Linear Hydraulic Cylinders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432298 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Linear Hydraulic Cylinders Market Size

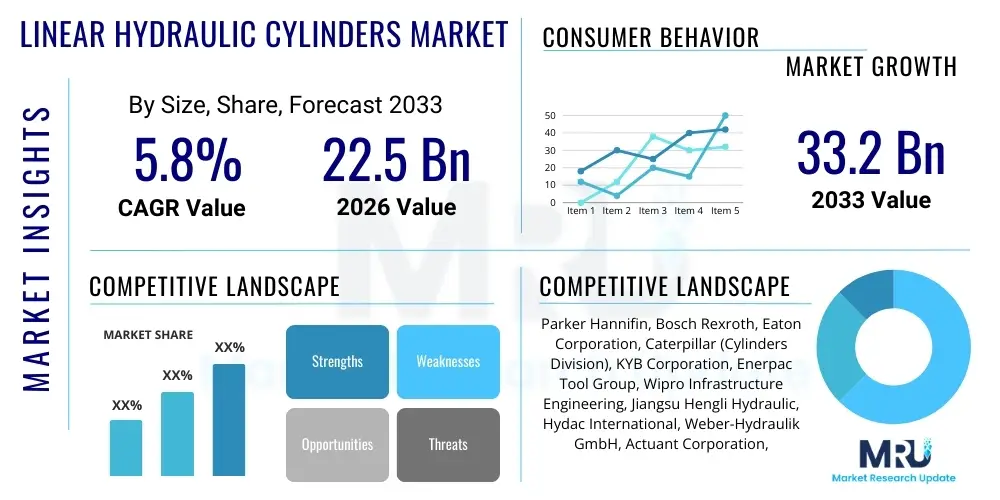

The Linear Hydraulic Cylinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 22.5 Billion in 2026 and is projected to reach USD 33.2 Billion by the end of the forecast period in 2033.

Linear Hydraulic Cylinders Market introduction

The Linear Hydraulic Cylinders Market encompasses the manufacturing, distribution, and utilization of mechanical actuators that convert fluid power into linear motion and force. These indispensable components are fundamental to modern heavy machinery and industrial automation, providing the high force output, rigid control, and reliability required for demanding applications. Products within this market segment include single-acting, double-acting, telescopic, and tie-rod cylinders, categorized by design and operational characteristics tailored for specific environments, ranging from high-speed production lines to extreme-duty construction sites. The market is driven primarily by sustained global infrastructure development, robust growth in the construction and mining sectors, and increasing demand for optimized material handling equipment that relies on precise linear actuation.

Linear hydraulic cylinders serve a crucial role across various major applications, including earthmoving equipment, agricultural machinery, oil and gas drilling systems, waste management vehicles, and aerospace ground support equipment. The intrinsic benefits of hydraulic systems, such as exceptional power density, shock resistance, and relatively simple maintenance requirements, solidify their position over pneumatic or electromechanical alternatives in high-load scenarios. Furthermore, recent technological advancements focusing on improved sealing materials, integrated sensors for predictive maintenance, and energy-efficient pump integration are enhancing the overall performance and lifespan of these cylinders, making them more attractive for next-generation automated industrial systems. This continuous focus on enhancing durability and integrating smart features ensures the market maintains a steady growth trajectory.

Key driving factors underpinning market expansion include the global shift towards sophisticated automation solutions in manufacturing, particularly in emerging economies where industrialization rates are accelerating. The necessity for reliable, high-force actuators in wind turbine pitch control systems and marine applications also contributes significantly. Moreover, regulatory standards pushing for reduced emissions and improved energy efficiency in mobile equipment necessitate hydraulic components capable of operating effectively within optimized power systems. This convergence of infrastructure spending, automation demand, and regulatory compliance catalyzes the demand for robust, high-performance linear hydraulic cylinders worldwide, ensuring sustained investment in product innovation.

Linear Hydraulic Cylinders Market Executive Summary

The Linear Hydraulic Cylinders Market is experiencing dynamic growth driven by business trends centered on digitalization and heavy equipment production efficiency. Current business strategies emphasize merger and acquisition activities aimed at consolidating market share and achieving economies of scale, particularly among suppliers catering to the construction and agricultural Original Equipment Manufacturers (OEMs). Technological advancements focus heavily on miniaturization for complex mobile applications, the integration of position sensors for closed-loop control, and the development of lightweight yet high-strength composite materials to improve fuel efficiency in machinery. The primary business objective across leading manufacturers is shifting from pure component supply to offering integrated, smart hydraulic subsystems that provide data telemetry and remote diagnostics capabilities, aligning with Industry 4.0 principles.

Regionally, the market demonstrates significant disparity, with Asia Pacific (APAC) serving as the undisputed engine of growth, primarily fueled by massive infrastructure projects in China, India, and Southeast Asian nations. North America and Europe, while mature, exhibit stable demand driven by the replacement of aging machinery and the adoption of high-precision hydraulic solutions required for advanced manufacturing and aerospace sectors. European stringent regulations regarding machinery safety and environmental protection necessitate continual upgrades to hydraulic systems, favoring suppliers offering technologically superior, leak-proof components. The Middle East and Africa (MEA) region shows accelerating growth, linked directly to ongoing diversification efforts in infrastructure, mining, and oil & gas operations, which are intensive users of heavy-duty hydraulic actuators.

Segmentation trends indicate that double-acting cylinders continue to dominate the market due to their prevalence in heavy-duty machinery requiring controlled force in both extension and retraction strokes, such as excavators and presses. However, the telescopic cylinder segment is projected to exhibit the highest CAGR, primarily due to their critical role in mobile applications like dump trucks and aerial platforms, where long strokes are required within constrained installation spaces. By application, the mobile hydraulics segment (construction, agriculture, marine) overwhelmingly leads the market share, reflecting the intensive use of these actuators in movement and load-bearing tasks. Conversely, the industrial segment (metal forming, plastic injection molding) demands high-pressure, precision-engineered cylinders, driving innovation in piston sealing and material fatigue resistance.

AI Impact Analysis on Linear Hydraulic Cylinders Market

User queries regarding the impact of Artificial Intelligence (AI) on the Linear Hydraulic Cylinders Market overwhelmingly center on how AI facilitates predictive maintenance, optimizes system efficiency, and enables autonomy in heavy machinery. Key concerns revolve around the integration complexity of AI algorithms with legacy hydraulic systems and the security implications of transmitting operational data. Users are highly interested in AI’s ability to analyze real-time sensor data—measuring pressure, temperature, and vibration—to anticipate cylinder failure, thus minimizing expensive downtime in critical operations like mining or oil drilling. Expectations are high that AI will drive the development of "smart cylinders" capable of self-diagnosis and dynamic adjustment, moving beyond traditional reactive maintenance models and ensuring hydraulic systems operate at peak efficiency under varying load conditions, thereby significantly extending component life and reducing operational expenditure.

AI's influence is also noted in the design and manufacturing phases. Generative design algorithms are being employed to optimize cylinder structural integrity, reducing material usage while maintaining or increasing pressure ratings. Furthermore, AI-driven quality control systems are enhancing the precision of cylinder production, particularly in critical areas like bore honing and surface finishing, which are paramount to sealing effectiveness and longevity. This intersection of advanced manufacturing processes guided by machine learning leads to higher component reliability straight out of the factory. For end-users, AI translates into smarter fleet management systems where hydraulic performance across hundreds of machines can be monitored and balanced proactively.

The implementation of AI algorithms, often facilitated by edge computing embedded within the hydraulic system controllers, allows for real-time analysis of load cycles and duty profiles. This capability is pivotal for applications requiring high precision and repeatability, such as robotics integrated with hydraulic actuators or specialized machine tools. By learning optimal operational parameters, AI minimizes wasted energy—a major concern in traditional hydraulic setups—and prevents overloading, fundamentally enhancing the sustainability and operational lifecycle of the hydraulic cylinder itself. As sensor technology becomes cheaper and more robust, the transition toward fully AI-optimized hydraulic control loops is expected to accelerate dramatically.

- Enables predictive maintenance through real-time telemetry analysis of pressure and temperature signatures.

- Optimizes cylinder usage cycles, minimizing wear and extending service life by learning duty profiles.

- Facilitates autonomous operation of machinery by providing precise, adaptive control over linear actuation forces.

- Improves manufacturing quality control by detecting microscopic defects in cylinder barrels and piston rods.

- Reduces energy consumption by dynamically adjusting pump output based on AI-derived demand forecasts.

- Drives generative design optimization for lighter, stronger cylinder structures.

DRO & Impact Forces Of Linear Hydraulic Cylinders Market

The Linear Hydraulic Cylinders Market is significantly shaped by a powerful matrix of Drivers (D), Restraints (R), Opportunities (O), and core Impact Forces. Key drivers include aggressive global urbanization and massive investment in infrastructure and mining activities, which are inherently dependent on hydraulic-powered heavy equipment. Concurrently, the increasing automation across the manufacturing sector demands precise and reliable linear motion control, further fueling cylinder uptake. However, growth is tempered by notable restraints, primarily the inherent inefficiency and potential for environmental pollution (leakage) associated with traditional hydraulic fluids, alongside the rising competition from advanced electro-mechanical actuators in medium-load, high-precision applications. These dynamics create substantial opportunities for innovation, particularly in developing energy-efficient, closed-loop systems and integrating IoT capabilities for remote monitoring and diagnostics, thus overcoming historic limitations and generating new revenue streams.

The competitive landscape is subject to intense impact forces driven by technological shifts and regulatory pressures. The most significant impact force is the stringent implementation of environmental regulations globally, especially those governing hydraulic fluid handling and waste disposal, pushing manufacturers toward biodegradable fluids and leak-proof sealing technologies. Secondly, the price volatility of raw materials, particularly steel and specialized alloys used in cylinder barrels and rods, exerts a consistent pressure on production costs and overall market pricing strategies. Finally, the rapid pace of digital integration acts as a powerful transformative force, necessitating that manufacturers invest heavily in sensor integration and data analytics capabilities to meet the demand for smart hydraulic components, thereby raising the barrier to entry for smaller, traditional players.

The long-term viability of the hydraulic cylinder market hinges on capitalizing on opportunities such as specialization in high-pressure, customized solutions for niche sectors (e.g., renewable energy and offshore applications) where electromechanical systems cannot compete effectively on power density. Addressing the restraint of inefficiency through the adoption of variable speed pump drives (VSPD) and hydrostatic transmissions provides a clear pathway for sustained relevance. The balancing act between meeting the demand for high-force capacity—a core advantage—and mitigating the associated environmental footprint dictates the strategic direction for market leaders, ensuring that hydraulic technology remains relevant and compliant within a modern industrial context characterized by efficiency demands and environmental responsibility.

Segmentation Analysis

The Linear Hydraulic Cylinders Market is strategically segmented based on several key dimensions, providing detailed insight into market dynamics, technology adoption, and end-user behavior. The primary segmentation includes product type, functional design, bore size, and end-user application. Product types such as Tie-Rod, Welded, and Telescopic cylinders exhibit distinct demand profiles correlating directly with application requirements—for instance, welded cylinders dominate rugged, mobile machinery due to their compact strength, while tie-rod designs are favored in industrial settings requiring easier maintenance. Analyzing these segments is critical for manufacturers to tailor production capabilities and marketing efforts, ensuring product offerings align precisely with the demanding specifications of industries ranging from construction and material handling to aerospace and defense.

Further segmentation by bore size (small, medium, large) reflects the load capacity requirements, with large bore cylinders typically associated with mining and marine heavy lift operations, commanding premium pricing due to complex material and manufacturing demands. Functionally, single-acting cylinders (gravity or spring return) remain relevant in simple lifting tasks, but double-acting cylinders, offering power in both directions, constitute the bulk of the market dueizing their critical role in heavy manipulation and controlled movement. The robust growth observed across all segments is fundamentally linked to global macroeconomic indicators, particularly capital expenditure on heavy equipment replacement and new infrastructure development, confirming the market’s reliance on capital-intensive industries.

The End-User application segment provides the most critical perspective on consumption patterns, classifying demand into Mobile Hydraulics (construction, agriculture, utility vehicles) and Industrial Hydraulics (machine tools, presses, manufacturing equipment). Mobile hydraulics overwhelmingly dominates the revenue share due to the sheer volume of heavy equipment utilized globally, driving demand for robust, temperature-resistant, and high-cycle-life cylinders. Conversely, the industrial segment demands high-precision, low-friction cylinders integrated into automated processes, reflecting a trend toward more technologically sophisticated, sensor-equipped components that enhance efficiency and safety in static plant operations.

- By Product Type:

- Tie-Rod Cylinders

- Welded Cylinders

- Telescopic Cylinders (Single-stage, Multi-stage)

- Mill-Type Cylinders

- By Function:

- Single-Acting Cylinders

- Double-Acting Cylinders

- By Bore Size:

- Small Bore (Under 50 mm)

- Medium Bore (50 mm to 150 mm)

- Large Bore (Over 150 mm)

- By End-User Application:

- Mobile Hydraulics (Construction, Agriculture, Mining, Material Handling, Marine)

- Industrial Hydraulics (Machine Tools, Presses, Aerospace & Defense, Energy)

Value Chain Analysis For Linear Hydraulic Cylinders Market

The value chain for the Linear Hydraulic Cylinders Market begins with the upstream suppliers responsible for sourcing and processing critical raw materials, primarily specialized high-strength steel alloys, chrome plating materials, and advanced polymer compounds for sealing systems. Upstream analysis highlights the dependence on stable global commodity markets, as fluctuations in steel prices directly impact manufacturing costs. Component specialization, such as the precision machining of piston rods and cylinder barrels, requires significant capital investment in highly specialized machinery and skilled labor. Manufacturers often vertically integrate or establish strategic, long-term relationships with material suppliers to mitigate supply chain risks and ensure consistent material quality, crucial for meeting the stringent performance requirements of hydraulic components subjected to extreme pressures and duty cycles.

Moving downstream, the distribution channel plays a pivotal role in market reach, incorporating both direct sales to major Original Equipment Manufacturers (OEMs) and indirect sales through a vast network of authorized distributors, service centers, and aftermarket retailers. Direct sales dominate transactions involving large volumes sold to global construction and agricultural machinery giants (e.g., Caterpillar, John Deere), where custom specification and integration services are non-negotiable. Conversely, indirect channels are vital for penetrating the fragmented Maintenance, Repair, and Operations (MRO) aftermarket and serving smaller localized industrial users who require immediate availability of standard cylinder sizes and repair kits. The increasing focus on lifetime support necessitates that distributors possess technical expertise for troubleshooting and repair.

The efficiency of the value chain is increasingly being enhanced by digitalization, affecting both upstream procurement and downstream customer service. The adoption of enterprise resource planning (ERP) systems facilitates better inventory management of specialized components, minimizing lead times. Downstream, e-commerce platforms and digital catalogs are streamlining the procurement process for MRO buyers. The direct and indirect distribution models operate synergistically; direct relationships foster technological collaboration and custom product development, while the indirect network ensures broad geographic coverage and efficient delivery of replacement parts, solidifying market presence across diverse industrial sectors globally. Quality assurance and certification (e.g., ISO standards) are embedded throughout the chain to ensure component reliability.

Linear Hydraulic Cylinders Market Potential Customers

The primary consumers and end-users of linear hydraulic cylinders are vast, reflecting the foundational role of hydraulics in heavy industry and mobility. Potential customers fall predominantly into the heavy equipment manufacturing sector, including OEMs of construction machinery such as excavators, bulldozers, wheel loaders, and crane manufacturers. These enterprises demand cylinders optimized for high-cycle fatigue resistance, durability against extreme environmental conditions, and maximum force output, often requiring custom-designed welded cylinders integrated seamlessly into the machine architecture. The agricultural sector represents another substantial customer base, with equipment like tractors, harvesters, and irrigation systems relying on robust hydraulics for implements and steering control, prioritizing cost-effectiveness alongside reliability for seasonal operation.

Beyond mobile applications, the industrial machinery sector, comprising manufacturers of metal forming presses, plastic injection molding equipment, and material handling systems (forklifts, platform lifts), constitutes a significant portion of the customer base. These industrial buyers prioritize precision control, speed, and clean operation, often requiring high-pressure, specialized cylinders compliant with strict industrial safety standards. The energy sector, including suppliers to onshore and offshore drilling platforms, wind turbine manufacturers (pitch control systems), and hydro power generation, also represents high-value customers needing highly specialized, corrosion-resistant, and high-reliability actuators capable of functioning flawlessly in harsh, remote environments with extended service intervals.

Additionally, the aftermarket segment—composed of maintenance and repair service providers, independent workshops, and fleet operators—forms a consistent demand stream for replacement parts and standard cylinder units. Government and municipal entities, responsible for waste management (compactors), public works (snow plows), and defense systems, are perennial buyers, demanding durable, often military-grade specification components. As machinery lifecycles extend and efficiency becomes paramount, customers are increasingly seeking suppliers who can provide integrated solutions, including cylinders bundled with sensors, control valves, and diagnostic software, shifting the purchasing criteria toward total cost of ownership and predictive capabilities rather than initial component cost alone.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 22.5 Billion |

| Market Forecast in 2033 | USD 33.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin, Bosch Rexroth, Eaton Corporation, Caterpillar (Cylinders Division), KYB Corporation, Enerpac Tool Group, Wipro Infrastructure Engineering, Jiangsu Hengli Hydraulic, Hydac International, Weber-Hydraulik GmbH, Actuant Corporation, Ligon Industries, SMC Corporation, Jining Jingda Hydraulic, MHI Group (Hydraulic Systems), Bailey International, Texas Hydraulics, Norrhydro Group, HYVA, and Hydroline. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Linear Hydraulic Cylinders Market Key Technology Landscape

The technology landscape for the Linear Hydraulic Cylinders Market is currently undergoing a transformative phase, shifting from purely mechanical reliability toward smart, integrated systems compliant with Industry 4.0 standards. A core technological focus is the advancement in sealing technology, utilizing proprietary elastomer and PTFE compounds to achieve near-zero leakage, significantly enhancing environmental compliance and operational efficiency. Furthermore, manufacturers are heavily investing in material science, utilizing high-grade, lightweight alloys and specialized surface treatments, such as thermal spray coatings and laser cladding, on piston rods to resist corrosion and abrasion, thereby extending cylinder life particularly in harsh marine and mining environments where traditional chrome plating faces premature degradation.

The integration of sensing and control technology is perhaps the most defining trend. Linear position sensors (e.g., magnetostrictive, inductive, or Hall effect) are increasingly embedded within or externally mounted to cylinders to provide precise feedback on stroke position and velocity. This data is critical for enabling closed-loop control systems, which are essential for high-precision applications like robotics and specialized machine tools. These smart cylinders, often referred to as "electro-hydraulics" or "smart actuation systems," communicate real-time operational status back to the central control unit, facilitating proactive maintenance schedules and enabling dynamic performance optimization based on real-world load conditions and environmental factors. This seamless data flow is fundamental to achieving high levels of automation and reducing manual intervention.

Another crucial technological development involves energy efficiency through the adoption of decentralized, compact power units. Traditional hydraulic systems rely on large, centrally located power packs; however, the emergence of integrated pump-motor-cylinder units allows for more localized power generation (e.g., hydraulic accumulators and variable speed pump drives, or VSPDs). VSPDs only run the pump motor when fluid pressure is needed, drastically cutting power consumption compared to continuously running systems. These technological advancements ensure that while electro-mechanical systems challenge hydraulics in lower power segments, the power density and inherent robustness of sophisticated hydraulic cylinders remain unmatched in heavy-duty, high-force applications, securing their long-term position in the industrial and mobile markets.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to maintain the fastest growth rate and largest market share, driven primarily by extensive government investments in public infrastructure, particularly in transportation, utilities, and commercial real estate across economies like China, India, and Indonesia. The robust manufacturing sector, coupled with high demand for localized agricultural machinery and mining equipment, necessitates substantial consumption of welded and telescopic hydraulic cylinders. Furthermore, the region is becoming a global manufacturing hub for OEMs, leading to strong local supply chains and increasing vertical integration among cylinder producers.

- North America: This region is characterized by high technological maturity and stable demand, focusing on the replacement and upgrade cycle of aging construction and oil & gas machinery. North American demand is particularly strong for high-precision, smart cylinders equipped with advanced sensor technology required for automated farming (precision agriculture) and high-tolerance industrial applications (aerospace manufacturing). Compliance with stringent safety standards and the drive for operational efficiency dictate product specifications, favoring premium, technology-enabled solutions.

- Europe: The European market, highly focused on sustainable engineering and energy efficiency, drives demand for advanced hydraulic systems using biodegradable fluids and leak-proof designs. Strict environmental directives and high labor costs encourage automation, leading to increased adoption of complex, integrated hydraulic circuits incorporating cylinders with embedded control electronics. Germany, as a manufacturing powerhouse, leads the demand for high-quality, long-life industrial and mobile cylinders used in machine tools and construction equipment.

- Latin America (LATAM): Growth in LATAM is closely linked to commodity cycles, particularly mining (Chile, Peru) and agriculture (Brazil). Economic recovery and investment in mining expansion are fueling the requirement for heavy-duty, large-bore hydraulic cylinders resistant to dust and extreme operational stresses. While price sensitivity remains a factor, the region shows increasing interest in aftermarket services and robust, low-maintenance components.

- Middle East and Africa (MEA): This region exhibits accelerating demand stemming from massive non-oil infrastructure investments, including massive construction projects in Saudi Arabia and UAE, coupled with substantial mining activity in South Africa. The harsh, high-temperature operating conditions necessitate customized cylinder designs featuring superior heat dissipation and specialized sealing materials, creating specific opportunities for high-specification component suppliers catering to the oil & gas and construction sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Linear Hydraulic Cylinders Market.- Parker Hannifin Corporation

- Bosch Rexroth AG

- Eaton Corporation plc

- Caterpillar Inc. (Cylinders Division)

- KYB Corporation

- Enerpac Tool Group Corp.

- Wipro Infrastructure Engineering

- Jiangsu Hengli Hydraulic Co. Ltd.

- Hydac International GmbH

- Weber-Hydraulik GmbH

- Actuant Corporation

- Ligon Industries LLC

- SMC Corporation

- Jining Jingda Hydraulic Co., Ltd.

- MHI Group (Mitsubishi Heavy Industries)

- Bailey International LLC

- Texas Hydraulics Inc.

- Norrhydro Group Plc

- HYVA Group

- Hydroline Oy

Frequently Asked Questions

Analyze common user questions about the Linear Hydraulic Cylinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between single-acting and double-acting hydraulic cylinders?

A single-acting cylinder uses hydraulic fluid to extend the piston rod, relying on gravity, weight, or a spring for retraction. A double-acting cylinder uses fluid power to control movement in both extension and retraction directions, offering greater control and force application crucial for heavy-duty, bi-directional tasks like operating excavators.

How is the Linear Hydraulic Cylinders Market being influenced by Industry 4.0?

Industry 4.0 influences the market through the integration of IoT sensors and AI-driven predictive maintenance systems within cylinders. This allows for real-time monitoring of performance parameters (pressure, temperature, position) to optimize operational efficiency, minimize unplanned downtime, and facilitate remote diagnostics and smart automation in machinery.

Which end-user segment drives the highest demand for hydraulic cylinders globally?

The Mobile Hydraulics segment, encompassing construction machinery, agricultural equipment, and mining vehicles, consistently drives the highest demand. These applications require robust, high-force actuators (primarily welded and telescopic cylinders) for critical functions like lifting, steering, and load manipulation in demanding environments.

What are the key technological advancements addressing environmental concerns in this market?

Technological advancements include the development of proprietary, high-performance sealing materials to achieve near-zero leakage, significantly reducing fluid loss. Additionally, there is a growing adoption of biodegradable and environmentally acceptable hydraulic fluids (EALs) across sensitive industries and regions with strict ecological regulations.

How does the rise of electro-mechanical actuators affect the hydraulic cylinder market?

Electro-mechanical actuators pose a competitive restraint, particularly in applications requiring medium load capacity and high precision, due to their superior energy efficiency and cleaner operation. However, hydraulic cylinders retain dominance in extreme-force, high-power density applications (e.g., mining and heavy construction) where electro-mechanical systems cannot match the force output or robustness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager