LIM & LSR Injection Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432855 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

LIM & LSR Injection Machine Market Size

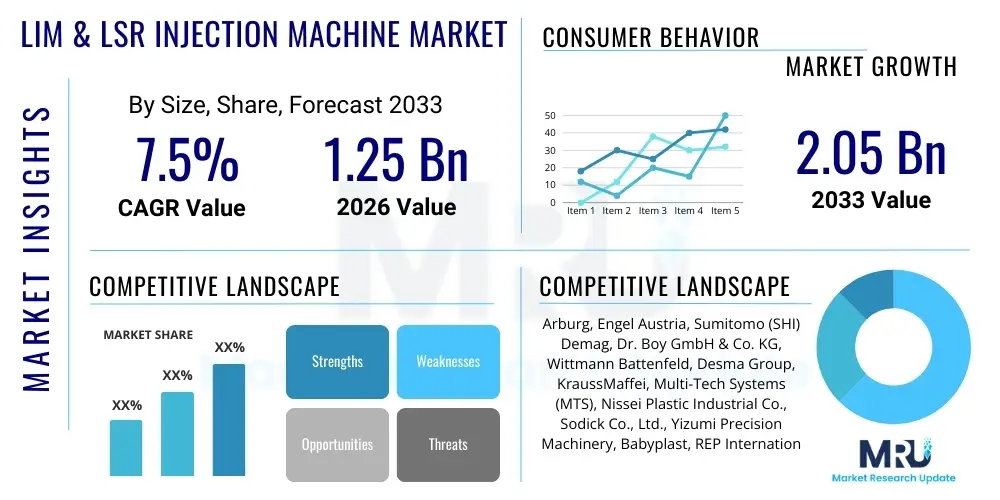

The LIM & LSR Injection Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.05 Billion by the end of the forecast period in 2033.

LIM & LSR Injection Machine Market introduction

The Liquid Injection Molding (LIM) and Liquid Silicone Rubber (LSR) Injection Machine Market encompasses highly specialized equipment designed for the precision processing of two-component liquid silicone rubber materials. These machines are engineered for stringent quality control, high throughput, and the ability to handle the unique rheological properties of LSR, which requires complex metering, mixing, and temperature control systems. The technology facilitates the production of intricate components with tight tolerances, superior elasticity, thermal stability, and biocompatibility, making it indispensable across critical industries such as healthcare, automotive, electronics, and consumer goods. The continuous miniaturization of devices and the rising demand for chemically resistant and flexible seals and gaskets are primary factors driving the adoption of these sophisticated injection molding solutions globally.

LSR injection molding machines are fundamentally distinct from traditional thermoplastic injection systems due to their specialized components, including volumetric metering pumps, static mixers, cold runner systems, and dedicated vacuum technology necessary to prevent trapped air and ensure flawless curing. Key applications span from medical device components—such as catheters, respirators, and wearable technology seals—to automotive parts like O-rings, seals, damping elements, and precision connectors in electrical vehicles. Furthermore, the market benefits significantly from the increasing consumer preference for high-performance, durable, and safe materials in electronic housings and kitchenware. The inherent advantages of LSR, including its rapid curing time and resilience to extreme temperatures, position LIM technology as a preferred manufacturing method for complex, high-volume production requirements.

Driving factors for market expansion include the global shift towards electric vehicles, requiring advanced sealing and thermal management solutions based on LSR; stringent regulatory standards in the medical sector mandating biocompatible materials; and the ongoing trend toward automation and Industry 4.0 integration within manufacturing processes. These factors necessitate investment in highly automated, all-electric LIM systems that offer enhanced energy efficiency, repeatability, and precision, ensuring minimal material waste and maximizing operational efficiency for manufacturers operating in high-cost environments. The convergence of material science breakthroughs and advanced machine control systems continues to propel the market forward.

LIM & LSR Injection Machine Market Executive Summary

The LIM & LSR Injection Machine Market is characterized by robust growth, primarily fueled by the accelerating transition in the medical device and automotive sectors toward high-performance, silicone-based components. Business trends indicate a strong move toward all-electric and hybrid machine architectures, emphasizing energy conservation, increased process stability, and reduced maintenance complexity compared to traditional hydraulic systems. Manufacturers are heavily investing in modular machine designs that allow for easy integration of advanced peripheral equipment, such as automated material feeding systems, demolding robots, and vision inspection systems, thereby enhancing overall production line efficiency and supporting lights-out manufacturing capabilities. This focus on automation and integration is a key differentiator in competitive positioning.

Regionally, Asia Pacific (APAC) holds the dominant market share, driven by massive expansion in manufacturing capabilities, particularly in China and South Korea, which serve as global hubs for electronics and automotive production. North America and Europe, however, exhibit the highest growth rates, spurred by stringent quality requirements in their mature medical and aerospace industries, necessitating investment in the most advanced, precision-focused LIM technologies. Trends in these regions favor smaller, high-cavitation molds and machines capable of micro-molding LSR components for complex diagnostics and minimal invasive surgical tools. Furthermore, regulatory alignment, such as the EU's Medical Device Regulation (MDR), is pushing manufacturers towards certified, high-standard machinery.

Segment trends highlight the dominance of smaller clamping force machines (under 100 tons), reflecting the common use of LSR for small, intricate sealing and cushioning components. By application, the healthcare segment remains the most lucrative due to the critical nature and high value of medical LSR parts, followed closely by the automotive segment, which is rapidly adopting LSR for battery sealing, wiring harnesses, and interior damping applications in electric vehicles (EVs). Technological segmentation shows a clear preference for closed-loop control systems and sophisticated Human-Machine Interfaces (HMIs) that enable real-time parameter adjustment, ensuring superior part quality and minimal variability in high-precision molding operations.

AI Impact Analysis on LIM & LSR Injection Machine Market

Common user questions regarding AI’s influence on the LIM & LSR Injection Machine Market center on how artificial intelligence can enhance process optimization, predictive maintenance, and quality assurance, which are traditionally challenging aspects of LSR molding due to the material's sensitivity. Users are concerned about the implementation complexity and the cost-benefit ratio of integrating sophisticated AI algorithms into existing machine control systems. Key expectations involve AI facilitating autonomous parameter adjustments (self-correction) to counteract real-time material variations, minimizing scrap rates, and predicting component failures or tooling wear before they impact production. There is significant interest in using machine learning (ML) models trained on vast operational datasets (pressure, temperature, flow rates) to achieve unprecedented levels of repeatability and efficiency, moving the industry toward truly adaptive manufacturing.

- AI-Driven Process Optimization: Utilizing machine learning algorithms to autonomously adjust injection profiles, curing temperatures, and cycle times based on sensor data feedback, minimizing material waste and energy consumption.

- Predictive Maintenance (PdM): Implementing AI to analyze vibration, hydraulic pressure, and temperature anomalies to forecast potential machine component failure (e.g., pump wear or heater element degradation), drastically reducing unplanned downtime.

- Enhanced Quality Control: Deploying deep learning and computer vision systems for real-time defect detection (e.g., flash, incomplete fill, or voids) with greater accuracy than traditional inspection methods, ensuring 100% quality throughput.

- Recipe Management and Transfer: AI systems help optimize mold settings and material recipes, ensuring seamless transfer of successful process parameters across different machines and production sites globally, standardizing quality.

- Supply Chain Resilience: ML models assist in correlating external factors (e.g., ambient temperature, humidity, raw material batch variations) with molding outcomes, helping operators proactively compensate for external supply chain inconsistencies.

DRO & Impact Forces Of LIM & LSR Injection Machine Market

The market dynamics are defined by several critical factors: the primary drivers include the accelerated shift towards miniaturization in medical and electronics sectors, which necessitates the high precision only attainable through LIM technology, coupled with the rising global demand for complex, high-durability seals in automotive battery systems. Restraints predominantly involve the high initial capital investment required for specialized LIM equipment, cold runner systems, and high-precision molds, which often deters smaller manufacturers, alongside the technical complexity associated with processing and handling two-component LSR materials, demanding highly skilled operators. Opportunities lie in the emerging fields of multi-component molding (LSR overmolding plastics or metals) and the expansion into new geographies, particularly developing economies adopting advanced manufacturing standards. These forces collectively shape the investment priorities and technological trajectory of the market.

The core drivers are heavily influenced by regulatory pushback against less stable materials and the inherent material benefits of LSR, such as its thermal resistance (-50°C to 250°C), UV stability, and excellent dielectric properties, which are essential for critical applications. The growth in wearable technology and personalized healthcare also acts as a significant catalyst, requiring millions of soft, biocompatible, and non-allergenic LSR components. However, market growth is consistently restrained by volatility in the supply chain for high-purity silicone rubber base polymers and the continuous need for complex validation and qualification procedures, particularly in regulated industries, slowing down the adoption cycle for new machine technologies. The proprietary nature of specialized dosing pumps and cold runner systems also creates reliance on a few key technology providers, affecting pricing and availability.

Impact forces indicate that technological advancement, specifically in all-electric machine development offering superior energy efficiency and repeatability, has a high positive influence. Conversely, the high cost of advanced tooling and the steep learning curve for operators act as persistent headwinds. The largest immediate opportunity stems from the electric vehicle (EV) revolution, where LSR is becoming the material of choice for crucial sealing, thermal management, and electrical insulation components, ensuring long-term battery life and safety. Strategic competitive responses are centered on vertical integration—where machine manufacturers partner with or acquire mold makers and material suppliers—to offer holistic, optimized production solutions to end-users, addressing the inherent complexity of the LIM process.

Segmentation Analysis

The LIM & LSR Injection Machine Market is comprehensively segmented based on machine type (hydraulic, hybrid, all-electric), clamping force (tonnage), and end-use application (medical, automotive, electronics). Analyzing these segments provides a nuanced understanding of current demand drivers and future growth pockets. The trend favors all-electric machines due to their precision and lower operating costs, particularly in the micro-molding sector. In terms of clamping force, the market is stratified, with high-tonnage machines serving large industrial parts (e.g., seals for infrastructure), while low-tonnage machines dominate the high-volume, precision components required by the medical and consumer electronics industries, reflecting the most significant investment activity.

- By Machine Type:

- Hydraulic Injection Machines

- Hybrid Injection Machines

- All-Electric Injection Machines

- By Clamping Force:

- < 100 Ton

- 100–300 Ton

- > 300 Ton

- By End-Use Application:

- Healthcare and Medical Devices (Implants, Seals, Respiratory Masks)

- Automotive (Gaskets, Seals, Connectors, Dampers)

- Consumer Electronics (Keypads, Gaskets, Wearable Bands)

- Industrial Applications (O-rings, Insulators, Valves)

- Others (Aerospace, Food & Beverage)

- By Sales Channel:

- Direct Sales

- Distributors/Agents

Value Chain Analysis For LIM & LSR Injection Machine Market

The value chain for the LIM & LSR injection machine market is highly complex, beginning with upstream suppliers of raw materials, particularly specialized metals, advanced ceramics for tooling components, and electronic control systems components. The primary upstream component involves the specialized manufacturing of the core machine components, such as high-precision screw/barrel assemblies, clamping units, specialized liquid dispensing systems (dosing pumps), and high-efficiency heating/cooling manifolds. Due to the high investment and technical know-how required, the machine manufacturing stage is concentrated among a few global technology leaders who emphasize proprietary cold runner system designs and precise volumetric dosing units essential for LSR processing accuracy. Quality control at this stage, particularly the calibration of the mixing ratio (A:B components), is paramount to ensure proper curing and final product performance.

Midstream activities involve the fabrication of high-precision molds, often subcontracted to specialized mold makers who possess expertise in LSR tooling, including polished surfaces and advanced venting techniques (often coupled with vacuum systems) required to eliminate air bubbles during rapid vulcanization. Following this, the machinery is integrated with peripheral equipment—such as robots, conveyer systems, and specialized vision inspection tools—before reaching the end-user. The distribution channel structure relies heavily on direct sales for large, customized orders, particularly to Tier 1 medical or automotive suppliers, allowing for deep technical consultation and customized machine configuration. For standardized or lower-tonnage machines, regional distributors and agents play a vital role in localized sales, installation, and post-sale support, ensuring timely service and access to spare parts.

Downstream analysis focuses on the high-value manufacturing processes undertaken by the end-users. These converters utilize the LIM machines to produce finished goods used in critical applications. The output components often undergo rigorous secondary processes, including post-curing, cleaning, sterilization (for medical parts), and quality validation. The market heavily relies on technical expertise and service support provided by the machine vendors throughout the lifecycle of the equipment. Furthermore, the increasing complexity of multi-shot and overmolding applications demands closer collaboration between machine manufacturers and downstream processors to ensure the seamless integration of disparate materials (e.g., LSR onto PBT or stainless steel), driving the need for complex, tailor-made solutions rather than off-the-shelf machinery.

LIM & LSR Injection Machine Market Potential Customers

The primary end-users and buyers of LIM & LSR injection machines are sophisticated manufacturers operating in highly regulated environments where material stability, precision, and bio-compatibility are non-negotiable requirements. The largest consumer base resides in the medical device manufacturing sector, including original equipment manufacturers (OEMs) specializing in respiratory care components, surgical instrument seals, diagnostic tools, and long-term implantable devices, where LSR’s inert properties and adherence to USP Class VI standards are critical. These customers require validated processes, high uptime, and machines compliant with stringent documentation and quality management systems (e.g., ISO 13485). Their purchasing decisions are driven by total cost of ownership (TCO) and machine repeatability rather than initial capital outlay.

Another major segment comprises Tier 1 and Tier 2 suppliers to the global automotive industry, particularly those focused on the rapidly expanding electric vehicle (EV) market. These customers utilize LIM machines for producing high-voltage seals, complex wire harness grommets, thermal pads for battery modules, and interior components requiring superior NVH (Noise, Vibration, Harshness) damping characteristics. As EV production scales globally, the demand for high-volume, automated LIM lines increases significantly. These buyers prioritize cycle time, material efficiency, and the ability to handle high-viscosity LSR grades suitable for large-format sealing applications within battery casings and protective enclosures.

The consumer electronics industry, covering manufacturers of mobile devices, smart wearables, and small home appliances, represents a substantial growth area. These customers purchase LIM machines for high-precision gaskets, water-resistant seals, specialized keypads, and ergonomic components (e.g., watch bands) that demand a pleasing tactile feel and high aesthetic quality. Their requirements lean towards high-speed, all-electric machines capable of micro-molding very thin-walled parts with minimal flash. Additionally, specialized industrial manufacturers—producing high-performance valves, electrical insulators, and technical textiles—also constitute a stable customer base, focusing on machines that can process highly technical, custom LSR formulations designed for chemical or extreme temperature resistance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arburg, Engel Austria, Sumitomo (SHI) Demag, Dr. Boy GmbH & Co. KG, Wittmann Battenfeld, Desma Group, KraussMaffei, Multi-Tech Systems (MTS), Nissei Plastic Industrial Co., Sodick Co., Ltd., Yizumi Precision Machinery, Babyplast, REP International, Milacron (now Hillenbrand), Sanjo Seiki. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LIM & LSR Injection Machine Market Key Technology Landscape

The technological landscape of the LIM & LSR injection machine market is defined by advancements aimed at increasing precision, automation, and energy efficiency, mitigating the inherent challenges of processing thermoset LSR materials. A pivotal technology is the widespread adoption of all-electric drive systems, replacing traditional hydraulics. All-electric machines offer superior repeatability in injection speed, dosage control, and clamping force management, crucial for ensuring consistent quality in high-precision, thin-walled LSR parts. These systems also significantly reduce energy consumption and operational noise, aligning with modern sustainability mandates. Furthermore, the integration of advanced servo-driven dosing systems ensures an extremely accurate and pulsation-free mixing ratio of the A and B components, vital for the curing reaction and preventing material wastage, a core concern in this high-cost material segment.

A second critical area is the evolution of cold runner technology and advanced mold temperature control. Cold runners are essential to keep the LSR material below its curing temperature before entering the cavity, reducing waste (flash) and accelerating cycle times. Modern systems utilize thermally isolated plates and sophisticated cooling circuits, often coupled with needle-valve gate systems controlled by dedicated servomotors, allowing for optimized flow control and clean gate separation. Concurrently, the use of specialized vacuum technology integrated into the molding process is standard practice. Vacuum application pulls air out of the mold cavity before injection, preventing the formation of air bubbles (voids) or trapped air pockets that can lead to structural weaknesses or cosmetic defects in the finished LSR part, especially critical for applications in high-pressure sealing or clear optical components.

Finally, the rapid implementation of Industry 4.0 concepts and sensor technology is revolutionizing process monitoring and control. LIM machines are increasingly equipped with high-resolution pressure and temperature sensors embedded directly within the barrel, runner, and cavity, providing real-time data on material behavior. This data feeds into advanced closed-loop control systems and sophisticated Human-Machine Interfaces (HMIs) that allow operators to monitor key metrics like viscosity changes and reaction progression. Furthermore, communication protocols like OPC UA enable seamless integration with centralized Manufacturing Execution Systems (MES) and enterprise resource planning (ERP) software, facilitating comprehensive traceability, essential for medical and automotive component validation, and paving the way for autonomous adjustments driven by AI and machine learning algorithms.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest market share, driven primarily by China, Japan, and South Korea, which serve as global manufacturing powerhouses for consumer electronics and automotive components. China, in particular, exhibits high growth due to massive investment in local production capabilities and the rapid scale-up of electric vehicle manufacturing, creating enormous demand for highly automated LIM systems for battery seals and sophisticated electronic enclosures. The market here is characterized by a strong competitive landscape, with both international giants and rapidly emerging local players vying for market dominance, often focusing on high-volume, cost-effective solutions while simultaneously enhancing technological precision to serve sophisticated exports. This region's favorable regulatory environment for mass production and lower initial operational costs continue to attract significant foreign investment in advanced manufacturing lines.

- North America: North America represents a mature yet high-growth market, distinguished by its dominant healthcare and aerospace industries. The demand here is centered on precision, validation, and compliance, driving the adoption of the most advanced, all-electric LIM systems designed for micro-molding and critical medical components (e.g., fluid management seals, drug delivery systems). The region places a premium on highly automated cells, validated process control, and local service support. The push toward reshoring manufacturing and the high concentration of specialized medical device OEMs ensure consistent investment in the latest generation of energy-efficient and highly precise machinery, ensuring compliance with FDA and ISO standards. The automotive sector, especially in EV components, is rapidly accelerating its investment in LSR capabilities, further fueling market expansion.

- Europe: Europe is characterized by a strong focus on technological innovation, sustainability, and high-quality industrial applications, particularly within Germany, Switzerland, and Italy. These nations emphasize the adoption of hybrid and all-electric machines that offer maximized energy efficiency and repeatability. The demand is heavily influenced by the strict requirements of the European Medical Device Regulation (MDR) and the mature industrial sector requiring durable LSR parts for robotics, machinery, and complex sealing systems. European manufacturers often pioneer multi-component molding techniques (LSR/LSR or LSR/Plastic overmolding), requiring sophisticated, multi-shot LIM machinery with complex tooling interfaces. The region's commitment to Industry 4.0 adoption translates into high demand for machines with integrated networking and comprehensive data monitoring capabilities for predictive maintenance and quality tracing.

- Latin America, Middle East, and Africa (LAMEA): LAMEA is an emerging market with significant potential, though currently representing a smaller share. Market expansion is geographically localized, driven primarily by industrial expansion in countries like Mexico (serving the North American automotive supply chain) and Brazil (domestic industrial and healthcare growth). The Middle East is seeing nascent demand tied to infrastructure development and diversified manufacturing initiatives. Adoption rates are slower, often favoring cost-effective hybrid or robust hydraulic systems, but an increasing focus on international quality standards is gradually pushing larger regional players toward more precise, modern LIM technology, particularly for high-value applications like oil and gas seals and basic medical consumables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LIM & LSR Injection Machine Market.- Arburg GmbH + Co KG

- Engel Austria GmbH

- KraussMaffei Technologies GmbH

- Sumitomo (SHI) Demag Plastics Machinery GmbH

- Wittmann Battenfeld GmbH

- Dr. Boy GmbH & Co. KG

- DESMA Group (Klöckner Desma Schuhmaschinen GmbH)

- Nissei Plastic Industrial Co., Ltd.

- Sodick Co., Ltd.

- Yizumi Precision Machinery Co., Ltd.

- REP International

- Milacron (Hillenbrand, Inc.)

- Multi-Tech Systems (MTS)

- Sanjo Seiki Co., Ltd.

- Rochling Engineering Plastics

- TIANHUA Injection Molding Machine Co., Ltd.

- Zhafir Plastics Machinery GmbH (Haitian International)

- Plastisud (Molds & Services)

- Magnum Venus Products (MVP)

- FISA

Frequently Asked Questions

Analyze common user questions about the LIM & LSR Injection Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using All-Electric LIM machines over Hydraulic or Hybrid systems?

All-electric LIM machines offer superior precision and repeatability in injection volume and speed, critical for micro-molding complex LSR components. They also significantly improve energy efficiency, reduce maintenance needs, operate cleaner, and provide faster cycle times due to independent servo motor control of all axes, optimizing the total cost of ownership (TCO).

How does the integration of AI and Industry 4.0 specifically benefit LSR molding processes?

AI integration utilizes machine learning to analyze real-time process data (pressure, temperature, viscosity) and autonomously adjust molding parameters to maintain zero-defect production, compensating for material batch variations. Industry 4.0 enables predictive maintenance and comprehensive traceability, which is crucial for compliance in the medical and automotive sectors.

Which industry segment drives the highest demand for LIM & LSR Injection Machines globally?

The Healthcare and Medical Device segment currently generates the highest value demand due to the requirement for biocompatible, high-precision seals, gaskets, and components for respiratory devices, diagnostics, and surgical tools. However, the Automotive sector, driven by EV battery technology seals, is the fastest-growing application area.

What is the main technical challenge associated with processing Liquid Silicone Rubber (LSR)?

The main technical challenge is managing the low viscosity and rapid thermal curing (vulcanization) of LSR. This requires specialized equipment such as cold runner systems to prevent premature curing and high-precision dosing pumps to ensure the correct 1:1 mixing ratio, minimizing flash and maximizing material efficiency.

What role does vacuum technology play in the LIM process and why is it essential?

Vacuum technology is essential in LIM to evacuate air from the mold cavity before injection. This process prevents air entrapment, which would otherwise cause voids, bubbling, or weak spots in the finished LSR part. Utilizing a vacuum system ensures uniform component density, especially critical for thin-walled or optically clear components.

What are the critical components of a specialized LSR injection system besides the core machine?

Key peripheral components include the two-component (A+B) material dosing and mixing unit, which uses volumetric pumps for precise ratio control; the specialized cold runner system for thermal isolation; and typically a mold-integrated vacuum system. Robotics for automated part removal and flash trimming are also increasingly standard.

How are environmental sustainability pressures influencing the design of new LIM machines?

Sustainability pressures accelerate the shift toward all-electric machines, which drastically reduce energy consumption compared to hydraulic counterparts. Manufacturers are also designing systems for reduced material waste (minimal flash and runner waste) and incorporating closed-loop systems to optimize efficiency and minimize the carbon footprint of the molding process.

What is the significance of the clamping force segmentation in the LIM market?

Clamping force segmentation dictates the type and size of parts produced. Machines under 100 tons dominate the market value as they are used for high-volume, small, intricate medical and electronics parts. Larger tonnage machines (over 300 tons) are primarily reserved for massive industrial seals and gaskets, particularly in infrastructure or large automotive components.

Why is the Asia Pacific region the market leader in terms of volume and consumption?

APAC leads due to the concentration of global supply chains for electronics and automotive components, high production volume mandates, favorable governmental support for manufacturing expansion, and robust domestic demand, particularly in China and South Korea, which drives large-scale adoption of automated machinery.

What material advancements are complementing the growth of the LIM machinery market?

Material advancements include the development of self-lubricating LSR grades, specialized liquid fluoro-silicones (F-LSR) for extreme chemical resistance, and electrically conductive LSRs for shielding and sensor applications. These specialty materials expand the applications into new high-value, niche markets like aerospace and complex medical diagnostics.

How do cold runner systems differ fundamentally in LSR molding compared to thermoplastic molding?

In LSR molding, the cold runner system's primary function is to keep the material cool (below the curing temperature) to prevent premature vulcanization, whereas in thermoplastic molding, runners are kept hot to maintain the material in a molten state. LSR cold runners require precise cooling and thermal isolation from the hot mold plates.

What is multi-component molding (MCM) in the context of LIM, and what opportunities does it present?

MCM involves molding LSR onto a second substrate, often a thermoplastic, metal, or another LSR grade, within the same machine cycle. This technique enables the creation of integrated components, such as seals bonded directly to plastic housings, reducing assembly costs and improving functional integrity, offering significant opportunity in complex electronic and medical assemblies.

What is the typical lifespan and maintenance profile for a modern, high-end LIM machine?

A modern, high-end all-electric LIM machine typically has an operational lifespan exceeding 15–20 years with proper maintenance. The maintenance profile shifts toward predictive scheduling based on sensor data, focusing primarily on the highly specialized dosing pumps, seals, and cold runner components, rather than frequent hydraulic fluid changes.

How does the EV market specifically drive demand for high-tonnage LIM machines?

The EV market requires large-format, robust seals and gaskets for battery packs and thermal management systems, necessitating high clamping forces (often over 300 tons) to prevent flash and ensure uniform curing across large surface areas, protecting sensitive internal components from moisture and environmental exposure.

What safety standards and regulatory hurdles impact the sales of LIM equipment in the medical sector?

Medical sector sales are heavily impacted by compliance with ISO 13485 (Quality Management Systems) and the machine’s ability to operate in cleanroom environments (ISO Class 7 or 8). Machines must facilitate process validation (IQ/OQ/PQ) and offer extensive data logging features for full component traceability, meeting stringent requirements like the FDA’s 21 CFR Part 820.

What distinguishes the dosing systems used for LIM from standard injection molding feeders?

LSR dosing systems are mandatory volumetric pump units, not gravity or screw feeders, specifically designed to handle two highly viscous liquid components (A and B) and precisely control their mixing ratio (typically 1:1 or 10:1) just prior to injection. Precision dosing is non-negotiable for consistent curing and mechanical properties.

How does the high initial cost of LIM tooling act as a market restraint?

LSR molding requires specialized molds made from highly polished, durable steel with very tight tolerances and precise venting mechanisms, coupled with complex cold runner manifolds and heating cartridges. This significantly increases the initial tooling cost compared to traditional thermoplastic molds, requiring high volume production to justify the investment.

What are the emerging opportunities related to micro-molding LSR components?

Micro-molding opportunities are exploding in wearable tech, advanced drug delivery systems, and microfluidics. These applications require sub-millimeter precision, driving demand for specialized, low-tonnage, all-electric machines equipped with specialized metering and clamping units capable of shot weights measured in milligrams.

Which key parameters are monitored by closed-loop control systems in modern LIM machines?

Closed-loop systems continuously monitor and adjust key parameters, including injection pressure profile, holding pressure, melt temperature (in the barrel and runner), mold temperature uniformity, and the real-time volumetric flow rate of the LSR dosing unit, ensuring extreme consistency across thousands of cycles.

How is the industrial applications segment (valves, insulators) contributing to market stability?

The industrial segment provides market stability by demanding high-performance, durable components that resist chemicals, oils, and extreme temperatures, such as seals for oil and gas infrastructure or high-voltage insulators. While lower in volume than medical or automotive, these applications require high-margin, specialized LSR formulations and robust machinery.

What impact does the supply chain for raw silicone rubber have on machine sales and pricing?

Volatility and regional concentration in the supply chain for high-purity silicone base polymers directly impact the operating costs of end-users. This encourages investment in highly efficient machines that guarantee minimal scrap rates, thereby offsetting the variable raw material costs and ensuring greater return on investment in LIM equipment.

What differentiates the maintenance requirements of all-electric vs. hydraulic LIM systems?

All-electric systems require less maintenance, primarily focusing on lubrication and wear parts for servo motors and ball screws, with no need for hydraulic fluid management (leaks, filtration, disposal). Hydraulic systems require regular checks of pumps, valves, and fluid quality, leading to higher operational costs and environmental overhead.

Define the concept of "flash" in LSR molding and explain how machines mitigate it.

Flash refers to excess material squeezing out between the mold halves due to low viscosity and high injection pressure. Modern LIM machines mitigate flash through extremely precise, high-speed clamping units, superior mold design (venting and sealing surfaces), and closed-loop pressure control that minimizes overpacking.

How are new materials like liquid fluoro-silicone rubber (F-LSR) driving innovation in machine design?

F-LSR, used for high-end chemical and fuel resistance, demands machines with specialized corrosion-resistant components (barrels, screws, nozzles) and even tighter temperature control than standard LSR, driving manufacturers to adopt premium, modular machine architectures capable of handling these specialized, costly materials effectively.

What role do third-party mold makers play in the overall LIM machine value chain?

Specialized third-party mold makers are crucial as they design and fabricate the complex, high-tolerance LSR molds, which significantly affect final part quality and cycle time. Machine manufacturers often collaborate closely with mold makers to ensure seamless integration of cold runner and vacuum systems.

Why is temperature control particularly critical in the barrel and nozzle of an LSR injection machine?

Temperature control in the barrel and nozzle must maintain the LSR material below its curing temperature (typically ambient or slightly elevated) to prevent premature vulcanization, which would damage the machine or block the runner system. Conversely, the mold cavities must be heated to the curing temperature (around 150-200°C) for rapid cross-linking.

How is the trend towards miniaturization impacting machine clamping force requirements?

Miniaturization drives increased demand for low clamping force machines (under 100 tons) specialized for micro-molding. These machines require high precision and stability, often using specialized clamping systems to apply highly uniform force across very small mold areas to prevent flash without damaging delicate tooling.

What are the economic implications of utilizing closed-loop control in LSR production?

Closed-loop control significantly improves part consistency, leading to drastically reduced scrap rates, lower material consumption (LSR is expensive), and maximized machine uptime. Although increasing initial machine cost, it delivers a rapid return on investment by minimizing waste and enhancing overall quality assurance.

How do regional differences in regulatory standards (e.g., EU vs. US medical) affect machine features?

European and US medical regulations necessitate machine features focused on data logging, validation support (IQ/OQ/PQ), and compatibility with cleanroom protocols. European MDR often drives demand for integrated, traceable production data, while US FDA requirements focus heavily on process control and audit trails, influencing HMI design and software integration.

What are the key differentiators manufacturers use to compete in the highly specialized LIM market?

Key differentiators include proprietary dosing system accuracy, advanced cold runner designs that minimize waste, expertise in multi-component molding, energy efficiency (all-electric platforms), and comprehensive global technical support and service networks, particularly in regulated application areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager