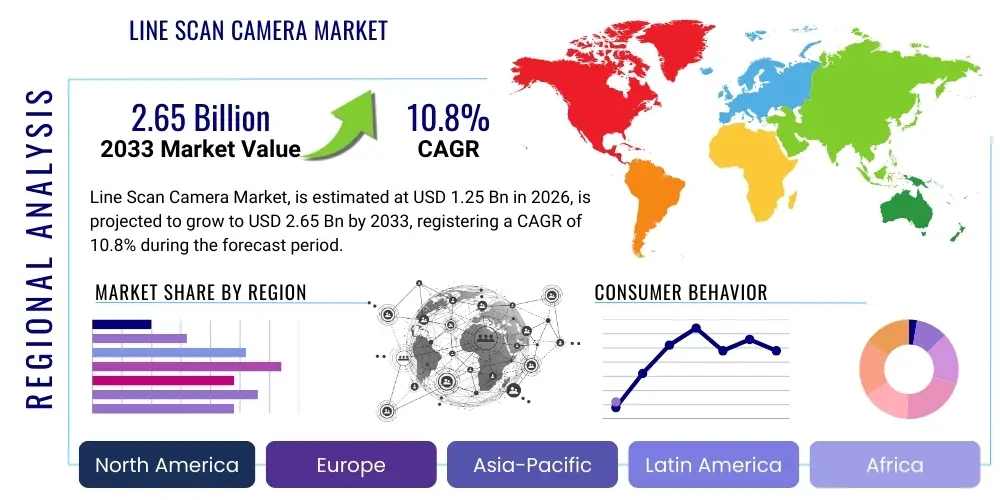

Line Scan Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438578 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Line Scan Camera Market Size

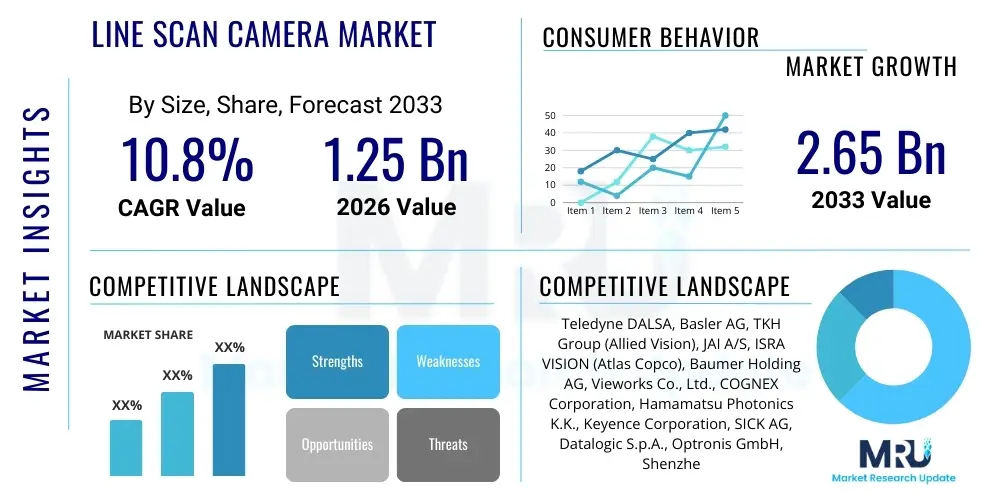

The Line Scan Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [10.8%] between 2026 and 2033. The market is estimated at [USD 1.25 Billion] in 2026 and is projected to reach [USD 2.65 Billion] by the end of the forecast period in 2033.

Line Scan Camera Market introduction

The Line Scan Camera Market encompasses sophisticated imaging solutions designed for high-speed, continuous inspection tasks across various industries. Unlike area scan cameras, line scan cameras capture images one line of pixels at a time, making them indispensable for inspecting web materials, cylindrical objects, and continuous production lines where uniform resolution across large, rapidly moving surfaces is critical. These cameras are crucial components in machine vision systems, offering ultra-high resolution and processing speeds essential for detecting minute defects, ensuring quality control, and performing precise measurements in real-time manufacturing environments.

Major applications for line scan cameras span industrial automation, food and beverage inspection, printing inspection (ensuring color fidelity and print quality), and semiconductor manufacturing (wafer and mask inspection). The primary benefits driving adoption include superior resolution, reduced data redundancy compared to tile-based area scanning for continuous materials, and the ability to operate at extremely high line rates, thus maximizing throughput. The demand for flawless product quality, coupled with the increasing integration of vision systems into smart factories (Industry 4.0), significantly propels market expansion.

Driving factors for sustained market growth include the transition from older CCD technology to advanced CMOS sensors, which offer higher speeds, lower noise, and better dynamic range. Furthermore, the rising proliferation of high-resolution displays and complex electronic components mandates stringent quality checks, fueling demand for 8K and 16K resolution line scan cameras. Geographical expansion of manufacturing bases in Asia Pacific and regulatory pressures requiring comprehensive product traceability also contribute to the robust adoption trajectory of this specialized imaging technology.

Line Scan Camera Market Executive Summary

The Line Scan Camera Market is characterized by robust technical innovation focused on enhancing sensor resolution, increasing line rates, and improving data interface standards, primarily driven by the exponential demands of high-throughput manufacturing and complex quality assurance protocols. Key business trends indicate a strategic shift toward smart camera architectures that integrate processing capabilities (edge computing), reducing reliance on external industrial PCs. Furthermore, fierce competition among sensor manufacturers is driving down component costs while increasing performance capabilities, democratizing access to ultra-high-resolution inspection systems for a broader range of mid-tier manufacturers. Partnerships between camera vendors and machine vision software developers are crucial for offering integrated, turnkey inspection solutions.

Regionally, the Asia Pacific (APAC) market, particularly China and South Korea, exhibits the highest growth rate, fueled by massive investments in electronics manufacturing, textile production, and automotive sectors that require stringent quality control. North America and Europe maintain technological leadership, focusing on high-precision applications like pharmaceutical packaging and advanced materials inspection, characterized by early adoption of multi-line and spectral imaging technologies. Segment trends highlight the dominance of the CMOS sensor segment due to performance superiority, while the industrial inspection and sorting application segment remains the largest revenue contributor, consistently demanding faster and more reliable inspection capabilities to minimize waste and operational downtime.

Future market momentum is intrinsically linked to the uptake of Industry 4.0 initiatives, necessitating line scan cameras that seamlessly integrate with IoT frameworks. The market is witnessing a convergence of high-speed imaging and artificial intelligence (AI) for sophisticated defect classification, moving beyond simple thresholding techniques to deep learning algorithms. This integration enables systems to identify and categorize subtle defects previously undetectable by traditional algorithms, significantly enhancing operational efficiency and the reliability of automated quality assurance processes across multiple vertical industries globally.

AI Impact Analysis on Line Scan Camera Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Line Scan Camera Market frequently center on the feasibility and practical implementation of deep learning for defect detection, the necessary hardware upgrades (such as processing power at the edge), and the expected improvement in false positive rates compared to conventional rule-based machine vision systems. Users are keen to understand how AI facilitates the handling of highly variable defects (e.g., surface textures, cosmetic flaws) in complex materials like fabrics, composite materials, or varied packaging. A primary concern revolves around the complexity and cost associated with training robust AI models for specialized inspection tasks and the capability of current line scan camera interfaces to handle the continuous stream of high-resolution data required for real-time inference using deep neural networks.

The integration of AI, particularly deep learning, revolutionizes the utility of line scan cameras by transforming raw visual data into actionable, categorized quality insights. Traditional machine vision relies on pre-defined parameters and fixed algorithms; however, AI allows line scan systems to learn from large datasets of both good and defective products, enabling superior anomaly detection and classification. This shift moves inspection from simple presence/absence checks to complex, subjective quality assessments, particularly valuable in industries like printing (assessing color shift tolerance) and food processing (identifying nuanced product irregularities). This capability significantly reduces manual intervention and dramatically improves the accuracy of defect identification, paving the way for adaptive manufacturing processes where quality control adjusts dynamically based on learned patterns.

Furthermore, AI significantly enhances the efficiency of data processing, addressing the immense throughput generated by high-resolution line scan sensors (often exceeding 10 Gigabits per second). Edge AI solutions, wherein processing units are embedded within or close to the camera, allow for immediate classification and filtering of data before it is transmitted to the cloud or central server. This distributed intelligence framework minimizes latency, critical for high-speed web inspection, and ensures that only relevant, categorized defect images or metadata are stored, optimizing network bandwidth and storage resources. The future trajectory involves AI driving multispectral and hyperspectral line scan applications, enabling the analysis of material composition far beyond visible light inspection capabilities, thereby unlocking new opportunities in advanced sorting and quality verification.

- AI enables sophisticated, subjective defect classification via deep learning, surpassing limitations of rule-based systems.

- Real-time image analysis is optimized using Edge AI processing, reducing data latency critical for high-speed continuous inspection.

- Deep learning models improve tolerance management, accurately distinguishing acceptable variations from critical manufacturing defects.

- AI drives the feasibility of multispectral and hyperspectral line scan applications for advanced material composition analysis and sorting.

- Predictive maintenance is facilitated by AI monitoring subtle changes in image quality or processing metrics, anticipating camera or system failures.

- Automated setup and calibration processes use AI to optimize lighting and lens focus settings based on material type, drastically reducing integration time.

- Increased data compression and intelligent data filtering are managed by AI, reducing bandwidth requirements for ultra-high-resolution line scan data transmission.

- AI supports adaptive quality control where inspection criteria dynamically adjust to manufacturing tolerances and input material variations.

DRO & Impact Forces Of Line Scan Camera Market

The dynamics of the Line Scan Camera Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's growth trajectory and competitive landscape. The primary drivers stem from the global pursuit of operational excellence, mandating zero-defect manufacturing standards across capital-intensive industries. Restraints often revolve around the high initial cost associated with complex line scan setups, which include high-power lighting, specialized lenses, and sophisticated image processing hardware and software. Opportunities are abundant, rooted in the potential integration with emerging technologies and expansion into non-traditional sectors requiring precise surface inspection.

Key drivers include the pervasive trend of industrial automation and the necessity for 100% inspection coverage on continuous production lines, particularly in sectors like flat panel displays, high-speed printing, and battery manufacturing for electric vehicles, which demand micron-level precision at high throughputs. Furthermore, regulatory mandates and consumer demand for safety and quality (especially in food, pharmaceuticals, and automotive parts) pressure manufacturers to adopt superior inspection technologies. The continual advancement in CMOS sensor technology—offering higher line rates, increased sensitivity, and reduced pixel size—also acts as a strong intrinsic driver, making high-performance line scan systems more accessible and capable.

Conversely, significant restraints hinder widespread adoption, particularly in small and medium enterprises (SMEs). The initial investment is substantial, requiring highly skilled technicians for complex calibration, integration, and maintenance of the complete vision system (including specialized illumination and optics). Additionally, the massive volume of data generated by ultra-high-resolution line scan cameras presents challenges related to data storage, processing bottlenecks, and real-time transmission, often requiring expensive high-speed interfaces like CoaXPress or 10 GigE Vision. However, the largest opportunity lies in the rapid development of low-cost, high-performance computing platforms (like GPUs and FPGAs) that mitigate the processing challenge, coupled with the expansion of hyperspectral and multi-spectral imaging techniques that broaden line scan camera utility beyond standard visible inspection into advanced material sorting and chemical analysis.

Segmentation Analysis

The Line Scan Camera Market is comprehensively segmented based on technology, resolution, interface, application, and end-use industry, providing a granular view of market dynamics and specialized demand pockets. Understanding these segments is crucial for manufacturers to tailor product development and market penetration strategies, focusing on specific performance metrics required by different industrial verticals. The market segmentation reflects the diverse and demanding requirements for continuous, high-speed inspection across global manufacturing environments, where the choice of camera often depends critically on the material velocity, required defect size detection, and ambient conditions.

Technological segmentation, primarily CMOS versus CCD, is undergoing a definitive shift toward CMOS dominance due to superior speed and noise performance, especially in new product launches designed for ultra-high line rates. Resolution segmentation reveals increasing market pull towards 8K, 12K, and 16K models, driven by the inspection of ever-wider materials and the need to detect smaller defects, demanding significant investment in corresponding high-resolution optics and high-speed interfaces. Interface standardization, led by CoaXPress and emerging high-speed Ethernet standards, is critical for seamless integration into complex factory networks and managing the massive data throughput generated by these advanced sensors.

Application segmentation remains the backbone of the market, with industrial inspection (surface quality, dimensional measurement) and sorting (material separation) dominating revenue shares. The semiconductor and electronics industry constitutes a highly lucrative niche, requiring the most advanced, high-precision, and color-sensitive line scan capabilities for critical inspections of wafers, printed circuit boards (PCBs), and flat panel displays (FPDs). Geographical segmentation underscores the Asia Pacific region's crucial role as both a manufacturing hub and the largest consumer market for line scan cameras, owing to extensive investments in automation across heavy industries and consumer electronics production.

- By Technology:

- CMOS (Complementary Metal-Oxide-Semiconductor)

- CCD (Charge-Coupled Device)

- By Resolution:

- Below 2K

- 2K to 8K

- 8K to 16K

- Above 16K (Ultra-High Resolution)

- By Interface:

- GigE Vision (1 GigE, 10 GigE)

- Camera Link

- CoaXPress (CXP)

- USB 3.0/3.1

- By Application:

- Industrial Inspection and Quality Control

- Web Inspection (Film, Paper, Textile)

- Print Inspection (Graphics, Currency)

- Sorting (Food, Recycling, Materials)

- Dimensional Measurement

- Surface Analysis (Metals, Glass, Ceramics)

- Optical Character Recognition (OCR/OCV)

- By Spectral Sensitivity:

- Monochrome

- Color (RGB)

- Multispectral

- Hyperspectral

- Infrared (IR)

- By End-Use Industry:

- Electronics and Semiconductor

- Food and Beverage

- Automotive

- Printing and Packaging

- Pharmaceutical and Medical Devices

- Textile and Fabric

- Metals and Logistics

Value Chain Analysis For Line Scan Camera Market

The value chain of the Line Scan Camera Market is highly specialized, beginning with fundamental component manufacturing and extending through complex system integration to deployment in demanding industrial environments. The upstream segment is dominated by a few global players specializing in high-performance imaging sensors (CMOS/CCD), often requiring proprietary fabrication facilities to achieve the required precision and line length. This upstream dependence creates inherent vulnerabilities related to supply chain resilience and technological leadership. Key activities at this stage include sensor design, high-speed circuit development, and specialized lens manufacturing, where technical excellence dictates product performance and pricing strategy.

Midstream activities involve the camera manufacturers, who procure sensors, high-speed processors, and interface components to assemble the final line scan camera unit. Critical steps here include firmware development, rigorous calibration (ensuring pixel uniformity and geometric accuracy), and adherence to industry standards (like GenICam and GigE Vision). The midstream also heavily involves System Integrators (SIs) and distributors who bundle the camera with necessary complementary components, such as frame grabbers, high-intensity LED lighting systems, and dedicated machine vision software. This integration step adds substantial value, transforming a component into a functional, application-specific solution ready for deployment.

Downstream analysis focuses on the distribution channels and the end-users. Distribution relies heavily on specialized distributors with technical expertise who can provide pre-sales consultation and post-sales support, crucial given the complexity of line scan installation. Direct sales channels are often utilized for large, custom projects involving major automotive or electronics manufacturers. End-users, ranging from Tier 1 manufacturers to food processing plants, utilize these systems for mission-critical 100% quality inspection. The ongoing service and maintenance, provided by SIs and camera manufacturers, form a crucial final link in the value chain, ensuring system uptime and ongoing performance optimization, particularly as manufacturing processes evolve and requirements change.

Line Scan Camera Market Potential Customers

The primary potential customers and end-users of line scan camera systems are organizations operating high-throughput manufacturing processes that require continuous, non-contact, and extremely high-resolution quality control or material sorting. These systems are indispensable where web materials (paper, film, textiles, metals) are processed at high speed or where objects are cylindrical or require inspection across a wide field of view with uniform resolution. The core purchasing decision is driven by the need to minimize manufacturing defects, enhance product yield, comply with stringent quality standards, and reduce human inspection errors, directly impacting operational efficiency and brand reputation.

The electronics and semiconductor sectors represent highly valuable customers, utilizing line scan cameras for defect inspection on wafers, photomasks, PCB manufacturing, and display panels, where defect sizes can be sub-micron. Another critical segment includes the printing and packaging industries, relying on these cameras to ensure color accuracy, print registration, and faultless packaging integrity at speeds unattainable by area cameras. Furthermore, the rapidly expanding battery manufacturing sector, particularly for electric vehicles, constitutes a high-growth customer base, deploying line scan systems for electrode coating inspection and separator film quality control to ensure battery safety and longevity, demonstrating the critical nature of this technology in cutting-edge manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teledyne DALSA, Basler AG, TKH Group (Allied Vision), JAI A/S, ISRA VISION (Atlas Copco), Baumer Holding AG, Vieworks Co., Ltd., COGNEX Corporation, Hamamatsu Photonics K.K., Keyence Corporation, SICK AG, Datalogic S.p.A., Optronis GmbH, Shenzhen Daheng New Epoch Technology Co., Ltd., PCO AG, Photonfocus AG, Imperx, Inc., Chromasens GmbH, Tattile S.r.l., National Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Line Scan Camera Market Key Technology Landscape

The technology landscape of the Line Scan Camera Market is fundamentally defined by the ongoing transition from mature Charge-Coupled Device (CCD) sensors to advanced Complementary Metal-Oxide-Semiconductor (CMOS) sensors. This shift is paramount, as modern CMOS technology offers significantly higher line rates (often exceeding 200 kHz), lower power consumption, and better noise characteristics, essential for maintaining image quality at maximum production speeds. Furthermore, the integration of multi-line CMOS sensors, such as four-line or eight-line configurations, is a major trend. These advanced sensors allow for simultaneous capture of multiple spectral bands or enhance sensitivity by aggregating light, moving beyond simple RGB capture to complex spectral analysis within a single camera unit, thereby increasing defect visibility and material differentiation capabilities.

Another crucial technological advancement involves the data interface standards used to transport the massive stream of pixel data generated by high-resolution line scan cameras. Older standards like Camera Link are being rapidly superseded by CoaXPress (CXP), which offers high bandwidth (up to 12.5 Gbps per channel) and the ability to transmit power and control signals over a single coaxial cable, simplifying system architecture. Additionally, 10 GigE Vision and emerging 25 GigE Vision standards are gaining traction, leveraging standard Ethernet infrastructure to provide high-speed, cost-effective, and longer-distance data transfer solutions, supporting the distributed architecture demands of large-scale smart factories operating under Industry 4.0 paradigms.

Future development is heavily focused on integrated intelligence and specialized spectral imaging. On the intelligence front, incorporating Field-Programmable Gate Arrays (FPGAs) or specialized processing units directly into the camera body allows for real-time preprocessing, pixel correction, and even AI-based inference at the edge, mitigating host PC processing load. In spectral imaging, the increasing demand for detailed material analysis drives innovation in hyperspectral and near-infrared (NIR) line scan cameras. These technologies enable quality checks based on chemical composition rather than just visual appearance, opening up critical applications in pharmaceutical counterfeit detection, food freshness assessment, and high-purity material sorting in recycling operations, marking a significant evolution in non-contact inspection capabilities.

Regional Highlights

The global Line Scan Camera Market demonstrates distinct growth profiles and application concentrations across major geographic regions, primarily driven by regional manufacturing intensity, technological adoption rates, and governmental initiatives supporting industrial automation. Asia Pacific (APAC) stands out as the highest growth market, propelled by its status as the world's leading manufacturing hub for consumer electronics, automotive components, and textiles. Countries like China, South Korea, and Japan are heavily investing in ultra-high-speed, high-resolution line scan systems to improve yield in semiconductor and flat panel display production lines, making regional technical expertise and competitive pricing paramount for market success.

North America and Europe represent mature, high-value markets characterized by early adoption of the latest, most sophisticated line scan technologies, including multi-spectral and 3D line scanning for high-precision tasks. The focus in these regions is heavily concentrated on regulated industries such as pharmaceuticals (ensuring serialization and packaging integrity), aerospace, and high-end automotive manufacturing, where quality assurance standards are exceptionally stringent. European demand is bolstered by the robust machinery and factory automation sectors, with strong emphasis on energy efficiency and seamless integration into established smart factory frameworks. The competitive landscape here favors providers offering robust service networks and highly customized inspection solutions.

Latin America, Middle East, and Africa (MEA) currently represent emerging markets with significant potential, especially in sectors like food and beverage processing, packaging, and raw material sorting (mining and agriculture). While currently smaller in terms of market size, these regions are experiencing gradual increases in automation investment to meet international export quality standards. The adoption is often centered on more standardized, cost-effective line scan solutions, but the long-term trend indicates a shift toward higher-resolution systems as industrial infrastructure modernizes and local manufacturing capabilities expand, requiring suppliers to focus on durability and ease of maintenance in challenging operational environments.

- Asia Pacific (APAC): Highest growth region driven by electronics, semiconductor, and massive textile manufacturing hubs in China, South Korea, and Taiwan. Dominant consumer of ultra-high-resolution and high-speed CMOS line scan cameras for FPD and wafer inspection.

- North America: Mature market focused on high-precision applications in aerospace, automotive components, and pharmaceuticals. Strong demand for advanced CoaXPress interfaces and AI-enabled vision systems.

- Europe: Key region for industrial automation (Germany, Italy), emphasizing integrated machine vision solutions for machinery manufacturing, print inspection, and specialized material sorting (recycling, composites). Early adopter of multi-spectral line scan technologies.

- Latin America (LATAM): Emerging market focused on food processing, packaging, and basic industrial inspection. Growth influenced by efforts to meet international export quality standards.

- Middle East and Africa (MEA): Nascent market primarily driven by infrastructure projects, logistics, and resource processing (oil and gas, mining), seeing gradual adoption of standardized line scan systems for quality assurance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Line Scan Camera Market.- Teledyne DALSA

- Basler AG

- TKH Group (Allied Vision)

- JAI A/S

- ISRA VISION (Atlas Copco)

- Baumer Holding AG

- Vieworks Co., Ltd.

- COGNEX Corporation

- Hamamatsu Photonics K.K.

- Keyence Corporation

- SICK AG

- Datalogic S.p.A.

- Optronis GmbH

- Shenzhen Daheng New Epoch Technology Co., Ltd.

- PCO AG

- Photonfocus AG

- Imperx, Inc.

- Chromasens GmbH

- Tattile S.r.l.

- National Instruments

- FLIR Systems (Teledyne Technologies)

- IDS Imaging Development Systems GmbH

- Ximea s.r.o.

Frequently Asked Questions

Analyze common user questions about the Line Scan Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a line scan camera over an area scan camera?

The primary advantage of a line scan camera is its ability to achieve extremely high resolution (up to 32K pixels) across the width of an object without the limitations of field-of-view stitching required by area cameras, making it ideal for continuous, high-speed inspection of web materials like paper, glass, or textiles with uniform, micron-level precision.

Which data interface standard is dominating high-speed line scan camera applications?

CoaXPress (CXP) is currently the dominant interface standard for ultra-high-speed line scan applications, offering superior bandwidth (up to 12.5 Gbps per channel) and robust data transmission over long distances, crucial for managing the immense throughput from high-resolution sensors in real-time industrial environments.

How is Artificial Intelligence (AI) enhancing the functionality of line scan systems?

AI, specifically deep learning, enhances line scan functionality by enabling subjective defect classification, reducing false positives, and managing complex variability in inspected materials that traditional rule-based systems struggle with. This allows for superior quality control, particularly in electronics and food sorting, by identifying subtle anomalies.

Why is the CMOS sensor technology replacing CCD sensors in this market?

CMOS technology offers significant performance improvements over CCDs, including much higher line rates, lower thermal noise, higher sensitivity, and superior dynamic range. These characteristics are critical for meeting the demanding speed and quality requirements of modern, high-throughput manufacturing lines in the Industry 4.0 era.

Which end-use industry is expected to drive the highest growth for line scan cameras?

The Electronics and Semiconductor industry is projected to drive the highest growth due to the unrelenting requirement for flawless inspection of small features on wafers, printed circuit boards (PCBs), and flat panel displays (FPDs), necessitating continuous upgrades to the latest ultra-high-resolution line scan technology.

What are the typical challenges faced during the integration of a line scan camera system?

Integration challenges typically include the complexity of setting up and maintaining specialized, uniform high-intensity lighting (often requiring custom LED bars), precise mechanical alignment, and ensuring sufficient host PC or edge processing power to handle the high-volume data stream generated by the camera without latency issues.

Are line scan cameras suitable for 3D measurement applications?

Yes, line scan cameras are highly suitable for 3D measurement when paired with specialized illumination techniques, such as laser triangulation or structured light. They capture precise cross-sectional profiles of an object as it passes underneath, allowing for accurate reconstruction of the 3D geometry and volumetric measurement.

What is the role of multispectral line scan cameras in industrial inspection?

Multispectral line scan cameras capture images across specific, non-visible wavelengths (like UV or NIR) in addition to visible light. This capability is vital for analyzing material composition, detecting contaminants, or identifying hidden defects that are transparent or invisible under standard white light, particularly in food sorting and pharmaceutical verification.

How does the resolution of a line scan camera affect system cost and complexity?

Higher resolution (e.g., 16K or 32K) significantly increases system cost and complexity. It necessitates more expensive, specialized optics (lenses), requires higher bandwidth interfaces (like CXP), and demands much more powerful computing resources (high-end frame grabbers and GPUs) to process the massive volume of data generated, impacting both hardware and integration expenditure.

Which geographical region holds the largest market share currently?

Asia Pacific (APAC), primarily driven by the colossal scale of manufacturing operations in China, South Korea, and Japan, currently holds the largest market share in terms of volume and revenue for line scan camera adoption, dominating high-speed electronics and web inspection applications.

What is meant by the term "line rate" in line scan technology?

Line rate refers to the speed at which the camera captures and transfers individual lines of pixels, usually measured in kilohertz (kHz). A higher line rate is crucial for inspecting materials moving at higher speeds, ensuring that every section of the material is adequately and seamlessly imaged without blur or gaps between successive lines.

Are thermal line scan cameras becoming relevant in machine vision?

Yes, thermal (infrared) line scan cameras are becoming increasingly relevant, particularly in continuous process monitoring where temperature distribution is critical, such as in metal rolling, high-speed plastic extrusion, and monitoring thermal uniformity in battery production, offering a unique layer of quality control based on heat signatures.

What is the significance of the shift toward 10 GigE and 25 GigE interfaces?

The shift toward 10 GigE and 25 GigE interfaces is significant because it leverages standardized, cost-effective Ethernet cabling, enabling longer cable lengths and simpler networking compared to specialized interfaces like Camera Link, facilitating the integration of high-resolution line scan cameras into large, distributed factory environments (IoT connectivity).

How do line scan cameras contribute to sustainability and waste reduction?

Line scan cameras contribute significantly to sustainability by enabling 100% inspection and precise defect identification on continuous materials (like paper, film, and textiles). This early and accurate detection reduces material waste, improves manufacturing yield, and supports higher quality material sorting in recycling processes, optimizing resource usage.

Which technical feature is most critical for color line scan quality?

For color line scan quality, the use of advanced tri-linear or multi-linear CMOS sensors is most critical. These sensors capture the RGB data simultaneously (or near-simultaneously) for the same line, minimizing color registration errors and ensuring accurate color representation even at high operating speeds.

How are frame grabbers evolving to meet line scan data demands?

Frame grabbers are evolving by integrating powerful FPGAs and specialized processors capable of handling high-speed CXP or GigE streams, performing initial data reduction, normalization, and pre-processing tasks (like flat-field correction) on the board itself, thereby offloading the computationally intensive tasks from the main host computer.

What challenges does high-speed motion present to line scan imaging?

High-speed motion necessitates extremely short exposure times and very high line rates. The challenge is ensuring sufficient light (illumination power) is delivered within the short exposure window to maintain adequate signal-to-noise ratio, preventing motion blur while preserving the required depth of field across the entire inspection width.

In the Value Chain, why are System Integrators (SIs) crucial for the line scan market?

System Integrators are crucial because line scan systems are highly customized and complex, requiring expertise to select appropriate lenses, lighting, frame grabbers, and machine vision software, and then calibrate these components precisely to meet specific end-user application requirements, effectively transforming components into turnkey solutions.

What role do line scan cameras play in the food and beverage industry?

In the food and beverage industry, line scan cameras are essential for high-speed sorting, foreign object detection, and quality grading of bulk materials (nuts, grains, fruits) based on color, size, and appearance. Multispectral imaging is increasingly used to assess freshness and chemical composition for quality assurance.

How does spectral sensitivity affect the market segmentation?

Spectral sensitivity defines a major segmentation axis, distinguishing standard visible (monochrome/color) cameras from specialized multispectral and hyperspectral cameras. The latter segment addresses advanced, non-visible inspection tasks, commanding higher prices and serving specialized niches like pharmaceutical analysis and advanced material separation.

What is the significance of high pixel count (e.g., 16K) in line scan applications?

A high pixel count, such as 16K, signifies the ability to maintain very high spatial resolution (detecting minute defects) over an extremely wide field of view. This is critical for inspecting large, wide web materials (like wide-format displays or metal sheets) without needing multiple cameras or compromising detection sensitivity.

Are there efforts to standardize the physical mounting and connection of line scan cameras?

Yes, standardization efforts follow general machine vision norms (like C-mount, F-mount for optics) and adhere to established mechanical interfaces. However, highly customized line scan systems, particularly those integrated into proprietary web inspection machinery, often require specialized mounting solutions dictated by the high-precision alignment necessary.

How does the market address the challenge of data storage for continuous line scan applications?

The market addresses data storage through intelligent data filtering, where only defect images or relevant metadata are stored, leveraging edge processing (AI/FPGAs) for immediate decision-making. High-speed solid-state storage arrays and cloud integration are also used for storing necessary historical data for process optimization and regulatory compliance.

What is the impact of global supply chain disruptions on the line scan camera market?

Supply chain disruptions, particularly affecting specialized high-resolution CMOS sensor components and high-end processing hardware (FPGAs/GPUs), lead to extended lead times and increased costs for camera manufacturers and system integrators, slightly constraining immediate market growth and influencing pricing stability.

How do line scan camera systems handle defects that vary widely in appearance?

Line scan systems handle widely varying defects by utilizing advanced AI and deep learning models. These models are trained on vast datasets encompassing acceptable variances and numerous defect types, enabling the system to generalize and identify novel or subtle anomalies that fixed-logic algorithms would typically fail to categorize accurately.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Line Scan Camera Market Statistics 2025 Analysis By Application (Industrials, Medical and Life Sciences, Scientific Research), By Type (Camera Link, GigE/10GigE, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Line Scan Camera for Industrial Market Statistics 2025 Analysis By Application (Manufacturing, Medical and Life Sciences, Santific Research), By Type (Camera Link, GigE Vision), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager