Lining Fabrics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432559 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Lining Fabrics Market Size

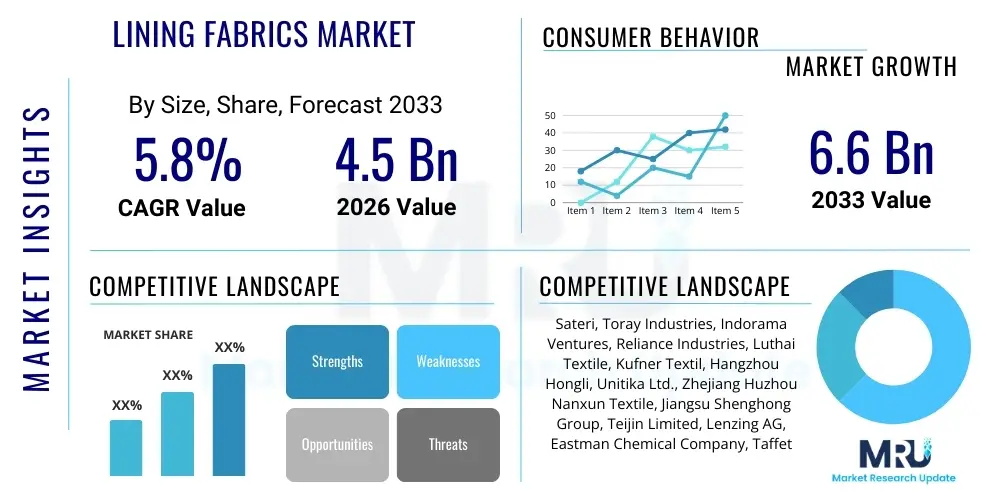

The Lining Fabrics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033.

Lining Fabrics Market introduction

Lining fabrics constitute essential components in the textile and apparel industry, primarily serving functional and aesthetic purposes within garments, luggage, and interior furnishings. These materials are utilized to conceal raw seams, provide internal structure, enhance comfort by preventing direct skin contact with outer shell fabrics, and facilitate ease of wear and removal. The market encompasses a diverse range of materials, including natural fibers like cotton and silk, and synthetic materials such as polyester, nylon, and acetate, each offering varying degrees of breathability, drape, durability, and antistatic properties suitable for specific end-use applications. Demand is fundamentally driven by the robust growth in the global fashion industry, the increasing consumer preference for high-quality, comfortable clothing, and specialized requirements within technical textiles and luxury goods.

Major applications of lining fabrics span across tailored clothing, including suits, jackets, and coats, where linings contribute significantly to the garment’s finished form and longevity. Beyond traditional apparel, these fabrics are critical in accessories like handbags and footwear, offering internal protection and structural integrity. Furthermore, specialized linings are increasingly adopted in performance wear and protective clothing to manage moisture, regulate temperature, or provide chemical resistance. The versatility and functional necessity of lining fabrics ensure their ubiquitous presence across mass-market, premium, and couture segments, tying market growth closely to global macroeconomic indicators and discretionary consumer spending patterns.

Key benefits derived from using appropriate lining fabrics include improved garment lifespan, enhanced thermal regulation, increased comfort due to smooth texture, and superior aesthetic appeal by offering a contrasting or complementary finish to the outer material. Driving factors fueling market expansion include rapid urbanization in emerging economies leading to increased apparel consumption, technological advancements in material science enabling development of high-performance and sustainable linings (e.g., recycled polyesters and bio-based polymers), and the rising trend of athleisure wear demanding lightweight and moisture-wicking lining solutions. The interplay between traditional craftsmanship demanding high-end natural linings and mass production seeking cost-effective synthetics defines the competitive landscape.

Lining Fabrics Market Executive Summary

The Lining Fabrics Market demonstrates resilient growth, underpinned by sustained expansion in the global apparel manufacturing sector and evolving consumer expectations regarding garment quality and sustainability. Business trends indicate a strong shift towards incorporating high-performance synthetic linings, particularly those derived from recycled or bio-degradable sources, driven by stringent environmental regulations and corporate sustainability mandates across major fashion houses. The market is characterized by intense competition among large integrated textile manufacturers and specialized niche producers focusing on luxury or technical specifications. Strategic partnerships between lining suppliers and apparel brands are becoming critical for supply chain optimization and innovation pipeline management.

Regionally, Asia Pacific maintains its dominance, primarily due to its status as the world’s leading hub for textile and apparel production, characterized by large-scale manufacturing capabilities in countries like China, India, and Vietnam. However, North America and Europe remain key markets for high-value and specialty linings, reflecting a high concentration of luxury fashion houses and technical textile innovators. Emerging regional trends involve the relocation of manufacturing activities to Southeast Asian nations and increasing investment in digitalization across the supply chain to enhance responsiveness and transparency, mitigating risks associated with global trade disruptions.

Segment trends highlight the sustained leadership of synthetic materials, particularly polyester, owing to its cost-effectiveness, durability, and ease of processing, though the fastest growth is observed in the niche segment of sustainable and specialized function linings (e.g., antimicrobial or thermal regulating). By application, the tailored clothing segment remains the largest consumer, but strong impetus is expected from the sports and activewear segment, demanding lightweight, stretchable, and breathable linings. Manufacturers are increasingly differentiating their offerings through material certifications and proprietary finishes to capture premium pricing and enhance brand loyalty in a commoditized market space.

AI Impact Analysis on Lining Fabrics Market

User queries regarding AI in the Lining Fabrics Market frequently center on themes such as automated quality control, optimization of fabric cutting and waste reduction, predictive demand forecasting for inventory management, and the use of AI in designing novel functional lining materials. Key concerns revolve around the capital expenditure required for adopting AI-driven machinery and the potential displacement of manual labor in traditional manufacturing environments. Users also express high expectations regarding AI's ability to enhance sustainability by minimizing material usage and energy consumption during the production process, and its role in accelerating trend analysis and customization for fast fashion cycles. The consensus suggests AI is viewed not as a replacement for human textile expertise but as a crucial tool for achieving unprecedented efficiency, precision, and agility in a highly competitive supply chain.

- AI-driven optimization of material yield, significantly reducing fabric wastage during the pattern cutting and nesting process.

- Enhanced predictive maintenance and quality inspection systems using machine vision to identify defects in lining fabric rolls instantly, improving overall quality standards.

- AI algorithms for rapid demand forecasting, enabling textile manufacturers to align production schedules precisely with apparel brand requirements, reducing inventory holding costs.

- Integration of AI tools in textile design software to simulate the drape, breathability, and functional performance of new lining compositions before physical sampling.

- Automation of complex logistics and supply chain routing, optimizing the timely delivery of specialized linings globally and responding rapidly to supply disruptions.

- Development of personalized or custom lining solutions using generative AI based on specific client comfort and aesthetic requirements.

DRO & Impact Forces Of Lining Fabrics Market

The dynamics of the Lining Fabrics Market are governed by a complex interplay of driving forces, restraining factors, opportunities, and pervasive impact forces shaping strategic decisions. Primary drivers include the continuous expansion of the global apparel industry, particularly in developing economies, coupled with an escalating consumer focus on garment longevity and internal comfort, necessitating high-quality linings. Furthermore, technological leaps in polymer science facilitate the production of highly functional, lightweight, and durable synthetic linings at competitive costs. However, the market faces significant restraints, notably the volatile pricing of raw petrochemical materials (for synthetic linings) and natural fibers (e.g., silk and cotton), which directly impacts manufacturing margins. Additionally, the increasing scrutiny on environmental impact and disposal of synthetic textiles poses a major challenge, pushing manufacturers towards costly sustainable alternatives.

Opportunities for growth are abundant, particularly in the realm of technical textiles and sustainable innovation. The burgeoning demand for smart textiles in sectors like healthcare and sports offers avenues for specialized linings incorporating conductive, thermal, or antimicrobial properties. The increasing adoption of circular economy principles presents an opportunity for companies specializing in closed-loop recycling processes for synthetic lining materials, differentiating them in the marketplace. Geographical expansion into untapped regions in Africa and Latin America, alongside strategic mergers and acquisitions to consolidate supply chain capabilities, further define the strategic opportunities available to market participants.

Impact forces currently reshaping the market include regulatory pressures (e.g., REACH regulations in Europe governing chemical use), which necessitate continuous compliance and formulation adjustments for dyes and finishes. Consumer awareness regarding ethical sourcing and manufacturing transparency is also a powerful force, compelling companies to certify their supply chains and adopt greener practices. The impact of rapid globalization mandates efficient and digitized logistics networks, as apparel production often involves complex cross-border material sourcing and assembly. Ultimately, the ability of manufacturers to innovate sustainable, high-performance linings while managing cost volatility dictates competitive positioning and long-term viability in this essential textile segment.

Segmentation Analysis

The Lining Fabrics Market is comprehensively segmented based on material type, application, and distribution channel, providing a granular view of market dynamics and identifying high-growth pockets. Material segmentation differentiates between natural fibers, synthetic materials, and blended fabrics, with performance characteristics like durability, breathability, and cost heavily influencing procurement choices. Synthetic fibers, due to their superior cost-to-performance ratio and functional versatility, command the largest market share, while natural fibers retain dominance in the high-end and luxury apparel segments. The continuous pursuit of performance enhancement drives the complexity within the material segment, leading to specialized coatings and finishes being applied post-production.

Segmentation by application clarifies the demand structure across different end-use industries. Apparel, particularly tailored clothing (suits, jackets, coats) and casual wear, represents the primary application area, critically reliant on linings for structural integrity and comfort. However, the non-apparel segment, encompassing footwear, bags, and home textiles (curtains, drapery), utilizes lining materials for protective and aesthetic functions, showing steady growth. The functional demands differ significantly across these applications; for instance, automotive linings require high abrasion resistance and fire retardancy, contrasting with the soft drape needed for formal wear linings.

The third critical segmentation involves distribution channels, distinguishing between direct sales to large apparel manufacturers, and indirect sales through distributors, agents, and wholesalers serving smaller bespoke tailors and specialized textile producers. This structure reflects the fragmented nature of the textile supply chain, where large volume buyers often negotiate direct contracts for economies of scale, while smaller buyers rely on efficient, regional distribution networks. Analyzing these segments is crucial for stakeholders to tailor production capabilities, marketing strategies, and R&D investments effectively, capitalizing on specific consumer and industrial requirements within the textile ecosystem.

- By Material Type:

- Synthetic (Polyester, Nylon, Acetate, Rayon, Viscose)

- Natural (Silk, Cotton, Wool)

- Blended Fabrics

- By Application:

- Apparel (Tailored Clothing, Outerwear, Casual Wear, Sportswear)

- Non-Apparel (Footwear, Bags and Luggage, Home Furnishings, Automotive, Industrial)

- By Distribution Channel:

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Lining Fabrics Market

The value chain for the Lining Fabrics Market begins with upstream activities involving raw material procurement and preparation. This stage is dominated by chemical companies providing polymers (for synthetics like polyester and nylon) and agricultural entities supplying natural fibers (cotton, silk). Fluctuations in crude oil prices directly impact synthetic fiber costs, making this initial stage highly sensitive to global commodity markets. Key tasks include polymerization, fiber spinning, and yarn preparation, focusing heavily on achieving the necessary fineness, strength, and dye affinity tailored for lining applications. Efficiency at this stage dictates the base cost and environmental footprint of the final fabric product.

The middle stage encompasses the core manufacturing process: weaving, knitting, and non-woven production, followed by dyeing, printing, and specialized finishing treatments. Textile mills focus on achieving specific fabric parameters such as desired hand-feel (softness), drape, durability, and functional properties like antistatic, antimicrobial, or thermal retention. Value addition is maximized through proprietary finishing technologies that enhance performance and aesthetic appeal, such as calendering for high gloss or specialized chemical baths for wrinkle resistance. Quality control checks are intensive here, ensuring the fabrics meet stringent apparel industry standards regarding color fastness and shrinkage.

Downstream analysis involves distribution and end-use application. Distribution channels bifurcate into direct relationships with large global garment manufacturers who require bulk, standardized orders, and indirect channels relying on regional agents and wholesalers to supply small-to-medium enterprises and local tailoring shops. The end-users—apparel brands and industrial manufacturers—incorporate the lining fabrics into final products. Direct sales offer higher margins and tighter quality loop control, while indirect channels provide market reach and flexibility. Efficient logistics and robust inventory management are crucial downstream activities, linking the textile producer rapidly and reliably to the global apparel production cycle.

Lining Fabrics Market Potential Customers

Potential customers for lining fabrics are diverse, encompassing major sectors within the global textile, apparel, and specialized industrial manufacturing landscapes. The primary customer segment is the Ready-to-Wear (RTW) apparel industry, ranging from high-street fashion brands and fast fashion retailers requiring vast volumes of cost-effective synthetic linings, to luxury fashion houses demanding premium natural fibers like silk, cupro, and high-grade viscose. These buyers prioritize cost, aesthetic compatibility with the shell fabric, and consistency in supply, often negotiating large-scale, long-term contracts directly with mills.

A rapidly expanding customer base resides within the performance and activewear segment, including sports apparel companies and outdoor gear manufacturers. These buyers specifically require technical linings that offer moisture management, enhanced stretch, thermal regulation, or antimicrobial protection, leading to higher-value specialized fabric orders. Another significant segment includes manufacturers of non-apparel goods, such as footwear companies (requiring durable, moisture-wicking shoe linings), luggage producers (seeking abrasion-resistant internal fabric), and automotive interior suppliers (demanding flame-retardant and highly durable linings for seat backs and door panels). These industrial buyers are driven by strict technical specifications and regulatory compliance.

Finally, smaller but crucial potential customers include bespoke tailors, custom clothing workshops, and small-to-medium sized home furnishing manufacturers. These entities typically source smaller volumes through established distributors and wholesalers, prioritizing variety, quick turnaround, and access to unique finishes or patterns. Capturing the diverse needs of these customers—from bulk efficiency to specialized functional requirements—requires a diversified product portfolio and a hybrid distribution strategy that balances direct sales with strong channel partnerships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sateri, Toray Industries, Indorama Ventures, Reliance Industries, Luthai Textile, Kufner Textil, Hangzhou Hongli, Unitika Ltd., Zhejiang Huzhou Nanxun Textile, Jiangsu Shenghong Group, Teijin Limited, Lenzing AG, Eastman Chemical Company, Taffeta Textile, Nilit Ltd., Coats Group plc, Kolon Industries, Asahi Kasei Corporation, Formosa Taffeta Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lining Fabrics Market Key Technology Landscape

The technological landscape of the Lining Fabrics Market is highly dynamic, driven by the dual goals of maximizing functional performance and achieving environmental sustainability. Key technological advancements revolve around innovative fiber production and specialized finishing techniques. For synthetic fibers, continuous polymerization methods and high-speed spinning technologies are used to create ultra-fine denier yarns (microfibers) that offer superior softness, drape, and moisture-wicking capabilities essential for sportswear linings. Furthermore, the commercialization of recycled synthetic fibers, utilizing chemical or mechanical recycling processes for post-consumer PET bottles and textile waste, represents a major technological pivot responding to sustainability pressures.

In terms of finishing, advanced functional treatments are critical differentiators. Technologies such as encapsulated phase change materials (PCMs) are being integrated into linings to provide dynamic thermal regulation, storing and releasing heat as needed. Antimicrobial and anti-odor finishes, often based on silver ion or zinc pyrithione technologies, are crucial for high-contact applications like footwear and athletic wear linings. Furthermore, nanotechnology is explored for producing water-repellent or stain-resistant linings without compromising breathability, enhancing the garment's protective features and ease of maintenance.

Process digitization, encompassing Computer-Aided Design (CAD) for pattern generation and 3D simulation for material performance, is streamlining the design-to-production cycle, minimizing the need for physical prototypes. Advanced dyeing techniques, such as supercritical carbon dioxide dyeing (CO2 dyeing), are gaining traction as they significantly reduce water consumption and eliminate the use of harmful chemicals typically required in conventional aqueous dyeing processes, positioning manufacturers at the forefront of ecological responsibility and operational efficiency within the textile sector.

Regional Highlights

The Lining Fabrics Market exhibits distinct regional dynamics heavily influenced by manufacturing concentration, consumer purchasing power, and regulatory frameworks.

- Asia Pacific (APAC): APAC is the epicenter of global textile manufacturing, dominating both production volume and consumption capacity. Countries like China, India, Vietnam, and Bangladesh serve as massive production bases for lining fabrics, benefiting from lower labor costs and integrated supply chains. The demand is massive, driven by both export-oriented garment production and rapidly expanding domestic consumer markets seeking affordable and durable linings. Growth in technical textile production is also prominent in Japan and South Korea, focusing on high-performance industrial and specialized apparel linings.

- Europe: Europe represents a high-value market characterized by stringent quality standards and a strong focus on sustainable and luxury linings. Western European countries, particularly Italy, France, and Germany, drive demand for natural fibers (silk, viscose) and certified recycled synthetics, reflecting the headquarters of major luxury and high-end fashion brands. Regulations like REACH heavily influence material and chemical choices, pushing manufacturers towards advanced, eco-friendly finishing technologies. While production volume is lower than APAC, the value generated per unit is significantly higher.

- North America: North America is a mature market primarily driven by high consumer purchasing power and demand for specialized performance linings in activewear, outdoor apparel, and functional workwear. While large-scale manufacturing has shifted overseas, domestic demand focuses on innovative, proprietary materials and linings used in specialized industrial applications (e.g., aerospace and defense). The focus on supply chain transparency and traceability is a key regional trend, prioritizing suppliers who can guarantee ethical sourcing and sustainable production methods.

- Latin America (LATAM): LATAM presents emerging growth opportunities, with Brazil and Mexico acting as major regional manufacturing and consumption hubs. Market growth is spurred by increasing domestic apparel consumption and expanding regional trade agreements. The demand often favors cost-effective polyester and nylon linings, though localized production is increasing to mitigate reliance on imports and improve supply chain resilience.

- Middle East and Africa (MEA): This region is characterized by fragmented demand, with the Middle East focusing on high-end luxury fabrics (often imported) for traditional and haute couture wear, while Africa is rapidly developing its textile manufacturing base. Investment in textile hubs, particularly in North Africa and parts of Sub-Saharan Africa, aims to capture lower-cost manufacturing opportunities, driving localized demand for bulk lining materials for domestic and export markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lining Fabrics Market.- Sateri

- Toray Industries

- Indorama Ventures

- Reliance Industries

- Luthai Textile

- Kufner Textil

- Hangzhou Hongli

- Unitika Ltd.

- Zhejiang Huzhou Nanxun Textile

- Jiangsu Shenghong Group

- Teijin Limited

- Lenzing AG

- Eastman Chemical Company

- Taffeta Textile

- Nilit Ltd.

- Coats Group plc

- Kolon Industries

- Asahi Kasei Corporation

- Formosa Taffeta Co., Ltd.

- Huntsman Corporation (Specialty Chemicals/Finishes)

Frequently Asked Questions

Analyze common user questions about the Lining Fabrics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Lining Fabrics Market?

The primary factor driving market demand is the sustained expansion of the global apparel industry, particularly the rise in fast fashion and the growing consumer preference for comfortable, durable, and structurally sound garments across all price points.

How is the focus on sustainability impacting lining material choices?

Sustainability is driving a significant shift toward recycled synthetic fibers (e.g., recycled polyester) and responsibly sourced natural fibers (like certified organic cotton and sustainable cellulosic fibers such as Tencel and Ecovero), pressuring manufacturers to adopt circular production models.

Which material type holds the largest market share in lining fabrics?

Synthetic materials, primarily polyester and its variants, hold the largest market share due to their superior combination of low cost, high durability, wrinkle resistance, and versatility across various apparel and industrial applications.

What role do technical linings play in market growth?

Technical linings, featuring specialized functions like moisture-wicking, thermal regulation, or antimicrobial properties, are crucial drivers of growth, particularly in the high-value segments of sports, activewear, and protective clothing.

Where is the highest concentration of Lining Fabrics manufacturing located globally?

The highest concentration of lining fabrics manufacturing is located in the Asia Pacific region, primarily in China, India, and Vietnam, due to established textile infrastructure, robust supply chains, and large-scale operational capabilities serving global export markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager