Line-Voltage Thermostats Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432164 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Line-Voltage Thermostats Market Size

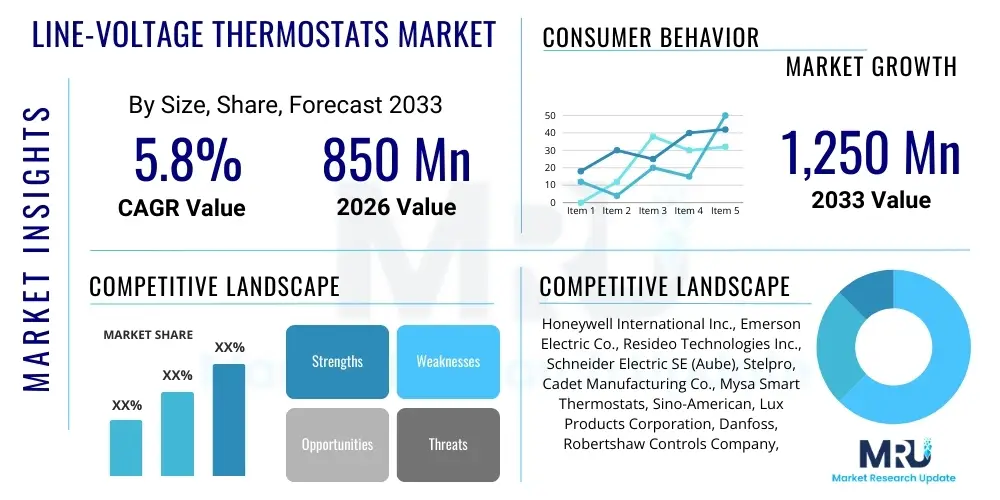

The Line-Voltage Thermostats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033.

Line-Voltage Thermostats Market introduction

The Line-Voltage Thermostats Market encompasses devices specifically designed to directly control heating systems operating on 120V or 240V electricity, commonly utilized for electric baseboard heaters, radiant ceiling panels, and certain fan-driven heating units. Unlike low-voltage counterparts which rely on a separate transformer, line-voltage thermostats manage the full electrical load, requiring robust internal components such as heavy-duty relays and precise sensors capable of handling high amperage. This direct control capability makes them essential components in decentralized or zone heating applications, particularly prevalent in older residential structures, apartments, and specialized commercial spaces where individual room temperature regulation is necessary without central HVAC intervention. The core function is to provide reliable, efficient, and direct switching of power to the heating elements, ensuring temperature setpoints are maintained with accuracy and safety.

The recent evolution of the market is characterized by a significant transition from purely mechanical (bi-metallic strip) and electro-mechanical models to highly advanced electronic and smart, Wi-Fi enabled line-voltage units. These newer generations offer enhanced precision, digital display interfaces, and advanced programming features, moving beyond simple on/off control to incorporate proportional-integral-derivative (PID) control algorithms for smoother temperature modulation and superior energy conservation. The primary application sectors demanding this sophistication include energy-conscious multi-family housing, hospitality, and residential renovations seeking upgrades to existing high-voltage heating infrastructure. The integration of connectivity allows end-users to manage their heating zones remotely, satisfying the growing consumer demand for seamless smart home integration and utility optimization.

Key benefits driving the adoption of modern line-voltage thermostats include improved energy efficiency through precise temperature control, ease of installation in existing line-voltage wiring setups, and significant reductions in energy consumption compared to older, inaccurate mechanical models. Furthermore, regulatory mandates focusing on energy conservation in building codes, particularly in regions relying heavily on electric heating, are accelerating the replacement cycle of antiquated units. These devices serve as a crucial interface between user comfort requirements and the substantial electrical loads of resistive heating systems, ensuring safety, reliability, and increasingly, enhanced user experience through connectivity and programmable schedules.

- Product Description: Devices operating directly on high electrical voltages (120V to 240V) to control decentralized electric heating loads like baseboard heaters and radiant panels.

- Major Applications: Residential apartments, custom homes with zone heating, hotel rooms, schools, and commercial offices utilizing supplemental or primary electric heating.

- Benefits: High switching capacity, direct control of high-amperage heating, improved energy efficiency (in electronic/smart models), and simplified installation in existing high-voltage setups.

- Driving Factors: Mandates for building energy efficiency, rise in smart home adoption, and the need for zone-specific heating optimization.

Line-Voltage Thermostats Market Executive Summary

The Line-Voltage Thermostats Market is experiencing robust growth fueled by technological advancements that are effectively bridging the gap between traditional high-voltage infrastructure and modern smart home ecosystems. Current business trends indicate a strong shift toward digitalization, with manufacturers heavily investing in developing connected, Wi-Fi enabled line-voltage thermostats that offer remote access, geofencing capabilities, and compatibility with leading smart home platforms such as Amazon Alexa and Google Home. This integration is crucial for maximizing energy savings in electrified heating systems. Furthermore, market competition is intensifying, pushing companies to focus on ergonomic design, reliability, and ease of professional installation to capture both the new construction and retrofit markets. The trend of decentralized energy management, where every heating unit acts as an independent controllable zone, is central to market expansion.

Regionally, North America, particularly Canada and the colder regions of the United States, represents the largest and most dynamic segment due to the widespread historical use of electric baseboard heating in residential and multi-family units. Stricter building codes, such as those implemented in certain Canadian provinces requiring highly accurate temperature control, are acting as significant market catalysts. Europe is also showing accelerated growth, particularly in countries utilizing electrical radiant floor heating and other supplemental high-voltage systems. In these regions, the emphasis is heavily placed on European Union directives concerning energy performance of buildings, driving demand for high-precision electronic and smart line-voltage control devices. Emerging markets are lagging but show potential as electrification of heating infrastructure progresses.

Segment trends highlight the overwhelming consumer preference for electronic and smart line-voltage thermostats over older mechanical models. The electronic segment, offering superior accuracy and programmability at a moderate price point, is dominating volume, especially in large-scale residential upgrades. However, the Smart/Wi-Fi segment is poised for the fastest CAGR, driven by the desire for seamless integration into the broader IoT landscape and the capability for algorithmic optimization of heating cycles. Application-wise, the residential sector remains the primary user base, but the hospitality sector is rapidly adopting these systems for precise, guest-controlled, and centrally managed room heating solutions, offering substantial operational cost savings through optimized usage tracking.

- Business Trends: Strong investment in smart connectivity (Wi-Fi, Bluetooth), focusing on user interface design, and developing highly accurate PID control algorithms for enhanced energy savings.

- Regional Trends: Dominance of North America due to legacy electric heating infrastructure; rapid adoption in Europe driven by energy efficiency standards and radiant heating proliferation.

- Segment Trends: Accelerated shift from mechanical to electronic thermostats; Smart/Wi-Fi segment exhibiting the highest growth rate due to IoT integration and remote management capabilities.

AI Impact Analysis on Line-Voltage Thermostats Market

User inquiries regarding AI's influence on the Line-Voltage Thermostats Market primarily revolve around the optimization of energy consumption, the feasibility of predictive maintenance for high-load electrical relays, and the potential for these traditionally simple devices to integrate into complex smart grid ecosystems. Users frequently ask how AI can learn individual room thermal characteristics, manage temperature overshoot (a common issue with high-inertia electric heating), and ensure long-term reliability given the stresses of switching line-voltage currents. The overarching concern is whether the added complexity of AI justification outweighs the cost for a device controlling a simple resistive load. Analysis shows that the key themes emerging are centered on achieving true proactive efficiency and maximizing component lifespan by utilizing machine learning algorithms to anticipate heating needs, minimize cycling, and detect imminent hardware failures before they occur.

- AI-driven optimization reduces energy waste by learning thermal inertia and anticipating heating requirements, minimizing on/off cycling.

- Predictive maintenance algorithms analyze relay switching frequency and voltage data to forecast potential component failure, enabling proactive replacement.

- Enhanced load management allows smart line-voltage thermostats to participate dynamically in demand-response programs initiated by utility companies.

- Machine learning improves self-calibration, adapting the thermostat's sensitivity to ambient conditions and insulation changes over time.

- Integration with external data sources (weather forecasts, utility rates) is facilitated by AI to create optimal, real-time heating schedules.

DRO & Impact Forces Of Line-Voltage Thermostats Market

The Line-Voltage Thermostats Market is propelled by the necessity for decentralized, precise heating control and constrained by the high cost and complexity associated with retrofitting smart technology into legacy electrical infrastructure. Opportunities abound in the burgeoning hospitality sector and specialized commercial real estate demanding autonomous zone management, while regulatory mandates focusing on building performance metrics enforce market growth. The balance between ease of installation (a driver) and competition from inherently lower-cost, lower-voltage HVAC systems (a restraint) shapes the competitive landscape. Impact forces center on technological innovation, specifically the cost reduction of robust microprocessors and Wi-Fi modules capable of handling electrical noise inherent in high-voltage environments, making sophisticated smart features more accessible and reliable.

Detailed Drivers:

The primary driver for the line-voltage thermostat market is the substantial global inventory of buildings, both residential and commercial, that rely exclusively on electric resistive heating, such as baseboard heaters and in-wall electric furnaces. Replacing these legacy mechanical thermostats with modern electronic or smart versions is the single most cost-effective way to immediately improve energy efficiency in these structures. New regulations and energy codes in many developed economies, particularly concerning mandatory minimum efficiency ratings for newly installed or replacement heating controls, mandate the transition to highly accurate electronic devices capable of adhering to precise setpoints, often eliminating older, less accurate mechanical models from sale entirely. This regulatory push creates a non-optional replacement market.

Secondly, the growing consumer and commercial preference for sophisticated zone control and smart home integration significantly boosts the demand for high-end line-voltage units. Modern users expect remote access, schedule programming, and energy usage analytics, functionalities only provided by connected smart thermostats. Manufacturers have successfully miniaturized and ruggedized the necessary electronic components (relays, power supplies, Wi-Fi chips) to fit within standard line-voltage junction boxes, making the upgrade path minimally disruptive. This allows consumers to maintain their existing baseboard heating infrastructure while gaining full smart home functionality, driving a premium segment of the market.

Furthermore, the inherent simplicity and lower initial installation cost of electric baseboard heating compared to complex central HVAC systems ensure a continuous market for line-voltage controls, particularly in multi-family dwellings and auxiliary spaces. As global energy prices remain volatile, the ability of modern line-voltage thermostats to utilize advanced algorithms (like proportional control) to maintain comfort while minimizing energy consumption provides a tangible return on investment, incentivizing homeowners and property managers to upgrade. This functional advantage, coupled with mandatory replacement cycles, provides sustained market momentum.

- Energy Efficiency Mandates: Governmental regulations requiring high-precision temperature control in electric heating systems.

- Prevalence of Electric Heating: High existing base of installed electric baseboard and radiant heating systems globally.

- Smart Home Integration Demand: Consumer demand for remote control, programmability, and energy usage monitoring features.

- Ease of Retrofitting: Minimal wiring changes required to upgrade mechanical units to electronic or smart line-voltage models.

Detailed Restraints:

One major restraint facing the line-voltage market is the substantial competition from low-voltage central HVAC systems, particularly in new construction. Low-voltage systems often utilize integrated network controls, offering centralized management and integration of heating, cooling, and ventilation from a single interface, which is often preferred in large commercial and high-end residential developments. While line-voltage systems are ideal for zone heating, they often lack the seamless, overarching control structure of a comprehensive central system, limiting their market penetration in projects designed for holistic energy management.

Another significant challenge is the technical complexity and regulatory hurdles associated with designing high-voltage electronic devices. Line-voltage components must meet stringent safety certifications (e.g., UL, ETL) due to the inherent risk of managing 120V/240V loads. This necessity drives up component costs (e.g., robust relays, insulated enclosures, specialized power management chips) compared to low-voltage alternatives. The development cycle is longer, and specialized expertise is required for installation, potentially limiting DIY adoption and relying heavily on qualified electricians and HVAC contractors.

Moreover, the perception of electric resistive heating as less efficient compared to modern heat pumps or natural gas systems acts as a market headwind. Although modern electronic line-voltage thermostats significantly improve the performance of electric heating, this entrenched perception can deter buyers in new construction from opting for electric baseboard systems altogether. This indirectly constrains the growth of the associated control market, requiring continuous education and demonstration of the enhanced energy management capabilities offered by smart line-voltage controls.

- Competition from Central HVAC: Preference for integrated low-voltage central heating/cooling systems in new construction.

- High Component Cost: Necessity for expensive, robust, certified components (relays, electronics) to handle high electrical loads safely.

- Perception of Low Efficiency: Consumer and builder bias against electric resistive heating systems compared to heat pumps.

- Installation Dependency: Reliance on licensed electricians for installation due to high voltage risks, increasing total deployment cost.

Detailed Opportunities:

A primary opportunity lies in the rapid expansion of the Internet of Things (IoT) ecosystem and the increasing focus on granular energy management. Smart line-voltage thermostats can become critical data collection points in decentralized building management systems, providing real-time data on energy consumption per zone. This data is invaluable for building automation systems (BAS) and property managers seeking to optimize energy expenditure across large portfolios of multi-family housing or hotel properties. The integration with predictive cloud analytics offers service providers new revenue streams related to ongoing energy monitoring and optimization services.

The hospitality sector presents an enormous untapped opportunity. Hotel rooms utilizing individual baseboard or radiant heating units can significantly benefit from networked smart line-voltage controls. These systems allow hotel management to enforce setpoint limits, detect unoccupied rooms (via occupancy sensors often integrated into smart units), and automatically adjust temperatures, leading to substantial energy savings without compromising guest comfort. The return on investment for upgrading to networked smart controls is often realized quickly due to the high energy intensity of constant hotel operations.

Furthermore, the ongoing global push toward decarbonization and building electrification, particularly in regions transitioning away from fossil fuel heating, opens new markets. As electric heating solutions become mandatory or preferred replacements for gas furnaces, the demand for precise, reliable, and connected line-voltage controls will surge. Innovations in materials and design that allow for even higher load handling or integration into emerging radiant heating technologies will solidify the market position of advanced line-voltage thermostat manufacturers.

- IoT and Cloud Integration: Leveraging connectivity for superior data analysis, utility optimization, and remote diagnostics.

- Hospitality and Commercial Zone Management: Specific application opportunity for energy control in multi-unit temporary residences.

- Building Electrification Trend: Increased installation base due to global shift away from fossil fuel heating systems.

- Development of Predictive Algorithms: Using machine learning to enhance energy efficiency and improve comfort profiles.

Segmentation Analysis

The Line-Voltage Thermostats Market is meticulously segmented based on the mechanism of temperature control (Type), the specific environment in which the device is deployed (Application), and the core functionality offered (Technology). The Type segment differentiates between basic Mechanical models, highly accurate Electronic non-programmable units, and advanced Smart/Wi-Fi connected systems, reflecting the maturity curve of the product category. Application segmentation provides insights into the dominant end-user demands, where Residential use accounts for the majority of installations, driven by electric baseboard heater prevalence, followed by Commercial and Institutional applications. Analyzing these segments helps stakeholders understand where technological investment is most impactful and where regulatory compliance drives replacement cycles.

- By Type:

- Mechanical

- Electronic (Non-Programmable & Programmable)

- Smart/Wi-Fi Enabled

- By Application:

- Residential (Single-Family, Multi-Family)

- Commercial (Office Spaces, Retail)

- Hospitality (Hotels, Resorts)

- Industrial and Institutional (Warehouses, Schools)

- By Heating System:

- Electric Baseboard Heaters

- Radiant Floor/Ceiling Heating

- Fan Forced Heaters

- By Voltage Rating:

- 120V

- 208V/240V

Value Chain Analysis For Line-Voltage Thermostats Market

The value chain for line-voltage thermostats begins with the upstream sourcing of crucial electronic components, including sophisticated temperature sensors (thermistors/RTDs), high-amperage relays, microprocessors, and specialized power supply circuitry capable of regulating incoming line power safely. Component precision is paramount due to the high regulatory requirements for safety and performance in high-voltage environments. Manufacturers then undertake highly specialized assembly and calibration processes, focusing on robust enclosure design and rigorous testing to ensure durability and adherence to stringent safety standards (e.g., UL 94, UL 873). The complexity of integrating connectivity (Wi-Fi/Z-Wave modules) while managing electrical noise adds a layer of specialization at the manufacturing stage. Downstream activities involve distribution, primarily through wholesale HVAC suppliers and specialized electrical distributors, who cater directly to professional contractors. Direct sales channels, including large home improvement retailers, are also crucial for capturing the DIY and immediate replacement market. Installation and post-sales support, mainly handled by licensed electricians and HVAC professionals, complete the value delivery cycle.

Upstream analysis reveals that key suppliers of high-reliability relays and sensors hold significant bargaining power, as the quality of these components directly impacts the thermostat's ability to handle high loads reliably over time. Given the market's emphasis on connectivity, the reliance on microprocessor and wireless module manufacturers also introduces external supply chain dependencies. Midstream, manufacturers leverage automation to maintain high volume while ensuring calibration accuracy. Major market players often vertically integrate or maintain strategic partnerships to secure supplies of critical components and streamline assembly.

Downstream analysis highlights the critical role of distribution channels. Indirect channels, involving wholesalers and professional contractors, dominate the high-value smart and programmable segments, as these installations often require professional expertise. Direct channels, such as big-box retailers and e-commerce platforms, are essential for the high-volume mechanical and basic electronic replacement market. Successful market penetration relies heavily on establishing strong relationships with certified electricians and ensuring product compatibility with existing wiring standards across diverse geographies. The effective management of warranties and technical support is crucial in the downstream, given the safety-critical nature of line-voltage devices.

Line-Voltage Thermostats Market Potential Customers

The primary buyers of line-voltage thermostats are broadly categorized into three major groups: Residential End-Users (for replacement and upgrade projects), Professional Contractors (HVAC, Electrical), and Commercial Property Managers/Owners. Residential customers frequently purchase electronic or smart models to replace outdated mechanical units in multi-family apartments, custom homes with electric radiant heating, and standard residential units relying on baseboard heat, driven primarily by the desire for energy savings and modern convenience. Professional contractors serve as the crucial intermediary, purchasing in bulk from wholesalers for new construction and large-scale retrofit projects, acting as the primary decision-makers based on ease of installation, reliability, and price point.

Commercial and institutional end-users represent a high-value customer segment, particularly for networked, smart line-voltage systems. Hospitality groups, educational institutions, and healthcare facilities require robust, centralized control over localized electric heating zones to manage utility costs and ensure specific temperature compliance across hundreds or thousands of rooms. These buyers prioritize features such as remote locking of setpoints, integration with building management systems (BMS), and detailed energy reporting capabilities. The deployment scale in the commercial sector means that procurement decisions often involve detailed vendor scrutiny regarding product lifespan and integration protocols.

A smaller but growing customer segment includes energy service companies (ESCOs) and utility companies that incorporate smart line-voltage thermostats into demand response programs. By offering incentives to their customers to install these devices, utilities gain the capability to momentarily adjust heating loads during peak demand periods, thereby stabilizing the electrical grid. These purchases are highly strategic, focusing on models with proven communication reliability and compatibility with utility-specific smart grid protocols, representing a crucial demand pool for high-connectivity models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Emerson Electric Co., Resideo Technologies Inc., Schneider Electric SE (Aube), Stelpro, Cadet Manufacturing Co., Mysa Smart Thermostats, Sino-American, Lux Products Corporation, Danfoss, Robertshaw Controls Company, EconoStat, TPI Corporation, King Electric, OJ Electronics A/S, Titan Controls, Flair, Johnson Controls International plc, Orbit Heating Systems, Neviweb. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Line-Voltage Thermostats Market Key Technology Landscape

The technology landscape of the Line-Voltage Thermostats Market is characterized by the ongoing transition from simple electromechanical switching to sophisticated digital control systems. The fundamental technological shift involves replacing bimetallic strips with precision Negative Temperature Coefficient (NTC) thermistors and integrated solid-state or heavy-duty electromechanical relays capable of handling continuous high-amperage switching without degradation. Modern electronic and smart thermostats incorporate microprocessors to execute Proportional-Integral-Derivative (PID) control algorithms, which minimize temperature fluctuations and overshoot common in high-inertia electric heating systems, dramatically improving comfort and efficiency. Connectivity technologies, specifically Wi-Fi (802.11 protocols) and low-power wireless standards like Z-Wave and Zigbee, are central to the smart segment, enabling cloud communication and integration into home automation hubs. Power management technology is also critical, requiring specialized circuits (e.g., transformer-less power supplies) to safely and reliably draw low-voltage power for the electronics directly from the line voltage without interfering with sensitive switching components, ensuring compliance with strict electromagnetic compatibility (EMC) standards.

The sophistication of modern line-voltage control extends to user interface design and safety features. Capacitive touchscreens are replacing physical buttons, enhancing user experience and durability. Furthermore, built-in current sensing and advanced diagnostic algorithms are being deployed to monitor the health of the connected heating element and the internal relay, providing an extra layer of safety. The use of robust, high-temperature rated materials for internal wiring and enclosure plastics is non-negotiable, given the heat generated during high-load operation. Manufacturers are increasingly utilizing integrated circuit solutions specifically designed for motor control or high-current switching applications, adapting them for thermostat use to enhance reliability and reduce the device footprint.

In terms of communication technology, the focus is shifting towards mesh networking capabilities in newer smart line-voltage thermostats, allowing multiple units within a large apartment or commercial building to communicate directly and optimize heating cycles across zones seamlessly, overcoming range limitations often faced by standard Wi-Fi setups in dense urban environments. Cloud-based data analytics platforms are becoming standard, utilizing the data gathered by the thermostats to provide personalized energy consumption reports and optimization suggestions directly to the end-user or property manager. This fusion of reliable high-voltage hardware with advanced software intelligence defines the leading edge of the market, focusing on optimizing high-energy systems safely and smartly.

Regional Highlights

Regional dynamics play a crucial role in shaping the Line-Voltage Thermostats Market due to varying climatic conditions, regulatory environments, and historical infrastructure choices. North America (NA) is the dominant market region, primarily driven by the historically high prevalence of electric baseboard heating systems in both residential and multi-family housing across the U.S. and Canada. The harsh winters in many parts of this region necessitate reliable and efficient heating controls. Furthermore, Canadian provinces, particularly Quebec and Ontario, have implemented progressive building codes and energy efficiency programs that heavily promote the replacement of older mechanical thermostats with highly accurate electronic and smart line-voltage units, providing significant impetus to market growth. The high consumer acceptance of smart home technology in the US further fuels the adoption of Wi-Fi-enabled products, making NA a central hub for technological innovation and deployment.

Europe represents the second most significant market, characterized by strong governmental emphasis on energy conservation and a growing adoption of electric radiant floor and panel heating systems, which often utilize line-voltage controls. Countries in Northern and Western Europe, such as Germany, France, and the Scandinavian nations, are highly focused on minimizing energy waste, leading to a strong demand for programmable and electronic thermostats that comply with rigorous European directives (e.g., EcoDesign). While central heating (gas/oil) remains dominant in many structures, the market for supplementary electric heating and high-efficiency electric towel warmers or bathroom heaters provides a steady demand for specialized line-voltage control units. Manufacturers targeting Europe must ensure adherence to CE marking and strict regional safety standards.

Asia Pacific (APAC) currently holds a smaller share but is poised for rapid expansion, especially in developed economies like Japan, South Korea, and Australia, where electrification of heating systems is increasing in dense urban areas. However, APAC presents unique challenges, including diverse voltage standards and a preference for air conditioning and heat pumps over dedicated electric resistive heating in many regions. Market penetration in APAC is primarily focused on luxury residential developments and commercial buildings utilizing localized electric panel heating. Latin America and the Middle East & Africa (MEA) remain emerging markets, where demand is constrained by lower overall usage of electric resistive heating and slower adoption of advanced smart home technologies, though localized growth is observed in specific high-income commercial developments.

- North America (NA): Market leader due to extensive legacy electric baseboard heating infrastructure and stringent governmental efficiency standards in Canada and the US Northeast. High smart thermostat adoption rate.

- Europe: Strong demand driven by EU energy efficiency mandates, proliferation of electric radiant heating, and focus on programmable control systems in Nordic countries and Germany.

- Asia Pacific (APAC): Emerging market, with growth concentrated in high-density urban areas of developed nations (Japan, South Korea) focusing on modern electronic controls for auxiliary heating.

- Latin America & MEA: Niche markets with limited current penetration, focusing mainly on commercial and institutional sectors where zone control is critical.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Line-Voltage Thermostats Market.- Honeywell International Inc.

- Emerson Electric Co.

- Resideo Technologies Inc.

- Schneider Electric SE (Aube)

- Stelpro

- Cadet Manufacturing Co.

- Mysa Smart Thermostats

- Sino-American

- Lux Products Corporation

- Danfoss

- Robertshaw Controls Company

- EconoStat

- TPI Corporation

- King Electric

- OJ Electronics A/S

- Titan Controls

- Flair

- Johnson Controls International plc

- Orbit Heating Systems

- Neviweb

Frequently Asked Questions

Analyze common user questions about the Line-Voltage Thermostats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a line-voltage and a low-voltage thermostat?

Line-voltage thermostats directly manage high electrical loads (typically 120V or 240V) for electric heating devices like baseboard heaters, requiring heavy-duty relays. Low-voltage thermostats operate on 24V power and control central HVAC systems using lighter wiring and signalling, not carrying the main heating current.

Are smart line-voltage thermostats genuinely more energy efficient than mechanical ones?

Yes. Smart line-voltage thermostats use highly accurate electronic sensors and advanced proportional control algorithms (PID) to maintain precise setpoints, minimizing temperature swings and unnecessary cycling, leading to verified energy consumption reductions often exceeding 15% compared to less accurate mechanical counterparts.

What safety certifications should I look for in a line-voltage thermostat?

Due to the high voltages involved, key safety certifications such as UL (Underwriters Laboratories) or ETL (Intertek), particularly standards like UL 873, are essential. For devices sold in Europe, the CE mark indicating compliance with relevant EU directives, including electromagnetic compatibility, is mandatory.

Can a line-voltage thermostat be integrated with a central smart home hub?

Modern smart line-voltage thermostats are specifically designed for integration. They typically utilize Wi-Fi, Z-Wave, or Zigbee protocols to connect with centralized smart hubs (e.g., Apple HomeKit, Google Home, Amazon Alexa), allowing for synchronized, whole-home management and remote control capabilities.

What is the expected lifespan of a modern electronic line-voltage thermostat?

High-quality electronic and smart line-voltage thermostats are designed for a lifespan exceeding 10 to 15 years. Their longevity is primarily determined by the durability of the internal high-amperage switching relays and the quality of the power supply electronics designed to handle continuous electrical load cycling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager