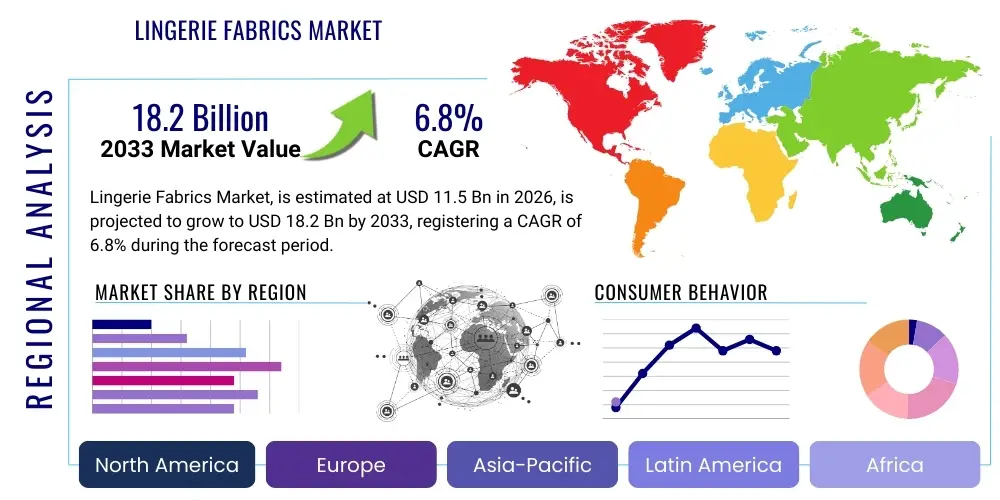

Lingerie Fabrics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436519 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Lingerie Fabrics Market Size

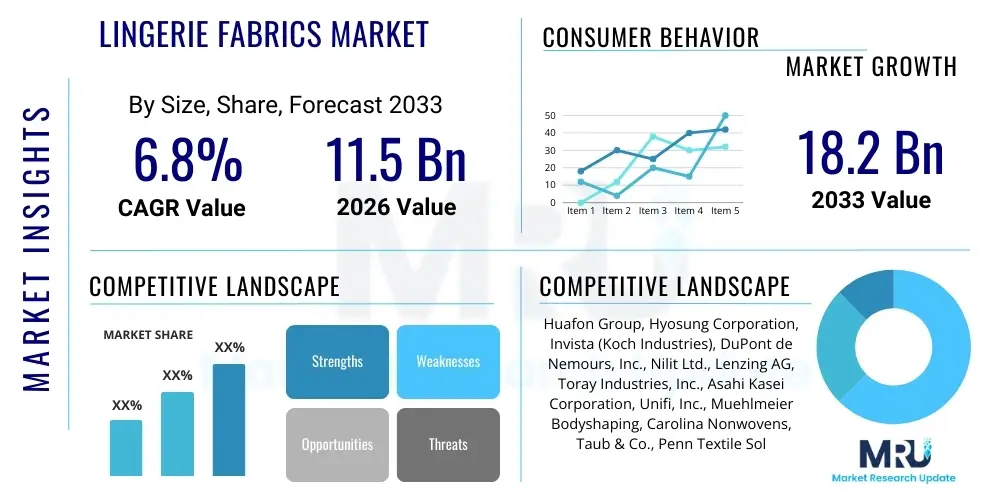

The Lingerie Fabrics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033.

Lingerie Fabrics Market introduction

The Lingerie Fabrics Market encompasses all textile materials specifically utilized in the manufacturing of intimate apparel, including bras, panties, shapewear, sleepwear, and specialized undergarments. These fabrics are selected based on their performance characteristics—such as stretch, breathability, softness, moisture-wicking properties, and aesthetic appeal—to ensure maximum comfort and desired fit for the consumer. Key materials include synthetic fibers like nylon and polyester, natural fibers such as cotton and silk, and specialized blends incorporating elastane (spandex) for stretch and recovery. The market's evolution is heavily influenced by shifts in consumer preferences towards seamless, sustainable, and technologically advanced textiles.

Major applications of these fabrics span various segments of intimate wear, with significant usage in everyday comfort wear, luxury segments demanding premium silks and intricate lace, and performance-driven active lingerie requiring high-tech synthetic blends. The increasing focus on body positivity, coupled with a rising demand for specialized products like maternity and adaptive wear, further drives the diversification of fabric requirements. Manufacturers are continuously innovating to balance aesthetic design with functional requirements, focusing on durability and skin compatibility. This necessitates advanced finishing processes and dyeing techniques that maintain the fabric's integrity and luxurious feel.

Key driving factors propelling market growth include rapid urbanization and rising disposable incomes, particularly in developing economies, leading to increased consumer spending on premium and branded lingerie. Furthermore, the burgeoning popularity of athleisure and body contouring shapewear has created substantial demand for specialized, high-performance stretch fabrics. The market also benefits significantly from technological advancements in textile manufacturing, enabling the production of microfibers, seamless knits, and environmentally friendly alternatives that appeal to the modern, conscious consumer.

Lingerie Fabrics Market Executive Summary

The Lingerie Fabrics Market is characterized by robust growth driven primarily by shifting consumer demographics, particularly the prioritization of comfort, fit, and sustainability in intimate apparel purchases. Business trends indicate a strong move toward digitalization in supply chain management and manufacturing processes, utilizing automation to optimize production efficiency and reduce waste. Key manufacturers are focusing heavily on vertical integration and strategic partnerships to secure the supply of innovative raw materials, such as bio-based synthetics and recycled fibers. The increasing market penetration of e-commerce platforms has also democratized access to specialized and international lingerie brands, significantly influencing material demand based on global fashion cycles and seasonal trends. Price volatility in key raw materials like crude oil derivatives (affecting nylon and polyester) presents a continuous challenge, compelling companies to diversify their material portfolios.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive population bases, rising economic prosperity in countries like China and India, and the subsequent growth of a fashion-conscious middle class. North America and Europe remain mature markets, focusing less on volume growth and more on premiumization, sustainable sourcing, and technological innovation, particularly in smart textiles capable of health monitoring or temperature regulation. Regulatory frameworks regarding textile safety and chemical use (such as REACH in Europe) are significantly shaping the material choices and production methods utilized by global vendors, demanding higher compliance standards across the supply chain.

Segment-wise, synthetic fibers, dominated by nylon and polyester, maintain the largest market share due to their versatility, low cost, and superior performance characteristics in terms of elasticity and durability. However, the cotton and natural fibers segment is experiencing renewed interest, especially in organic and sustainable variants, driven by consumer preference for natural, hypoallergenic materials for everyday wear. The lace and embroidery segment, while niche, commands premium pricing and is vital for the luxury lingerie market. Innovation is most concentrated in the application segment of shapewear and activewear, demanding specialized blends with high compression and moisture management capabilities, thus driving the growth of high-elastane content fabrics.

AI Impact Analysis on Lingerie Fabrics Market

Common user inquiries concerning AI’s influence on the Lingerie Fabrics Market predominantly revolve around customization capabilities, demand forecasting accuracy, and the optimization of sustainable manufacturing practices. Users are keen to understand how AI-driven design software can accelerate textile innovation and personalize fit measurements based on body scanning data. There is also significant interest in AI's role in improving supply chain resilience, specifically minimizing fabric inventory waste through predictive analytics, and ensuring timely sourcing of specialized materials like organic cotton or proprietary microfibers. Key concerns often focus on data privacy related to body shape data used for customized sizing and the initial investment required to integrate sophisticated AI platforms into traditional textile manufacturing setups.

- AI-driven trend forecasting optimizes material inventory, reducing waste associated with overproduction of unpopular fabric types or colors.

- Predictive maintenance for textile machinery minimizes downtime and ensures consistent quality control for delicate processes like lace knitting or silk weaving.

- Customized fit algorithms utilizing AI analyze consumer body metrics, driving demand for specific stretch ratios and fabric types tailored for individual needs.

- AI enhances quality inspection systems, automatically identifying flaws in large volumes of fabric rolls faster and more accurately than human inspection.

- Generative design AI accelerates the development of novel fabric structures and patterns, particularly complex knits and engineered lace designs.

- Optimizing sustainable supply chains by tracing the source of fibers (e.g., recycled materials) and calculating the environmental impact of dyeing processes.

DRO & Impact Forces Of Lingerie Fabrics Market

The market dynamics are shaped by a complex interplay of growth drivers, structural restraints, and emerging opportunities, all subjected to several immediate and latent impact forces. A primary driver is the accelerating consumer shift towards specialized functional wear, requiring high-performance fabrics that offer both aesthetic appeal and advanced technical properties such as enhanced breathability, antimicrobial finishes, and superior stretch recovery. This demand is intrinsically linked to rising health and wellness trends globally. Conversely, major restraints include the volatile pricing of petrochemical raw materials, which directly affects synthetic fiber production costs, and increasingly stringent environmental regulations governing the use of dyes and chemicals, necessitating costly R&D into cleaner production methods.

Significant opportunities lie in the development and commercialization of fully sustainable and circular economy fabrics, including textiles made from recycled polyester (rPET), bio-based polymers, and closed-loop rayon production systems. Furthermore, integrating smart textile technology, such as embedded sensors for physiological monitoring, into performance lingerie represents a high-potential revenue stream. These factors are continuously monitored by impact forces, notably economic instability affecting discretionary spending on non-essential items like luxury lingerie, and rapid shifts in fashion trends dictated by social media, requiring nimble and adaptable supply chains to manage short product lifecycles.

The competitive landscape is subject to intense impact forces from both established textile giants and innovative small-scale sustainable producers. Geopolitical stability also plays a critical role, as the textile supply chain is heavily globalized, often relying on manufacturing hubs in Southeast Asia. Intellectual property protection for proprietary fiber blends and specialized finishing techniques acts as a crucial barrier to entry, ensuring premiumization for market leaders. Ultimately, consumer education regarding fabric quality, sustainability certifications, and functional benefits is a force that guides purchasing decisions and influences R&D investment priorities across the industry.

Segmentation Analysis

The Lingerie Fabrics Market is meticulously segmented across key dimensions including raw material type, application, and distribution channel, reflecting the diverse requirements of intimate apparel manufacturing. Raw material segmentation delineates synthetic fibers (like nylon and spandex) from natural fibers (cotton, silk) and specialized blends, with functional properties dictating their commercial viability across different price points. Application segmentation clarifies end-use focus, differentiating between everyday comfort wear, technical shapewear, specialized performance athletic garments, and high-end luxury attire. This detailed analysis allows market participants to tailor their innovation and marketing strategies to address distinct consumer needs and regulatory landscapes associated with each category.

- By Raw Material Type:

- Synthetic Fibers (Nylon, Polyester, Elastane/Spandex, Microfibers)

- Natural Fibers (Cotton, Silk, Modal, Bamboo)

- Blended Fabrics

- By Application:

- Bras and Bra Components

- Underwear/Panties

- Shapewear and Control Garments

- Sleepwear and Loungewear

- Athletic/Active Lingerie

- Maternity and Specialty Wear

- By Fabric Type/Construction:

- Knitted Fabrics (Warp Knit, Weft Knit)

- Woven Fabrics

- Lace and Embroidery

- Seamless Fabrics

- By End-Use Sector:

- Mass Market/Volume Segment

- Premium/Mid-Range Segment

- Luxury Segment

Value Chain Analysis For Lingerie Fabrics Market

The value chain for the Lingerie Fabrics Market begins at the upstream segment, involving the sourcing and processing of raw materials. This includes petrochemical companies providing inputs for synthetic fibers (nylon, polyester) and agricultural producers supplying natural fibers (cotton, silk). This stage is capital-intensive and highly sensitive to commodity price fluctuations. Key activities involve polymerization, spinning, and fiber extrusion, often demanding specialized chemical treatment to achieve desired fiber characteristics like micro-denier count or inherent antimicrobial properties. Efficiency at this stage directly influences the cost structure and sustainability profile of the final fabric, driving substantial investment into recycling and bio-based material development.

The midstream process involves textile manufacturing, encompassing knitting, weaving, dyeing, finishing, and patterning (e.g., printing or embroidery). This segment is characterized by advanced technological requirements, particularly for achieving seamless construction, high elasticity, and sophisticated coloration with stringent colorfastness standards. Manufacturers utilize specialized machinery for delicate fabrics like lace and fine silks. The distribution channel analysis reveals a dual structure: direct sales to major lingerie brands (Original Equipment Manufacturers - OEMs) for large volume orders, and indirect sales through specialized textile agents or regional distributors, particularly for smaller designers or niche fabric types.

The downstream segment includes lingerie garment manufacturing, branding, and retail distribution. Direct distribution involves major international brands selling through their proprietary stores or robust e-commerce channels, offering higher margin control and direct consumer interaction. Indirect distribution primarily utilizes multi-brand retailers, department stores, and online marketplaces, offering broader market reach but often requiring greater promotional support. The effectiveness of the value chain is increasingly reliant on fast fashion responsiveness and ethical sourcing transparency, dictating partner selection from fiber producer to final retailer.

Lingerie Fabrics Market Potential Customers

The primary end-users and buyers of specialized lingerie fabrics are global intimate apparel manufacturers, encompassing major multinational corporations, specialized niche brands, and private label producers. These entities require fabrics that meet precise technical specifications related to stretch, hand-feel, compression, and durability, often necessitating long-term supply agreements with specialized textile mills. A critical potential customer group includes specialized performance wear and athleisure brands that integrate intimate apparel technology into their product lines, demanding high-wicking, temperature-regulating, and quick-drying fabrics suitable for active use.

Secondary customer segments involve high-end fashion designers and bespoke ateliers who focus on luxury lingerie, demanding premium, natural fibers like Grade A silk, intricate French lace, and fine embroidery materials. Additionally, institutional buyers, such as healthcare facilities and providers of adaptive clothing, represent a growing market for medically compliant fabrics that are hypoallergenic, easily washable, and feature structural components suitable for adaptive closure systems. The increasing prevalence of private labeling by large retailers also positions these retailers as influential buyers, negotiating massive volumes directly from primary textile producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huafon Group, Hyosung Corporation, Invista (Koch Industries), DuPont de Nemours, Inc., Nilit Ltd., Lenzing AG, Toray Industries, Inc., Asahi Kasei Corporation, Unifi, Inc., Muehlmeier Bodyshaping, Carolina Nonwovens, Taub & Co., Penn Textile Solutions, Teijin Limited, Nylstar, Lauffenmühle GmbH & Co. KG, Baltex, Egartex, Best Pacific International Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lingerie Fabrics Market Key Technology Landscape

The Lingerie Fabrics Market is undergoing rapid transformation driven by material science and advanced manufacturing techniques, collectively forming a sophisticated technology landscape. Central to this evolution is the increasing adoption of seamless knitting technology (circular and warp knitting), which allows for the production of body-contoured garments with minimal stitching, significantly enhancing comfort and reducing manufacturing waste. Furthermore, proprietary fiber engineering, such as microencapsulation technology, enables the incorporation of functional additives like moisturizers, phase-change materials for temperature regulation, and antimicrobial agents directly into the textile structure, enhancing product performance and perceived value.

Another dominant technological trend is the focus on sustainable fabric production. This involves innovations in closed-loop systems for manufacturing cellulosic fibers (like Tencel Modal), utilizing recycled feedstocks (such as rPET and regenerated nylon from ocean waste), and developing eco-friendly dyeing processes that drastically reduce water and chemical consumption (e.g., digital printing and supercritical fluid dyeing). The industry is also witnessing the rise of high-gauge knitting machinery capable of producing incredibly fine, lightweight, yet durable fabrics, crucial for creating "second skin" feel garments and ultra-lightweight shapewear components.

The integration of smart textile components represents the frontier of technological development. This includes the subtle incorporation of conductive yarns and flexible micro-sensors capable of monitoring vital signs, heart rate, and movement without compromising the garment's aesthetic or comfort. Although currently a niche segment, the convergence of performance lingerie with health technology is expected to drive significant R&D spending, focusing on washability, durability of integrated electronics, and data accuracy in intimate settings. Furthermore, 3D body scanning technology is being leveraged to inform pattern making, ensuring optimized fabric usage and enhanced fit precision for mass-customization efforts.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the market, primarily fueled by robust growth in major economies like China and India, characterized by increasing industrialization of textile manufacturing and a rapidly expanding middle class with heightened discretionary income for intimate wear. The region serves as the global manufacturing hub for synthetic and blended fabrics, benefiting from lower labor costs and established supply chain infrastructure, though the domestic consumption growth in countries like Japan and South Korea also drives demand for premium, high-tech textiles.

- North America: This region is a mature, high-value market defined by a strong emphasis on brand loyalty, sustainability, and technological innovation. North American consumers drive demand for specialized performance lingerie, shapewear, and organic/eco-friendly fabrics. The market is also heavily influenced by e-commerce penetration and the athleisure trend, necessitating fabrics with superior stretch, recovery, and moisture-wicking properties, commanding premium pricing for proprietary materials developed by large textile firms.

- Europe: Europe is characterized by stringent environmental and safety regulations (e.g., REACH), which mandate the use of safe, certified textiles, driving innovation toward sustainable, non-toxic dyeing and finishing techniques. Countries like France and Italy maintain a dominant position in the luxury and high-fashion lingerie segment, creating consistent demand for exquisite, high-quality materials such as intricate French lace, fine silk, and premium modal. Regional textile manufacturers focus on quality, traceability, and ethical sourcing.

- Latin America (LATAM): The LATAM market, while smaller in scale, shows promising growth, particularly in countries like Brazil and Mexico. Demand is highly responsive to price points, although local manufacturers are increasingly investing in modern weaving and knitting technologies to compete on quality. Cultural emphasis on body shape and aesthetics boosts the demand for specialized control garments and figure-enhancing fabrics, fostering local production of high-elastane content materials.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with the Gulf Cooperation Council (GCC) countries showing strong demand for luxury and imported intimate wear fabrics due to high disposable income, while the broader African market focuses more on durable, cost-effective synthetic fibers for mass-market consumption. The region presents opportunities for specialized fabrics catering to conservative dress codes, such as lightweight, opaque, and breathable textiles for layering.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lingerie Fabrics Market.- Huafon Group

- Hyosung Corporation

- Invista (Koch Industries)

- DuPont de Nemours, Inc.

- Nilit Ltd.

- Lenzing AG

- Toray Industries, Inc.

- Asahi Kasei Corporation

- Unifi, Inc.

- Muehlmeier Bodyshaping

- Carolina Nonwovens

- Taub & Co.

- Penn Textile Solutions

- Teijin Limited

- Nylstar

- Lauffenmühle GmbH & Co. KG

- Baltex

- Egartex

- Best Pacific International Holdings

- Noyon Dentelles

Frequently Asked Questions

Analyze common user questions about the Lingerie Fabrics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Lingerie Fabrics Market?

The market is primarily driven by rising consumer demand for comfort-focused, high-performance intimate wear, the integration of athleisure and shapewear technologies, and increasing consumer awareness and preference for sustainable and eco-friendly fabric options such as recycled nylon and organic cotton.

Which raw material segment holds the largest market share in lingerie fabric production?

Synthetic fibers, specifically nylon (polyamide) and polyester, currently dominate the market share due to their superior elasticity, durability, quick-drying properties, and cost-effectiveness, making them essential components for high-stretch and technical lingerie applications like seamless garments and shapewear.

How is sustainability impacting material innovation in intimate apparel?

Sustainability is profoundly impacting innovation, pushing manufacturers to adopt closed-loop production methods for fibers like Tencel Modal, utilize recycled materials (rPET), and develop non-toxic, water-efficient dyeing processes. This shift addresses growing consumer desire for traceable and environmentally responsible garment sourcing.

What is the projected Compound Annual Growth Rate (CAGR) for the Lingerie Fabrics Market between 2026 and 2033?

The Lingerie Fabrics Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven by product innovation and market expansion in the Asia Pacific region.

What role does technology play in the seamless lingerie segment?

Technology, particularly advanced circular and warp knitting machinery, is crucial for the seamless lingerie segment. These technologies enable the creation of garments with integrated shaping zones, varying degrees of compression, and minimal seams, maximizing wearer comfort and minimizing production waste, aligning with AEO trends.

What are the main challenges facing textile manufacturers in the lingerie supply chain?

Key challenges include managing the high volatility and fluctuating prices of petrochemical raw materials used for synthetic fibers, navigating complex and varied global textile safety regulations, and meeting the demand for quick turnaround times dictated by fast-fashion cycles while maintaining high quality standards for delicate fabrics.

How is AI influencing consumer behavior analysis for intimate apparel?

AI is increasingly used to analyze vast datasets of consumer preferences, fit issues, and body metrics (often collected via digital platforms) to optimize demand forecasting and facilitate hyper-customization of fabric specifications, ensuring the correct balance of stretch, recovery, and breathable zones in tailored garments.

Which application segment is showing the fastest adoption of technical fabrics?

The shapewear and athletic/active lingerie application segments are exhibiting the fastest adoption of high-tech fabrics. These segments require specialized textiles with advanced features such as enhanced compression ratios, moisture management, temperature regulation capabilities, and antimicrobial finishes to meet performance demands.

Why is the Asia Pacific region considered the primary growth engine for lingerie fabrics?

APAC is the primary growth engine due to the rapid urbanization, substantial growth in the middle-class consumer base, high concentration of textile manufacturing capacity, and increasing domestic consumer spending on branded and higher-quality intimate apparel, particularly in countries like China and India.

What types of natural fibers are seeing increased demand in the luxury lingerie market?

In the luxury segment, demand is consistently high for premium natural fibers such as pure silk, known for its lustrous aesthetic and superior hand-feel, and high-quality Modal and Tencel fibers derived from sustainably sourced wood pulp, valued for their exceptional softness and drape.

How do specialized finishes contribute to the value proposition of modern lingerie fabrics?

Specialized finishes significantly enhance the value proposition by adding functional benefits such as permanent antimicrobial protection, odor control, UV resistance, cooling technology (phase change materials), and improved moisture-wicking performance, transforming basic textiles into technical fabrics desirable to modern consumers.

What role do microfibers play in the contemporary lingerie fabrics market?

Microfibers (synthetic fibers with a very fine denier count) are critical as they provide an extremely soft, lightweight, and luxurious feel, often referred to as "second skin" fabrics. They are essential for producing comfortable, seamless underwear and components that require a smooth, invisible finish under outerwear.

What is the significance of elastane (Spandex) in modern lingerie manufacturing?

Elastane, commonly known as Spandex or Lycra, is crucial for imparting high elasticity and superior shape retention to fabrics. It is indispensable for producing stretch lace, comfortable bra bands, and all forms of shapewear where high recovery and compression are required to maintain the garment’s structure and fit over time.

How does the volatile crude oil price affect the lingerie fabrics industry?

As nylon and polyester are derivatives of petrochemicals, fluctuating crude oil prices directly impact the cost of synthetic fiber raw materials. This volatility introduces significant cost management challenges for textile producers and can lead to increased prices for final garment manufacturers, thereby affecting market stability.

What is the impact of 3D printing technology on lingerie components?

3D printing is emerging as a niche technology, primarily impacting non-fabric components like specialized bra cups, support structures, and customized padding. It offers the potential for highly precise, personalized fit components and rapid prototyping of complex support elements that cannot be easily achieved through traditional molding.

Why are knitting technologies favored over weaving in most lingerie applications?

Knitting technologies, especially warp and circular knitting, are preferred because they produce fabrics with inherent stretch and superior drape, essential for intimate apparel that needs to conform closely to the body's contours. Woven fabrics are generally used only for specific components or rigid luxury items like silk robes.

How are strict European regulations influencing the sourcing of lingerie dyes?

Strict European regulations, particularly REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), force manufacturers globally to use certified, non-hazardous dyes and chemical finishes, accelerating the adoption of sustainable and water-saving dyeing methods and promoting transparency in the chemical supply chain.

What opportunities exist in the market for bio-based and biodegradable lingerie materials?

Significant opportunities exist in developing fabrics from renewable resources (e.g., corn, sugar cane, or bio-waste) that can fully biodegrade or compost after disposal. This aligns with circular economy principles and appeals to environmentally conscious Gen Z and Millennial consumer bases, offering a long-term competitive advantage.

How does the increasing popularity of e-commerce affect the fabric selection process?

E-commerce drives demand for fabrics that photograph well and can be accurately described by their technical features (stretch, breathability). More importantly, the high rate of returns associated with poor fit online emphasizes the need for consistent, dimensionally stable fabrics that guarantee precise sizing consistency across batches.

What are the key differences between fabrics used for everyday wear versus shapewear?

Everyday wear prioritizes soft, breathable natural fibers (like cotton or modal) with moderate stretch. Shapewear utilizes high-denier synthetic blends with significantly higher concentrations of elastane, often engineered with specialized compression zones, demanding high-recovery power and firm structure to contour the body.

In the value chain, where is the highest value addition typically achieved?

The highest value addition is typically achieved at the downstream stage—specifically in brand positioning, garment design complexity, and proprietary finishing (e.g., seamless bonding, specialized coatings). Upstream fiber innovation also captures significant value through intellectual property protection.

How do manufacturers ensure the skin compatibility of synthetic lingerie fabrics?

Manufacturers ensure skin compatibility by using OEKO-TEX certified materials, rigorous testing for harmful substances, and incorporating hypoallergenic finishes. Furthermore, microfibers are preferred over conventional fibers as their finer filaments offer a smoother surface, reducing friction and potential skin irritation.

What factors differentiate luxury lingerie fabrics from mass-market fabrics?

Luxury fabrics are differentiated by the use of premium raw materials (e.g., Grade A silk, imported French lace), higher thread counts, complex weaving/knitting structures, superior dimensional stability, and meticulous finishing processes, ensuring an exceptional hand-feel, durability, and intricate aesthetic appeal not found in mass-market synthetics.

What is the primary function of antimicrobial finishes on lingerie fabrics?

Antimicrobial finishes are applied to synthetic and blended fabrics to inhibit the growth of bacteria and fungi, thereby preventing odor development and enhancing hygiene. This feature is particularly vital for performance lingerie, activewear, and specialized medical textiles within the intimate apparel category.

How do smart textiles function in the context of intimate apparel?

Smart textiles in intimate apparel incorporate conductive fibers or embedded micro-sensors, often integrated into the bra band or fabric structure, to measure physiological data such as heart rate, respiratory rate, and body temperature. This data is wirelessly transmitted for health monitoring without compromising comfort.

What are the key components of a Value Chain Analysis for Lingerie Fabrics?

The key components include upstream raw material sourcing (fibers and polymers), midstream textile manufacturing (knitting, dyeing, finishing), downstream garment assembly and branding, and the distribution channels (direct OEM sales, agents, and retail logistics).

Why is lace and embroidery still a high-growth segment despite material innovation in synthetics?

Lace and embroidery remain high-growth in the luxury and premium segments because they provide unique aesthetic value, complexity, and artisanal craftsmanship that cannot be replicated by basic synthetic textiles. Technological advancements in computerized embroidery and lace machines allow for intricate patterns that command high retail prices.

What geopolitical factors influence the lingerie fabric supply chain?

Geopolitical factors include trade tariffs affecting textile imports/exports, political stability in major manufacturing hubs (e.g., Vietnam, Bangladesh), and international agreements on labor standards and ethical sourcing, all of which influence manufacturing location decisions and raw material procurement costs.

How are brands addressing ethical sourcing of natural fibers like cotton and silk?

Brands are increasingly adopting certifications (e.g., GOTS for Organic Cotton, Fair Trade standards) and implementing blockchain traceability systems to verify the ethical sourcing and processing of natural fibers, ensuring compliance with social responsibility goals and minimizing environmental impact claims.

What is the significance of the "hand-feel" property in selecting lingerie fabrics?

Hand-feel (or tactile quality) is paramount in lingerie as it directly correlates with perceived comfort and luxury. Fabric developers prioritize achieving a soft, smooth, or silky feel through mechanical finishing processes or selection of fine micro-denier fibers, heavily influencing consumer purchase decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager