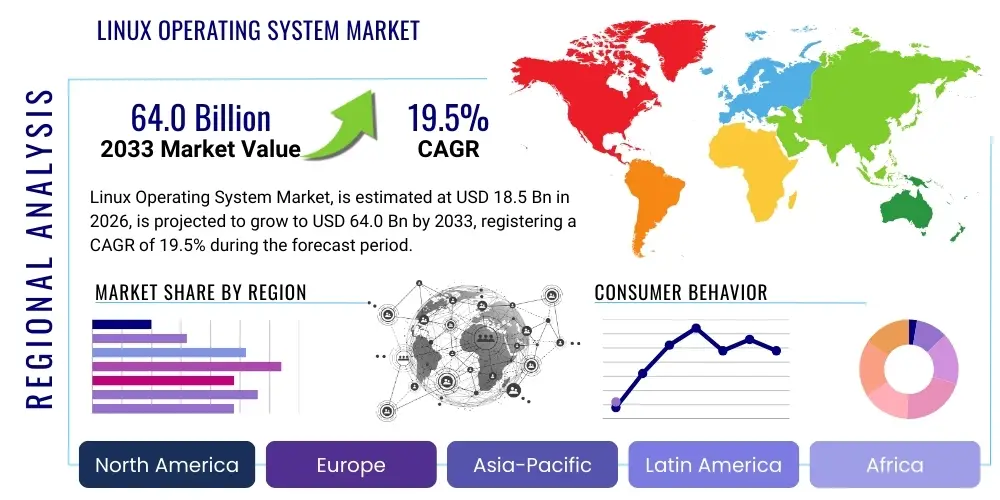

Linux Operating System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436978 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Linux Operating System Market Size

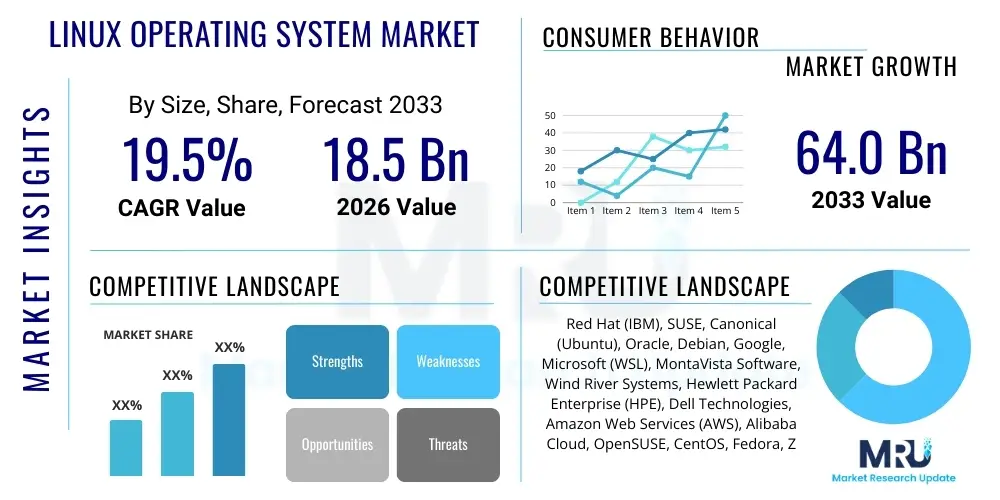

The Linux Operating System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 64.0 Billion by the end of the forecast period in 2033.

Linux Operating System Market introduction

The Linux Operating System Market encompasses the commercial and institutional deployment of various open-source operating system distributions based on the Linux kernel. This ecosystem extends far beyond traditional desktop usage, dominating the server market, cloud infrastructure, high-performance computing (HPC), embedded systems, and increasingly, specialized edge computing devices. The fundamental product description centers on a highly secure, stable, and customizable platform that offers unparalleled flexibility due to its open-source license, allowing for modifications tailored to specific organizational needs, thereby fostering rapid innovation and reducing vendor lock-in dependencies.

Major applications of Linux span critical infrastructural domains, including web servers (hosting the vast majority of websites globally), large-scale data centers managed by hyper-scalers, telecommunications networks (particularly 5G infrastructure), and mission-critical enterprise applications utilizing containerization technologies like Docker and Kubernetes, which are inherently optimized for Linux environments. The core benefits driving market adoption include low total cost of ownership (TCO) compared to proprietary alternatives, superior security features derived from community peer review and rapid patching cycles, and exceptional performance efficiency crucial for managing demanding workloads in cloud and big data environments. Furthermore, its inherent compatibility with modern development tools and languages positions it as the preferred choice for contemporary software development lifecycles.

The primary driving factors propelling the Linux OS market expansion are the exponential growth in cloud computing adoption, where Linux powers approximately 90% of public cloud workloads; the proliferation of Internet of Things (IoT) devices and embedded systems requiring lightweight, robust, and secure operating environments; and the growing strategic preference among large enterprises and government entities worldwide for open-source solutions to ensure transparency, security, and long-term cost predictability. The continuous contributions from a global community and major technology corporations ensure the kernel remains at the forefront of technological advancements, particularly in areas like virtualization, networking performance, and hardware compatibility, solidifying its market dominance in critical infrastructure sectors.

Linux Operating System Market Executive Summary

The Linux Operating System market is experiencing dynamic shifts, primarily driven by accelerated digital transformation and the mainstream adoption of cloud-native architectures, which heavily favor Linux distributions for efficiency and scalability. Current business trends indicate a strong movement toward specialized, hardened distributions tailored for security-sensitive industries like finance and defense, alongside the rising dominance of container-optimized operating systems that streamline deployment and management in large Kubernetes clusters. The market is consolidating around key enterprise vendors like Red Hat and SUSE, who are successfully translating open-source innovation into reliable, commercially supported packages, addressing enterprise concerns regarding stability and guaranteed service level agreements (SLAs). Furthermore, geopolitical trends emphasizing digital sovereignty are pushing governments and national entities to prioritize open-source software, viewing Linux as a critical tool for maintaining technological independence and mitigating supply chain risks inherent in proprietary software.

Regionally, North America remains the largest revenue contributor due to the concentration of major technology companies, hyper-scale cloud providers, and substantial investment in data center infrastructure, all heavily reliant on Linux servers. However, the Asia Pacific (APAC) region, led by China and India, is poised for the fastest growth, fueled by massive governmental digital initiatives, rapid expansion of local cloud services, and explosive growth in the mobile and embedded device markets. Europe demonstrates steady growth, bolstered by strict data privacy regulations (GDPR compliance often favors transparent open-source solutions) and increasing governmental mandates promoting open-source software adoption within the public sector. These regional trends underscore Linux's versatility as an operating system capable of meeting highly divergent regulatory, scale, and performance requirements across diverse global markets.

Segmentation trends highlight the increasing importance of application-specific distributions. The Server segment continues to dominate market share, but the Embedded & IoT segment is exhibiting the highest growth CAGR, driven by the massive roll-out of smart devices, industrial IoT, and autonomous vehicles, all requiring compact and efficient Linux variants. Within the component segment, services (including managed services, technical support, and consulting) are growing faster than pure subscription revenue, indicating that enterprises are seeking comprehensive support models to manage complex, customized Linux deployments effectively. The shift from traditional operating system sales toward subscription models based on service level agreements (SLAs) rather than simple license counts further characterizes the maturity and evolving business model within the specialized enterprise Linux environment.

AI Impact Analysis on Linux Operating System Market

User inquiries regarding AI's influence on the Linux Operating System Market primarily center on performance optimization, hardware compatibility, and the emergence of AI-specific distributions. Common concerns revolve around whether proprietary operating systems offer better integration with AI hardware (GPUs, TPUs), the reliability of open-source toolchains (TensorFlow, PyTorch) on Linux, and the security implications of running high-value AI models in an open-source environment. Users are keenly interested in how Linux distributions, particularly Ubuntu and specialized enterprise variants, are adapting kernel architecture and driver management (such as eBPF utilization) to maximize resource utilization for intensive machine learning tasks and ensure seamless deployment of complex AI models at scale, both in the cloud and at the edge. The underlying expectation is that Linux, due to its inherent efficiency and customization capabilities, will remain the foundational operating system for professional AI and data science environments.

The impact of Artificial Intelligence technologies is profoundly positive for the Linux OS market, positioning Linux as the undisputed backbone for virtually all major AI development and deployment initiatives. AI workloads, characterized by their intensive computational requirements and need for streamlined hardware interaction, thrive in the highly optimized, low-overhead environments provided by Linux. Specialized distributions are being created to preload essential AI frameworks, ensure optimal CUDA and GPU driver compatibility, and manage resource allocation efficiently, significantly lowering the barrier to entry for data scientists. Furthermore, the extensive toolchain integration, including native support for containerization and orchestration platforms, enables enterprises to manage, scale, and deploy complex neural networks across heterogeneous infrastructure, ranging from massive supercomputers to diminutive edge inference devices, all running specialized Linux kernels.

This dynamic interplay ensures that as AI innovation accelerates, the demand for Linux increases proportionally. Major technology firms are investing heavily in contributing to the Linux kernel, specifically to enhance performance features crucial for large language models (LLMs) and advanced machine learning algorithms, such as improved I/O handling, memory management, and process scheduling optimization. The open nature of Linux facilitates rapid adaptation to novel hardware accelerators, providing a significant competitive advantage over proprietary systems which often lag in driver support or require vendor-specific integrations. Consequently, the adoption of AI is not merely a driver for Linux market growth but a fundamental technological necessity that strengthens Linux's market position across the data center and beyond.

- AI model training and inference overwhelmingly rely on Linux due to superior performance characteristics and stability.

- The open-source nature of Linux allows rapid integration and optimization for specialized AI accelerators (GPUs, TPUs, NPUs).

- Linux facilitates seamless deployment of containerized AI applications (Docker/Kubernetes) essential for MLOps pipelines.

- Increased demand for specialized Linux distributions (e.g., Ubuntu Data Science, Fedora Scientific) tailored for deep learning workflows.

- eBPF technology within the Linux kernel is leveraged for high-efficiency monitoring and networking required by large-scale AI clusters.

- Linux acts as the primary host for all significant open-source AI frameworks (PyTorch, TensorFlow, Scikit-learn).

DRO & Impact Forces Of Linux Operating System Market

The Linux Operating System Market is shaped by a powerful confluence of drivers, restraints, and opportunities that dictate its growth trajectory and competitive dynamics. Key drivers include the unparalleled expansion of cloud services, where Linux is the default operating environment; the global trend toward utilizing open-source software to mitigate licensing costs and achieve technological independence; and the intrinsic stability and security offered by community-reviewed kernels necessary for running mission-critical enterprise workloads. These forces create a positive feedback loop, where increased adoption leads to greater community investment and more robust features, further accelerating market penetration across diverse industry verticals. Conversely, market growth is often restrained by the perceived complexity of management and administration compared to graphically-intensive proprietary systems, the lingering challenge of fragmentation across numerous distributions, and the necessity for specialized technical expertise to implement and maintain highly customized Linux deployments in non-technical organizational settings, posing a hurdle for widespread non-specialized adoption.

Opportunities for significant market expansion are concentrated in burgeoning technology sectors, particularly in edge computing, where lightweight and real-time optimized Linux variants are indispensable for low-latency processing in devices ranging from industrial robots to smart infrastructure. The automotive industry represents a high-growth sector, with Linux powering the majority of modern in-vehicle infotainment (IVI) systems and the foundational software for autonomous driving platforms. Furthermore, the persistent threat of cyber-attacks increases the value proposition of Linux, given its robust security architecture and the transparency of its source code, driving adoption in regulated and high-security environments. These opportunities are catalyzed by impact forces such such as the increasing global regulatory emphasis on software transparency and the accelerating pace of hardware innovation (especially RISC-V and ARM architectures), which Linux is uniquely positioned to rapidly integrate and support across its broad ecosystem.

Impact forces currently shaping the competitive landscape include the strategic integration of Linux technologies by major proprietary vendors, such as Microsoft's substantial investment in Windows Subsystem for Linux (WSL), which validates Linux's necessity in the developer ecosystem and simultaneously exposes more users to the OS environment. This coexistence, alongside the dominant role of hyper-scalers (AWS, Azure, GCP) who heavily rely on and contribute to Linux, ensures sustained investment in kernel development and distribution management. The enduring impact force is the community-driven, decentralized development model, which guarantees rapid security patching and continuous innovation unconstrained by commercial release cycles, making Linux the preferred choice for forward-thinking enterprises seeking maximum agility and future-proofing capabilities in their core IT infrastructure investments.

Segmentation Analysis

The Linux Operating System market is comprehensively segmented based on its component structure, deployment methodology, the type of application it supports, and the specific industry vertical utilizing the technology. This segmentation provides critical insights into consumption patterns, highlighting where commercial support and tailored distributions are most required. The component segmentation differentiates between core subscriptions (the commercial offering of the OS itself, providing support and patches) and ancillary services (including consulting, migration, integration, and training, which represent a significant and rapidly growing revenue stream). Analyzing these segments allows vendors to align their offerings with specific user needs, addressing the enterprise demand for comprehensive support packages and managed solutions that mitigate the risks associated with deploying complex open-source infrastructure.

- By Component:

- Subscriptions

- Services (Professional Services, Training, Support & Maintenance)

- By Deployment Type:

- Cloud-Based (Public Cloud, Private Cloud, Hybrid Cloud)

- On-Premise (Data Centers, Physical Servers)

- By Application:

- Servers (Web Servers, Application Servers, Database Servers)

- Desktops & Workstations

- Embedded Systems (Automotive, Industrial Controls, Consumer Electronics)

- High-Performance Computing (HPC)

- By End-User Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology and Telecommunication (IT & Telecom)

- Government and Defense

- Healthcare

- Manufacturing and Automotive

- Retail and E-commerce

- Education and Research

Value Chain Analysis For Linux Operating System Market

The Linux Operating System value chain begins with the upstream segment, dominated by the highly collaborative open-source community, core kernel developers, and major sponsoring entities (like IBM/Red Hat, Google, Intel) that contribute foundational code and architectural designs. This segment is responsible for the research, development, and maintenance of the Linux kernel and associated core utilities, functioning as the vital source of innovation and continuous improvement. The midstream segment involves the distribution providers (e.g., Canonical, SUSE), who package the raw code into stable, tested, and commercially supported distributions, adding proprietary tools and certification for specific hardware, thereby transforming freely available software into enterprise-grade products suitable for mass deployment and high-stakes operations.

Distribution channels in this market are predominantly indirect, leveraging a network of system integrators, value-added resellers (VARs), and technology partners who provide localized expertise and integrate Linux solutions into broader enterprise IT frameworks. Cloud providers constitute a unique and dominant distribution channel, offering pre-configured Linux images and managed services directly to the end-user, thereby bypassing traditional hardware vendors. Direct channels are also utilized, primarily by the major commercial Linux vendors who sell subscription and support contracts directly to large enterprise customers requiring highly customized solutions and direct technical access to vendor experts. The balance between direct customer engagement for specialized needs and widespread indirect channel deployment through cloud marketplaces is crucial for maximizing market reach.

The downstream segment consists of the vast array of end-users, ranging from individual developers utilizing Linux workstations to massive corporate data centers and governments operating critical national infrastructure. This segment captures revenue through subscription renewals, professional service fees, and specialized consulting engagements necessary to optimize complex deployments (such as scaling Kubernetes or implementing SELinux policies). The efficiency of this value chain hinges on the fluidity of knowledge transfer from the upstream community to the midstream commercial distributors, ensuring that the latest technological advancements are rapidly and reliably packaged for enterprise consumption, thus sustaining the competitive advantage derived from the open-source development model.

Linux Operating System Market Potential Customers

Potential customers for Linux Operating System solutions are overwhelmingly characterized by organizations that prioritize operational efficiency, infrastructure scalability, and technological flexibility, extending far beyond the traditional IT sector. Large-scale cloud service providers (CSPs) and hyperscalers represent the most significant buyers, utilizing Linux as the mandatory foundation for their global infrastructure and virtual machine offerings, driven by cost efficiency and performance. Additionally, telecommunication companies are rapidly adopting specialized, carrier-grade Linux distributions to run 5G core networks and network functions virtualization (NFV) services, where real-time performance and system stability are non-negotiable requirements, making them high-value customers for enterprise-grade distributions and long-term support contracts.

The Financial Services and Insurance (BFSI) sector, encompassing banks, trading firms, and regulatory bodies, constitutes another critical customer segment. These institutions leverage Linux for high-frequency trading platforms, data analytics engines, and secure transaction processing systems, benefiting from the OS's robust security features (e.g., strong auditing capabilities and reduced attack surface) and ability to handle high transaction volumes with low latency. These entities frequently invest in premium support and compliance-focused Linux variants to meet stringent industry regulations, highlighting their need for reliability and commercial backing. Furthermore, the global manufacturing and automotive industries are emerging as key purchasers, embedding specialized Linux variants into industrial control systems, robotics, and advanced driver-assistance systems (ADAS) for autonomous vehicles, driven by the demand for a secure, customizable, and hardware-agnostic embedded platform.

Governments and public sector organizations globally represent a segment increasingly shifting towards Linux. Motivated by mandates to promote open standards, reduce reliance on single foreign vendors, and achieve significant cost savings, many national and regional governments are migrating critical infrastructure and desktop environments to open-source platforms. This includes national defense agencies, public health systems, and educational institutions, which require vendor-agnostic systems that guarantee access to source code for internal auditing and security purposes. These end-users typically require extensive professional services for migration, integration with legacy systems, and specialized security hardening, making them attractive targets for comprehensive service offerings from commercial Linux distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 64.0 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Red Hat (IBM), SUSE, Canonical (Ubuntu), Oracle, Debian, Google, Microsoft (WSL), MontaVista Software, Wind River Systems, Hewlett Packard Enterprise (HPE), Dell Technologies, Amazon Web Services (AWS), Alibaba Cloud, OpenSUSE, CentOS, Fedora, Zorin OS, Elementary OS, Linux Mint, Slackware. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Linux Operating System Market Key Technology Landscape

The technological landscape of the Linux Operating System market is dynamically shaped by the constant evolution required to meet modern computing demands, particularly around agility, security, and resource efficiency. Central to this evolution is the pervasive adoption of containerization technologies like Docker and the Kubernetes orchestration platform. Linux provides the optimal foundation for these technologies, utilizing features like namespaces and control groups (cgroups) natively within the kernel, which ensures superior efficiency and isolation necessary for running microservices architectures at scale. This reliance on core Linux technologies for container management drives continuous kernel development focused on improving density, security isolation, and networking performance within containerized environments, establishing Linux as the undisputed operating system for modern cloud-native development and deployment workflows across all major hyper-scalers.

Further enhancing this technological foundation is the rise of extended Berkeley Packet Filter (eBPF), a revolutionary kernel technology that allows developers to run sandboxed programs within the Linux kernel, enabling dynamic, programmatic control over networking, security, and tracing without modifying the kernel source code or rebooting. eBPF is fundamentally changing how monitoring, network observability, and cloud security are implemented, transforming Linux into a highly observable and programmable platform essential for sophisticated data centers and AI/ML infrastructure. Simultaneously, there is a specialized focus on optimizing Linux for resource-constrained and time-sensitive applications, leading to advancements in real-time kernels (RT-Linux) used extensively in industrial automation, robotics, and telecommunication infrastructure where determinism and minimal latency are critical operational requirements that proprietary general-purpose operating systems struggle to achieve reliably.

Security remains a paramount concern, driving continuous technological enhancements within the Linux ecosystem. Technologies such as SELinux (Security-Enhanced Linux) and AppArmor provide mandatory access control (MAC) capabilities, establishing granular security policies that significantly harden the operating system against intrusion and internal threats, moving beyond traditional discretionary access controls. These security mechanisms, coupled with rapid patch deployment enabled by the open-source model and the use of immutable operating systems (like CoreOS or Fedora Silverblue) for server deployments, represent the cutting-edge of operating system security. The collective advancements in container optimization, programmable kernel capabilities (eBPF), and reinforced security frameworks ensure the Linux OS remains technically superior and strategically positioned to handle the most demanding computational and security requirements of the future digital economy.

Regional Highlights

Market dynamics for the Linux Operating System vary significantly across key geographical regions, reflecting differences in enterprise IT maturity, regulatory frameworks, and national technology mandates.

- North America (NA): Dominates the global market in terms of revenue and technological innovation. The strong presence of global hyperscalers (AWS, Microsoft Azure, Google Cloud) and a highly mature enterprise IT sector ensures continuous high demand for commercially supported Linux distributions. Investment is heavily focused on specialized high-performance computing (HPC), AI infrastructure, and advanced cloud-native application deployment, leveraging enterprise distributions from Red Hat and SUSE.

- Europe: Characterized by strong governmental and public sector support for open-source initiatives driven by regulatory compliance (GDPR, digital sovereignty mandates). European countries often mandate the use of open-source software in public administration to reduce vendor lock-in and ensure technological independence. Growth is steady, focused particularly on telecommunications infrastructure (5G deployment) and maintaining IT resiliency across the BFSI and automotive sectors, with a growing emphasis on security-hardened Linux solutions.

- Asia Pacific (APAC): Exhibits the highest projected growth rate, fueled by rapid digitization in economies like China, India, and Southeast Asia. Market expansion is driven by vast governmental cloud adoption, the proliferation of low-cost computing devices, and massive investment in national IT infrastructure, including smart cities and indigenous cloud services. Local players are increasingly adapting Linux for specialized applications, such as China's heavy reliance on Linux for governmental and state-owned enterprise systems to mitigate reliance on foreign technology.

- Latin America: This region is characterized by high price sensitivity, making the low total cost of ownership (TCO) associated with Linux highly appealing. Adoption is steadily increasing, particularly in the public sector and among small to medium enterprises (SMEs) seeking cost-effective and scalable IT solutions. Telecommunication modernization and growth in local cloud providers are primary drivers, leading to higher demand for reliable support services.

- Middle East and Africa (MEA): Growth is accelerating, driven by large-scale infrastructure projects (e.g., smart city developments in the GCC region) and significant investment in data center modernization and digital transformation across large energy and financial institutions. Security and high availability are key requirements, favoring enterprise Linux distributions with comprehensive support packages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Linux Operating System Market.- Red Hat (IBM)

- SUSE

- Canonical (Ubuntu)

- Oracle

- Debian

- Microsoft (WSL)

- MontaVista Software

- Wind River Systems

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Amazon Web Services (AWS)

- Alibaba Cloud

- OpenSUSE

- CentOS

- Fedora

- Zorin OS

- Elementary OS

- Linux Mint

- Slackware

Frequently Asked Questions

Analyze common user questions about the Linux Operating System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Linux Operating System Market?

The Linux Operating System Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period from 2026 to 2033, driven primarily by the global expansion of cloud computing and embedded systems.

How is the adoption of cloud computing influencing the Linux OS Market?

Cloud computing is the single largest market driver, as Linux powers approximately 90% of public cloud workloads due to its superior efficiency, stability, and compatibility with essential cloud-native technologies like Docker and Kubernetes orchestration.

Which geographical region is expected to show the fastest market growth for Linux OS?

The Asia Pacific (APAC) region is forecasted to experience the fastest growth, largely due to extensive governmental digitalization initiatives, rapid expansion of local cloud services, and significant deployment in telecommunication and IoT infrastructure.

What are the primary challenges restraining the widespread adoption of Linux?

Key restraints include market fragmentation across numerous distributions, which can complicate standardized deployment, and the necessity for organizations to employ specialized technical expertise for complex system administration and customized kernel deployments.

Which key technological advancements are crucial to the future of the Linux OS market?

Containerization (Kubernetes), the implementation of eBPF for advanced kernel observability and security, and specialized real-time kernel modifications for embedded and edge computing are the most crucial technological drivers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager