustained demand for light industrial conveyor belts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Habasit AG, Ammeraal Beltech (AMMEGA Group), Forbo Siegling, Continental AG, Semperit AG Holding, Trelleborg AB, Volta Belting Technology Ltd., Ashworth Bros., Inc., Chiorino S.p.A., Derco Conveyor Belts, Intralox, WCCO Belting, Fenner Precision, Esbelt S.A., Belt Power, Sparks Belting Company, Fives Group, Nitta Corporation, Rexnord Corporation, Miracon Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Light Industrial Conveyor Belts Market Key Technology Landscape

The technological landscape of the Light Industrial Conveyor Belts Market is rapidly evolving, driven by the need for enhanced durability, reduced maintenance, and seamless integration with smart factory environments. A pivotal technology advancement is the proliferation of thermoplastic vulcanizates (TPVs) and high-performance elastomers, which offer superior chemical and temperature resistance compared to traditional PVC or rubber, extending belt life and expanding application potential in harsh or sanitary washdown environments. Furthermore, proprietary manufacturing techniques focused on reducing belt weight while maintaining tensile strength—through advanced weaving patterns or multi-layer construction—are leading to significant reductions in energy consumption by lowering the required drive power. Another critical technological focus is on the development of low-friction coatings and specialized surface textures that minimize static build-up and improve product grip, optimizing delicate handling operations in electronics assembly and pharmaceutical packaging. These material science breakthroughs are essential for meeting the performance demands of modern, high-speed sorting and merging systems.

Integration of Industry 4.0 principles, specifically through the use of embedded sensors and RFID technology within the belt or along the conveyor structure, represents a significant technological leap. These smart systems enable real-time monitoring of belt tracking, tension, temperature, and wear patterns, facilitating condition-based monitoring rather than time-based preventive maintenance. This proactive approach significantly reduces unplanned downtime, a major cost factor for high-throughput operations like e-commerce logistics. Moreover, the design methodology is shifting towards modular plastic belt (MPB) systems, which use interlocked plastic modules (often HDPE or PP) that can be individually replaced or reconfigured. This modularity not only simplifies maintenance but also allows for flexible layouts, including tight radius turns and spirals, which are essential for maximizing floor space utilization in urban logistics centers. The focus on hygienic design is also paramount, with new belts featuring simplified hinge designs and antimicrobial additives to facilitate quick, thorough cleaning and reduce bacterial entrapment, crucial for FDA-regulated environments.

Further technological differentiation occurs in the drive and control systems associated with light conveying, moving away from centralized, large motor setups toward decentralized, highly efficient servo drives (often synchronous reluctance motors) located directly near the belt segment. This decentralization allows for precise control over individual zones, enabling dynamic speed matching and accumulation capabilities critical for buffering and merging diverse product flows without causing jams or product damage. The rise of automation requires highly specialized tracking technologies, including precision v-guides and positive drive mechanisms, to ensure zero slippage and exact positioning—a requirement for precise robotic loading and unloading applications. Manufacturers are continuously investing in digital twin technology to simulate belt performance under various operating conditions (load, speed, incline) before deployment, ensuring optimal system design and minimizing costly on-site adjustments, thereby enhancing project delivery speed and reliability for complex material handling projects.

Regional Highlights

The Light Industrial Conveyor Belts Market displays distinct regional growth profiles influenced by varying levels of industrial maturity, logistics infrastructure investment, and regulatory stringency. Asia Pacific (APAC) currently dominates the market both in terms of volume and growth rate, primarily driven by massive government and private sector investment in manufacturing capacity expansion, particularly in Vietnam, Indonesia, and India. China remains the single largest consumer due to its unparalleled scale in electronics manufacturing, textile production, and, critically, its domestic e-commerce volume, which necessitates constant construction and upgrading of automated distribution centers. The rising labor costs in traditionally low-cost manufacturing regions are accelerating the adoption of automated conveying systems, ensuring continued robust demand for light industrial belts across the entire continent.

North America and Europe represent mature yet highly demanding markets characterized by high labor costs, which mandate continuous automation and technological upgrades to maintain global competitiveness. Demand in these regions is less about greenfield expansion and more focused on the replacement and retrofitting of existing systems with newer, high-efficiency, and smarter belts that offer lower TCO. European regulations regarding energy consumption (e.g., Ecodesign directive) and workplace safety are pushing the adoption of advanced materials that require less power and offer superior fire retardancy. The push towards sophisticated warehouse management systems in the U.S. and Canada is also driving demand for specialized belts compatible with automated storage and retrieval systems (AS/RS) and complex parcel sorting mechanisms, demanding extreme precision and durability.

Latin America and the Middle East & Africa (MEA) are emerging markets exhibiting high potential. Latin American demand is concentrated in the burgeoning food processing and agricultural sectors, requiring rugged yet hygienic belts. In MEA, particularly the GCC countries, significant investments in logistics hubs, airport expansion, and pharmaceutical manufacturing are driving demand. However, market adoption in MEA can be volatile, often tied to large-scale infrastructure projects. These regions increasingly rely on imported technology and systems, making distributor partnerships and localized service capabilities crucial for market entry and sustained success. The high ambient temperatures in parts of the MEA region also necessitate specialized heat-resistant belt materials, creating unique product specifications.

- Asia Pacific (APAC): Highest growth rate, fueled by e-commerce boom in China and India, massive investments in manufacturing automation, and expansion of automotive light assembly lines across Southeast Asia.

- North America: Strong demand driven by the modernization of logistics centers, pharmaceutical compliance upgrades, and replacement cycles focused on adopting energy-efficient and predictive maintenance-enabled belt systems.

- Europe: Stable growth underpinned by stringent regulatory standards for hygiene (food) and efficiency, resulting in high adoption rates of advanced modular and hygienic PU belts for specialized applications.

- Latin America (LATAM): Growth concentrated in agricultural processing (e.g., fruit sorting) and packaging industries; market highly sensitive to commodity prices and currency fluctuations.

- Middle East & Africa (MEA): Emerging market driven by government diversification efforts, leading to large-scale infrastructure projects in logistics, ports, and localized food manufacturing capacity building.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Light Industrial Conveyor Belts Market.- Habasit AG

- Ammeraal Beltech (AMMEGA Group)

- Forbo Siegling

- Continental AG

- Semperit AG Holding

- Trelleborg AB

- Volta Belting Technology Ltd.

- Ashworth Bros., Inc.

- Chiorino S.p.A.

- Derco Conveyor Belts

- Intralox

- WCCO Belting

- Fenner Precision

- Esbelt S.A.

- Belt Power

- Sparks Belting Company

- Fives Group

- Nitta Corporation

- Rexnord Corporation

- Miracon Corporation

Frequently Asked Questions

Analyze common user questions about the Light Industrial Conveyor Belts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the current growth of the Light Industrial Conveyor Belts Market?

The market growth is primarily driven by the unprecedented expansion of global e-commerce logistics, necessitating advanced, high-speed material handling systems for parcel sorting, and the increasing worldwide adoption of automation across food processing, packaging, and pharmaceutical sectors to mitigate rising labor costs and ensure hygiene compliance.

How are strict hygiene regulations impacting the demand for light industrial belts?

Stringent hygiene regulations (e.g., FDA, HACCP) are significantly boosting demand for specialized, non-porous, and easily cleanable belt materials, such as monolithic Polyurethane (PU) belts and modular plastic belts, which reduce bacterial entrapment and withstand intensive chemical washdown processes required in sanitary environments.

Which segment—PVC or PU—is showing faster growth, and why?

While PVC maintains volume dominance due to its low cost and versatility, Polyurethane (PU) belts are exhibiting faster growth, particularly in high-demand niche applications like food contact and deep-freeze logistics, owing to their superior chemical resistance, higher abrasion resistance, and monolithic (homogeneous) structure, which offers enhanced hygiene.

What role does Industry 4.0 play in the evolution of light conveyor belt technology?

Industry 4.0 integration involves embedding IoT sensors and utilizing AI-driven data analytics for predictive maintenance, real-time tracking, and optimal energy management. This transition allows end-users to maximize operational uptime and shift from reactive repairs to condition-based, proactive asset management, thereby reducing total cost of ownership.

What is the key technological restraint preventing faster adoption of specialized belts?

The primary restraint is the higher initial capital expenditure and complexity associated with specialized conveying systems, such as modular plastic belts or advanced timing belts, compared to traditional flat belts, alongside persistent volatility in the cost of high-grade polymer raw materials required for manufacturing these advanced, specialty products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager