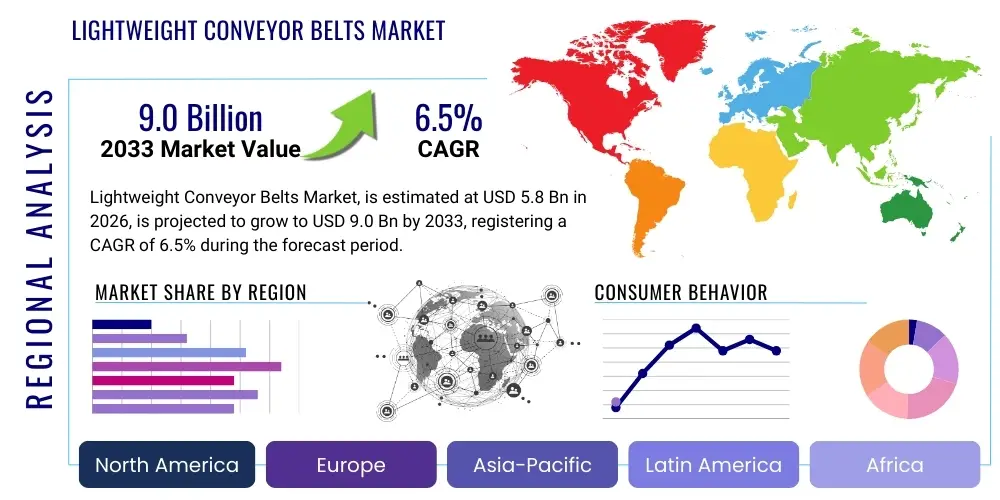

Lightweight Conveyor Belts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437300 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Lightweight Conveyor Belts Market Size

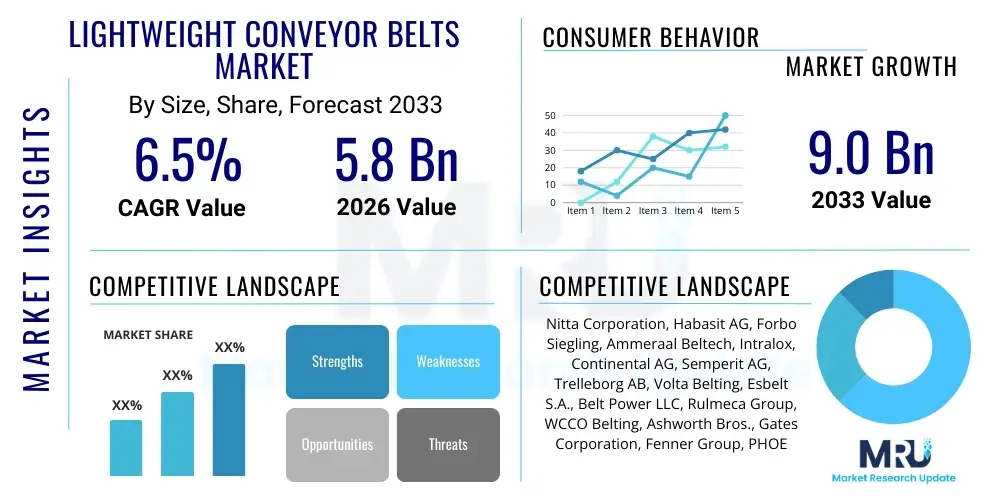

The Lightweight Conveyor Belts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Lightweight Conveyor Belts Market introduction

The Lightweight Conveyor Belts Market encompasses materials handling equipment designed for moving goods in industries where weight reduction, energy efficiency, and hygiene are paramount. These belts are typically made from polymers such as PVC, polyurethane (PU), and silicone, offering superior flexibility, lower operational noise, and easier installation compared to traditional heavy-duty rubber belts. Their construction focuses on minimizing the running weight and maximizing resistance to chemicals, oils, and abrasion, making them essential components in high-speed, automated production lines. The primary objective of lightweight conveyor systems is to enhance throughput while simultaneously decreasing the overall maintenance burden and energy consumption, aligning with modern industrial mandates for sustainable manufacturing practices and operational excellence.

Product descriptions vary significantly based on material composition. Polyurethane (PU) belts, for instance, are highly favored in the food processing industry due to their excellent hygiene characteristics, non-toxic properties, and resistance to hydrolysis and cleaning agents. Conversely, Polyvinyl Chloride (PVC) belts, offering robust chemical resistance and cost-effectiveness, dominate general manufacturing, packaging, and logistics applications where stringent hygiene standards are less critical but durability and resistance to wear are still necessary. The market is driven by continuous innovation in composite materials and specialized fabric layers, ensuring belts meet diverse industry requirements, such as antistatic properties for electronics assembly or flame retardancy for bulk material handling.

Major applications of lightweight conveyor belts span diverse sectors including automated warehousing and sorting facilities, high-speed food and beverage processing lines, pharmaceuticals manufacturing, textiles production, and airport baggage handling. The benefits derived from their adoption are manifold: reduced power requirements due to lower belt mass, extended equipment lifespan because of less stress on motors and components, and significant ease of cleaning and sanitation, which is crucial in regulated environments. Furthermore, the rapid expansion of e-commerce and the subsequent boom in logistics and distribution centers necessitate fast, reliable, and flexible conveyor solutions, cementing the role of lightweight belts as foundational elements in the modern supply chain infrastructure.

Lightweight Conveyor Belts Market Executive Summary

The Lightweight Conveyor Belts Market is undergoing robust expansion, fundamentally driven by pervasive automation across global manufacturing and logistics sectors. Key business trends indicate a strong shift towards application-specific materials, particularly high-performance polyurethane (PU) and advanced fabric-reinforced PVC, which cater to stringent industry compliance, such as FDA standards in food handling and fire safety regulations in mining. Companies are heavily investing in modular systems and rapid splice technologies to minimize downtime and enhance maintenance efficiency, pushing the market towards service-based models alongside product sales. Sustainability is also emerging as a critical factor, with increasing demand for belts made from recyclable or bio-based polymers, aligning with corporate environmental, social, and governance (ESG) goals.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure investments in manufacturing hubs, particularly China, India, and Southeast Asian nations, alongside the exponential growth of their domestic e-commerce markets. North America and Europe, while representing mature markets, exhibit high adoption rates of advanced, specialized, and highly automated lightweight belts, focusing on high throughput and energy optimization within existing sophisticated supply chains. Regulatory pressures regarding worker safety and food hygiene in these developed regions also drive the continuous upgrade cycle towards certified and compliant lightweight belting solutions. Latin America and MEA are experiencing steady growth, linked to increasing urbanization and the modernization of their essential industries, such as agriculture and resource processing.

Segment trends highlight the dominance of the Packaging and Logistics sectors in terms of market volume, driven by the structural changes introduced by direct-to-consumer fulfillment models. However, the Food Processing segment demands the highest value belts due to stringent material requirements for sanitation and resistance to aggressive cleaning cycles, driving innovation in monolithic and homogenous belt structures that eliminate bacterial traps. Material-wise, PVC belts maintain the largest share due to their cost-effectiveness and versatility, but PU belts are rapidly gaining traction, commanding a higher price point due to their superior performance characteristics in cleanroom and food-contact environments. The market structure emphasizes the importance of distribution networks, where specialized distributors and integrators provide tailored installation and maintenance services, strengthening their position in the value chain.

AI Impact Analysis on Lightweight Conveyor Belts Market

User inquiries regarding the intersection of AI and lightweight conveyor belts primarily revolve around predictive maintenance, optimization of flow dynamics, and autonomous operations. Common questions focus on how AI algorithms can utilize sensor data (vibration, temperature, tension) embedded within or around lightweight belts to forecast potential failures, thereby reducing catastrophic breakdowns and unscheduled downtime, a critical concern for high-speed logistics operations. Users are also keen to understand how AI-driven system controls can dynamically adjust belt speed and sequencing based on real-time inventory and sorting demands, maximizing throughput efficiency while minimizing energy waste. Furthermore, interest lies in the integration of visual AI systems for quality control, where cameras monitor the belt surface and conveyed materials for damage or misalignment, directly impacting the longevity and performance of the lightweight belt itself.

The immediate influence of Artificial Intelligence on the lightweight conveyor belt market is not directly on the physical product’s composition, but rather on its operational intelligence and ecosystem integration. AI enables 'smart belts' through sophisticated monitoring systems that collect massive datasets on operational parameters. This data is then analyzed by machine learning models to identify subtle anomalies indicative of wear and tear, such as changes in belt slip, roller bearing degradation, or early signs of delamination. This shift towards condition-based monitoring, powered by AI, transforms the maintenance paradigm from reactive to predictive, significantly extending the lifespan of lightweight belts and justifying the higher initial investment in sensor technology.

Ultimately, AI facilitates unparalleled levels of process optimization in environments utilizing lightweight conveyors. By analyzing thousands of data points related to product mix, load balancing, speed, and energy consumption, AI algorithms can suggest or execute real-time adjustments to the conveyor network. This ensures optimal belt tension, minimizes excessive friction or slippage—key determinants of lightweight belt degradation—and schedules operations to align with peak energy efficiency targets. The successful integration of AI systems directly enhances the value proposition of lightweight conveyor solutions by promising higher reliability, reduced total cost of ownership (TCO), and superior operational transparency, which are non-negotiable requirements in highly automated facilities.

- Enhanced Predictive Maintenance: AI analyzes vibration and thermal data to forecast belt failure, reducing unplanned downtime by up to 30%.

- Optimized Energy Consumption: Machine learning algorithms dynamically adjust belt speeds based on real-time load requirements, achieving significant power savings.

- Real-time Flow Optimization: AI-driven control systems manage bottlenecks and route prioritization in logistics hubs utilizing lightweight belts for higher throughput.

- Improved Quality Control: Visual AI systems inspect conveyed products for defects, reducing the risk of damage to sensitive lightweight belt surfaces.

- Automated Inventory Tracking: Integration with WMS systems utilizes AI to link product location with specific belt segments, improving inventory accuracy.

DRO & Impact Forces Of Lightweight Conveyor Belts Market

The Lightweight Conveyor Belts Market is governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and competitive landscape. The primary driver stems from the global proliferation of e-commerce and subsequent massive investments in automated warehousing, logistics, and material handling systems, which rely heavily on high-speed, flexible, and energy-efficient lightweight belting solutions. Concurrently, increasing regulatory mandates for hygiene and sanitation in the food, beverage, and pharmaceutical industries necessitate the adoption of specialized monolithic and homogenous polyurethane belts, further boosting market value, particularly in developed economies. These driving forces emphasize speed, sanitation, and sustainability as key purchasing criteria for end-users.

However, the market faces significant restraints, including the high initial capital investment required for specialized, high-performance belts (e.g., those with advanced fabric reinforcement or complex non-toxic coatings) compared to traditional rubber alternatives. Furthermore, technical challenges related to splicing and maintenance expertise for sophisticated lightweight materials can be a deterrent for smaller enterprises without dedicated technical teams. The lifespan of some polymer-based belts, particularly PVC, may be shorter than heavy rubber counterparts under extremely harsh or abrasive conditions, requiring more frequent replacement and incurring higher lifetime operational costs if not properly managed, posing a key concern for cost-sensitive buyers.

Significant opportunities abound, particularly in the realm of technological advancement and geographical expansion. The development of smart belts incorporating IoT sensors for real-time diagnostics and predictive maintenance represents a major value-added opportunity, moving the market towards integrated systems rather than mere component sales. Geographically, untapped potential lies in emerging economies across Asia Pacific and Latin America, where rapid industrialization and the establishment of modern manufacturing facilities create substantial demand for lightweight and efficient conveyance infrastructure. Furthermore, the push towards circular economy models and the development of fully recyclable lightweight belt materials present long-term opportunities for market players to gain a competitive advantage based on sustainability credentials.

Segmentation Analysis

The Lightweight Conveyor Belts Market is comprehensively segmented based on material, type, and application, reflecting the diverse industrial requirements they fulfill. The core segmentation by material—PVC, PU, Silicone, and others—is critical as it dictates the belt's suitability for specific environments, such as resistance to oil, chemicals, or temperature extremes, as well as regulatory compliance, particularly in food and pharmaceutical settings. Segmentation by type differentiates between ply belts, which utilize fabric layers for strength, and monolithic (homogenous) belts, which offer superior hygiene and ease of cleaning, directly influencing purchasing decisions in sanitation-critical sectors. The application segment, including logistics, food & beverage, automotive, and packaging, is the largest determinant of market volume and value, aligning product features with operational demands.

The segmentation structure underscores the highly specialized nature of this market. For example, within the food industry application, segments are further refined by process—bakery, meat processing, or confectionery—each requiring different specific belt characteristics (e.g., non-stick surfaces, cut resistance, or low-temperature flexibility). This granularity allows manufacturers to tailor their product lines precisely, offering high-margin solutions for niche applications. The continuous evolution of manufacturing technology, especially in high-speed automation, constantly drives demand for specialized types, such as advanced antistatic PVC belts for electronics assembly or specialized silicone belts for extreme heat applications, ensuring segment dynamics remain fluid and responsive to industrial innovation.

Market analysts leverage these segmentation layers to understand consumer preferences and technological shifts. The Packaging segment currently consumes the largest volume of belts due to global packaging trends and the high throughput demanded by logistics operations. However, the fastest growth is often observed in segments requiring high-performance PU materials, driven by stricter global hygiene standards and the premium commanded by homogenous belt designs. Understanding the regional distribution of these segments—for instance, the high concentration of food-grade PU belts in regulated markets like Western Europe and North America versus the dominance of cost-effective PVC in rapidly industrializing regions—is crucial for strategic market positioning and resource allocation.

- Material:

- Polyvinyl Chloride (PVC)

- Polyurethane (PU)

- Silicone

- Rubber (Light-duty specialized)

- Others (e.g., TPE, Polyester)

- Type:

- Ply Belts

- Monolithic/Homogeneous Belts

- Application:

- Food Processing

- Packaging and Labeling

- Logistics and Distribution

- Textile Industry

- Automotive Industry

- Pharmaceuticals and Medical

- Electronics Assembly

Value Chain Analysis For Lightweight Conveyor Belts Market

The value chain for the Lightweight Conveyor Belts Market initiates with upstream activities focused on raw material procurement, primarily the sourcing of specialized polymers (PVC resins, PU elastomers), reinforcing fabrics (polyester, nylon), and associated chemical additives (stabilizers, plasticizers). This stage involves crucial technological partnerships between belt manufacturers and specialized chemical suppliers to develop materials that meet evolving performance criteria, such as enhanced abrasion resistance, improved flexibility, and specific regulatory compliance. Cost management and quality control at this stage are paramount, as the inherent properties of the raw materials determine the final belt's operational lifespan and energy efficiency. Suppliers who offer specialty materials enabling high-hygiene monolithic designs command premium pricing and play a critical enabling role in the market.

Midstream activities involve the core manufacturing processes, including compounding, calendering, coating, and vulcanization, where raw polymers and fabrics are transformed into finished belt products. This stage requires significant capital investment in highly accurate manufacturing equipment to ensure dimensional stability and uniform thickness, which is crucial for high-speed applications. Direct sales and indirect sales through specialized distributors constitute the primary distribution channels. Direct sales are often preferred for large, customized, or strategic projects involving major OEMs or large end-users (like global logistics providers), offering better control over installation and service. However, the indirect distribution channel, comprising industrial supply houses and specialized conveyor system integrators, forms the backbone of the market, providing localized inventory, quick turnaround for replacements, and expert splicing services.

Downstream analysis focuses on installation, maintenance, and after-sales services, which are increasingly vital differentiators. Due to the precision required for lightweight belts in automated systems, correct installation and tensioning are essential for optimal performance and belt longevity. Specialized system integrators often provide crucial services here, consulting on system design and layout. End-users span diverse industries, with packaging, logistics, and food processing being the largest consumers. The total cost of ownership (TCO) calculation, heavily influenced by maintenance frequency and belt lifespan, dictates end-user purchasing decisions. The circular economy trend is beginning to influence the downstream stage, with manufacturers exploring take-back and recycling programs for used polymer belts, creating opportunities for value recapture and improved corporate social responsibility reporting.

Lightweight Conveyor Belts Market Potential Customers

The primary consumers, or potential customers, of the Lightweight Conveyor Belts Market are entities operating high-volume, automated material handling systems where product size is relatively small to medium, and operational efficiency or hygiene is a critical constraint. End-users fall broadly into discrete manufacturing, process industries, and the rapidly growing logistics sector. In the discrete manufacturing space, this includes automotive component manufacturers, electronics assembly plants requiring antistatic belts, and the textile industry. These customers prioritize abrasion resistance, precision tracking, and operational quietness, which lightweight belts inherently provide due to their low mass and high flexibility compared to heavy-duty alternatives.

The most significant segment of potential customers currently resides within the Logistics, E-commerce, and Parcel Distribution industries. Companies operating massive fulfillment centers and sorting hubs require thousands of kilometers of lightweight conveyor belts capable of high-speed, continuous operation with minimal failure rates. For these customers, the key purchasing criteria include ease of maintenance, modularity for rapid expansion, and energy efficiency, which directly impacts the operational expenditure of vast automated warehouses. The expansion of same-day delivery services globally necessitates ever-faster sorting systems, directly linking the growth of e-commerce to the demand for advanced lightweight belting technology.

Furthermore, the Food and Beverage (F&B) sector represents a high-value customer base due to regulatory compliance. F&B manufacturers, ranging from large multinational corporations to smaller specialized producers, require belts that are non-toxic, resistant to high-pressure washdown cycles, and specifically designed to prevent bacterial accumulation (often leading to the choice of homogeneous PU belts). Similarly, the Pharmaceutical and Medical device manufacturing industries constitute premium potential customers, demanding belts suitable for cleanroom environments (ISO Class compliance) that exhibit superior chemical resistance and zero material shedding, justifying the higher costs associated with highly specialized silicone and high-grade PU lightweight solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nitta Corporation, Habasit AG, Forbo Siegling, Ammeraal Beltech, Intralox, Continental AG, Semperit AG, Trelleborg AB, Volta Belting, Esbelt S.A., Belt Power LLC, Rulmeca Group, WCCO Belting, Ashworth Bros., Gates Corporation, Fenner Group, PHOENIX Conveyor Belt Systems, Bando Chemical Industries, Chiorino S.p.A., Derco Conveyor Belt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lightweight Conveyor Belts Market Key Technology Landscape

The technology landscape of the Lightweight Conveyor Belts Market is characterized by continuous material science innovation aimed at improving belt performance and sanitation capabilities. A central technological focus is the development of monolithic (homogenous) belts, primarily made from highly advanced thermoplastic polyurethanes (TPU). These belts eliminate fabric plies and rough surfaces, which are prone to harboring bacteria and difficult to clean. This technology is critical for meeting stringent FDA and HACCP standards in the food industry, driving a shift away from traditional layered PVC and rubber constructions. Innovations in TPU composition allow for superior resistance to hydrolysis, oils, and cleaning chemicals, significantly extending the belt's service life in wet and aggressive environments, thereby justifying the higher material cost associated with homogenous designs.

Another crucial technological advancement is the integration of specialized coatings and additives to enhance functional properties. This includes the application of low-friction top covers to improve energy efficiency and reduce product damage, as well as the incorporation of antistatic or conductive additives essential for environments handling sensitive electronic components or explosive powders. Furthermore, advancements in splicing technology are paramount, with rapid mechanical splicing systems and reliable thermoset techniques reducing installation and repair downtime. Manufacturers are constantly refining splicing methods to ensure joint strength and flexibility are comparable to the parent material, maintaining the lightweight belt’s intended performance characteristics throughout its operational cycle, a non-trivial challenge given the high speeds at which these belts often run.

The emerging technological front involves the adoption of Internet of Things (IoT) sensors and smart monitoring systems directly into or alongside the conveyor infrastructure, transforming standard belts into smart assets. These IoT systems utilize miniature sensors to monitor critical parameters such as belt tension deviation, localized temperature spikes, and overall vibration levels. Data collected is transmitted wirelessly to cloud-based predictive maintenance platforms. While the belts themselves remain polymeric, this integration allows for the deployment of AI-driven analytics, which optimizes operational settings and schedules maintenance proactively. This digital transformation adds significant value to the lightweight conveyor solution by offering enhanced reliability and contributing to overall system efficiency, moving the market toward P-A-S (Product-as-a-Service) models where predictive maintenance is bundled with the physical product.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global lightweight conveyor belts market, exhibiting the highest growth rate driven by industrialization in China, India, and Southeast Asia. The region’s rapid urbanization and massive government investments in infrastructure, particularly in airport expansion and modern logistics parks, fuel demand. China, as the world's factory, consumes enormous volumes of lightweight PVC and PU belts for its manufacturing and rapidly expanding e-commerce fulfillment operations. Local manufacturing capacity is high, but demand for specialized, high-grade PU belts for high-end food exports often requires imports from European specialists.

- North America: North America represents a mature, high-value market characterized by high automation levels and stringent regulatory requirements, especially in food safety (FDA) and pharmaceutical compliance. The logistics and e-commerce sector is a massive consumer, focusing on highly optimized, high-speed sorting and distribution centers. Market growth is primarily driven by system upgrades, replacement cycles, and the adoption of technologically advanced, energy-efficient lightweight belts that integrate seamlessly with IoT and automated warehouse management systems.

- Europe: Europe is a key innovation hub, particularly in the development and adoption of specialized, hygienic, monolithic PU belts. Strong regulatory frameworks (e.g., HACCP, CE certification) ensure high quality and safety standards, driving manufacturers towards premium, specialized products. Germany, Italy, and the Benelux countries, with strong manufacturing bases in food, packaging, and automotive sectors, are primary consumers. Focus areas include sustainable belt materials and sophisticated splicing technologies to minimize system downtime.

- Latin America (LATAM): This region is experiencing steady growth, linked to the modernization of its resource processing, agricultural, and domestic manufacturing sectors. Market adoption is currently tilted towards cost-effective PVC belts, but the increasing presence of multinational food and beverage corporations is driving a gradual shift towards higher-performance PU belts in line with international hygiene standards. Brazil and Mexico are the regional market leaders, driven by domestic logistics growth and automotive production.

- Middle East and Africa (MEA): The MEA market is developing, with growth focused primarily on infrastructure projects, food production (e.g., dairy, poultry), and logistics hubs like those in the UAE and Saudi Arabia. Market demand is highly dependent on foreign investment and technology transfer. The requirement for lightweight, energy-efficient solutions in climate-controlled warehouses is increasing, but procurement remains highly sensitive to pricing, favoring mid-range PVC solutions unless specific sanitation needs dictate otherwise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lightweight Conveyor Belts Market.- Nitta Corporation

- Habasit AG

- Forbo Siegling (Habasit Group)

- Ammeraal Beltech (Ammeraal Beltech/Intralox)

- Intralox (Laitram LLC)

- Continental AG

- Semperit AG Holding

- Trelleborg AB

- Volta Belting Technology Ltd.

- Esbelt S.A.

- Belt Power LLC

- Rulmeca Group

- WCCO Belting

- Ashworth Bros., Inc.

- Gates Corporation

- Fenner Group (Michelin Group)

- PHOENIX Conveyor Belt Systems

- Bando Chemical Industries, Ltd.

- Chiorino S.p.A.

- Derco Conveyor Belt

Frequently Asked Questions

Analyze common user questions about the Lightweight Conveyor Belts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of lightweight conveyor belts over traditional heavy-duty belts?

Lightweight conveyor belts offer reduced energy consumption due to lower mass, lower operational noise, enhanced flexibility, and superior hygiene characteristics, particularly monolithic PU types. They also simplify installation and require less robust support structures, lowering overall system costs.

Which material segment currently dominates the lightweight conveyor belts market?

Polyvinyl Chloride (PVC) currently dominates the market by volume due to its favorable cost structure, good chemical resistance, and wide applicability across logistics and general manufacturing. However, Polyurethane (PU) belts are rapidly increasing in value share due to high demand from hygiene-critical sectors like food and pharmaceuticals.

How does the expansion of e-commerce influence the demand for lightweight conveyor belts?

E-commerce expansion necessitates massive investments in highly automated sorting and distribution centers. These centers rely exclusively on lightweight belts for high-speed, continuous parcel handling, driving significant volume growth and demand for belts integrated with predictive maintenance technologies.

What is a monolithic conveyor belt and where is it primarily used?

A monolithic (or homogenous) conveyor belt is constructed from a single layer of material, typically polyurethane, without fabric plies or layers. This design eliminates potential areas for bacteria growth, making it the preferred and often mandated choice for applications in the food, beverage, and pharmaceutical industries where sanitation and ease of cleaning are paramount.

Which geographic region exhibits the fastest growth in the Lightweight Conveyor Belts Market?

The Asia Pacific (APAC) region, particularly driven by industrial modernization and infrastructure spending in countries like China and India, exhibits the fastest growth. This growth is supported by large-scale adoption of automation in local manufacturing and the unprecedented expansion of regional e-commerce logistics networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager