Lipiodol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437071 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Lipiodol Market Size

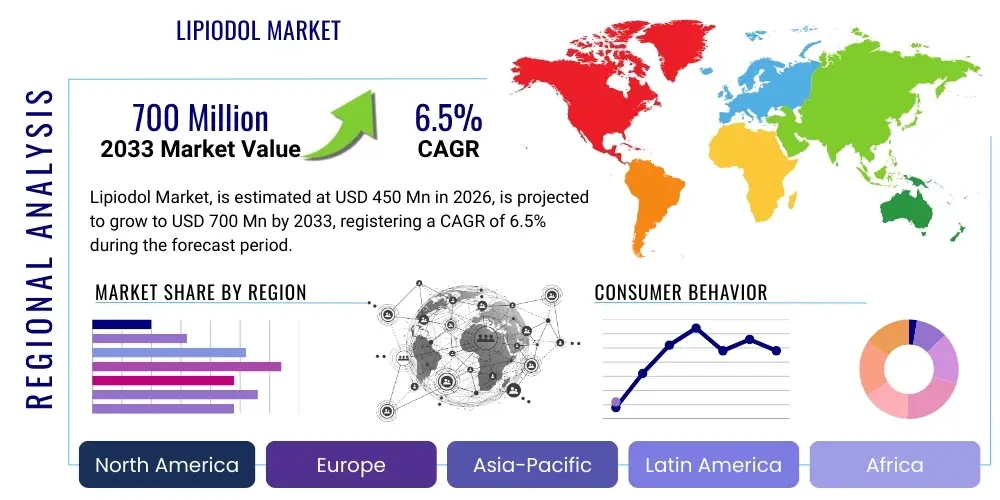

The Lipiodol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

The expansion of the Lipiodol market is fundamentally driven by the rising global incidence of hepatocellular carcinoma (HCC), the primary indication for its use in Transarterial Chemoembolization (TACE). As interventional oncology continues to gain prominence as a minimally invasive treatment option for localized liver cancers, the demand for Lipiodol, which serves both as a contrast agent and a carrier for chemotherapy drugs in conventional TACE (cTACE), experiences sustained momentum. Furthermore, increasing awareness and adoption of image-guided procedures in developing economies contribute significantly to volume growth, despite pricing pressures in mature markets.

Market valuation reflects the continued relevance of Lipiodol in diagnostic procedures, specifically hysterosalpingography (HSG) and lymphography, although therapeutic applications, particularly in oncology, represent the highest-value segment driving revenue growth. Regulatory approvals for new indications or formulations, coupled with strategic partnerships aimed at optimizing distribution networks, are critical factors influencing the market size trajectory over the forecast period. The competitive landscape, characterized by the presence of established pharmaceutical giants, necessitates continuous innovation in packaging, delivery mechanisms, and enhanced clinical data supporting efficacy and safety profiles.

Lipiodol Market introduction

The Lipiodol Market encompasses the global sales and usage of ethiodized oil, a sterile, iodine addition product of the ethyl esters of fatty acids of poppyseed oil, primarily recognized under the trade name Lipiodol Ultra-Fluid. This pharmaceutical product functions critically as an oil-based contrast agent utilized across diagnostic imaging and therapeutic interventional procedures. Its unique property of selective retention within hepatic tumors following intra-arterial injection makes it indispensable in treating liver cancer, particularly hepatocellular carcinoma (HCC), through the highly effective Transarterial Chemoembolization (TACE) technique. Lipiodol acts as both a visualization tool, guiding the interventional radiologist, and a delivery vehicle for cytotoxic agents, maximizing localized drug concentration while limiting systemic exposure, thereby improving patient outcomes.

Major applications for Lipiodol extend beyond oncology, including its established role in lymphography for visualizing the lymphatic system, especially in the diagnosis and management of chylous leakage or lymphedema. Additionally, it remains a standard contrast agent for hysterosalpingography (HSG), crucial for assessing tubal patency in female infertility diagnostics. The growing global prevalence of chronic liver diseases such as hepatitis B and C, which are significant risk factors for HCC, directly fuels the demand for Lipiodol in therapeutic settings. Market expansion is further propelled by driving factors such as the increasing sophistication of interventional radiology infrastructure globally, the shift towards minimally invasive procedures, and supportive clinical guidelines recommending TACE as a standard treatment for intermediate-stage HCC.

The core benefit of Lipiodol lies in its excellent imaging capabilities and its therapeutic efficacy when combined with chemotherapy drugs. It provides precise localization and sustained delivery of therapy, translating to high response rates and improved survival for eligible HCC patients. However, the market faces competition from alternative embolization agents, including drug-eluting beads (DEBs), necessitating continuous demonstration of cost-effectiveness and comparative advantages in specific clinical subpopulations. Geographical expansion into emerging markets, where HCC incidence rates are notably high and access to advanced interventional procedures is rapidly improving, presents substantial growth opportunities for stakeholders.

Lipiodol Market Executive Summary

The Lipiodol Market is poised for stable expansion, primarily anchored by robust demand from the interventional oncology segment, driven by the escalating global incidence of hepatocellular carcinoma (HCC). Business trends indicate a focus among key players on securing supply chain integrity and expanding clinical trials to support the use of Lipiodol in combination therapies or novel delivery methodologies, particularly in challenging tumor environments. Strategic alliances between pharmaceutical manufacturers and medical device companies specializing in delivery catheters are defining the competitive strategy, aiming to optimize procedural efficiency and safety in TACE. Furthermore, the trend toward value-based healthcare is encouraging manufacturers to provide extensive evidence documenting the long-term clinical and economic benefits of Lipiodol-based procedures compared to systemic treatments.

Regional trends reveal that Asia Pacific (APAC) currently dominates the market both in terms of volume and growth potential, attributable to the high endemic rates of chronic hepatitis (B and C) leading to high HCC prevalence in countries like China, Japan, and South Korea. North America and Europe maintain significant market shares, characterized by advanced healthcare infrastructure, high procedural reimbursement rates, and intensive research and development activities focused on refining interventional techniques. However, Latin America and MEA are emerging as high-growth regions, spurred by improvements in diagnostic accessibility and the establishment of dedicated interventional radiology centers capable of performing TACE procedures, thus transitioning away from traditional surgical or systemic approaches.

Segmentation trends highlight that the therapeutic segment, specifically Transarterial Chemoembolization (TACE), remains the largest and fastest-growing application market, consistently outpacing diagnostic uses like lymphography and HSG. Within the end-user segmentation, hospitals and specialized cancer centers account for the majority of consumption due to the complexity and infrastructure required for interventional oncology procedures. Future growth within the therapeutic segment will increasingly depend on the integration of Lipiodol with other advanced therapies, such as combining TACE with immunotherapy or targeted molecular agents, aiming to enhance treatment efficacy and expand the scope of treatable HCC stages.

AI Impact Analysis on Lipiodol Market

User inquiries regarding AI's impact on the Lipiodol market primarily revolve around how artificial intelligence can optimize TACE procedures, improve patient selection, and enhance the interpretation of post-procedure imaging crucial for assessing treatment success. Common themes include the use of AI for automated tumor segmentation, prediction of Lipiodol uptake patterns, and early detection of recurrence, all aimed at boosting the precision of interventional radiology. Users are keen to understand if AI-driven planning software could potentially reduce procedural variability, thereby optimizing the delivered dose of the Lipiodol-drug mixture and improving overall clinical outcomes in HCC treatment.

AI is beginning to integrate into the workflow of interventional radiology, significantly impacting the utility and efficiency of Lipiodol-based procedures. Machine learning algorithms are being developed to analyze pre-procedural imaging (CT, MRI) and automatically delineate tumor margins and feeding vessels, enhancing the precision of the Lipiodol injection site during TACE. Furthermore, AI models are used to rapidly process post-embolization imaging to quantify Lipiodol retention and ensure complete tumor coverage, a critical predictor of treatment response. This enhanced visualization and predictive analytics capability derived from AI directly improves the therapeutic yield of Lipiodol, solidifying its position in the competitive landscape against alternative embolization agents by demonstrating superior procedural control and measurable efficacy.

While AI does not replace the chemical compound itself, it transforms the procedural context, making the utilization of Lipiodol safer, more predictable, and highly personalized for each patient’s tumor characteristics. The integration of AI tools, particularly in complex cases or high-volume centers, reduces fluoroscopy time, minimizes contrast usage, and allows radiologists to make real-time adjustments based on AI-generated predictive insights regarding drug distribution and tissue viability. This technological synergy enhances the competitive edge of cTACE (conventional TACE using Lipiodol) and encourages wider clinical adoption by reducing operator dependence and standardizing high-quality outcomes across diverse medical settings.

- AI-driven tumor segmentation and volumetric analysis enhance targeting precision during Lipiodol injection in TACE.

- Machine learning models predict Lipiodol distribution patterns and treatment response based on pre-procedural vascular anatomy.

- Automated quantitative analysis of Lipiodol retention post-TACE allows faster and more objective assessment of treatment completeness.

- AI optimization of imaging protocols potentially reduces overall procedural time and radiation exposure for patients and staff.

- Integration of AI tools standardizes procedural techniques, reducing variability among different interventional radiologists.

DRO & Impact Forces Of Lipiodol Market

The dynamics of the Lipiodol market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. The primary driver is the overwhelming global burden of chronic liver disease leading to rising rates of Hepatocellular Carcinoma (HCC), where TACE utilizing Lipiodol is a highly effective, standard-of-care, first-line treatment for unresectable intermediate-stage cancer. This clinical necessity, combined with the increasing global infrastructure for interventional radiology and favorable clinical guideline updates endorsing TACE, provides sustained momentum. However, restraints include intense competition from newer, alternative embolization technologies, notably drug-eluting beads (DEBs), which offer pre-loaded drug delivery and sometimes lower rates of systemic toxicity. Additionally, high manufacturing costs for maintaining the specialized quality of the ethiodized oil and stringent regulatory requirements pose market barriers, especially concerning product labeling and shelf-life extension.

Opportunities for growth are substantial, primarily focusing on expanding the therapeutic utility of Lipiodol beyond traditional cTACE. This includes investigating its role in Transarterial Radioembolization (TARE) combined procedures, or exploring novel applications in non-hepatic interventions, such as complex lymphatic interventions where its diagnostic visualization capabilities are unmatched. Furthermore, geographic market penetration into highly populous but underdeveloped healthcare systems in Southeast Asia and Africa, where HCC is rampant and minimally invasive options are preferred, represents a significant avenue for revenue expansion. Strategic pricing models tailored to these emerging markets and localized clinical evidence generation are essential for capitalizing on these opportunities.

The overall Impact Forces indicate a market characterized by high clinical demand countered by strong technological competition. The market's resilience relies on its foundational role in interventional oncology and its long history of clinical efficacy and safety. The continuous push for better clinical outcomes in HCC treatment ensures that Lipiodol remains relevant, provided manufacturers invest in generating comparative effectiveness data that highlights its benefits over alternatives, particularly in cost-effectiveness and sustained tumor response rates. Regulatory support for TACE procedures globally also acts as a positive impact force, ensuring consistent reimbursement and integration into clinical pathways.

Segmentation Analysis

The Lipiodol market is meticulously segmented based on Application, End-User, and Geography to provide granular insights into demand patterns and growth drivers. Application segmentation differentiates between the primary therapeutic use in oncology, dominated by Transarterial Chemoembolization (TACE) for treating liver malignancies, and various diagnostic applications, which include lymphography for visualizing the lymphatic system and hysterosalpingography (HSG) for assessing fallopian tube patency. The TACE segment is significantly larger due to the high global incidence of HCC and the established role of Lipiodol as the standard carrier/contrast agent in cTACE procedures. Diagnostic applications, while stable, exhibit slower growth compared to the dynamic interventional oncology space.

End-User segmentation clarifies the consumption points of Lipiodol, with Hospitals and Specialized Cancer Centers representing the major consumers. These facilities possess the necessary infrastructure, specialized surgical and interventional radiology teams, and volume capacity to perform complex, image-guided procedures like TACE. Ambulatory Surgical Centers (ASCs) and standalone Diagnostic Imaging Centers utilize Lipiodol primarily for diagnostic purposes (HSG, Lymphography). The trend towards outpatient interventional procedures is gradually increasing the share held by ASCs, especially in developed healthcare systems, driven by cost-effectiveness and patient convenience.

Geographically, the market is segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). APAC holds the largest market share due to the highest burden of HCC cases worldwide, particularly driven by high prevalence rates of Hepatitis B and C infections. North America and Europe demonstrate mature markets characterized by high per-procedure spending and advanced technological adoption, contributing substantial revenue. Strategic focus on emerging economies in APAC, Latin America, and MEA, characterized by rapid healthcare infrastructure development, is critical for future market expansion.

- By Application:

- Transarterial Chemoembolization (TACE)

- Lymphography

- Hysterosalpingography (HSG)

- Others (e.g., specific diagnostics)

- By End-User:

- Hospitals

- Specialized Cancer Centers

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Imaging Centers

- By Geography:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Lipiodol Market

The Lipiodol market value chain initiates with the upstream analysis, focusing heavily on the sourcing and refinement of raw materials, primarily poppyseed oil derivatives, which must adhere to strict pharmaceutical-grade purity standards for the synthesis of ethiodized oil. Given the specialized chemical nature and stringent quality control required for an injectable contrast agent, only a few specialized manufacturers possess the capability for this high-level synthesis and formulation. Upstream activities are characterized by high barriers to entry, intellectual property protection surrounding the manufacturing process, and intensive regulatory oversight, ensuring the final product meets pharmacopeial standards for sterility and stability, essential for patient safety during interventional procedures.

The midstream phase involves the core manufacturing process, sterile filling, packaging, and quality assurance. Due to the limited number of globally approved manufacturing sites capable of producing Lipiodol Ultra-Fluid, the supply chain is highly centralized. Distribution channel analysis reveals a critical reliance on specialized logistics capable of handling pharmaceutical products, maintaining temperature control, and managing complex regulatory clearances for international shipment. Direct and indirect distribution routes are both essential; direct channels involve large tender contracts with national health systems and major hospital groups, ensuring bulk supply. Indirect channels utilize specialized medical distributors and wholesalers, especially for reaching smaller clinics, regional hospitals, and foreign markets where local regulatory knowledge is paramount for product importation and market access.

The downstream analysis focuses on the end-users—interventional radiologists, oncologists, diagnostic imagers, and gynecologists—who prescribe and utilize Lipiodol. Market success is heavily dependent on educational outreach and professional training for these specialists, ensuring correct procedural protocols for TACE, lymphography, and HSG are followed. Key performance indicators in the downstream segment include procedural volume, reimbursement rates, and the adoption of clinical guidelines. The value chain concludes with post-market surveillance and continuous feedback loops concerning product efficacy and safety, which inform future R&D efforts and regulatory maintenance.

Lipiodol Market Potential Customers

The primary end-users and buyers of Lipiodol are healthcare professionals and institutions specializing in oncology, interventional radiology, and diagnostic imaging. Potential customers are categorized mainly as Hospitals and Specialized Cancer Centers, which perform the highest volume of therapeutic procedures, specifically TACE for hepatocellular carcinoma (HCC). These centers require large, consistent supplies of Lipiodol for their interventional suites. The purchasing decisions within these large institutions are typically handled by centralized pharmacy departments or procurement officers, often influenced heavily by interventional radiology department heads who dictate preferred contrast and embolization agents based on clinical experience, efficacy data, and cost-effectiveness analysis.

Secondary potential customers include smaller community Hospitals and Ambulatory Surgical Centers (ASCs) that provide routine diagnostic services. In these settings, Lipiodol is purchased for non-oncology applications such as hysterosalpingography (HSG) in fertility clinics or lymphography for lymphatic vessel visualization. These customers value ease of purchase, product stability, and strong customer support from distributors. Additionally, academic research institutions and university hospitals represent another segment, utilizing Lipiodol for clinical trials aimed at expanding its application scope or optimizing TACE techniques in combination with emerging technologies like targeted molecular therapies or personalized medicine approaches.

Geographically, potential customers in emerging markets like China, India, and Brazil are characterized by a growing demand driven by increasing affordability and accessibility of basic healthcare infrastructure, paired with a high prevalence of underlying risk factors for HCC. Targeting these regions involves navigating complex tendering processes, demonstrating compelling cost-benefit ratios against systemic treatments, and ensuring local clinical validation to encourage rapid adoption by newly established interventional radiology units. Effective engagement requires robust local distribution networks and dedicated medical affairs teams focusing on specialist education and training.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Guerbet, Laboratories I.E. Kim, S.A.S. (Guerbet Group), Teva Pharmaceutical Industries Ltd., Hikari Pharmaceutical Co. Ltd., B. Braun Melsungen AG, GE Healthcare, Daiichi Sankyo Company, Limited, Bristol-Myers Squibb Company, Eli Lilly and Company, Novartis AG, Bayer AG, Pfizer Inc., Merck KGaA, AbbVie Inc., Johnson & Johnson, Boston Scientific Corporation, Cardinal Health Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lipiodol Market Key Technology Landscape

The core technology surrounding the Lipiodol market is the pharmaceutical formulation and delivery mechanism of the ethiodized oil itself, ensuring stable emulsion properties and optimal particle size distribution for selective tumor targeting during TACE. However, the market's technological landscape is increasingly defined by the integration of advanced visualization and delivery systems that optimize the product's performance. The primary technological advancements lie in microcatheter technology, which is crucial for navigating the complex and tortuous hepatic arterial tree to deliver the Lipiodol-chemo mixture precisely into the tumor-feeding vessels. High-resolution angiography systems, including C-arm CT and cone-beam CT (CBCT), are critical technologies that provide real-time 3D image guidance, allowing interventional radiologists to confirm optimal Lipiodol distribution and minimize non-target embolization, enhancing both safety and efficacy.

Further innovation is seen in the development of specialized TACE kits and preparation techniques designed to standardize the mixing and administration of Lipiodol with various chemotherapy agents (like Doxorubicin). These innovations address challenges related to emulsion stability and consistency, ensuring that the Lipiodol mixture remains homogeneous until injected, maximizing the sustained local concentration of the cytotoxic agent within the tumor bed. The adoption of advanced imaging fusion technologies, which merge pre-operative scans (MRI/CT) with real-time fluoroscopy, significantly improves targeting accuracy, reducing procedural complexity and increasing the overall efficiency of Lipiodol-based interventions, thus making the procedure more accessible to a wider range of patients.

In the non-oncology segment, technological advancements focus on improving diagnostic output. For HSG procedures, the integration of 3D ultrasound and digital imaging systems enhances the visualization provided by Lipiodol, allowing gynecologists to better assess minor abnormalities in the fallopian tubes. Similarly, in lymphography, combining Lipiodol with newer dynamic imaging techniques helps in better mapping lymphatic drainage pathways for diagnosing complex disorders. Overall, the technological focus remains on minimizing invasiveness, maximizing procedural precision, and leveraging digital health tools (including AI-driven planning software) to ensure the optimal clinical outcome derived from the properties of Lipiodol.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Lipiodol, driven predominantly by the high prevalence of chronic viral hepatitis (HBV and HCV), which leads directly to a massive burden of Hepatocellular Carcinoma (HCC), especially in densely populated countries like China and India. Japan and South Korea, with their highly advanced interventional radiology infrastructure and established TACE protocols, maintain high utilization rates. Market expansion is supported by government initiatives aimed at improving cancer care and increasing accessibility to minimally invasive treatments, leading to high procedural volume growth. The market here is highly competitive, focusing on cost-effective supply solutions and localized clinical data dissemination.

- North America: The North American market is characterized by high procedural reimbursement rates, advanced clinical adoption of TACE as a first-line treatment for intermediate HCC, and a strong presence of key opinion leaders who drive procedural innovation. While the prevalence of HCC is lower than in APAC, the high cost per procedure and well-established diagnostic pathways ensure high revenue generation. The region focuses heavily on clinical trials combining Lipiodol-based TACE with systemic therapies, aiming for superior treatment protocols. Regulatory clarity from the FDA concerning Lipiodol's use in combination regimens is crucial for market stability and incremental growth.

- Europe: Europe represents a mature market with stable growth, benefiting from standardized clinical guidelines (e.g., EASL/ESMO) that endorse TACE. Market dynamics vary significantly among countries; nations with strong centralized healthcare systems (like the UK or France) prioritize volume-based contracts, while others (like Germany) focus on high-quality, specialized interventions. The challenge in Europe involves balancing the use of Lipiodol against competing technologies like DEBs, necessitating strong pharmacoeconomic data demonstrating the value of conventional TACE in diverse patient populations. Research efforts are concentrating on procedural refinement and patient stratification.

- Latin America (LATAM): LATAM is an emerging market showing robust growth potential, primarily in countries like Brazil and Mexico, where healthcare infrastructure improvements are increasing the accessibility of interventional oncology services. Market growth is fueled by an increasing awareness of minimally invasive options and rising foreign investment in specialized medical centers. However, this region faces challenges related to inconsistent regulatory pathways and economic volatility, which can affect the pricing and steady supply of premium contrast agents like Lipiodol. Local training and education programs are key to unlocking market potential.

- Middle East and Africa (MEA): The MEA region is at an early stage of adoption, though growth is significant, particularly in Gulf Cooperation Council (GCC) countries which invest heavily in specialized medical tourism and high-technology health centers. HCC prevalence is a concern in certain parts of Africa due to endemic hepatitis, creating a long-term demand curve. Market penetration requires navigating diverse cultural and regulatory environments and establishing reliable cold-chain logistics to ensure product integrity across vast geographical distances.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lipiodol Market.- Guerbet

- Laboratories I.E. Kim, S.A.S. (Guerbet Group)

- Teva Pharmaceutical Industries Ltd.

- Hikari Pharmaceutical Co. Ltd.

- B. Braun Melsungen AG

- GE Healthcare

- Daiichi Sankyo Company, Limited

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Novartis AG

- Bayer AG

- Pfizer Inc.

- Merck KGaA

- AbbVie Inc.

- Johnson & Johnson

- Boston Scientific Corporation

- Cardinal Health Inc.

- Terumo Corporation

- Medtronic plc

Frequently Asked Questions

Analyze common user questions about the Lipiodol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary therapeutic application of Lipiodol in the current market?

The primary therapeutic application of Lipiodol (Ethiodized oil) is in conventional Transarterial Chemoembolization (cTACE), a minimally invasive procedure used globally to treat intermediate-stage Hepatocellular Carcinoma (HCC) by delivering localized chemotherapy directly to the liver tumor.

How does Lipiodol compare to alternative embolization agents like Drug-Eluting Beads (DEBs)?

Lipiodol, when used in cTACE, is generally considered cost-effective and provides excellent radiographic visualization and sustained drug release. While DEBs offer controlled, pre-loaded drug delivery, Lipiodol remains the gold standard in many centers, particularly in Asia, due to extensive clinical history and strong efficacy data in specific HCC patient profiles.

Which geographical region holds the largest market share for Lipiodol and why?

The Asia Pacific (APAC) region holds the largest market share. This dominance is due to the significantly higher prevalence of chronic hepatitis B and C, which translates directly to a massive burden of Hepatocellular Carcinoma (HCC), the main indication for Lipiodol use in TACE procedures.

What are the key driving factors influencing the growth of the Lipiodol Market?

Key drivers include the rising global incidence of liver cancer (HCC), advancements in interventional radiology techniques (microcatheter precision), supportive clinical guidelines endorsing TACE, and the increasing global adoption of minimally invasive oncological procedures over traditional surgery.

Is Lipiodol still relevant for non-oncology diagnostic procedures?

Yes, Lipiodol maintains relevance in non-oncology diagnostics, most notably in hysterosalpingography (HSG) for assessing female infertility, where its oil-based properties aid in fallopian tube imaging, and in lymphography for visualizing the lymphatic system in specific vascular anomalies or injury assessments.

The Lipiodol Market is heavily influenced by the regulatory environment surrounding contrast media and interventional oncology procedures. Regulatory bodies like the FDA, EMA, and their counterparts in APAC require comprehensive clinical data demonstrating the safety and efficacy of Lipiodol, especially when used off-label or in combination with novel chemotherapeutic agents. Maintaining compliance with Good Manufacturing Practices (GMP) and ensuring the sterile filling process meets international standards are continuous obligations for manufacturers, adding complexity and cost to operations. Furthermore, obtaining regulatory approval for new indications, such as specialized lymphatic interventions, requires substantial investment in Phase III clinical trials, acting as a crucial bottleneck in market expansion beyond the core TACE application.

The pricing strategy for Lipiodol must be carefully balanced, reflecting its premium pharmaceutical status and the high value derived from TACE procedures, while remaining competitive against alternatives that may offer perceived procedural simplification. In mature markets like the U.S. and Western Europe, pricing is supported by favorable reimbursement codes for interventional oncology. Conversely, in emerging markets, successful market penetration necessitates flexible pricing models or tiered strategies to align with local healthcare budgets and tender processes. The intellectual property landscape, although established for the primary compound, still sees ongoing R&D regarding formulation improvements or optimized delivery systems, leading to secondary patents that protect minor competitive advantages in specific jurisdictions.

In terms of sustainability and supply chain resilience, dependence on natural raw materials (poppyseed oil derivatives) presents a moderate supply risk, necessitating secure long-term sourcing contracts and robust inventory management systems. Disruptions in global logistics or geopolitical instability in sourcing regions can directly impact the manufacturing continuity of ethiodized oil. Therefore, major manufacturers prioritize maintaining multiple, geographically diverse manufacturing facilities to mitigate risk and ensure uninterrupted supply to critical therapeutic markets globally. This commitment to supply chain robustness is a hidden but essential component of maintaining market leadership.

Looking ahead, the market dynamics will be significantly shaped by the outcomes of comparative effectiveness studies between cTACE (Lipiodol-based) and drug-eluting bead TACE (DEB-TACE). If future large-scale, randomized controlled trials demonstrate clear superiority or non-inferiority of cTACE in certain patient groups, especially regarding long-term overall survival or recurrence rates, the market position of Lipiodol will be strongly reaffirmed. Conversely, if DEBs gain broader clinical preference based on ease of use or toxicity profiles, Lipiodol manufacturers will need to pivot towards advanced delivery technologies or combination therapies that leverage Lipiodol's unique imaging properties, transforming it into a multimodal therapeutic tool rather than solely a drug carrier.

The impact of technological convergence, specifically the merging of digital health platforms with interventional oncology, is a defining feature of the future landscape. Tele-radiology and AI-assisted planning systems are enabling specialized TACE procedures to be performed or supervised remotely, expanding access to Lipiodol treatment in regions lacking local interventional expertise. This democratization of procedural knowledge, facilitated by digital tools, indirectly benefits the Lipiodol market by broadening the operational footprint of TACE globally. Investment in data infrastructure and clinical software compatibility is becoming as vital as investment in the core drug formulation itself.

Furthermore, the shift towards personalized medicine requires Lipiodol manufacturers to support research into biomarkers that can predict a patient's response to cTACE. Identifying which HCC patients derive the maximum benefit from Lipiodol treatment, versus those better suited for systemic therapy or radioembolization, allows for optimized clinical resource allocation and improved patient segmentation. This focus on precision diagnostics linked to therapeutic decisions ensures that Lipiodol is used where it provides the highest clinical value, thereby securing its economic viability and long-term acceptance in sophisticated healthcare systems. This analytical approach, leveraging genomic and proteomic data alongside imaging, is rapidly becoming integral to competitive strategy.

The environmental and societal aspects (ESG) are also influencing market operations. The disposal of pharmaceutical waste, particularly contrast agents containing iodine, is subject to increasing environmental regulations. Manufacturers are required to implement sustainable production processes and packaging solutions to minimize their environmental footprint. Socially, ensuring equitable access to high-cost cancer treatments like Lipiodol-based TACE in low- and middle-income countries remains a critical challenge. Corporate social responsibility initiatives focusing on price accessibility, donation programs, and local healthcare worker training are important for enhancing brand reputation and securing long-term goodwill in emerging markets.

Competition in the Lipiodol market is multifaceted. While Guerbet holds a near-monopoly on the patented Lipiodol Ultra-Fluid formulation, the competition arises primarily from functional substitutes in the therapeutic space, specifically drug-eluting beads (DEBs) and, increasingly, from Yttrium-90 microspheres used in Transarterial Radioembolization (TARE). DEBs compete on the promise of standardized, controlled release kinetics, which can be appealing to some clinicians. TARE, although significantly more expensive, is often positioned for patients with specific tumor characteristics or as a salvage therapy. Lipiodol maintains its market strength through its established dual function (imaging and delivery) and generally lower procedural costs compared to these advanced alternatives, positioning it favorably in cost-sensitive healthcare environments.

Strategic mergers and acquisitions (M&A) are common strategies employed by key players to secure market share or acquire niche technologies that complement Lipiodol's delivery. Companies involved in interventional devices (catheters, microcatheters) or chemotherapy agents are potential targets for Lipiodol manufacturers seeking vertical integration and control over the entire TACE procedural workflow. Conversely, larger pharmaceutical conglomerates may look to acquire Lipiodol manufacturers to integrate a vital oncology asset into their existing portfolio of cancer treatments, especially systemic therapies, offering a comprehensive solution for liver cancer management. These strategic moves dictate shifts in global distribution and market access capabilities.

The diagnostic segment, although smaller, provides stability. The use of Lipiodol in HSG for fertility treatments, particularly its unique characteristic of being oil-soluble, which some studies suggest may improve pregnancy rates compared to water-soluble contrasts, ensures continued demand. Manufacturers leverage this unique clinical benefit to maintain market presence in gynecology clinics. Future research in this area, focused on standardized evidence demonstrating improved fertility outcomes following Lipiodol HSG, could unlock moderate growth potential within the diagnostic application segment, offering diversification away from the competitive oncology market pressures.

A crucial factor in the Lipiodol market is the continuous training and proficiency maintenance of interventional radiologists. The success of a Lipiodol TACE procedure is highly operator-dependent, requiring advanced skills in superselective catheterization and emulsion preparation. Manufacturers actively invest in global professional education programs, simulation training, and product demonstrations to ensure high standards of procedural execution. This direct involvement in clinical education creates strong loyalty among the end-user community, serving as a non-price competitive advantage that supports sustained product uptake and favorable clinical outcomes across different global centers of excellence.

The ongoing refinement of surgical techniques, particularly the move towards curative liver resection for early-stage HCC, influences the pool of patients eligible for TACE. As early detection improves through better screening programs (especially for high-risk patients with cirrhosis or chronic hepatitis), the target patient population for TACE might shift towards intermediate-stage patients who are not candidates for surgery or ablation. This dynamic interplay between surgical, ablative, and locoregional therapies (TACE/TARE) means Lipiodol manufacturers must continuously adapt their clinical messaging to define the product’s optimal role within the evolving multidisciplinary tumor board decision-making process, ensuring appropriate patient referral patterns are maintained for TACE.

The global pharmaceutical supply chain's vulnerability, as highlighted by recent geopolitical and pandemic events, emphasizes the need for redundant manufacturing capacity and robust inventory management. Lipiodol, being a critical, sterile injectable product with a specific shelf life, requires precise handling and inventory rotation across global distribution centers. Failures in cold chain management or supply disruptions can have immediate and severe impacts on cancer treatment schedules. Therefore, investment in supply chain resilience and end-to-end monitoring technology is a high priority, assuring healthcare providers of product availability and quality integrity from production facility to patient bedside, reinforcing manufacturer reliability in a highly sensitive therapeutic area.

In summary, while the market faces headwinds from competing locoregional therapies and the need for rigorous clinical evidence, the foundational role of Lipiodol in TACE for HCC, combined with the expanding prevalence of liver disease globally, ensures its sustained growth trajectory. Success relies on strategic investment in clinical education, supply chain security, and leveraging technological integration (like AI and advanced imaging) to maintain the product’s competitive edge and maximize procedural precision and outcome predictability in interventional oncology.

The growth opportunities in niche diagnostic applications, while not revenue drivers, contribute significantly to market diversification and product stability. For instance, in pediatric interventional procedures, Lipiodol is sometimes utilized for visualizing complex lymphatic malformations where other contrast agents are inadequate. These highly specialized, low-volume applications underscore the unique physiochemical properties of ethiodized oil that differentiate it from water-soluble iodinated contrasts. Manufacturers supporting research in these orphan indications build goodwill within the medical community and future-proof the product's relevance beyond mainstream oncology, ensuring a diverse demand base across multiple medical specialties, thus mitigating risks associated with single-application dependence.

The long-term market sustainability of Lipiodol is also tied to global efforts in early cancer screening and prevention. If vaccination programs for Hepatitis B become universally successful, or if effective antiviral treatments drastically reduce the incidence of chronic Hepatitis C, the total pool of HCC patients may decline in the long term. While this would be a positive public health outcome, it poses a strategic challenge for the Lipiodol market. Consequently, manufacturers are proactively exploring new therapeutic areas, such as using Lipiodol as a vector for novel radiopharmaceuticals in internal radiation therapy, diversifying the application portfolio to maintain growth even if the HCC incidence rate stabilizes or decreases in developed countries. This strategic foresight is critical for sustained revenue generation over the 2026-2033 forecast period.

The regulatory landscape is further complicated by the fact that Lipiodol is often compounded by pharmacists with various chemotherapy agents (like Doxorubicin, Cisplatin) immediately prior to injection. The stability, consistency, and optimal ratio of these compounded emulsions are not always standardized globally, leading to variations in procedural efficacy. Market leaders are investing in research to provide validated, standardized compounding protocols and potentially developing pre-mixed or dedicated kits that simplify the process for interventional radiologists, ensuring reproducible outcomes. This emphasis on procedural standardization is a subtle but powerful driver of adoption, particularly in emerging markets where clinical experience levels may vary significantly. Standardized protocols reduce the margin for error and reinforce the clinical effectiveness of Lipiodol-based cTACE.

Finally, the economic volatility across various geographic markets dictates the rhythm of purchase and inventory cycles. In regions facing currency depreciation or strict capital controls, hospitals may delay high-value purchases or opt for alternatives perceived as cheaper, even if less clinically proven. Lipiodol manufacturers must employ sophisticated market access teams capable of navigating these complex economic factors, offering creative financing or flexible payment terms to ensure essential supplies reach patients in need, thereby maintaining consistent sales volumes across economically diverse operational territories. The financial health of the end-user hospitals, often tied to public or private reimbursement systems, directly impacts the procurement patterns within the Lipiodol market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager