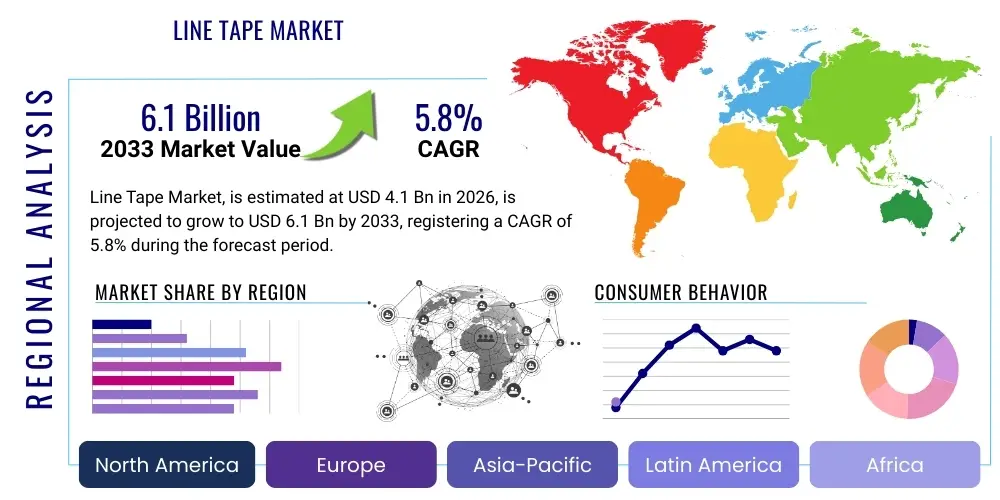

Line Tape Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435408 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Line Tape Market Size

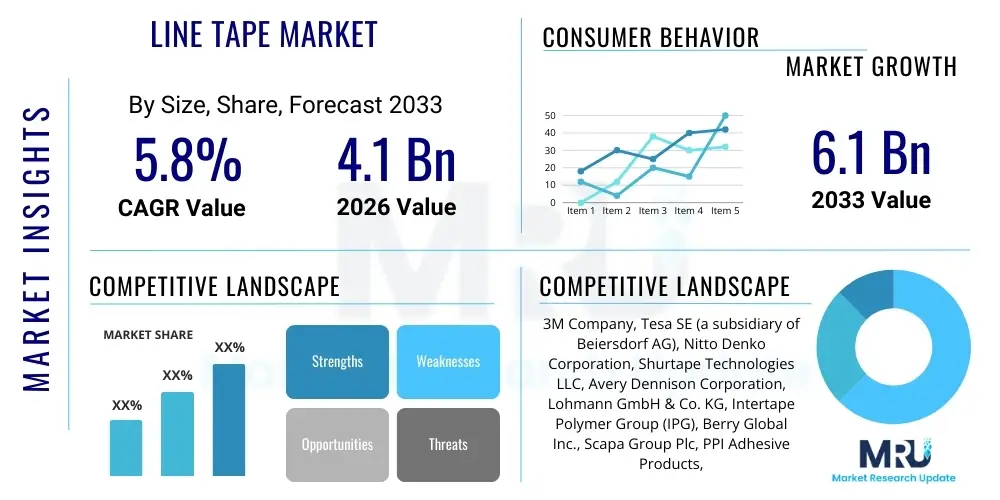

The Line Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Line Tape Market introduction

The Line Tape Market encompasses a diverse range of adhesive and non-adhesive materials utilized primarily for demarcation, safety indication, floor marking, and organizational purposes across various industrial, commercial, and recreational settings. Line tapes, often manufactured from materials such as PVC (Polyvinyl Chloride), polyethylene (PE), and specialized rubber compounds, provide durable, visible, and often temporary or semi-permanent solutions for defining operational zones, ensuring compliance with safety standards, and improving workflow efficiency. Their primary applications span highly regulated sectors like manufacturing, construction, logistics, and automotive maintenance, where precise boundary marking is essential for operational integrity and worker safety. The increasing stringency of workplace safety regulations globally acts as a foundational catalyst for market expansion, ensuring sustained demand for high-visibility and durable line marking solutions.

Key products within this market segment include hazard warning tapes, reflective tapes, aisle marking tapes, and specialty tapes designed for extreme environments, such as those with high abrasion, chemical exposure, or fluctuating temperatures. The product description emphasizes durability, high adhesion tailored to specific substrates (concrete, wood, metal), and color stability, which is crucial for maintaining compliance and visibility over extended periods. Major applications involve the creation of 5S systems in lean manufacturing, defining pathways for automated guided vehicles (AGVs) in warehouses, marking evacuation routes, and segmenting areas for specific tasks like inventory storage or machinery operation. The evolution of materials technology, particularly the development of vinyl tapes that resist fading and tearing, continually enhances product efficacy and lifecycle.

The core benefits derived from the adoption of line tapes include enhanced workplace safety by clearly indicating hazards, improved operational efficiency through visual management systems, and cost-effectiveness compared to permanent solutions like paint, which require significant downtime for application and curing. Driving factors for the market include rapid expansion in the global logistics and warehousing sectors driven by e-commerce growth, renewed focus on industrial automation requiring defined floor paths, and mandated adherence to international occupational safety and health standards (such as OSHA and ISO norms). Furthermore, the quick and easy application process of tapes, coupled with their removability for flexible layout changes, makes them highly attractive in dynamic industrial environments, further bolstering market growth prospects.

Line Tape Market Executive Summary

The Line Tape Market is experiencing robust growth fueled by transformative business trends, particularly the global shift toward automation in warehousing and manufacturing sectors. The integration of automated systems, including AGVs and robotic assembly lines, necessitates clearly defined, highly durable, and easily adaptable floor markings, favoring specialized industrial line tapes over traditional painted lines. Business trends also highlight an increasing preference for sustainable and low-VOC (Volatile Organic Compound) tape solutions, pushing manufacturers toward eco-friendly PVC alternatives and rubber-based products. Furthermore, the market structure is characterized by intense competition and a strong focus on innovation, where key players are investing in advanced adhesive formulations to improve tape longevity on challenging surfaces like oiled concrete or textured industrial floors, securing a premium positioning for high-performance products.

Regionally, the market exhibits dynamic growth patterns. Asia Pacific (APAC) is projected to be the fastest-growing region, driven by massive infrastructure development in countries like China and India, coupled with the rapid establishment of new manufacturing facilities and large-scale distribution hubs. North America and Europe, characterized by stringent safety regulations and mature industrial bases, represent the largest market shares, focusing predominantly on replacing older marking systems with high-specification, compliance-focused tapes, particularly within automotive and aerospace maintenance applications. Regional trends indicate that mature markets are prioritizing customization, demanding tapes tailored to specific harsh environments, whereas emerging markets are driven by volume consumption focused on general safety and basic logistics marking needs.

Segment trends confirm that the Industrial Safety and Logistics segments dominate application areas, reflecting the global commitment to accident reduction and supply chain optimization. The Material segment shows a strong trend towards high-grade vinyl and proprietary blended polymers, moving away from lower-quality polyethylene tapes in critical applications. Within the Type segment, specialized and heavy-duty tapes designed for permanence and high traffic are gaining prominence over temporary marking solutions, especially in permanent factory layouts. This segmentation shift underscores a market maturation where end-users are increasingly valuing the total cost of ownership (TCO) associated with durability and compliance over initial purchase price, leading to premiumization in industrial-grade product offerings.

AI Impact Analysis on Line Tape Market

User inquiries regarding the impact of Artificial Intelligence on the Line Tape Market primarily revolve around how automation and data analytics influence the need for physical line marking, particularly concerning maintenance, replacement cycles, and integration with smart infrastructure. Common questions address whether AI-driven warehouse management systems (WMS) can optimize floor layouts, thus changing tape usage patterns, or if computer vision systems used in AGVs require specific tape reflectance or color properties for enhanced performance. The core theme summarizes key concerns about potential displacement—if advanced robotics and sensor technology reduce the reliance on human-readable floor markings—balanced against the expectation that AI will optimize tape application and maintenance, leading to more precise, condition-based replacement cycles rather than time-based ones. Users seek clarity on how AI enhances the efficiency of line marking processes and materials used in smart factories.

AI's primary influence is indirect, focusing on optimization and integration within automated ecosystems rather than directly manufacturing the tape. AI and machine learning algorithms are utilized in facility design software to calculate optimal path widths, turning radii, and storage zone placements, directly dictating the required linear footage and placement accuracy of line tapes. This level of optimization reduces material waste and ensures compliance with minimal effort. Moreover, the integration of AI-powered computer vision and LiDAR systems in automated equipment demands high-contrast, uniformly colored, and highly durable tapes to ensure consistent visibility and readability by these sophisticated guidance systems. Therefore, AI acts as a driver for higher quality, specialized tape formulations rather than a replacement for the physical marking requirement itself.

Furthermore, predictive maintenance systems, often powered by machine learning, can monitor floor traffic and environmental wear factors, alerting facility managers precisely when a section of tape falls below acceptable visibility or durability thresholds. This capability shifts the procurement pattern from reactive replacement to proactive maintenance planning, demanding manufacturers provide detailed specifications on material wear rates and reflective qualities. The future impact centers on creating "smart tapes"—tapes with integrated RFID or small embedded sensors for real-time tracking, which, while not a core product for most current line tape manufacturers, represents a long-term convergence point where AI-driven inventory and asset tracking rely on the defined floor geography created by the line tape.

- AI-driven optimization software dictates precise tape placement and linear requirements in smart warehouses.

- Computer vision systems used in AGVs increase the demand for high-contrast, specific color and texture-optimized tapes.

- Predictive maintenance analytics enable condition-based replacement of worn tapes, optimizing material lifespan and reducing downtime.

- AI enhances compliance monitoring by validating floor markings against defined safety standards using real-time facility scans.

- Integration potential for tapes with embedded passive RFID tags facilitates AI-powered inventory tracking and asset location.

DRO & Impact Forces Of Line Tape Market

The dynamics of the Line Tape Market are significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and structural impact forces. The primary driver is the accelerating focus on occupational health and safety (OHS) legislation across industrialized and rapidly industrializing nations, mandating clear demarcation of hazardous areas, traffic lanes, and exclusion zones within factories and construction sites. This legislative push creates a non-negotiable baseline demand. Parallelly, the massive expansion of the e-commerce sector has led to an explosion in the number and size of logistics and fulfillment centers globally, all of which require extensive use of line tape for spatial organization, traffic control, and 5S methodology implementation. These two factors—regulatory compliance and logistics expansion—form the core growth engine.

Restraints primarily revolve around the challenges posed by long-term durability and the presence of low-cost, inferior quality substitutes. While premium tapes offer excellent longevity, maintaining adhesion on constantly wet, dirty, or heavily chemically treated industrial floors remains a technical challenge, requiring frequent reapplication and increasing the total maintenance cost for end-users. Additionally, the fluctuating prices of raw materials, particularly petrochemical derivatives like PVC and specialized polymers, introduce cost volatility for manufacturers, potentially restraining stable pricing and profitability. Furthermore, competition from traditional marking methods, such as industrial epoxy paints, remains a restraint in environments where permanent, ultra-high durability marking is preferred despite the higher initial cost and application downtime.

Significant opportunities exist in the development of highly specialized tapes and market penetration in emerging segments. Opportunities are concentrated in the innovation of tapes with enhanced sensory features, such as glow-in-the-dark or photo-luminescent capabilities for emergency egress paths, and magnetic tapes for highly reconfigurable layouts often seen in flexible manufacturing cells. Geographically, untapped potential lies in expanding market reach within small and medium-sized enterprises (SMEs) in developing economies, which are beginning to adopt formal OHS standards. The impact forces underscore competitive intensity, technological shifts towards sustainable materials, and the increasing bargaining power of large distributors and facility management groups who demand bulk purchasing efficiency and specialized product ranges.

Segmentation Analysis

The Line Tape Market is meticulously segmented based on material, type, application, and geography, allowing for a precise understanding of demand patterns and market penetration strategies. This structured segmentation highlights the heterogeneity of end-user requirements, ranging from the need for basic temporary demarcation to highly specified, chemical-resistant markings necessary for cleanroom environments or automotive production lines. Material segmentation, which includes PVC, PE, and specialized polymers, reflects trade-offs between cost, durability, and environmental compliance, with premium pricing generally associated with specialized, high-performance compounds capable of withstanding extreme physical and chemical stress. The Application segment is crucial as it dictates the required technical specifications, with industrial safety demanding high visibility and specific color coding, while sports and recreation focus more on consistent line definition and resistance to outdoor elements.

The segmentation by type—Permanent, Temporary, and Specialized—helps differentiate market offerings based on intended use and expected lifespan. Permanent tapes are characterized by robust, high-tack adhesives and thicker carriers, designed for high-traffic zones in fixed factory layouts. Temporary tapes, often used for short-term logistical changes, events, or maintenance shutdowns, prioritize easy, residue-free removal. Specialized tapes encompass products like reflective tapes, anti-slip variants, or tapes resistant to extreme temperatures, carving out niche, high-value markets in sectors such as aerospace, cold storage, and hazardous waste handling. Analyzing these types provides insights into inventory management strategies for end-users and product diversification paths for manufacturers, emphasizing the move towards customizable product specifications.

Geographic segmentation remains essential for identifying growth hotspots, with APAC showing the highest volumetric demand driven by new infrastructure projects, while North America and Europe lead in terms of value, driven by strict regulatory standards that necessitate the use of higher-specification, certified products. Understanding these segment dynamics is vital for market participants to tailor their marketing and distribution efforts. For instance, focusing on high-grade PVC and specialty tapes in European industrial markets leverages the regulatory drivers and established premium pricing environment, whereas focusing on cost-effective, durable PE tapes might be more suitable for volume-driven construction projects in emerging Asian markets, demonstrating clear regional strategic differentiators.

- By Material:

- PVC (Polyvinyl Chloride)

- Polyethylene (PE)

- Rubber and Vinyl Composites

- Specialty Polymers (e.g., Polyurethane)

- By Type:

- Permanent Line Tapes

- Temporary Line Tapes

- Specialized/High-Performance Tapes (e.g., Reflective, Anti-slip)

- By Application:

- Industrial Safety and Logistics

- Construction and Infrastructure

- Automotive and Aerospace

- Sports and Recreation (Courts, Fields)

- Healthcare and Cleanroom Facilities

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Line Tape Market

The Value Chain of the Line Tape Market begins with the upstream sourcing of raw materials, primarily focusing on petrochemical derivatives essential for the adhesive and carrier components. Key upstream activities involve the procurement of polymers (PVC resin, PE pellets, acrylics, and specialized elastomers) and adhesive raw materials (natural rubber, synthetic rubber, and various resins for tack and cohesion). The cost and quality of these raw materials, which are subject to global commodity price fluctuations and supply chain logistics, significantly impact the final manufacturing cost of line tape products. Manufacturers must maintain robust relationships with chemical suppliers to ensure a steady, cost-effective supply of standardized polymer grades necessary for mass production and specialized formulations, making supply risk management a crucial element of the upstream segment.

The core manufacturing stage involves converting raw polymers into the tape carrier film and blending adhesives, followed by coating, slitting, and packaging. Efficiency in this midstream process is critical, focusing on optimizing coating thickness, ensuring adhesive uniformity, and minimizing waste during the slitting process, where large rolls are cut into standard market widths. Technological investments in high-speed coating machinery and quality control systems that verify adhesion strength and tensile properties are essential competitive differentiators. Companies often employ vertical integration strategies, managing both polymer formulation and adhesive creation in-house to maintain proprietary control over product performance and quickly adapt to changing regulatory requirements, such as restrictions on certain solvents or heavy metals.

The downstream segment involves distribution and end-user application. Line tapes are distributed through a complex network comprising large industrial distributors (e.g., Grainger, Fastenal), specialized safety equipment suppliers, and direct sales channels to large industrial clients (e.g., major automotive plants). The choice of distribution channel heavily influences market reach and pricing. Direct sales are common for high-volume, customized industrial orders, whereas indirect sales through distributors are standard for the broad, fragmented SME market. The final link is the end-user application, where installation training and product compatibility with existing floor types (concrete porosity, sealant usage) become important factors determining customer satisfaction and repeat business. Effective inventory management at the distributor level is key, given the sheer variety of colors, widths, and material specifications required by diverse end-users.

Line Tape Market Potential Customers

Potential customers for the Line Tape Market are broadly categorized into entities requiring systematic visual management, safety compliance, and operational efficiency improvements in their physical facilities. The largest consumer base resides within the manufacturing and heavy industrial sectors, encompassing automotive assembly, aerospace, machinery production, and chemical processing plants. These environments necessitate clear delineation of pedestrian walkways, forklift paths, material staging areas, and production cells to comply with rigorous safety standards (e.g., OSHA, European Directives). Line tape is an indispensable component of the 5S methodology (Sort, Set in Order, Shine, Standardize, Sustain), making facility managers and safety officers within these organizations the primary decision-makers and high-volume buyers.

A second major customer category includes the rapidly expanding logistics and warehousing sector, driven by global e-commerce. Fulfillment centers, distribution hubs, and third-party logistics (3PL) providers require extensive use of line tape to define racking system boundaries, designate picking zones, mark dock doors, and guide AGVs. The demand here is often for durable, heavy-duty tapes capable of withstanding constant forklift traffic and large-scale automated machinery wear. Purchasing decisions in this segment are typically centralized under warehouse operations managers or supply chain procurement departments, focusing heavily on total lifespan, ease of application, and compliance with fire safety codes regarding aisle width maintenance.

Other significant end-user segments include construction companies for temporary site marking and hazard warning, municipal and government entities for infrastructure maintenance and public safety markings, and institutional users such as schools, hospitals, and sports facilities. Hospitals, in particular, require specialized, easy-to-clean tapes for marking zones in operating rooms or patient flow paths, often demanding low-residue and antimicrobial properties. Sports facilities, ranging from professional arenas to community centers, represent a substantial segment for specialized tapes used to temporarily or permanently mark courts and fields (e.g., basketball, volleyball, temporary athletic tracks), focusing on non-damaging adhesion and UV resistance for outdoor applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Tesa SE (a subsidiary of Beiersdorf AG), Nitto Denko Corporation, Shurtape Technologies LLC, Avery Dennison Corporation, Lohmann GmbH & Co. KG, Intertape Polymer Group (IPG), Berry Global Inc., Scapa Group Plc, PPI Adhesive Products, Saint-Gobain S.A., Sekisui Chemical Co. Ltd., Chemence, Bostik (Arkema Group), Lintec Corporation, MacTac Americas LLC, Advance Tapes International, General Formulations Inc., Heskins Limited, Stop-Painting Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Line Tape Market Key Technology Landscape

The technology landscape in the Line Tape Market is centered around advancements in polymer science, adhesive chemistry, and specialized coating techniques aimed at improving durability, adhesion on difficult substrates, and environmental compliance. A major technological focus involves migrating from traditional solvent-based adhesives to advanced water-based (acrylic) or 100% solid rubber-based adhesives. This shift is driven by stringent environmental regulations, particularly in North America and Europe, mandating lower VOC emissions during production and application. Water-based adhesives offer superior performance, stability, and curing characteristics, enabling quicker application and less facility downtime compared to older formulations, positioning them as the standard for high-performance industrial tapes.

Another critical area of innovation lies in the development of engineered polymer carriers. Manufacturers are constantly refining PVC, polyurethane, and proprietary vinyl blends to enhance abrasion resistance and tensile strength, crucial for tapes used in high-traffic forklift lanes. Specifically, the introduction of multi-layered carrier films, sometimes incorporating fiberglass or polyester mesh reinforcement, significantly increases the tape's resistance to ripping and stretching. This technological advancement allows tapes to compete more effectively with durable epoxy coatings by offering near-equivalent lifespan under harsh conditions but maintaining the inherent flexibility and removability advantages of tape, which is a major value proposition for end-users seeking adaptable facility layouts.

Furthermore, the coating technology itself is evolving, with technologies like hot-melt coating and precise calendaring systems ensuring uniform adhesive application, which is crucial for maximizing tape lifespan and preventing edge lift—a common failure point. Reflective and photoluminescent technologies are also becoming standard features for specialized hazard and emergency tapes, utilizing micro-prismatic or glass bead technology embedded in the carrier to maximize light return, adhering to modern safety standards for low-light environments. The integration of specialty additives, such as anti-microbial agents for healthcare applications or chemical stabilizers for resistance against industrial solvents and oils, further defines the specialized technological segment, ensuring that line tapes remain relevant in highly technical operating environments.

Regional Highlights

Geographic analysis reveals that North America currently holds a commanding position in the Line Tape Market by value, primarily due to the stringent enforcement of occupational safety regulations (e.g., OSHA 1910 standards) across the US and Canada. The region’s mature industrial base, especially in the automotive, aerospace, and advanced manufacturing sectors, requires consistent investment in high-quality, certified line marking solutions. Furthermore, the massive scale of e-commerce warehousing and distribution infrastructure in the United States drives unparalleled demand for high-durability floor marking tape essential for guiding automated systems and managing complex inventory flows. High labor costs also incentivize rapid application solutions like tape over labor-intensive painting methods, further bolstering market consumption.

Europe represents another key region, characterized by a focus on sustainable manufacturing and adherence to demanding ISO standards. The European market prioritizes environmentally friendly products, leading to a higher penetration rate of water-based and solvent-free adhesive tapes. Germany, the UK, and France are major consumers, driven by robust automotive production and highly regulated chemical and pharmaceutical industries that require specialized tapes (e.g., anti-static, cleanroom-compatible). European regulations, particularly those related to workplace signage and visual management, ensure a consistent demand for premium, high-visibility hazard tapes, with a strong emphasis on product compliance documentation and traceability from the manufacturer.

Asia Pacific (APAC) is projected to exhibit the highest CAGR during the forecast period. This exponential growth is underpinned by rapid urbanization, massive government investment in infrastructure development (roads, railways, ports), and the establishment of vast manufacturing hubs, particularly in China, India, and Southeast Asian nations. As safety regulations gradually become more standardized and strictly enforced in these emerging economies, the adoption of industrial safety products, including line tape, witnesses a surge. While the APAC market is currently price-sensitive, the accelerating shift toward automated logistics and the adoption of lean manufacturing techniques are rapidly increasing the demand for high-quality, durable floor marking solutions, signaling a transition toward value-based purchasing similar to mature Western markets.

- North America: Market leader by value, driven by strict OSHA compliance and extensive warehousing footprint, favoring high-grade PVC and specialized AGV path tapes.

- Europe: Strong demand for environmentally compliant products (low VOC), driven by stringent ISO and workplace safety regulations, with high adoption in automotive and pharmaceuticals.

- Asia Pacific (APAC): Fastest growing region, fueled by large-scale infrastructure projects, rapid industrialization, and increasing adoption of formal safety standards in manufacturing sectors.

- Latin America: Emerging market characterized by growing construction and manufacturing sectors, with increasing focus on basic safety demarcation and gradual improvement in product quality requirements.

- Middle East and Africa (MEA): Growth driven by oil and gas industry safety needs and large-scale logistics investments in Gulf Cooperation Council (GCC) countries, requiring tapes resistant to high temperatures and harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Line Tape Market.- 3M Company

- Tesa SE (a subsidiary of Beiersdorf AG)

- Nitto Denko Corporation

- Shurtape Technologies LLC

- Avery Dennison Corporation

- Lohmann GmbH & Co. KG

- Intertape Polymer Group (IPG)

- Berry Global Inc.

- Scapa Group Plc

- PPI Adhesive Products

- Saint-Gobain S.A.

- Sekisui Chemical Co. Ltd.

- Chemence

- Bostik (Arkema Group)

- Lintec Corporation

- MacTac Americas LLC

- Advance Tapes International

- General Formulations Inc.

- Heskins Limited

- Stop-Painting Inc.

Frequently Asked Questions

Analyze common user questions about the Line Tape market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the increased demand for industrial line tape over traditional floor paint?

The primary drivers are enhanced flexibility in facility layout, faster application time leading to minimal operational downtime, and strict adherence to workplace safety regulations (e.g., 5S methodology). Tapes are also preferred for their durability, clean removability, and the lack of VOC emissions associated with painting processes, making them a safer, more adaptable, and often more cost-effective long-term solution.

Which material segment dominates the Line Tape Market in terms of performance and value?

High-grade PVC (Polyvinyl Chloride) and specialized vinyl composite tapes dominate the market for high-value industrial and logistics applications. These materials offer superior abrasion resistance, chemical resilience, and durability compared to standard polyethylene (PE) tapes, ensuring compliance and longer service life in heavy-traffic environments, justifying their premium pricing.

How does the growth of e-commerce influence the Line Tape Market globally?

E-commerce growth necessitates the rapid establishment of large, highly efficient fulfillment and distribution centers globally. These modern warehouses rely heavily on durable line tape for systematic organization, traffic management for forklifts and Automated Guided Vehicles (AGVs), and defining inventory zones, thereby creating a massive, sustained demand for industrial-grade marking solutions.

What are the key technological advancements expected to shape the future of line tape products?

Future innovation focuses on sustainable solutions (e.g., water-based adhesives, non-PVC polymers), enhanced durability through reinforced carriers (fiberglass/mesh), and the integration of sensory capabilities. Specialized tapes offering photoluminescence for emergency paths or highly precise visual cues for AI-driven robotics systems are critical technological focus areas for market growth.

Which geographical region is expected to show the fastest growth rate for line tape adoption?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid industrialization, increasing governmental enforcement of occupational safety standards across manufacturing sectors, and substantial investments in logistics and infrastructure development across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager