Linear Friction Welder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432527 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Linear Friction Welder Market Size

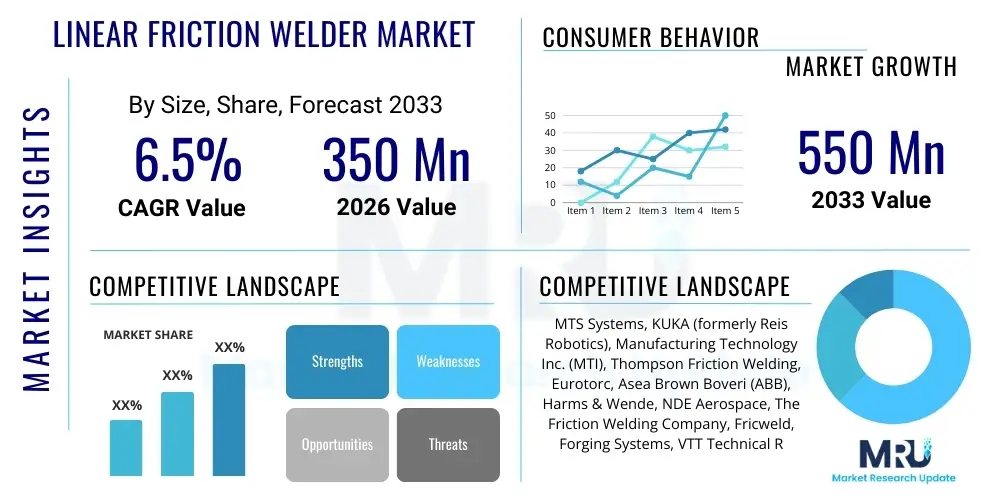

The Linear Friction Welder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 550 Million by the end of the forecast period in 2033. This growth is primarily attributable to the accelerating demand for high-integrity, lightweight components, particularly within the aerospace and defense sectors, where component performance and reliability are non-negotiable critical factors. The unique ability of linear friction welding (LFW) to join complex and dissimilar materials without melting further solidifies its value proposition in demanding manufacturing environments.

Linear Friction Welder Market introduction

The Linear Friction Welder (LFW) Market encompasses the manufacturing, sales, and service of specialized equipment designed for solid-state joining processes. LFW utilizes relative linear motion between two workpieces under substantial pressure to generate frictional heat, plastically deforming the material interface and creating an extremely strong metallurgical bond without reaching the melting temperature. This fundamental characteristic allows for the reliable joining of materials historically considered difficult to weld, such as nickel-based superalloys, titanium alloys, and various combinations of dissimilar metals, which is paramount for advanced engineering applications requiring superior material properties and structural integrity.

Major applications of LFW technology span critical sectors including aerospace (turbine blades, blisks, engine cases), automotive (valves, drivetrain components), defense (missile components, armor plating), and industrial machinery (tooling, specialized shafts). The primary benefits of employing LFW equipment include achieving full-strength joints, minimal heat-affected zones (HAZ), superior control over material microstructure, high repeatability, reduced processing time compared to fusion welding methods, and substantial material cost savings due to near-net-shape manufacturing capabilities. This technological efficiency, coupled with the stringent quality requirements in end-user industries, acts as a pivotal driving factor for market expansion.

Key driving factors propelling the adoption of LFW technology include increasing global defense expenditures focused on advanced jet engine programs, the pervasive industry trend toward engine lightweighting to improve fuel efficiency and reduce emissions in both commercial and military aviation, and the rising demand for robust joining solutions in the electric vehicle (EV) sector for battery trays and motor components. Furthermore, the inherent need to join complex and high-cost engineered materials in a repeatable and quality-assured manner reinforces the necessity and growth trajectory of the specialized Linear Friction Welder Market globally.

Linear Friction Welder Market Executive Summary

The Linear Friction Welder Market is characterized by robust growth, driven primarily by the escalating requirements of the aerospace industry for lightweight, high-performance components, specifically blisks (bladed disks) manufacturing, and the increasing adoption of superalloys. Business trends show a strategic shift toward automated, high-throughput LFW systems integrated with advanced monitoring and control software to enhance quality assurance and reduce cycle times. Major original equipment manufacturers (OEMs) are investing heavily in customized, high-tonnage machines capable of handling larger components, aligning with the scaling needs of commercial aircraft engine production rates. Furthermore, the convergence of LFW with advanced manufacturing processes like Additive Manufacturing (AM) presents a significant business opportunity, allowing for the repair or joining of complex, expensive additively manufactured parts, thereby optimizing material usage and extending component lifecycle.

Regionally, North America maintains market dominance, fueled by substantial military expenditure, the presence of major aerospace and defense contractors, and significant research and development investments aimed at next-generation engine designs. Europe follows closely, driven by stringent environmental regulations necessitating fuel-efficient engines and robust growth in high-end automotive R&D, particularly in performance vehicles and specialty machinery. Asia Pacific is emerging as the fastest-growing region, stimulated by rapid industrialization, massive infrastructure projects, and the expanding domestic aviation markets in countries like China and India, leading to increased investment in localized high-precision manufacturing capabilities.

Segment trends reveal that the high-tonnage machine segment (above 50 tons) commands the largest market share by value due to its indispensable role in manufacturing large turbine components. Conversely, the smaller tonnage machines (below 25 tons) are expected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting their growing utility in the automotive industry for specialized components and in research institutions for material science development and process optimization. The service segment, particularly focused on maintenance, calibration, and software updates for complex LFW systems, is also witnessing rapid expansion, reflecting the long asset life and high criticality of these machines in production environments, making reliable post-sales support essential for operational continuity and efficiency.

AI Impact Analysis on Linear Friction Welder Market

Common user questions regarding AI's impact on the Linear Friction Welder Market typically revolve around how artificial intelligence can address core challenges such as process variability, optimal parameter selection for dissimilar material joins, and the integration of LFW into smart factory ecosystems for predictive maintenance. Users are concerned with achieving 'first-time-right' welds, minimizing expensive material wastage, and enhancing quality control without slowing down production. The consensus expectation is that AI algorithms, particularly machine learning (ML) models, will revolutionize process optimization by analyzing high-frequency sensor data (force, velocity, displacement, temperature) generated during the welding process to instantaneously adjust machine parameters, thereby compensating for minor material inconsistencies and operational drift. Furthermore, users anticipate AI-powered vision systems replacing manual inspection methods, leading to faster defect detection and traceability, thereby fundamentally elevating the standard of quality assurance in critical LFW applications.

The integration of sophisticated AI and machine learning techniques is transforming LFW from a highly controlled, fixed-parameter process into an adaptive, intelligent manufacturing operation. By training ML models on historical weld data and sensor inputs, LFW systems can autonomously identify the optimal oscillation frequency, forge force, and upset distance required for a perfect bond between specific material pairings, drastically reducing setup time and the reliance on extensive, costly trial-and-error testing. This capability is especially impactful when dealing with advanced or novel alloys where empirical data is scarce.

Beyond process control, AI enhances the operational efficiency and reliability of the high-value LFW equipment itself. Predictive maintenance schedules, powered by AI analyzing vibration and temperature signatures from internal machine components (such as hydraulics and drive mechanisms), can anticipate failures long before they occur, minimizing unplanned downtime. This transition from reactive or preventative maintenance to truly predictive maintenance ensures maximum machine uptime, which is crucial given the high capital cost and critical production role of LFW machines in aerospace supply chains.

- AI enables real-time, adaptive control over welding parameters, optimizing the bond integrity for varying material batches.

- Machine Learning algorithms facilitate predictive maintenance of LFW machinery, significantly reducing costly unplanned downtime and improving overall equipment effectiveness (OEE).

- AI-driven quality control systems, utilizing computer vision and acoustic sensors, provide instantaneous, non-destructive inspection of weld quality and surface finish.

- Data aggregation and analysis through AI enhance traceability and compliance, providing detailed digital records for regulatory requirements in aerospace and defense.

- Optimization of energy consumption and cycle time through neural networks processing multivariate sensor data, leading to operational cost savings.

DRO & Impact Forces Of Linear Friction Welder Market

The Linear Friction Welder Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively shape its trajectory and are influenced by powerful impact forces originating from technology, economy, and regulation. Key drivers include the relentless push for engine efficiency and lightweighting in the aerospace industry, necessitating the use of advanced, difficult-to-weld materials like Ti-Aluminides and nickel superalloys, which LFW handles exceptionally well. Another major driver is the increasing complexity of components manufactured via solid-state joining, demanding the high repeatability and integrity that LFW systems inherently provide. The rising global investment in defense and military aviation programs further solidifies the demand base for high-tonnage, high-precision welding equipment.

Restraints primarily revolve around the substantial initial capital investment required for high-capacity LFW machinery, which poses a significant barrier to entry for smaller manufacturers and limits widespread adoption outside of tier-one suppliers. Furthermore, the technological complexity of the process necessitates highly skilled operators and specialized maintenance technicians, contributing to high operational expenditure and a reliance on OEM-provided service contracts. There are also material limitations, as LFW is not universally applicable; it requires specific component geometries and material characteristics suitable for solid-state forging, which restricts its use in certain high-volume commercial applications where fusion welding remains adequate and cheaper.

Opportunities for market growth are abundant, particularly in emerging applications such as the Electric Vehicle (EV) battery and motor manufacturing sector, where LFW can join dissimilar metals (e.g., copper to aluminum) for thermal management and current conduction with superior reliability compared to traditional methods. Furthermore, the integration of LFW into hybrid manufacturing workflows, especially post-Additive Manufacturing (AM) consolidation or repair processes, offers significant value by allowing manufacturers to join large components composed of multiple additively manufactured sections. The impact forces acting on the market include stringent regulatory requirements (e.g., FAA, EASA) for structural component integrity, which mandates the use of proven, high-reliability joining technologies like LFW, thereby positively influencing adoption rates, particularly when coupled with real-time process monitoring.

Segmentation Analysis

The Linear Friction Welder Market segmentation provides a detailed framework for understanding the market structure based on key differentiating characteristics such as tonnage capacity, application, and end-user industry. Analyzing these segments helps stakeholders pinpoint high-growth areas and tailor product development and market strategies effectively. Segmentation by tonnage is crucial as it dictates the size and complexity of components the machine can handle, directly correlating to the target end-user industry (e.g., high tonnage for aerospace, lower tonnage for automotive). Application segmentation differentiates between manufacturing processes such as blisk production, material repair, and general component joining, each requiring specific machine features and operational tolerances. End-user segmentation highlights the market's dependence on highly regulated sectors like aerospace and defense, alongside emerging areas like electric mobility, providing a clear roadmap of current and future revenue streams.

- By Tonnage Capacity:

- Low Tonnage (Below 25 Tons)

- Medium Tonnage (25 Tons to 50 Tons)

- High Tonnage (Above 50 Tons)

- By Application:

- Blisk Manufacturing

- Component Repair and Overhaul (MRO)

- General Component Joining

- Near-Net Shape Manufacturing

- By End-User Industry:

- Aerospace and Defense

- Automotive and Transportation

- Industrial Machinery and Tooling

- Oil and Gas

- Research and Development/Academia

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Linear Friction Welder Market

The value chain for the Linear Friction Welder Market commences with upstream activities involving the sourcing of highly specialized components, including high-precision hydraulic systems, ultra-reliable mechanical drive mechanisms, proprietary control software, and high-frequency oscillation motors. OEMs rely on a select group of niche component suppliers capable of meeting stringent quality and performance standards necessary for the extreme forces and precision required in LFW operations. Research and development activities, which are highly capital-intensive, form a crucial part of the upstream segment, focusing on developing new material bonding capabilities and optimizing control algorithms for complex dissimilar metal combinations, thus maintaining technological leadership and proprietary process knowledge.

The midstream segment is dominated by the primary LFW equipment manufacturers who are responsible for the design, assembly, testing, and rigorous certification of the machines. Due to the custom nature and high cost of these systems, sales are often direct or handled through highly specialized distribution partners who provide extensive pre-sales technical consultation. This stage involves significant expenditure on specialized engineering talent and advanced manufacturing facilities to ensure machines meet the exacting standards of the aerospace and defense sectors, often requiring long lead times due to customization and extensive Factory Acceptance Testing (FAT) before shipment to the end-user facility.

Downstream activities include installation, commissioning, specialized training, and ongoing post-sales service and maintenance. Given the high-cost nature of the equipment, the service contract segment, covering software updates, recalibration, and preventive maintenance, represents a significant and stable recurring revenue stream for OEMs. Distribution channels are predominantly direct, particularly for high-tonnage machines, ensuring direct control over the installation and support process, which is critical for minimizing potential performance issues. Indirect distribution may be used for lower-tonnage, standardized machines intended for industrial tooling or R&D applications, often utilizing technical representatives or regional agents who can offer localized, rapid response support and application expertise to niche customer groups.

Linear Friction Welder Market Potential Customers

The primary end-users and potential buyers of Linear Friction Welder technology are large-scale manufacturers operating within industries where component integrity, lightweighting, and high material performance are paramount to product safety and efficacy. The aerospace and defense sector represents the largest and most critical customer segment, including global jet engine manufacturers (e.g., Rolls-Royce, Pratt & Whitney, GE Aviation) and their Tier 1 suppliers who utilize LFW extensively for manufacturing blisks, rotors, shafts, and structural engine components from complex superalloys like Inconel and titanium. These customers demand the highest levels of process control and traceability, often integrating LFW machines directly into automated production lines, and prioritize reliability and uptime over cost.

A rapidly expanding segment of potential customers includes specialized manufacturers within the automotive and transportation industry, focusing on performance vehicles, motorsports, and increasingly, the electric vehicle (EV) sector. While LFW penetration is lower here compared to aerospace, the technology is highly sought after for joining dissimilar metals within electric motor rotors, shafts, and complex thermal management structures (e.g., joining copper conductor to aluminum casing), where achieving high electrical conductivity and structural integrity simultaneously is essential for maximizing battery performance and range. This group of customers often seeks lower-to-medium tonnage machines optimized for cycle speed and efficiency in a high-volume context.

Furthermore, research institutions, material science laboratories, and contract manufacturing service providers form a key customer base. These buyers often require highly flexible, lower-tonnage LFW systems capable of rapid prototyping, testing new alloy combinations, and establishing optimal welding parameters before full-scale production implementation. Contract manufacturers specializing in MRO (Maintenance, Repair, and Overhaul) for gas turbines and industrial components also represent a consistent customer base, relying on LFW's repair capabilities to salvage expensive, damaged components, thus extending their operational lifespan and generating significant cost savings for their clientele. The demand from the oil and gas sector, specifically for joining tool joints and specialized downhole components where extreme durability is required, also contributes significantly to the customer base, requiring rugged, high-force LFW solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 550 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MTS Systems, KUKA (formerly Reis Robotics), Manufacturing Technology Inc. (MTI), Thompson Friction Welding, Eurotorc, Asea Brown Boveri (ABB), Harms & Wende, NDE Aerospace, The Friction Welding Company, Fricweld, Forging Systems, VTT Technical Research Centre of Finland, ESAB, Nitto Seiko, TWI Ltd., Grenzebach Group, ELCO, Friction Welding Technologies, Jiangsu Litian, Superior Friction Welding |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Linear Friction Welder Market Key Technology Landscape

The key technology landscape of the Linear Friction Welder Market is centered around precision mechanical actuation, sophisticated control systems, and advanced sensor integration designed to achieve repeatable, high-integrity solid-state bonds. Modern LFW systems utilize powerful, stiff mechanical frames coupled with high-efficiency hydraulic or servo-electric actuation systems to deliver the necessary forge force, often exceeding 100 tons, with minimal deviation. The oscillation system is equally critical, employing proprietary high-frequency mechanisms (up to 100 Hz or more) to generate the friction heat, requiring exceptionally reliable bearings and linear guides that can withstand continuous, high-speed, high-force oscillatory movement over extended production cycles, ensuring dimensional accuracy and process stability.

A defining technological advancement is the deployment of closed-loop control systems. These systems utilize real-time feedback from high-resolution displacement encoders, force transducers, and torque sensors to instantaneously adjust parameters such as oscillation amplitude, frequency, and forge pressure during the welding sequence. This level of dynamic control is essential for managing the transition from the friction phase to the forge phase and ensures the production of high-quality flash (the expelled material), which serves as an indicator of a successful bond. The integration of advanced data acquisition software allows for the capture, storage, and analysis of every weld cycle parameter, crucial for satisfying the stringent quality assurance and traceability mandates of the aerospace industry.

Furthermore, contemporary LFW technology is increasingly moving towards automation and integration with Industry 4.0 principles. This includes automated component loading and unloading (often utilizing robotics for handling large or complex components), seamless integration with upstream and downstream machining operations, and implementation of IoT capabilities for remote diagnostics and performance monitoring. Research is also focused on developing specialized tooling materials and geometries that improve heat distribution and flash containment, alongside the exploration of novel oscillation kinematics beyond simple linear motion to further enhance the weldability of highly specialized material combinations, ensuring the technology remains at the forefront of solid-state joining capabilities.

Regional Highlights

- North America (NA): North America dominates the global Linear Friction Welder Market, primarily due to the substantial presence of major aerospace and defense primes in the United States. The region benefits from massive governmental and private investments in next-generation military and commercial aircraft engine programs, such as the F-35 Joint Strike Fighter engine components and the sustained demand for advanced, fuel-efficient commercial turbofans. Key drivers include stringent FAA quality requirements, which LFW technology is ideally positioned to meet, and the necessity to manufacture complex components like blisks (Bladed Disks) from expensive superalloys. The focus is heavily on high-tonnage, customized machines integrated into highly automated manufacturing cells. Research institutions and large defense contractors in the US also drive demand for R&D systems focused on exploring new material combinations for space and hypersonics applications, solidifying the region's technological leadership and market share in high-value, low-volume production.

- Europe: Europe represents a mature and technologically advanced market for LFW, driven by strong foundations in the automotive, high-end industrial machinery, and aerospace sectors, particularly in countries like Germany, the UK, and France. The European aerospace industry, led by companies such as Airbus and Safran, requires highly reliable LFW equipment for turbine blade and structural airframe component manufacturing, stimulated by collaborative international engine development projects and commitments to carbon reduction targets necessitating lighter engines. The European automotive sector leverages LFW for high-performance transmission and engine components, and increasingly, in specialized electric motor production where optimal copper-to-aluminum joining is required for efficiency. Regulatory factors, particularly environmental standards and worker safety regulations, encourage the adoption of automated, precision-controlled solid-state processes like LFW over traditional, fusion-based welding methods, reinforcing stable, incremental market growth.

- Asia Pacific (APAC): The Asia Pacific region is projected to experience the fastest growth rate, fueled by aggressive industrialization, expansion of domestic aircraft manufacturing capabilities (especially in China), and substantial government investment in modernizing defense fleets across the region. China and India are emerging as major consumers of LFW technology as they strive for self-sufficiency in high-tech manufacturing, reducing reliance on imported Western components for aircraft engines and large-scale industrial equipment. This rapid expansion is characterized by demand for medium-to-high tonnage machines to establish foundational capabilities in aerospace component production and general industrial component fabrication. While initial adoption was slow due to high capital costs, localized manufacturing and increased foreign direct investment are accelerating the deployment of LFW technology, particularly among joint ventures and domestic entities focusing on high-quality, export-grade components.

- Latin America (LATAM): The Latin America LFW market is comparatively smaller but demonstrates consistent demand primarily anchored in Brazil, driven by its indigenous aerospace industry (Embraer) and robust resource extraction sectors, particularly oil and gas. LFW applications in this region are centered on MRO (Maintenance, Repair, and Overhaul) activities for existing aerospace fleets and the repair and fabrication of high-stress components used in heavy machinery and oilfield drilling tools, where component durability and structural integrity are essential in harsh operating environments. Market penetration is often constrained by economic volatility and higher import tariffs, necessitating a focus on essential service contracts and niche, high-value applications rather than large-scale, automated production setups. However, targeted investments in high-precision manufacturing centers show potential for future growth, especially in specialized repair operations.

- Middle East and Africa (MEA): The MEA region's demand for LFW technology is largely concentrated in the Middle East, driven by significant defense modernization programs, massive investment in national airlines, and the establishment of sophisticated MRO hubs servicing global aviation routes. Countries like the UAE and Saudi Arabia are investing heavily in establishing high-tech manufacturing ecosystems to diversify their economies away from hydrocarbon dependence, creating new demand for advanced joining technologies. LFW systems are crucial for maintaining and repairing the large installed base of gas turbines used in both power generation and aviation within the region. The African market, conversely, shows nascent demand, primarily focused on heavy industrial component repair and infrastructure development projects, relying mostly on imported equipment and international service contracts for specialized welding needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Linear Friction Welder Market.- Manufacturing Technology Inc. (MTI)

- KUKA (formerly Reis Robotics)

- Thompson Friction Welding

- MTS Systems Corporation

- Eurotorc

- Asea Brown Boveri (ABB)

- Harms & Wende

- NDE Aerospace

- The Friction Welding Company

- Fricweld

- Forging Systems

- VTT Technical Research Centre of Finland (R&D focus)

- ESAB Corporation

- Nitto Seiko Co., Ltd.

- TWI Ltd. (Research and Consulting)

- Grenzebach Group

- ELCO

- Haimer GmbH

- Hydromat Inc.

- Litian Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Linear Friction Welder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Linear Friction Welding (LFW) over traditional fusion welding methods?

LFW offers superior metallurgical bond integrity by operating in a solid-state process, eliminating defects associated with melting such as solidification cracking and porosity. This method produces minimal heat-affected zones (HAZ), preserves material strength, and allows for the reliable joining of dissimilar materials like certain superalloys and intermetallics crucial for high-performance applications in aerospace and defense.

How does the high initial cost of Linear Friction Welder equipment impact market adoption?

The substantial capital investment required for LFW machinery acts as a key restraint, limiting adoption primarily to Tier 1 aerospace manufacturers and large industrial OEMs. However, the high initial cost is often justified by the superior quality, repeatability, reduced material waste, and the ability to manufacture highly specialized, complex components that are impossible or impractical using lower-cost conventional methods, leading to favorable long-term operational returns.

Which end-user industries represent the highest growth potential for LFW technology outside of aerospace?

The Electric Vehicle (EV) manufacturing sector represents the highest growth potential. LFW is increasingly valuable for joining dissimilar conductive materials, such as copper terminals to aluminum components in battery trays and electric motor assemblies. This application ensures optimal electrical conductivity and thermal management, which are critical factors for maximizing EV performance and battery lifespan.

What role does automation and Industry 4.0 play in the future development of the Linear Friction Welder Market?

Automation and Industry 4.0 principles, including AI integration and IoT monitoring, are central to LFW's future. These technologies enable high-throughput production, predictive maintenance, and autonomous parameter optimization based on sensor data. This ensures consistent quality, minimizes expensive component rejects, and facilitates seamless integration into large, smart factory ecosystems, boosting overall equipment effectiveness (OEE).

What is the significance of LFW tonnage capacity, and how does it relate to machine application?

Tonnage capacity (the maximum forging force the machine can exert) is crucial as it determines the maximum cross-sectional area and type of material that can be welded. High-tonnage machines (above 50 tons) are indispensable for manufacturing large aerospace components like turbine shafts and blisks. Lower-to-medium tonnage machines are typically used for smaller automotive parts, tooling, and specialized R&D applications, impacting the machine's primary function and target market segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager